ELE 3911 Introduction to quantitative finance

– Practice Exam –

To be answered individually.

Instructions and notes.

1. Report all calculations with three digits of precision after the decimal point.

2. You may use a BI-approved calculator (Hewlett Packard (HP) 10bII Plus).

3. The test is closed book.

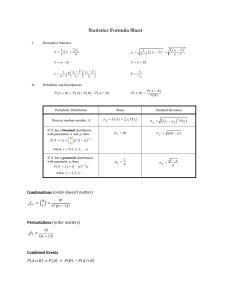

4. See appendix A for critical value tables and B for equations.

5. No variable definitions will be provided for the equations in the appendix.

• Grading:

– Section 1: +3 points for each correct answer, 0 points for no answer, and -1 point for

each incorrect answer.

– Section 2: +1 point for each correct answer, 0 points for no answer, and -1 point for

each incorrect answer.

• Notes:

– The actual final exam will be delivered at school on WISEflow and will require you to

install a lockdown browser in advance.

– You will receive the same formula sheet and critical value tables on the final exam.

Total exam points

(100 points)

Section 1: Multiple Choice

(90 points)

1. The nominal monthly rate for a loan is quoted at 7%. Which one of the following statements is TRUE?

(a) The equivalent annual rate is 7.229%.

(b) The equivalent annual rate is 7.344%.

(c) The equivalent quarterly rate is 7.211%.

(d) The equivalent quarterly rate is 7.103%.

(e) I choose not to answer.

q12 ´ 1q “ 7.229%.

• Annual: 100 ˚ pp1 ` 0.07

12

• Quarterly: 100 ˚ pp1 ` 0.07

q4 ´ 1q “ 7.186%.

4

– Correct answer: (a).

2. Over the course of the year, the log return on a stock market index is 6.8%. The starting

value of the index is 102. What is the value at the end of the year?

(a) 108.168

(b) 109.177

(c) 109.844

(d) I choose not to answer.

• 109.177 “ expp6.8{100q ˚ 102.

– Correct answer: (b).

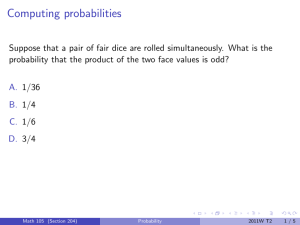

3. You have a portfolio of 5 bonds. In how many different ways can exactly three bonds

default? Assume the order in which the bonds default is unimportant.

(a) 8

(b) 10

(c) 24

(d) 60

(e) I choose not to answer.

ˆ ˙

5

5!

“

• Cp5, 3q “

“ 3!p5´3q!

3

– Correct answer: (b).

5¨4

2!

“

20

2

“ 10

4. What is the present value of a 20-year bond with a $50 face value, which pays a 5%

coupon annually? Use an 6% annual discount rate.

(a) $44.121

(b) $44.265

(c) $45.912

(d) $46.631

(e) I choose not to answer.

• V “

$2.5

$2.5

$2.5

$50

` 1.06

2 ` ¨ ¨ ¨ ` 1.0619 ` 1.0620 ` 1.0620

ř ` 1 ˘i

$50

• “ $2.5 ˚ 20

` 1.06

20 “ $2.5 ˚ 11.470 ` $15.590 “ $44.265.

i“1 1.06

– Correct answer: (b).

$2.5

1.06

5. You are given the following function, F pxq, which is defined for 1 ď x ď 10. Which

statement about the function is FALSE?

px ´ 1q2

F pxq “

100

(1)

(a) F p1q “ 0.

(b) F p10q “ 0.81.

(c)

d

F pxq

dx

“

x´1

.

50

(d) F pxq has all of the properties of a CDF.

(e) I choose not to answer.

02

“ 0.

100

92

F p10q “ 100 “ 0.81.

d

F pxq “ x´1

.

dx

50

• F p1q “

•

•

• F pxq does not have the properties of a CDF, since F p10q “ 0.81 ‰ 1.0.

– Correct answer: (d).

6. Which statement is FALSE about the estimator shown below?

µ̂ “

1 n

Σ xi

n i“1

(2)

(a) It is unbiased.

(b) It is linear.

(c) It has a lower variance than any biased estimator.

(d) It has the lowest variance among all unbiased linear estimators.

(e) I choose not to answer.

• The sample mean estimator is BLUE (i.e. (a), (b), and (d) are true).

• It will not have a lower variance than any biased estimator. The estimator µ̂ “ c,

for example, where c is a constant has a variance of zero.

– Correct answer: (c).

7. You are given the probability density function for a random variable X, where 0 ď X ď 10.

What value of c makes f pxq a valid PDF?

f pxq “

(a) 33.33

x2

c

(b) 66.67

(c) 100.00

(d) 333.33

(e) 1000.00

(f) I choose not to answer.

• Solve for c:

ż 10

0

„

x3

3c

x2

dx “ 1

c

ȷ10

“

0

Ñc“

(3)

1000

“1

3c

(4)

1000

3

(5)

– Correct answer: (d)

8. You are given the probability density function for a random variable X, where 0 ď X ď 10.

Find the median value of X.

f pxq “

x

50

(a) 3.051

(b) 6.918

(c) 7.071

(d) 7.119

(e) 7.441

(f) I choose not to answer.

żm

0

x

dx “ 0.50

50

m2

“ 0.50

100

Ñ m “ 7.071

Ñ

(6)

(7)

(8)

Correct answer: (c)

9.

– A company announces its earnings four times per year. Based on historical data, you

estimate that in any given quarter the probability that the company’s earnings will exceed

consensus estimates is 0.10. Also, the probability of exceeding the consensus in any one

quarter is independent of the outcome in any other quarter. What is the probability that

it will exceed estimates two times in a given year?

(a) 0.028

(b) 0.031

(c) 0.039

(d) 0.046

(e) 0.049

(f) I choose not to answer.

ˆ ˙

4

• P rX “ 2s “

0.102 0.902

2

• “ 6 ¨ 0.102 ¨ 0.902

• “ 0.049

– Correct answer: (e)

10. The market risk group at your firm has developed a value at risk (VaR) model. Assume

the probability of an exceedance event on any given day is 0.03, and the probability of an

exceedance event occurring on any given day is independent of an exceedance event having

occurred on any previous day. What is the probability that there are four exceedances

over 30 days?

(a) 0.001

(b) 0.010

(c) 0.015

(d) 0.020

(e) 0.033

(f) I choose not to answer.

• The number of

events follows a binomial distribution.

ˆ exceedance

˙

30

• P rX “ 4s “

0.034 0.9726 “ 0.010

4

– Correct answer: (b)

11. X is a uniformly distributed with a lower bound of 2 and an upper bound 6. Which

statement about X is FALSE?

1

4

(a) The PDF of X is f pxq “

for 2 ě X ě 6 and 0 otherwise.

(b) The mean of X is 4.

(c) The median of X is 4.

(d) The mode of X is 4.

(e) I choose not to answer.

• f pxq “

1

b´a

“

1

6´2

“

1

4

• Mean = Median = 21 pa ` bq “ 4.

• All values within the support of the distribution are the mode.

– Correct answer: (d)

12. The probability that gross domestic product (GDP) decreases is 0.15. The probability

that unemployment increases is 0.12. The probability that unemployment increases given

that GDP has decreased is 0.30. Which one of the following statements is TRUE?

(a) P[GDP down | unemployment up] = 0.375

(b) P[GDP down] = 0.120

(c) P[unemployment up | GDP down] = 0.291

(d) P[unemployment up] = 0.150

(e) I choose not to answer.

• P rGDP down | unemployment ups “

•

•

•

•

P runemployment up|GDP downs¨P rGDP downs

P runemployment ups

0.30¨0.15

“ 0.375

0.12

P rGDP down | unemployment ups “

P rGDP downs “ 0.150 ‰ 0.120

P runemployment up|GDP downs “ 0.300 ‰ 0.291

P runemployment ups “ 0.120 ‰ 0.150

– Correct answer: (a)

13. In R, what will the statement sd(df$excess return) do? Assume you have loaded df

into memory, but have not loaded any libraries.

(a) Return the standard deviation of the excess return column of the df data frame.

(b) Throw an exception, since sd() is not part of the base R package.

(c) Neither option.

(d) I choose not to answer.

– Correct answer: (a)

14. You are given the data sample below. Which of the following statements is FALSE?

59 29 39 61 51 24 17 71 94 86 79

(a) The sample mean µ̂ is 55.454.

(b) The variance is 610.612.

(c) The standard error of the mean is 7.814.

(d) The test statistic for the null hypothesis that µ̂ “ 45 is 1.438.

(e) I choose not to answer.

•

•

•

•

Sample mean: 55.454.

Variance: 610.612.

a

Standard Error of the Mean: 610.612{p11 ´ 1q “ 7.814.

Test statistic: 55.454´45

“ 1.338 ‰ 1.438.

7.814

– Correct answer: (d)

15. You are presented with an investment strategy with a mean return of 15% and a standard

deviation of 7%. The distribution of returns is known to be symmetric, but no other information is known about the distribution. Which statement is TRUE about the probability

of receiving a return that is either less than 1% or greater than 29%?

(a) It is not possible to place bounds on this probability without more information about

the returns distribution.

(b) It is possible to compute the probability exactly with the information given and it

is 0.20.

(c) The probability is at most 0.25.

(d) The probability is at least 0.30.

(e) I choose not to answer.

• We cannot compute the exact probability without more information about the distribution of returns.

• By Chebyshev’s inequality, the probability of observing a realization that is more

than two standard deviations away from the mean is at most 212 “ 0.25.

– Correct answer: (c)

16. Suppose you invest in a product whose returns follow a uniform distribution between

´30% and `50%. Which statement below is TRUE?

(a) The 95% VaR is 26%.

(b) The 95% VaR is 27%.

(c) The 95% VaR is 28%.

(d) The expected return is 15%.

(e) The expected return is 5%.

(f) I choose not to answer.

• Expected return: 12 p´30% ` 50%q “ 10%.

şα 1

• The 95% VaR: ´30 80

dx “ 0.05 Ñ α “ ´26% Ñ V aR “ 26%.

– Correct answer: (a)

17. What statement below is FALSE about expected shortfall (ES) and value at risk (VaR)?

(a) If ES and VaR are measured as losses, then ES ě V aR.

(b) VaR satisfies subadditivity, but ES does not.

(c) ES provides information about the size and probability of losses in left tail.

(d) I choose not to answer.

• ES ě V aR: ES computes the conditional expectation of the tail from the lower

bound of the support up to the VaR threshold.

• Subadditivity: Adding more assets always increases VaR, but not ES. Thus, the

opposite is true.

• ES has the advantage of providing information about returns in the tails.

– Correct answer: (b)

18. You are given a one-year transition matrix, T1 , for bond rating statuses. Which of the

following statements is FALSE about transition a matrix?

(a) A transition matrix contains the probability of moving between any pairs of states

in a system.

(b) A transition matrix can be symmetric.

(c) A transition matrix can be lower triangular.

(d) The probabilities in each row of a transition matrix must sum to one.

(e) We can calculate the n-year transition matrix as Tn “T1n´1 .

(f) I choose not to answer.

•

•

•

•

•

A transition matrix does not need to be symmetric or lower triangular.

It does contain the probability of moving between pairs of states.

The probabilities in the rows and columns both sum to one.

We can calculate the n-year transition matrix as Tn “Tn1 ‰T1n´1 .

I choose not to answer.

– Correct answer: (e)

19. You are given the vectors below: a, b, and c. Which pair of vectors is NOT orthogonal?

»

fi

5

a “ – ´8 fl

´2

»

fi

2

b “ – 1 fl

1

»

fi

6

c “ – 1 fl

11

(a) a and c.

(b) a and b.

(c) b and c.

(d) I choose not to answer.

Vectors b and c are not orthogonal, but a and b, and a and b are orthogonal. We know

this from their inner products, which we can calculate as follows:

»

fi » fi

5

2

a ¨ b “ – ´8 fl ¨ – 1 fl “ 5 ¨ 2 ` p´8q ¨ 1 ` ´2 ¨ p´1q “ 10 ´ 8 ´ 2 “ 0

´2

1

» fi »

fi

2

6

b ¨ c “ – 1 fl ¨ – 1 fl “ 2 ¨ 6 ` 1 ¨ 1 ` 1 ¨ 11 “ 12 ` 1 ` 11 “ 24

1

11

»

fi »

fi

5

6

a ¨ c “ – ´8 fl ¨ – 1 fl “ 5 ¨ 6 ` p´8q ¨ 1 ` p´2q ¨ 11 “ 30 ´ 8 ´ 22 “ 0

´2

11

• Correct answer: (c)

20. In R, what will the statement kurtosis(df$returns) do? Assume you have loaded df

into memory, but have not loaded any libraries.

(a) Return the standard deviation of the excess return column of the df data frame.

(b) Throw an exception, since kurtosis() is not part of the base R package.

(c) Neither option.

(d) I choose not to answer.

– We must load a library or define a function to calculate kurtosis in R.

– Correct answer: (b)

21. Assume that the columns of matrix B form an orthonormal basis in R4 . What statement

is FALSE about the columns of B?

(a) Its columns are linearly independent.

(b) It is the only orthonormal basis for R4 .

(c) Each column has a unit length.

(d) The inner product of each pair of columns is zero.

(e) I choose not to answer.

• In order for B to be an orthonormal basis, we require that the column vectors are

orthogonal and have a magnitude of one.

• For any matrix with columns that form an orthonormal basis, (a), (c), and (d) are

true.

• It is not the only orthonormal basis in R4 . We can obtain another by performing a

rotation around the origin.

– Correct answer: (b)

22. In R, the command runif(2, 3, 5) will generate the following:

(a) Two draws from a uniform distribution with min 3 and max 5.

(b) Five draws from a uniform distribution with min 2 and max 3.

(c) A warning message, since the min is set to 5 and the max is set to 3.

(d) I choose not to answer.

– Correct answer: (a)

23. The following regression equation describes the daily returns of stock, r, in terms of an

index return, rindex , and a mean zero disturbance term, ε:

r “ α̂ ` β̂rindex ` ε

Both r and rindex are given in decimal. Estimating the regression, we find that α̂ is 0.02,

and β̂ is 1.14. If the index return on a given day is 0.05, what is the expected return of r?

(a) 0.056

(b) 0.077

(c) 0.079

(d) 0.088

(e) 0.091

(f) I choose not to answer.

• The expected return of r:

E rr | rindex s “ α̂ ` β̂rindex “ 0.02 ` 1.14 ¨ 0.05 “ 0.077

– Correct answer: (b)

24. You perform a regression analysis of a hedge fund’s returns against an industry benchmark. The total sum of squares (TSS) is 0.13. The residual sum of squares (RSS) is 0.06.

Which statement below is TRUE?

(a) It is not possible to compute R2 without more information.

(b) R2 is 0.538.

(c) R2 is 0.462.

(d) Adjusted-R2 can be computed using the information given.

(e) I choose not to answer.

• R2 “ 1 ´ RSS

“ 1 ´ 0.06

“ 0.538.

TSS

0.13

– Correct answer: (b)

25. Which of the following statements is FALSE?

(a) rt “ α ` λ1 rt´1 ` εt is an AR(1) process.

(b) rt “ α ` λ1 rt´1 ` λ2 rt´2 ` εt is an AR(2) process.

(c) rt “ α ` εt is a drift-diffusion process.

(d) rt “ λ1 rt´1 ` λ2 rt´2 ` εt ` θ1 εt´1 ` θ2 εt´2 is an ARMA(2,3) process.

(e) I choose not to answer.

• rt “ λ1 rt´1 ` λ2 rt´2 ` εt ` θ1 εt´1 ` θ2 εt´2 is an ARMA(2,2) process.

– Correct answer: (d)

26. You are given the following time series model. Which values of α and λ are associated

with the highest long-term expected value of rt ?

rt “ α ` λrt´1 ` εt

(9)

(a) α “ 0.05, λ “ 0.8.

(b) α “ 0.07, λ “ 0.74.

(c) α “ 0.04, λ “ 0.82.

(d) α “ 0.03, λ “ 0.89.

(e) I choose not to answer.

α

• E rrt s “ 1´λ

.

• Calculate for each.

• Correct answer: (d)

27. In the Bayesian network shown below, each node represents a random variable that can

be in one of four states. Which of the following statements is FALSE?

A

B

C

(a) There are 64 possible states in the network.

(b) We must define 56 probabilities to specify the Bayesian network depicted in the

figure.

(c) Variable A causes variable C.

(d) Variable B does not cause variable A.

(e) I choose not to answer.

• The network can be in 64 “ 43 different states.

• In the Bayesian network shown, A and B cause C, but B does not cause A, A does

not cause B, and C does not cause either A or B.

• We must define three probabilities for A and B. We can compute the fourth by

subtracting the sum of the first three from one. Since we have 4 states A and 4

states of B, there are 16 possible configurations of the joint state of A and B. For

each of these, we must specify 3 probabilities, yielding 48 additional probabilities.

• In total, 54 “ 48 ` 3 ` 3 ‰ 56 probabilities must be defined to specify the Bayesian

network depicted.

– Correct answer: (b).

28. Suppose you invest in a product whose returns follow a uniform distribution between

´20% and `30%. Which of the following statements is TRUE?

(a) The expected return is 25%.

(b) The 90% VaR is 17%.

(c) The 95% VaR is 15%.

(d) The 90% expected shortfall is 17.5%.

(e) The 95% expected shortfall is 17.5%.

(f) I choose not to answer.

• The expected return is 12 p´20% ` 30%q “ `5%.

• The 90% VaR is 15%:

• The 95% VaR is 15%:

α´p´20%q

30%´p´20%q

α´p´20%q

30%´p´20%q

“

α`20%

50%

“ 0.10 Ñ α “ ´15% “ ´V aR.

α`20%

50%

“ 0.05 Ñ α “ ´17.5% “ ´V aR.

ş

1 ´15 x

• The 90% expected shortfall is 17.5%: ES “ ´ 0.1

dx “ 17.5.

´20 50

ş´17.5 x

1

• The 95% expected shortfall is 18.75%: ES “ ´ 0.05 ´20 50 dx “ 18.75.

– Correct answer: (d).

“

29. You are the risk manager for a portfolio with a mean daily return of 0.25% and a daily

standard deviation of 3.1%. Assume returns are normally distributed. Which of the following is the value for the 99% VaR?

(a) 5.471

(b) 6.810

(c) 6.973

(d) 7.102

(e) I choose not to answer.

• For a normal distribution, 1% of the values are more than 2.33 standard deviations

below the mean.

• The 99% VaR can be found as: 0.25% ´ 2.33 ¨ 3.10% “ ´6.973%.

• Stated as a loss, the final answer is VaR “ 6.973%.

– Correct answer: (c).

30. You are given a data frame, df, in R. The column simple return in df provides the

simple returns to a stock at a daily frequency. You compute the following statistics:

r max <- max(df$simple return)

r min <- min(df$simple return)

r mode <- mode(df$simple return)

You want to model the distribution of simple returns. Given the statistics you computed,

which distribution could you parameterize?

(a) The normal distribution.

(b) The triangular distribution.

(c) The Poisson distribution.

(d) The Bernoulli distribution.

(e) I choose not to answer.

• Part (a): False. This requires the mean and variance.

• Part (b): True. A triangular distribution is specified by the max, min, and mode.

• Part (c): False. A Poisson distribution is specified by λ, which is both the mean and

variance.

• Part (d): False. A Bernoulli distribution is parameterized by p, the probability that

an event occurs.

– Correct answer: (b).

Section 2: True or false questions.

(10 points)

Mark each question as TRUE, FALSE, or NO ANSWER. You do not need to provide a justification for your answer.

1. [TRUE/FALSE/NO ANSWER]. The sum of two annual log returns is the cumulative,

two-year log return.

TRUE.

2. [TRUE/FALSE/NO ANSWER]. The probability distribution function is the first

derivative of the cumulative distribution function.

TRUE.

3. [TRUE/FALSE/NO ANSWER]. For two correlated random variables, X and Y ,

ErXY s “ ErXsErY s.

FALSE.

4. [TRUE/FALSE/NO ANSWER]. The normal distribution has slightly positive excess

kurtosis.

FALSE.

5. [TRUE/FALSE/NO ANSWER]. A random variable, X, that is Poisson distributed

is assumed to have the same mean and variance.

TRUE.

6. [TRUE/FALSE/NO ANSWER]. A Cholesky decomposition transforms a matrix into

the product of a lower triangular matrix and its transpose.

TRUE.

7. [TRUE/FALSE/NO ANSWER]. OLS assumes that regressors are stochastic.

FALSE.

8. [TRUE/FALSE/NO ANSWER]. An ARMA model has both an autoregressive component and a moving average component.

TRUE.

9. [TRUE/FALSE/NO ANSWER]. The no-arbitrage condition in models prevents an

investor from profiting if the value of her portfolio was zero in the previous period.

TRUE.

10. [TRUE/FALSE/NO ANSWER]. An alternative expression for the variance of a random variable is ErXs2 ´ ErX 2 s.

FALSE.

A

A.1

Critical values for Student’s t-distribution

t-table

0.010

0.025

0.050

0.100

0.900

0.950

0.975

0.990

t10

´2.76

´2.23

´1.81

´1.37

1.37

1.81

2.23

2.76

t100

´2.36

´1.98

´1.66

´1.29

1.29

1.66

1.98

2.36

t1,000

´2.33

´1.96

´1.65

´1.28

1.28

1.65

1.96

2.33

Source: Miller (2013).

N

´2.33

´1.96

´1.64

´1.28

1.28

1.64

1.96

2.33

B

Equations and Definitions

Note that you must be able to understand the equations below without any additional context.

You are assumed to have enough familiarity with each concept that the equations do not require

variable definitions.

B.1

Returns

• Simple Return: Rt “

Pt ´Pt´1

Pt´1

• Log Return: rt “ lnp1 ` Rt q

• Simple Interest Rule: V ptq “ p1 ` trqP

• Continuous Compounding: V ptq “ etr P

• Effective Rate: p1 `

B.2

n!

k!pn´kq!

• P pn, kq “

n!

pn´kq!

• px ` yqn “

řn

`n˘

k“0

k

xn´k yk

Geometric Series

• S“

ř8

• S“

řn´1

B.4

“ 1 ` re

Combinatorics

• Cpn, kq “

B.3

r m

q

m

i“0

i“0

δi Ñ

1

1´δ

δi Ñ

1´δ n

1´δ

Probability

• P rr1 ă X ă r2 s “

şr2

f pxqdx “ p

şα

• CDF: P rX ď αs “ F pαq “ ´8 f pxqdx

ř

• Conditional Probability: P rY s “ ni“1 P rY |xi sP rxi s

B.5

r1

Statistics

şxmax

• Expectation (CRV): µ “ xmin

xf pxqdx

şxm ax

• Variance (CRV): σ 2 “ xmin

px ´ µq2 f pxqdx

• Sample Skewness:

• Sample Kurtosis:

n

pn´1qpn´1q

řn

i“1 p

npn`1q

pn´1qpn´2qpn´3q

xi ´µ̂ 3

q

σ̂

řn

i“1 p

xi ´µ̂ 4

q

σ̂

B.6

Distributions

• Uniform: P rX “ xs “

1

b´a

• Binomial: P rK “ ks “

• Poisson: P rX “ ns “

#

• Triangular: f pxq “

• Beta: f pxq “

B.7

for all x P ra, bs. Otherwise, 0.

`n˘

k

pk p1 ´ pqn´k

λn ´λ

e

n!

2px´aq

pb´aqpc´aq

2pb´xq

pb´aqpb´cq

1

xa´1 p1

Bpa,bq

aďxďc

căxďb

´ xqb´1

0ďxď1

Hypothesis Testing

• Chebyshev’s Inequality: P r|X ´ µ| ě nσs ď

1

n2

• Value at Risk: P rL ě V aRγ s “ 1 ´ γ

• Expected Shortfall: ErL|L ě V aRγ s

B.8

Matrix Algebra & Vector Spaces

• Orthogonality: v1 ¨ v2 “ 0.

• Linear Independence: c1 v1 ` ... ` cn vn “ 0; only solution is c1 “ ... “ cn “ 0.

B.9

Linear Regression

• Univariate Regression Intercept: α̂ “ Ȳ ´ β̂ X̄

• Univariate Regression Slope: β “

řn

i“1 xi yi ´nȲ X̄

ř

n

2

2

i“1 xi ´nX̄

• Multivariate Regression: β̂ “ pX 1 Xq´1 X 1 Y

t´1

• Adjusted-R2 : 1 ´ p1 ´ R2 q t´n

B.10

Time Series Models

• Reformulated AR(1): rt “ θµ ` p1 ´ θqrt´1 ` ϵt .

2

2

• GARCH: σt2 “ α0 σ̄ 2 ` α1 σt´1

u2t´1 ` βσt´1