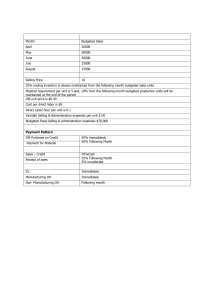

Managerial Accounting Professor Xinlei Li 2023 Spring Chapter 8 Budgetary Planning 8-1 Learning Objective 8-1 Describe 1. how and why organizations use budgets for planning and control and 2. potential behavioral issues to consider when implementing a budget. 8-2 Planning and Control Cycle 8-3 Planning Process • Strategic Plan – Long-term Objectives (5 – 10 years) Tactics – Short-term Objectives (< 1 yr.) Tactics 8-4 Role of Budgets in the Planning and Control Cycles • A budget is a comprehensive financial plan for achieving the financial and operational goals of an organization. • Planning – Identifies resources and expenditures required. – Future-oriented. • Control – Used to determine whether goals have been met. – Review portion of the cycle. 8-5 Benefits of Budgeting Thinking Ahead Communication Motivation Forcing managers to look ahead and state their goals for the future Communicating management’s expectations and priorities Providing motivation for employees to work toward organizational objectives Providing lead time to solve potential problems Promoting cooperation and coordination between functional areas of the organization Providing a benchmark for evaluating performance 8-6 Behavioral Effects of Budgets Budget Problems Solution • Perceived unfair or unrealistic goals. • Reasonable and attainable budgets. • Poor management-employee communications. • Employee participation in budgeting process. • Building budget slack into budgets. • Different budgets for planning and for performance evaluation. • Continuous, or rolling budgets. • automatically add a budget period as one budget period expires, keeping managers in continuous planning mode and always looking into the future • Zero-based budgeting. • the entire budget must be constructed from zero each period, rather than starting with the last period’s actual results. • • A “use-it-or-lose-it” mentality. Managers may feel they need to spend their entire budgets to avoid a reduction in the next budget period. This attitude is most prevalent at the end of periods when managers have unused resources 8-7 Learning Objective 8-2 Describe the major components of the master budget and their interrelationships. 8-8 Components of the Master Budget • The starting point for preparing the master budget is the sales budget or sales forecast. All other parts of the master budget are dependent on the sales budget. • The primary financial budget that we prepare in this chapter is the cash budget, which provides information about budgeted cash receipts and payments. We focus primarily on the cash budget because it provides critical information for managing daily operations. 8-9 Learning Objective 8-3 Prepare the following components of the operating budget: a. b. c. d. e. f. g. h. Sales budget. Production budget. Direct materials purchases budget. Direct labor budget. Manufacturing overhead budget. Cost of goods sold budget. Selling and administrative expense budget. Budgeted income statement. 8-10 Preparation of the Operating Budgets Let’s take a closer look at the operating budgets using a hypothetical division of Levi Strauss & Co. as our example. 8-11 Sales Budget (1 of 2) • Sales Budget – Estimated Unit Sales Last period’s actual Industry trends Company’s sales objectives Planned marketing activities New products/features – Estimated Unit Price Analysis of economic and market conditions + Forecasts of customer needs from marketing personnel 8-12 Sales Budget (2 of 2) We begin the preparation of operating budgets with the sales budget using information from a single Levi Strauss & Co. location. We prepare the sales budget by multiplying the number of units we expect to sell times the budgeted unit price. 8-13 Production Budget (1 of 3) The production budget is directly related to the sales budget and to the quantity of finished goods inventory the company wants to have on hand at the beginning and end of each period. Budgeted Unit Sales + Budgeted Ending Finished Goods Inventory – Budgeted Beginning Finished Goods Inventory = Budgeted Production Units If the company is planning to reduce its finished goods inventory, they should produce fewer units than they plan to sell. 8-14 Production Budget (2 of 3) Prepare a production budget for Levi Strauss & Co. using the sales budget and the following inventory policy: Levi Strauss maintains an ending inventory of finished goods equal to 5 percent of budgeted sales in units for the next period. The beginning inventory for Quarter 1 (for the year) is 1,300 units. 8-15 Production Budget (3 of 3) Notes: *Beginning inventory for quarter 1 = 26,000 x 5% = 1,300 **Ending inventory for quarter 4 is given at 1,600 units. Yearly unit sales and production is the sum of the 4 quarter values. Ending inventory of 1,600 is from the end of Quarter 4. Beginning inventory of 1,300 is from the beginning of Quarter 1. 8-16 Direct Materials Purchases Budget (1 of 3) • Next, we must determine what quantity of direct materials to purchase to use for the production budget. • Budgeted material purchases will depend on budgeted production needs and on planned levels of beginning and ending direct materials inventory. • The relationship between budgeted direct material purchases, budgeted production, and direct materials inventory is summarized in the following formula: Direct Materials Need for Production + Budgeted Ending Direct Materials Inventory – Budgeted Beginning Direct Materials Inventory = Budgeted Direct Materials Purchases 8-17 Direct Materials Purchases Budget (2 of 3) Prepare a direct materials purchases budget for Levi Strauss & Co. using the production budget and the following inventory policy: Levi Strauss maintains an ending inventory of materials equal to 3 percent of the next quarter’s production needs, making the beginning inventory for each quarter equal to 3 percent of the current quarter’s production needs. The ending inventory for Quarter 4 (for the year) is assumed to be 3,500 yards. Each pair of 441 jeans requires a total of 2 yards of denim at a cost of $1.50 per yard. 8-18 Direct Materials Purchases Budget (3 of 3) Notes: *Beginning direct materials inventory for quarter 1 = 52,400 x 3% = 1,572 **Ending direct materials inventory for quarter 4 is given at 3,500, but cannot be determined based on information given. 8-19 Direct Labor Budget • Each pair of 441 jeans requires 0.25 hour (15 minutes) of direct labor (DL) time. The direct labor rate is $14.00 per hour. 8-20 Manufacturing Overhead Cost Budget • For our hypothetical example, variable manufacturing overhead cost is 40% of direct labor cost and the fixed manufacturing overhead cost is $66,150 per quarter. 8-21 Budgeted Cost of Goods Sold (1 of 2) First, let’s compute the manufacturing cost per unit, and then we will compute cost of goods sold for each period. Budgeted Manufacturing Costs Direct materials 2 yards per unit × $1.50 per yard Per Unit $3.00 Direct labor 0.25 hours per unit × $14 per hour 3.50 Variable manufacturing overhead 40% x $3.50 1.40 Fixed manufacturing overhead $264,600 per year ÷ 132,300 units produced 2.00 Budgeted manufacturing cost per unit $9.90 8-22 Budgeted Cost of Goods Sold (2 of 2) • we can compute cost of goods sold for each period by multiplying the unit cost $9.90 by the budgeted unit sales for the period. 8-23 Selling and Administrative Expense Budget • Variable selling expenses for a period are 10 percent of sales revenue for that same period. • Fixed administrative expenses are $200,000 per quarter. 8-24 Budgeted Income Statement 8-25 Learning Objective 8-4 Prepare the cash budget and describe the relationships among the operating budgets, cash budget, and budgeted balance sheet. 8-26 Preparation of the Financial Budgets Now, let’s focus on the financial budgets for Levi Strauss. The financial budgets focus on the financial resources needed to support the company’s operations, including cash receipts and payments, inventory, capital expenditures, and financing. 8-27 Cash Budget (1 of 2) Our focus is on cash flows that arise from operating activities and are directly related to the operating budgets for Levi Strauss. The cash budget consists of three sections: • Budgeted cash receipts (collections) • Budgeted cash payments (disbursements) • Cash borrowed or repaid (financing) The relationship between budgeted cash collections and budgeted cash payments from operating activities and cash balances is summarized in the following formula: Beginning Cash Balance + Budgeted Cash Receipts – Budgeted Cash Payment ± Cash Borrowed or Repaid = Ending Cash Balance 8-28 Cash Budget (2 of 2) • All budgeted cash collections will come from sales revenue. To calculate the budgeted cash collections, we will assume that 40% of Levi Strauss' revenue is from cash sales. The other 60% is from sales on credit, which is collected as follows: – 75% of credit sales collected in the quarter of sale. – 25% of credit sales collected in the quarter following the sale. Budgeted Sales Revenue Quarter 1 Quarter 2 Quarter 3 Quarter 4 $ 1,040,000 $ 1,200,000 $ 1,600,000 $ 1,440,000 8-29 Budgeted Cash Collections Notes: Quarter 1: Cash sales = $1,040,000 x 40% = $416,000 Quarter 1: Cash collected from quarter 1 credit sales = $1,040,000 x 60% x 75% = $468,000 Quarter 1: Cash collected from last year’s quarter 4 credit sales assumed to be $125,000 8-30 Budgeted Cash Payments (1 of 2) We will use the following additional information to develop a cash payments budget for Levi Strauss: • 20% of direct materials purchases are paid for during the quarter purchased. • 80% are paid for in the following quarter. Cash paid for material purchases for the fourth quarter of last year was $70,000. • Manufacturing overhead includes $50,000 in depreciation expense (a noncash item). • All other operating expenses are paid in cash during the quarter incurred. • Management plans to invest in new sewing equipment during Quarter 1 at a total cost of $1,200,000. The company will pay 50 percent cash and the balance evenly across Quarters 2, 3, and 4. 8-31 Budgeted Cash Payments (2 of 2) 20% Notes: Quarter 1: Cash paid for quarter 1 purchases = $78,987 x 20% = $15,797 Quarter 1: Cash paid from last year’s quarter 4 credit sales assumed to be $70,000 Quarter 2: Cash paid for quarter 1 purchases = $78,987 x 80% = $63,190 8-32 Cash Budget (1 of 2) We will use the following additional information to develop the cash budget for Levi Strauss: • At the beginning of the first quarter, the cash account balance was $108,000. • Levi Strauss & Co. has a bank agreement enabling the company to borrow and repay cash in increments of $1,000 as needed to maintain a minimum cash balance of $100,000. No interest is charged if the loan is repaid by the end of the next quarter. • The balance on the loan at the beginning of Quarter 1 is zero. Cash Budget (2 of 2) Budgeted Balance Sheet Learning Objective 8-5 Prepare a merchandise purchases budget for a merchandising firm. Budgeting in Non-Manufacturing Firms (1 of 3) • The primary operating budget for a merchandiser is a merchandise purchases budget, which is similar in form to a direct materials purchases budget for a manufacturer. • Since a merchandising company does not manufacture, it does not have direct material, direct labor, and manufacturing overhead budgets. • Budgeted Sales + Budgeted Ending Merchandise Inventory – Budgeted Beginning Merchandise Inventory = Budgeted Merchandise Purchases Budgeting in Non-Manufacturing Firms (2 of 3) Assume that you are a purchasing manager for a Gap retail store responsible for purchasing denim jeans and preparing the merchandise purchases budget. In your experience, inventory on hand at the beginning of each quarter should be equal to 20 percent of that quarter’s sales. In other words, ending inventory should be equal to 20 percent of next quarter’s sales. Budgeting in Non-Manufacturing Firms (3 of 3) 20% 20% 20% 20%