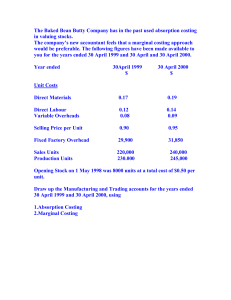

ACC 206│VARIABLE AND ABSORPTION COSTING Straight Problems 1. Unit product costs, profit and cost of ending inventory. Northern Bicycle produces an inexpensive motorbike that sells for P 12,000. Selected data for the company’s operations last year follows: Units in the beginning inventory Units produced Units sold Units in ending inventory: Direct Materials Direct labor Manufacturing overhead Selling and administrative Fixed costs per year: Manufacturing overhead Selling and administrative 300 1,000 800 P1,300 800 500 200 P4,000,000 2,000,000 Required: 1. Compute the unit costs under absorption and variable costing methods. Problem 1 (1) Direct materials Direct labor Variable Manufacturing Overhead Fixed Manufacturing Overhead Unit Cost (P4,000,000/ 1,000) Absorption Costing P 1,300 800 500 4,000 P 6,600 Variable Costing P 1,300 800 500 --P 2,600 2. Compute the operating income under absorption and variable costing methods. Problem 1 (2) Sales Variable Cost of Goods Sold Variable Selling and Administrative Cost Fixed Manufacturing Overhead Fixed Selling and Administrative Cost Operating Income (800 x 12,000) (800 x 2600) (800 x 200) (800 x 4,000) Absorption Costing P 9,600,000 (2,080,000) (160,000) (3,200,000) (2,000,000) P 2,160,000 Variable Costing P 9,600,000 (2,080,000) (160,000) (4,000,000) (2,000,000) P 1,360,000 3. Compute the value of ending inventory under absorption and variable costing methods. Problem 1 (3) Absorption Costing Ending Inventory: (500 x 6,600) (500 x 2,600) Variable Costing P 3,300,000 P 1,300,000 4. Reconcile the difference in operating income under the absorption and variable costing methods. Problem 1 (4) Abs. Costing – Operating Income Var. Costing – Operating Income Diff. in Operating Income P 2,160,000 Units produced (1,360,000) Units sold P 800,000 Change in Inventory Fixed Mfg. OH per unit Diff. in Operating Income 1,000 (800) 200 x P 4,000 P 800,000 2. Complete the table below by filing out the missing values. Sales Variable CGS Fixed overhead Variable expenses Fixed expenses Profit Absorption Costing Variable Costing Quantity Unit Price Amount Quantity Unit Price Amount ? 30.0 ? ? ? ? 8,000 12.00 ? ? ? ? ? 3.00 ? 10,000 ? ? ? 2.50 ? ? ? ? ? 4.00 ? ? ? ? ? ? ? ? ? FORMULAS Sales Variable costs of goods sold Variable cost of goods manufactured = = = Variable expenses Standard Fixed Overhead Rate = = Standard Fixed Expenses Rate = Quantity sold x Unit sales price Quantity sold x Unit variable production costs Quantity produced x Unit variable production costs Quantity sold x Unit variable expenses Budgeted Fixed Overhead Normal Capacity Budgeted Fixed Expenses Normal Capacity Problem 2 Complete the table below. Absorption Costing Quantity Unit Amount Price Sales Variable CGS Fixed overhead Variable Expenses Fixed Expenses Profit Variable Costing Quantity Unit Amount Price 8,000 8,000 8,000 8,000 P 30.00 12.00 3.00 2.50 P240,000 (96,000) (24,000) (20,000) 8,000 8,000 10,000 8,000 P30.00 12.00 3.00 2.50 P240,000 (96,000) (30,000) (20,000) 10,000 42,000 4.00 (40,000) P60,000 10,000 44,000 4.00 (40,000) P54,000 3. Inventoriable cost, profit and ending inventory values. Anton Company produces and sells a unique type of TV antenna. It has just opened a new plant to manufacture the antenna, and the following costs and revenue data are reported for the first month of the company’s operations. The management is anxious to see how profitable the new antenna will be and has asked that an income statement be prepared for the month. Beginning inventory Units produced Units sold Sales price per unit Selling and administrative expenses: Variable per unit Fixed Manufacturing costs: Direct Materials cost per unit Direct labor cost per unit Variable overhead cost per unit Fixed overhead cost (total) 0 42,000 35,000 P 80 5% of sales P 560,000 15 7 2 640,000 Required: 1. Under variable costing and absorption costing, respectively, compute the: a. Unit product costs. b. Profit. 2. Reconcile the difference in profit between absorption and direct costing methods. Problem 3 (1a) Absorption Costing P 15 7 2 15.24 P 39.24 Direct materials Direct labor Variable Factory Overhead Fixed Factory Overhead Product Cost Per Unit Variable Costing P 15 7 2 --P 24 Problem 3 (1b) Sales (35,000 units x 80) Less: Cost of Sales (35,000 units x 39.24) Gross Income Less: Selling & Admin Expenses Variable Fixed Absorption Costing Income P 2,800,000 (1,373,400) 1,426,600 140,000 560,000 Sales Less: Cost of Sales (35,000 units x 24) Manufacturing Margin Less: Variable S&A Expenses Contribution Margin Less: Fixed Costs Fixed Factory Overhead S&A Expenses Variable Costing Income P 2,800,000 (840,000) 1,960,000 (140,000) 1,820,000 640,000 560,000 Problem 3 (2) Absorption Costing Income Variable Costing Income Difference in Income (700,000) P 726,600 P 726,600 1,740,000 (P 1,014,000) ( 80,000) P 1,740,000 4. Unit product cost, fixed cost and profit. Haiyan Corporation produces a product with the following data: A. Standard production costs per unit (Normal capacity = 20,000 units): Direct Materials 2 lbs @ P 6.00 Direct Labor 1.2 hrs. @ P 20.00 Variable overhead 1.25 hrs. @ P4.00 Fixed overhead 1.25 hrs. @ P 8.00 B. Standard distribution and administrative expenses: Variable Expenses Fixed Expenses C. Regular unit sales price D. Actual data: Beginning Inventory Production Sales P 12.00 25.00 5.00 10.00 P 3.00 per unit P 200,000 per month P 200.00 2,200 units 19,000 units 18,400 units Required: a. The standard unit product cost under absorption costing and variable costing systems. Problem 4 (a) Direct materials Direct labor Variable Factory Overhead Fixed Factory Overhead Standard Product Cost Per Unit Absorption Costing P 12.00 25.00 5.00 10.00 P 52.00 b. The budgeted fixed production costs. Problem 4 (b) Budgeted Fixed Expenses = Normal capacity x Standard Fixed Expenses Rate = 20,000 units x P 10 = P 200,000 Variable Costing P 12.00 25.00 5.00 --P 42.00 c. Profit using absorption costing and variable costing under each of the following independent cases: Production 1. 20,000 2. 20,000 3. 20,000 4. 23,500 5. 17,500 Sales 22,000 19,300 20,000 23,500 17,200 Problem 4 (c) 1. Production: 20, 000; Sales: 22, 000 Sales Variable CGS Fixed Overhead Variable expenses Fixed expenses Profit (loss) Computation 22,000 x P 200 22,000 x P 42 22,000 x P 10 20,000 x P 10 22,000 x P 3 20,000 x P 10 Absorption P 4,400,000 (924, 000) (220,000) (66,000) (200,000) P 2, 990,000 Variable P 4,400,000 (924, 000) (200,000) (66,000) (200,000) P 3, 010,000 2. Production: 20, 000; Sales: 19, 300 Sales Variable CGS Fixed Overhead Variable expenses Fixed expenses Profit (loss) Computation 19,300 x P 200 19,300 x P 42 19,300 x P 10 19,300 x P 3 20,000 x P 10 Absorption P 3,860,000 (810,600) (193,000) (57,900) (200,000) P 2, 598,500 Variable P 3,860,000 (810,600) (200,000) (57,900) (200,000) P 2,591,500 3. Production: 20, 000; Sales: 20, 000 Sales Variable CGS Fixed Overhead Variable expenses Fixed expenses Profit (loss) Computation 20,000 x P 200 20,000 x P 42 20,000 x P 10 20,000 x P 3 20,000 x P 10 Absorption P 4,000,000 (840,000) (200,000) (60,000) (200,000) P 2,700,000 Variable P 4,000,000 (840,000) (200,000) (60,000) (200,000) P 2,700,000 Problem 4 (c) 4. Production: 23, 000; Sales: 23, 500 Sales Variable CGS Fixed Overhead Variable expenses Fixed expenses Profit (loss) Computation 23,500 x P 200 23,500 x P 42 23,500 x P 10 23,000 x P 10 23,500 x P 3 20,000 x P 10 Absorption P 4,700,000 (987, 000) (235,000) (70,500) (200,000) P 3,207,500 Variable P 4,700,000 (987, 000) (230,000) (70,500) (200,000) P 3,212,500 5. Production: 17, 500; Sales: 17, 200 Sales Variable CGS Fixed Overhead Variable expenses Fixed expenses Profit (loss) Computation 17,200 x P 200 17,200 x P 42 17,200 x P 10 17,200 x P 3 20,000 x P 10 Absorption P 3,440,000 (722,400) (172,000) (51,600) (200,000) P2,294,000 Variable P 3,440,000 (722,400) (200,000) (51,600) (200,000) P 2,266,000 C Absorption P_________ P_________ 12000 P_________ P_________ P_________ 144,000 118,000 P_________ P_________ 72,000 D Variable P_________ 8,000 8,200 P_________ P_________ 6.00 P_________ P_________ 7.00 2.00 P_________ 6. Fill out the missing values in the following table: Unit sales price Unit sold Units Produced Normal Capacity Sales in pesos Unit var prod costs Variable CGS Fixed Overhead Std. unit fixed OH rate Unit variable expense Variable Expenses A Absorption P 300,000 20,000 23,200 23,200 P_________ P 140.00 P_________ P_________ 20.00 P_________ 200,000 B Variable P_________ 32,000 30,000 30,000 P_________ P_________ P1,600,000 330,000 P_________ P_________ 480.000 Unit fixed expenses Fixed expenses Volume Variance Profit(loss) Difference in profit Profit (loss) other method 12.00 P_________ None P_________ P_________ P_________ 320,000 None 4,000,000 P_________ P_________ 250,000 None (400,000) 500,000 1.20 P_________ None P_________ P_________ P_________ P_________ P_________ 29,000 Problem 6 Unit sales price Unit sold Units produced Normal capacity Sales in pesos Unit var prod costs Variable CGS Fixed overhead Std. unit fixed OH rate Unit variable expense Variable expenses Unit fixed expenses Fixed expenses Volume variance Profit (loss) Difference in profit Profit (loss) other method a Absorption P 300.00 20,000 23,200 23,200 P 6,000,000 P 140.00 P 2,800,000 P 400,000 B Variable 210.31 32,000 30,000 30,000 6,730,000 50 1,600,000 330,000 c Variable 2.9277 62,848 12,000 12,000 184,000 2.29124 144,000 118,000 d Absorption 20.03 8,000 8,200 8,200 160,240 6.00 48,000 56,000 P 10 P 200,000 P 12.00 P 278,400 None P 2,321,600 64,000 15 480,000 10.67 320,000 None 4,000,000 22,000 1.14562 72,000 3.97785 250,000 None (400,000) 500,000 2.00 16,000 1.20 9,840 None 30,400 1,400 P 3,978,000 P(900,000) P 29,000 P 2,257,600 7. Profit inventoriable costs and costs of ending inventory. Golden Company produces an inexpensive product branded as “Ginto”. Selected data for the company’s last year’s operations follow: Units: Beginning inventory Normal Capacity Unit sales price Variable cost per unit Direct material Direct labor Manufacturing overhead Selling and administrative Fixed costs Manufacturing overhead per unit 4,000 50,000 P 250 P 30 20 25 12 P 14 Selling and administrative, total 300,000 Required: For each of the following independent cases, determine the profit and account for the difference in profits under absorption and variable costing methods: Production 1. 50,000 2. 50,000 3. 50,000 4. 52,000 5. 47,500 Sales 52,000 49,500 50,000 51,000 52,500 Problem 7 (1) Sales 52,000 > Production 50,000 Sales Variable CGS Fixed Overhead Variable Expenses Fixed Expenses Profit Computation 52,000 x 250 52,000 x 75 52,000 x 14 50,000 x 14 52,000 x 12 Absorption 13,000,000 (3,900,000) (728,000) (624,000) (300,000) P 7,448,000 Variable 13,000,000 (3,900,000) (700,000) (624,000) (300,000) P 7,476,000 Change in Profit Production Less: Sales Change in inventory x Standard Fixed Overhead Rate Change in Profit P 50,000 (52,000) (2,000) P 14 (P 28,000) Problem 7 (2) Sales (49,500) < Production (50,000) Sales Variable CGS Fixed Overhead Variable Expenses Fixed Expenses Profit Computation 49,500 x 250 49,500 x 75 49,500 x 14 50,000 x 14 49,500 x 12 Absorption 12,375,000 (3,712,500) (693,000) (594,000) (300,000) P 7,075,500 Variable 13,000,000 (3,712,500) (700,000) (594,000) (300,000) P 7,068,500 Change in Profit Production Less: Sales Change in inventory x Standard Fixed Overhead Rate Change in Profit P 50,000 (49,500) 500 P 14 P 7,000 Problem 7 (3) Sales (50,000) = Production (50,000) Sales Variable CGS Fixed Overhead Variable Expenses Fixed Expenses Profit Computatio n 50,000 x 250 50,000 x 75 50,000 x 14 52,000 x 12 Absorption 12,500,000 (3,750,000) (700,000) (600,000) (300,000) P 7,150,000 Variable 12,500,000 (3,750,000) (700,000) (600,000) (300,000) P 7,150,000 * There is no difference in profit because there is no change in inventory. Problem 7 (4) Sales 51,000 < Production 52,000 Sales Variable CGS Fixed Overhead Variable Expenses Fixed Expenses Profit Computation 51,000 x 250 51,000 x 75 51,000 x 14 52,000 x 14 51,000 x 12 Absorption 12,750,000 (3,825,000) (714,000) (612,000) (300,000) P 7,299,000 Change in Profit Production Less: Sales Change in inventory x Standard Fixed Overhead Rate Change in Profit 52,000 (51,000) 1,000 P 14 P 14,000 Variable 12,750,000 (3,825,000) (728,000) (612,000) (300,000) P 7,285,000 Problem 7 (5) Sales 52,500 < Production 47,500 Computation 52,500 x 250 52,500 x 75 52,500 x 14 47,500 x 14 52,500 x 12 Sales Variable CGS Fixed Overhead Variable Expenses Fixed Expenses Profit Absorption 13,125,000 (3,937,500) (735,000) (630,000) (300,000) P 7,522,500 Variable 13,125,000 (3,937,500) (665,000) (630,000) (300,000) P 7,592,500 Change in Profit Production Less: Sales Change in inventory x Standard Fixed Overhead Rate Change in Profit 47,500 (52,500) (5,000) P 14 (P 70,000) 8. Profit computation and reconciliation. Maggie has just obtained a patent on a small electronic device and organized Maggie Products, Inc., in order to produce and sell the device. During the first month of operations, the device was very well received on the market and a statement of profit and loss shown below was prepared. The President was discouraged over the loss shown on the profit or loss statement. Maggie Products, Inc. Statement of Profit or Loss First Month Sales (40,000 units) Less Variable expenses: Cost of goods sold (*) Selling and administrative Contribution Margin Less fixed expenses: Manufacturing overhead Selling and administrative Loss P 200,000 P80,000 30,000 75,000 20,000 (* consist of direct materials, direct labor and variable overhead.) 110,000 90,000 95,000 (5,000) Other data: Units produced Units sold Variable cost per unit: Direct material Direct labor Manufacturing overhead Selling and administrative expenses 50,000 40,000 P 1.00 0.80 0.20 0.90 Required: 1. Calculate the unit product cost under absorption costing. Problem 8 (1) Unit variable costs (80,000/40,000) Unit fixed factory overhead (75,000/50,000) Unit cost – Absorption Costing P 2.00 1.50 P 3.50 2. Calculate the profit (loss) under absorption costing. Problem 8 (2) Sales (40,000 x P 5) Less: Cost of goods sold (40,000 x P 3.50) Gross Profit Less: Operating Expenses: Fixed selling and administrative expenses Variable selling and administrative expenses Net Income P 200,000 (140,000) P 60,000 P 20,000 30,000 50,000 P 10,000 3. Reconcile the difference in profit under absorption costing and variable costing. Problem 8 (3) Change in net income [P 10,000 – (P 5,000)] Change in inventory (50,000 – 40,000) Multiply: Unit fixed factory overhead rate Change in Net income P 15,000 10,000 units 1.50 P 15,000 9. Profit reconciliation. Alfred Company manufactures and sells a single product. Cost data for the product follow: Variable cost per unit: Material Labor Factory overhead Selling and administrative Fixed costs per month: Factory overhead Selling and administrative P6 12 4 3 240,000 180,000 The product sells for P 40 per unit. Production and sales data for May and June, the first two months of operations are as follows: May June Unit Produced 30,000 30,000 Units Sold 26,000 34,000 Income statements prepared by the accounting department, using absorption costing, are presented below: Sales Less Cost of goods sold: Beginning inventory Add: Cost of goods manufactured Goods Available for Sale Less: Ending Inventory Cost of goods sold Gross Margin Less: Selling and administrative expenses Profit May P 1,040,000 June P 1,360,000 0 900,000 900,000 120,000 780,000 260,000 120,000 900,000 1,020,000 0 1,020,000 340,000 258,000 282,000 P 2,000 P 58,000 Required: 1. Prepare the statement of profit or loss for May and June using the contribution approach. Problem 9 (1) For the month of May Sales (26,000 x P 40) Less: Variable costs: Cost of goods sold (26,000 x P 22*) Selling and Administrative expenses (26,000 x P 3) Contribution Margin Less: Fixed costs: Factory overhead Selling and Administrative expenses Profit (Loss) P 1,040,000 572,000 78,000 240,000 180,000 (650,000) 390,000 (420,000) P (30,000) For the month of June Sales (34,000 x P 40) Less: Variable costs: Cost of goods sold (34,000 x P 22) Selling and Administrative expenses (34,000 x P 3) Contribution Margin Less: Fixed costs: Factory overhead Selling and Administrative expenses Profit (Loss) P 1,360,000 748,000 102,000 240,000 180,000 (850,000) 510,000 (420,000) P 90,000 * [Materials P 6 + Labor 12 + Factory overhead 4] 2. Account for the difference in profit between variable costing and absorption costing. Problem 9 (2) May Change in Net Income [(P 2,000) – (P 30,000)] [P 58,000 – P 90,000] Change in Inventory (30,000 – 26,000) (30,000 – 34,000) Multiply: Fixed factory overhead Change in Net Income June P 32,000 P 32,000 4,000 units P8 P 32,000 4,000 units P8 P 32,000 10. Reconciliation of profit and volume variance. Aldrin Products has organized a new division to manufacture and sell specially designed tables for mounting and using personal computers. Its new plant is highly automated and requires high monthly fixe cost as shown below: Manufacturing costs: Variable costs per unit: Direct Materials P 60 Direct labor 26 Overhead cost 24 Fixed overhead cost 240,000 Selling and administrative costs: Variable 12% of sales Fixed 160,000 During the month of operations, the following activity was recorded: Units produced 5,500 Units sold 5,200 Selling price per unit P 410 Net materials variance-unfavorable 12,000 Net direct labor variance- favorable 5,000 Net variable overhead variance- favorable 2,500 The company has a normal capacity of 6,000 units. Required: 1. Unit inventoriable costs under absorption costing and variable costing. Problem 10 (1) Direct Materials Direct Labor Variable Factory Overhead Fixed Factory Overhead (240,000/6,000) Unit Inventoriable Costs Absorptio n Costing P 60 26 24 40 P 150 Variable Costing P 60 26 24 P 110 2. Calculate the volume variance. Problem 10 (2) Normal Capacity 6,000 units Actual Capacity Volume Variance in Units Standard Fixed Overhead Rate Volume Variance in Pesos (5,500 units) 500 units - Unfavorable x 40 P 20,000– Unfavorable 3. Cost of goods sold at actual under absorption costing and variable costing. Problem 10 (3) Cost of Goods Sold, at Standard o Absorption (5,200 x 150) o Variable (5,200 x 110) Fixed Overhead Net Materials Variance – Unfavorable Net Direct Labor Variance – Favorable Net Variable Overhead Variance - Favorable Volume Variance – Unfavorable Cost of Goods Sold, at Actual Absorption Costing P 780,000 12,000 (5,000) (2,500) 20, 000 P 804,5000 Variable Costing P 572,000 240, 000 12,000 (5,000) (2,500) P 816, 500 4. Operating income under absorption costing and variable costing. Problem 10 (4) Sales (5,200 x 410) Less: Cost of Goods Sold, at Actual Variable Selling and Administrative Expense o (2,132,000 x 12%) Fixed Selling and Administrative Expense Operating Income Absorption Costing P 2,132,000 (804, 500) Variable Costing P 2,132,000 (816,500) (255,840) (255,840) (160,000) P 911, 660 (160,000) P 899, 660 5. Reconciliation of income under absorption costing and variable costing. Problem 10 (5) Absorption Costing Income Variable Costing Income Change in Operating Income P 911,660 P 899,660 P 12, 000 Production 5,500 units Sales (5,200 units) Change in inventory 300 units Unit Fixed Factory Overhead x 40 Change in Operating Income P 12, 000 11. Volume variance units and in hours. Consider the following standard cost per unit based on a normal capacity of 40,000 units: Direct Materials Direct Labor Variable overhead Fixed overhead 1.4 kgs @ P 20 0.2 hr. @ P 80 0.2 hr. @ P 100 0.2 hr. @ P 50 P 28.00 16.00 20.00 10.00 Compute the volume variance under each of the following independent actual production conditions (identify the variances as unfavorable or favorable): a. 40,000 units. Problem 11 (a) Normal Capacity in units Less: Actual Capacity in units Volume Variance Standard Fixed Overhead rate Volume Variance in Pesos x P 40,000 (40,000) 0 10 P0 b. 43,200 units Problem 11 (b) Normal Capacity in units Less: Actual Capacity in units Volume Variance Standard Fixed Overhead rate Volume Variance in Pesos x P 40,000 43,200 (3,200) F 10 P 32,000 F c. 37,800 units. Problem 11 (c) Normal Capacity in units Less: Actual Capacity in units Volume Variance Standard Fixed Overhead rate Volume Variance in Pesos x P 40,000 (37,800) 2,200 U 10 P 22,000 U d. 40,000 units and 8,000 hours. Problem 11 (d) Normal Capacity in units Less: Actual Capacity in units Volume Variance Standard Fixed Overhead rate Volume Variance in Pesos x P 40,000 (40,000) 0 10 P0 x P 8,000 (8,000) 0 10 P0 e. 41,400 units and 7,650 hours. Problem 11 (e) Normal Capacity in units Less: Actual Capacity in units Volume Variance Standard Fixed Overhead rate Volume Variance in Pesos x P 40,000 (41,400) (1,400) F 10 P (1,400) F x P 8,000 (7,650) 350 U 10 P 3,500 U f. 38,800 units and 9,800 hours. Problem 11 (f) Normal Capacity in units Less: Actual Capacity in units Volume Variance Standard Fixed Overhead rate Volume Variance in Pesos x P 40,000 (38,800) 1,200 U 10 P 12,000 U x P 8,000 (9,800) (1,800) F 10 P 18,000 F 12. Statement of profit or loss. Bark Manufacturing Company began its operations on January 1, 20CY, and produces a single product that sells for P 12 per unit. During 20CY, 100,000 units of the product were produced, 90,000 of which were sold. There was no work in process inventory at the end of the year. Manufacturing costs and marketing and administrative expenses for 20CY were as follows: Materials Direct labor Factory overhead Marketing and administrative Fixed P 200,000 100,000 Variable P 2.00 per unit produced 1.50 per unit produced .50 per unit produced .20 per unit produced Required: Prepare the statement of profit or loss for 20CY using direct costing. Problem 12 Bark Manufacturing Company Statement of Profit or Loss For the Year Ended 20CY P 1,080,000 Less: Variable Cost of Goods Materials Labor Variable Factory Overhead P 180,000 135,000 45,000 Manufacturing Margin 720,000 Less: Variable Selling and Administrative Expenses Contribution Margin (18,000) Sales Less: Fixed Factory Overhead 200,000 Fixed Selling and Administrative Expenses 100,000 Profit (360,000) 702,000 300,000 P 402,000 13. Profit and Volume Variance. Holland Products began operations on January 3 of the current year. Standards were established in early January assuming a normal production volume of 160,000 units. However, the company produced only 140,000 units of product and sold 100,000 units at a selling price of P 180 per unit during the current year. Variable cost totaled P 7,000,000 of which 60% were manufacturing and 40% were selling. Total fixed costs amount to P 11,200,000 of which 50% comes from manufacturing. There were no raw materials or work in process inventories at the end of the year. Actual input prices per unit of product and actual input quantitative per unit of product were equal to standard. Required: 1. Determine the cost of goods sold at standard cost, using full absorption costing (excluding standard cost variances). Problem 13 (1) Unit variable costs [(P7, 000,000 x 60%)/140,000 units] Unit fixed costs [(P11, 200,000 x 50%)/160,000 units] Total Unit Cost – Absorption Costing CGS- absorption costing (100,000 units x P65) P 30.00 35.00 P 65.00 P6, 500,000 2. How much cost would be assigned to ending inventory using direct costing? Problem 13 (2) Ending inventory- direct costing [(140,000-10,000) x P30] P 1,200,000 3. Compute the factory overhead volume variance for the year. Problem 13 (3) Normal Capacity Less: Actual Capacity Volume Variance in units Unit Fixed Overhead Volume Variance in Pesos P 160,000 units 140,000 units 20,000 U P 35 P 700,000 U 4. How much would operating income be, using direct costing? Problem 13 (4) Sales (100,000 units x P 180) Variable Cost of goods sold (100,000 units x P 30) Variable expenses (P7, 000,000 x 40%) Fixed costs and expenses Operating Income- direct costing P 18,000,000 (3,000,000) (2,800,000) (11,200,000) P 1,000,000 15. Statement of profit or loss and reconciliation of profit. The Mass Company manufactures and sells a single product. The following data cover the two latest years of operations: Selling Price Sales in units Beginning inventory in units Ending inventory in units Fixed manufacturing costs Fixed marketing and administrative costs Standard variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable marketing and administrative 20PY P 40 25,000 1,000 1,000 P 120,000 P 190,000 20CY P 40 25,000 1,000 5,000 P 120,000 P 190,000 P 10.000 9.50 4.00 1.20 The denominator level is 30,000 output units per year. Mass Company’s accounting records produce variable costing information, and year-end adjustments are made to produce external reports showing absorption costing information. Any variances are charged to cost of goods sold. Required: 1. Prepare two statements of profit or loss for 20PY and 20CY, one under variable and one under absorption costing. 2. Explain briefly why the profit figured computed in requirement “a” agrees or do not agree. 3. Give two advantages and two disadvantages of using variable costing. Problem 15 (1) MASS COMPANY Comparative Income Statement Sales (25,000 x P40) Less: Variable Cost of goods sold (25,000 X P23.50) Fixed CGS (25,000 X P4) Volume variance Total 20PY Absorption Variable Costing Costing P 1,000,000 P 1,000,000 587,500 100,000 20,000 U 707,500 587,500 587,500 587,500 100,000 12,000 U 699,500 587,500 587,500 292,500 412,500 300,500 412,500 - 30,000 - 30,000 292,500 30,000 190,000 220,000 382,500 120,000 190,000 310,000 300,500 30,000 190,000 220,000 382,500 120,000 190,000 310,000 P 72,500 P 72,500 P 80,500 P 72,500 Gross profit/Mfg. Margin Less: Variable Expenses (25,000 x P1.20) Gross profit Contribution margin Less: Variable expenses Fixed overhead Fixed expenses Total Net Income 20CY Absorption Variable Costing Costing P 1,000,000 P 1,000,000 Supporting Analysis: a. Unit fixed manufacturing costs = P 120,000/30,000 units = P 4.00 units b. Normal capacity Less: Actual capacity (25,000 + 3,000 – 1,000) Under (Over) absorbed capacity x Unit Fixed Overhead rate Volume Variance – U (F) 20PY 30,000 units 25,000 5,000 U P4 P 20,000 U 20CY 30,000 units 3,000 U P4 P 12,000 U Problem 15 (2) Change in net income Production Less: Sales Change in inventory x Unit Fixed Overhead Change in Net Income 20PY P0 25,000 units 25,000 0 P4 P0 20CY P 8,000 27,000 units 25,000 2,000 P4 P 8,000 Problem 15 (3) Advantages of variable costing: 1. It classifies costs and expenses into either fixed or variable which leads to the use of contribution margin model for profit prediction. 2. It more significantly relates to the managerial concept of performance measurement and evaluation where the concept of cost and profit controllability is at utmost importance. Disadvantages of variable costing: 1. It is not accordance with the generally accepted accounting principles. GAAP uses the traditional principle that fixed overhead is a necessary cost of production and should be classified as product costs. 2. It treats fixed overhead as a period cost (i.e. expenses) which may lead to lower inventoriable cost and, consequently; lower sales price thereby negating the potentials of maximizing income. 16. Statement of profit or loss and reconciliation of profit. RGB Corporation is a manufacturer of a synthetic element. A. B. Cruz, president of the company, has been eager to obtain the operating results for the fiscal year just completed. Cruz was surprised when the income statement revealed that operating income dropped to P645,000 from P900,000, although sales volume had increased by 100,000 units. This drop in operating income occurred even though Cruz had implemented the following changes during the past 12 months to improve the profitability of the company. (1) In response to a 10% increase in production costs, the sales price of the company’s product was increased by 12%. This action took place on December 3,20PY. (2) The management of the selling and administrative departments were given strict instructions to spend no more in fiscal 20CY than they did in fiscal 20PY. RGB’s accountants prepared the following schedule of selected data to assist management. The company’s comparative income statement also appears below. RGB uses the FIFO method for finished goods. RGB Corporation Selected Operating and Financial Data For 20PY and 20CY Sales price per unit 20PY P 10.00 20CY P 11.20 Materials cost per unit Direct labor cost per unit 1.50 2.50 1.55 2.75 Variable factory overhead per unit Fixed factory overhead per unit Total fixed factory overhead Total selling and administrative expenses Quantity of units budgeted (normal capacity) Quantity of the units actually produced Quantity of units sold Quantity of units in beginning inventory 1.00 3.00 P3,000,000 1,500,000 1,000,000 1,200,000 900,000 0 1.10 3.30 P3,300,000 1,500,000 1,000,000 850,000 1,000,000 300,000 Quantity of units in ending inventory 300,000 150,000 RGB Corporation Statement of Operating Income For The Years Ended November 30, 20PY, and 20CY Sales revenue 20PY P 9,000 20CY P 11,200 Cost of goods sold Volume variance (favorable) unfavorable Gross profit Selling and administrative expenses Operating income P 7,200 ( 600) _6,600 2,400 _1,500 P 900 P 8,700 ___495 __9,195 2,005 __1,500 P 505 Required: 1. Explain to A. B. Cruz why RGB Corporation’s profit decreased in the current fiscal year, despite the sales price and sales volume increase. 2. A member of RGB’s Accounting Department has suggested that the company adopt direct costing for internal reporting purposes. a. Prepare and operating income statement for the fiscal years ended November 30, 20PY and 20CY, for RGB Corporation using the direct costing method. b. Present a numerical reconciliation of the difference in operating income between the absorption costing method currently in the use and the direct costing method proposed. c. Identify and discuss some of the advantages and disadvantages of using direct costing method for internal reporting purposes. Problem 16 (1) RGB Corporation’s profit decreased in the current fiscal year, although the sales price and sales volume increased. It may be due to some factors like the increase in production costs and the opening inventory balance from the past year. The fixed factory overhead expense of the beginning inventories from the past year were applied to the cost of goods sold of the current year, which made the current costs incurred higher than the past year. This factor resulted in increased in the cost of goods sold and decreased in gross margin as well as the recognized profit. Problem 16 (2a) RGB Corporation Statement of Operating Income For the year ended November 30, 20PY, and 20CY. 20PY Sales (900,000 x 10) 20CY P 9,000,000 (1,000,000 x 11.20) P 11,200,000 Less: Var. Expenses Materials (900,000 x 1.50) (1,350,000) (1,000,000 x 1.55) (1,550,000) Direct Labor (900,000 x 2.50) (2,250,000) (1,000,000 x 2.75) (2,750,000) Var. FOH (900,000 x 1.00) (900,000) (1,000,000 x 1.10) (1,100,000) Contribution Margin Fixed Expenses: P 4,500,000 P 5,800,000 Problem 16 (2a) RGB Corporation Statement of Operating Income For the year ended November 30, 20PY, and 20CY. 20PY Sales (900,000 x 10) 20CY P 9,000,000 (1,000,000 x 11.20) P 11,200,000 Less: Var. Expenses Materials (900,000 x 1.50) (1,350,000) (1,000,000 x 1.55) (1,550,000) Direct Labor (900,000 x 2.50) (2,250,000) (1,000,000 x 2.75) (2,750,000) Var. FOH (900,000 x 1.00) (900,000) (1,000,000 x 1.10) (1,100,000) Contribution Margin P 4,500,000 P 5,800,000 Fixed FOH (3,000,000) (3,300,000) Selling & Admin. Exp. (1,500,000) (1,500,000) P0 P 1,000,000 Fixed Expenses: Operating Income Problem 16 (2b) Computation of Difference in Operating Income 20PY 20CY ABS OI P 900,000 ABS OI P 505,000 VAR OI (0) VAR OI (1,000,000) Difference in OI P 900,000 Difference in OI P (495,000) Problem 16 (2b) Reconciliation of Absorption Costing and Variable Costing Operating Income 20PY VAR OI Add: (300,000 x 3) ABS OI 20CY P 0 VAR 900,000 Add: (-150,000 x 3.30) P 900,000 ABS OI P 1,000,000 (495,000) P 505,000 Problem 16 (3) Advantages 1. Variable costing provides a better understanding of the effect of fixed costs on the net profits because total fixed cost for the period is shown on the income statement. 2. Various methods of controlling costs such as the standard costing system and flexible budgets have close relation with the variable costing system. Understanding variable costing systems makes the use of those methods easy. 3. Companies using variable costing systems prepare income statements in a contribution margin format that provides necessary information for cost volume profit (CVP) analysis. This data cannot be directly obtained from a traditional income statement prepared under an absorption costing system. 4. The net operating income figure produced by variable costing is usually close to the flow of cash. It is useful for businesses with a problem of cash flows. 5. Under the absorption costing system, income of different periods changes with the change of inventory levels. Sometimes income and sales move in opposite directions. But it does not happen under variable costing. Disadvantages 1. Financial statements prepared under variable costing methods do not conform to generally accepted accounting principles (GAAP). The auditors may refuse to accept them. 2. Tax laws of various countries require the use of absorption costing. 3. Variable costing does not assign fixed cost to units of products. So, the production costs cannot be truly matched with revenues. 4. Absorption costing is usually the base for evaluating a top executive’s efficiency. Reco. Content by accountingformanagement.org [Rashid Javed (M.Com, ACMA)] Retrieved from: https://www.accountingformanagement.org/advantages-and-disadvantagesof-variable-costing/ Basic concepts A. 1. In absorption costing, as contrasted with direct costing, the following are absorbed into inventory. a. All the elements of fixed and variable manufacturing overhead. b. Only the fixed manufacturing overhead. c. Only the variable manufacturing overhead. d. Neither fixed nor variable manufacturing overhead. A. 2. Under the direct costing, which is classified as product costs? a. Only variable production costs. b. Only direct costs. c. All variable costs. d. All variable and fixed production costs. A. 3. Which one of the following considers the impact of fixed overhead costs? a. Full absorption costing. b. Marginal costing. c. Direct costing. d. Variable costing. B. 4. When all manufacturing cost used in production are attached to the products, whether direct, or indirect, variable of fixed, this is called: a. Process costing b. Absorption costing. c. Variable costing d. Job Order costing B. 5. An operation costing system is a. Identical to a process costing system except that actual cost is used for manufacturing overhead. b. The same as a process costing system except that materials are allocated on the basis of batches of production. c. The same as a job order costing system except that materials are accounted for in the same way as they are in a process costing system. d. The same as a job order costing system except that no overhead allocations are made since actual costs are used throughout. A. 6. If production is greater than sales (units), then absorption costing net income will generally be a. greater than direct costing net income. b. less than direct costing net income. c. equal to direct costing net income. d. additional data is needed to be able to answer. B. 7. Which of the following statements is correct? a. When production is higher than sales, absorption costing net income is lower than variable costing net income, b. If all the products manufactured during the period are sold in that period, variable costing net income is equal to absorption costing net income. c. When production is lower than sales, variable costing net income is lower than absorption costing net income. d. When production and sales level are equal, variable costing net income is lower than absorption costing net income. D. 8. Which of the following is an argument against the use of direct (variable) costing? a. Absorption costing overstates the balance sheet value of inventories. b. Variable factory overhead is a period cost. c. Fixed factory overhead is difficult to allocate properly. d. Fixed factory overhead is necessary for the production of a product. B. 9. The difference between variable costs and fixed costs is a. Variable costs per unit fluctuate and fixed costs per unit remain constant. b. Variable costs per unit are fixed over the relevant range and fixed costs per unit are variable. c. Total variable costs are variable over the relevant range and fixed in the long term, while fixed costs never change. d. Variable costs per unit change in varying increments, while fixed costs per unit change in equal. Increments. D. 10. Determine the following statements as true or false. Statement 1. Direct costing and variable costing are different terms that mean the same thing. Statement 2. In a variable costing income statement, sales revenue is typically lower than in absorption costing income statement. D. 11. Jansen, Inc. pays bonuses to its managers based on operating income. The company uses absorption costing, and overhead is applied on the basis of direct labor hours. To increase bonuses, Jansen's managers may do all of the following except a. Produce those products requiring the most direct labor. b. Defer expenses such as maintenance to a future period. c. Increase production schedules independent of customer demands. d. Decrease production of those items requiring the most direct labor. C. 12. The management of a company computes et income using both the absorption and variable costing approaches to product costing. This year, the net income under the variable costing approach was greater than the net income under the absorption costing approach. This difference is most likely the result of a. A decrease in the variable marketing expenses. b. An increase in the finished goods inventory. c. Sales volume exceeding production volume. d. Inflationary effects on overhead costs. C. 13. When comparing absorption costing with variable costing, which of the following statements is not true? a. Absorption costing enables managers to increase operating profits in the short run by increasing inventories. b. When sales volume is more than production volume, variable costing will result in higher operating profit. c. A manager who is evaluated based on variable costing operating profit would be tempted to increase production at the end of a period in order to get a more favorable review. d. Under absorption costing, operating profit is a function of both sales volume and production volume. B. 14. Which one of the following statements is correct regarding absorption costing variable costing? a. Overhead costs are treated in the same manner under both costing methods. b. If finished goods inventory increases, absorption costing results in higher income. c. Variable manufacturing costs are lower under variable costing. d. Gross margins are the same under both costing methods. C. 15. When comparing absorption costing with variable costing, which of the following statements is not true? a. Absorption costing enables managers to increase operating profits in the short run by increasing inventories. b. When sales volume is more than production volume, variable costing will result in higher operating profit. c. A manager who is evaluated based on variable costing operating profit would be tempted to increase production at the end of a period in order to get a more favourable review. d. Under absorption costing, operating profit is a function of both sales volume and production volume. D. 16. Which of the following is an argument against the use of direct (variable) costing? a. Absorption costing overstates the balance sheet value of inventories. b. Variable factory overhead is a period cost. c. Fixed factory overhead is difficult to allocate properly. d. Fixed factory overhead is necessary for the production of a product. Inventoriable costs The next 2 questions are based on the following data: Lina company produced 100,000 units of Product Zee during the month of June. Costs incurred during June were as follows. Direct materials P 100,000 Direct labor 80,000 Variable manufacturing overhead 40,000 Fixed manufacturing overhead 50,000 Variable selling and general expenses 12,000 Fixed selling and general expenses 46,000 P 327,000 B. 17. What was product Zee’s unit cost under absorption costing? a. P 3.27 b. P 2.70 c. P 2.32 d. P 1.80 17. Direct materials (P 100,000/100,000 units) Direct labor (P 80,000/100,000 units) Variable overhead (P 40,000/100,000 units) Fixed overhead (P 50,000/100,000 units) Unit product cost – absorption costing (P 270,000/100,000 units) P 1.00 0.80 0.40 0.50 P 2.70 D. 18. What was product Zee’s unit cost under variable (direct) costing? a. P 2.82 b. P 2.70 c. P 2.32 d. P 2.20 18. Direct materials (P 100,000/100,000 units) Direct labor (P 80,000/100,000 units) Variable overhead (P 40,000/100,000 units) Unit product cost-variable costing (P 220,000/100,000 units) P 1.00 0.80 0.40 P 2.20 B. 19. Excellent Writer produces and sell boxes of signing pens for P 1,000 per box. Direct materials are P 400 per box and direct manufacturing labor averages P 75 per box. Variable overhead is P 25 per box and fixed overhead is P 12,500,000 per year. Administrative expenses, all fixed, run P4, 50000,000 per year, with sales commissions of P 100 per box. Production is expected to be 100,000 boxed, which is met every year. For the year just ended, 75,000 boxed were sold. What is the inventoriable cost per box using variable costing? a. P 770 b. P 500 c. P 475 d. P 625 19. Direct materials Direct labor Variable overhead Unit product cost- variable costing P 400 75 25 P 500 A. 20. For P 1,000 per box, the Majestic Producers, Inc., produces and sell delicacies. Direct materials are P 400 per box and direct manufacturing labor averages P 75 per box. Variable overhead is P 25 per box and fixed overhead is P 12,500,000 per year. Administrative expenses, all fixed, run P 4,50000,000 per year, with sales commissions of P 100 per box. Production is expected to be 100,000 boxed, which is met every year. For the year just ended, 75,000 boxed were sold. What is the inventoriable cost per box using absorption costing? a. P 625 b. P 500 c. P 770 d. P 670 20. Direct materials Direct labor Variable overhead Fixed overhead (P 12,500,000/100,000) Unit product cost- variable costing P 400 75 25 125 P 625 B. 21. Compute for the inventory value under the direct costing method using the data given: units unsold at the end of the period, 45,000; raw materials used, P 6.00 per unit; raw materials inventory, beginning, P 5.90 per unit; direct labor, P 3.000 per unit; variable overhead per unit, P 2.00 per unit, indirect labor for the month, P 33,750. Total fixed costs, P 67,500. a. P 16.90 b. P 11.00 c. P 17.45 d. P 19.15 21. Direct materials Direct labor Variable overhead Unit product cost- variable costing P 6.00 3.00 2.00 P 11.00 C. 22. The absorption costing method includes in inventory. a. b. c. d. Fixed Factory overhead No No Yes Yes Variable factory overhead No Yes Yes No C. 23. In an income statement prepared as an internal report using the direct (variable) costing method, fixed selling and administrative expenses would a. not be used. b. Be used in the computation of the contribution margin. c. Be used in the computation of operating income but not in the computation of the contribution margin. d. Be treated the same as variable selling and administrative expense. B. 24. In an income statement prepared as an internal report using the variable costing method, variable selling and administrative expenses would a. not be used. b. Be used in the computation of the contribution margin. c. Be used in the computation of operating income but not in the computation of the contribution margin. d. Be treated the same as variable selling and administrative expense. D. 25. Care Company’s 20CY fixed manufacturing overhead cost totaled P 100,000 and variable selling costs totaled P 80,000. Under direct costing, how should these costs be classified? Period Cost Product Cost P0 P 180,000 b. P 80,000 P 100,000 c. P 100,000 P 80,000 d . P 180,000 P0 a. 25. Manufacturing overhead cost Variable selling costs Total period cost P 100,000 80,000 P 180,000 B. 26. With a production of 200,000 units of product A during the month of June, Bucayao Corporation has incurred costs as follows: Direct materials P 200,000 Direct labor used 135,000 Manufacturing overhead: Variable 75,000 Fixed 90,000 Selling and administrative expenses: Variable 30,000 Fixed 85,000 Total 615,000 Under absorption costing, the unit cost of product A was: a. P 2.20 b. P 2.50 c. P 3.25 d. P 2.05 26. Direct materials (P200,000/200,000 units) Direct labor (P135,000/200,000 units) Variable overhead (P75,000/200,000 units) Fixed overhead (P 90,000/200,000 units) Unit product cost- absorption costing P 1.000 0.675 0.375 0.450 P 2.500 Profit determination C. 27. The Blue Company has failed to reach its planned activity level during its first 2 years of operation. The following table shows the relationship among units produced, sales, and normal activity for these years and the projected relationship for Year 3. All prices and costs have remained the same for the last 2 years and are expected to do so in Year 3. Income has been positive in both Year 1 and Year 2. Units Produced Sales Planned Activity Year 1 90,000 90,000 100,000 Year 2 95,000 95,000 100,0000 Year 3 90,000 90,000 100,000 Because Blue Company uses an absorption-costing system, one would predict gross margin for Year 3 to be a. Greater than Year 1 b. Greater than Year 2 c. Equal to Year 1 d. Equal to Year 2 A. 28. HY & Company completed its first year of operations during which time the following information were generated: Total units produced 100,000 Total units sold 80,000 at 100 per unit Work in process ending inventory costs: Fixed cost Factory overhead P 1.2 million Selling and administrative P 0.7 million Per unit variable cost: Raw materials P 20.00 Direct labor 12.50 Factory overhead 7.50 Selling and administrative 10.00 If the company used the variable (direct) costing method, the operating income would be a. P 2, 100,000 b. P 4,000,000 c. P 2, 480,000 d. P 3,040,000 28. Sales (P80,000 x P100) Variable costs and expenses (P80,000 x P50) Fixed costs and expenses Operating Income P8,000,000 (4,000,000) (1,900,000) P2,100,000 B. 29. Gordon Company began its operations on January 20CY, and produces a single product that sell for P 10 per unit. Gordon uses an actual (historical) cost system. In 20CY, 100,000 units were produced and 80,000 units were sold. There was no work-in-process inventory at December 31, 20CY. Manufacturing costs and selling and administrative expenses for 20CY were as follows: Fixed costs Variable costs Raw materials - P 2.00 per unit produced Direct labor - P 1.25 per unit produced Factory overhead P 120,000 0,75 per unit produced Selling and administrative 70,000 1.00 per unit produced What would be Gordon’s operating income for 20CY under the variable (direct) costing method? a. P 114,000 c. P 234,000 b. P 210,000 d. P 330,000 29. Contribution margin (P80,000 x P5) Fixed costs and expenses Operating Income P400,000 190,000 P210,000 B. 30. If net earnings were higher using standard direct costing than using standard absorption costing, what can be said about sales during the period if inventory is priced using the FIFO method? a. Sales increased. c. Sales decreased. b. Sales exceed production. d. Sales were less than production FURTHER EXPLANATION FOR THEORIES (#s 1-30) 1. A. All the elements of fixed and variable manufacturing overhead. All manufacturing costs, whether variable or fixed, are included in the determination of product costing using the absorption costing method. 2. A. Only variable production costs. Under the direct costing model, only variable production costs such as direct materials, direct labor, and factory overhead are include in the determination of the product costs. Fixed factory overhead is classified as a period costs, that is automatically deducted from sales as an expense regardless of sales volume level. 3. A. Full absorption costing Full absorption costing treats fixed factory overhead costs as product costs. Thus, inventory and cost of goods sold include (absorb) fixed factory overhead. 4. B. Absorption costing Absorption costing includes all manufacturing costs, whether direct or indirect, foxed or variable, controllable or not as part of product costs. 5. B. The same as process costing system except those materials are allocated on the basis of batches of production. Operation costing is used in a situation in which a company produces similar items that differ mostly in the materials that are used. 6. A. greater than direct costing net income. The unit product cost of absorption costing (AC) which includes the fixed factory overhead is greater than that of the variable costing (VC). Therefore, if production is greater than sales, the cost of ending inventory under absorption costing method shall be much higher. Because of this, the net income under absorption costing shall also be much higher. 7. B. If all the products manufactured during the period are sold in that period, variable costing net income is equal to absorption costing net income. If production and sales are equal, the net income under the absorption costing and variable costing methods are also equal, under the assumption that the unit cost remains constant. 8. D. Fixed factory overhead is necessary for the production of a product. Fixed factory overhead is necessary part for the production of a product. 9. B. Variable costs per unit are fixed over the relevant range and fixed costs per unit are variable. Variable cost per unit cost always fixed, total variable cost will change according to unit of products total fixed cost will remain constant, per unit fixed cost will change according to units of products. 10. D. Statement 1 – True; Statement 2 – False Technically, direct costing and variable costing mean differently. Direct costing deals with the process of underlining the importance of segment of margin (direct margin) while variable costing emphasizes the contribution margin in its analysis. In practice, however, some accountants interchange direct costing to variable costing as having the same meaning. Hence, statement 1 is true. Statement 2 is false because the sales revenue under absorption costing method are the same under the variable costing method. 11. D. Decrease production of those items requiring the most direct labor. Under an absorption costing system, income can be manipulated by producing more products than are sold because more fixed manufacturing overhead will be allocated to the ending inventory. When inventory increases, some fixed costs are capitalized rather than expensed. Decreasing production, however, will result in lower income because more of the fixed manufacturing overhead will be expensed. 12. C. Sales volume exceeding production volume When sales exceed production, this means that inventory decreased. When inventory decreases, the income under the variable method is greater than under the absorption method. This is because under the absorption method, some of the prior period’s fixed costs are being expensed as part of cost of goods sold this period. 13. C. A manager who is evaluated based on variable costing operating profit would be tempted to increase production at the end of a period in order to get more favourable review. Absorption (full) costing is the accounting method that considers all manufacturing costs as product costs. These costs include variable and fixed manufacturing costs whether direct or indirect. Variable (direct) costing considers only variable manufacturing costs to be product costs, i.e., inventoriable. Fixed manufacturing costs are considered period costs and are expensed as incurred. If production is increased without increasing sales, inventories will rise. However, all fixed costs associated with production will be an expense of the period under variable costing. Thus, this action will not artificially increase profits and improve the manager’s review. 14. B. If finished goods inventory increases, absorption costing results in higher income. Under variable costing, inventories are charged only with the variable costs of production. Fixed manufacturing costs are expensed as period costs. Absorption costing charges to inventory all costs of production. If finished goods inventory increases, absorption costing results in higher income because it capitalizes some fixed costs that would have been expensed under variable costing. When inventory declines, variable costing results in higher income because some fixed costs capitalized under the absorption method in prior periods are expensed in the current period. 15. C. A manager who is evaluated based on variable costing operating profit would be tempted to increase production at the end of a period in order to get more favourable review. Absorption (full) costing is the accounting method that considers all manufacturing costs as product costs. These costs include variable and fixed manufacturing costs whether direct or indirect. Variable (direct) costing considers only variable manufacturing costs to be product costs, i.e., inventoriable. Fixed manufacturing costs are considered period costs and are expensed as incurred. If production is increased without increasing sales, inventories will rise. However, all fixed costs associated with production will be an expense of the period under variable costing. Thus, this action will not artificially increase profits and improve the manager’s review. 16. D. Fixed factory overhead is necessary part for the production of a product. Fixed manufacturing costs are necessary part of the production. 17. B. P2.70 Direct materials (P 100,000/100,000 units) Direct labor (P 80,000/100,000 units) Variable overhead (P 40,000/100,000 units) Fixed overhead (P 50,000/100,000 units) Unit product cost – absorption costing (P 270,000/100,000 units) 18. D. P2.20 Direct materials Direct labor Variable overhead Unit product cost – variable costing P 1.00 0.80 0.40 P 2.20 Direct materials Direct labor Variable overhead Unit product cost – variable costing P 400 75 25 P 500 19. B. P500 20. A. P625 Direct materials Direct labor Variable overhead Fixed overhead (P 12,500,000/100,000) Unit product cost – absorption costing P 400 75 25 125 P 625 Direct materials P 6.00 21. B. P11.00 P 1.00 0.80 0.40 0.50 P 2.70 Direct labor 3.00 Variable overhead 2.00 Unit product cost – variable costing P 11.00 Indirect labor is not included because it is a fixed cost and is not a product cost under the direct costing method. 22. C. Fixed overhead – Yes; Variable factory overhead – Yes The following items are included in the inventory cost using the absorption costing method: Direct material, direct labor, variable overhead, and fixed overhead. 23. C. Be used in the operating income but not in the computation of the contribution margin. Under direct (variable) costing, fixed selling and administrative expenses are treated as period costs (or expenses) and are charged against revenues in computing operating income. Contribution margin s sales less variable costs and expenses and does not include in fixed costs and expenses in the computation thereof. 24. B. Be used in the computation of the contribution margin. Under variable costing method, variable selling and administrative expenses, are treated as period cost and are included in the computation of contribution margin. 25. D. Period cost – P 180,000; Product cost – P 0 Manufacturing overhead cost P 100,000 Variable selling costs 80,000 Total period cost P 180,000 Using direct costing method, fixed manufacturing overhead is a period cost, and variable selling costs are also period costs. Period costs are those charged against sales in the period incurred. 26. B. P2.50 Direct materials (200,000/200,000 units) Direct labor (135,000/200,000 units) Variable overhead (75,000/200,000 units) Fixed overhead (90,000/200,000 units) Unit product cost – absorption costing P 1.000 0.675 0.375 0.450 P2.500 27. C. Equal to Year 1 Gross margin is calculated as sales minus cost of goods sold. Since all of the costs have remained the same over the period and there has been no change in inventory for any period (since sales have been equal to production each year), the gross margin for Year 3 will be equal to the gross margin from the year in which sales were the same level, and this is Year 1. Because this is a new company and for every year since its beginning, sales have been equal to production, inventory at year end for each year has been zero. Because of this, we do not need to know whether the company closes out under- and over-applied overhead to cost of goods sold only, or whether the company prorates it between cost of goods sold and inventory. Since inventory is zero, all under- or over-applied overhead will have been closed to cost of goods sold only. And for each year since its beginning, the company has had under-applied fixed overhead, because actual production has been lower than planned production. Unless fixed overhead has been very different in Year 3 than it was in Year 1, the gross margin for the two years should be substantially the same. 28. A. P 2,100,000 The total unit variable costs and expenses is P50 (P20+12.50+7.50+10.00). Sales (P80,000 x P100) Variable costs and expenses (P80,000 x P50) Fixed costs and expenses Operating Income P8,000,000 (4,000,000) (1,900,000) P2,100,000 29. B. P 210,000 The total unit variable costs and expenses is P5 (2.00+1.25+0.75+1.00) and the unit contribution margin is P5 (P10.00-P5.00). Contribution margin (P80,000 x P5) Fixed costs and expenses Operating Income P400,000 190,000 P210,000 30. B. Sales exceed production. The difference in operating income between variable (direct) costing and absorption costing is in the treatment of fixed overhead, not in the type of costing method used in the valuation on inventory (as if in this case, FIFO method). If variable costing income is higher than the absorption costing income, then sales exceeds production. Remember, variable costing follows the pattern of sales. A. 31. If sales equal production, one would expect net income under the variable costing method to be a. the same as net income under the absorption costing method. b. Greater than net income under the absorption method. c. Differing in as much as the difference between sales and production. d. Less than net income under the absorption costing method. C. 32. When a firm prepares financial reports by using absorption costing a. Profits will always increase with increases in sales. b. Profit will always decrease with decreases in sales. c. Profits may decrease with increased sales even if there is no change in selling prices and costs. d. Decreased output and constant sales result in increased profits. The next two questions are based on the following information: Expected to operate at normal capacity, Golder Corporation plans to manufacture 275,000 units of products in20CY, and the following estimates with respect to sales: Sales in units 250,000 Unit selling price P 35.00 Finished goods inventory on December 31, 20PY is estimated at 25,000 units costing P 500,000. Included in this amount is the fixed manufacturing overhead amounting to P 300,000. No change in both the fixed manufacturing cost and the variable cost per unit of produce are expected in20CY. A. 33. What is the estimated income from manufacturing using the absorption costing method? a. P 3,750,000 b. P 3,450,000 c. P 3,550,000 d. P 3,550,000 33. Sales (P250,000 x P35) Costs of goods sold (P250,000 x P20) Manufacturing Income( Gross profit) P8,750,000 (5,000,000) P3,750,000 C. 34. What is the estimated income from manufacturing using the variable costing method? a. P 3,150,000 c. P 3,450,000 b. P 3,550,000 d. P 3,750,000 34. Sales (P250,000 x P35) Variable Costs of goods sold (P250,000 x P8) Fixed factory overhead (P275,000 x P12) Manufacturing Income( Gross profit) P8,750,000 (2,000,000) (3,300,000) P3,450,000 D. 35. Oldies Biscuits manufactures and sells boxed coconut cookies. The biggest markets for these cookies are as gift that college students buy for their business teachers. There are 100 cookies per box. The following income statement shows the results of the first year of operations. The statement was the one included in the company’s annual report to the shareholders. Sales (400 boxes at P 12.50) Less: Cost of goods sold (400 boxes at P 8.00) Gross Margin Less: selling and administrative expenses Profit P 5,000.00 3,200.00 1,800.00 800 1,000.00 Variable selling and administrative expenses are P 0.90 per box unit. The company produced 500 boxes during the year. Variable manufacturing costs are P 5.25 per box and fixed manufacturing overhead costs total P 1,375 for the year. What is the company’s direct costing net income? a. P 2,540 b. P 2,265 c. P 1,000 d. P 725 35. Sales (400 boxes at P12.50) Variable Costs of goods sold (400 boxes at P5.25) Fixed factory overhead Selling and administrative expenses Net Income P5,000 (2,100) (1,375) (800) P 725 B. 36. Don Papot Ltd., manufactures a single product for which the costs and selling prices are: Variable production costs Selling price Fixed production costs Fixed selling and administrative overhead P 50 per unit P 150 per unit P 200,000 per quarter P 480,000 per quarter Normal capacity is 20,000 units per quarter. Production in 1 quarter was 19,000 per units and sales volume was 16,000 units. No opening inventory for the quarter. The absorption costing profit for the quarter was: a. P 920,000 b. P 950,000 c. P 960,000 d. P 970,000 36. Normal Capacity Less: Actual production Under absorbed capacity Unit fixed overhead (P200,000/20,000) Volume Variance x 20,000 units 19,000 1,000 U P 10 P 10,000 U The next two questions are based on the following information: The following operating data are available from the records of Jonathan Company for the month of January 20CY: Sales (P 70 per unit) Direct materials Direct labor Manufacturing overhead: Fixed Variable Marketing and general expenses: Fixed Variable Production in units – 3,280 units Beginning inventory- none P 210,000 59, 200 48,000 36,080 24,000 11,000 5% of sales A. 37. The ending finished goods inventory under absorption costing method would be: a. P 14,280 b. P 16,968 c. P 12,096 d. P 16,072 37. The cost of the ending inventory shall be the ending inventory in units multiplied by the unit cost. Since there were 3,000 units sold (i.e., P210,000 / P70), then the ending inventory in units would be 280 units (i.e., 3,280 – 3,000). The unit cost under the absorption costing method is P51.00 [(P59,200 + P48,000 + P24,000 + P36,080) / 3,280 units). Therefore, the cost of the ending inventory under the absorption costing method shall be P14, 280 (280 units x P51). A. 38. The profit for the month under the variable costing method would be: a. P 32,420 b. P 25,500 c. P 23,320 d. P 22,420 38. Sales Variable Costs of goods sold (3,000 units x P40) Variable expenses (210,000 x 5%) Fixed factory overhead Fixed expenses Net Income P210,000 (120,000) (10,500) (36,080) (11,000) P 32,420 The next four questions are based on the following information: Sales per unit Variable production cost Annual fixed production cost Variable office expense (unit) Annual fixed selling expense Produced 12,500 units during the period No inventory at January 1 (beg.) Sold 10,000 units P 15,000 8.00 35,000.00 3.00 5,000.00 C. 39. The ending inventory under direct costing is a. P 25,000 b. P 27,500 c. P 20,000 d. P 32,500 39. The unit inventoriable cost under direct costing is P8.00 per unit and the ending inventory in units is 2,500 (i.e., 12,500 units – 10,000 units). The cost of the ending inventory under direct costing shall be P 20,000 (i.e., 2,500 units x P8). D. 40. Ending inventory under absorption costing is a. P 32,500 b. P 20,000 c. P 25,000 d. P 27,000 40. The unit fixed overhead is P2.80 (i.e., P 35,000 / 12,500 units). The total unit inventoriable cost under absorption costing method is P10.80 (i.e. P8.00 + P2.80). Since, the ending inventory in units is 2,500, then the cost of the ending inventory under the absorption costing method is P 27,000 (i.e., 2,500 units x P10.80). A. 41. Total variable annual cost charged to expense in direct costing a. P 110,000 b. P 117,500 c. P 80,000 d. P 100,000 41. Variable Costs of goods sold (10,000 X P8) Variable expenses (10,000 x P3) Total P80,000 30,000 P 32,420 D. 42. Total fixed cost charged against current year’s operations in absorption costing. a. P 35,000 b. P 25,000 c. P 15,000 d. P 43,000 42. Fixed overhead (10,000 X P2.80) Fixed expenses Total P28,000 15,000 P 43,000 Reconciliation of profit The next two (2) questions are based on the following information: The books of Mariposa Company pertaining to the year ended Dec 31,20CY operations showed the following figures relating to product A: Beginning inventory- finished goods and work-in-process No. of units produced No. of units sold at P 15 Direct materials used Direct labor used Manufacturing costs: Fixed Variable Fixed administrative expenses None 40,000 units 32,500 units P 177,500 P 85,000 P 110,000 61,500 171,500 P 30,000 B. 43. Under variable costing, what would be the finished goods inventory as at December 31, 20CY? a. P 81,375.00 b. P 60,750.00 c. P 87,000.00 d. P 49,218.00 e. Answer not given 43. Ending inventory in units (P40,000-32,500) Unit product costs [(P177,500+P85,000+P61,500)/40,0000 units)] Ending inventory in pesos P7,500 x 8.10 P60,750 A. 44. Which costing method, variable or absorption costing, would show a higher operating income for 20CY, and by how much? a. Variable by P 20,625 b. Absorption by P 20,625 c. Variable by P 26,250 d. Absorption by P 26,250 e. Answer not given 44. Change in inventory (P40,000-32,500) Unit fixed overhead (P110,000/40,000) Change in net income (in favor of absorption costing) P7,500 x 2.75 P 20,625 A. 46. During its first year of operations, a company produced 275,000 units and sold 250,000 units. The following cost were incurred during the year: Variable cost per unit: Direct materials P 15.00 Direct labor 10.00 Manufacturing overhead 12.50 Selling and administrative 2.50 Total fixed costs: Manufacturing overhead P 2,200,000 Selling and administrative 1,375,000 What is the difference between operating income calculated on the absorption-costing basis and on the variable-costing basis? a. Absorption-costing operating income is greater than variable-costing operating income by P200,000 b. Absorption-costing operating income is greater than variable-costing operating income by P220,000 c. Absorption-costing operating income is greater than variable-costing operating income by P325,000 d. Variable-costing operating income is greater than absorption-costing operating income by P62,500. B. 47. A manufacturing company employs variable costing for internal reporting and analysis purposes. However, it converts to absorption costing for external reporting. The Accounting Department always reconciles the two operating income figures to assure that no errors have occurred in the conversion. Financial data for the year are presented below. The fixed manufacturing cost per unit was based on the planned level of production of 480,000 units. Budgeted and Actual levels for sales and production ` Budget Sales (in units) Production (in units) Actual 495,000 480,000 510,000 500,000 Standard Unit Manufacturing Costs Variable Costs Fixed manufacturing overhead Total unit manufacturing cost Variable Costing P 10.00 0 Absorption Costing P 10.00 6.00 P 10.00 P 16.00 The difference between the operating income calculated under the variable costing method and the operating income calculated under absorption costing method would be a. P 57,600 b. P 60,000 c. P 90,000 d. P 120,000 47. The difference between variable costing and absorption costing is that the former treats fixed manufacturing overhead as a period cost. The latter method treats it as a product cost. Given that sales exceeded production, both methods expense all fixed manufacturing overhead incurred during the year. However, 10,000 units (510,000 sales – 500,000 production) manufactured in a prior period were also sold. These units presumably recorded at P10 under variable costing and P16 under absorption costing. Consequently, absorption costing operating income is P 60,000 (10,000 x P6) less than that under variable costing. B. 48. During the year 20CY, Catara Corporation manufactured 70,000 units of product A, a new product. Only 65,000 units were sold during the year. There was no beginning inventory. Manufacturing cost per unit was P 20.00 variable and P 50.00 fixed. What would be the effect on net income if absorption costing is used instead of variable costing? a. Net income is P 250,000 lower. b. Net income is P 250,000 higher. c. Net income is P 100,000 lower. d. None of the above. 48. Change in units (P70,000-65,000) Unit fixed overhead Change in net income (in favor of absorption costing) P5,000 x 50 P 250,000 C. 49. Bajada Industries manufactures a single product. Variable production costs are P 20 and fixed production costs are P 300,000. Bajada uses a normal activity of 20,000 units to sets its standard costs. Bajada began the year with no inventory, produced 22,000 units, and sold P21, 0000 units. Ending inventory under absorption costing would be a. P 30,000 b. P 35,000 c. P 20,000 d. P 25,000 C. 50. Last year, Ben Company’s income under absorption costing was P 4,400 lower than its income under variable costing. The company sold 8,000 units during the year, and its variable costs were P 8 per unit, of which P 3 was variable selling expense. Fixed manufacturing overhead was P1 per unit in beginning inventory under absorption costing. How many units did the company produce during the year? a. 7,450 units b. 7,120 units c. 3,600 units d. 12,400 units C. 51. Last year, Vulcan Company’s variable production costs totaled P 7,500 and its fixed manufacturing overhead costs totaled P 4,500. The company produced 3,000 units during the year and sold 2,400 units. There were no units in the beginning inventory. Which of the following statements is true? a. The net income under absorption costing for the year will be P 900 lower than the net income under variable costing. b. Under absorption costing, the units in ending inventory will be costed at P 2.50 each. c. The ending inventory under variable costing will be P 900 lower than the ending inventory under absorption costing d. Under variable costing, the units in the ending inventory will be costed at P4 each. Volume Variance B. 52. The production volume variance occurs when using a. The absorption costing approach because of production exceeding the sales. b. The absorption costing approach because of production differs from that use in setting the fixed overhead rate used in applying fixed overhead to production. c. The variable costing approach because of sales exceeding the production for the period. d. The variable costing approach because of production exceeding the sales for the period. A. 53. Unabsorbed fixed overhead cost in an absorption costing system are a. fixed manufacturing costs not allocated to units produced. b. variable overhead costs not allocated to units produced. c. excess variable overhead costs. d. costs that cannot be controlled. C. 54. How will favorable volume variance affect net income under each of the following method? Absorption a Reduce b Reduce c Increase d Increase Variable No effect Increase No effect Reduce A. 55. An unfavorable production-volume variance occurs when a. production exceeds the denominator level b. the denominator level exceeds production c. production exceeds unit sales d. unit sales exceed production Use the following information for the next questions: Frances Corporation incurred fixed manufacturing costs of P 6,000 during 20CY. Other information for 20CY includes: The budgeted denominator level is 1,000 units Units produced total 750 units Units sold total 600 units Beginning inventory was zero The company uses absorption costing and the fixed manufacturing rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold. A. 56. Fixed manufacturing cost expensed on the income statement (excluding adjustments of variances) total a. P 3,600 b. P 4,800 c. P 6,000 d. Zero 56. Fixed manufacturing costs incurred Divided by budgeted denominator level(P6,000/1,000) Sold total units Total P6,000 6 x 600 P 3,600 C. 57. Fixed manufacturing costs included in ending inventory total a. P 1,200 b. P 1,500 c. P 900 d. Zero 57. Fixed manufacturing costs incurred Divided by budgeted denominator level(P6,000/1,000) Sold total units Fixed manufacturing costs included in ending inventory x P6,000 6 150 P 900 B. 58. The production-volume variance is a. P 2,000 b. P 1,500 c. P 2,400 d. Zero 58. Fixed manufacturing costs incurred Divided by budgeted denominator level(P6,000/1,000) Sold total units Fixed manufacturing costs included in ending inventory P6,000 6 x 250 P 1,500 B. 59. Operating income using absorption costing will be ___________ than operating income if using variable costing. a. P 2,400 higher b. P 2,400 lower c. P 900 higher d. P 3,600 lower 59. Units produced Less: units sold Total Fixed manufacturing costs /denominator level Operating income x 750 600 150 6 P 900