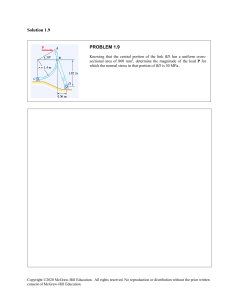

Chapter 1 Review and Applications of Basic Mathematics Copyright © 2020 McGraw-Hill Education Limited. Microsoft® PowerPoint® Presentation by Julie Howse, St. Lawrence College. Previous edition updated by Rob Sorenson, Camosun College. Textbook you need Cost: Digital version $93 Hard copy version $147 Copyright © 2017 McGraw-Hill Education Limited. 2-2 Why do you need math at all? Copyright © 2017 McGraw-Hill Education Limited. 2-3 Introduction Basic math skills are essential for success in your business courses, and the world of business, and in life! 14 Introduction You may ask: is most of the calculations I need not done by the financial calculator and excel? Here is what a financial calculator cannot do for you: • Decide what information is relevant • Analyse and interpret the results/answers • Explain the results to clients These are the math competencies expected by employers Copyright © 2020 McGraw-Hill Education Limited. 1-5 Chapter 1: Overview This chapter begins with a review of basic concepts and then explores some business applications. Copyright © 2017 McGraw-Hill Education Limited. 1-6 Learning Objectives LO1 Perform arithmetic operations in their proper order. Order of operations LO2 Convert fractions to their percent and decimal equivalents. LO3 Maintain the proper number of digits in calculations. Rounding LO4 Perform calculations using fractions, decimals and percentages. Copyright © 2020 McGraw-Hill Education Limited. 1-7 Learning Objectives (cont’d) LO5 Calculate gross earnings of employees paid a salary, an hourly wage or commissions. LO6 Calculate simple or weighted ation averages. LO7 Perform basic calculations for the GST, HST, PST Copyright © 2020 McGraw-Hill Education Limited. 1-8 Arithmetic Operations • Order of operations: BEDMAS 1. 2. 3. 4. Perform all operations within brackets. Evaluate the powers (exponents). Perform multiplication and division. Perform addition and subtraction. • BEDMAS - Brackets, Exponents, Division, Multiplication, Addition, Subtraction Copyright © 2020 McGraw-Hill Education Limited. 1-9 Order of Operations Example • Consider the following expression. • BEDMAS tells us to complete the bracket first, then the exponent and then the addition/subtractions. 10 + (2 × 3)2 −5 = 10 + 62 − 5 = 10 + 36 − 5 = 41 Copyright © 2020 McGraw-Hill Education Limited. 1-10 Order of Operations Example • Consider the following expression. • BEDMAS tells us to complete the division first and then the addition/subtractions. • If no brackets – do the addition and subtraction from left to right. Or be very mindful of the sign 30 − 6 ÷ 3 + 5 = 30 − 2 + 5 = 33 Copyright © 2020 McGraw-Hill Education Limited. 1-11 Skill Check • Evaluate the following using Order of Operations i. (−3)3 + 4 × 5 + 3 − 6 Copyright © 2020 McGraw-Hill Education Limited. 1-12 Skill Check • Evaluate the following using Order of Operations i. (−3)3 + 4 × 5 + 3 − 6 = (-3 X -3 X -3) + (20 + 3) – 6 = – 27 + 23 – 6 = – 10 Copyright © 2020 McGraw-Hill Education Limited. 1-13 Skill Check • Evaluate the following using Order of Operations 5 + 12 − 24 4 + 34 1-14 Skill Check • Evaluate the following using Order of Operations 5 + 12 − 24 4 + 34 = 5+12−16 4+81 = 17−16 85 = 1 85 1-15 Skill Check • Evaluate the following using Order of Operation − −5 Copyright © 2020 McGraw-Hill Education Limited. 2 3 +6×2+4 1-16 Skill Check • Evaluate the following using Order of Operation − −5 2 + 6 × 2 + 43 = – 25 + 12 + 64 = 51 Copyright © 2020 McGraw-Hill Education Limited. 1-17 One more example • Do Exercise question 1.1 # 14 on page 4 in your textbook (4 x 3 – 2)2 ÷ (4 – 3 x 22) Copyright © 2017 McGraw-Hill Education Limited. 1-18 One more example • Do Exercise question 1.1 # 14 on page 4 (4 x 3 – 2)2 ÷ (4 – 3 x 22) = (12 – 2)2 ÷ ( 4 – 12) = (10)2 ÷ (– 8) = 100 ÷ – 8 = - 12.50 Copyright © 2017 McGraw-Hill Education Limited. 1-19 See page 8 • Example 1.2G. Optimal use of your calculator. • Show Appendix 1A. AOS versus Chn see page 35 Copyright © 2017 McGraw-Hill Education Limited. 1-20 Example 1.2H – Evaluating Complex Fractions Evaluate each of the following complex fractions accurate to the cent. a. b. $425 0.09 24 1+ 12 87 $1265 1+0.115× 365 43 1+0.125× 365 Copyright © 2020 McGraw-Hill Education Limited. 1-21 Skill Check Let’s try these two examples with our calculators i. $5600 1+0.175× 46 365 Tip: Either use the two-step process or brackets for the denominator. Also, be careful not to press = on your calculator too soon. ii. $480 1 + 0.05 × Copyright © 2020 McGraw-Hill Education Limited. 271 365 1-22 Fractions, Decimals & Percent • A faction consists of a numerator 𝑛𝑢𝑚𝑒𝑟𝑎𝑡𝑜𝑟 and a denominator. 𝑑𝑒𝑛𝑜𝑚𝑖𝑛𝑎𝑡𝑜𝑟 • Proper faction – the numerator is smaller than the denominator. • Improper faction – the numerator is larger than the denominator. • Mixed number – a whole number plus a fraction. Copyright © 2020 McGraw-Hill Education Limited. 3 4 5 2 1 2 2 1-23 Fractions, Decimals & Percent 𝑛𝑢𝑚𝑒𝑟𝑎𝑡𝑜𝑟 𝑑𝑒𝑛𝑜𝑚𝑖𝑛𝑎𝑡𝑜𝑟 • The numerator signifies the number of parts taken out of the whole. • Denominator signifies the whole. Copyright © 2017 McGraw-Hill Education Limited. 1-24 Equivalent Fractions page 5 • Equivalent fractions are equal in value even though their respective numerators and denominators may differ. 1 2 5 • For example: = = 2 4 10 • To create an equivalent fraction, both the numerator and denominator must be multiplied by the same number. Copyright © 2020 McGraw-Hill Education Limited. 1-25 Decimal and Percent Equivalents • The decimal equivalent of a fraction is obtained by dividing the numerator by the denominator. • The percent equivalent is found by multiplying the decimal equivalent by 100 and adding the % sign. 3 = 0.75 = 75% 4 Fraction Copyright © 2020 McGraw-Hill Education Limited. Decimal Equivalent Percent Equivalent 1-26 Calculating Percent of a Number To find the percent of a number, convert the percent to its decimal equivalent by diving the percent by 100 For example: 22% 𝑜𝑓 $185 = 0.22 × $185 = $40.70 Copyright © 2020 McGraw-Hill Education Limited. 1-27 Example 1.2J – A Problem Using Percents A battery manufacturer encloses a rebate coupon for 15% off in a package of AAA batteries retailing for $6.29. What rebate does the coupon represent? Solution: Convert the percentage to a decimal and then find the rebate. 𝑅𝑒𝑏𝑎𝑡𝑒 = 0.15 × $6.29 = $0.94 The 15% rebate is equivalent to a cash rebate of $0.94. Show the easy way to do this on your calculator Copyright © 2020 McGraw-Hill Education Limited. 1-28 Skill Check Jenica puts 15% of every paycheque into a savings plan and 45% of the money in the savings plan is in a Tax-Free Savings Account (TFSA). If she earns $1,560 every paycheque, how much money is she putting into the TFSA? Copyright © 2020 McGraw-Hill Education Limited. 1-29 Skill Check: answer Jenica puts 15% of every paycheque into a savings plan and 45% of the money in the savings plan is in a Tax-Free Savings Account (TFSA). If she earns $1,560 every paycheque, how much money is she putting into the TFSA? $1,560 x 0.15 = $234 x 0.45 = $105.30 Copyright © 2020 McGraw-Hill Education Limited. 1-30 Skill Check Convert each of the following to their equivalent decimal, percent and fractional form. Decimal Fraction Percent 0.38 3 8 64% 1-31 Rounding Decimals • Some decimal equivalents have an endless series of digits (nonterminating decimal). • Some may even be repeating decimals. • A shorthand notation for a repeating decimal is to place a bar over the repeating portion. 2 = 0.222222 = 0. 2 9 Copyright © 2020 McGraw-Hill Education Limited. 1-32 Rules for Rounding Decimals 1. If the first digit dropped is 5 or greater, increase the last retained digit by 1. 2. If the first digit dropped is less than 5, leave the last retained digit unchanged. 3. In intermediate results, keep one more figure than the number of figures required in the final result. See page 7 in your textbook for “common rounding errors” * Calculator Tip: Use the memory registers to save intermediate results. This will eliminate rounding errors. Copyright © 2020 McGraw-Hill Education Limited. 1-33 Payroll. We only do gross salary An employee’s remuneration may be based on: • a salary, • hourly wage, • a piecework rate or • a rate of commission Copyright © 2020 McGraw-Hill Education Limited. 1-34 Salaries • A salary is a fixed amount of pay per period (i.e. $45,000 per year). • We can convert from annual to another period: Monthly Semi-monthly Bi-weekly 12 periods/year 24 periods/year 26 periods/year Weekly 52 periods/year An annual salary of $45,000 would become: Monthly Semi-monthly Bi-weekly Weekly $45,000 12 $45,000 24 $45,000 26 $45,000 52 = $3,750 = $1,875 = $1,730.77 = $865.38 Copyright © 2020 McGraw-Hill Education Limited. 1-35 Why does Bi-weekly have 26 payment periods while semimonthly only has 24? Exhibit 3.6 Example of a Biweekly Pay Period Schedule See example 1.3A 0n page 14 Copyright © 2017 McGraw-Hill Education Limited. 1-37 • In jobs where the amount of work varies, employees may be paid an hourly wage. Hourly Wages • A premium rate may apply when more than a certain number of hours per week are worked (overtime) or when an employee works on a statutory holiday. • Overtime is normally paid at: 1.5x the normal wage (called time and a half) Copyright © 2020 McGraw-Hill Education Limited. 1-38 Hourly Wages For example, consider an employee who works 45 hours in one week (40 regular hours and 5 overtime hours) and is paid a wage of $12.00/hr and 1.5 times that for overtime. • The gross wages for the week would be: (40 × $12.00) + (5 × $18.00) = $570.00 Copyright © 2020 McGraw-Hill Education Limited. 1-39 See problem 1 on page 17 Copyright © 2017 McGraw-Hill Education Limited. 1-40 $58,800/52 weeks = $1,130.77 per week How much is that per hour: 1,130.77/35 hours = $32.31 per hour Overtime pay is: 32.31 x 1.5 = $48.46 Gross salary for the week in which she worked 39 hours: $1,130.77 + ($48.46 x 4 hours) = $1,324.62 Copyright © 2017 McGraw-Hill Education Limited. 1-41 Skill Check Ming is paid an annual salary of $60,500 based on a 44-hour workweek. What is his gross pay for a biweekly pay period if he works 46 hours in the first week and 48.5 hours in the second week? Overtime is paid at time and a half. Copyright © 2020 McGraw-Hill Education Limited. 1-42 Skill Check: Solution Ming is paid an annual salary of $60,500 based on a 44-hour workweek. What is his gross pay for a biweekly pay period if he works 46 hours in the first week and 48.5 hours in the second week? Overtime is paid at time and a half. 60,500/26 = $2,326.92 Regular pay : 2,326.92/2 weeks = $1,163.46/44 hours =$26.44 per hour Overtime pay: $26.44 x 1.5 = $39.66 per hour 6.5 hours overtime x $39.66 = $257.79 Pay: $257.79 + $2,326.92 = $2,584.71 Copyright © 2020 McGraw-Hill Education Limited. 1-43 Piecework pay • Piecework pay is often paid in manufacturing jobs. Employees receive money for each item (i.e. piece) they produce. Copyright © 2020 McGraw-Hill Education Limited. 1-44 Piecework pay Copyright © 2017 McGraw-Hill Education Limited. 1-45 See page 17 • Question 8 on page 17 is another good example of piecework pay. …Herb packs fish Copyright © 2017 McGraw-Hill Education Limited. 1-46 See page 17 • Question 8 on page 17 is another good example of piecework pay. Weight packed per day = 7.5(250)(0.500kg) = 937.5 kg. Earnings per day = 7.5($8.25) + (937.5 – 500)($0.18) = $140.63 Copyright © 2017 McGraw-Hill Education Limited. 1-47 Commissions • For sales positions, it is typical to base at least a portion of the salesperson’s remuneration on sales volume. • Straight commission – earnings are based entirely on a percentage of sales. • Graduated commission – the commission becomes higher with higher levels of sales. • Salary plus commission – earnings include a base salary plus a commission. Copyright © 2020 McGraw-Hill Education Limited. 1-48 Example 1.3D – Salary Plus Commission James manages a men’s clothing store. His monthly remuneration has three components: a $2500 base salary, plus 2% of the amount by which the store’s total sales volume for the month exceeds $40,000, plus 8% of the amount by which his personal sales exceed $4000. Calculate his gross compensation for a month in which his sales totalled $9900 and other staff had sales amounting to $109,260. Solution: Base salary $2,500.00 Commission on total 0.02($109,260+$9,900-$40,000) store’s volume: Commission on personal sales: Total compensation Copyright © 2020 McGraw-Hill Education Limited. 0.08($9,900-$4,000) 1,583.20 472.00 $4,555.20 1-49 $15,000 + 37,000 = 52,000 Copyright © 2017 McGraw-Hill Education Limited. 50 Skill Check Georgia sells cosmetics from her part-time home-based business. She receives a straight commission of 15% from her supplier. At the year-end, she also receives a 4% bonus on sales exceeding her annual quota of $100,000. What will her gross annual earnings be for a year in which her average monthly sales are $10,000? Copyright © 2020 McGraw-Hill Education Limited. 1-51 Answer to: Georgia sells cosmetics • Annual salary before bonus: • $10,000 per month x 12 = $120,000 • Commission on $120,000 x 0.15 = $18,000 Bonus: $120,000 - $100,000 = $20,000 x 0.04 = $800 Gross annual salary: $18,000 + $800 = $18,800 Copyright © 2017 McGraw-Hill Education Limited. 1-52 Let’s just look at • Question 4 on page 24. Copyright © 2017 McGraw-Hill Education Limited. 1-53 Question 4 on page 24: answer a) The average commission rate will be $30,000 3% $20,000 4% $10,000 6% $60,000 average commission rate will be: $30,000(3%)+$20,000(4%)+$50,000(6%) $100,000 = 3.83% b. The = 4.70% Copyright © 2017 McGraw-Hill Education Limited. 1-54 Simple and Weighted Averages • Determining the average of a set of numbers is a useful business calculation. • A simple average is the sum of a set of values divided by the number of values in the set. • It is useful in cases where each item in the set has the same importance. Example: class average on a test • A weighted average attaches a weighting factor to each value to represent its relative importance. • This is useful in cases where each item in the set has a different level of importance. Copyright © 2020 McGraw-Hill Education Limited. 1-55 Simple Averages • To calculate a simple average, we take the sum of a set of values and divide by the number of values in the set. 𝑆𝑢𝑚 𝑜𝑓 𝑡ℎ𝑒 𝑣𝑎𝑙𝑢𝑒𝑠 𝑆𝑖𝑚𝑝𝑙𝑒 𝑎𝑣𝑒𝑟𝑎𝑔𝑒 = 𝑇𝑜𝑡𝑎𝑙 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑣𝑎𝑙𝑢𝑒𝑠 • For example, the simple average age of three people ages 20, 23 and 24 would be: 20 + 23 + 24 = 22.33 3 Copyright © 2020 McGraw-Hill Education Limited. 1-56 Let’s look at an example Question 6 on page 24 15 7 4 nights x $158 = $632 2 nights x $199 = $398 1 night x $239 = $239 5 nights x $130 = $650 2 nights x $118 = $236 14 nights $2,155 Solution to Question 6 on page 24 15 8 Look at Just look at question 9 on top of page 25. (No need to do this in class. I just wanted students to see another example where simple average is the appropriate method to use) Copyright © 2017 McGraw-Hill Education Limited. 1-59 The simple average is not always the best number to use. For example Copyright © 2017 McGraw-Hill Education Limited. 1-60 Weighted Averages A weighted average includes the relative importance, or “weight”, of each item in the set. Copyright © 2020 McGraw-Hill Education Limited. 1-61 Weighted average Copyright © 2017 McGraw-Hill Education Limited. 1-62 Example 1.4B – Investment Portfolio One year ago, Mrs. Boyd divided her savings among four mutual funds as follows: 20% was invested in a bond fund, 15% in a money market fund, 40% in a Canadian equity fund, and 25% in a global equity fund. During the past year, the rates of return on the individual mutual funds were 10%, 4%, −2%, and 15%, respectively. What was the overall rate of return on her portfolio? Solution: Rate of return(Value) Fraction of money invested (Weighting factor) (Weighting factor) ×(Value) 10% 0.20 2.0% 4% 0.15 0.6% Canadian equity fund −2% 0.40 −0.8% Global equity fund 15% 0.25 3.75% 1.00 5.55% Mutual fund Bond fund Money market fund Total: Copyright © 2020 McGraw-Hill Education Limited. 1-63 Simple vs. Weighted? Copyright © 2020 McGraw-Hill Education Limited. 1-64 Let us do: Question 12 on page 25 Copyright © 2017 McGraw-Hill Education Limited. 1-65 Let us do • Question 12 on page 25 0.1514% 0.2010% 0.10 13% 0.3512% 0.2027% 1.00 = 12.40% Copyright © 2017 McGraw-Hill Education Limited. 1-66 Answer to question 12 on page 25 Each rate of return should be weighted by the fraction of the money invested in the respective security. The rate of return on the portfolio is: 0.150.14 0.200.10 0.10 0.13 0.350.12 0.200.27 1.00 = 0.1240 x 100 = 12.40% Copyright © 2017 McGraw-Hill Education Limited. 1-67 Question 14 at the bottom of page 25 Copyright © 2017 McGraw-Hill Education Limited. 1-68 Question 14 at the bottom of page 25 The weighted average price increase was 0.3010% 0.20 5% 0.5015% 1.00 = 9.50% Stats Canada: How to think about inflation Personal Inflation calculator Copyright © 2017 McGraw-Hill Education Limited. 1-69 One more example to consider: Question 17 on page 34 Copyright © 2017 McGraw-Hill Education Limited. 1-70 Weighted average answer to Question 17 on page 34 Security Amount Invested ($) Rate of return (%) Company U shares $5000 30% = 0.30 5,000/62,500 = 0.08 0.30x0.08 =0.0240 Province V bonds $20,000 -3% = -0.03 20,000/62,5000 =0.32 - 0.03x0.32 = - 0.0096 Company W shares $8,000 -15% = 0.15 8,000/62,500= 0.128 - 0.15x0.129 = - 0.0194 Units in Funds X $25,000 13% = 0.13 25,000/62,500= 0.40 0.13x0.40= 0.0520 Company Y shares $4,500 45% = 0.45 4,500/62,500 = 0.720 0.45x0.720= 0.03240 Total amount invested 5,000 + 20,000+8,000+25,000 +4,500 = $62,500 Copyright © 2017 McGraw-Hill Education Limited. Amount Invested as (%) Weighted average 0.08+0.32+0.128 0.0242+(+0.40+0.720 = 1 0.0096)+(0.0192)+0.052+ 0.03240 = 7.96% 1-71 Goods and Services Tax (GST); Harmonized Sales Tax (HST) The Goods and Services Tax (GST) is a federal sales tax. The tax is collected by the seller from the purchaser at the point of sale. Consequently, a business collects the GST on the prices of things it sells to customers, and it pays the GST on the prices things it buys from suppliers. The GST rate is 5%. Copyright © 2020 McGraw-Hill Education Limited. 1-72 Goods and Services Tax (GST); Harmonized Sales Tax (HST) Copyright © 2020 McGraw-Hill Education Limited. 1-73 Taxes Paid on Consumer Purchases Sales Taxes and Rates in Canadian Provinces and Territories EXAMPLE 1.5B-Calculating the PST, GST, and HST Calculate the total sales taxes on a $100 item in a. Manitoba b. Quebec c. Prince Edward Island Copyright © 2020 McGraw-Hill Education Limited. 1-75 Skill testing Calculate the total amount, including both GST and PST, that an individual will pay for a car priced at $32,500 in i. Alberta ii. Saskatchewan iii. Quebec Like question 3 on page 31 Copyright © 2020 McGraw-Hill Education Limited. 1-76 Exclude: • Exclude property Tax on page 29 onward Copyright © 2017 McGraw-Hill Education Limited. 1-77 Chapter 1 End of Chapter Copyright © 2020 McGraw-Hill Education Limited. Microsoft® PowerPoint® Presentation by Julie Howse, St. Lawrence College. Previous edition updated by Rob Sorenson, Camosun College.