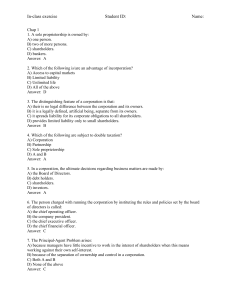

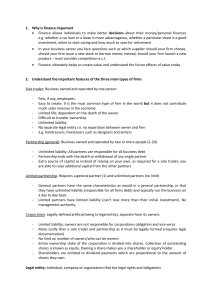

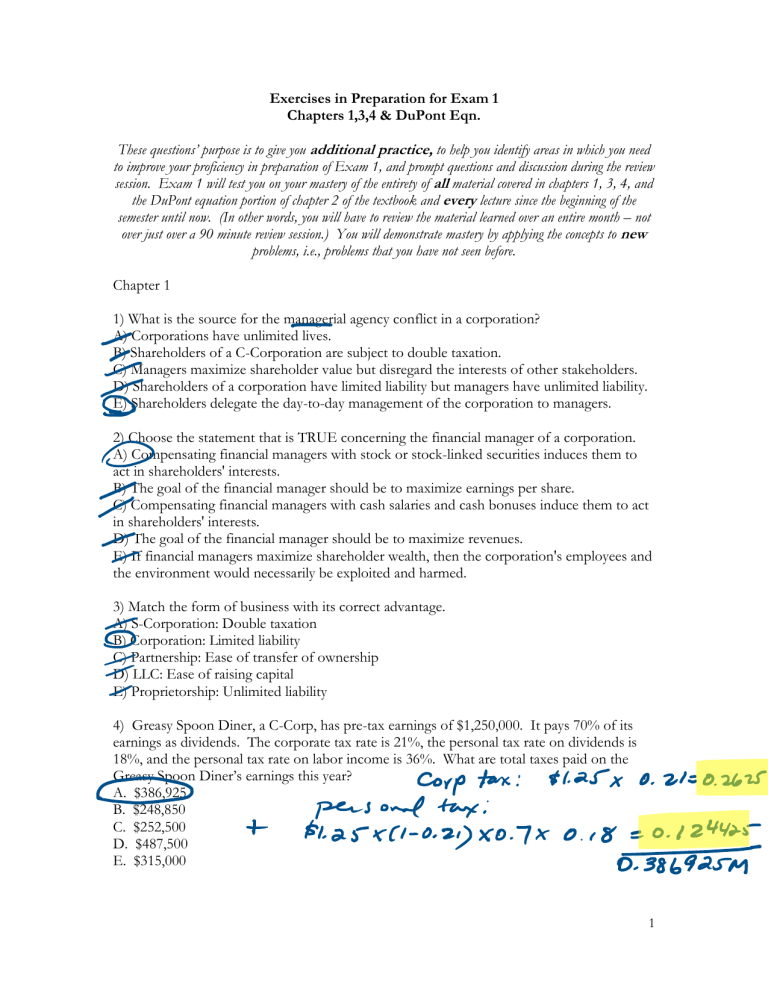

Exercises in Preparation for Exam 1 Chapters 1,3,4 & DuPont Eqn. These questions’ purpose is to give you additional practice, to help you identify areas in which you need to improve your proficiency in preparation of Exam 1, and prompt questions and discussion during the review session. Exam 1 will test you on your mastery of the entirety of all material covered in chapters 1, 3, 4, and the DuPont equation portion of chapter 2 of the textbook and every lecture since the beginning of the semester until now. (In other words, you will have to review the material learned over an entire month – not over just over a 90 minute review session.) You will demonstrate mastery by applying the concepts to new problems, i.e., problems that you have not seen before. Chapter 1 1) What is the source for the managerial agency conflict in a corporation? A) Corporations have unlimited lives. B) Shareholders of a C-Corporation are subject to double taxation. C) Managers maximize shareholder value but disregard the interests of other stakeholders. D) Shareholders of a corporation have limited liability but managers have unlimited liability. E) Shareholders delegate the day-to-day management of the corporation to managers. 2) Choose the statement that is TRUE concerning the financial manager of a corporation. A) Compensating financial managers with stock or stock-linked securities induces them to act in shareholders' interests. B) The goal of the financial manager should be to maximize earnings per share. C) Compensating financial managers with cash salaries and cash bonuses induce them to act in shareholders' interests. D) The goal of the financial manager should be to maximize revenues. E) If financial managers maximize shareholder wealth, then the corporation's employees and the environment would necessarily be exploited and harmed. 3) Match the form of business with its correct advantage. A) S-Corporation: Double taxation B) Corporation: Limited liability C) Partnership: Ease of transfer of ownership D) LLC: Ease of raising capital E) Proprietorship: Unlimited liability 4) Greasy Spoon Diner, a C-Corp, has pre-tax earnings of $1,250,000. It pays 70% of its earnings as dividends. The corporate tax rate is 21%, the personal tax rate on dividends is 18%, and the personal tax rate on labor income is 36%. What are total taxes paid on the Greasy Spoon Diner’s earnings this year? A. $386,925 B. $248,850 C. $252,500 D. $487,500 E. $315,000 1 5) Why should a corporation's managers pursue maximization of shareholder wealth as their primary objective? A) Shareholders have the first claim on a corporation's cash flows before other stakeholders. B) Shareholders can sue management if a dividend payment is missed. C) A corporation's shareholders deserve to have their wealth maximized because they have unlimited liability. D) Shareholders of a C-Corp face double taxation. E) All shareholders can agree that they benefit from their wealth being maximized. 6) Which of the following is an example of a primary market transaction? A) A floor broker of the New York Stock Exchange submits a limit order written on a slip of blue, red, or yellow paper. B) A stock dealer quotes an ask price for Ezekiel Enterprises on the NASDAQ, which a buyer eventually accepts. C) Jeremiah Jewelers raises $10 million from issuing bonds through an investment bank. D) A GM-owned dealership sells a Cadillac in Germantown. E) One day after the company went public, Ruth buys 10 shares of its stock on the New York Stock Exchange. DuPont Equation 7) James & Co.'s management is under pressure by its board to improve the company's return on equity (ROE) to match that of its peers in the industry. It has sales of $800 million, net income of $40 million, assets of $2 billion, and debt of $1.5 billion. In order to achieve and ROE of 12%, what minimum profit margin should management target, assuming assets, sales, and debt remains constant? A) 5.0% B) 6.5% C) 7.0% D) 6.0% E) 7.5% 2 8) Leah Limited Partners has assets of $5 billion, liabilities of $2 billion, and a profit margin of 15%. Its rival firm, Rachel Corp., has a total asset turnover of 3.0, profit margin of 12%, and equity multiplier of 1. What asset turnover should Leah Limited try to achieve to match Rachel Corp.’s return on equity (ROE)? A) 3.00 B) 1.20 C) 1.44 D) 0.82 E) 1.64 3 Chapter 3 9) You are offered two investments, Alpha and Bravo. Investment Alpha will pay you $5,000 in 7 years. Investment Bravo will pay you $4,000 in 5 years. At a discount rate of 15%, which investment is worth more? How much more will you pay for it than the other? A) You will pay $109.02 more for Investment Bravo. B) You will pay the same for both investments. C) You will pay $826.45 more for Investment Alpha. D) You will pay $513.16 more for Investment Bravo. E) You will pay $756.14 more for Investment Alpha. 4 10) On January 1, 1985, Esther invested $100 in the S&P 500 index. On January 1, 2021, her investment was worth $2,357. At this rate of growth, how much would her investment be worth on January 1, 2025? A) $2,719.62 B) $2,917.26 C) $2,629.17 D) $3,348.45 E) $3,834.54 5 11) You are offered an investment opportunity with the “guarantee” that your investment will double in 5 years. Assuming annual compounding, what annual rate of return would this investment provide? a. 40% b. 100% c. 14.87% d. 20% e. 18.74% 6 12) You have a savings account with a current balance of $10,000. Starting one year from now, you will deposit $250 in the account every year until your account has a balance of $100,000. How long will it take you to reach this amount if your account earns 9% annually? A) 24.19 years B) 40.71 years C) 19.77 years D) 26.48 years E) 38.33 years 7 13) Which of the following is an example of arbitrage? A) Mr. Howard uses dividend payments from his Amazon stock to purchase more shares of Amazon stock. B) Ms. Hall sells her share of Uber because she wants to use the money to buy new shoes. C) Ms. Smith purchases a share of Under Armour stock before she moves to California where she plans on selling the share. D) Hershey’s Corporation buys cocoa and milk and sells chocolate for a higher price than the raw ingredients. E) Mr. Kelly buys shares of Gamestop on the New York Stock Exchange (NYSE) and immediately sell them on the NASDAQ because price on the NYSE is lower than the price on the NASDAQ. 8 Chapter 4 14) The lottery winner can either receive 30 payments of $3 million every year starting today or a single lump sum of $62 million today. Using a discount rate of 4%, which option should the winner select? 9 13) You decide to begin saving towards the purchase of a new car in 5 years. If you put $1,000 at the end of each of the next 5 years in a savings account paying 6% compounded annually, how much will you accumulate after 5 years? a. $6,691.13 b. $5,637.09 c. 1,338.23 d. $5,975.32 e. $5,731.94 15) An entrepreneur is seeking an investment from a venture capitalist. In return, the entrepreneur promises to make annual payments beginning 8 years from now that will grow by 4% per year indefinitely. The first payment 8 years from now will be $10,000. If the venture capitalist requires a 13% return on her investment, what is the most she will invest in the enterprise today? A) $76,923.08 B) $60,781.58 C) $40,975.45 D) $111,111.11 E) $47,228.96 10 16) A company is offering bonds that pay $100 per year indefinitely. If you require a 12% return on these bonds what is the value of each bond? a. $1,000 b. $962 c. $904.67 d. $866.67 e. $833.33 11 17) You are planning to retire 50 years from today. Starting one year after the day you retire, you will withdraw money every year from your retirement savings for 30 years. You will save $5,000 per year starting one year from today. At an annual rate of return of 9%, what is the most amount you can withdraw per year in retirement? A) $5,334.85 B) $135,847.26 C) $8,333.33 D) $153,334.38 E) $396,686.30 12 18) Juan Marco is a professional baseball player negotiating a salary for a four-year contract. He has already agreed to $1 million in year 1, $1.5 million in year 2, and $2.5 million in year 4. He has instructed his agent to negotiate the third-year salary so that the contract is worth the same as receiving $7 million today at 4% interest. What should the third-year salary be? 13 Spring 2022 Practice test: McKeldin Company is signing a multi-year lease contract that has a present value of $30 million. The cash flows of the years are as follows: Year 1: $4 million Year 2: $7 million Year 3: ??? Year 4: $9 million What is the cash flow in year 3 if the discount rate is 7%? 14