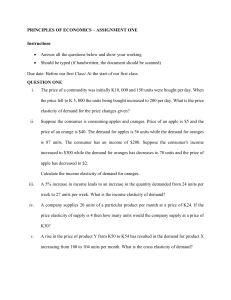

Answer all the following questions: Question 1 A. Suppose it requires 3 labor hours for the country Technoland to produce 1 apple, and 3 labor hours to produce 1 banana. Country Farmville can produce 1 apple using 5 labor hours and 1 banana using 1 labor hours. Technoland has 1200 units of labor available and Farmville has 800 units of labor. Draw the PPF for country Technoland? What is the opportunity cost of producing apples in Technoland? What is the opportunity cost of producing bananas in Farmville? Which country has a comparative advantage in apple production? Give a price at which the country explained above would like to trade apples. Show your work. [7 points] [Answer] First note that Technoland spent all its time on 1 good, then it can produce 400 apples or 400 bananas. Likewise, Farmville can produce the 160 apples or 800 bananas. The PPFs for Technoland is given below. [3 pts. Take off one point if axes are not labeled. Take off one point if the intercepts are wrong. Take off 1 point if PPF is not straight. Note that the scale will probably be off for most students, and that’s okay so long as axes are labeled] For Technoland, • • the opportunity cost of apples is 400/400 = 1 banana per apple [1 pt for correct number. 0.5pt for not including units] the opportunity cost of bananas is 400/400 = 1 apple per computer [not asked for but useful] For Farmville • • the opportunity cost of apples is 800/160 = 5 bananas per apple [not asked for but useful] the opportunity cost of bananas is 160/800 = 0.2 apples per banana [1 pt for correct number -0.5 pt for not including units] Technoland has a comparative advantage in apples. [1 pt. Either right or wrong] Any price between 1 banana per apple and 5 bananas per apple is acceptable. [1 pt. Must actually give a price. -0.5 points for just saying that it needs to be between opportunity costs] B. Indicate whether the following statement is true or false and justify your answer: “If wages for accountants rose, then accountants’ leisure time would have a lower opportunity cost.”. [4 points] [Answer] False. Opportunity costs is measured in terms of what you are not doing (or in what you are giving up). By taking leisure, this means that you are giving up time spent working. The increase in wage tells us that the time spent working is more valuable, thus are opportunity cost of leisure would be higher. [1 pts for saying False. 3 Pts explanation: 2pts for saying that the opportunity cost of leisure is the wage. 1 pt for saying if wage increases, the opportunity cost increases.] C. What three principles does the Production possibility frontier explain? What will be the likely impact of large-scale outflow of foreign capital on the PPC of the economy, and why? [4 points] [Ans:] I can imagine there being quite a few different answers to this question. Here is a list that I think can be argued: • choice • tradeoffs • scarcity o feasible and infeasible allocations • efficiency • opportunity costs o increasing opportunity costs • trade as the only way to attain outside the PPF [1.5 pts, 0.5 for each reasons listed] With a large-scale outflow of capital, we would expect the PPC to shift inwards because we would have less an input to produce goods, which means that we cannot produce as much. The PPF represents the maximum that we could produce if using all of our inputs efficiently, so if we have fewer inputs, then the max amount that we could produce would be smaller. [2.5 pt total, 1 pt for identifying shift inwards, and 1.5 pt for explanation. 1 pt for recognizing that capital is an input to the production process. 0.5 pt for saying a decrease in capital reduces the max output note a drawing is sufficient for the first part (i.e. with arrows showing an inward shift), but does not suffice as an explanation. ] Question 2 A. The supply and demand for solar panels are given by QS = 5P – 5,000 and QD = 15,000 – 5P, where P is the price per solar panel and Q measures the quantity of solar panels. Calculate the equilibrium price and quantity of Solar panels. At what price will there be 20 units of surplus? [6 points] Q_d = Q_s 15000 – 5P = 5P -5000 20000 = 10 P P = 2000 Plug into either supply or demand Q_d = 15000 – 5(2000) = 5000 Q_s = 5(2000) – 5000 = 5000 Surplus occurs when Q_s > Q_d Q_s – Q_d = 20 5P – 5000 – (15000 – 5P) = 20 10 P – 20000 = 20 10 P = 20020 P = 2002 At price of 2002 dollars per unit, there will be a surplus of 20 units [1 pt for Q_s = Q_d] [1 pt for P =2000] [1 pt for Q = 5000] [2 pt for Q_s - Q_d = 20, can give 1 point partial credit if they say a surplus means Q_s > Q_d or that P must be higher than 2000] [1 pt for P=2002] B. Indicate whether the following statement is true or false and justify your answer: Over the last two decades, tuition fees at Johns Hopkins University have increased by 20%. At the same time, the number of students enrolled has increased from 20,000 to over 30,000. This example demonstrates that the Law of Demand is false. [4 points] False. If there was an increase in the demand for college education (for example, the expectation on the return to college increased in the last two decades), this would mean that price (the tuition) and the quantity (number of college students) both increase. If you draw it out, you still have two demand curves that are downward-sloping, which means that they both do not violate the Law of Demand while still explaining the fact. Graph below. [1 pt for False. 3 pts for explanation. 2 points for saying an increase in demand explains the result 1 point for explaining how the Law of Demand is not violated in the counterexample ] C. In the summer of 69, the price of oil increased (input for gasoline), and at the same time, the price of gasoline increased tremendously while the quantity of gasoline consumed also increased. Using a supply and demand diagram of the market for gasoline, explain what could have caused this outcome. [5 points] [Answer: The price of oil shifts decreases supply, which means higher prices and lower quantity. However, there is increased quantity, so this must mean that demand must of increased during this time (for example, an buyers of gasoline due to Baby Boomers becoming legal driving age could have increased the demand) enough such that the quantity increased. See graph below ] [1 pt for saying demand increased so much that it outweighed the Supply effect on Q] [1 pt for giving a reason why demand might have increased] [1 pt for labelling Supply/Demand Graph] [1 pt for have a supply shift to the left] [1 pt for having demand shift to the right such that equilibrium quantity increased] Q3 A. Please refer to the following figure. In the market for asparagus, the original equilibrium Price is $4, and the Equilibrium quantity is 3000, as shown in the figure. Suppose the consumer income rises by 10%, leading to the new demand curve: QD = −0.5P + 6.5. What is the income elasticity of demand between the old and new equilibrium prices? (6 points) 1 Answers We can read from the graph that: Q s = P − 1. Solve for the new equilibrium price and quantity by equating Q s = Qd Solve −0.5P + 6.5 = P − 1, we get Pnew = 5 and Qnew = 4 The income elasticity = (Qnew −Qold )/Qold (incomenew −incomeold )/incomeold = 10/3 solving for the new equilibrium, 3 points; correct computation of income elasticity, 3 points. Setting up equilibrium condition and correctly write out the income elasticity definition, each worth 2. Correct number of equilibrium/elasticity, 1 for each. If students use middle point to compute the percentage change in Q, also considered as correct. B. Indicate whether the following statement is true or false and justify your answer: “The elasticity of demand is the same as the slope of the demand curve.” (4 points) Answers False. Given a demand curve: Q = a − bP, the formula for price elasticity of demand is: Price Elasticity of Demand ∆Q Q = ∆P P ∆Q P ∆P Q P =b × , Q = (1) It is obvious that slope b is just one component of the elasticity. Students can also use the example of linear demand curve from the textbook. Linear demand curve has a constant slope but does not have constant elasticity, because ratio of changes in two variables is different from ratio of percentage changes in two 2 variables. 1 point for saying False; 3 for explanation. If students can point out slope is only part of the formula, or can use the linear demand curve example, then get full credit. C. Explain the Price effect and Quantity effect at different points along the linear demand curve. How do these two effects influence the total revenue? (5 points) Answers Use the graph from the textbook: 3 As price increases from 0, at first the elasticity is smaller than 1, then price effect dominates the quantity effect: revenue will increase as price increases. After some threshold, elasticity becomes larger than 1, then quantity effect dominates the price effect and revenue decreases as price increases. Key point is that with elasticity smaller or larger than 1, revenue increases or decreases with price. As long as this key point is mentioned, then should get full credit; if omitting the condition for price effect to be larger/smaller than quantity effect in affecting revenue, but generally discusses those two effects, then 3 points at most. Q4 A. The city council of a small college town decides to regulate rents in order to reduce student living expenses. Suppose the average annual market-clearing rent for a two4 bedroom apartment had been $700 per month, and rents were expected to increase to $900 within a year. The city council limits rents to their current $700-per-month level. Draw a supply and demand graph to illustrate what will happen to the rental price of an apartment after the imposition of rent controls. Do you think this policy will benefit all students? Why or why not? What will happen to the city council policy if they dont change it in a few years?(6 points) Answers The rental price will remain at $700 since the new pricing ceiling is binding. There will be a shortage as shown in the graph. Some students now can’t find apartments to live with the price ceiling, they definitely get hurt. And in the rationing process, longer waiting time or discrimination may happen. If this policy keeps working, landlords won’t have incentives to improve the property or to respond to concerns of tenants. Graph with good labels of axises, demand/supply curves, and a shortage get 2 points, if incomplete, then lose 1; Students can also draw a perfectly inelastic supply curve as in the textbook; 2 points for answering that not all students benefit from this policy and offering at least one plausible reason; 2 points for pointing out what will happen in the long run. 5 B. In 1991, a sales tax was imposed for the first time in California on “junk foods.” This was the so-called “snack tax.” It imposed a sales tax on goods like pretzels. Would the incidence of this sales tax be mostly on the buyers of these foods, or would it be mostly on the stores that sell them? Explain why.(5 points) Answers The side that has a lower elasticity will have a higher burden of the tax. The firm that produces the snack can easily shift their sales to other states but Californian residents buy snacks locally, so it is easier for the producers to make adjustment. An educated guess would be that buyers have a higher burden of the tax. If students say that consumers can also quickly shift to a different type of food so the 6 elasticity of demand is higher and consumers face a lower burden, then they also get full credit. This is an empirical question, though the educated guess in the answers may be more plausible. As long as the answer specifies that the side with a lower elasticity faces a higher burden, and gives a plausible reason why the side they choose has a lower elasticity, then get full credit. Any guess of incidence without reason gets at most 1; any guess of elasticity but without a reason gets at most 3. C. Indicate whether the following statement is true or false and justify your answer: “A tax always raises the price the buyers pay, lowers the price the sellers receive, and reduces the quantity sold.” (4 points) Answers False. For example, if the supply is perfectly inelastic (a vertical line), then tax burden is all on firms and quantity won’t change. False is worth 1 point; explanation is 3. Any counterexample to refute the statement works. For example, a perfectly elastic demand curve. 7