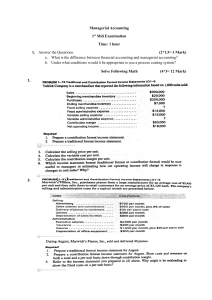

Basics of Managerial Economics* *Introduction + Ch.1 with emphasis on section1.1 What is Managerial Economics? Managerial Economics provides valuable economics tools for managers so that they can take optimal decisions: What should be the pricing and output policy? What should be the input mix? What product quality to choose? How many employees to hire? How to ensure quality work from employees? How to take into account the action of rival firms? The Manager! Who is a manager? A person responsible for • His/her own actions • Actions of other resources such as individuals, machines etc. Directs efforts of others, buys inputs and/or makes pricing or quality decisions. Managerial Economics When the resources are scarce, managers can make cost-effective decisions by applying the discipline of managerial economics. Managerial Economics studies how managers can direct scarce resources in the most efficient ways and achieve their goals. Example Think about the managerial decisions in a coffee shop: What varieties of coffee to provide for customers? (think about all the variety of coffee that you get in a coffee shop) How to price different glass/cup sizes? (how much do you pay for a small, medium or tall?) How many workers to employ? (How many workers do you typically see in a coffee shop?) How to ensure quality work from the workers? How to maintain product quality? Next month, another coffee shop is opening in the same shopping complex. How to not lose business to the rival firm? What new decisions need to be made? Managerial Decision Making – Different Managers There are many decisions made by different managers A production manager’s objective is normally to achieve a production target at the lowest possible cost. Of course, the manager has to use the existing factory and resources. Human resource managers design compensation systems to encourage employees to work hard. Of course, the manager has limited resources available in the firm. A marketing manager must allocate an advertising budget to promote the product most effectively. Of course, the manager has a limited marketing budget. Managerial Decision Making – The CEO The job of the chief executive officer (CEO), is to focus on maximizing profit. The CEO is also concerned with how a firm is positioned in a market relative to its rivals. Maximizing profit requires coordination! The CEO asks the production manager to minimize the cost of producing the particular good or service. The CEO asks the market research manager to determine how many units can be sold at any given price, and so forth. It would be a major coordination failure if the marketing department set up a system of pricing and advertising based on selling 8,000 units a year, while the production department managed to produce only 2,000. Managerial Decision Making – Trade Offs In an environment of scarcity, managers must focus on the tradeoffs that directly or indirectly affect profits. Evaluating trade-offs often involves marginal reasoning: considering the effect of a small change. How to Produce To produce a given level of output, a firm must use more of one input if it uses less of another input. Example: Metal and plastic substitute each other in the production of cars. Small increments and reductions of them affect the car’s weight, safety, and cost. Managerial Decision Making – Trade Offs What Prices to Charge Consumers buy fewer units of a product when its price rises given their limited budgets. Example: When a manager sets the price of a product, the manager must consider whether raising the price offsets the loss from selling fewer units. Whether to Innovate There are short run and long run profits. Example: Investments in innovation such as designing new products and better production methods may raise the long run profit, but these typically lower the short run profit. Managerial Decision Making Other Decision Makers Consumers purchase products subject to their limited budgets Workers decide on which jobs to take and how much to work given their scarce time and limits on their abilities. Rivals may introduce new, superior products or cut the prices of existing products. Governments around the world may tax, subsidize, or regulate products. Managerial Decision Making Strategy A strategy is a battle plan that specifies the actions or moves that the manager will make to maximize the firm’s profit when interacting with a small number of rival firms. One tool that is helpful in understanding and developing such strategies is game theory, which we will see in later in the course. Managerial Decision-Making Example: Pepsi’s price-cutting strategy in the 1930s In 1931, the Pepsi-Cola company was in a desperate condition. The company had entered bankruptcy for the second time in 12 years. The president of Pepsi, Charles G. Guth tried to sell Pepsi to its rival Coca-Cola, but Coke wanted no part of it. During this period, Pepsi and Coke sold cola in 6-ounce bottles. To reduce costs, Guth purchased a large supply of recycled 12-ounce beer bottles. Pepsi priced the 12-ounce bottles at 10 cents, twice the price of 6-ounce Cokes. But this strategy failed to boost sales! Then Guth had an idea: to sell 12-ounce Pepsi bottles for the same price as 6-ounce Cokes. This worked for Pepsi! Pepsi’s sales shot up. By 1934, Pepsi was out of bankruptcy. Its profits rose to $2.1 million by 1936, and to $4.2 million by 1938. Ref: Tedlow, Richard, New and Improved: The Story of Mass Marketing in America, New York, Basic Books, 1990 Pepsi’s success in the 1930s can be understood using economics In 1931, Pepsi’s main objective was to increase profits. But the president could not just order his subordinates to increase Pepsi’s profits. The management cannot directly control its profits or market share. However, the management can control marketing, production and the administrative decisions that determine profitability. Pepsi put in use the basic principle of the law of demand. By selling at a lower price, it could increase the quantity sold. Will that translate into higher sales revenues? This depends on price elasticity of demand. Economic Analysis continued.. As long as Coke didn’t respond to Pepsi’s price cut with its own, we would expect that the demand for Pepsi would have been relatively sensitive to price, in other words, price-elastic. (Coke had a large share of the market, it was more profitable to keep its price high than to respond with a price cut of its own). And price-elastic demand implies that price cut leads to higher sales revenue. Will higher sales revenue lead to higher profits? This will depend on the economic relationship between the additional sales revenue that the price cut generated and the additional cost of producing more quantity. That profits increased after the price-cut suggests that the additional sales revenue far exceeded the additional costs of production.