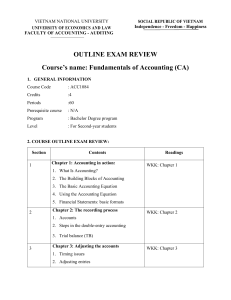

ACC201 PRINCIPLES OF ACCOUNTING Unit Guide AK49 Trimester 2 2023 - 2024 ACC201_PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 CONTACTS Unit Instructor Assoc.Prof Doan Anh Tuan Email: tuandoan@isb.edu.vn Ms. Nhung Nguyen Email: nhung.nguyen@isb.edu.vn Program Administrator An Nguyen 279 Nguyen Tri Phuong, Ward 5, District 10, HCM Phone: 08 54465555 Email: an.nguyen@isb.edu.vn I. About Principles of Accounting (ACC201) UNIT OVERVIEW Accounting is the practice of recording, classifying, summarizing, analyzing and interpreting information of an economic nature for the purpose of helping people make decisions. In the world of business, the role of accounting is to support management in providing timely and accurate financial information about the business so that informed decisions can be made. This unit examines some of the basic rules and principles underpinning financial accounting, as well as studying the practical uses of the information supplied through the accounting process. PRE-REQUISITES None Page | 1 ACC201 PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 II. Assessment Information UNIT LEARNING OUTCOMES The table below outlines the unit learning outcomes (ULOs) for this unit. Upon completion of this unit, students will be able to: 1. Explain the role of accounting in business 2. Understand the meanings of key accounting terms 3. Identify and understand the use of different accounting records 4. Outline key accounting principles and standards 5. Complete analysis charts and record transaction details from journal to ledger 6. Interpret and make simple corrections to a trial balance 7. Explain the difference between cash and accrual accounting methods 8. Construct basic financial statements 9. Analyze and interpret financial statements PROGRAM LEARNING OUTCOMES In line with its focus on assuring students’ skills in unit learning outcomes 1-7 above, this unit is also responsible for introducing/developing/assuring the following program-level learning outcomes (PLOs): Knowledge & Application 1. 2. 3. 4. Solid understanding and competency of appropriate application of business disciplinespecific knowledge. Teamwork Effective collaboration in teamwork or other tasks in organizational settings. Critical thinking Critical thinking through appropriate observing, analyzing and reasoning, etc. Problem solving Effective and constructive problem solving. Page | 2 ACC201 PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 ASSESSMENT SUMMARY Assessment tasks are an integral part of the learning framework. Assessment tasks are designed to measure student progress in achieving unit learning outcomes. ASSESSMENT TYPE DUE WEIGHT (%) LEARNING OUTCOMES ASSESSED 1. In-class participation & discussion (Group) Students are assigned in groups and required to complete in-class discussion as well as practice exercises each week. Each week 15 % ULO1-9 PLO1-4 2. Mid-term exam (Individual) Close-book exam. Chapters covered 1,2,3,4,5,6 Week 7 20 % ULO1-8 PLO1,3,4 3. Group Assignment Students are assigned in groups and required to complete a given case study. Week 11 15 % ULO1-9 PLO1-4 4. Final exam (Individual) Close-book exam: combination of multiple choice, theoretical and practical questions; all topics are examined. TBA 50 % ULO1-9 PLO1,3,4 Final marks and grades are subject to confirmation by the School Assessment Committees which may scale, modify or otherwise amend the marks and grades for the unit, as may be required by University policies. Note: To successfully complete this unit, students must: ▪ ▪ ▪ Achieve a minimum of 50 marks. Complete all assessment items; and Attend 80 percent of class time. See attendance requirements in the section of class policies and rules below. Page | 3 ACC201 PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 ASSESSMENT TASK DETAILS Assessment title In-class participation & discussion (15%) Purpose and description Purpose: Part of active student learning, this assessment tests students’ engagement to acquire knowledge across all topics in the unit, and their ability to discuss and debate, apply and communicate that knowledge to solve problems. Description: Key slides preview and further guidance and illustration will be provided, as well as pre-prepared problems and questions will be discussed in class, therefore, active participation is compulsory to achieve 20% of this assessment. Assessment length Varies from week to week. Criteria to grade quality The following criteria will be used to assess the percentage of participation & discussion during class: - Attendant - Homework submission - Participation in in-class activities - Completed given problem sets Completed in class and submitted via Google Form Completed in class. Some evidence of preparation may be collected in class and returned the following week. Staff and peer feedback provided in class as problems and cases discussed. Submission method Return method Feedback provided Assessment title Mid-term exam (20%) Purpose, description and topics covered Purpose: This exam provides students with an opportunity to demonstrate their understanding of the topics covered in Chapter 1,2,3,4,5,6. Description: This exam will be held during Week 5. You must attend the lecture in which you are enrolled to take this assessment. You should be prepared to complete recording journal entries, adjusting entries, geneal ledger as well as preparing financial statements, including balance sheet, income statement, owner’s equity statement, trial balance. Students are also required to complete transactions for merchandising operations and calculation of inventory cost by using cost flow methods. This is a close-book assessment. Assessment length TBA Page | 4 ACC201 PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 Criteria to grade quality The following criteria will be used to assess the exam papers: 1. Correct answers to the questions. 2. Demonstrated discipline knowledge - understanding of theories, concepts and frameworks. Submission method In-class assessment in Week 5 of the semester. Return method Written feedback will be provided to each student. All the results will appear on www.e-learning.isb.edu.vn Feedback provided The report will summarise marks awarded for each correct answer to the provided questions. Assessment title Group Assignment (15 %) Purpose, description and topics covered Purpose: Group work is a valuable mechanism for assisting students to develop collaborative and leadership skills. Description: Students will be divided into small groups. Each group is required to prepare and present an answer to an assigned case study. The presentations for the case studies must be delivered in WEEK 9 seminar and be of 10-15 minutes duration. You may use the overhead projector, PowerPoints or whiteboard in your presentation. Each member should have something to say during the presentation. Each student's mark will be his/her group assignment mark weighted by his peer evaluation score. All the members in the team should complete the “PEER AND SELF ASSESSMENT OF TEAMWORK” form separately, which is available on E-learning. Team members do not necessarily receive the same mark. Assessment length Criteria to grade quality Submission method Assignment task will be given in Week 6 of the semester. All written reports and presentations are due in Week 9. 1. 2. 3. 4. 5. Teamwork Criterion (check details on Moodle) Contributions to group meetings Leadership Fostering teamwork Presentation of a convincing argument Individual contribution to achievement of outcomes Online Submission via e-learning Each member in the team should complete the “PEER AND SELF ASSESSMENT OF TEAMWORK” form separately. All need to be submitted to the Submission Box on E-Learning. Return method Immediate feedback will be given after the presentation and results will appear on www.e-learning.isb.edu.vn Feedback provided The report will summarise marks awarded for presentation. Page | 5 ACC201 PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 Assessment title Final examination (50 %) Purpose, description and topics covered Purpose: Final examination provides students with an opportunity to demonstrate their understanding of unit-related material covered during the semester. Description: A two-hour final examination for this unit will be held during International School of Business Examination period. The questions for the final examination will be sourced from any of the topics covered during the term of the unit. The structure of the final examination will be provided in the week prior to the examination date. This is a close-book examination. Topics to be covered: All chapters Assessment length Criteria to grade quality TBA The following criteria will be used to assess the exam papers: 1. Correct answers to consolidation worksheet entries 2. Demonstrated discipline knowledge - understanding of theories, concepts and frameworks. Submission method - Return method N/A Feedback provided There will be no formal feedback. Page | 6 ACC201 PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 III. Teaching Activities DELIVERY AND RESOURCES Classes ▪ This unit provides 15 sessions (12 x 3 hours Senior Lecturer and 5 x 3 hours Tutor) Textbook ▪ Weygandt J.J., Kimmel P.D.& Kieso D.E. (2020). Accounting Principles (14thed.).John Wiley & Son (Asia) Pte Ltd. International student version. Reference books E-library ▪ Not Applicable http://search.proquest.com/login Username: UEHCMC2010 Password: thuvien0810 E-learning https://e-learning.isb.edu.vn/ Referencing requirements Student assignments are to contain original content created by the students. Assignments will be rejected if they include plagiarised content or contain excessive amounts of quoted/cited material and minimal original content. Students will receive a grade of ZERO (0%) for any assignments rejected for this reason. Written assignments WILL BE RANDOMLY checked by the lecturer with Turnitin.com, an online plagiarism-checking tool. Furthermore, your reference to support your statements must be from a reliable source, such as textbooks, additional reading materials, and reference books. However, many websites are not reliable sources. Examples are Wikipedia.org, about.com, and ask.com. If you are not sure if a reference is acceptable or not, please contact the lecturer. The Publication Manual of the American Psychological Association (APA) 6th ed. will serve as the primary reference materials for all students. Therefore, all papers must be submitted in APA format. The mechanics of student papers and work will be evaluated, as well as the content. It is imperative that guidelines be reviewed before an assignment is begun. It is also important that the required submission format be followed in compiling the final paper or assignment. Page | 7 ACC201_PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 SCHEDULE OF ACTIVITIES WEEK SESSION PEDAGOGICAL METHOD THRESHOLD CONCEPT ENGAGED TOPIC COVERED Chapter 1 Accounting in Action 1 1 - Lecture Chapter 2 The Recording Process - 2 2 Lecture Chapter 3 Adjusting the Accounts - Accounting Process Users of Accounting Information Accounting Conventions: Ethics, Principles and Assumptions Accounting equation and its components Effect of business transactions on the accounting equation Different types of Financial Statements and how to prepare them. Introduction to Debit and Credit rules General Journal: indicate how a journal is used in the recording process General Ledger: explain how a ledger and posting help in the recording process Prepare a Trial Balance Fiscal vs Calendar Years Cash vs Accrual Accounting: explain the accrual basis of accounting and the reasons for adjusting entries. Adjusting Entries: prepare adjusting entries for Deferrals and Accruals Describe the nature and purpose of an Adjusted Trial Balance. Qualities of Financial Information WEEKLY READING & ACTIVITIES WKK: Chapter 1 WKK: Chapter 2 WKK: Chapter 3 Page | 8 ACC201 PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 3 3 4 Tutorial Lecture Practical #1 Chapter 4 Completing the Accounting Cycle - Key Review of Chapter 1,2,3 Problems & Exercises - Prepare a worksheet Closing Entries: prepare Closing Entries and a Postclosing Trial Balance Correcting Entries Explain the steps in the accounting cycle Identify the sections of a Classified Balance Sheet - Chapter 5 Merchandising Operations 5 Lecture - Describe Merchandising Operation and Inventory system. Introduction to Perpetual vs Physical Inventory system. How to record under Perpetual & Physical Inventory system Prepare Multi-step and Single-step Income Statements WKK: Chapter 1 H/W: WKK: Chapter 1: E1-6, E1-7, P14A WKK: Chapter 2 H/W: WKK: Chapter 2 –P2-1A, P2-2A WKK: Chapter 3 H/W: WKK: Chapter 3 –E3-3, E3-10 H/W: WKK: Chapter 3 –E3-7 WKK: Chapter 4 WKK: Chapter 5 Page | 9 ACC201 PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 Chapter 6 Inventories 6 - 4 7 Tutorial Practical #2 - Discuss how to classify and determine Inventory: ownership, terms of sale Apply Inventory cost flow methods and discuss their financial effects: FIFO, LIFO, Average Cost (focused on Perpetual rather than Periodic) Indicate the effects of Inventory errors on the Financial Statements Key Review of Chapter 4,5,6 Problems & Exercises WKK: Chapter 6 WKK: Chapter 4 H/W: WKK: Chapter 4 –E4-1, E4-2 H/W: WKK: Chapter 4 – P4-1A WKK: Chapter 5 H/W: WKK: Chapter 5 –E5-1, E5-9, Ẹ5-10 H/W: WKK: Chapter 5 –P5-1A WKK: Chapter 6 WKK: Chapter 6 – E6-4, E6-7 WKK: Chapter 6 – E6-11, E6-14 MID-TERM EXAM 5 Chapter 9 Accounting for Receivables 6 8 Lecture Chapter 10 Plant Assets, Disposal of Plant Assets - How companies recognize, record, value and dispose Accounts Receivable. How companies recognize, record, value and dispose of Notes Receivable. Recognition and recording of Plant Expenditures/ PPE (Property, Plant & Equipments). Capital vs Revenue Expenditure. Valuation of PPE based on depreciation methods. WKK: Chapter 9 Group Assignment Available WKK: Chapter 10 Page | 10 ACC201 PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 - How to account for the disposal of Plant Assets. (discard, trade and exchange) How Plant Assets are reported and analyzed 7 9 8 10 11 Tutorial Practical #3 Lecture Chapter 17 Statement of Cash Flows Lecture Chapter 18 Financial Statement Analysis - Key Review of Chapter 9&10 Problems & Exercises - Discuss the usefulness and format of the Statement of Cash Flows Prepare a Statement of Cash Flows using the indirect method. Prepare the worksheet Analyze the Statement of Cash Flows. - Apply horizontal and vertical analysis to Financial Statements. Analyze a company’s performance using ratio analysis. 9 12 10 Tutorial Practical #4 - Key Review of Chapter 17&18 Problems & Exercises WKK: Chapter 9 HW WKK: Chapter 9 – E9-1, E9-4, E96 WKK: Chapter 10 H/W WKK: Chapter 10 – E10-4, E10-7 WKK: Chapter 17 WKK: Chapter 18 Group Assignment Submission WKK: Chapter 17 H/W: WKK: Chapter 17 – E17-2, E175, E17-7 WKK: Chapter 18 H/W: WKK Chapter 18 – E18-1, E182, E18-3 Revision Week – All Chapters Page | 11 ACC201_PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 TUTORIALS Tutorials following the lecture in each session provide students the opportunity to apply and share knowledge by doing a variety of in-class activities individually or in group such as exercises, discussion, and presentation. These activities focus on demonstrating your skills and help you build your ability to achieve the learning outcomes for this unit. Practical questions/exercises will be provided in class. You will be expected to have completed specific reading and exercises from the textbook and other required materials prior to attending each lecture and practicals class. If you have not prepared adequately, you will not get the full benefit from this learning opportunity. Attendance at Practicals are COMPULSORY to receive a full grade for the in-class exercises. Absentees will receive marks penalty for absence at these sessions. ADDITIONAL UNIT INFORMATION Referencing Plagiarism Student assignments are to contain original content created by the students. Assignments will be rejected if they include plagiarised content or contain excessive amounts of quoted/cited material and minimal original content. Students will receive a grade of ZERO (0%) for any assignments rejected for this reason. Written assignments WILL BE checked by the lecturer with Turnitin.com, an online plagiarism-checking tool. Sources Furthermore, your reference to support your statements must be from a reliable source, such as textbooks, additional reading materials, and reference books. However, many websites are not reliable sources. Examples are Wikipedia.org, about.com, and ask.com. If you are not sure if a reference is acceptable or not, please contact the lecturer. Referencing & Citation The Publication Manual of the American Psychological Association (APA) 6th ed. will serve as the primary reference materials for all students. Therefore, all papers must be submitted in APA format. The mechanics of student papers and work will be evaluated, as well as the content. Attendance Students are required to attend a minimum of 80% of all classes (which normally 12/15 sessions). Other cases equating to an absence: ▪ ▪ ▪ Arriving to class late by 15 minutes at the beginning, Arriving late by 5 minutes after the break Leaving prior to the scheduled end time without the permission of the lecturer If you are unable to attend any session, please let your lecturer know AND submit a request for absence form to program administrator prior to the session. Page | 12 ACC201 PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 MPORTANT: Students will not be allowed to sit in the final examination if violating the above absence rule. Electronic devices are not allowed: ▪ Cell phones will be turned off or switched to vibrate mode before class starts. ▪ No phone calls or text messaging are allowed inside classroom during class time. ▪ Portable listening and/or music devices may not be operated in the classroom. IMPORTANT: If you are in violation of these policies you will be excused from class and an absence will be assessed. Grades Final marks and grades are subject to confirmation by the ISB Examinations Committee which may adjust, modify or otherwise amend the marks and grades for the unit, as may be required by SIBT policies. SIBT’s Examinations Committee has a set of guidelines on the distribution of grades across the range from Fail to High Distinction. Final results will include a grade. Grade Range Description HD High Distinction 8.5 -10 Complete and comprehensive understanding of the unit content; development of relevant skills to a comprehensive level; demonstration of insight in interpretation, analysis and intellectual initiative; and achievement of all major and minor objectives of the unit. D Distinction 7.5-8.4 Very high level of understanding of the course unit; development of relevant skills to a very high level; demonstration of a very high level of interpretive and analytical ability and intellectual initiative; and achievement of all major and minor objectives of the unit. CR Credit 6.5-7.4 High level of understanding of unit content development of relevant skills to a high level; demonstration of a high level of interpretive and analytical ability; and achievement of all major objectives of the unit; some minor objectives not fully achieved. P Pass 5.0-6.4 Adequate understanding of most of the basic unit content; development of relevant skills to a satisfactory level; adequate interpretive and analytical ability; and achievement of most of all the major objectives of the unit; some minor objectives not achieved. Page | 13 ACC201 PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 F Fail S Satisfactory W Withdrawn 0-4.9 An unsatisfactory quality of performance or standard of learning achievement. There was evidence of achievement of desired learning outcomes below the passing standard. 5.0-10 Provides evidence of achievement of the learning outcomes, within the context of a Pass/Fail unit. Withdrawal from a unit prior to the academic census date. This is NOT counted as failure but is an administrative record of a student’s initial enrolment in this unit. It is not included in GPA calculations. WF Withdrawn Fail Withdrawal from a unit after the academic census date with academic penalty. EX Exempt Recognition of prior learning resulting in an exemption from undertaking the unit. FA Fail Absent Required assessment tasks within the unit are not completed and the student has not withdrawn. It is included in the GPA calculation. Note that your raw coursework and exam scores cannot be used directly to calculate your standardized mark or to determine your final grade. The process of assigning grades involves moderating the performance indicated by your raw scores against the academic standards. Email etiquette Your lecturers receive many emails each day. In order to enable them to respond to your emails appropriately and in a timely fashion, students are asked to follow basic requirements of professional communication. Your emails should: ▪ ▪ ▪ Have a concise and descriptive title, including the class and name of the unit you are enquiring about Be clear about the intention of their emails Use appropriate tone and language, proof-read what is written in the email before sending it. Students should also allow 3-4 working days for a response before following up. If the matter is legitimately urgent, you may indicate “URGENT” in the email subject header. Make an appointment: If your email request is complex and requires a lengthy response it may be probably best to make an appointment with your lecturer/instructor to meet in person. Student behaviour guidelines Page | 14 ACC201 PRINCIPLES OF ACCOUNTING TRIMESTER 2. 2023-2024 Everyone must behave professionally. Students are expected to demonstrate respect for teacher and fellow students at all times. Behaviour that is disruptive to a positive learning environment reported to the teacher will result in a warning on the first instance; the second instance might result in a failing grade along with expulsion from the school. Unacceptable behaviors can be: ▪ ▪ ▪ ▪ ▪ Cheating on an exam Collaborating with others on work to be presented, if contrary to the stated rules of the course Submitting, if contrary to the rules of the course, work previously submitted in another course Knowingly and intentionally assisting another student in any of the above actions, including assistance in an arrangement whereby work, classroom performance, examination, or other activity is submitted or performed by a person other than the student under whose name the work is submitted or performed Plagiarising IMPORTANT: ▪ ▪ First violation will result in a grade ZERO (0%) for that assignment. Second violation will result in a failing course grade. Disability support services Students with disabilities are advised that accommodations and services are available at UEH-ISB. It is the student's responsibility to contact UEH-ISB office and submit appropriate documentation prior to receiving such services. Additional information This unit guide may be revised at the discretion of the Academic Department with approval from Program Academic Director and School Academic Committee where appropriate. Page | 15