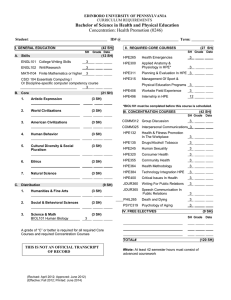

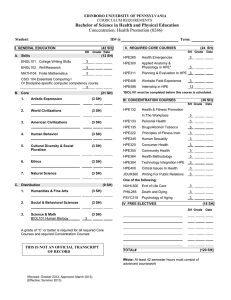

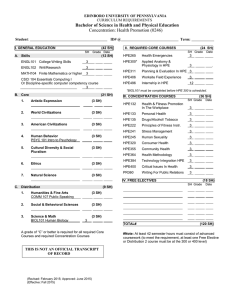

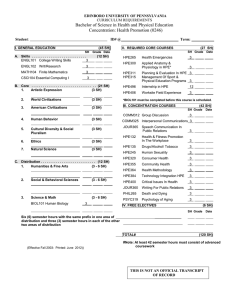

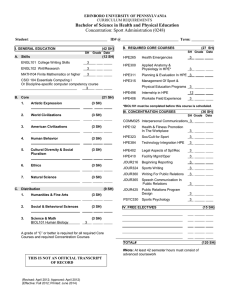

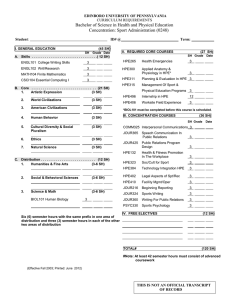

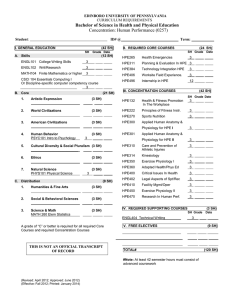

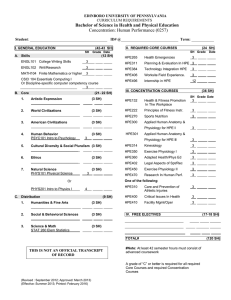

Student ID: @00611084 Effective word count: 3143 1 Executive summary Digitalisation and progressive development of the IT sector, the key enablers of global sourcing, broke down geographical boundaries by enabling better global connectivity. The later enabled Small and Medium enterprises to act independently and to source globally, limited only by their entrepreneurship skills. The paper is built on web-based research methods of open sources that enabled a partial insight into Hewlett Packard Enterprise organisational structure, a corporate tech giant that orients its strategy toward producing cutting-edge software and hardware components. The company's product portfolio represents the latest commodities in the IT sector that enable networking, data storage and data analysis, cloud services and edge computing. The company is B2B oriented and seizes a considerable global market share. The purpose and aim of this research are to familiarise the reader with the company, their commodity portfolio, possible business process deficiencies and probable strategies that could enhance the company's business process. 2 Table of Contents 1. Introduction ........................................................................................................................ 5 2. Hewlett Packard Enterprise ................................................................................................ 6 3. 2.1. Hewlett Packard Enterprise Revenue Breakdown .................................................... 10 2.2. Procurement requirements......................................................................................... 11 2.3. Kraljic Portfolio matrix ............................................................................................. 14 2.4. The Bensaou model ................................................................................................... 16 2.5. HPE core products ..................................................................................................... 18 2.6. Supply chain sustainability ....................................................................................... 18 2.7. Supply chain resilience and capacity ........................................................................ 19 Path to procurement excellence ........................................................................................ 20 3.1. The inventory cost ‘creeps on’ .................................................................................. 20 3.2. E2open inventory management ................................................................................. 20 3.3. Improvement of overall business process ................................................................. 21 4. Conclusion ........................................................................................................................ 22 5. List of references .............................................................................................................. 24 3 List of figures Figure 1. Fragment of the HPE organisational structure chart (Official Board, 2021). .......... 8 Figure 2. Hewlett Packard Enterprise Raw Materials chart (YCharts, 2021a). ....................... 9 Figure 3. Microsoft Corp Raw Materials chart (YCharts, 2021b). ......................................... 10 Figure 4. HPE annual breakdown by business segment (Craft, 2021). .................................. 10 Figure 5. HPE annual breakdown by geographic segment (Craft, 2021). .............................. 11 Figure 6. NVIDIA P40 24GB Computational Accelerator for HPE (HPE, 2021c). ............... 12 Figure 7. HPE XP7 Storage (HPE, 2021d). ............................................................................ 12 Figure 8. HPE ProLiant DL180 Gen10 server (HPE, 2021f). ................................................ 13 List of tables Table 1. Kraljic portfolio matrix of HPE items (adopted from Kraljic, 1983). ....................... 15 Table 2. Bensaou contextual profiles of HPE items (adopted from Baily et al., 2015). .......... 17 4 1. Introduction Global sourcing as a set of coordinated activities undertaken by a company or a conglomerate can give the organisation a competitive advantage in several key elements of the business process. "Some of the benefits of the global sourcing in regards to the business process can be seen as a reduction of cost of ownership and cycle-time, improved quality and volume availability of the product, higher possibility of countertrade due to the geopolitical position of the parties involved et cetera" Baily et al. (2015). "Global sourcing has become one of the most significant trends across industries and countries in the past few decades", argue Kenney et al. (2009). "The trend has taken momentum on the worldwide scale notably in the U.S. wherein 2000 10% of the firms were engaged in global sourcing activities, and by 2007 that number has risen to 50%" Lewin and Couto (2007). Although the main driver of global sourcing is of an economic nature, i.e., a search for higher profits and cost efficiencies, the key drivers would be improved global connectivity and digitalisation, which strengthens and consolidates the global supply chain. Whilst global sourcing is more characteristic for larger enterprises example, Apple, Jaguar Land Rover, IBM, Hewlett-Packard Enterprise, Starbucks, Toyota, Samsung Electronics, et cetera; it can be dexterity of Small and Medium Enterprises (SME). One example of SME global sourcing is Rimac Automobili, a small automotive company from Croatia. In 2011, while the company counted only 20 employees with Mate Rimac as CEO, the company produced the fastest electric hypercar in the world (100 km/h (0–62 mph) in 2.5 seconds), the Concept One. "The wheels for the Concept were supplied by HRE Performance wheels but developed in collaboration with Rimac Automobili designers. The partnership continued in Concept Two's production, the electric hypercar released in 2017" HRE Wheels (2018). 5 The strategy and approach that Rimac Automobili used in the development of this particular item are consistent with the research that argues that "when a company evolves to the highest level, it proactively integrates and coordinates common items, processes, designs, technologies and suppliers across worldwide purchasing centres and with other functional groups" Trent and Monczka (2003). Although Rimac Automobili attracted Porsche, Camel Group and Hyundai Motor Group's attention, there is a scarcity of available information that hinders proper research and critical review of the company. 2. Hewlett Packard Enterprise One of the corporate tech giants that reap global sourcing benefits is Hewlett-Packard Enterprise (HPE), a multinational enterprise information technology company located in Houston, Texas. "The company was founded on January 1, 1939, by William R. Hewlett and David Packard, two recent electrical-engineering graduates of Stanford University" Hall (2019). "HPE started experimenting with offshore sourcing back in 1963 when the company, then called HP, partnered with Sony and the Yokogawa Electric companies in Japan to develop several high-quality products" Internet Archive (2003). Birou and Fawcett (1993, p.29) define Strategic Global Sourcing (SGS) as "coordination and integration of procurement requirements across worldwide business units, looking at common items, processes, technologies and suppliers". If the above-mentioned definition of SGS is aligned with the business process of HPE, a Multinational Company (MNC), the following linkages that identify HPE global sourcing strategy can be adopted; 6 - "95% of HPE's procurement expenditures for materials, manufacturing, and assembly is being sourced from 33 global suppliers that come from 12 countries, but notably the U.S. and China. This list includes final assembly suppliers, which may include contract manufacturers, electronic manufacturing service providers, and original design manufacturers, as well as commodity and component suppliers" HPE (2021a). - "HPE has 317 executives and 56 subsidiaries which are located globally according to the company's strategic objectives" Official Board (2021). - from the above-mentioned facts, it is evident that HPE purses a centralised/decentralised global sourcing strategy through cross-functional business teams integrated into the organisational structure that stream the company’s business strategy through globally dispersed business units. This approach ensures HPE supply availability, more integration and control over the supply chain upstream, optimal prices through scale economies and volume, and quality level insurance. "Global operations and strategic procurement are positioned in N 3 tier directly under the Chief finance officer (CFO) who is positioned under in N 2 tier of the organisational structure, directly under the CEO of the company" Official Board (2021). Figure 1. presents a fragment of the HPE's organisation chart. - "HPE's portfolio contains various types of software and hardware products such as servers, data storage products, hybrid infrastructure, cloud services, edge computing services and networking equipment" HPE (2021a). - "In order to gain a competitive advantage over its competition, streamline its operations and to build a reliable supply chain, in the time frame from 2015 to 2019, through acquisition HPE successfully vertically integrated 15 high techs complimentarily firms" HPE (2021b). 7 - "In 2000 HP developed and implemented a mathematical model, business process, and software to measure and manage supply chain risks on the procurement side that has in the period of six years enabled the company to realise more than $425 million in cumulative cost savings" Nagali et al. (2008). This information might be outdated because, in 2015, the company Hewlett Packard (HP) split into HPE and HP Inc. Figure 1. Fragment of the HPE organisational structure chart (Official Board, 2021). Even though HPE is a large MNC and its business results indicate that its global sourcing strategy is effective, there are arguments that the strategy can be approved. HPE buys its raw material from several suppliers. “The statistical data shows that in last four years, the company has increased raw material inventory for 314.455% from 505 million U.S. $ to 1.588 billion U.S. $., and that the trend is rising” YCharts (2021a). Figure 2. depicts the amount of HPE’s capital that is tied up in raw material inventory. “The results from the SWOT analysis indicate that the company has relatively high days inventory in comparison to the competition, i.e., the company needs to raise more capital 8 to invest in the channel what can consequently have a negative impact on long term growth of Hewlett Packard Enterprise Company” Fon Fert University (2021). This fact contradicts one of the Just in Time (JIT) principle, which is “delivering materials directly to operations and virtually eliminating stock” Waters (2003, p.179). Figure 2. Hewlett Packard Enterprise Raw Materials chart (YCharts, 2021a). The fact that HPE's high day's inventory has an ascending curve might indicate that MNC is facing problems with the reliability of production, long lead time or/and dependability of supply. One of the MNC that represents HPE fierce competitor is MNC Microsoft. "In contrast to HPE, Microsoft has much less capital tied up in inventory" YCharts (2021a). Figure 3. depicts Microsoft's amount of capital that is tied up in raw material inventory. 9 Figure 3. Microsoft Corp Raw Materials chart (YCharts, 2021b). 2.1. Hewlett Packard Enterprise Revenue Breakdown The annual revenue breakdown of the company depicts that the company has been more oriented B2B data analytics software in the course of the past year 43.8% and that its overall revenue, 27 billion U.S. $ comes from the global sector that encompasses Europe, the Middle East and Africa, 36.1%” Craft (2021). Figure 4. HPE annual breakdown by business segment (Craft, 2021). 10 Figure 5. HPE annual breakdown by geographic segment (Craft, 2021). 2.2. Procurement requirements To have insight into what are HPE’s procurement requirements, one must know what products the company offers on the global market. “HPE’s portfolio covers various types of enterprise products, including servers, data storage products, hybrid infrastructure, edge computing services and networking equipment” IT Pro team (2020). “HPE has four first tiers suppliers that supply the company with server accelerators, i.e., components for HPE servers: NVIDIA Corporation (NVIDIA), INTEL Corporation, Advanced Micro Devices (AMD) and Xilinx. NVIDIA supplies HPE with a total of 29 components, i.e., Computational Accelerators for HPE ProLiant servers” HPE (2021c). 11 Figure 6. NVIDIA P40 24GB Computational Accelerator for HPE (HPE, 2021c). A widely known fact is that some of the above-mentioned HPE suppliers have their headquarters in the United States, but the manufacturing facilities are located globally, as are HPE offices and some of the subsidiaries. Hybrid Graphics Ltd. from Finland, Arm Ltd from the United Kingdom, and Mellanox Technologies Ltd. are just some of the companies acquired by NVIDIA that produce the company’s hardware, and the company has its manufacturing facilities located globally. “Some other global suppliers of commodity, components and final assemblies for HPE are Samsung Electronics, Sony Corporation, Hitachi, Ltd., Toshiba Corporation, Hon Hai Precision Industry Co. Ltd. (Foxconn) et cetera” HPE (2021a). Hitachi, Ltd. supplies HPE with underlying hardware and software, for HPE XP7 enterprise-class data storage platform” Raffo 2016. In the HPE suppliers list, Hitachi, Ltd. is listed as one of the HPE’s supplier of final assembly storage components” HPE (2021a). Figure 7. HPE XP7 Storage (HPE, 2021d). 12 Although it is difficult to find information regarding the origin of commodity and component suppliers because, from some perspective, they are perceived as industrial secret, a logical assumption can be drawn regarding manufacturers of commodity and components that are the integral parts of HPE’s hardware. For example, “Samsung Electronics from South Korea from Japan is on the list of HPE’s list of commodity and components suppliers” HPE (2021a). A well-known fact is that Samsung Electronics affiliate, Samsung SDI is one of the largest lithium-ion batterie manufacturers. “HPE hardware like HPE ProLiant DL180 Gen10 server has in its storage controller integrated a specific set of Smart Storage Batteries; one of the battery models is P408-ia lithium-ion battery” HPE (2021f). HPE R&D department design specifications had to be compatible with Samsung SDI engineers finished goods inventory, i.e., lithium-ion batteries to be integrated into the functional hardware. Figure 8. HPE ProLiant DL180 Gen10 server (HPE, 2021f). Compatibility of such a level of complexity existing in the three items listed above could not have been achieved if the sourcing personnel from HPE did not interact with the supplier on a global and regional/local level. “In the light of the above-mentioned facts, it is necessary to mention that to coordinate and oversee company’s global sourcing strategy, HPE has 317 executives and 56 subsidiaries that are located globally (mentioned before)” Official Board (2021). The alternative choice for HPE supplier for this specific hardware would be AMD with its flagship CPU “EPYC”. “AMD EPYC processors see much wider utilisation because of their performance specifications paired with a small price” ServerStore (2021). 13 Sourcing that would require the least effort and customisation would be sourcing racks for servers as there are many manufacturers on the market. “Liebert, APC and Kendall Howard are some of the server rack manufacturers” Server Racks Online (2021). From the above-mentioned facts, it is evident that HPE is pursuing a hybrid sourcing strategy by balancing global and regional/local sourcing. “Hybrid sourcing approach is undertaken by the creators of the overall company strategy with following objectives: costs reductions, higher quality, more efficiency, faster services and an increase in transparency, and is the indicator of the company’s higher maturity stage” Capgemini Consulting (2014). 2.3. Kraljic Portfolio matrix The previous section has described four items from the HPE portfolio that are being sourced according to its strategy. "By using 'procurement positioning' tool based on the Kraljic Portfolio matrix, the items' classification can be performed in four categories: non-critical, leverage, bottleneck, and strategic items. The category in which the item falls depends on the following criteria; - the reliability of the sources of supply; - the availability of the commodity or service required; - the degree of response by suppliers to the company's requirements; - the quality of the product in relation to the role it is required to fulfil" Baily et al. (2015). 14 Table 1. Kraljic portfolio matrix of HPE items (adopted from Kraljic, 1983). Kraljic Portfolio Matrix (KPM), illustrated in table 1. is a tool that qualifies the items according to four categories. “Another quantitative method for categorisation of the four above listed items is the Analytical Hierarchy Process (AHP) that would position the items more precisely within the Kraljic Portfolio Matrix (KPM)” Lee and Drake (2010). This research is limited by the availability of quantifiable data, i.e., in the concrete case, a number of items purchased in contract/period, the amount paid per item and market performance data that would enable calculation of the Single Attribute Values Function (SAVF) score in order to perform detailed item categorisation. 15 2.4. The Bensaou model “Bensaou suggests a framework for managing a portfolio of investments in alliance with four profiles; market exchange, captive buyer, captive supplier and strategic partnerships. For each of the mentioned profiles, the Bensaou model framework identifies distinguishing product” Baily et al. (2015). The items described in section 2.2. are in alliance with Bensaou model, presented in table 2. 16 Items that are subject of procurement Final assembly storage component for HPE XP7 enterprise class data storage platform NVIDIA P40 24GB Computational Accelerator P408-ia lithium ion battery for HPE ProLiant DL180 Gen10 server Intel Scalable Xenon Family Processor Server Racks Bensou buyer relationship profiles Strategic partnerships Product identification "Product characteristics High level of customisation required Tight mutual adjustments needed in key processes Strong engineering expertise required Market Characteristics Buyer maintains in-house design & testing capability Partner Characteristics Strong supplier proprietary technology Active in research and innovation (R&D costs) Strong recognised skills and capabilities in design, engineering and manufacturing" Baily et al. (2015, p. 278). Capital Buyer "Product characteristics Technical complicated Based on mature, well understood technology Market Characteristics Stable demand with limited market growth Concentrated market with few established players Supplier proprietary technology Few strongly established suppliers Supplier Characteristics Supplier proprietary technology Few strongly established suppliers" Baily et al. (2015, p. 278). Captive Supplier "Product Characteristics Technically complicated products Based on new technology (developed by suppliers) Important and frequent innovations and new functionalities in the product category Significant engineering effort and expertise required Heavy capital investments required Market Characteristics High growth market segment Fierce competition Few qualified players Unstable market with shifts between suppliers Supplier Characteristics Strong supplier proprietary technology Suppliers with strong financial capabilities and good R&D skills Heavy supplier dependency on the buyer and economic reliance on the IT tehnology sector in general" Baily et al. (2015, p. 278). Captive Supplier "Product Characteristics Technically complicated products Based on new technology (developed by suppliers) Important and frequent innovations and new functionalities in the product category Significant engineering effort and expertise required Heavy capital investments required Market Characteristics High growth market segment Fierce competition Few qualified players Unstable market with shifts between suppliers Supplier Characteristics Strong supplier proprietary technology Suppliers with strong financial capabilities and good R&D skills Heavy supplier dependency on the buyer and economic reliance on the IT tehnology sector in general" Baily et al. (2015, p. 278). Market Exchange "Product Characteristics Highly standardised products Mature technology Little innovation & rare design changes Technically simple products or well-structured complicated manufacturing process Low engineering effort and expertise required Market Characteristics Stable or declining demand Highly competitive market Many capable suppliers Supplier Characteristics No proprietary technology Low switching costs Low bargaining power Strong economic reliance on IT technology business" Baily et al. (2015, p. 278). Table 2. Bensaou contextual profiles of HPE items (adopted from Baily et al., 2015). 17 What is evident if we compare the Kraljic portfolio matrix and the Bensaou model is that categorisation in both methods perfectly aligns. The items categorised as Strategic in the Kraljic matrix are identified as items that require Strategic partnership; bottleneck items are in the capital buyer profile, leverage items are in captive supplier portfolios, and non-critical items in market exchange of the Bensaou model. 2.5. HPE core products Beside its hardware products like servers, data storage platforms and high-performance computing infrastructure, HPE advances in networking by performing a vertical integration. "In order to control its value or supply chain and maintain a competitive edge, on 3th of February 2015, HPE acquired Aruba Networks" HBE (2021b). Aruba Networks is the industry leader in wired, wireless and security networking solutions. "HPE Edgeline, the company's core service product in alliance with Aruba Networks resources and technologies, makes the company an industry leader in Edge computing" HPE (2021g). 2.6. Supply chain sustainability Regardless of the legal and cultural environments in which suppliers operate throughout the world, the HPE policy for supplier’s choice is consistent with the company’s ethical standards. “While performing supplier selection, HPE is performing the suppliers screening procedure in alliance with eight different policies that are in alliance with HPE supplier social and environmental responsibility (SER) requirements” HPE (2021h). These policies main objective is to navigate the supplier’s business process toward supply chain sustainability. 18 2.7. Supply chain resilience and capacity The other objective that HPE is pursuing in supplier management is the supplier capacity building program in alliance with Industry 4.0 principles. “HPE is working toward enhancement of supply chain resilience and efficiency through integration, optimization and automatization of manufacturing by using tools such as and Big data analytics, Industrial Internet of Things (IoT) and digital platforms” HPE (2017). 19 3. Path to procurement excellence A humble statement is to say that to purpose a global procurement strategy for a corporate tech giant like HPE from a single person perspective would be a challenging task. To start things off, one must search for deficiencies compared to other companies with the same characteristics and roughly the same qualitative and quantitate global market share. 3.1. The inventory cost ‘creeps on’ It is mentioned in chapter 2. that the company has a dynamic increase of raw material inventory. “The company’s revenue in 2020, as mentioned in the same chapter, was 27 billion U.S. $ and that the capital invested in raw material inventory at the current moment is 1.588 billion U.S. $” YCharts (2021a). The bitemporal data extracted from the open sources depict that HPE has 5.8815% of its yearly revenue invested in raw material inventory. “Raw material inventory is just one of five basic types of inventory which are; raw materials, work-in-progress, finished goods, components and sub-assemblies, and MRO supplies” Lysons and Farrington (2016). 3.2. E2open inventory management Waters (2003) argues that "the overall aim of the procurement is to guarantee that an organisation has a reliable supply of materials what can be achieved through following actions; an uninterrupted and timely flow of materials into an organisation, cross-departmental cooperation, improvement of supplier-buyer relationship, optimal quantitative and qualitative purchases at the right price, proper inventory management and through the establishment of Lean Supply Chain (LSC)." 20 HPE supply chain is vast and geographically dispersed, so, naturally, there will be some uncertainties through the supply chain that can, to a certain extent, cause disruption that can consequently lead to the 'bullwhip effect'. A possible solution to address this particular internal component of HPE Supply Chain Management (SCM) would be E2open Collaborative Inventory Management that has been, according to literature, proven in extremely large supply chains. "E2open Collaborative Inventory Management intelligent software enables supply chain optimisation, providing some of the following results: - real-time inventory visibility - 20-30% inventory reduction - 35% reduction in the cycle times - what-if scenario through multiple tiers - 30-50% improvement in inventory turns” E2open (2021). 3.3. Improvement of overall business process Incremental changes can be made at HPE if the overall company’s business process is perceived from a holistic perspective. Performance of metric and practice benchmarking at competitor level would give HPE guidelines toward procurement excellence. The companies that would serve as a benchmarking target would have to be HPE’s market competitors. “Some of the HPE’s competitors are Dell EMC, Cisco, NetApp, Lenovo, IBM, Huawei, Amazon, Oracle, Fujitsu and Juniper Networks” Owler (2021). “By performing first practice, and then metric benchmarking at competitor level, the company would first have to obtain an understanding of other processes and to benefit from 21 quick gains, and then follow up on results with metric benchmarking once a relationship and mutual benefits have been obtained” Graham, Shulver, and Johnston (2012, p.371). HPE’s benchmarking team would have to pay specific attention to inventory management as their business process seems to be the most vulnerable in this segment. Unlike the inventory management in section 3.2, this kind of benchmarking approach would cover vide spectre of internal and external components of the company’s business process, but the path toward improvement would be much longer. 4. Conclusion HPE is one of the salient players in the IT technology sector. The has company long years of heritage in the IT technology sector, and its orientation toward networking, cloud and storage technology and edge computing depicts that the company follows recent trends in IT development. The next step in company strategy would be further and more intense involvement in Blockchain technology as it is gaining more and more popularity on a global scale at an unprecedented rate. “HPE has already joined, the largest open-source Ethereum-based blockchain initiative, The Enterprise Ethereum Alliance (EEA)” Coincodex (2017). Blockchain technology is at the threshold between the infancy and growth stage, so the benefits from its applications are yet to be seen. The “black swan “event crippled all small and large-sized companies and HPE was not immune to it. A sharp rise in raw material inventory illustrated in section 2. depicts that the SCM management was compensating for the uncertainty caused by the event by increasing inventories. 22 Nevertheless, this research, albeit limited because of lack of information, depicts that HPE stays one of the market major players and will continue to hold this position. 23 5. List of references Baily, P., Farmer, D., Crocker, B., Jessop, D., and Jones, D. (2015). Procurement, Principles & Management. (11th ed.). Harlow. United Kingdom. Pearson Education UK Birou, L. M., and Fawcett, S. E. (1993). International purchasing: benefits, requirements, and challenges. International Journal of Purchasing and Materials Management, 29(2) Capgemini Consulting. (2014). “Don’t wait, go hybrid!” Hybrid Sourcing – Beyond Shared Services. Available at: https://www.capgemini.com/consulting-fr/wpcontent/uploads/sites/31/2017/08/cc_hybrid_sourcing_study.pdf (accessed 09 March 2020) Coincodex. (2017, October 24). Enterprise Ethereum Alliance Announces 48 New Members, including Hewlett Packard Enterprise. Available at: https://coincodex.com/article/65/enterprise-ethereum-alliance-announces-48-new-membersincluding-hewlett-packard-enterprise/ (accessed 13 March 2020) Craft. (2021). Hewlett Packard Enterprise [Image]. Available at: https://craft.co/hewlettpackard-enterprise (accessed 09 March 2020) Craft. (2021). Hewlett Packard Enterprise [Image]. Available at: https://craft.co/hewlettpackard-enterprise (accessed 09 March 2020) E2open. (2021). Collaborative Inventory Management. Available at: https://www.e2open.com/intelligent-applications/supply-management/inventorycollaboration/ (accessed 12 March 2020) 24 Graham, C., Shulver, M., and Johnston, R. (2012). Service operations management: Improving service delivery. (4th ed.) Pearson Education. Hall, M. (2019, April 29). Hewlett-Packard Company. Encyclopedia Britannica. Available at: https://www.britannica.com/topic/Hewlett-Packard-Company HPE. (2021a). Hewlett Packard enterprise suppliers. Available at: https://www.hpe.com/us/en/pdfViewer.html?docId=a00000377&parentPage=/us/en/about/hu man-progress/supply-chainresponsibility&resourceTitle=Hewlett+Packard+Enterprise+Suppliers+reference+guide (accessed 05 March 2020) HPE. (2021b). Acquisitions. Avaliable at: https://investors.hpe.com/financial/acquisitions (accessed 05 March 2020) HPE. (2021c). NVIDIA Accelerators for HPE. Avaliable at: https://buy.hpe.com/uk/en/options/server-accelerators/computational-graphics-acceleratorsfor-servers/computational-graphics-accelerators-for-proliant-servers/nvidia-accelerators-forhpe/p/4206249 (accessed 08 March 2020) HPE. (2021d). NVIDIA P40 24GB Computational Accelerator for HPE [Image]. Retrieved from:https://buy.hpe.com/uk/en/options/server-accelerators/computational-graphicsaccelerators-for-servers/computational-graphics-accelerators-for-proliant-servers/nvidiaaccelerators-for-hpe/nvidia-p40-24gb-computational-accelerator-for-hpe/p/Q0V80A (Accessed: 08 March 2021) HPE. (2021e). HPE XP7 Storage QuickSpecs. Retrieved from: https://h20195.www2.hpe.com/v2/GetPDF.aspx/c04272890.pdf (Accessed: 08 March 2021) 25 HPE. (2021e). HPE XP7 Storage [Image]. Retrieved from: https://h20195.www2.hpe.com/v2/GetPDF.aspx/c04272890.pdf (Accessed: 08 March 2021) HPE. (2021f). HPE ProLiant DL180 Gen10 Server QuickSpecs. Retrieved from: https://h20195.www2.hpe.com/v2/GetDocument.aspx?docname=a00021862enw (Accessed: 09 March 2021) HPE. (2021f). HPE ProLiant DL180 Gen10 Server [Image]. Retrieved from: https://h20195.www2.hpe.com/v2/GetDocument.aspx?docname=a00021862enw (Accessed: 09 March 2021) HPE. (2021g). HPE EDGELINE converged edge systems and ot link. Retrieved from: https://www.hpe.com/us/en/servers/edgeline-systems.html (Accessed: 10 March 2021) HPE. (2021h). HPE Sustainable Procurement Framework. Available at: https://psnow.ext.hpe.com/doc/a00070198enw?jumpid=in_lit-psnowred#:~:text=HPE%20Sustainable%20Procurement%20Framework%20Hewlett%20Packard% 20Enterprise%27s%20commitment,operations%20in%20a%20socially%20and%20environm entally%20responsible%20manner (Accessed: 11 March 2021) HPE. (2017, October 13). Four Ways to Future-Proof Your Supply Chain. Retrieved from: https://www.hpe.com/us/en/newsroom/blog-post/2017/10/four-ways-to-future-proof-yoursupply-chain.html (Accessed: 11 March 2021) HRE Wheels (2018, May 2). HRE Presents | Road to Rimac. Retrieved from https://www.youtube.com/watch?v=MszKNhe7XbI&feature=emb_logo (Accessed: 03 March 2021) 26 Internet Archive. (2003, June 27). Hp timeline — 1960s. Retrieved from: https://web.archive.org/web/20030627234507/http://www.hp.com:80/hpinfo/abouthp/histnfac ts/timeline/hist_60s.html (Accessed: 03 March 2021) IT Pro team. (2020, February 14). Everything you need to know about HPE. Retrieved from: https://www.itpro.co.uk/strategy/28233/everything-you-need-to-know-about-hpe (accessed 07 March 2020) JCharts. (2021a). Hewlett Packard Enterprise Co (HPE). Available at: https://ycharts.com/companies/HPE/raw_materials (accessed 07 March 2020) JCharts. (2021b). Microsoft Corp (MSFT). Available at: https://ycharts.com/companies/MSFT/raw_materials (accessed 07 March 2020) Kenney, M., Massini, S., and Murtha, T. (2009). Offshoring administrative and technical work: New fields for understanding the global enterprise. Journal of International Business Studies, 40(6): 887-900 Kraljic, Peter. (1983). Purchasing must become supply management. Harvard Business Review, 61(5), 109 Lee, D.M., Drake, P.R. (2010). A portfolio model for component purchasing strategy and the case study of two South Korean elevator manufacturers. Int. J. Prod. Res. 48 (22), 6651–6682 Lewin, A., and Couto, V. (2007). Next generation offshoring: the globalization of innovation. Durham, NC: Duke University CIBER/Booz Allen Hamilton Lysons, K. and Farrington, B. (2016). Procurement and Supply Chain Management (9th ed.). Harlow: Pearson Education Limited 27 Nagali, V., Hwang, J., Sanghera, D., Gaskins, M., Pridgen, M., Thurston, T., and Shoemaker, G. (2008). Procurement risk management (PRM) at Hewlett-Packard company. Interfaces, 38(1), 51-60 Official Board. (2021). Hewlett Packard Enterprise. Available at: https://www.theofficialboard.com/org-chart/hewlett-packard-enterprise-2 (accessed 03 March 2020) Official Board. (2021). Hewlett Packard Enterprise [Image]. Retrieved from https://www.theofficialboard.com/org-chart/hewlett-packard-enterprise-2 Owler. (2021). HPE top competitors or alternatives. Available at: https://www.owler.com/company/hpe (accessed 12 March 2020) Raffo, D (2016, October 25). HPE launches new XP7 based on Hitachi technology. Available at: https://searchstorage.techtarget.com/blog/Storage-Soup/HPE-launches-new-XP7-basedon-Hitachi-technology (accessed 08 March 2020) Rimac Automobili. (2011, September 13). Available at: https://www.rimacautomobili.com/media/press-releases/the-concept_one-world-debut-at-frankfurt-motor-show/ (accessed 03 March 2020) Server Racks Online. (2021). Server Racks & Accessories by Manufacturer. Available at: https://www.server-rack-online.com/server-racks.html (accessed 10 March 2020) 28 ServerStore. (2021). AMD EPYC Servers. Available at: https://www.serverstore.com/servers/amdepyc/#:~:text=AMD%20EPYC%20Servers%20AMD%20EPYC%20are%20the%20latest,ex cellent%20contender%20against%20Intel%20in%20price%20per%20performance (accessed 10 March 2020) Trent, R.J. and Monczka, R.M. (2003). Understanding integrated global sourcing. International Journal of Physical Distribution & Logistics Management, 33 (7), pp. 607-629 Waters, D. (2003). Logistics an introduction to supply chain management (1th ed). Basingstoke: Palgrave Macmillan 29