Betting to Win: A Professional Guide to Profitable Betting

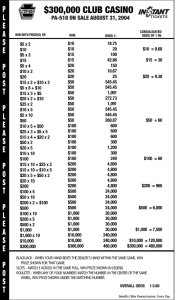

advertisement