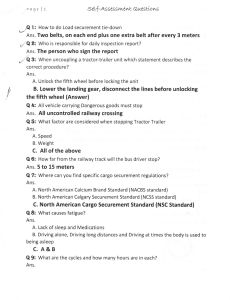

ilide.info-financial-management-3-autorecovered-pr 1fed2e4fd36d12b416adb85a51420fba

advertisement