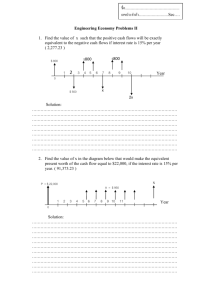

22 Cash-flow forecasting and working capital Revision answers 1 Money coming into the business in cash form. 2 i) Capital invested. ii) Bank loan. iii) Cash from sale of goods. iv) Cash from sale of assets. 3 Money paid out by the business in cash form. 4 i) Paying for supplies. ii) Paying wages. iii) Interest on loans. 5 Cash ‘flows’ through the business: as it is received (for example, from customers) it is then used to buy supplies and pay wages. This helps to produce products that can be sold. When payment for these is received, cash flows back into the business. 6 The capital needed by a business for day-to-day expenditure (current assets less current liabilities – see Chapter 24). 7 Cash is received (for example, from customers) at 1; it is then used at 2 to pay for essential materials and other factors of production; goods are produced at 3 so working capital is ‘tied up’ in inventories at 3; the goods are then sold at 4 but the cash might not be received immediately (credit often offered to customers); finally cash payment is received from customer at 5 and then reused again in the business. 8 If the time period is very long between buying materials/paying for factors of production and receiving payment from customers then more cash is needed to invest in working capital during this period – in inventories, work in progress and debtors. 9 a) 800 b) 800 c) 1200 d) 3700 10 a) All figs in $000 April May June Cash in: Cash sales 7 8 7 Cash from debtors 7.5 7 8 14.5 15 15 Purchases of supplies 7 8 7 Expenses 6 8 12 13 16 19 Total cash in Cash out: Total cash out Opening balance 1 2.5 1.5 Net cash-flow 1.5 (1) (4) Closing balance 2.5 1.5 (2.5) Cambridge IGCSE Business Studies 4th edition Teacher’s CD © Hodder & Stoughton Ltd 2013 1 22Cash-flow forecasting and working capital b) Expenses seem to be major problem. Find out why they have increased and try to reduce them, for example, spend less on advertising (but will this reduce sales in future?) or reduce management salaries. Use a cheaper supplier for materials, but will this reduce product quality? Try to boost sales in June to increase cash-inflow, but lower prices or more advertising to achieve this could make cash position worse. Student’s final conclusion. Answers to activities Activity 22.1 Cash-outflows: purchase of computer; interest; wages; supplier’s payment; overdraft repayment. All others are cash-inflows. Activity 22.2 a) Gross profit = $33 000 b) Net cash-flow = $10 500 c) Credit has been offered to customers equivalent to 50 per cent of sales, so cash for these sales will be received next month. (This is a simplified question: in June the business might also have received cash from May’s customers who were offered credit.) Activity 22.3 a) x = $2000; y = $4000; z = $22 000 b) The business might be preparing increased output of goods to meet higher demand in the next few months. c) Student’s own answer (the closing balance should be $16 100). Activity 22.4 a) Student’s own answer. b) Student’s own answer but closing balances should be: Jan $9000; Feb $8500; Mar $3500; April ($500). c) There is a negative closing balance: the business will need an overdraft this month. Action it could take to avoid a negative closing balance could be: cheaper supplies; lower wages; cut expenses; attempt to increase sales without spending any more on advertising or cutting prices (which could lead to lower sales if demand does not increase). Activity 22.5 a) Student’s own answer. b) Banks, potential investors, suppliers as they want to be confident that the business can pay them in future. c) Some costs stay the same as they are fixed costs (do not vary with output), for example, heating and business tax; others change as they are varying with output, for example, more plants must be bought in as previous ones are sold; or they change with the overdraft of the business, for example, interest charges. d) Costs of buying-in plants will increase so cash-outflows will rise: if no action is taken then the next cash-flow and closing balance of the business will both fall. e) Use a cheaper supplier of plants and compost; use cheaper seasonal labour; ask for credit from suppliers; do not offer credit to customers. Recommendation – student’s own answer. Cambridge IGCSE Business Studies 4th edition Teacher’s CD © Hodder & Stoughton Ltd 2013 2 22Cash-flow forecasting and working capital Sample answers to Paper 1 style questions (with mark annotations for Question 2) 1 a) Money paid out by the business in cash form. b) i) Payments to food and drinks suppliers. ii) Wages paid to chefs and waiters. c) i) It increases the hotel’s working capital needs as the customers will become debtors and payments from them will be received one month (for example) after they have stayed at the hotel. ii) More customers might be attracted to stay at the hotel because they do not have to pay cash at the time of their stay. d) i) It will help Bruno plan for future cash-flow needs: if the hotel needs to be decorated soon and he does not put this in the cash-flow forecast then Bruno might not plan to have the cash needed to pay the decorators. ii) It will encourage the bank to lend to Bruno or increase the overdraft when the hotel is decorated as they can see that he is planning the future cash needs of the business and is being responsible. e) Delay redecoration: this will reduce future cash-outflows but it might make the hotel less attractive to guests and reduce income in the future. Insist that customers pay cash immediately; do not offer them credit: this will increase cash-inflow in the short term but customers might prefer to stay at another hotel that offers credit. Other answers possible. Overall conclusion/judgement needed. 2 a) Cash-inflow less cash-outflow. [2K] b) i)To pay for large inventories in case there are large orders from major car manufacturers. ii) To finance the long credit periods demanded by major car manufacturers. [2App] c) Net cash-flow = cash in − cash out = 595 000 − 495 000 = $100 000 Closing balance = opening balance + net cash-flow = (180 000) + 100 000 = ($80 000) d) $000 July Cash-inflows Cash from debtors’ payments Sale of old equipment Total cash in 605 [1] 0 605 [1] Cash-outflows Materials purchased 176 [1] Employee costs 185 New computers 0 Other costs 155 Total cash out 516 [1] Opening cash balance (75) Net cash-flow 89 [1] Closing cash balance 14 [1] Cambridge IGCSE Business Studies 4th edition Teacher’s CD © Hodder & Stoughton Ltd 2013 3 22Cash-flow forecasting and working capital e) Do not buy the new equipment. This would save $145 000 and would reduce the negative closing balance in August to $35 000. But this could reduce the efficient operation of the business and damage long term profitability. Reduce the credit period offered to customers (major car manufacturers) to two months and this will increase cash-inflows in the month when this decision is taken. BUT the major car manufacturers might place orders with a rival to Abbas Manufacturing and sales revenue might fall. Other answers possible. Student’s overall conclusion. [1K; 1App; 2An] + [2Eval] Answers to revision test 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 3) 1) 4) 3) 1) 2) 4) 3) 3) 2) 1) 3) 4) 2) 3) 3) Cambridge IGCSE Business Studies 4th edition Teacher’s CD © Hodder & Stoughton Ltd 2013 4