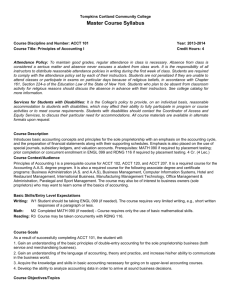

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CHAPTER 1 THE PURPOSE AND USE OF FINANCIAL STATEMENTS LEARNING OBJECTIVES 1. 2. 3. 4. Identify the uses and users of accounting information. Describe the primary forms of business organization. Explain the three main types of business activity. Describe the purpose and content of each of the financial statements. SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND BLOOM’S TAXONOMY Item LO BT Item LO BT Item LO BT Item LO Questions BT Item LO BT 1. 1 K 6. 2 C 11. 3 C 16. 4 K 21. 4 C 2. 1 C 7. 2 C 12. 3 C 17. 4 AP 22. 4 C 3. 1 K 8. 2 C 13. 3 C 18. 4 C 23. 4 K 4. 1 C 9. 2 C 14. 3 C 19. 4 K 5. 1 C 10. 2 K 15. 4 K 20. 4 C Brief Exercises 1. 1 C 3. 3 C 5. 4 AP 7. 4 K 9. 4 C 2. 2 K 4. 3 C 6. 4 AP 8. 4 K 10. 4 AN Exercises 1. 1 C 4. 3 C 7. 4 AN 10. 4 AP 13. 4 AP 2. 2 C 5. 4 K 8. 4 AN 11. 4 AP 14. 4 AN 3. 3 K 6. 4 AP 9. 4 AP 12. 4 AP Problems: Set A and B 1. 1 C 3. 3 C 5. 4 AP 7. 4 AP 9. 4 AN 2. 2 C 4. 4 K 6. 4 AN 8. 4 AN 10. 4 AN 7. 1,2,3,4 C Cases 1. 4 AN 3. 4 AN 5. 4 AN 2. 4 AN 4. 1,2 C 6. 1 E Solutions Manual 1-1 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Legend: The following abbreviations will appear throughout the solutions manual file. LO Learning objective BT Bloom's Taxonomy K Knowledge C Comprehension AP Application AN Analysis S Synthesis E Evaluation Level of difficulty S Simple M Moderate C Complex Difficulty: Time: Estimated time to prepare in minutes AACSB Association to Advance Collegiate Schools of Business Communication Communication Ethics Ethics Analytic Analytic Technology Tech. Diversity Diversity Reflective Thinking Reflec. Thinking CPA Canada Competency Ethics Professional and Ethical Behaviour PS and DM Problem-Solving and Decision-Making Comm. Communication Self-Mgt. Self-Management Team & Lead Teamwork and Leadership Reporting Financial Reporting Stat. & Gov. Strategy and Governance Mgt. Accounting Management Accounting Audit Audit and Assurance Finance Finance Tax Taxation CPA CM cpa-e001 cpa-e002 cpa-e003 cpa-e004 cpa-e005 cpa-t001 cpa-t002 cpa-t003 cpa-t004 cpa-t005 cpa-t006 Solutions Manual 1-2 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ANSWERS TO QUESTIONS 1. Accounting is the information system that identifies and records the economic events of an organization, and then communicates them to a wide variety of interested users. LO 1 BT: K Difficulty: S TIME: 3 min. AACSB: None CPA: cpa-t001 CM: Reporting 2. (a) Internal users of accounting information work for the company and include finance directors, marketing managers, human resource personnel, production supervisors, and company officers. Internal users have access to company information that is not available to external users. (b) Some external users may be individuals who are employees of the company but are not directly involved in managing the company. External users of accounting information generally do not work for the company. The primary external users are investors, lenders, and other creditors. Other external users include labour unions, customers, the Canada Revenue Agency (CRA), and securities commissions. LO 1 BT: C Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 3. Internal users may want the following questions answered: • Is there enough cash to purchase a new piece of equipment? • What price should we sell our product for to cover costs and to maximize net income? • How many employees can we afford to hire this year? • Which product line is the most profitable? • How much of a pay raise can the company afford to give me? External users may want the following questions answered: • Is the company earning enough to give me my required return on investment? • Will the company be able to repay its debts as the debts come due? • Will the company stay in business long enough to service the products I buy from it? LO 1 BT: K Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-3 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 4. Financial Accounting, Seventh Canadian Edition Primary users of accounting information include investors, lenders, and creditors. These external users need to make decisions concerning their ongoing business relationship with the company. They need to be able to assess the company’s performance and financial health because they intend to start, continue, or discontinue having transactions with the company. Other decision makers who have specific needs for certain financial information, such as the amount of taxes paid by the company, are not considered primary users. LO 1 BT: C Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 5. Decision makers rely on financial statement information and expect the accounting information to have been prepared ethically. Without the expectation of ethical behaviour, the information presented in the financial statements would have no credibility for the users of the accounting information. Without credibility, financial statement information would be useless to financial statement users. LO 1 BT: C Difficulty: M TIME: 5 min. AACSB: None Ethics CPA: cpa-t001 CM: Reporting and Ethics 6. (a) Proprietorship: Proprietorships are easier to form (and dissolve) than other types of business organizations. They are not taxed as separate entities; rather, the proprietor pays personal income tax on the company’s net income. Depending on the circumstances, this may be an advantage or disadvantage. Disadvantages of a proprietorship include unlimited liability (proprietors are personally liable for all debts of the business) and difficulty in obtaining financing compared to other forms of organization. In addition, the life of the proprietorship is limited as it is dependent on the willingness and capability of the proprietor to continue operations. Solutions Manual 1-4 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition 6. (continued) (b) Partnership: Partnerships are easier to form (and dissolve) than a corporation, although not as easy as a proprietorship. Similar to proprietorships, partnerships are not taxed as separate entities. Instead, the partners pay personal income tax on their share of income. Depending on the circumstances, this may be an advantage or disadvantage. Disadvantages of partnerships include unlimited liability (partners are jointly and severally liable for all debts of the business) and difficulty in obtaining financing compared to corporations. In addition, the life of a partnership can be limited depending on the terms of the partnership agreement and actions of the other partners. (c) Private corporation: Advantages of a private corporation include limited liability (shareholders not being personally liable for corporate debts), indefinite life, and transferability of ownership. In many cases, depending on the size of the corporation, a creditor such as a bank will ask for a personal guarantee which will void the limited liability advantage. In addition, transferability of ownership may be limited since shares are not publicly traded. Disadvantages of a private corporation include increased government regulations and paperwork. The fact that corporations are taxed as a separate legal entity may be an advantage or a disadvantage. Corporations often receive more favourable income tax treatment than other forms of business organizations. As mentioned above, depending on the size of the corporation, many of the advantages of the corporate form are not available to a small private corporation. (d) Public corporation: The advantages of a public corporation include limited liability, indefinite life, and transferability of ownership. These features make it easier for publicly traded corporations to raise financing compared to other forms of business organizations. Corporations often receive more favourable income tax treatment than other forms of business organizations. Solutions Manual 1-5 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition 6. (d) (continued) Disadvantages include increased government regulations and paperwork. In addition, because the shares of public companies are listed and traded on Canadian or other exchanges such as the Toronto Stock Exchange (TSX), these corporations are required to distribute their financial statements to investors, lenders, creditors and other interested parties, and the general public. This requirement involves greater costs to the corporation. LO 2 BT: C Difficulty: M TIME: 20 min. AACSB: None CPA: cpa-t001, cpa-t006 CM: Reporting and Tax 7. While both public and private corporations enjoy many of the same advantages and disadvantages, one key difference is that public corporations list their shares for sale to the public on Canadian or other stock exchanges. In contrast, while private corporations issue shares, they do not make them available to the general public or trade them on public stock exchanges. Private corporations may also not enjoy the advantages of limited liability and ease of transfer of ownership that public corporations generally experience because of their size and distribution of shares. LO 2 BT: C Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 8. (a) Public corporations must apply International Financial Reporting Standards (IFRS). Private corporations can apply either IFRS or Accounting Standards for Private Enterprises (ASPE). (b) The information needs of users of public corporations and private corporations are different. Users of financial information of public corporations require more extensive disclosure. They may also be benefit from the enhanced comparability to global companies provided by international standards. Since private corporations tend to be smaller with easier access to company information, their users do not require as extensive reporting. LO 2 BT: C Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 9. A private company that has plans to grow significantly in the near future, and that wishes to have access to large amounts of capital obtained from external investors will want to go public. In order to go public, the company would be required to have several years of past financial statements prepared using IFRS. In addition, some businesses choose to follow IFRS in order to be able to compare their performance with businesses in the same industry that are public and whose financial information is readily available. LO 2 BT: C Difficulty: C TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-6 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 10. Financial Accounting, Seventh Canadian Edition The reporting entity concept means that economic activity of any business organization or economic entity is kept separate and distinct from the activities of the owner and all other economic entities. In the case of corporations such as The North West Company Inc., it also means that economic activities of related corporations that are owned or controlled by one corporation are consolidated. The results of these individual companies are also reported separately as separate economic entities. LO 2 BT: K Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 11. (a) (b) (c) (d) (e) Assets are what the company owns such as cash and equipment. A liability is an amount the company owes such as accounts payable and income tax payable. Shareholders’ equity represents the residual interest (assets less liabilities) of a company at a point in time and includes share capital and retained earnings, in addition to other possible components. Revenues are increases in a company’s economic resources from operating activities such as the sale of a product. Expenses are the cost of assets that are consumed or services that are used in the process of generating revenues. Examples include cost of goods sold, rent expense, and salaries expense. LO 3 BT: C Difficulty: M TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-7 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 12. Financial Accounting, Seventh Canadian Edition Operating activities are the activities that the organization undertakes to earn net income. They include the day-to-day activities that generate revenues and cause expenses to be incurred. In order to earn net income, a company must first purchase resources they need to operate. The purchase of these resources (assets) is considered to be an investing activity. Finally, the company must have sufficient funds to purchase assets and to operate. While some of the necessary cash will be generated from operations, often the company has to raise external funds by either issuing shares or borrowing money. Financing activities involve the activities undertaken by the company to raise cash externally. LO 3 BT: C Difficulty: M TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 13. (a) Two examples of operating activities are revenue generated from providing auto repair services (an inflow of cash) and the expenses related to paying employee salaries (an outflow of cash). (b) Two examples of investing activities are the purchase of property, plant, and equipment, such as a building (an outflow of cash), and the sale of a long-term investment (an inflow of cash). (c) Two examples of financing activities for a corporation are borrowing money (debt), which is an inflow of cash, and declaring and paying dividends (equity), an outflow of cash LO 3 BT: C Difficulty: M TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 14. Local companies providing services and therefore generating service revenue would include doctors, dentists, architects, engineers, law practices, and accountants. The names of these businesses would likely include the name of the practitioners or groups providing these services. Local companies providing sales revenue would include farms that provide produce or milk products and the retail stores selling the local produce to customers. LO 3 BT: C Difficulty: M TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 15. A fiscal year is an accounting time period that is one year in length, but does not have to end on December 31. Corporations can select their fiscal year end based on when their operations are low or when inventory is low. Selecting a fiscal year end when operations are low provides more time for accounting staff to complete the year-end reporting requirements. If inventories are low, this simplifies the inventory count and minimizes the business disruption caused by counting the inventory. LO 4 BT: K Difficulty: S TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-8 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 16. Financial Accounting, Seventh Canadian Edition The internal accounting records do use exact figures. However, for presentation purposes, it is unlikely that the use of rounded figures would change a decision made by the users of the financial statements. As well, presenting the information in this manner makes the statements easier to read and analyze thereby increasing their utility to the users. Rounding the numbers to the nearest million does not have a material impact on decision-making using the financial statements. LO 4 BT: K Difficulty: S TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 17. Assets = Liabilities + Shareholders’ Equity $793,795 = $436,183 + $357,612 (amounts are in thousands of dollars) LO 4 BT: AP Difficulty: M TIME: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting 18. A statement of changes in equity explains the changes in the components of shareholders’ equity, such as share capital and retained earnings. Examples of items that increase the components are issue of shares (increases share capital) and net income (increases retained earnings). Examples of items that decrease the components are repurchases of shares (decreases share capital) and payment of dividends (decrease retained earnings). LO 4 BT: C Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-9 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 19. Financial Accounting, Seventh Canadian Edition (a) The primary purpose of the statement of cash flows is to provide financial information about the cash receipts (inflows) and cash payments (outflows) of a company for a specific period of time. (b) The three categories of the statement of cash flows are operating activities, investing activities, and financing activities. These categories represent the three principal types of business activities. LO 4 BT: K Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 20. The cash obtained from operating activities is not necessarily expected to be positive in the early years of a company’s life. If a business offers credit to its customers and needs to hold a significant amount of inventory to satisfy customer demands, a large amount of working capital obtained from selling goods will be tied up in accounts receivable and inventory. Creditors on the other hand will have little leniency on a new business when expecting to be paid. Consequently, the amount of cash from operating activities could very likely be negative. For investing activities, a negative cash outflow would also be expected as the business must invest in longlived assets needed for operations. LO 4 BT: C Difficulty: C TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 21. The statement of financial position is prepared as at a specific point in time because it shows what the business owns (its assets) and what it owes (its liabilities). These items are constantly changing. It is necessary to select one point in time at which to present them. The other statements (income statement, statement of changes in equity, and statement of cash flows) cover a period of time as they report activities and measure performance that takes place over time. LO 4 BT: C Difficulty: M TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-10 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 22. Financial Accounting, Seventh Canadian Edition (a) The income statement reports net income for the period. The net income figure from the income statement is shown on the statement of changes in equity as an addition to beginning retained earnings. If there is a loss, it is deducted from beginning retained earnings. (b) The statement of changes in equity explains the change in the balances of the components of shareholders’ equity (for example, common shares and retained earnings) from one period to the next. The ending balances are reported in the shareholders’ equity section of the statement of financial position. (c) The statement of cash flows explains the change in the cash balance from one period to the next. The ending balance of cash reported in the statement of cash flows agrees with the ending cash balance reported in the current assets section on the statement of financial position. LO 4 BT: C Difficulty: M TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 23. (a) Companies using IFRS must report an income statement, statement of changes in equity, statement of financial position, and statement of cash flows. In addition, companies using IFRS may also need to prepare a statement of comprehensive income. (b) Companies using ASPE must report an income statement, statement of retained earnings, balance sheet, and a statement of cash flows. LO 4 BT: K Difficulty: S TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-11 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 1-1 Investor Marketing manager Creditor Chief financial officer Canada Revenue Agency Labour union (a) Type of Evaluation (b) Type of User 5 4 1 6 2 3 External Internal External Internal External External LO 1 BT: C Difficulty: S TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 1-2 (a) (b) (c) (d) (e) 1 4 3 2 4 Proprietorship Private corporation Public corporation Partnership Private corporation LO 2 BT: K Difficulty: S TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-12 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 1-3 (a) (b) (c) (d) (e) (f) (g) (h) (i) F O I F F F O I O Inflow Inflow Inflow Outflow Inflow Outflow Outflow Outflow Outflow Note to instructors: As we will learn later in Chapter 13, companies reporting under IFRS have a choice in classifying dividends paid as an operating or financing activity. We have chosen to classify dividends paid as financing activities in this textbook. LO 3 BT: C Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 1-4 1. 2. 3. 4. 5. 6. (a) (b) O F O O O I NE + + - LO 3 BT: C Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-13 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 1-5 (a) Total assets = = = Total liabilities + Shareholders’ equity $55,000 + $120,000 $175,000 (Liabilities + Shareholders’ equity = Assets) (b) Total assets = = = Total liabilities + Shareholders’ equity (share capital + retained earnings) $170,000 + ($100,000 + $90,000) $360,000 (Liabilities + Shareholders’ equity = Assets) (c) Total liabilities = = = Total assets – Shareholders’ equity (share capital + retained earnings) $150,000 – ($50,000 + $25,000) $75,000 (Assets – Shareholders’ equity = Liabilities) (d) Shareholders’ equity = = = Total assets – Total liabilities $500,000 – ($500,000 ÷ 2) $250,000 (Assets – Liabilities = Shareholders’ equity) LO 4 BT: AP Difficulty: M TIME: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-14 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 1-6 Beginning of Year: Assets = Liabilities + Shareholders’ equity Beginning of Year: $720,000 = $420,000 + Shareholders’ equity Beginning of Year: Shareholders’ equity = $300,000 (a) ($720,000 + $250,000) = ($420,000 – $80,000) + Shareholders’ equity Shareholders’ equity = $630,000 [(Assets ± Change in assets) – (Liabilities ± Change in liabilities) = Shareholders’ equity] (b) Assets = ($420,000 – $100,000) + ($300,000 + $90,000 + $125,000) Assets = $835,000 [(Liabilities ± Change in liabilities) + (Shareholders’ equity ± Change in shareholders’ equity) = Assets] (c) ($720,000 – $90,000) = Liabilities + ($300,000 + $120,000) Liabilities = $210,000 [(Assets ± Change in assets) – (Shareholders’ equity ± Change in shareholders’ equity) = Liabilities] LO 4 BT: AP Difficulty: C TIME: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 1-7 (a) (b) (c) (d) (e) (f) (g) (h) IS SFP SCE SCF SFP SCF IS SCE LO 4 BT: K Difficulty: S TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-15 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 1-8 (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) L A L L A A A SE L SE A LO 4 BT: K Difficulty: S TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 1-9 (a) (b) (c) (d) (e) (f) (g) (h) Net income Repayment of bank loan Declared dividends Issue of common shares Cash Repurchase of common shares Net loss Issue of long-term debt Share Capital Retained Earnings Total Shareholders' Equity NE NE NE + NE NE NE + NE NE NE NE NE + NE + NE NE LO 4 BT: C Difficulty: C TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-16 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 1-10 (a) Beginning balance Issue additional shares Net income Dividends declared Ending balance (b) Beginning balance Issue additional shares Net loss Ending balance (1) (2) Common Shares $100,000 50,000 Retained Earnings $475,000 $150,000 75,000 (15,000) $535,000 (1) (2) Common Shares $100,000 50,000 Retained Earnings $475,000 $150,000 (75,000) $400,000 (3) Total Shareholders' Equity $575,000 50,000 75,000 (15,000) $685,000 (3) Total Shareholders' Equity $575,000 50,000 (75,000) $550,000 (Beginning equity ± Changes to equity = Ending equity) LO 4 BT: AN Difficulty: M TIME: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-17 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO EXERCISES EXERCISE 1-1 (a) Chief Financial Officer – Does Facebook generate enough cash to expand its operations and purchase other businesses? Human Resource Manager – What is Facebook’s annual salary expense? (b) Creditor – Does Facebook have enough cash available to make its monthly debt payments? Investor – How much did Facebook pay in dividends last year? Other examples are also possible. LO 1 BT: C Difficulty: M TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-18 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-2 Proprietorship Partnership 1. 2. 3. 4. 5. No personal liability Owner(s) pay(s) personal income tax on company income Generally easiest form of organization to raise capital Ownership indicated by shares Required to issue quarterly financial statements Public Corporation Private Corporation F F T T T T F F F F T F F F T T F F T F 6. Owned by one person T F F F 7. Limited life T T F F T F F F F F T F F F F T 8. 9. Usually easiest form of organization to set up Required to use IFRS as its accounting standards 10. Shares are closely held LO 2 BT: C Difficulty: M TIME: 10 min. AACSB: None CPA: cpa-t001, cpa-t006 CM: Reporting and Tax Solutions Manual 1-19 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-3 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. O I O F F F O O O F LO 3 BT: K Difficulty: S TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting EXERCISE 1-4 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. (a) O F I F I I O O I F F O (b) + + + + + - LO 3 BT: C Difficulty: M TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-20 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-5 1. 2. 3. 4. 5. 6. 7. 8. IS SFP, SCF SCF IS SCE, SFP SCE IS, SCE SFP 9. 10. 11. 12. 13. 14. 15. SFP IS IS SCF SFP SCE, SFP SFP LO 4 BT: K Difficulty: S TIME: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting EXERCISE 1-6 ; (a) Assets – Liabilities = Shareholders’ equity 2017: $550,000 – $400,000 = $150,000 2018: $630,000 – $420,000 = $210,000 (Assets – Liabilities = Shareholders’ equity) (b) Change in shareholders’ equity $210,000 – $150,000 = $60,000 increase (c) 1. Net income is $60,000 = the increase in shareholders’ equity 2. Net income is $70,000 = the increase in shareholders’ equity + dividends declared of $10,000 3. Net income is $30,000 = the increase in shareholders’ equity – common shares issued of $30,000 4. Net income is $50,000 = the increase in shareholders’ equity + dividends declared of $10,000 – common shares issued of $20,000 LO 4 BT: AP Difficulty: M TIME: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-21 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-7 [1] Total revenues – Net income = Total expenses $1,000,000 – $150,000 = $850,000 [2] Common shares, end of year $100,000 = Beginning balance of common shares + Issue of shares of $100,000 [3] $150,000 equal to Net income given above [4] Beginning balance of retained earnings plus net income less dividends declared = Ending balance of retained earnings. $0 + $150,000 – Dividends declared = $100,000 Dividends declared = $50,000 [5] Beginning balance in shareholders' equity + Issue of shares + Net income – Dividends declared = Ending balance in shareholders’ equity $0 + $100,000 + $150,000 – $50,000 = $200,000 [6] Total assets – Total liabilities = total Shareholders’ equity $1,050,000 – $850,000 = $200,000 or [5] above [7] Total revenues – Total expenses = Net income Total revenues – $250,000 = $50,000 Total revenues = $300,000 [8] Beginning balance of common shares + Issue of shares = Common shares, end of year $0 + Issue of shares = $20,000 Issue of shares = $20,000 [9] $50,000 equal to Net income given above [10] Common shares, end of year + Retained Earnings, end of year $20,000 + $40,000 = $60,000 Total shareholders’ equity, end of year Solutions Manual 1-22 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-7 (CONTINUED) [11] Total liabilities + Total shareholders’ equity = Total assets $150,000 + $60,000 (from [10]) = $210,000 [12] $60,000 (from [10]) or $210,000 (from [11]) − $150,000 total liabilities = $60,000 total shareholders’ equity LO 4 BT: AN Difficulty: C TIME: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting EXERCISE 1-8 [1] Total expenses + Net income = Total revenues $1,700,000 + $1,100,000 = $2,800,000 [2] Common shares, end of year $200,000 = Beginning balance of common shares (nil) + Issue of shares of $200,000 [3] $1,100,000 equal to Net income given above [4] Beginning balance of retained earnings plus net income less dividends declared + Beginning balance of common shares + Issue of shares = Ending balance in shareholders’ equity. $0 + $1,100,000 – $300,000 + $0 + $200,000 = $1,000,000 Ending balance in total shareholders’ equity = $1,000,000 [5] Total liabilities + Total Shareholders’ equity = Total assets $1,600,000 + $1,000,000 or [4] above = $2,600,000 [6] [4] above $1,000,000 [7] Total revenues – Net income = Total expenses $3,200,000 – $1,500,000 = $1,700,000 Solutions Manual 1-23 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-8 (CONTINUED) [8] Beginning balance of common shares + Issue of shares = Common shares, end of year $0 + Issue of shares = $500,000 Common shares, end of year $500,000 [9] $1,500,000 equal to Net income given above [10] Beginning balance of retained earnings plus net income less dividends declared = Ending balance of retained earnings. $0 + $1,500,000 – Dividends declared = $1,200,000 Dividends declared = $300,000 [11] Common shares, end of year + Retained Earnings, end of year $500,000 (from [8]) + $1,200,000 = $1,700,000 Total shareholders’ equity, end of year [12] Total assets – Total Shareholders’ equity = Total liabilities $3,100,000 – $1,700,000 = $1,400,000 LO 4 BT: AN Difficulty: C TIME: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-24 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-9 ($ in thousands) (a) Assets – Liabilities = Shareholders’ equity 2015: $2,630,865 – $577,731 = $2,053,134 2014: $2,876,490 – $631,994 = $2,244,496 (b) Assets = Liabilities + Shareholders’ equity 2015: $2,630,865 = $577,731 + $2,053,134 Assets = Liabilities + Shareholders’ equity 2014: $2,876,490 = $631,994 + $2,244,496 (c) Change in shareholders’ equity $2,053,134 – $2,244,496= $191,362 decrease (d) Shareholders’ equity, Dec. 31, 2014 Add: Net income Deduct: Dividends declared Other shareholders’ equity items Shareholders’ equity, Dec. 31, 2015 $2,244,496 ? 44,668 188,274 $2,053,134 Solving for Net income: $2,053,134 + $188,274 + $44,668 − $2,244,496 = $41,580. (Beginning equity ± Changes to equity = Ending equity) LO 4 BT: AP Difficulty: M TIME: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-25 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-10 (a) L A L A A SE A L (b) Accounts payable Accounts receivable Bank loan payable Buildings Cash Common shares Equipment Income tax payable A A inventory L SE A Land IMerchandise Mortgage payable Retained earnings Supplies Note to instructors: Students may list the accounts in the following statement in any order within the assets, liabilities, and shareholders’ equity classifications as they have not yet learned how to classify/order accounts. Solutions Manual 1-26 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-10 (CONTINUED) AVENTURA INC. Statement of Financial Position November 30, 2018 Assets Cash Accounts receivable Merchandise inventory Supplies Land Buildings Equipment Total assets Liabilities and Shareholders’ Equity Liabilities Accounts payable Income tax payable Bank loan payable Mortgage payable Total liabilities Shareholders’ equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders’ equity $ 20,000 19,500 18,000 700 44,000 100,000 30,000 $232,200 $ 26,200 6,000 34,000 97,500 163,700 20,000 48,500 68,500 $232,200 (Assets = Liabilities + Shareholders’ equity) LO 4 BT: AP Difficulty: M TIME: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-27 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-11 (a) E E NR E R E E R (b) Administrative expenses Cost of goods sold Dividends declared Finance expenses Finance income Income tax expense (recovery) Selling and distribution expenses Sales REITMANS (Canada) Limited Income Statement Year Ended January 30, 2016 (in thousands) Revenues Sales Finance income Total revenues Expenses Selling and distribution expenses Cost of goods sold Administrative expenses Finance expenses Total expenses Loss before income tax Income tax recovery Net loss $937,155 7,998 945,153 $497,854 410,035 46,950 16,443 971,282 (26,129) 1,426 $ (24,703) [Revenues – Expenses = Net income or (loss)] LO 4 BT: AP Difficulty: M TIME20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-28 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-12 KON INC. Income Statement Year Ended December 31, 2018 Revenues Service revenue Expenses Salaries expense Rent expense Utilities expense Office expense Total expenses Income before income tax Income tax expense Net income $61,000 $30,000 12,400 2,400 1,600 46,400 14,600 3,000 $11,600 [Revenues – Expenses = Net income or (loss)] KON INC. Statement of Changes in Equity Year Ended December 31, 2018 Balance, January 1 Issued common shares Net income Dividends declared Balance, December 31 Common Shares $20,000 10,000 $30,000 Retained Earnings $58,000 11,600 (5,000) $64,600 Total Equity $78,000 10,000 11,600 (5,000) $94,600 (Beginning equity ± Changes to equity = Ending equity) LO 4 BT: AP Difficulty: M TIME: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-29 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-13 (a) Camping revenue Expenses Operating expenses Income tax expense Net income $283,000 $245,000 10,000 255,000 $ 28,000 [Revenues – Expenses = Net income or (loss)] (b) Balance, January 1 Issued common shares Net Income Dividends declared Balance, December 31 SEA SURF CAMPGROUND INC. Statement of Changes in Equity Year Ended December 31, 2018 Common Shares $30,000 15,000 $45,000 Retained Earnings $18,000 28,000 (12,000) $34,000 Total Equity $48,000 15,000 28,000 (12,000) $79,000 (Beginning equity ± Changes to equity = Ending equity) Note to instructors: Students may list the accounts in the following statement in any order within the assets, liabilities, and shareholders’ equity classifications as they have not yet learned how to classify/order accounts. Solutions Manual 1-30 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-13 (CONTINUED) (b) (continued) SEA SURF CAMPGROUND INC. Statement of Financial Position December 31, 2018 Assets Cash Supplies Equipment Total assets Liabilities and Shareholders’ Equity Liabilities Accounts payable Bank loan payable Total liabilities Shareholders’ equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders’ equity $ 19,000 2,500 124,000 $145,500 $ 16,500 50,000 66,500 45,000 34,000 79,000 $145,500 (Assets = Liabilities + Shareholders’ equity) LO 4 BT: AP Difficulty: M TIME: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-31 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 1-14 1. Yu Corporation is distributing nearly all of this year's net income as dividends. This suggests that Yu is not pursuing rapid growth. Companies that are pursuing opportunities for growth normally retain their net income and pay low, or no dividends. 2. Surya Corporation is not generating sufficient cash from operating activities to fund its investing activities. The company is borrowing to finance its investing activities. This is common for companies in their early years of existence. It could also be in an expansion stage. 3. Naguib Ltd. is financing its assets in a slightly higher proportion through equity than through debt. The company has $450,000 ($200,000 + $250,000) of total assets, which are funded 44.4% ($200,000 ÷ $450,000) by liabilities and 55.6% ($250,000 ÷ $450,000) by equity. Since equity does not have to be repaid and does not require interest payments, the company appears to be in a healthy financial position. 4. Rijo Inc. does not have any liabilities and its assets are completely financed by equity. This places it in a very strong financial position since there are no outside claims on the company’s assets. This also means that the company is using its own funds to finance assets. While this reduces risk, it may also reduce return if borrowed funds can be employed to generate an internal return higher than the cost of borrowing. LO 4 BT: AN Difficulty: C TIME: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-32 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO PROBLEMS PROBLEM 1-1A (a) 1. The South Face Inc. is an external user of accounting information in assessing the creditworthiness of their customer. 2. An investor purchasing common shares of Orbite Online Inc. is an external user. 3. In deciding whether to extend a loan, Caisse d’Économie Base Montréal is an external user. 4. As an employee of Tech Toy Limited, the CFO is an internal user. (b) 1. In deciding to extend credit, South Face would focus its attention on the statement of financial position of the new customer. The terms of credit they are extending require repayment in a short period of time. Funds to repay the credit would come from cash on hand and other current assets. The statement of financial position of the new customer will show if the company has enough current assets to meet its current obligations. 2. Since the investor intends to hold the shares for a long period of time (at least five years), s(he) should focus on the company’s income statement. The income statement reports the company’s past performance in terms of revenues, expenses, and net income. This is generally regarded as a good indicator of the company’s future performance. Solutions Manual 1-33 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-1A (CONTINUED) 3. The Caisse is interested in two things—the ability of the company to make interest payments on a monthly basis for the next three years and the ability to repay the principal amount at the end of the three years. In order to evaluate both of these factors, the focus should be on the statement of cash flows. This statement provides information on the cash the company generates from its operations on an ongoing basis. It also tells whether the company is currently borrowing or repaying debt. 4. The CFO should focus on the statement of cash flows as this statement clearly sets out the cash generated from operating activities and the amount the company has spent in the past on purchasing equipment and paying dividends. Note to instructors: Other answers may be valid provided they are properly supported. LO 1 BT: C Difficulty: M TIME: 40 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-34 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-2A (a) 1. The professors should incorporate their business as a private corporation because of their concerns about legal liabilities. A corporation is the only form of business that provides limited liability. Since the professors do not need access to large amounts of investment capital, a private corporation provides the limited liability advantage the professors need. 2. Joseph should run his bicycle rental shop as a proprietorship because this is the simplest and least costly form of business organization to establish and eventually dissolve. He is the only person involved in the business and is planning to operate for a limited time. 3. The size of the businesses is not given, but Robert and Tom should likely form a public corporation, if possible, when they combine their operations. This is the best form of business for them to choose because they expect to raise funds in the coming year. A public corporation will enable them to raise significant amounts of funds for their manufacturing company. A corporation may also receive more favourable income tax treatment. If they are not large businesses, then Robert and Tom may choose to form a private corporation. 4. A partnership would be the most likely form of business for Darcy, Ellen, and Meg to choose. It is simpler to form than a corporation and less costly. 5. Hervé is most likely to select to operate his business as a private corporation. This will assist him with the liability of storing goods for others. He will also be able to raise funds to purchase equipment, rent space in airports, and hire employees. It is easier to raise funds through a private corporation rather than a proprietorship or partnership. Solutions Manual 1-35 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-2A (CONTINUED) (b) 1. 2. 3. 4. 5. ASPE ASPE IFRS ASPE ASPE LO 2 BT: C Difficulty: M TIME: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-36 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-3A (a) Operating (b) Investing Financing Indigo Books & Music Sale of books Purchase of store equipment Issue of shares High Liner Foods Payment for fish Purchase of production equipment Borrowing money from a bank Mountain Equipment Co-op Payment for inventory Purchase of store fixtures Borrowing money from a bank Ganong Bros. Payment of salaries and benefits Purchase of production equipment Payment of dividends to shareholders Royal Bank Payment of interest on savings accounts Purchase of office Issue of bonds equipment Financing Issuing shares is common to all corporations. Issuing debt is common to most corporations. Borrowing from a bank is common to most companies. Payment of dividends is common to many, but not all, corporations. Issuing bonds is common to large public corporations. Investing Purchasing property, plant, and equipment is common to most companies—the types of assets would vary according to the nature of the business. Some types of companies require a larger investment in long-lived assets. A new business or expanding business would be more apt to be acquiring assets. Operating The general activities identified above would be common to most corporations with the exception of the payment of interest on savings accounts. The source of the cash receipt (for example, from the sale of books) and cash payment (for example, for the payment for fish) would vary by the nature of the business. LO 3 BT: C Difficulty: C TIME: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-37 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-4A Accounts payable Accounts receivable Bank indebtedness Bank loan payable Cash Common shares Equipment Goodwill Income tax expense Income tax payable Interest expense Office expense Prepaid insurance Rent expense Repair and maintenance expense Salaries payable Service revenue Supplies Vehicles (a) (b) L A L L A SC A A E L E E A E E L R A A SFP SFP SFP SFP SFP SFP, SCE SFP SFP IS SFP IS IS SFP IS IS SFP IS SFP SFP LO 4 BT: K Difficulty: S TIME: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-38 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-5A (a) and (b) (b) Accounts payable Accounts receivable Bank loan payable Cash Common shares Equipment Income tax payable Intangible assets Interest payable Inventory Prepaid insurance Retained earnings Salaries payable Supplies Unearned revenue Vehicles Totals $15,600 13,100 32,000 9,350 20,000 30,500 1,800 5,000 300 9,200 1,000 21,250 700 2,800 1,800 22,500 (a) L A L A SE A L A L A A SE L A L A Assets Liabilities $ 15,600 Shareholders’ Equity $13,100 32,000 9,350 $ 20,000 30,500 1,800 5,000 300 9,200 1,000 21,250 700 2,800 22,500 $93,450 1,800 ______ $52,200 ______ $41,250 Assets = Liabilities + SE $93,450 = $52,200 + $41,250 (c) Beginning balance in Retained Earnings + Revenues – Expenses – Dividends declared = Ending balance in Retained Earnings $18,000 + $296,750 – $278,500 – $15,000 = $21,250 LO 4 BT: AP Difficulty: M TIME 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-39 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-6A (a) (All amounts are in millions of dollars) Sears [1] Total assets = Total liabilities + Total shareholders’ equity Total assets = $1,203.3 + $570.8 Total assets = $1,774.1 [2] Total liabilities = Total assets – Total shareholders’ equity Total liabilities = $1,633.2 – $554.2 Total liabilities = $1,079.0 [3] Shareholders’ equity, beginning of year + Total revenues – Total expenses – Other increases in shareholders’ equity = Shareholders’ equity, end of year $570.8 + $3,145.7 – [3] + $51.3 = $554.2 [3] Total expenses = $3,213.6 Canadian Tire [4] Total liabilities = Total assets – Total shareholders’ equity Total liabilities = $14,553.2 – $5,630.8 Total liabilities = $8,922.4 [5] Total assets = Total liabilities + Total shareholders’ equity Total assets = $9,198.1 + $5,789.7 [6] Total assets = $14,987.8 [6] Shareholders’ equity, beginning of year – Repurchase of shares – Dividends declared + Total revenues – Total expenses + Other increases in shareholders’ equity = Shareholders’ equity, end of year $5,630.8 − $434.6 – $162.4 + $12,279.6 – $11,543.7 + $20.0 = $5,789.7 Solutions Manual 1-40 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-6A (CONTINUED) (b) At the end of the most recent fiscal year, Sears has a higher proportion of debt financing and Canadian Tire has a higher proportion of equity financing. Canadian Tire financed 38.6% ($5,789.7 million ÷ $14,987.8 million) of its assets with equity and 61.4% of its assets with debt ($9,198.1 million ÷ $14,987.8 million). For the equivalent fiscal year end, 33.9% ($554.2 million ÷ $1,633.2 million) of Sears’s assets were financed by equity and 66.1% ($1,079.0 million ÷ $1,633.2 million) by debt. Sears is riskier because more of its assets are financed by debt. (c) Both retailers typically have low inventories at the end of December and at the end of January as a result of the Christmas sales, with little or no new inventory purchased during the month of January so no major differences in financial position at the end of December compared to January would be anticipated. As long as there were no significant economic events that affected one company more than the other in the intervening period (January), it is unlikely that the different year-end dates would affect the comparison in (b). LO 4 BT: AN Difficulty: C TIME: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-41 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-7A (a) ONE PLANET COSMETICS CORP. Income Statement Month Ended June 30, 2018 Revenues Service revenue Expenses Salaries expense Office expense Utilities expense Supplies expense Interest expense Total expenses Income before income tax Income tax expense Net income $24,200 $5,700 1,500 1,500 2,100 800 11,600 12,600 700 $11,900 [Revenues – Expenses = Net income or (loss)] ONE PLANET COSMETICS CORP. Statement of Changes in Equity Month Ended June 30, 2018 Balance, June 1 Issued common shares Net income 11,900 Dividends declared (1,000) Balance, June 30 Common Shares $ 0 36,000 Retained Earnings $ 0 Total Equity $ 0 36,000 11,900 (1,000) $36,000 $10,900 $46,900 (Beginning equity ± Changes to equity = Ending equity) Solutions Manual 1-42 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-7A (CONTINUED) (a) (continued) Note to instructors: Students may list the accounts in the following statement in any order within the assets, liabilities, and shareholders’ equity classifications as they have not yet learned how to classify/order accounts. ONE PLANET COSMETICS CORP. Statement of Financial Position June 30, 2018 Assets Cash Accounts receivable Supplies Equipment Total assets $ 15,000 9,000 1,200 52,000 $77,200 Liabilities and Shareholders’ Equity Liabilities Accounts payable Bank loan payable Total liabilities Shareholders’ equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders’ equity $ 7,300 23,000 30,300 0 36,000 10,900 46,900 $77,200 (Assets – Liabilities = Shareholders’ equity) Solutions Manual 1-43 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-7A (CONTINUED) (b) The financial statements must be prepared in the order of (1) income statement, (2) statement of changes in equity, and (3) statement of financial position. This is because each subsequent financial statement depends on information contained in the previous statement. The net income from the income statement flows to the retained earnings account on the statement of changes in equity. The shareholders’ equity totals in the statement of changes in equity (for example, for common shares and retained earnings) then flow to the shareholders’ equity section of the statement of financial position. LO 4 BT: AP Difficulty: M TIME: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-44 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley (a) Financial Accounting, Seventh Canadian Edition PROBLEM 1-8A Cash dividends paid Cash paid to purchase equipment Cash payments for operating activities Cash receipts from operating activities Cash received from issue of long-term debt Cash received from issue of shares $ 10,000 35,000 120,000 140,000 20,000 20,000 Activity financing investing operating operating financing financing (b) MAISON CORPORATION Statement of Cash Flows Year Ended December 31, 2018 Operating activities Cash receipts from operating activities Cash payments for operating activities Net cash provided by operating activities $140,000 (120,000) Investing activities Purchase of equipment Net cash used by investing activities $(35,000) Financing activities Issue of long-term debt Issue of shares Payment of dividends Net cash provided by financing activities $ 20,000 20,000 (10,000) Net increase in cash Cash, January 1 Cash, December 31 $20,000 (35,000) 30,000 15,000 12,000 $27,000 (Cash flows from operating, investing, and financing activities = Net change in cash) Solutions Manual 1-45 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-8A (CONTINUED) (c) The company is generating less cash from operating activities (+$20,000) than it is using for its investing activities (–$35,000) and the payment of dividends (–$10,000). The company, however, is making up for the deficiency by generating cash from financing activities. Cash from financing activities is not a renewable source of cash and usually entails future cash payments in the form of interest on debt, principal repayment, and dividend payments for shares. LO 4 BT: AN Difficulty: M TIME: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-46 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-9A (a) [1] Operating expenses = Service revenue – Income before income tax Operating expenses = $225,000 – $45,000 Operating expenses = $180,000 [2] Net income = Income before income tax – Income tax expense Net income = $45,000 – $9,000 Net income = $36,000 [3] Net income (from [2]) = $36,000 [4] Ending retained earnings = Beginning retained earnings + Net income – Dividends declared Ending retained earnings = $0 + $36,000 (from [2]) – $15,000 Ending retained earnings = $21,000 [5] Total issued common shares = $250,000 [6] Net income = $36,000 (from [3]) [7] Total equity = Beginning balance + Issued common shares + Net income – Dividends declared Total equity = $0 + $250,000 (from [5]) + $36,000 (from [6]) – $15,000 Total equity = $271,000 [8] Land = Total assets (from [9]) – Cash – Accounts receivable – Building – Equipment Land = $964,000 – $22,000 – $34,000 – $390,000 – $218,000 Land = $300,000 [9] Total assets = Total liabilities + Shareholders' equity Total Assets = $964,000 [10] Accounts payable = Total liabilities – Bank loan payable Accounts payable = $693,000 – $600,000 Accounts payable = $93,000 Solutions Manual 1-47 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-9A (CONTINUED) (b) [11] Common shares = $250,000 (from the Statement of Changes in Equity) [12] Retained earnings = $21,000 (from [4]) [13] Total shareholders' equity = Common shares + Retained earnings Total shareholders' equity = $250,000 (from [11]) + $21,000 (from [12]) = $271,000 or (from [7]) (1) In preparing the financial statements, the first statement to be prepared is the income statement, followed by the statement of changes in equity, and then the statement of financial position. Note to instructors: While the statements must be prepared in this sequence, these statements can be presented in a variety of orders. Often the statement of financial position is presented first, as the most “permanent” statement. (2) The reason the statements must be prepared in the order indicated above is that each statement depends on information in the previously prepared statement. For example, the net income figure from the income statement is used in the statement of changes in equity to calculate the ending balance of retained earnings. The shareholders’ equity section of the statement of financial position is then completed using the ending balances of common shares and retained earnings, as calculated in the statement of changes in equity. LO 4 BT: AN Difficulty: C TIME: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-48 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-10A (a) 1. Remove the boat from the listing of assets since it does not belong to the corporation. Remove the boat loan payable from the listing of liabilities since this is a personal loan of Guy Gélinas. 2. Remove the $10,000 outstanding receivable from Guy’s brother. This is not a company receivable and should not be listed on the company’s statement of financial position. 3. Correct the Common Shares account to remove the extra amount that had been added to “balance”: Remove accounts receivable $10,000 Remove boat asset 24,000 Remove bank loan (40,000) Net adjustment to common shares $ 6,000 Provide separate totals for liabilities and shareholders’ equity as the two components that are financing the assets of the company. Solutions Manual 1-49 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-10A (CONTINUED) (b) GG CORPORATION Statement of Financial Position July 31, 2018 Assets Cash Accounts receivable ($50,000 − $10,000) Inventory Total assets Liabilities and Shareholders’ Equity Liabilities Accounts payable Total liabilities Shareholders’ equity Common shares [$50,000 + $6,000 (from (3) above)] Retained earnings Total shareholders’ equity Total liabilities and shareholders’ equity $20,000 40,000 36,000 $96,000 $34,000 34,000 0 56,000 6,000 62,000 $96,000 (Assets – Liabilities = Shareholders’ equity) (c) As a private company, GG Corporation should also prepare an income statement, a statement of retained earnings, and a statement of cash flows. LO 4 BT: AN Difficulty: C TIME: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-50 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-1B (a) 1. An investor purchasing common shares of Fight Fat Ltd. is an external user. 2. As a potential creditor, Comeau Ltée is an external user. 3. The chief financial officer is an internal user. 4. As a potential creditor, Drummond Bank is an external user. (b) 1. In making an investment in common shares, the Ontario investor is becoming a partial owner (shareholder) of the company. In this case, the investment will be held for at least three years. The information that will be most relevant to him/her will be on the income statement. The income statement reports the past performance of the company in terms of its revenue, expenses, and net income. This is the best indicator of the company’s future potential. 2. In deciding to extend credit to a new customer, Comeau would focus its attention on the new customer's statement of financial position. The terms of credit they are extending require repayment in a short period of time. Funds to repay the credit would come from current assets. The statement of financial position of the new customer will show whether the company has enough current assets to meet its current obligations. 3. In order to determine whether the company is generating enough cash to increase the amount of dividends paid to investors, the CFO of Private Label needs information on the amount of cash generated and used in various activities of the business. The statement of cash flows is the most useful statement for this purpose. This statement presents the amount of cash at the beginning and end of the period as well as the details of the amount of cash generated by operating activities and the amount spent on expanding operations (investing activities). Solutions Manual 1-51 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-1B (CONTINUED) 4. In deciding whether to extend a loan, Drummond Bank is interested in two things: the ability of the company to make its monthly interest payments for the next five years and the ability to repay the principal amount at the end of five years. In order to evaluate both of these factors the focus should be on the statement of cash flows. This statement provides information on the cash the company generates from its operating activities on an ongoing basis. This will be the most important factor in determining if the company will survive and be able to repay the principal and interest on the loan. Note to instructors: Other answers may be valid provided they are properly supported. LO 1 BT: C Difficulty: M TIME: 40 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-52 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-2B (a) 1. Dawn will likely operate her vegetable stand as a proprietorship because she is planning on operating it for a short time period. A proprietorship is the simplest and least costly business organization to form and dissolve. 2. Joseph and Sabra should form a private corporation when they combine their operations. A private corporation will be easier and less expensive to form than a public corporation. It will also be an easier type of organization in which to raise funds than a proprietorship or partnership. A corporation may also receive more favourable income tax treatment. 3. The professors should incorporate their business as a private corporation because of their concerns about the legal liabilities. A corporation is the only form of business that provides limited liability to its owners. 4. Abdul would likely form a public corporation because he needs to raise funds to invest in inventories and property, plant, and equipment. He has no savings or personal assets and it is normally easier to raise funds through a corporation than through a proprietorship or partnership. A public corporation will allow Abdul to raise larger amounts of funds by selling shares to the public. 5. A partnership would be the most likely form of business for Mary, Richard, and Jigme to choose. It is simpler to form than a corporation and less costly. (b) 1. 2. 3. 4. 5. ASPE ASPE ASPE IFRS ASPE LO 2 BT: C Difficulty: M TIME: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-53 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-3B (a) Operating Investing Financing WestJet Airlines Payment for jet fuel Purchase of airplanes Issue of shares University of Calgary Students’ Union Payment of salaries and benefits Payment of research expenses Payment for facilities rentals Purchase of office equipment Purchase of other companies Purchase of equipment Borrowing money from a bank Issue of bonds Receipt of revenue from sales of food from Sobeys Purchase of real estate to build Sobeys’ stores Repaying money to a bank GlaxoSmithKline Maple Leaf Sports & Entertainment Empire Company (b) Payment of dividends to shareholders Financing Issuing shares is common to all corporations. Borrowing from and repaying money to a bank is common to most companies. Payment of dividends is common to many, but not all, corporations. Issuing bonds is common to large corporations. Investing Purchasing property, plant, and equipment would be common to most companies—the types of assets would vary according to the type of business. Some types of businesses require a larger investment in longlived assets. A new business or expanding business would be more likely to engage in investing activities (for example, acquiring assets). The purchase of other companies would not be common to all companies. Solutions Manual 1-54 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-3B (CONTINUED) Operating The general activities identified above (sales and expenditures) would be common to most businesses, although the service or product might change. LO 3 BT: C Difficulty: C TIME: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-55 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-4B Accounts payable Accounts receivable Bank loan payable Buildings Cash Common shares Cost of goods sold Equipment Income tax expense Income tax payable Intangible assets Interest expense Land Merchandise inventory Mortgage payable Office expense Prepaid insurance Retained earnings Salaries payable Sales Unearned revenue (a) (b) L A L A A SE E A E L A E A A L E A SE L R L SFP SFP SFP SFP SFP SFP, SCE IS SFP IS SFP SFP IS SFP SFP SFP IS SFP SFP, SCE SFP IS SFP LO 4 BT: K Difficulty: S TIME: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 1-56 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-5B (a) and (b) (b) Accounts payable Accounts receivable Bank loan payable Cash Common shares Equipment Income tax payable Interest payable Inventory Prepaid insurance Retained earnings Salaries payable Supplies Unearned revenue Totals $23,100 6,950 25,000 17,750 20,000 66,200 1,900 500 21,300 950 39,850 3,050 3,750 3,500 (a) L A L A SE A L L A A SE L A L Assets Liabilities $23,100 Shareholders’ Equity $ 6,950 25,000 17,750 $ 20,000 66,200 1,900 500 21,300 950 39,850 3,050 3,750 _______ $116,900 3,500 $57,050 _______ $59,850 Assets = Liabilities + Shareholders’ equity $116,900 = $57,050 + $59,850 (c) Beginning balance in Retained Earnings + Revenues – Expenses – Dividends Declared = Ending balance in Retained Earnings $8,850 + $365,000 – $333,000 – $1,000 = $39,850 LO 4 BT: AP Difficulty: M TIME: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-57 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-6B (a) (All amounts are in U.S. millions of dollars) Restaurant Brands [1] Total liabilities = Total assets – Total shareholders’ equity Total liabilities = $21,343.0 – $7,636.8 Total liabilities = $13,706.2 [2] Total shareholders' equity = Total assets – Total liabilities Total shareholders' equity = $18,408.5 – $12,198.4 Total shareholders' equity = $6,210.1 [3] Shareholders’ equity, beginning of year – Repurchase of shares – Dividends declared + Total revenues – Total expenses – Other decreases in shareholders’ equity = Shareholders’ equity, end of year $7,636.8 − $293.7 − $[3] + $4,052.2 – $3,540.5 − $1,167.8 = $6,210.1 [3] Dividends declared = $476.9 Starbucks [4] Total assets = Total liabilities + Total shareholders’ equity Total assets = $5,479.2 + $5,273.7 Total assets = $10,752.9 [5] Total assets = Total liabilities + Total shareholders’ equity Total assets = $6,626.3 + $5,038.4 (from [6]) Total assets = $11,664.7 [6] Shareholders’ equity, beginning of year + Issuance of shares – Dividends declared + Total revenues – Total expenses – Other increases in shareholders’ equity = Shareholders’ equity, end of year $5,273.7 + $23.5 − $1,016.2 + $19,162.7 – $18,616.6 + $211.3 = $5,038.4 Solutions Manual 1-58 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-6B (CONTINUED) (b) At the end of the most recent fiscal year, Restaurant Brands has a higher proportion of debt financing and Starbucks has a higher proportion of equity financing. Starbucks financed 43.2% (U.S. $5,038.4 million ÷ U.S. $11,664.7 million) of its assets with equity and 56.8% of its assets with debt (U.S. $6,626.3 million ÷ U.S. $11,664.7 million). For the same period, 33.7% ($6,210.1 million ÷ $18,408.5 million) of Restaurant Brands’ assets were financed by equity and 66.3% ($12,198.4 million ÷ $18,408.5 million) by debt. Restaurant Brands is riskier because more of its assets are financed by debt. (c) As long as there are no unusual transactions or economic events that affect one company differently than another during the intervening period of time (October through December), or at each company’s year-end date, the differing year ends should not have a significant impact on the assessment of the financial position and performance for the two companies. LO 4 BT: AN Difficulty: C TIME: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-59 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-7B (a) AERO FLYING SCHOOL LTD. Income Statement Month Ended May 31, 2018 Revenues Service revenue Expenses Fuel expense Rent expense Office expense Salaries expense Repair and maintenance expense Interest expense Income before income tax Income tax expense Net income $215,300 $85,400 12,100 12,700 36,600 40,900 12,500 200,200 15,100 2,800 $ 12,300 [Revenues – Expenses = Net income or (loss)] AERO FLYING SCHOOL LTD. Statement of Changes in Equity Month Ended May 31, 2018 Balance, May 1 Issued common shares 180,000 Net income 12,300 Dividends declared (2,700) Balance, May 31 Common Shares $ 0 180,000 Retained Earnings $ 0 Total Equity $ 0 12,300 (2,700) $180,000 $9,600 $189,600 (Beginning equity ± Changes to equity = Ending equity) Solutions Manual 1-60 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-7B (CONTINUED) (a) (continued) Note to instructors: Students may list the accounts in the following statement in any order within the assets, liabilities, and shareholders’ equity classifications as they have not yet learned how to classify/order accounts. AERO FLYING SCHOOL LTD. Statement of Financial Position May 31, 2018 Assets Cash Accounts receivable Supplies Equipment Total assets $ 26,900 22,600 15,000 372,500 $ 437,000 Liabilities and Shareholders’ Equity Liabilities Accounts payable Bank loan payable Total liabilities Shareholders’ equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders’ equity $ 6,400 241,000 247,400 180,000 9,600 189,600 $437,000 (Assets – Liabilities = Shareholders’ equity) Solutions Manual 1-61 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-7B (CONTINUED) (b) The financial statements must be prepared in the order of (1) income statement, (2) statement of changes in equity, and (3) statement of financial position. This is because each subsequent financial statement depends on information contained in the previous statement. The net income from the income statement flows to the retained earnings in the statement of changes in equity. The shareholders’ equity totals (for example, for common shares and retained earnings) in the statement of changes in equity then flow to the shareholders’ equity section of the statement of financial position. LO 4 BT: AP Difficulty: M TIME: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-62 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-8B (a) Cash payments for operating activities Cash paid for equipment Repayment of long-term debt Cash dividends paid Cash receipts from operating activities $109,000 40,000 15,000 13,000 158,000 Activity operating investing financing financing operating (b) FURLOTTE CORPORATION Statement of Cash Flows Year Ended June 30, 2018 Operating activities Cash receipts from operating activities Cash payments for operating activities Net cash provided by operating activities $158,000 (109,000) Investing activities Cash paid to purchase equipment Net cash used by investing activities $(40,000) Financing activities Repayment of long-term debt Cash dividends paid Net cash used by financing activities $(15,000) (13,000) Decrease in cash Cash, July 1, 2017 Cash, June 30, 2018 $49,000 (40,000) (28,000) (19,000) 40,000 $21,000 (Cash flows from operating, investing, and financing activities = Net change in cash) Solutions Manual 1-63 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-8B (CONTINUED) (c) The company is not generating sufficient cash from its operating activities ($49,000) to pay for the total of its investing activities ($40,000) and dividend payments ($13,000). If the company expects to continue to use cash for investing activities and dividend payments in future years, it will either have to generate more cash from its operating activities or from its financing activities (for example, borrow money) as its ending cash balance will not sustain this cash outflow on its own. LO 4 BT: AN Difficulty: M TIME: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-64 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-9B (a) [1] Operating expenses = Service revenue – Income before income tax Operating expenses = $325,000 – $116,000 Operating expenses = $209,000 [2] Net income = Income before income tax – Income tax expense Net income = $116,000 – $23,000 Net income = $93,000 [3] Net income = $93,000 (same as [2]) [4] Dividends declared = Beginning retained earnings + Net income – Ending retained earnings Dividends declared = $440,000 + $93,000 – $521,000 Dividends declared = $12,000 [5] Beginning total equity = Beginning common shares + Beginning retained earnings Beginning total equity = $250,000 + $440,000 Beginning total equity = $690,000 [6] Total common shares issued = $60,000 [7] Net income = $93,000 (same as [3]) [8] Dividends declared = $12,000 (same as [4]) [9] Ending total equity = Ending common shares + Ending retained earnings Ending total equity = $310,000 + $521,000 Ending total equity = $831,000 [10] Cash = Total assets – (Accounts receivable + Land + Buildings + Equipment) Cash = $1,351,000 (from [11]) – ($34,000 + $310,000 + $616,000 + $364,000) Cash = $27,000 Solutions Manual 1-65 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 1-9B (CONTINUED) (b) [11] Total assets = Total liabilities and shareholders’ equity Total assets = $1,351,000 [12] Common shares = $310,000 (as per statement of changes in equity) [13] Retained earnings = $521,000 (as per statement of changes in equity) (1) In preparing the financial statements, the first statement to be prepared is the income statement, followed by the statement of changes in equity, and then the statement of financial position. While the statements must be prepared in this sequence, these statements can be presented in a variety of orders. Often the statement of financial position is presented first, as the most “permanent” statement. (2) The reason the statements must be prepared in the order indicated above is that each statement depends on information in the previously prepared statement. For example, the net income figure in the income statement is used in the statement of changes in equity to calculate the ending balance of retained earnings. The shareholders’ equity section of the statement of financial position is then completed using the ending balances of the shareholders’ equity components (such as common shares and retained earnings) as calculated in the statement of changes in equity. LO 4 BT: AN Difficulty: C TIME: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-66 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley PROBLEM 1-10B (a) (b) Financial Accounting, Seventh Canadian Edition 1. Remove accounts receivable from the revenue section of the income statement since it is a current asset and does not belong on the income statement. 2. Remove the $3,000 of service revenue that has not yet been earned. 3. Remove the $12,000 rent expense. This is not an actual transaction and cannot be listed on the company’s income statement. 4. Remove the $4,000 vacation expense. This is not a business expense but rather a personal expense of the business owner. 5. Deduct expenses from revenues rather than adding them. INDEPENDENT BOOK SHOP LTD. Income Statement Year Ended March 31, 2018 Revenues Service revenue ($41,000 – $3,000) Expenses Office expense Income before income tax Income tax expense Net income $38,000 5,000 33,000 5,000 $28,000 [Revenues – Expenses = Net income or (loss)] (c) As a private company, Independent Book Shop should also prepare a statement of financial position, a statement of retained earnings, and a statement of cash flows. LO 4 BT: AN Difficulty: C TIME: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 1-67 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT1-1 (a) Financial Accounting, Seventh Canadian Edition FINANCIAL REPORTING CASE North West presents the following five financial statements: Statement of Earnings (which we call income statement in the chapter), Statement of Comprehensive Income, Balance Sheet (which we call statement of financial position), Statement of Changes in Shareholders’ Equity (which we call statement of changes in equity), and Statement of Cash Flows. All of the above financial statements, except the Statement of Comprehensive Income, were discussed in this chapter. (b) As demonstrated in the table below, North West’ sales and net income increased in fiscal 2016. ($ in thousands) Sales Net income (net earnings) 2016 $1,796,035 69,779 2015 $1,624,400 62,883 Change $171,635 6,896 Net income is affected by revenue and expenses incurred by a company during the year. An increase in sales does not always translate into an increase in net income. For North West, both revenue and net income increased. (c) ($ in thousands) (1) January 31, 2016 Total assets Total liabilities Total shareholders’ equity $793,795 436,183 357,612 (2) January 31, 2015 $724,299 395,016 329,283 (Assets = Liabilities + Shareholders’ equity) Solutions Manual 1-68 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT1-1 (CONTINUED) (d) ($ in thousands) Share capital Retained earnings January 31, 2016 $167,910 156,664 January 31, 2015 $167,460 140,527 Yes, the above balances taken from the statement of changes in equity agree with the amounts reported in the shareholders’ equity section of the balance sheet. Note that these do not comprise all of North West’s’ shareholders’ equity. Other shareholders’ equity items make up the remainder of the total shareholders’ equity balances reported on both statements as shown below. ($ in thousands) Share capital Contributed surplus Retained earnings Accumulated other comprehensive income Total shareholders’ equity (e) ($ in thousands) Cash January 31, 2016 January 31, 2015 $167,910 2,620 156,664 $167,460 2,831 140,527 30,418 $357,612 18,465 $329,283 January 31, 2016 $37,243 January 31, 2015 $29,129 This information can be obtained on the balance sheet (statement of financial position) or on the statement of cash flows. LO 4 BT: AN Difficulty: M TIME: 40 min. AACSB: Communication and Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 1-69 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT1-2 (a) and (b) Financial Accounting, Seventh Canadian Edition FINANCIAL ANALYSIS CASE [North West ($ in thousands)] 1. Assets Liabilities Shareholders’ equity 2. Sales Net income 2016 $793,795 436,183 357,612 2015 $724,299 395,016 329,283 % change 9.6% 10.4% 8.6% 2016 $1,796,035 69,779 2015 $1,624,400 62,883 % change 10.6% 11.0% 2016 $7,960.6 5,230.9 2,729.7 2015 $10,261.0 5,282.6 4,978.4 % change (22.4)% (1.0)% (45.2)% 2016 $24,618.8 (2,119.2) 2015 $23,928.8 366.7 % change 2.9% * Sobeys ($ in millions) 1. Assets Liabilities Shareholders’ equity 2. Sales Net income (loss) *not meaningful (c) North West experienced growth in assets, liabilities, and shareholders’ equity. However, its liabilities grew at a faster pace than its assets which is not always a positive sign. From a profitability standpoint, the 10.6% increase in sales caused an increase in net income of 11% which demonstrates a strong management of expenses. Due to the nature of the goodwill impairment loss of just under $3 billion in 2016, both assets and equity decreased substantially for Sobeys. In addition, the impairment did not affect increases in sales. The size of the impairment loss removes the opportunity to assess profitability. Solutions Manual 1-70 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT1-2 (CONTINUED) (d) In 2016, Sobey’s fiscal year (May 3, 2015 through May 7, 2016) covers the majority of the same period as North West’s fiscal year (Feb. 1, 2015 through January 31, 2016). The same is true for their previous fiscal years. Consequently, unless there was a significant economic impact that affected the stores in the non-overlapping period of three months (February through April), I would have no concerns about the comparisons made in (c) as they both cover a single fiscal year. LO 4 BT: AN Difficulty: M TIME: 40 min. AACSB: Communication and Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 1-71 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT1-3 (a) Financial Accounting, Seventh Canadian Edition FINANCIAL ANALYSIS CASE Both North West and Sobeys declared and paid dividends in fiscal year 2016 as revealed in their respective statement of changes in equity, as follows: North West Sobeys (in thousands) (in millions) Dividends (b) $58,210 $130.3 Both North West and Sobeys generated positive cash flows from their operations as revealed in their respective statement of cash flows, as follows: North West Sobeys (in thousands) (in millions) Cash from operating activities (A) $132,987 $837.7 Cash used in investing activities (B) 75,813 631.4 175% 133% A divided by B Both companies are reinvesting cash from operations back into the business. (c) Only Sobeys repaid long-term debt during the 2016 fiscal year as revealed in their respective statement of cash flows, as follows: North West Sobeys (in thousands) (in millions) Repayment of long-term debt nil $594.4 Although it appears as if Sobeys paid off debt, this is really not the case since new debt of $582.7 was obtained. Consequently, the two companies have similar changes to long-term debt. Solutions Manual 1-72 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT1-3 (CONTINUED) (d) Only North West issued common shares during the 2016 fiscal year as revealed in their respective statement of cash flows, as follows: North West Sobeys (in thousands) (in millions) Issuance of common shares $115 nil LO 4 BT: AN Difficulty: M TIME: 30 min. AACSB: Communication and Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 1-73 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT1-4 (a) Financial Accounting, Seventh Canadian Edition PROFESSIONAL JUDGEMENT CASE Both public and private companies are separate legal entities owned by shareholders. One of the key differences between the two types of companies is the availability of the shares. Shares of public companies are traded on organized stock exchanges and are available to the general public. In contrast, shares of a private company are not made available to the general public, nor are they traded on a public stock exchange. Another difference is access to capital. Since public companies are traded on organized stock exchanges, they generally have more access to capital than do private companies. Private companies tend to rely upon bank financing for capital. Public and private companies also differ in terms of the amount of information they disclose publicly. Public companies are required to file financial statements with the regulators of the stock exchange. This makes their statements widely available. In contrast, private companies do not have any requirement to make their financial statements publicly available. (b) The key users of public company financial statements are shareholders, lenders and other creditors, regulators, analysts, and the general public. In contrast, the key users of private company financial statements are generally lenders and other creditors as well as private shareholders. Solutions Manual 1-74 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT1-4 (CONTINUED) (c) The key difference between the users of public and private financial statements is the different areas of emphasis of the users’ objectives and needs when reviewing the financial statements. Users of public company financial statements can represent a wide range with varying levels of understanding about the company and its operations. They tend to be a broad group of users who benefit from detailed disclosure that will help them make the appropriate financial decision to invest or to lend, etc. On the other hand, users of private company financial statements tend to be a small group, who usually have a high degree of understanding of the company and its operations. They consist mostly of lenders and other creditors and a small group of shareholders. These users tend to place a greater emphasis on liquidity, solvency, and short-term cash flow planning. (d) One of the main reasons that Canada adopted IFRS is that these global set of standards will be beneficial to investors, lenders, other creditors, and other financial statement users by increasing the comparability and quality of financial statements. In other words, users will be able to make an “apples to apples” comparison. If Canadian public companies had a choice of which GAAP to use, then it would entirely defeat the purpose of increasing comparability among public companies. (e) Since most private companies in Canada are small to medium-sized businesses, the Canadian Accounting Standards Board (AcSB) decided that IFRS, with its extensive disclosure reporting requirements and sophisticated reporting, was not appropriate for most of these companies. However, since private companies can represent a wide range of companies – from large multinationals to small local restaurants, the AcSB decided it was best if private companies have a choice of which standard to adopt. A company’s choice of which GAAP to adopt is generally driven by users’ objectives and needs. LO 1, 2 BT: C Difficulty: M TIME: 30 min. AACSB: Communication CPA: cpa-t001, cpa-e003 CM: Reporting and Comm. Solutions Manual 1-75 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT1-5 Financial Accounting, Seventh Canadian Edition FINANCIAL ANALYSIS CASE Note to instructors: All of the material supplementing this group activity, including a suggested solution, can be found in the Collaborative Learning section of the Instructor Resource site accompanying this textbook as well as in the Prepare and Present section of WileyPLUS. (a) Divide revenue by the hourly rate charged to clients: IMS: $1,020,000 ÷ $17 per hour = 60,000 hours PCS: $900,000 ÷ $30 per hour = 30,000 hours (b) Knowing the hours worked from the above, we can derive the hourly salary by dividing total salary expense for each company by the hours worked as follows: IMS: $600,000 ÷ 60,000 hours = $10 per hour PCS: $450,000 ÷ 30,000 hours = $15 per hour (c) IMS uses larger facilities because its rent expense is higher. This makes sense because they have larger types of cleaning equipment that will need to be stored. Furthermore, the company has a larger staff given the size of its operations and may need more office space. (d) PCS has higher other operating expenses because that company owns and operates vehicles. (e) Given that both companies pay interest at the same rate, IMS has the larger bank loan because its interest expense higher. (f) The most significant factor that makes PCS more profitable is the fact that this company charges its clients an hourly rate that is double the hourly wage rate paid to its employees. IMS is not able to charge its clients at double the wage rate. LO 4 BT: AN Difficulty: M TIME20 min. AACSB: Communication and Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 1-76 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT1-6 Financial Accounting, Seventh Canadian Edition ETHICS CASE (a) The stakeholders in this situation are the new CEO and CFO, and the creditors and investors who rely on the financial statements to make business decisions. (b) The CEO and CFO should not sign the certification until they have taken steps to assure themselves that the most recent reports accurately and completely reflect the activities of the business. However, as the current management of the company, they cannot refuse to sign the certification just because they are new. They are the management team now and must assume the responsibilities that go with these positions. (c) The CEO and CFO have no alternative other than to take the steps necessary to assure themselves of the accuracy and completeness of the financial information, and, if accurate, sign the certification. If the information is not accurate or complete, they need to make the required corrections to the financial information. The company may need to delay issuing its financial statements. LO 1 BT: E Difficulty: M TIME15 min. AACSB: Communication and Ethics CPA: cpa-t001, cpa-e001 CM: Reporting and Ethics Solutions Manual 1-77 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT1-7 (a) Financial Accounting, Seventh Canadian Edition SERIAL CASE Compu-Tech Consulting is a proprietorship. A proprietorship has the advantage of lower administrative costs than a corporation—fewer regulations and procedures to adhere to. Emily may also have more flexibility in working for herself (or less depending on the demands of the business). In addition, as a separate proprietorship, all of the income of the business belongs to Emily. However, the disadvantage of a proprietorship is that Emily has personal and unlimited liability for the debts of the business. She may also have difficulty in raising capital to grow the business. Anthony Business Company Ltd. (ABC) is a private corporation. It has the advantage of limited liability for the shareholders’ investments in the business compared to a proprietorship. However, this advantage may be negated by a demand from creditors (such as the bank) for a personal guarantee by the shareholders. Another disadvantage is that if net income is distributed by declaring dividends, it must be shared with all shareholders in proportion to their shareholdings. More regulations and paperwork are required for a corporation compared to that of a proprietorship; however, more opportunities exist to share the administrative burdens and to grow the business. (b) Given its current size, Compu-Tech Consulting likely has no requirements to produce financial statements used by external creditors. It could choose to follow Accounting Standards for Private Enterprises (ASPE) if it was required to produce financial statements. Anthony Business Company Ltd. would most likely use Accounting Standards for Private Enterprises (ASPE) ) but could also, if it wished, choose to use International Financial Reporting Standards (IFRS). We will assume the former for the purpose of this case. Solutions Manual 1-78 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT1-7 (CONTINUED) (c) Emily will need information on the revenues and cost of the services performed and the cost of products and accessories sold so she can determine if new contracts are profitable. She will need this information more often initially (for example, on a weekly basis) so she can monitor the results of the contracts and their impact on the operations of the company. She will also need forecasts of future services and product and accessory sales to plan the work, estimate staffing and other costs, and determine delivery schedules. Emily would also find financial statements useful to better understand ABC’s business and identify financial issues as early as possible. Monthly financial statements would be best as the more timely the information is, the more useful it is for managing the business. d) The users of ABC’s accounting information include the existing shareholders (Emily’s parents), potential shareholders such as Emily, creditors such as the bank, and taxing authorities such as the CRA. Emily’s parents are internal users and they need accounting information to plan, organize, and run the company and determine if they can obtain the financing to meet the increased demand. Emily needs accounting information to determine if her parents’ business is a sound investment for her and what her responsibilities as administrator would be. Creditors and taxing authorities would be considered external users. The bank and the CRA require financial statements—income statement, statement of retained earnings (since it is assumed that ABC follows ASPE; however, if it follows IFRS then it would be required to prepare a statement of changes in equity), statement of financial position, statement of cash flows, in addition to accompanying notes to the financial statements—to assess the financial health of the company. Solutions Manual 1-79 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT1-7 (CONTINUED) (e) The following are examples of activities that ABC is likely to be engaged in: Operating activities include cash collection from revenue generated from the sale of products and accessories and from providing business services. Cash payments would be made for products, accessories, supplies, salaries, utilities, and interest on bank loans. Investing activities include the purchase of equipment or the sale of used equipment no longer in use. Financing activities include borrowing money from the bank (debt) and paying dividends to shareholders (equity). LO 1,2,3,4 BT: C Difficulty: M TIME: 50 min. AACSB: Comm. CPA: cpa-t001 CM: Reporting Solutions Manual 1-80 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Legal Notice Copyright © 2017 by John Wiley & Sons Canada, Ltd. or related companies. All rights reserved. The data contained in these files are protected by copyright. This manual is furnished under licence and may be used only in accordance with the terms of such licence. The material provided herein may not be downloaded, reproduced, stored in a retrieval system, modified, made available on a network, used to create derivative works, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise without the prior written permission of John Wiley & Sons Canada, Ltd. (MMXVII vi F2) Solutions Manual 1-81 Chapter 1 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CHAPTER 2 A FURTHER LOOK AT FINANCIAL STATEMENTS LEARNING OBJECTIVES 1. Identify the sections of a classified statement of financial position. 2. Identify and calculate ratios for analyzing a company’s liquidity, solvency, and profitability. 3. Describe the framework for the preparation and presentation of financial statements. SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND BLOOM’S TAXONOMY Item LO BT Item LO BT Item LO BT Item LO Questions BT Item LO BT 1. 1 K 7. 1 C 13. 2 C 19. 3 C 25. 3 C 2. 1 C 8. 1 K 14. 2 K 20. 3 C 26. 3 C 3. 1 C 9. 2 C 15. 2 C 21. 3 C 27. 3 K 4. 1 K 10. 2 C 16. 2 C 22. 3 C 28. 3 C 5. 1 C 11. 2 C 17. 2 K 23. 3 C 29. 3 C 6. 1 C 12. 2 C 18. 2 C 24. 3 C Brief Exercises 1. 1 K 3. 1 AP 5. 2 AP 7. 2 AN 9. 3 C 2. 1 K 4. 1 AP 6. 2 AN 8. 3 K 10. 3 C Exercises 1. 1 K 3. 1 AP 5. 1 AP 7. 2 AN 9. 3 K 2. 1 AP 4. 1 AP 6. 2 E 8. 2 AN 10. 3 C Problems: Set A and B 1. 1 K 3. 1 AP 5. 2 AN 7. 2 AN 9. 3 E 2. 1 AP 4. 1 AP 6. 2 AN 8. 2 AN 10. 3 E Cases 1. 1 K 3. 3 S 5. 3 E 2. 2 C 4. 1,2 AN 6. 2,3 E Solutions Manual 2-1 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Legend: The following abbreviations will appear throughout the solutions manual file. LO Learning objective BT Bloom's Taxonomy K Knowledge C Comprehension AP Application AN Analysis S Synthesis E Evaluation Difficulty: Level of difficulty S Simple M Moderate C Complex Time: Estimated time to complete in minutes AACSB Association to Advance Collegiate Schools of Business Communication Communication Ethics Ethics Analytic Analytic Technology Tech. Diversity Diversity Reflec. Thinking Reflective Thinking CPA CM CPA Canada Competency Map Ethics Professional and Ethical Behaviour PS and DM Problem-Solving and Decision-Making Comm. Communication Self-Mgt. Self-Management Team & Lead Teamwork and Leadership Reporting Financial Reporting Stat. & Gov. Strategy and Governance Mgt. Accounting Management Accounting Audit Audit and Assurance Finance Finance Tax Taxation cpa-e001 cpa-e002 cpa-e003 cpa-e004 cpa-e005 cpa-t001 cpa-t002 cpa-t003 cpa-t004 cpa-t005 cpa-t006 Solutions Manual 2-2 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ANSWERS TO QUESTIONS 1. (a) Current assets are assets that are expected to be converted into cash, sold, or used up within one year of the company’s financial statement date or its operating cycle, whichever is longer. (b) Examples of current assets include cash, accounts receivable, inventory, and supplies. Current assets are listed in order of liquidity in the current asset section of the statement of financial position. LO 1 BT: K Difficulty: S Time: 3 min. AACSB: None CPA: cpa-t001 CM: Reporting 2. The term operating cycle stands for the average time it takes to go from cash to cash in producing revenue. In a merchandising business, this means the time it takes to purchase inventory on account, pay cash to suppliers, sell the inventory on account, and then collect cash from customers. In a service business, it stands for the time it takes to pay employees, provide services on account, and then collect the cash from customers. LO 1 BT: C Difficulty: M Time: 3 min. AACSB: None CPA: cpa-t001 CM: Reporting 3. (a) Current assets are assets that are expected to be converted into cash, sold, or used up within one year of the company’s financial statement date or its operating cycle, whichever is longer. Noncurrent assets are assets that are not expected to be converted into cash, sold, or used up by the business within one year of the financial statement date or its operating cycle. In other words, non-current assets are all assets that are not classified as current assets. Solutions Manual 2-3 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition (3) (continued) (b) Current assets are assets that are expected to be converted into cash, sold, or used up within one year of the company’s financial statement date or its operating cycle, whichever is longer. Current liabilities are obligations that are to be paid or settled within one year of the company’s financial statement date or its operating cycle, whichever is longer. Ideally, current assets will exceed current liabilities for a company. Showing items as current in nature matters because doing so assists the user of the financial statements to assess the business’s liquidity. LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 4. (a) Current liabilities are obligations that are to be paid or settled within one year of the company’s financial statement date or its operating cycle, whichever is longer. (b) Examples of current liabilities include bank indebtedness, accounts payable, accrued liabilities, and current maturities of long-term debt. Current liabilities are listed in the order in which they are expected to be paid, in the current liability section of the statement of financial position. LO 1 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-4 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 5. (a) Financial Accounting, Seventh Canadian Edition The major differences between current liabilities and non-current liabilities are: Difference Source of payment Current Liabilities Existing current assets or other current liabilities Non-Current Liabilities Other than existing current assets or other current liabilities Time of expected payment Within one year Beyond one year Nature of items Debts pertaining to the operating cycle and other short-term debts Mortgages, notes, loans, bonds, and other noncurrent liabilities (b) Some liabilities, such as bank loans, appear on the statement of financial position with a current and non-current portion. Included in the balance of the bank loan payable are principal payments that will be due in the next year. That amount must be shown as a current liability as at the company’s financial statement date. The remaining principal balance is classified as a non-current liability. LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 6. (a) Contra accounts are accounts that offset the account to which they relate. Contra accounts serve to keep track of and disclose the amount of the reduction to the balance of the related account and arrive at its carrying amount. An example is accumulated depreciation, which is offset against the related asset account to arrive at the asset’s carrying amount. (b) In the case of property, plant, and equipment, users find it useful to know the historical cost of assets as well as the cumulative amount of depreciation (contra account called accumulated depreciation) that has been recorded to date on them. The difference between cost and accumulated depreciation is referred to as the carrying amount, also commonly known as net book value or just simply book value. LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-5 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 7. Financial Accounting, Seventh Canadian Edition Current assets and liabilities are listed in the statement of financial position in the order in which they are expected to be converted into cash, sold or used up in the case of assets and paid or settled, in the case of liabilities; that is, in their order of liquidity. Liquidity is enhanced when an asset can be converted to cash more quickly than another asset. In the case of liabilities, some liabilities will be paid more quickly than others and so they would be deemed to be more liquid. Other assets are listed in the order of permanency. Long-term assets, such as property, plant, and equipment, are usually presented in order of permanence, with the most permanent (land) being presented first. LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 8. (a) The two components of shareholders' equity and the purpose of each are: (1) Share capital is used to record investments of assets, i.e. cash, in the business by the owners (shareholders). If there is only one class of shares, it is known as common shares. (2) Retained earnings is used to record accumulated profit, net of any losses and dividends declared, retained in the company. (b) Under ASPE, the ending balances of share capital and retained earnings would appear on the statement of financial position and the ending balance of retained earnings would also appear on the statement of retained earnings. Under IFRS, the presentation on the statement of financial position would be the same, and both share capital and retained earnings would appear on the statement of changes in shareholders’ equity. LO 1 BT: K Difficulty: S M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-6 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 9. Financial Accounting, Seventh Canadian Edition Intracompany ratio comparisons compare elements and ratios within the same financial statements (example, current assets and current liabilities) or between the income statement and the statement of financial position (example, basic earnings per share) from the same company. Intracompany ratio comparisons can also involve comparing elements or ratios in two or more accounting periods for the same company. Intercompany ratio comparisons compare elements or ratio results between different companies. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 10. (a) Liquidity ratios measure a company’s short-term ability to pay its current liabilities and meet its unexpected needs for cash. Examples of liquidity ratios include working capital and current ratios. (b) Solvency ratios measure a company’s ability to survive over a long period of time. An example of a solvency ratio is the debt to total assets ratio. (c) Profitability ratios measure a company’s operating success for a given period of time. Examples of profitability ratios include basic earnings per share and the price-earnings ratio. LO 2 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-7 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 11. Financial Accounting, Seventh Canadian Edition (a) Working capital is arrived at by deducting current liabilities from current assets. (b) Positive working capital means that there are more current assets than current liabilities. Whenever there is positive working capital, the current ratio is greater than 1:1. (c) Having positive working capital does not mean that a company has lots of cash. It could mean the company has significant accounts receivable or inventory. The working capital may be a very large amount and yet the company may have no cash as it is instead borrowing all of the necessary cash from the bank to make day-today payments to suppliers and employees. LO 2 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance 12. The current ratio is a better measure of liquidity than working capital when making comparisons between different businesses. The amount of working capital is an absolute amount. It could vary tremendously depending on the size of the operations of the business. The current ratio on the other hand presents a relationship of current assets to current liabilities and is therefore appropriate as a tool to compare the liquidity of different sized businesses. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 13. Current assets include accounts receivable and inventory. These may have increasing balances because of uncollectible receivables or slow-moving inventory. This would cause the current ratio to increase. Even though the current ratio may seem high, it is an artificial measure of liquidity if receivables and inventory cannot be easily or quickly converted into cash. Consequently, the current ratio alone does not provide a complete assessment of liquidity. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-8 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 14. Financial Accounting, Seventh Canadian Edition Dong Corporation is more solvent as only 45% of its assets are financed by debt whereas 55% of Du's assets are financed by debt. A company carrying a higher proportion of debt has an increased likelihood of encountering financial difficulties and is therefore considered less solvent. LO 2 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance 15. Raising money using debt adds more risk to a company than raising money through equity because the terms of repayment of debt require cash outflows for the payment of interest and repayment of principal. These payments tap into cash balances that could hurt the company’s liquidity. In contrast to debt, equity does not have to be repaid. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 16. Basic earnings per share comparisons among different companies are difficult due to variations in the financing structure of the companies and in the number of shares issued. Hence, there is no industry average for basic earnings per share. On the other hand, since the price-earnings ratio uses basic earnings per share relative to the market price of the common shares, the ratio can be compared among companies. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-9 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 17. Financial Accounting, Seventh Canadian Edition Investors appear to favour TD Bank. Its higher price-earnings ratio indicates that investors are willing to pay proportionately more for TD's shares and have more favourable expectations of future growth. LO 2 BT: K Difficulty: S Time: 5 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance 18. Increases in the basic earnings per share, price-earnings ratio, and the current ratio are considered to be signs of improvement because: • An increase in the basic earnings per share means that the amount of net income per share is greater than in the previous period. • An increase in the price-earnings ratio means that the share price has increased at a greater rate than the company’s basic earnings per share, which implies the market believes future net income will continue to increase. • An increase in the current ratio indicates that the company has more current assets available to settle its current liabilities and is more liquid (assuming the components of current assets (e.g., receivables and inventory) are also liquid. On the other hand, the debt to total assets ratio measures how much of the company is financed by debt. The more debt a company has, the higher the debt to total assets ratio. A company with a higher debt level has increased financial risk due to higher fixed interest and principal repayments, and is less solvent than a company with a lower level of debt. LO 2 BT: C Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-10 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 19. Financial Accounting, Seventh Canadian Edition (a) The conceptual framework is a coherent system of interrelated objectives and fundamentals that can lead to consistent standards. The framework prescribes the nature, function, and limits of financial accounting statements. It guides choices about what to present in financial statements, decisions about alternative ways of reporting economic events, and the selection of appropriate ways of communicating such information. (b) Internationally, the conceptual framework may vary from country to country. Canadian companies use the same framework, whether they are reporting under IFRS or under ASPE. LO 3 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 20. (a) The primary objective of financial reporting is to provide information useful to existing and potential investors, lenders, and other creditors in making decisions about providing resources to the company. (b) The main users of financial reporting are investors, lenders, and other creditors. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 21. The going concern assumption states that the business will remain in operation for the foreseeable future. The timing of when the asset will be converted to cash or used in operations and when liabilities are to be paid determines their classification on the statement of financial position. Since the business is expected to remain in operation for the foreseeable future, these elements can continue to be reported in accordance with their respective current or non-current classifications. If the company were about to be shut down, all of its assets and liabilities would be classified as current. LO 3 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-11 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 22. Financial Accounting, Seventh Canadian Edition The fundamental qualitative characteristics are (1) relevance and (2) faithful representation. Relevant information will impact a user’s decision by having predictive value, confirmatory value, or both. Faithful representation means that the financial statements should reflect the economic reality of what really exists or has happened. The information must be complete, neutral, and free from material error. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 23. Enhancing qualitative characteristics make useful financial information more useful (i.e. they enhance its usefulness). To be useful, financial information must reflect the two fundamental qualitative characteristics of relevance and faithful representation. Enhancing characteristics bring more specific support to the objectives achieved by using the fundamental qualitative characteristics. Enhancing qualitative characteristics cannot enhance the usefulness of financial information that is not useful (i.e. information which does not reflect the fundamental qualitative characteristics). LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 24. Materiality is related to relevance in that they are both defined in terms of what influences or makes a difference to the decision-maker. In order to be relevant to a financial statement user, a transaction, a narrative explanation in the notes to the financial statements, or an amount reported for an element must make a difference to the user in the making of a decision. An item is considered to be material if its omission or misstatement could influence the decision. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 25. The four enhancing qualitative characteristics are (1) comparability, (2) verifiability, (3) timeliness, and (4) understandability. There is no prescribed order in applying these characteristics. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-12 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 26. Financial Accounting, Seventh Canadian Edition The cost constraint means that information will be presented only when the benefit associated with it exceeds the cost of obtaining and providing it. In attempting to fulfill a completeness objective when obtaining financial information, one could expend considerable resources. The cost of this search may greatly outweigh any benefit in achieving the completeness objective. Consequently, the search for completeness will be restricted by this constraint. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 27. The elements of financial statements are broad categories or classes of financial statement effects of transactions and other events. They include assets, liabilities, equity, income (which includes revenues and gains), and expenses (which include losses). The grouping is selected in accordance with the economic characteristics of the transactions. LO 3 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 28. The two bases are historical cost and current value. The current value basis of accounting is applied to those assets that are intended to be sold and whose current value is readily available. Securities traded on the stock exchanges would be a good example of assets reported at their current value. The historical cost basis of accounting is used for most of the remaining assets used by the business. Since in most cases the intention is to use the assets to earn revenue, the current value of the asset is not as relevant as its historical cost. LO 3 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-13 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 29. Financial Accounting, Seventh Canadian Edition In order to be relevant for decision making, the measurement of elements of financial statements need to reflect amounts that are reliable. For assets that are intended to be sold, the current value of the assets becomes the most relevant measurement as it approximates the current amount of cash that could be obtained on the sale of the asset. On the other hand, for assets held for use by the corporation, the value at resale is not as relevant to the financial statement user. In that case, the historical cost of the assets is the better measurement for reporting the financial statement element. An example of a revenue generating asset is land used for a parking lot. It is relevant to compare the actual cost of the land to the amount of the revenue generated from its use. Using the historical cost basis of accounting gives a faithful representation to the financial statement users. LO 3 BT: C Difficulty: M Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-14 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 2-1 (a) (b) (c) (d) (e) (f) (g) 5 1 3 3 1 7 5 (h) 4 Accounts payable Accounts receivable Accumulated depreciation Buildings Cash Common shares Current portion of mortgage Payable Patents (i) (j) (k) (l) (m) (n) (o) 8 5 2 3 1 1 6 (p) (q) 1 5 Dividends declared Income tax payable Long-term Investments Land Inventory Supplies Mortgage payable, due in 20 years Prepaid insurance Unearned revenue LO 1 BT: K Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 2-2 (a) (b) 1 2 Accounts receivable Accumulated depreciation (i) (j) 1 1 (c) (d) 4 5 (k) 1 (e) (f) (g) (h) 1 6 2 3 Bank indebtedness Bank loan payable, due in three years Cash Common shares Equipment Goodwill Inventory Notes receivable, due in six months Prepaid rent (l) (m) (n) (o) (p) (q) 6 4 1 4 1 4 Retained earnings Salaries payable Supplies Unearned revenue Prepaid insurance Accounts payable LO 1 BT: K Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-15 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 2-3 SHUM CORPORATION Statement of Financial Position (Partial) Assets Current assets Cash Accounts receivable Inventory Supplies Prepaid insurance Total current assets Property, plant, and equipment Land Buildings Less: Accumulated depreciation—buildings Equipment Less: Accumulated depreciation—equipment Total property, plant, and equipment Total assets $16,400 14,500 9,000 4,200 3,900 48,000 65,000 $110,000 33,000 $70,000 25,000 77,000 45,000 187,000 $235,000 (Assets = Liabilities + Shareholders’ equity) LO 1 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-16 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 2-4 HIRJIKAKA INC. Statement of Financial Position (Partial) Current liabilities Accounts payable Salaries payable Interest payable Income tax payable Unearned revenue Current portion of mortgage payable Total current liabilities $22,500 3,900 5,200 6,400 900 5,000 $43,900 LO 1 BT: AP Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-17 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 2-5 (a) ($ in thousands) 2016 Working capital: 2015 Working capital: $453,254 – $235,400 = $217,854 $421,955 – $223,239 = $198,716 Current Assets – Current Liabilities Current ratio: $453,254 $235,400 Current ratio: = 1.9:1 $421,955 $223,239 = 1.9:1 Current Assets Current Liabilities (b) The working capital increased slightly in 2016 and the current ratio remained the same. Indigo's liquidity is slightly stronger in 2016 compared with 2015. LO 2 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-18 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 2-6 (a) (in US$ millions) 2016 Debt to total assets ratio: ($2,705.5 + $4,554.8) = 59.0% ($2,934.8 + $9,369.1) 2015 Debt to total assets ratio: ($2,470.3 + $4,655.1) = 64.6% ($2,742.3 + $8,286.1) Total Liabilities Total Assets (b) The company’s solvency was stronger in 2016 compared with 2015 because total debt has decreased as a proportion of total assets. LO 2 BT: AN Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-19 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 2-7 (a) ($ in thousands) 2015 Basic earnings per share: $76,629 = $1.08 per share 71,218 2014 Basic earnings per share: $75,524 = $1.07 per share 70,899 Income available to common shareholders Weighted average number of common shares Price-earnings ratio: $13.99 = 13.0 times $ 1.08 Price-earnings ratio: $17.31 = 16.2 times $ 1.07 Market price per share Basic earnings per share (b) The increase in net income and in the basic earnings per share during the year would indicate that profitability has improved in 2015. In spite of the increase in net income, investors appear to have less confidence in Leon’s future income as indicated by the decrease in the price-earnings ratio in 2015. LO 2 BT: AN Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-20 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 2-8 (a) (b) (c) (d) (e) (f) Faithful representation Verifiability Understandability Cost Going concern Current value LO 3 BT: K Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 2-9 (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) (m) 10 5 13 8 12 9 1 2 4 3 11 6 7 LO 3 BT: C Difficulty: C Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-21 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 2-10 (a) Sosa Ltd. has purchased the land for sale and not for use. The current value of the land becomes the more relevant measurement as it approximates the current amount of cash that could be obtained on the sale of the asset. (b) Mohawk has purchased land for use and not for sale. The current value is not as relevant to the financial statement user in this case. The historical cost of the land is the better measurement for reporting the land on the statement of financial position. LO 3 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-22 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO EXERCISES EXERCISE 2-1 (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) (m) (n) 5 1 3 3 7 5 5 4 5 1 1 3 6 1 Accounts payable and accrued liabilities Accounts receivable Accumulated depreciation Buildings and leasehold improvements Common shares Current maturities of long-term debt Dividends payable Patents Income and other taxes payable Income and other taxes receivable Inventories Land Long-term debt Prepaid expenses LO 1 BT: K Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-23 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 2-2 BIG ROCK BREWERY INC. Statement of Financial Position (partial) December 31, 2015 (in thousands) Assets Current assets Cash Accounts receivable Inventories Prepaid expenses and other Total current assets Property, plant, and equipment Land Buildings Less: Accumulated depreciation Machinery and equipment Less: Accumulated depreciation Mobile equipment Less: Accumulated depreciation Office furniture and equipment Less: Accumulated depreciation Total property, plant, and equipment Intangible assets Total assets $ 540 2,221 4,935 1,573 $ 9,269 $ 8,377 $17,692 1,817 $24,860 10,122 $ 1,054 434 $ 1,286 516 15,875 14,738 620 770 40,380 456 $50,105 LO 1 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-24 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 2-3 SAPUTO INC. Statement of Financial Position (partial) March 31, 2016 (in millions) Liabilities and Shareholders' Equity Current liabilities Accounts payable and accrued liabilities Income taxes payable Bank loans payable Total current liabilities Non-current liabilities Long-term debt Deferred income taxes payable Other long-term liabilities Total non-current liabilities Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders' equity $ 896.6 37.1 423.1 $ 1,356.8 $1,208.3 475.6 61.8 1,745.7 3,102.5 $ 821.0 3,180.8 4,001.8 $7,104.3 LO 1 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-25 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 2-4 (a) Net income = Revenues – Expenses = $183,040 – $158,680– $4,550 – $5,200 = $14,610 Retained earnings = Beginning retained earnings + Net income – Dividends declared = $116,520 + $14,610 – $0 = $131,130 Solutions Manual 2-26 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 2-4 (CONTINUED) (b) SUMMIT LTD. Statement of Financial Position December 31, 2018 Assets Current assets Cash Accounts receivable Supplies Prepaid insurance Total current assets Long-term investments Property, plant, and equipment Land Buildings $133,800 Less: Accumulated depreciation 50,600 Equipment $ 66,100 Less: Accumulated depreciation 21,470 Total property, plant, and equipment Total assets $ 24,040 20,780 1,240 1,420 $47,480 28,970 $194,000 83,200 44,630 Liabilities and Shareholders' Equity Current liabilities Accounts payable $21,050 Interest payable 2,100 Current portion of mortgage payable 30,500 Total current liabilities Mortgage payable ($104,000 – $30,500) Total liabilities Shareholders' equity Common shares $140,000 Retained earnings 131,130 Total shareholders’ equity Total liabilities and shareholders' equity 321,830 $398,280 $ 53,650 73,500 127,150 271,130 $398,280 LO 1 BT: AP Difficulty: M Time: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-27 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 2-5 BATRA CORPORATION Income Statement Year Ended July 31, 2018 Revenues Service revenue Rent revenue Total revenues Expenses Salaries expense Operating expenses Rent expense Depreciation expense Utilities expense Interest expense Supplies expense Total expenses Income before income tax Income tax expense Net Income $113,600 18,500 132,100 $44,700 32,500 10,800 3,000 2,600 2,000 900 96,500 35,600 5,000 $30,600 [Revenues – Expenses = Net income or (loss)] BATRA CORPORATION Statement of Changes in Equity Year Ended July 31, 2018 Balance, August 1, 2017 Issued common shares Net income Dividends declared Balance, July 31, 2018 Common Shares Retained Earnings $ 15,000 10,000 $17,940 000 000 $25,000 30,600 (12,000) $36,540 Total Equity $32,940 10,000 30,600 (12,000) $61,540 [Ending retained earnings = Beginning retained earnings ± Net income or (loss) – dividends declared] Solutions Manual 2-28 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 2-5 (CONTINUED) BATRA CORPORATION Statement of Financial Position July 31, 2018 Assets Current assets Cash Held for trading investments Accounts receivable Supplies Total current assets Property, plant, and equipment Equipment Less: Accumulated depreciation Total property, plant, and equipment Total assets $ 5,060 20,000 17,100 1,500 $ 43,660 $62,900 6,000 56,900 $100,560 Liabilities and Shareholders' Equity Current liabilities Accounts payable Interest payable Unearned revenue Bank loan payable Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders' equity $ 4,220 1,000 12,000 21,800 $ 39,020 $25,000 36,540 61,540 $100,560 (Assets = Liabilities + Shareholders’ equity) LO 1 BT: AP Difficulty: M Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-29 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 2-6 (a) Current ratio: $60,000 $40,000 = 1.5:1 Current Assets Current Liabilities (b) Current ratio: ($60,000 – $20,000) = 2:1 ($40,000 – $20,000) (c) The request of the CFO to pay off an accounts payable ahead of the due date is clearly done to manipulate the current ratio. His instructions to make the payment came after he was presented with the calculation of the current ratio. In this case the current ratio that is meant to show Padilla’s liquidity position has been artificially altered by a simple payment on account. That said, it is not unethical to pay an account payable in advance of its due date. Rather, it is the motivation for the transaction that would lead one to conclude that the CFO is acting unethically. LO 2 BT: E Difficulty: M Time: 15 min. AACSB: Analytic and Ethics CPA: cpa-e001, cpa-t001 and cpat005 CM: Reporting Solutions Manual 2-30 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 2-7 (a) (in thousands) 2015 2014 Working capital: $167,816 – $158,120 = $9,696 Working capital: $63,150 – $193,384 = $(130,234) Current Assets – Current Liabilities Current ratio: $167,816 = 1.1:1 $158,120 $63,150 = 0.3:1 $193,384 Current Assets Current Liabilities Debt to total assets ratio: ($158,120 + $2,166,843) = 67.0% ($167,816 + 3,304,377) ($193,384 + $2,036,716) = 65.3% ($63,150 + $3,350,264) Total Liabilities Total Assets (b) Crombie REIT’s liquidity improved dramatically in 2015 when compared to 2014, while at the same its solvency deteriorated slightly. Solutions Manual 2-31 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 2-7 (CONTINUED) (c) 2015 CT Choice Industry $9,696 $(215,889) 1.1:1 0.1:1 67.0% 49.1% $(416,879) 0.4:1 90.5% n/a 0.3 :1 43.8% Crombie Working capital (in thousands) Current ratio Debt to total assets ratio Crombie Working capital (thousands) Current ratio Debt to total assets ratio 2014 CT $(130,234) $(295,123) 0.3:1 0.0:1 65.3% 50.2% Choice Industry $(142,356) 0.6:1 87.3% n/a 0.4:1 45.9% Based on working capital and the current ratio, Crombie’s liquidity is the best (highest) of the three companies, as the current ratio far exceeds the ratios for CT and Choice as well as the industry average. Compared to 2014, Crombie and CT improved working capital and the current ratio, while both deteriorated for Choice. The industry average current ratio also declined. Based on the debt to total assets ratio, CT’s solvency is the best of the three companies, but it is not as good as the industry average. Crombie’s solvency deteriorated slightly. Choice’s solvency is the worst of the three companies. LO 2 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-32 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 2-8 (a) (in thousands) 2015 2014 Basic earnings per share: Basic earnings per share: $65,286 = $0.16 per share 395,793 $185,234 395,740 = $0.47 per share Income available to common shareholders Weighted average number of common shares Price-earnings ratio: $17.07 $0.16 = 106.7 times Price-earnings ratio: $18.62 $0.47 = 39.6 times Market price per share Basic earnings per share (b) The decrease in the basic earnings per share during the year would indicate that profitability has deteriorated dramatically in 2015. However, investors appear to have some confidence in Cameco's future profitability as its share price has declined by only 8%. LO 2 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting Solutions Manual 2-33 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 2-9 (a) (b) (c) (d) (e) (f) 7 10 11 3 2 8 (g) (h) (i) (j) (k) (l) 1 6 4 5 9 12 LO 3 BT: K Difficulty: M Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting EXERCISE 2-10 1. (a) (b) The historical cost basis of accounting is involved in this situation. The historical cost basis of accounting has been violated. The land was reported at its current value when it should have remained at its historical cost. 2. (a) (b) The current value basis of accounting is involved in this situation. The principle has not been violated since the parcel of land is being held for resale and not for use. 3. (a) The assumption involved in this situation is the going concern assumption. The going concern assumption has been violated. The elements on the statement of financial position should have been classified between current and non-current. (b) LO 3 BT: C Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-34 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO PROBLEMS PROBLEM 2-1A Item Accounts payable Accounts receivable Accumulated depreciation Statement of Financial Position Category Cash Common shares Computer equipment Current portion of long-term debt Furniture and equipment Goodwill Land, buildings and improvements Long-term debt Prepaid expenses Current liabilities Current assets Contra asset to property, plant, and equipment Current assets Share capital Property, plant, and equipment Current liabilities Property, plant, and equipment Goodwill Property, plant, and equipment Non-current liabilities Current assets Unearned revenue Current liabilities LO 1 BT: K Difficulty: S Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-35 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-2A (a) Item Statement of Financial Position Category Accounts receivable Accumulated depreciation—aircraft Accumulated depreciation—buildings Accumulated depreciation—ground, property and equipment Aircraft Current assets Property, plant, and equipment (contra account) Property, plant, and equipment (contra account) Property, plant, and equipment (contra account) Buildings Cash Ground and other property and equipment Intangible assets Inventory Other assets Prepaid expenses, deposits, and other Property, plant, and equipment Current assets Property, plant, and equipment Property, plant, and equipment Intangible assets Current assets Other assets Current assets Solutions Manual 2-36 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-2A (CONTINUED) (b) WESTJET AIRLINES LTD. Statement of Financial Position (partial) December 31, 2015 (in thousands) Assets Current assets Cash Accounts receivable Inventory Prepaid expenses, deposits, and other Total current assets Property, plant, and equipment Aircraft Less: Accumulated depreciation Ground and other property and equipment Less: Accumulated depreciation Buildings Less: Accumulated depreciation Total property, plant, and equipment Intangible assets Other assets Total assets $1,252,370 82,136 36,018 131,747 $1,502,271 $3,912,617 1,170,643 $ 821,753 196,829 $ 136,783 30,419 $2,741,974 624,924 106,364 3,473,262 63,549 89,942 $5,129,024 LO 1 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-37 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-3A (a) Item Accounts payable and accrued liabilities Advance ticket sales Current portion of long-term debt Deferred income tax (long-term) Long-term debt Other current liabilities Other long-term liabilities Other shareholders’ equity items Retained earnings Share capital Statement of Financial Position Category Current liabilities Current liabilities Current liabilities Non-current liabilities Non-current liabilities Current liabilities Non-current liabilities Shareholders’ equity Shareholders’ equity Shareholders’ equity Solutions Manual 2-38 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-3A (CONTINUED) (b) WESTJET AIRLINES LTD. Statement of Financial Position (partial) Liabilities and Shareholders' Equity December 31, 2015 (in thousands) Current liabilities Accounts payable and accrued liabilities Advanced ticket sales Other current liabilities Current portion of long-term debt Total current liabilities Non-current liabilities Long-term debt Other long-term liabilities Deferred income tax Total non-current liabilities Total liabilities Shareholders' equity Share capital Retained earnings Other shareholders’ equity items Total shareholders’ equity Total liabilities and shareholders' equity $545,438 620,216 158,880 227,391 $1,551,925 $1,276,475 13,603 327,028 1,617,106 3,169,031 $ 582,796 1,292,581 84,616 1.959.993 $5,129,024 (c) Yes, these two amounts agree. Assets of $5,129,024 thousand equal total liabilities plus shareholders’ equity of the same amount. LO 1 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-39 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-4A (a) MBONG CORPORATION Income Statement Year Ended December 31, 2018 Revenues Service revenue Interest revenue Total revenues Expenses Salaries expense Operating expense Depreciation expense Repair and maintenance expense Insurance expense Utilities expense Interest expense Supplies expense Total expenses Income before income tax Income tax expense Net income $213,900 500 $214,400 $129,800 39,400 6,200 2,800 2,200 2,000 1,500 1,000 184,900 29,500 6,000 $23,500 [Revenues – Expenses = Net income or (loss)] Solutions Manual 2-40 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-4A (CONTINUED) MBONG CORPORATION Statement of Changes in Equity Year Ended December 31, 2018 Common Shares Balance, January 1 Issued common shares Net income Dividends declared Balance, December 31 $30,000 4,200 _ _____ $34,200 Retained Earnings $221,000 23,500 (5,000) $239,500 Total Equity $251,000 4,200 23,500 (5,000) $273,700 (Beginning equity ± Changes to equity = Ending equity) [Ending retained earnings = Beginning retained earnings ± Net income or (loss) – dividends declared] Solutions Manual 2-41 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-4A (CONTINUED) (a) (continued) MBONG CORPORATION Statement of Financial Position December 31, 2018 Assets Current assets Cash Held for trading investments Accounts receivable Supplies Prepaid insurance Total current assets Property, plant, and equipment Land Buildings $72,000 Less: Accumulated depreciation—buildings 18,000 Equipment $66,000 Less: Accumulated depreciation—equipment 17,600 Total property, plant, and equipment Total assets Liabilities and Shareholders' Equity Current liabilities Accounts payable Salaries payable Current portion of bank loan payable Total current liabilities Non-current liabilities Bank loan payable ($15,000 - $1,500) Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders' equity $ 11,900 20,000 14,200 200 2,000 $ 48,300 $156,000 54,000 48,400 258,400 $306,700 $15,000 3,000 1,500 $ 19,500 13,500 33,000 $ 34,200 239,500 273,700 $306,700 (Assets = Liabilities + Shareholders’ equity) Solutions Manual 2-42 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-4A (CONTINUED) (b) The income statement reports the net income or loss for the period. This figure is then used in the statement of changes in equity, along with dividends declared and any issues (or repurchases) of shares, to calculate the balances in common shares and retained earnings at the end of the period. These ending balances are then used in the statement of financial position to determine shareholders’ equity and complete the accounting equation. LO 1 BT: AP Difficulty: M Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-43 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-5A (a) 1. 2. Working capital Current assets – Current liabilities $ 446,900 – $142,500 = $304,400 Current ratio Current assets Current liabilities $446,900 = 3.1 :1 $142,500 3. Debt to total assets Total liabilities Total assets $452,500 = 42.2% $1,072,200 4. 5. (b) Basic earnings per share Price-earnings ratio Income available to common shareholders Weighted average number of common shares $160,000 = $4.00 40,000 Market price per share Basic earnings per share $35.00 = 8.8 times $4.00 Johanssen’s liquidity has improved dramatically as the working capital is greater in 2018 and the current ratio is almost double that of 2017. On the other hand, the solvency has deteriorated as the debt to total assets ratio is higher in 2018. Johanssen’s profitability has improved as the basic earnings per share ratio has increased in 2018, as has investors’ expectations for future profitability as indicated by the increasing priceearnings ratio. LO 2 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance. Solutions Manual 2-44 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-6A (a) Working capital Chen Caissie = = = Current ratio = Current assets – Current liabilities $407,200 – $166,325 = $190,400 – $133,700 = Current assets Current liabilities Chen $407,200 $240,875 $56,700 Caissie = 2.4 :1 $166,325 $190,400 = 1.4 :1 $133,700 Chen is significantly more liquid than Caissie. It has a higher current ratio and more current assets available to pay current liabilities as they come due. (b) Debt to total assets = Chen ($166,325 + $108,500) ($407,200 + $532,000) Total liabilities Total assets Caissie = 29.3% ($133,700 + $40,700) = 52.8% ($190,400 + $139,700) Caissie is considerably less solvent than Chen. Caissie's debt to total assets ratio of 52.8% is almost double that of Chen’s ratio of 29.3%. The lower the percentage of debt to total assets, the lower the risk that a company may be unable to pay its debts as they come due. Solutions Manual 2-45 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-6A (CONTINUED) (c) Service revenue Operating expenses Interest expense Income tax expense Total expenses Chen $1,800,000 1,458,000 10,000 85,000 1,553,000 Caissie $620,000 438,000 4,000 35,400 477,400 Net income $ 247,000 $142,600 Basic earnings per share = Income available to common shareholders Weighted average number of common shares Chen Caissie $247,000 = $3.25 76,000 Price-earnings ratio Chen $25.00 $3.25 = 7.7 times $142,600 62,000 = = $2.30 Market price per share Basic earnings per share Caissie $15.00 $2.30 = 6.5 times Based on the price-earnings ratio, investors believe that Chen will be more profitable than Caissie in the future. It is not meaningful to compare basic earnings per share between companies. LO 2 BT: AN Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-46 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-7A (a) (in thousands) Le Château 1. (b) Working capital Reitmans $116,724 – $36,038 = $80,686 $319,362 – $121,172 = $198,190 2. Current ratio $116,724 $36,038 = 3.2:1 $319,362 $121,172 = 2.6:1 3. Debt to total assets $108,136 $168,490 = 64.2% $160,915 $542,083 = 29.7% 4. Basic earnings per share $(35,745) 29,964 = $(1.19) $(24,703) 64,079 = $(0.39) 5. Price-earnings ratio = N/A = N/A Liquidity With a current ratio of 3.2:1, Le Château is more liquid than Reitmans and both companies have stronger ratios than the industry average of 1.8:1. Solvency Reitmans is more solvent than Le Château as evidenced by its lower debt to total assets ratio, which is better than the industry average of 57%. Profitability Although the basic earnings per share ratio does not provide a basis for comparison by investors, both companies have net losses for the year and therefore negative earnings per share. Consequently, no price-earnings ratio can be calculated to compare to each other or to the industry average. LO 2 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-47 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-8A (a) The higher the amount of working capital, the better a company’ liquidity. From 2016 to 2018 Pitka Corporation’s working capital deteriorated and showed a constant downward trend over the three-year period. A higher current ratio is evidence of better liquidity for a company (assuming the components of the current assets are also liquid). Although the current ratio stayed the same from 2016 to 2017, it deteriorated 2017 to 2018 and is low. A smaller (lower) debt to total assets ratio shows evidence of better solvency. The percentage of total liabilities to total assets increased from 2016 to 2017, showing deterioration in the solvency for Pitka. On the other hand, the ratio improved substantially from 2017 to 2018. The higher the basic earnings per share, the better the profitability. Profitability decreased from 2016 to 2017, but improved from 2017 to 2018. The investors appeared to have less confidence in the future net income of Pitka as evidenced by Pitka's price-earnings ratio, which declined from 2016 to 2017. This view changed as demonstrated by the climb in the priceearnings ratio from 2017 to 2018. (b) Liquidity Pitka’s current ratio, although steady in 2016 and 2017, declined slightly in 2018. This trend is of concern given the low level of liquidity the company has with a current ratio of 1.1:1. Solvency Pitka’s debt to total assets ratio improved in the last year. It appears to be reasonable in size, as does the solvency of the company in 2016. Solutions Manual 2-48 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-8A (CONTINUED) (b) (continued) Profitability Pitka’s profitability declined and then recovered as is demonstrated by the basic earnings per share ratio. The price-earnings ratio in 2018 indicates expectations of improving profitability. LO 2 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-49 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-9A (a) The objective of financial reporting is to provide information that is useful to existing and potential investors, lenders, and other creditors in making decisions about providing resources to the company. In this case, the information will be used by the team’s bank. Bucky’s suggestions concerning how elements should be reported on the financial statements do not meet the objective of financial reporting. His suggestions would lead to a violation of the fundamental basis on which financial statements are prepared: accrual accounting. The suggested changes to the financial statements would not portray economic reality and would not faithfully represent the performance of the business and its financial position at December 31, 2018. Bucky’s suggestions show bias and an attempt to portray a financial picture that would be perceived as more favourable than it is in reality. (b) 1. Failing to include the estimated expenses for utilities and the corresponding liability for the utilities already consumed by December 31, 2018 violates accrual accounting. The expense was incurred and a liability exists, and although the exact amount is not known, a reasonable estimate can be made as this type of expense occurs often. The definitions of the elements have been met. Failing to include the expense would represent an error of omission done on purpose to increase the profitability and reduce the liabilities of the company at December 31, 2018. 2. Unless the company uses the revaluation model for all of its long-lived assets, increasing the value of the building to its current value would violate the historical cost basis of accounting. It is likely far more relevant to the financial statement user of this company to see the original purchase price of the building rather than its current value as it is unlikely to be resold soon. Assets and revenue (from the recording of an unrealized gain from the increase in the value of the asset) would be overstated if Bucky’s instructions were followed. Solutions Manual 2-50 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-8A (CONTINUED) (b) (continued) 3. The signing bonus paid to Wayne Crosby does not represent an asset at December 31, 2018. No future benefit can be derived from this payment as it was not conditional upon the occurrence of a future event. Consequently, the expenditure does not fit the definition of an asset. LO 3 BT: E Difficulty: C Time: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-51 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-10A (a) The advantage of the current value basis of accounting is that it represents a more up-to-date measurement of the value of the asset reported. Consequently, the amounts reported are more relevant to the financial statement users. The disadvantage of the current value basis of accounting and corresponding advantage of historical cost is that historical cost is more reliable and shows the amount paid for the asset. The historical cost might provide a more faithful representation because it can be easily verified and is neutral. (b) The reason a company might choose to adopt the current value basis of accounting for real estate is that assets reported on the statement of financial position will have higher values than they would using the historical cost basis. It is inherent in the nature of real estate that the land will increase in value over time. Creditors will find the current value a more relevant basis for making lending decisions. The increase in the assets will have a corresponding increase in equity. (c) The reason a company might choose to adopt the historical cost basis of accounting for real estate is that assets reported on the statement of financial position will have more faithful representation because it reports the actual cost of the asset when it was acquired and this measurement can be easily verified and it is neutral. There is also a significant cost to obtaining reliable current value information, on a regular basis, to be reported in the financial statements. (d) When comparing real estate companies, the reader is well advised to read the accounting policy note to the financial statements disclosing the measurement policy used for the real estate property. One would need to determine the corresponding current value for real estate for the company that used the historical cost basis of accounting. In fact, this information is required to be disclosed for real estate companies, even if they adopted the historical cost basis of accounting, to improve comparability and disclosure. Otherwise, trying to compare businesses that use different bases of accounting would be very difficult. LO 3 BT: E Difficulty: C Time: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-52 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-1B Item Accumulated amortization—patents and trademarks Accumulated depreciation—industrial machinery and equipment Bank overdraft Cash Common (ordinary) shares Current borrowings and debts Income tax payable (current) Industrial machinery and equipment Inventories Land Long-term investments Non-current borrowings and debts Patents and trademarks Prepaid expenses Trade accounts payable Trade accounts receivable Statement of Financial Position Category Intangible assets (contra account) Property, plant, and equipment (contra account) Current liabilities Current assets Share capital Current liabilities Current liabilities Property, plant, and equipment Current assets Property, plant, and equipment Non-current assets Non-current liabilities Intangible assets Current assets Current liabilities Current assets LO 1 BT: K Difficulty: S Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-53 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-2B (a) Item Accounts receivable Accumulated depreciation— buildings Accumulated depreciation— equipment Buildings Cash Equipment Goodwill Held for trading investments Inventory Land Patent Prepaid expenses Statement of Financial Position Category Current assets Property, plant, and equipment (contra account) Property, plant, and equipment (contra account) Property, plant, and equipment Current assets Property, plant, and equipment Goodwill (after intangibles) Current assets Current assets Property, plant, and equipment Intangible assets Current assets Solutions Manual 2-54 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-2B (CONTINUED) (b) DEVON LIMITED Statement of Financial Position (partial) December 31, 2018 Assets Current assets Cash Held for trading investments Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Land Buildings $ 58,275 Less: Accumulated depreciation 27,595 Equipment $287,400 Less: Accumulated depreciation 146,550 Total property, plant, and equipment Intangible assets Patent Goodwill Total assets $100,460 52,520 13,345 105,320 13,950 $285,595 $207,290 30,680 140,850 378,820 20,225 39,590 $724,230 LO 1 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-55 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-3B (a) Item Accounts payable Common shares Current portion of mortgage payable Mortgage payable Retained earnings Unearned revenue Category Current liabilities Shareholders’ equity Current liabilities Non-current liabilities Shareholders’ equity Current liabilities (b) DEVON LIMITED Statement of Financial Position (partial) December 31, 2018 Liabilities and Shareholders' Equity Current liabilities Accounts payable Unearned revenue Current portion of mortgage payable Total current liabilities Non-current liabilities Mortgage payable Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders' equity (c) $ 13,100 14,180 29,000 $ 56,280 231,255 287,535 $115,400 321,295 436,695 $724,230 Yes, the total assets of $724,230 matches the total liabilities and shareholders’ equity. LO 1 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-56 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-4B (a) BEAULIEU LIMITED Income Statement Year Ended December 31, 2018 Revenues Service revenue Interest revenue Total revenues Expenses Salaries expense Interest expense Depreciation expense Utilities expense Insurance expense Total expenses Income before income tax Income tax expense Net Income $193,100 500 $193,600 $145,600 8,000 5,400 3,700 2,400 165,100 28,500 5,000 $23,500 [Revenues – Expenses = Net income or (loss)] BEAULIEU LIMITED Statement of Changes in Equity Year Ended December 31, 2018 Common Shares Balance, January 1 Issued common shares Net income Dividends declared Balance, December 31 $25,000 20,000 _ _____ $45,000 Retained Earnings $34,000 23,500 (3,500) $54,000 Total Equity $59,000 20,000 23,500 (3,500) $99,000 (Beginning retained earnings ± Changes in retained earnings = Ending retained earnings) [Ending retained earnings = Beginning retained earnings ± Net income or (loss) – dividends declared] Solutions Manual 2-57 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-4B (CONTINUED) (a) (continued) BEAULIEU LIMITED Statement of Financial Position December 31, 2018 Assets Current assets Cash Accounts receivable Prepaid insurance Total current assets Long-term investments Property, plant, and equipment Land Buildings Less: Accumulated depreciation—buildings Equipment Less: Accumulated depreciation—equipment Total property, plant, and equipment Total assets $11,170 7,500 250 $ 18,920 20,000 $145,800 $105,000 12,000 $ 32,000 19,200 Liabilities and Shareholders' Equity Current liabilities Accounts payable Salaries payable Current portion of mortgage payable Total current liabilities Non-current liabilities Mortgage payable ($175,800 - $35,100) Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders' equity 93,000 12,800 251,600 $290,520 $ 9,550 6,170 35,100 $ 50,820 140,700 191,520 $45,000 54,000 99,000 $290,520 Solutions Manual 2-58 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-4B (CONTINUED) (b) The income statement reports the net income or loss for the period. This figure is then used in the statement of changes in equity, along with dividends declared and issues (or repurchases) of shares to calculate the balances in common shares and retained earnings at the end of the period. These ending balances are then used in the statement of financial position, to determine shareholders’ equity and complete the accounting equation. LO 1 BT: AP Difficulty: M Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-59 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-5B (a) Working capital 1. 2. Current ratio Current assets – Current liabilities $253,850 – $156,550 = $97,300 Current assets Current liabilities $253,850 = 1.6 :1 = 40.1% $156,550 3. Debt to total assets Total liabilities Total assets $288,550 $719,150 Income available to common shareholders 4. 5. Basic earnings per share Price-earnings ratio Weighted average number of common shares $96,600 = $2.42 40,000 Market price per share Basic earnings per share $30.00 = 12.4 $2.42 (b) times Fast’s liquidity has improved as the working capital is larger in 2018 and the current ratio is greater than that of 2017. The solvency has improved as the debt to total assets ratio is a smaller percentage in 2018 than in 2017. Fast’s profitability has improved dramatically as the basic earnings per share ratio has increased by a large amount in 2018, as has the price-earnings ratio, suggesting that investors are excited about the company’s future prospects. LO 2 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-60 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-6B (a) Working capital Belliveau Current assets – Current liabilities $180,000 – $75,000 = $700,000 – $300,000 = = = = Shields Current ratio Current assets Current liabilities = Belliveau $180,000 $105,000 $400,000 Shields = $700,000 2.4 :1 $75,000 = 2.3 :1 $300,000 Belliveau is slightly more liquid than Shields as it has a higher current ratio, even though its absolute working capital amount is lower. (b) Debt to total assets = Total liabilities Total assets Belliveau ($75,000 + $190,000) ($180,000 + $600,000) Shields = 34.0% ($300,000 + $200,000) ($700,000 + $800,000) = 33.3% The debt to asset ratios are similar and both companies are solvent. The lower the percentage of debt to total assets, the lower the risk that a company may be unable to pay its debts as they come due. Solutions Manual 2-61 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-6B (CONTINUED) (c) Service revenue Operating expenses Interest expense Income tax expense Total expenses Belliveau $450,000 390,000 6,000 10,000 406,000 Shields $890,000 679,000 10,000 65,000 754,000 Net income $ 44,000 $136,000 Basic earnings per share = Income available to common shareholders Weighted average number of common shares Belliveau $44,000 200,000 Shields = $0.22 Price-earnings ratio Belliveau $2.50 $0.22 = 11.4 times $136,000 200,000 = = $0.68 Market price per share Basic earnings per share Shields $6.00 $0.68 = 8.8 times Investors have higher expectations for Belliveau’s future profitability, as evidenced by the price-earnings ratio. It is not useful to compare basic earnings per share between companies. LO 2 BT: AN Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-62 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-7B (a) (in US$ millions) Walmart 1. Working capital 2. Current ratio 3. Debt to total assets 4. 5. (b) Costco $60,239 – $64,619 = $(4,380) $60,239 $64,619 $17,299 – $16,540 = $759 = 0.9:1 $17,299 $16,540 = 1.0:1 $115,970 $199,581 = 58.1% $22,597 $33,440 = 67.6% Basic earnings per share $14,694 3,207 = $4.58 $2,377 439 = $5.41 Price-earnings ratio $65.39 $4.58 = 14.3 times $133.58 $5.41 = 24.7 times Liquidity Both companies are not very liquid, with Walmart having a working capital deficiency. Both Walmart and Costco have current ratios that are lower (worse) than the industry average. Solvency Walmart is more solvent than Costco as evidenced by its lower debt to total assets ratio. However, since both companies have a debt to total assets ratio that is lower than the industry average, they are more solvent than the average company in the industry. Solutions Manual 2-63 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-7B (CONTINUED) (b) (continued) Profitability Although the basic earnings per share ratio does not provide a basis for comparison, investors appear to have more confidence in the future net income of Costco as evidenced by Costco’s price-earnings ratio. Both Costco and Walmart have lower price-earnings ratios than the industry. LO 2 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-64 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-8B (a) The higher the amount of working capital, the better a business’ liquidity. From 2016 to 2017, Giasson Corporation’s working capital improved. It then deteriorated from 2017 to 2018, decreasing by $17,000. A higher current ratio is evidence of better liquidity for a business, assuming all components of current assets are also liquid. The current ratio for Giasson has been deteriorating steadily from 2016 to 2018. The corporation remains liquid, as its current ratio was 1.5:1 in 2018. A smaller debt to total assets ratio shows evidence of better solvency. The percentage of total liabilities to total assets increased from 2016 to 2017, showing deterioration in the solvency for Giasson. On the other hand, this ratio improved from 2017 to 2018. Less than half of the company’s assets have been financed using debt. The higher the basic earnings per share, the better evidence of improved profitability. Profitability increased from 2016 to 2017 but declined significantly from 2017 to 2018 indicating poorer profitability. The investors appear to have less confidence in the future profitability of Giasson as evidenced by Giasson's price-earnings ratio which declined from 2016 to 2018. (b) Liquidity Giasson’s current ratio, although declining over the past two years, demonstrates adequate liquidity. There is $1.50 of current assets available to cover each $1 of current liabilities. Solvency Giasson’s debt to total assets ratio, although deteriorating from 2016 to 2018, remains modest in size and so the solvency of the company continues to be good. Solutions Manual 2-65 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-8B (CONTINUED) (b) (continued) Profitability Giasson’s profitability is declining steadily as is demonstrated by the basic earnings per share ratio and the price-earnings ratio. LO 2 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-66 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-9B (a) The objective of financial reporting is to provide information that is useful to existing and potential investors, lenders, and other creditors in making decisions about providing resources to the company. Virginia’s suggestions concerning how elements should be reported on the financial statements do not meet the objective of financial reporting. Two of her suggestions would lead to a violation of the fundamental basis on which financial statements are prepared: accrual accounting. The suggested changes to the financial statements would not portray the economic reality and would not faithfully represent the performance of the construction company and the financial position at its year end. Virginia’s suggestions show bias and an attempt to portray a financial picture that would be perceived as more favourable than it is in reality. (b) 1. Failing to include the estimated expense and the related liability for the damages that have already occurred by the end of the year violates accrual accounting. The expense was incurred and a liability exists that can be estimated. The definitions of the elements have been met. Failing to include the expense would represent an error of omission done on purpose to increase the profitability and reduce the liabilities of the construction company at its year end. 2. The suggestion of increasing the revenues from construction would result not only in the recording of revenue but the recording of an accounts receivable. The revenue from construction has not been earned as no work has been performed. Furthermore, no account receivable should be recorded because no asset exists yet. Because revenue would be overstated if recorded, equity would also be overstated if Virginia’s instructions were followed. Virginia’s suggestions would not faithfully represent the reality of the performance of Ace Construction Limited for the current fiscal year. Solutions Manual 2-67 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-9B (CONTINUED) (b) (continued) 3. Although there are no fixed repayment terms for the bank overdraft, the bank can require repayment on demand since no contract or agreement has been entered into to delay the repayment of the overdraft. For this reason, the classification of the bank overdraft as a non-current liability would falsely portray the financial position of Ace Construction Limited at the year end. When assessing the construction company’s liquidity, the users of the financial statements would be misinterpreting the financial position because of this misclassification. Classifying the debt as non-current would not faithfully represent the economic reality of the construction company’s liquidity position. LO 3 BT: E Difficulty: C Time: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-68 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-10B (a) The advantage of the current value basis of accounting is that it represents a more up-to-date measurement of the value of the asset reported. Consequently, the amounts reported are more relevant to the financial statement users. The disadvantage of the current value basis of accounting and corresponding advantage of historical cost is that historical cost is more reliable and shows the amount paid for the asset. The historical cost might provide a more faithful representation because it can be easily verified and is neutral. (b) The following is the recommended basis of measurement that should be used for the following purchases: 1. Due the nature of the asset, a textbook purchase should be recorded at the historical cost basis of accounting because of its intended use. The objective of owning the asset is to use it and not to immediately resell it at a profit. 2. In the case of an iPad, the use of the asset will be limited due to technological obsolescence. Because of this obsolescence, the iPad purchase should be recorded and reported using the historical cost basis of accounting. 3. Software is very similar to the iPad of item 2 above in that it becomes technologically obsolete very quickly. On the other hand, the manufacturer has recognized this problem and has included in the sale of the software, automatic upgrades to attempt to deal with the future needs and demands of the purchaser. This asset is purchased for use and not for resale at a gain and consequently, the historical cost basis of accounting should be used for its recording and reporting. 4. If the purchase of the used car is for use in the business, the historical cost basis of accounting should be used. On the other hand, if the purchase is for resale, the current value basis of accounting should be used. Solutions Manual 2-69 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 2-7B (CONTINUED) (b) (continued) 5. Since the intention of the buyer of land is to eventually build a home on the land, the purchase of the land should be recorded using the historical cost basis of accounting. If the intention changes over the years and the buyer decides to resell the property and intends to hold the land for resale at a gain, the reporting of the asset should change to the current value basis of accounting used for investments, assuming the current value is readily available. LO 3 BT: E Difficulty: C Time: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-70 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT2-1 FINANCIAL REPORTING CASE (a) Total current assets were $335,581,000 at January 31, 2016, and $315,840,000 at January 31, 2015. Total assets were $793,795,000 at January 31, 2016, and $724,299,000 at January 31, 2015. (b) Current assets are listed in the order of liquidity from most to least liquid. Cash is the most liquid asset and is reported first. Non-current assets are listed in order of permanency, with property, plant, and equipment listed first. (c) The current liabilities total $155,501,000 at January 31, 2016, and $146,275,000 at January 31, 2015. The total liabilities at January 31, 2016 and January 31, 2015 were $436,183,000 and $395,016,000, respectively. (d) The current liabilities are listed in order of due date from those due first to those due last, with accounts payable and accrued liabilities listed first. It is not clear what order was chosen for non-current liabilities. Accounting standards do not suggest any particular order for the presentation of noncurrent liabilities. LO 1 BT: K Difficulty: S Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-71 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT2-2 Financial Accounting, Seventh Canadian Edition FINANCIAL ANALYSIS CASE (a) North West (in thousands) 1. Working capital Sobeys (in millions) $335,581 – $155,501 = $180,080 $2,581.4 – $2,707.4 = $(126.0) 2. Current ratio $335,581 $155,501 = 2.2:1 $2,581.4 $2,707.4 = 1.0:1 3. Debt to total assets $436,183 $793,795 = 54.9% $5,230.9 $7,960.6 = 65.7% (b) Liquidity: Working capital is not comparable, because of the differing sizes of the two companies involved. However, using the current ratio to assess liquidity, we can determine that North West is significantly more liquid than Sobeys and well ahead of the industry average. Sobeys is in a difficult position of having a working capital deficiency. Solvency: The higher a company’s percentage of debt to total assets is, the greater the risk that this company may be unable to meet its maturing obligations. North West has a better ratio than the industry while Sobeys has a worse ratio. LO 2 BT: C Difficulty: S Time: 25 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-72 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT2-3 (a) Financial Accounting, Seventh Canadian Edition FINANCIAL REPORTING CASE McCain’s multinational structure means that accounting personnel from various countries are involved with preparing financial statements. Since IFRS is a global standard, most of the accounting personnel would be familiar with IFRS. Also, by using one standard across all subsidiaries, there is no need to make adjustments for various GAAP differences (this was often the case for Canadian multinationals prior to the adoption of IFRS). For McCain, it means that the company will reduce cost as well as the chance for errors. In addition, the users of McCain’s financial statements are located throughout the world. Those located in countries using IFRS, or wishing to compare McCain’s financial statements to other global public companies, would better understand financial statements prepared using this standard. (b) Relevance – Researchers have found that companies who voluntarily adopt IFRS find that IFRS’ accounting measures are better tools for evaluating performance. Therefore, IFRS statements are more relevant to McCain’s management. Also, when global lenders are looking at financial statements prepared according to IFRS, they are no longer concerned about differences in GAAP. This increases the relevance to lenders. Faithful Representation – In comparison to ASPE, IFRS requires more detailed information to be disclosed in the notes to the financial statements. From a user’s perspective, more information and explanation is provided to help understand the economic event being depicted. Comparability - McCain Foods is a global company that competes against various other global companies (most of whom follow IFRS). By adopting IFRS, it is easier for McCain to compare its results to other similar companies. This information would be useful to both internal users (management) as well as external (lenders). Solutions Manual 2-73 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT2-3 (CONTINUED) (b) (continued) Understandability – When different accounting standards are used by various companies within a corporate group, they are less understandable. Furthermore, when users are not resident in the country where the head office of the company is located, they often have a difficult time understanding financial statements that are presented using standards that they are not familiar with. For instance, a McCain manager in a United States subsidiary that follows U.S. GAAP may have difficulty understanding the statements of a McCain subsidiary located in the U.K. (that follows IFRS). (c) The assumption that small companies would avoid IFRS can relate to many things like: i. Not planning to take their company public in the future; ii. They like the simplicity and familiarity of ASPE; iii. They have many competitors, customers, and suppliers that use ASPE which makes their financial statements comparable and understandable. Examples of why private companies may adopt IFRS: i. Private companies that plan to be public sometime in the near future or who have foreign private investors, may choose to adopt IFRS. ii. Private companies that have global shareholders or lenders (who are more familiar with IFRS). They may also want to provide financial statements to customers. LO 3 BT: S Difficulty: M Time: 25 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 2-74 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT2-4 Financial Accounting, Seventh Canadian Edition FINANCIAL ANALYSIS CASE Note to instructors: All of the material supplementing this group activity, including a suggested solution, can be found in the Collaborative Learning section of the Instructor Resource site accompanying this textbook as well as in the Prepare and Present section of WileyPLUS. (a) Sheila paid $25,000 for 10,000 common shares of Kenmare Architects Ltd. (or $2.50 per share) when the company was formed. This amount is reported as the balance in the Common Shares account on the statement of financial position of December 31, 2017. Sheila’s mother paid $10,000 for 1,000 common shares (or $10.00 per share) in early 2018. This amount paid can be determined by calculating the increase of $10,000 ($35,000 less $25,000) in the Common Shares account on the statement of financial position of December 31, 2018. (b) By December 31, 2017, Uncle Harry wanted $8,000 of the loan paid off in 2018. This amount is classified as the current portion of the loan due at December 31, 2017. The actual amount of principal paid in 2018 was $30,000. This amount paid can be determined by calculating the total decrease in the loan payable from December 31, 2017 to December 31, 2018: [($52,000 + $8,000) less ($26,000 + $4,000)]. During 2017, Uncle Harry received only interest, in the amount of $3,600, as indicated in the statement of income for interest expense. In 2018, Uncle Harry received $32,700. This amount is equal to the principal repayment of $30,000 and the interest of $2,700. Solutions Manual 2-75 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT2-4 (CONTINUED) (c) Current ratio 2018 $46,000 $33,580 = 1.4:1 2017 $31,000 $22,490 = 1.4:1 Although the current ratio is unchanged, we need to further examine the account balances that make up the ratio. There has been deterioration in liquidity due to the declining cash balance and a significant rise in accounts receivable which may indicate difficulty in collecting amounts owed from customers. This decreased cash flow from customers has probably caused the increase in accounts payable, as the company seems to have delayed payment to suppliers. (d) Debt to total assets 2018 $59,580 $106,000 = 56.2% 2017 $74,490 $103,000 = 72.3% Kenmare’s solvency improved significantly. The decrease in the ratio occurred mainly because of changes in the numerator rather than in the denominator. Total liabilities fell because of the large pay down of the loan from the uncle even though accounts payable rose. This had an impact on the income statement by lowering interest expense because of the lower loan balance. Because Kenmare’s debt level is lower, the amount of interest expense is also lower, making the business more profitable. Solutions Manual 2-76 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT2-4 (CONTINUED) (e) Basic earnings per share 2018 $7,910 11,000 = $0.72 2017 $3,510 10,000 = $0.35 The basic earnings per share more than doubled because net income more than doubled while there was only a 10% increase in the number of shares. (f) Sheila paid $2.50 per share for her shares ($25,000 ÷ 10,000). The amount Sheila’s mother paid for her shares was $10.00 per share ($10,000 refer to part (a) above ÷ 1,000). 2018 2017 Price-earnings ratio $10.00 = 13.9 times $2.50 = 7.1 times $0.72 $0.35 The service revenue increased 20% from 2017 to 2018 [($120,000 – $100,000) ÷ $100,000]. The net income increased by 125% from 2017 to 2018 [($7,910 – $3,510) ÷ $3,510]. Sheila’s salary increased by 25% from 2017 to 2018 [($74,000 – $59,000) ÷ $59,000]. The price-earnings ratio changed mostly because of the price difference paid by the two shareholders. Sheila’s mother paid four times the price Sheila paid for her shares. This increase is very dramatic, taking into account other ratios for measurement of performance. The fourfold increase in the share price is not justified by the financial performance of the business. The future profitability of the business is based on the amount of service revenue that can be generated by the single employee, Sheila, and is therefore limited. (g) The likely reason for the sale in shares in 2018 was to obtain $10,000, which was used to repay the debt to Uncle Harry earlier than originally scheduled. LO 1,2 BT: AN Difficulty: C Time: 40 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-77 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT2-5 (a) Financial Accounting, Seventh Canadian Edition ETHICS CASE The stakeholders in this case are: Kathy Onishi, controller Redondo’s vice-president of finance Users of the company's financial statements, including shareholders and creditors (b) The ethical consideration in this situation is whether or not switching from ASPE to IFRS would affect the decisions of the users of the financial statements. Because Redondo Corporation is a private corporation, the use of IFRS is not required. It is ethically preferable to disclose the most financially relevant information to the users of the financial statements so that they can make informed decisions. One should question the reasoning of Redondo’s vice-president of finance, who is focusing on the effect of the implementation on the net income for the year. (c) As the controller, by supporting the conversion from ASPE to IFRS, Kathy could gain the trust and respect of the board of directors and the shareholders in general. The users of the company’s financial statements will find the information provided under IFRS to be more useful in making comparisons with Redondo’s competitors. This in turn will lead to better decisions being made by users of the financial statements. LO 3 BT: E Difficulty: M Time: 15 min. AACSB: Ethics CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance Solutions Manual 2-78 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT2-6 (a) Financial Accounting, Seventh Canadian Edition SERIAL CASE Software Solutions’ financial statements will include the statement of financial position, income statement, statement of changes in equity, and statement of cash flows. It may also include a statement of comprehensive income. It will also include the notes to the financial statements. The statement of financial position reports the assets, liabilities, and shareholders’ equity at a specific date. The income statement presents the revenues and expenses and resulting net income or loss for a specific period of time. The statement of changes in equity summarizes the changes in equity accounts, including common shares and retained earnings, for a specific period of time. Finally, the statement of cash flows provides information about the cash inflows and cash outflows provided or used for operating, investing, and financing activities for a specific period of time. (b) Because Software Solutions is a public company, it is required to have its financial statements audited. The auditor’s report provides users with assurance that the financial statements are fairly presented. As a public company, Software Solutions is also required to file its financial statements on a timely basis with the regulator of the stock exchange on which its shares trade. (c) By looking at the statement of financial position and determining the composition of Software Solutions’ current assets and current liabilities, we can assess its ability to pay its short-term obligations. We can also calculate liquidity ratios, such as working capital and the current ratio, for the current and prior periods to help determine its ability to meet its current obligations. This will not guarantee that Software Solutions is able to pay ABC’s invoices in the future, but it will provide some assurance with respect to how it has performed in the past. The statement of cash flows also provides information to determine if Software Solutions generates positive cash flows from its operating activities. Solutions Manual 2-79 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT2-6 (CONTINUED) (d) By looking at the types of revenues and expenses reported in the income statement, we can determine if Software Solutions is profitable. If revenues earned by Software Solutions exceed expenses incurred, then Software Solutions is profitable. As well, profitability ratios that measure a company’s ability to generate net income over a period of time can be determined. These profitability ratios include basic earnings per share and the priceearnings ratio. The latter measures investors’ expectations about Software Solutions’ future profitability. (e) By looking at the statement of financial position, we can determine Software Solutions’ total liabilities, and the mix of current and non-current debt. We can also calculate solvency ratios, such as the debt to total assets ratio, to determine whether Software Solutions has the ability to repay its total debt. Solvency ratios help measure a company’s ability to survive over a long period of time. Reviewing the company’s income statement and statement of cash flows helps in determining whether Software Solutions is able to pay its interest expense. The more profitable the company, the better able it is to make the interest payments on its debt and generate sufficient cash to repay its obligations. Solutions Manual 2-80 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT2-6 (CONTINUED) (f) Be aware that the financial statements of Software Solutions provide a historical perspective of what has already taken place. The financial statements may not prove to be the best indicator of what will happen in the future. Consumer tastes change and as a result the demand for Software Solutions’ products may also change. As well, consider this business opportunity from your perspective. Ask yourself if the price obtained for the hours worked is reasonable, considering some of the risks involved. There is a risk that, by taking on this obligation, additional opportunities cannot be pursued. Does Anthony Business Company have the ability to meet the demands of Software Solutions? Is it able to commit to providing 500 hours of service per month? Does it have enough staff to enable the company to do so? Does it have enough cash to pay for the staff that will be required, along with other operating expenses, and wait 30 days from the date of the invoice to collect from Software Solutions? LO 2,3 BT: E Difficulty: M ime: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 2-81 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Legal Notice Copyright Copyright © 2017 by John Wiley & Sons Canada, Ltd. or related companies. All rights reserved. The data contained in these files are protected by copyright. This manual is furnished under licence and may be used only in accordance with the terms of such licence. The material provided herein may not be downloaded, reproduced, stored in a retrieval system, modified, made available on a network, used to create derivative works, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise without the prior written permission of John Wiley & Sons Canada, Ltd. (MMXVII vi F2) Solutions Manual 2-82 Chapter 2 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CHAPTER 3 THE ACCOUNTING INFORMATION SYSTEM LEARNING OBJECTIVES 1. 2. 3. 4. 5. Analyze the effect of transactions on the accounting equation. Explain how accounts, debits, and credits are used to record transactions. Journalize transactions in the general journal. Post transactions to the general ledger. Prepare a trial balance. SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND BLOOM’S TAXONOMY Item LO 1. 2. 3. 4. 1 1 1 2 BT Item LO C C C C 5. 6. 7. 8. 2 2 3 3 BT Item LO BT Item LO Questions C C C C 9. 10. 11. 12. 3,4 3,4 4 4 C C K K BT Item LO BT 13. 14. 15. 16. 4 5 5 5 K C C C 17. 1,3,4,5 C 13. 5 AN Brief Exercises 1. 1 C 4. 2 AP 7. 3 AP 10. 4 AP 2. 1 AN 5. 1,2 AN 8. 3 AP 11. 4 AP 3. 2 AP 6. 3 AP 9. 4 AN 12. 5 AP Exercises 1. 1 AN 4. 1,2 AN 7. 10. 4,5 AP 13. 5 AP 2. 1 AN 5. 3 AP 8. 1,2,3,4 AN 4 AP 11. 5 AP 14. 5 AP 3. 2 K 6. 3 AP 9. 4 AN 12. 5 AP 15. 5 AN AP Problems: Set A and B 1. 1 AN 4. 2 K 7. 3,4 AP 10. 5 2. 1 AN 5. 1,2,3 AN 8. 3,4,5 AP 11. 5 AP 3. 2 AP 6. 3 AP 9. 3,4,5 AP 12. 5 AN Accounting Cycle Review 1. 3,4,5 AP 2. 3,4,5 AP Cases 1. 1 AP 3. 3,4,5 E 5. 5 S 2. 1 AN 4. 5 AN 6. 3,4,5 AN Solutions Manual 3-1 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Legend: The following abbreviations will appear throughout the solutions manual file. LO Learning objective BT Bloom's Taxonomy K Knowledge C Comprehension AP Application AN Analysis S Synthesis E Evaluation Level of difficulty S Simple M Moderate C Complex Estimated time to prepare in minutes Association to Advance Collegiate Schools of Business Communication Communication Ethics Ethics Analytic Analytic Technology Tech. Diversity Diversity Reflective Thinking Reflec. Thinking CPA Canada Competency Ethics Professional and Ethical Behaviour PS and DM Problem-Solving and Decision-Making Comm. Communication Self-Mgt. Self-Management Team & Lead Teamwork and Leadership Reporting Financial Reporting Stat. & Gov. Strategy and Governance Mgt. Accounting Management Accounting Audit Audit and Assurance Finance Finance Tax Taxation Difficulty: Time: AACSB CPA CM cpa-e001 cpa-e002 cpa-e003 cpa-e004 cpa-e005 cpa-t001 cpa-t002 cpa-t003 cpa-t004 cpa-t005 cpa-t006 Solutions Manual 3-2 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ANSWERS TO QUESTIONS 1. (a) (b) Only events that cause a change in an asset, liability, or shareholders’ equity account are recorded as accounting transactions. Other events, such as the agreement to provide a service, do not immediately impact an asset, liability, or shareholder’s equity account and, therefore, are not considered an accounting transaction. Examples of events that would not be recorded include hiring employees, signing a lease, and placing an order to purchase services. LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 2. Accounting transactions that affect the accounting equation (assets = liabilities + shareholders’ equity) should be recorded. (a) (b) (c) (d) (e) Winning an award is not an accounting transaction, as it does not affect the accounting equation. The award did not involve the receipt of an asset, such as cash. Supplies purchased on account is an accounting transaction because it affects the accounting equation (assets are increased because supplies were received and liabilities are increased because accounts payable were incurred). A shareholder dying is not an accounting transaction, as it does not affect the accounting equation. Declaring and paying a cash dividend to shareholders is an accounting transaction as it does affect the accounting equation (shareholders’ equity is decreased and assets (cash) are decreased). The agreement to provide legal services to the company is not an accounting transaction as it does not affect the accounting equation. No expense has been incurred yet and no liabilities have been affected as yet. Once the lawyer begins providing services and an amount is paid or owed, then a transaction would be recorded. LO 1 BT: C Difficulty: C Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-3 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 3. Financial Accounting, Seventh Canadian Edition Yes, a company can enter into a transaction in which only the left (assets) side of the accounting equation is affected. An example would be a transaction where an increase in one asset is offset by a decrease in another asset. A decrease in the Accounts Receivable account which is offset by an increase in the Cash account is a specific example (that is, a customer paying for goods previously purchased on account). LO 1 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 4. The structure of the accounting equation matches the debit-credit rules in accounting. Assets are shown on the left-hand side of the accounting equation and debits are shown on the left-hand side of the accounting equation and T accounts. Because of this, asset accounts have normal debit balances. Liabilities and shareholders’ equity are shown on the right-hand side of the accounting equation and credits are shown on the right-hand side of the accounting equation and T accounts. Liabilities and shareholders’ equity accounts (such as share capital and retained earnings) have normal credit balances. Following the debit-credit rules will ensure that the accounting equation will be consistently applied. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 5. Shareholders' equity consists of different components, and they do not all move in the same direction. Shareholders’ equity is usually comprised of share capital (which is increased by credits) and retained earnings. Retained earnings can be further subdivided into revenues and expenses and dividends declared which are then added to opening retained earnings in the case of revenues, and deducted from opening retained earnings in the case of expenses and dividends. Revenues are increased by credits while expenses and dividends declared are increased by debits. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-4 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 6. Financial Accounting, Seventh Canadian Edition Emily is likely relating the term debit and credit to the normal balances of accounts. Since assets have normal debit balances and, from a personal standpoint, acquiring and possessing assets is viewed in a positive light, it might follow in Emily’s mind that debits are favourable. On the other hand, liabilities have a normal credit balance and might be viewed by Emily in a negative light because debt is unfavourable from a personal standpoint. However, Emily is incorrect. Debits mean nothing more than the left side of accounts and credits the right side of the accounts. Neither is favourable or unfavourable. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 7. (a) (b) A general journal is a book of original entry, in which transactions are recorded in chronological order. The general journal facilitates the recording process by documenting the debit and credit effects on specific accounts. The general journal discloses the complete effect of a transaction in one place, including an explanation and, where applicable, identification of the source document. The general journal provides a chronological record of transactions and it helps to prevent and locate errors, because the debit and credit amounts for each entry can be quickly compared. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 8. While the account title choices suggested by Meghan provide details of the type of truck the company purchased, the title of the account used to record the purchase should be more generic to include all types of trucks and other vehicles that can be owned and used by the business. Ambiguous or multiple account titles with similar names can lead to incorrect financial reporting. The name of the account often used by companies for purchases of this nature is Vehicles. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-5 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 9. Financial Accounting, Seventh Canadian Edition This would not be efficient because the journal provides a record that shows both “sides” of the transaction along with a description of the transaction. This information is vital to the understanding of the event. A general ledger is not intended to be used to capture the recording of transactions, but to tabulate the effects of transactions in separate accounts. The balances arrived at in the ledger are then used to communicate information to the users of the financial statements. If one attempted to omit the use of journal entries, one could not retrace the transactions as they originated in the journal. One would only see one side of a transaction at a time by looking at an account in the ledger. It would become very confusing and unruly to try to keep track of transactions. LO 3,4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 10. Posting should be done on a timely basis, at least monthly, so that account balances can be monitored and reconciled. This ensures that any errors are identified as soon as possible. LO 3,4 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 11. (a) (b) The general ledger is the entire group of accounts maintained by a company, including all the asset, liability, and shareholders' equity accounts, including the share capital, retained earnings, dividends declared, revenue, and expense accounts. The general ledger is often arranged in the order in which accounts are presented in the financial statements, beginning with the statement of financial position accounts. The asset accounts come first, followed by liability accounts, and then shareholders’ equity accounts, including the share capital, retained earnings, dividends declared, revenue, and expense accounts. LO 4 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-6 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 12. (a) (b) Financial Accounting, Seventh Canadian Edition The chart of accounts is a list of a company’s accounts. The chart of accounts is important, particularly for a company that has a large number of accounts, because it helps organize the accounts and identify their location in the general ledger. Numbering the accounts helps identify and sort the accounts. LO 4 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 13. Cash, Accounts Receivable, Supplies, Prepaid Insurance, Accounts Payable, Unearned Revenue, Common Shares, Dividends Declared, Service Revenue, Salaries Expense, and Income Tax Expense. LO 4 BT: K Difficulty: S Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting 14. (a) (b) A trial balance is a list of accounts and their balances at a point in time. The primary purpose of a trial balance is to prove the mathematical equality of debits and credits after all journalized transactions have been posted. A trial balance also facilitates the discovery of errors in journalizing and posting. In addition, it is useful in preparing financial statements. While it does not matter in what order the accounts are listed in the trial balance, it is usual for the accounts in the trial balance to be listed in the same order as they are listed in the general ledger (asset accounts, liability accounts, and shareholders’ equity accounts, including the share capital, retained earnings, dividends declared, revenue, and expense accounts). This makes it easier to compare the trial balance accounts to the general ledger accounts, as well as to prepare the financial statements from the trial balance. LO 5 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-7 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 15. Financial Accounting, Seventh Canadian Edition The retained earnings account in the unadjusted trial balance shows the beginning balance of the period (which is the same as the ending balance of the prior period) as it has not yet been updated for the effect that the revenues, expenses, and dividends declared have on retained earnings for the current accounting period. (Note to instructors: This chapter only includes references to an unadjusted and pre-closing trial balance; the post-closing trial balance is not introduced until Chapter 4.) LO 5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 16. Claire, here are some tips to help you find the $100 difference in the trial balance columns assuming it is a single error: 1. 2. 3. 4. If the difference between the debit and credit totals is an amount such as $1, $100, or $1,000, re-add the trial balance columns and recalculate the account balances. If the amount of the difference can be evenly divided by two, (which it is in this case) scan the trial balance to see if a balance equal to half the error has been entered in the wrong column. If the amount of the difference can be evenly divided by nine, (which it is not in this case) retrace the account balances on the trial balance to see whether they have been incorrectly copied from the ledger. For example, if a balance was $12 but was listed as $21, a $9 error has been made. Reversing the order of numbers is called a transposition error. A slide, which is adding or deducting one or several zeros in a figure, has the same effect. If the amount of the difference cannot be evenly divided by two or nine, scan the ledger to see whether an account balance in the amount of the error has been omitted from the trial balance. Scan the journal to see whether a posting in the amount of the error has been omitted. When all else fails, all of the transactions should be carefully traced through the process again. LO 5 BT: C Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-8 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 17. Financial Accounting, Seventh Canadian Edition The first four steps in the accounting cycle are: (a) (1) Analyze the business transactions and determine their effects on the accounting equation and also determine when and how to record the transactions. (2) Journalize the transactions in the general journal to record the effects of the transactions on the accounts involved in the transactions. (3) Post to the general ledger accounts to provide an accumulation of the effect of several journalized transactions in the individual accounts. (4) Prepare a trial balance to prove that the sum of the debit account balances equals the sum of the credit account balances after posting. (b) It does matter in which order the steps of the accounting cycle are completed. Each step performed has been designed in the sequence with the understanding that the previous step has been performed. Failing to do so would result in incomplete and inaccurate financial information. LO 1,3,4,5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-9 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 3-1 (a) 1. 2. 3. 4. 5. (b) Assets (+) (-) NE NE (+) NE = Liabilities NE NE NE NE NE + Shareholders’ Equity NE NE NE (+) NE Items 1 and 4 are accounting transactions that should be recorded in the accounting records. Each of these transactions have an impact on the accounting equation as shown in part (a). Items 2, 3, and 5 should not be recorded in the accounting equation. They do not yet impact the accounting equation. LO 1 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-10 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-2 Assets = Liabilities Shareholders’ Equity Retained Earnings + = Transaction 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Total Cash Accounts Receivable Supplies +$250 Prepaid Insurance Accounts Payable +$250 Unearned Revenue Common + Shares +$500 –$300 +5,000 –100 +500 −250 –100 +300 $5,050 + Revenues – Expenses – Dividends Declared +$500 −$300 +$5,000 −$100 −500 −250 +$100 + $0 TOTAL ASSETS = $5,400 +$250 + $100 = $0 +$300 −300 + $0 + $5,000 +300 + $800 – $300 TOTAL LIABILITIES + SHAREHOLDERS’ EQUITY = $5,400 LO 1 BT: AN Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-11 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. – $100 Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-3 1. Accounts Payable (a) Basic Type Liability (b) Normal Balance Credit (c) Debit Effect decrease (d) Credit Effect increase 2. Accounts Receivable Asset Debit increase decrease 3. Cash Asset Debit increase decrease 4. Common Shares Shareholder's equity Credit decrease increase 5. Dividends Declared Shareholder's equity Debit increase decrease Debit increase decrease Debit increase decrease Credit decrease increase Credit decrease increase Credit decrease increase 6. Equipment 7. Income Tax Expense 8. Retained Earnings 9. Service Revenue 10. Unearned Revenue Asset Shareholder's equity Shareholder's equity Shareholder's equity Liability LO 2 BT: AP Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-12 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-4 (a) Transaction Basic Type Account Debited (b) Specific Account (c) Effect Account Credited (b) Specific Basic Type Account (a) (c) Effect 1. Asset Cash Increase Shareholders’ equity Common Shares Increase 2. Asset Prepaid Rent Increase Asset Cash Decrease 3. Shareholders’ equity Salaries Expense Increase Asset Cash Decrease 4. Asset Accounts Receivable Increase Shareholders’ equity Service Revenue Increase 5. Asset Cash Increase Asset Accounts Receivable Decrease 6. Asset Supplies Increase Liability Accounts Payable Increase 7. Liability Accounts Payable Decrease Asset Cash Decrease 8. Asset Cash Increase Liability Bank Loan Payable Increase LO 2 BT: AP Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-13 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-5 Transaction 1 June 1: Issued common shares to shareholders in exchange for $2,500 cash. (a) Basic Analysis The asset account Cash is increased by $2,500; the shareholders’ equity account Common Shares is increased by $2,500. (b) Equation Analysis Assets = Liabilities + Cash +$2,500 Shareholders’ Equity Common Shares +$2,500 (c) Debit−Credit Analysis Debits increase assets: debit Cash $2,500. Credits increase share capital (shareholders’ equity): credit Common Shares $2,500. Transaction 2 June 4: Purchased supplies on account for $250. (a) Basic Analysis The asset account Supplies is increased by $250; the liability account Accounts Payable is increased by $250. (b) Equation Analysis Assets Supplies +$250 (c) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Accounts Payable +$250 Debits increase assets: debit Supplies $250. Credits increase liabilities: credit Accounts Payable $250. Solutions Manual 3-14 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-5 (CONTINUED) (a), (b), and (c) (continued) Transaction 3 June 7: Billed J. Kronsnoble $300 for welding work done. (a) Basic Analysis The asset account Accounts Receivable is increased by $300; the revenue account Service Revenue is increased by $300. (b) Equation Analysis Assets = Liabilities + Accounts Receivable +$300 Shareholders’ Equity Service Revenue +$300 (c) Debit−Credit Analysis Debits increase assets; debit Accounts Receivable $300. Credits increase revenues; credit Service Revenue $300. Transaction 4 June 18: Received partial payment from J. Kronsnoble for work billed on June 7. (a) Basic Analysis The asset account Cash is increased by $200; the asset account Accounts Receivable is decreased by $200. (b) Equation Analysis Assets = Liabilities + Shareholders’ Equity Cash +$200 Accounts Receivable -$200 (c) Debit−Credit Analysis Debits increase assets: debit Cash $200. Credits decrease assets: credit Accounts Receivable $200. Solutions Manual 3-15 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-5 (CONTINUED) (a), (b), and (c) (continued) Transaction 5 June 25: Hired new employee to start work on July 3. (a) Basic Analysis An accounting transaction has not occurred. There is only an agreement of employment to start on July 3. Transaction 6 June 27: Received cash of $200 from Liu Controls Ltd. as a deposit for welding work to be done in July. (a) Basic Analysis The asset account Cash is increased by $200; the liability account Unearned Revenue is increased by $200. (b) Equation Analysis Assets Cash +$200 (c) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Unearned Revenue +$200 Debits increase assets: debit Cash $200. Credits increase liabilities: credit Unearned Revenue $200. Solutions Manual 3-16 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-5 (CONTINUED) (a), (b), and (c) (continued) Transaction 7 June 28: Paid for supplies purchased on June 4. (a) Basic Analysis The asset account Cash is decreased by $250; the liability account Accounts Payable is decreased by $250. (b) Equation Analysis Assets = Liabilities + Shareholders’ Equity Accounts Payable -$250 Cash -$250 (c) Debit−Credit Analysis Debits decrease liabilities: debit Accounts Payable $250. Credits decrease assets: credit Cash $250. Transaction 8 June 29: Paid $100 for monthly income tax instalment. (a) Basic Analysis The expense account Income Tax Expense is increased by $100; the asset account Cash is decreased by $100. (b) Equation Analysis Assets Cash -$100 (c) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Income Tax Expense -$100 Debits increase expenses: debit Income Tax Expense $100. Credits decrease assets: credit Cash $100. LO 1,2 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-17 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-6 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Supplies ....................................................... Accounts Payable ................................. 250 Accounts Receivable ................................... Service Revenue ................................... 500 Salaries Expense ......................................... Cash ...................................................... 300 Cash ............................................................ Common Shares ................................... 5,000 Dividends Declared ...................................... Cash ...................................................... 100 Cash ............................................................ Accounts Receivable ............................. 500 Accounts Payable ..................................... Cash ................................................... 250 Prepaid Insurance ........................................ Cash ................................................... 100 Cash .......................................................... Unearned Revenue ............................ 300 Unearned Revenue .................................... Service Revenue ................................ 300 250 500 300 5,000 100 500 250 100 300 300 LO 3 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-18 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-7 1. 2. 3. 4. 5. 6. 7. 8. Cash ............................................................ Common Shares ................................... 5,000 Prepaid Rent ................................................ Cash ...................................................... 2,100 Salaries Expense ......................................... Cash ...................................................... 500 Accounts Receivable ................................... Service Revenue ................................... 1,200 Cash ............................................................ Accounts Receivable ............................. 900 Supplies ....................................................... Accounts Payable.................................. 500 Accounts Payable ........................................ Cash ...................................................... 500 Cash ............................................................ Bank Loan Payable ............................... 1,000 5,000 2,100 500 1,200 900 500 500 1,000 LO 3 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-19 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-8 June 1 4 7 18 Cash ....................................................... Common Shares.......................... 2,500 Supplies ................................................. Accounts Payable ........................ 250 Accounts Receivable .............................. Service Revenue ......................... 300 Cash ....................................................... Accounts Receivable ................... 200 2,500 250 300 200 25 No transaction – no asset, liability, or equity account affected 27 Cash ..................................................... Unearned Revenue ...................... 200 Accounts Payable .................................. Cash ............................................ 250 Income Tax Expense ............................. Cash ............................................ 100 28 29 200 250 100 LO 3 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-20 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-9 Accounts Receivable Aug. 10 17,500 15 6,500 Aug. 23 (a) 15,000 Bal. 9,000 Sept. 5 (b) 4,000 Sept. 15 8,000 Bal. 5,000 Accounts Payable Aug. 5 (c) 6,000 18 3,400 Aug. 29 5,800 Bal. 3,600 Sept. 12 7,700 Sept. 23 5,900 Bal. (d) 5,400 (a) $17,500 + $6,500 – $9,000 = $15,000 (b) $5,000 – $9,000 + $8,000 = $4,000 (c) $3,600 + $5,800 – $3,400 = $6,000 (d) $3,600 + $7,700 – $5,900 = $5,400 (e) $50,000 – $500 + $45,000 = $94,500 (f) $99,000 + $450 – $94,500 = $4,950 Service Revenue Aug. 10 50,000 Aug. 12 500 15 45,000 Bal. (e) 94,500 Sept. 5 (f) 4,950 Sept. 25 450 Bal. 99,000 LO 4 BT: AN Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-21 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-10 June 1 June 18 June 27 Bal. June 7 Bal. June 4 June 28 June 29 Cash 2,500 June 28 200 June 29 200 2,550 Accounts Receivable 300 June 18 100 250 100 200 Supplies 250 Accounts Payable 250 June 4 Bal. 250 0 Unearned Revenue June 27 200 Common Shares June 1 2,500 Service Revenue June 7 300 Income Tax Expense 100 LO 4 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-22 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-11 (a) May 4 May 7 May 11 May 21 May 25 May 28 May 31 Billed clients $3,200 for services provided on account Declared and paid dividends of $500 Collected $1,900 from a customer on account Received $2,000 from client for services provided Paid salaries of $2,500 Paid supplier $200 on account Paid income tax of $750 (b) Apr. 30 May 11 May 21 1,500 1,900 2,000 Bal. 1,450 Apr. 30 May 4 Bal. May 28 Cash May 7 May 25 May 28 May 31 Accounts Receivable 1,800 May 11 3,200 3,100 Accounts Payable 200 Apr. 30 Bal. 500 2,500 200 750 May 7 Service Revenue May 4 May 21 Bal. 1,900 900 700 Dividends Declared 500 May 30 Income Tax Expense 750 May 25 Salaries Expense 2,500 3,200 2,000 5,200 LO 4 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-23 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-12 (a) Account Normal Balance Accounts payable ............................................................ Credit Accounts receivable ........................................................ Debit Accumulated depreciation—equipment ........................... Credit Cash ................................................................................ Debit Common shares .............................................................. Credit Dividends declared .......................................................... Debit Equipment ....................................................................... Debit Held for trading investments............................................ Debit Income tax expense ........................................................ Debit Rent expense .................................................................. Debit Retained earnings ........................................................... Credit Salaries expense ............................................................. Debit Service revenue .............................................................. Credit Unearned revenue .......................................................... Credit Solutions Manual 3-24 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-12 (CONTINUED) (b) CARLAND INC. Trial Balance June 30, 2018 Debit Cash Accounts receivable Held for trading investments Equipment Accumulated depreciation—equipment Accounts payable Unearned revenue Common shares Retained earnings Dividends declared Service revenue Salaries expense Rent expense Income tax expense Totals Credit $ 4,400 4,000 6,000 17,000 $ 3,600 3,000 150 10,000 12,650 200 7,600 4,000 1,000 400 $37,000 _ $37,000 (Total of debit account balances = Total of credit account balances) LO 5 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-25 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 3-13 Error 1. 2. 3. 4. 5. 6. (a) In Balance No No Yes Yes Yes No (b) Difference $ 900 1,000 N/A N/A N/A 1,000 (c) Larger Column Debit Credit N/A N/A N/A Debit LO 5 BT: AN Difficulty: C Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-26 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO EXERCISES EXERCISE 3-1 (a) 1. Received cash of $1,000 from a customer as a deposit for work to be done in the future. 2. Purchased equipment for $5,000 paying cash $1,000 with the remaining balance of $4,000 on account. 3. Paid $750 for supplies. 4. Performed services for $9,500 collecting cash of $4,100 and the remaining balance on account of $5,400. 5. Paid $2,000 to suppliers on account. 6. Declared and paid dividends of $1,000. 7. Paid for operating expenses of $4,800 8. Collected $5,000 on account from customers. 9. Paid interest expense of $300 10. Paid income tax expense of $880. (b) Service revenue Less: Expenses Operating expenses Interest expense Income tax expense Total expenses Net income $9,500 $4,800 300 880 Retained earnings: Beginning balance Add: Net income Less: Dividends declared Ending balance 5,980 $3,520 $4,500 3,520 (1,000) $7,020 [Revenues – Expenses = Net income or (loss)] Solutions Manual 3-27 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-1 (CONTINUED) (c) = Assets Liabilities Shareholders’ Equity + Retained Earnings Cash July 31 Bal. Accounts Receivable Supplies Equipment = Unearned Common Revenue + Shares $2,000 $5,000 Bal. + – Revenues Expenses (1) $6,500 +1,000 (2) −1,000 (3) −750 (4) +4,100 (5) -2,000 (6) -1,000 (7) -4,800 (8) +5,000 (9) -300 -300 (10) -880 -880 Aug. 31 Bal. $5,870 $5,000 Accounts Payable – Dividends Declared $4,500 +$1,000 +$5,000 +4,000 +$750 +5,400 +$9,500 -2,000 -$1,000 -$4,800 -5,000 + $5,400 + $750 TOTAL ASSETS = $17,020 + $5,000 = $4,000 + $1,000 + $5,000 +$4,500 + $9,500 - $5,980 TOTAL LIABILITIES + SHAREHOLDERS’ EQUITY = $17,020 LO 1 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-28 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. - $1,000 Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-2 Assets Trans. Apr. 30 Bal. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. May 31 Bal. = Liabilities Bank Loan Payable Accounts Prepaid Accounts Cash Receivable Insurance Equipment = Payable + $5,000 $6,000 $2,000 +$8,000 +8,000 −1,600 +3,800 −300 +20,000 +$20,000 −8,000 −8,000 −500 +$500 +3,000 −3,000 −500 −250 $16,850 + $6,800 + $500 + $8,000 = $2,000 + $20,000 TOTAL ASSETS = $32,150 Shareholders’ Equity Retained Earnings + – Common + – Dividends Shares Balance Revenues Expenses Declared $5,000 $4,000 -$1,600 +$3,800 −300 −$500 +$5,000 +$4,000 + $3,800 −250 – $2,150 TOTAL LIABILITIES + SHAREHOLDERS’ EQUITY = $32,150 LO 1 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-29 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. – $500 Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-3 (a) Type of Account (b) Normal Balance Liabilities Credit Buildings Assets Debit Cash Assets Debit Depreciation expense Expenses Debit Income Statement Dividends declared Dividends Debit Statement of Changes in Equity Finance income Revenues Credit Income Statement Furniture, machinery, and equipment Assets Debit Statement of Financial Position Income tax expense Expenses Debit Income Statement Income taxes payable Liabilities Credit Statement of Financial Position Interest expense Expenses Debit Income Statement Inventories Assets Debit Prepaid expenses Assets Debit Receivables Assets Debit Revenues Credit Account Bank loans payable Revenues (c) Financial Statement Statement of Financial Position Statement of Financial Position Statement of Financial Position Statement of Financial Position Statement of Financial Position Statement of Financial Position Income Statement LO 2 BT: K Difficulty: S Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-30 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-4 Transaction 1 March 2: Issued common shares for $11,000 cash. (a) Basic Analysis The asset account Cash is increased by $11,000; the shareholders’ equity account Common Shares is increased by $11,000. (b) Equation Analysis Assets = Liabilities + Cash +$11,000 Shareholders’ Equity Common Shares +$11,000 (c) Debit−Credit Analysis Debits increase assets: debit Cash $11,000. Credits increase share capital (shareholders’ equity): credit Common Shares $11,000. Transaction 2 March 4: Purchased used car for $1,000 cash and $9,000 on account, for use in the business. (a) Basic Analysis The asset account Vehicles is increased by $10,000; the liability account Accounts Payable is increased by $9,000; the asset account Cash is decreased by $1,000. (b) Equation Analysis Assets Cash -$1,000 = Liabilities + Shareholders’ Equity Account Payable +$9,000 Vehicles +$10,000 (c) Debit−Credit Analysis Debits increase assets: debit Vehicles $10,000. Credits increase liabilities: credit Accounts Payable $9,000. Credit decrease assets: credit Cash $1,000. Solutions Manual 3-31 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-4 (CONTINUED) (a), (b), and (c) (continued) Transaction 3 March 10: Billed customers $2,300 for services performed. (a) Basic Analysis The asset account Accounts Receivable is increased by $2,300; the revenue account Service Revenue is increased by $2,300. (b) Equation Analysis Assets = Liabilities + Accounts Receivable +$2,300 Shareholders’ Equity Service Revenue +$2,300 (c) Debit−Credit Analysis Debits increase assets: debit Accounts Receivable $2,300. Credits increase revenues: credit Service Revenue $2,300. Transaction 4 March 13: Paid $225 cash to advertise business opening. (a) Basic Analysis The expense account Advertising Expense is increased by $225; the asset account Cash is decreased by $225. (b) Equation Analysis Assets Cash -$225 (c) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Advertising Expense -$225 Debits increase expenses: debit Advertising Expense $225. Credits decrease assets: credit Cash $225. Solutions Manual 3-32 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-4 (CONTINUED) (a), (b), and (c) (continued) Transaction 5 March 25: Received $1,000 cash from customers billed on March 10. (a) Basic Analysis (b) Equation Analysis The asset account Cash is increased by $1,000; the asset account Accounts Receivable is decreased by $1,000. Assets = Liabilities + Shareholders’ Equity Cash +$1,000 Accounts Receivable -$1,000 (c) Debit−Credit Analysis Debits increase assets: debit Cash $1,000. Credits decrease assets: credit Accounts Receivable $1,000. Transaction 6 March 27: Paid amount owing for used car purchased on March 4. (a) Basic Analysis The liability account Accounts Payable is decreased by $9,000; the asset account Cash is decreased by $9,000. (b) Equation Analysis Assets Cash -$9,000 (c) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Accounts Payable -$9,000 Debits decrease liabilities: debit Accounts Payable $9,000. Credits decrease assets: credit Cash $9,000. Solutions Manual 3-33 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-4 (CONTINUED) (a), (b), and (c) (continued) Transaction 7 March 30: Received $700 cash from a customer for services to be performed in April. (a) Basic Analysis The asset account Cash is increased by $700; the liability account Unearned Revenue is increased by $700. (b) Equation Analysis Assets = Liabilities + Shareholders’ Equity Unearned Revenue +$700 Cash +$700 (c) Debit−Credit Analysis Debits increase assets: debit Cash $700. Credits increase liabilities: credit Unearned Revenue $700. Transaction 8 March 31: Declared and paid $300 of dividends to shareholders. (a) Basic Analysis The asset account Cash is decreased by $300; the Dividends Declared account is increased by $300. (b) Equation Analysis Assets Cash -$300 (c) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Dividends Declared -$300 Debits increase dividends: debit Dividends Declared $300. Credits decrease assets: credit Cash $300. LO 1,2 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-34 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-5 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Equipment ............................... Accounts Payable............... 8,000 Rent Expense .......................... Cash ................................. 1,600 Accounts Receivable ............... Service Revenue .............. 3,800 Utilities Expense ...................... Cash ................................. 300 Cash ........................................ Bank Loan Payable .......... 20,000 Accounts Payable.................... Cash ................................. 8,000 Prepaid Insurance ................... Cash ................................. 500 Cash ........................................ Accounts Receivable........ 3,000 Dividends Declared ................. Cash ................................. 500 Income Tax Expense............... Cash ................................. 250 8,000 1,600 3,800 300 20,000 8,000 500 3,000 500 250 LO 3 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-35 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-6 Mar. 2 4 10 13 25 27 30 31 Cash ........................................ Common Shares................. 11,000 Vehicles ................................... Cash .................................. Accounts Payable ............. 10,000 Accounts Receivable ............... Service Revenue .............. 2,300 Advertising Expense ................ Cash ................................. 225 Cash ........................................ Accounts Receivable ........ 1,000 Accounts Payable .................... Cash ................................. 9,000 Cash ........................................ Unearned Revenue .......... 700 Dividends Declared ................. Cash ................................. 300 11,000 1,000 9,000 2,300 225 1,000 9,000 700 300 LO 3 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-36 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-7 Transaction 1 Sept. 1: Issued common shares for $20,000 cash. (a) Basic Analysis The asset account Cash is increased by $20,000; the shareholders’ equity account Common Shares is increased by $20,000. (b) Equation Analysis Assets = Liabilities + Cash +$20,000 Shareholders’ Equity Common Shares +$20,000 (c) Debit−Credit Analysis Debits increase assets: debit Cash $20,000. Credits increase share capital (shareholders’ equity): credit Common Shares $20,000. Transaction 2 Sept. 2: Performed $9,000 of services on account for a customer. (a) Basic Analysis The asset account Accounts Receivable is increased by $9,000; the revenue account Service Revenue is increased by $9,000. (b) Equation Analysis Assets Accounts Receivable +$9,000 (c) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Service Revenue +$9,000 Debits increase assets; debit Accounts Receivable $9,000. Credits increase revenues; credit Service Revenue $9,000. Solutions Manual 3-37 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-7 (CONTINUED) (a), (b), and (c) (continued) Transaction 3 Sept. 4: Purchased equipment for $12,000 paying $5,000 in cash and borrowing the balance from the bank. (a) Basic Analysis The asset account Equipment is increased by $12,000; the asset account Cash is decreased by $5,000 and the liability account Bank Loan Payable increased by $7,000. (b) Equation Analysis Assets Cash -$5,000 = Liabilities + Shareholders’ Equity Bank Loan Payable +$7,000 Equipment +$12,000 (c) Debit−Credit Analysis Debits increase assets: debit Equipment $12,000. Credits decrease assets: credit Cash $5,000 Credits increase liabilities: credit Bank Loan Payable $7,000. Solutions Manual 3-38 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-7 (CONTINUED) (a), (b), and (c) (continued) Transaction 4 Sept. 10: Purchased $500 of supplies on account. (a) Basic Analysis The asset account Supplies is increased by $500; the liability account Accounts Payable is increased by $500. (b) Equation Analysis Assets = + Shareholders’ Equity Accounts Payable +$500 Supplies +$500 (c) Debit−Credit Analysis Liabilities Debits increase assets: debit Supplies $500. Credits increase liabilities: credit Accounts Payable $500. Transaction 5 Sept. 25: Received $4,500 cash in advance for architectural services to be provided next month. (a) Basic Analysis The asset account Cash is increased by $4,500; the liability account Unearned Revenue is increased by $4,500. (b) Equation Analysis Assets Cash +$4,500 (c) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Unearned Revenue +$4,500 Debits increase assets: debit Cash $4,500. Credits increase liabilities: credit Unearned Revenue $4,500. Solutions Manual 3-39 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-7 (CONTINUED) (a), (b), and (c) (continued) Transaction 6 Sept. 30: Paid $300 on account in partial payment of amount owing for supplies purchased Sept. 10. (a) Basic Analysis The liability account Accounts Payable is decreased by $300; the asset account Cash is decreased by $300. (b) Equation Analysis Assets = Liabilities Shareholders’ Equity + Accounts Payable -$300 Cash -$300 (c) Debit−Credit Analysis Debits decrease liabilities: debit Accounts Payable $300. Credits decrease assets: credit Cash $300. Transaction 7 Sept. 30: Collected $5,000 on account owing from customer from Sept. 2. (a) Basic Analysis The asset account Cash is increased by $5,000; the asset account Accounts Receivable is decreased by $5,000. (b) Equation Analysis Assets = Liabilities + Shareholders’ Equity Cash +$5,000 Accounts Receivable -$5,000 (c) Debit−Credit Analysis Debits increase assets: debit Cash $5,000. Credits decrease assets: credit Accounts Receivable $5,000. Solutions Manual 3-40 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-7 (CONTINUED) (d) Sept. 1 2 4 10 25 30 30 Cash................................................... Common Shares ......................... 20,000 Accounts Receivable.......................... Service Revenue......................... 9,000 Equipment .......................................... Cash ........................................... Bank Loan Payable ..................... 12,000 Supplies ............................................. Accounts Payable ....................... 500 Cash................................................... Unearned Revenue ..................... 4,500 Accounts Payable .............................. Cash ........................................... 300 Cash................................................... Accounts Receivable .................. 5,000 20,000 9,000 5,000 7,000 500 4,500 300 5,000 Solutions Manual 3-41 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-7 (CONTINUED) (e) Sept. 1 Sept. 25 Sept. 30 Bal. Cash 20,000 Sept. 4 4,500 Sept. 30 5,000 24,200 Sept. 2 Bal. Accounts Receivable 9,000 Sept. 30 4,000 Sept. 10 Supplies 500 Sept. 4 Sept. 30 5,000 300 5,000 Equipment 12,000 Accounts Payable 300 Sept. 10 Bal. 500 200 Unearned Revenue Sept. 25 4,500 Bank Loan Payable Sept. 4 7,000 Common Shares Sept. 1 20,000 Service Revenue Sept. 2 9,000 LO 1,2,3,4 BT: AN Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-42 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-8 Cash Mar. Mar. 2 11,000 Mar. 4 1,000 25 1,000 13 225 30 700 27 9,000 31 300 25 1,000 31 Bal. 2,175 Accounts Receivable Mar. 10 2,300 Mar. Mar. 31 Bal. 1,300 Vehicles Mar. 4 10,000 Accounts Payable Mar. 27 9,000 Mar. Mar. 4 31 Bal. 9,000 0 Unearned Revenue Mar. 30 700 Common Shares Mar. 2 11,000 Dividends Declared Mar. 31 300 Service Revenue Mar. 10 2,300 Advertising Expense Mar. 13 225 LO 4 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-43 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-9 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Operating activity Investing activity Operating activity Operating activity Operating activity Financing activity Operating activity Operating activity Operating activity Operating activity LO 4 BT: AN Difficulty: C Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting EXERCISE 3-10 (a) Aug. 7 Aug. 10 Aug. 14 Aug. 16 Aug. 28 Aug. 30 Aug. 31 Provided services and was paid cash Purchased equipment with a down payment of $1,500 and the balance from a bank loan payable Performed services on account Collected cash in advance of providing services Received a collection from a customer on account Paid salaries Declared and paid dividends Solutions Manual 3-44 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-10 (CONTINUED) (b) Cash July 31 bal. 4,000 Aug. 7 1,800 Aug. 10 16 900 30 28 700 31 Bal. 3,400 Accounts Receivable July 31 bal. 2,000 Aug. 14 1,450 Aug. 28 Bal. 2,750 Bank Loan Payable Aug. 10 1,500 2,000 500 Unearned Revenue Aug. 16 Common Shares July 31 bal. 2,000 Retained Earnings July 31 bal. 5,000 700 Equipment July 31 bal. 2,500 Aug. 10 4,000 Bal. 6,500 Accounts Payable July 31 bal. 2,500 Aug. 31 Dividends Declared 500 Service Revenue Aug. 7 14 Bal. 1,500 Aug. 30 1,800 1,450 3,250 Salaries Expense 2,000 900 Solutions Manual 3-45 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-10 (CONTINUED) (c) KANG LTD. Trial Balance August 31 Debit Cash Accounts receivable Equipment Accounts payable Unearned revenue Bank loan payable Common shares Retained earnings Dividends declared Service revenue Salaries expense Totals Credit $ 3,400 2,750 6,500 $ 1,500 900 2,500 2,000 5,000 500 2,000 $15,150 3,250 _ $15,150 (Assets, dividends, and expense accounts have debit balances) LO 4,5 BT: AP Difficulty: M Time: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-46 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-11 (a) Oct. 1 Oct. 2 Oct. 3 Oct. 4 Oct. 5 Oct. 9 Oct. 12 Oct. 16 Oct. 17 Oct. 22 Oct. 30 Oct. 31 Oct. 31 Issued common shares in exchange for cash Purchased equipment using a bank loan payable Performed services on account Purchased advertising on account Purchased supplies for cash Received cash for services to be performed in the future Made a partial payment on account Declared and paid dividends Received a collection on account Performed services on account Paid rent for the month of October Paid salaries Recorded income taxes owing Solutions Manual 3-47 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-11 (CONTINUED) (b) After summing the debit and credits in each account, the following net balances would result. Note that because the Supplies, Equipment, Income Tax Payable, Bank Loan Payable, Unearned Revenue, Common Shares, Dividends Declared, Salaries Expense, Advertising Expense, Rent Expense, and Income Tax Expense accounts have only one entry, there is no need to sum these accounts. Cash Accounts receivable Supplies Equipment Accounts payable Income tax payable Unearned revenue Bank loan payable Common shares Dividends declared Service revenue Salaries expense Advertising expense Rent expense Income tax expense Balance 550 2,240 400 3,500 100 180 650 3,500 2,000 300 2,740 500 250 1,250 180 Debit or Credit Debit Debit Debit Debit Credit Credit Credit Credit Credit Debit Credit Debit Debit Debit Debit Solutions Manual 3-48 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-11 (CONTINUED) (c) HOLLY CORP. Trial Balance October 31 Debit Cash Accounts receivable Supplies Equipment Accounts payable Income tax payable Unearned revenue Bank loan payable Common shares Dividends declared Service revenue Salaries expense Advertising expense Rent expense Income tax expense Totals Credit $ 550 2,240 400 3,500 $ 100 180 650 3,500 2,000 300 2,740 500 250 1,250 180 $9,170 0 $9,170 (Total of debit account balances = Total of credit account balances) LO 5 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-49 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-12 BOURQUE LTD. Trial Balance December 31, 2018 Debit Cash Accounts receivable Supplies Equipment Accumulated depreciation—equipment Accounts payable Salaries payable Unearned revenue Common shares Retained earnings Dividends declared Service revenue Salaries expense Office expense Depreciation expense Rent expense Supplies expense Income tax expense Credit $10,000 6,500 3,500 10,000 $ 4,000 1,500 3,000 2,200 5,000 16,000 4,500 22,000 9,100 4,400 2,000 2,000 1,200 500 $53,700 $53,700 (Liabilities, common shares, retained earnings, and revenue accounts have credit balances) LO 5 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-50 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-13 BOURQUE LTD. Income Statement Year Ended December 31, 2018 Revenues Service revenue Expenses Salaries expense Office expense Depreciation expense Rent expense Supplies expense Total expenses Income before income tax Income tax expense Net income $22,000 $9,100 4,400 2,000 2,000 1,200 18,700 3,300 500 $ 2,800 BOURQUE LTD. Statement of Changes in Equity Year Ended December 31, 2018 Common Shares Balance, January 1, 2018 Net income Dividends declared Balance, December 31, 2018 $5,000 $5,000 Retained Earnings $16,000 2,800 (4,500) $14,300 Total Equity $21,000 2,800 (4,500) $19,300 Solutions Manual 3-51 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-13 (CONTINUED) BOURQUE LTD. Statement of Financial Position December 31, 2018 Assets Current assets Cash Accounts receivable Supplies Total current assets Property, plant, and equipment Equipment Less: Accumulated depreciation Total property, plant, and equipment Total assets $10,000 6,500 3,500 $20,000 $10,000 4,000 6,000 $26,000 Liabilities and Shareholders' Equity Current liabilities Accounts payable Salaries payable 3,000 Unearned revenue 2,200 Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders’ equity $ 1,500 6,700 $ 5,000 14,300 19,300 $26,000 [Ending retained earnings = Beginning retained earnings ± Net income or (loss) – dividends declared] LO 5 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-52 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-14 (a) SPEEDY SERVICE INC. Trial Balance July 31, 2018 Debit Cash Held for trading investments Accounts receivable Prepaid insurance Equipment Accumulated depreciation—equipment Accounts payable Salaries payable Bank loan payable, due 2020 Common shares Retained earnings Dividends declared Service revenue Salaries expense Depreciation expense Rent expense Repairs and maintenance expense Interest expense Insurance expense Income tax expense Totals Credit $ 8,000 20,000 14,000 200 99,000 $ 21,400 9,500 800 39,000 38,000 20,850 800 75,000 25,000 9,700 9,000 10,450 3,600 1,800 3,000 $204,550 0 $204,550 (Asset, dividends, and expense accounts have debit balances) Solutions Manual 3-53 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-14 (CONTINUED) (b) SPEEDY SERVICE INC. Income Statement Year Ended July 31, 2018 Revenues Service revenue Expenses Salaries expense Repairs and maintenance expense Depreciation expense Rent expense Interest expense Insurance expense Total expenses Income before income tax Income tax expense Net income $75,000 $25,000 10,450 9,700 9,000 3,600 1,800 59,550 15,450 3,000 $12,450 SPEEDY SERVICE INC. Statement of Changes in Equity Year Ended July 31, 2018 Balance, August 1, 2017 Issued common shares Net income Dividends declared Balance, July 31, 2018 Common Shares Retained Earnings $27,000 11,000 $20,850 $38,000 12,450 (800) $32,500 Total Equity $47,850 11,000 12,450 (800) $70,500 Solutions Manual 3-54 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-14 (CONTINUED) (b) (continued) SPEEDY SERVICE INC. Statement of Financial Position July 31, 2018 Assets Current assets Cash Held for trading investments Accounts receivable Prepaid insurance Total current assets Property, plant, and equipment Equipment Less: Accumulated depreciation Total property, plant, and equipment Total assets $ 8,000 20,000 14,000 200 $ 42,200 $99,000 21,400 77,600 $119,800 Liabilities and Shareholders' Equity Current liabilities Accounts payable Salaries payable Total current liabilities Non-current liabilities Bank loan payable, due 2020 Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders’ equity $9,500 800 $ 10,300 39,000 49,300 $38,000 32,500 70,500 $119,800 [Ending retained earnings = Beginning retained earnings ± Net income or (loss) – dividends declared] Solutions Manual 3-55 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 3-14 (CONTINUED) (c) If the amount of the retained earnings was not known, it would be more difficult to prepare the three financial statements in part (b) above. However, the beginning balance of retained earnings could either be derived from the trial balance or worked backwards by determining the ending retained earnings amount from a complete (except for retained earnings) statement of financial position and adjusting the ending amount by calculating and deducting net income and adding dividends declared. Remember that ending retained earnings = beginning retained earnings + net income – dividends declared; so it follows mathematically that beginning retained earnings = ending retained earnings – net income + dividends declared LO 5 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting EXERCISE 3-15 Error (a) In Balance (b) Difference (c) Larger Column 1. 2. 3. 4. 5. 6. No Yes Yes No No No $400 0 0 500 225 9 Debit n/a n/a Credit Debit Credit LO 5 BT: AN Difficulty: C Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-56 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO PROBLEMS PROBLEM 3-1A (a) Assets Transaction 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Apr. 30 Bal. Cash +$5,000 +20,000 –11,000 –1,200 –1,450 Accounts Receivable Supplies = Equipment = Liabilities Accounts Payable Bank Loan Payable Shareholders’ Equity Retained Earnings + + Common Shares +$5,000 + Revenues +$20,000 +$11,000 –$1,200 +$1,450 –600 +$600 +2,000 –400 –2,000 –600 –100 –6,400 +12,000 –1,500 $14,350 – Expenses – Dividends Declared +$16,000 +$18,000 –$400 –2,000 –600 –100 –6,400 –12,000 + $4,000 +$1,450 + $11,000 = $0 + $20,000 + $5,000 + $18,000 –1,500 –$11,800 –$400 PROBLEM 3-1A (CONTINUED) (b) TOTAL ASSETS = $30,800 TOTAL LIABILITIES + SHAREHOLDERS’ EQUITY = $20,000 + ($5,000 + $18,000 – $11,800 – $400) = $30,800 NET INCOME = $18,000 – $11,800 = $6,200 LO 1 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-57 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-2A (a) Assets Shareholders’ Equity Retained Earnings Liabilities Bank Accounts Loan Accounts Common Cash + Receivable +Supplies+Equipment= Payable + Payable + Shares + Jul 31 Bal.. Aug. 2 3 6 7 13 17 17 20 22 24 28 31 Aug. 31 Bal. $4,000 +1,200 +1,300 −2,700 +3,000 –400 –4,675 +3,500 –500 $1,500 –1,200 $500 $5,000 $4,100 $3,500 Balance Dividends +Revenues – Expenses– Declared $3,400 +1,300 −2,700 +3,500 +$6,500 +1,200 +800 –$3,500 –900 –275 –3,500 –$500 +1,000 +1,000 +2,000 –500 $6,225 +$2,000 $1,300 $1,300 + 0 0 $500 00 00 $6,200 + 700 000 $2,000 + +275 00 000 $2,475+ 00 000 $4,800 00 000 $3,400 + –275 −500 $5,450 00 000 $7,500 + – TOTAL ASSETS $14,225 = TOTAL LIABILITIES & SHAREHOLDERS’ EQUITY $14,225 Note: The August 27th transaction does not affect the accounting equation and is therefore not recorded in the accounting records. Solutions Manual 3-58 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. 00 0 $500 – Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-2A (CONTINUED) (b) HILLS LEGAL SERVICES INC. Income Statement Month Ended August 31, 2018 Revenues Service revenue Expenses Salaries expense Rent expense Advertising expense Utilities expense Total expenses Income before income tax Income tax expense Net income $7,500 $3,500 900 275 275 4,950 2,550 500 $2,050 [Revenues – Expenses = Net income or (loss)] HILLS LEGAL SERVICES INC. Statement of Changes in Equity Month Ended August 31, 2018 Balance, August 1 Issued common shares Net income Dividends declared Balance, August 31 Common Shares Retained Earnings $3,500 1,300 $3,400 00 $4,800 2,050 (500) $4,950 Total Equity $6,900 1,300 2,050 (500) $9,750 Solutions Manual 3-59 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-2A (CONTINUED) (b) (continued) HILLS LEGAL SERVICES INC. Statement of Financial Position August 31, 2018 Assets Current assets Cash Accounts receivable Supplies Total current assets Property, plant, and equipment Equipment Total assets $6,225 1,300 500 $ 8,025 6,200 $14,225 Liabilities and Shareholders' Equity Current liabilities Accounts payable Bank loan payable Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders' equity $2,475 2,000 $ 4,475 $4,800 4,950 9,750 $14,225 (Assets = Liabilities + Shareholders’ equity) LO 1 BT: AN Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-60 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-3A (a) Account Debited (2) Specific Basic Type Account (1) Transaction (3) (1) Effect Basic Type Account Credited (2) Specific Account (3) Effect Apr. 2 Shareholders’ equity Rent Expense Increase Assets Cash Decrease Apr. 3 Assets Accounts Receivable Increase Shareholders’ equity Sales Increase Apr. 5 Assets Cash Increase Shareholders’ equity Sales Increase Apr. 6 Assets Equipment Increase Liabilities Accounts Payable Cash Increase Assets Decrease Apr. 12 Assets Cash Increase Assets Accounts Receivable Decrease Apr. 15 Shareholders’ equity Dividends Declared Increase Assets Cash Decrease Apr. 16 Assets Inventory Increase Liabilities Accounts Payable Increase PROBLEM 3-3A (CONTINUED) (a) (continued) Account Debited Account Credited Solutions Manual 3-61 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley (1) Transaction Apr. 19 Apr. 20 Apr. 25 Apr. 27 Apr. 30 Basic Type (2) Specific Account Financial Accounting, Seventh Canadian Edition (3) (1) Basic Type (2) Specific Account Effect (3) Effect Shareholders’ equity Repairs and Maintenance Expense Increase Assets Cash Decrease Assets Accounts Receivable Increase Shareholders’ equity Sales Increase Liabilities Accounts Payable Decrease Assets Cash Decrease Assets Cash Increase Liabilities Unearned Revenue Increase Shareholders’ equity Salaries Expense Increase Assets Cash Decrease Solutions Manual 3-62 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-3A (CONTINUED) (b) Normal Balance debit Date Apr. 2 Account Rent Expense Apr. 3, 12, 20 Accounts Receivable debit Apr. 3, 5, 20 Sales credit Apr. 2, 5, 6, 12, 15, 19, 25, 27, 30 Cash debit Apr. 6 Equipment debit Apr. 6, 16, 25 Accounts Payable credit Apr. 15 Dividends Declared debit Apr. 16 Inventory debit Apr. 19 Repairs and Maintenance Expense debit Apr. 27 Unearned Revenue credit Apr. 30 Salaries Expense debit LO 2 BT: AP Difficulty: M Time: 40 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-63 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-4A (a) Account Accumulated depreciation Administrative expenses Buildings Common shares, beginning of year Cost of goods sold Dividends declared Finance income Goodwill Income tax expense Income taxes recoverable Inventories Prepaid expenses Retained earnings, beginning of year Sales Trade and other payables Trade and other receivables (1) Increases By Credit Debit Debit Credit Debit Debit Credit Debit Debit Debit Debit Debit Credit Credit Credit Debit (2) Normal Balance Credit Debit Debit Credit Debit Debit Credit Debit Debit Debit Debit Debit Credit Credit Credit Debit Solutions Manual 3-64 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-4A (CONTINUED) (b) Account Accumulated depreciation Administrative expenses Buildings Common shares, beginning of year Cost of goods sold Dividends declared Finance income Goodwill Income tax expense Income taxes recoverable Inventories Prepaid expenses Retained earnings, beginning of year Sales Trade and other payables Trade and other receivables Financial Statement Statement of Financial Position Income Statement Statement of Financial Position Statement of Changes in Equity Income Statement Statement of Changes in Equity Income Statement Statement of Financial Position Income Statement Statement of Financial Position Statement of Financial Position Statement of Financial Position Statement of Changes in Equity Income Statement Statement of Financial Position Statement of Financial Position Note: Beginning-of-the-year equity amounts such as opening common shares or opening retained earnings balances are shown on the statement of changes in equity and do not appear on the statement of financial position. Only end-of-year amounts for equity accounts would appear on the statement of financial position. (c) Account Accumulated depreciation Buildings Goodwill Income taxes recoverable Inventories Prepaid expenses Trade and other payables Trade and other receivables Classification Non-current assets Non-current assets Non-current assets Current assets Current assets Current assets Current liabilities Current assets LO 2 BT: K Difficulty: S Time: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-65 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5A (a) Transaction 1 Feb.2: Purchased supplies on account for $600. (1) Basic Analysis The asset account Supplies is increased by $600; the liability account Accounts Payable is increased by $600. (2) Equation Analysis Assets = Liabilities + Shareholders’ Equity Accounts Payable +$600 Supplies +$600 (3) Debit−Credit Analysis Debits increase assets: debit Supplies $600. Credits increase liabilities: credit Accounts Payable $600. Transaction 2 Feb.3: Purchased equipment for $10,000 by signing a bank loan due in three months. (1) Basic Analysis The asset account Equipment is increased by $10,000; the liability account Bank Loan Payable is increased by $10,000. (2) Equation Analysis Assets Equipment +$10,000 (3) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Bank Loan Payable +$10,000 Debits increase assets: debit Equipment $10,000. Credits increase liabilities: credit Bank Loan Payable $10,000. Solutions Manual 3-66 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5A (CONTINUED) (a) (continued) Transaction 3 Feb.6: Earned service revenue of $50,000. Of this amount, $30,000 was received in cash. The balance was on account. (1) Basic Analysis The asset account Cash is increased by $30,000; the asset account Accounts Receivable is increased by $20,000; the shareholders’ equity account Service Revenue is increased by $50,000. (2) Equation Analysis Assets Cash +$30,000 = Liabilities + Shareholders’ Equity Service Revenue +$50,000 Accounts Receivable +$20,000 (3) Debit−Credit Analysis Debits increase assets: debit Cash $30,000. Debits increase assets: debit Accounts Receivable $20,000. Credits increase revenues: credit Service Revenue $50,000. Solutions Manual 3-67 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5A (CONTINUED) (a) (continued) Transaction 4 Feb.13: Declared and paid dividends of $500 to shareholders. (1) Basic Analysis The asset account Cash is decreased by $500; the Dividends Declared account is increased by $500. (2) Equation Analysis Assets = Liabilities + Cash -$500 Shareholders’ Equity Dividends Declared -$500 (3) Debit−Credit Analysis Debits increase dividends: debit Dividends Declared $500. Credits decrease assets: credit Cash $500. Transaction 5 Feb. 18: Received cash of $2,000 from a customer as a deposit for services to be provided next month. (1) Basic Analysis The asset account Cash is increased by $2,000; the liability account Unearned Revenue is increased by $2,000. (2) Equation Analysis Assets = Cash +$2,000 (3) Debit−Credit Analysis Liabilities + Shareholders’ Equity Unearned Revenue +$2,000 Debits increase assets: debit Cash $2,000. Credits increase liabilities: credit Unearned Revenue $2,000. PROBLEM 3-5A (CONTINUED) (a) (continued) Transaction 6 Feb. 20: Paid amount owing from the supplies purchased on Feb. 2. Solutions Manual 3-68 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley (1) Basic Analysis (2) Equation Analysis The asset account Cash is decreased by $600; the liability account Accounts Payable is decreased by $600. Assets Cash -$600 (3) Debit−Credit Analysis Financial Accounting, Seventh Canadian Edition = Liabilities + Shareholders’ Equity Accounts Payable -$600 Debits decrease liabilities: debit Accounts Payable $600. Credits decrease assets: credit Cash $600. Solutions Manual 3-69 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5A (CONTINUED) (a) (continued) Transaction 7 Feb. 23: Collected $20,000 of the amount owing from the Feb. 6 transaction. (1) Basic Analysis The asset account Cash is increased by $20,000; the asset account Accounts Receivable is decreased by $20,000. (2) Equation Analysis Assets = Liabilities + Shareholders’ Equity Cash +$20,000 Accounts Receivable -$20,000 (3) Debit−Credit Analysis Debits increase assets: debit Cash $20,000. Credits decrease assets: credit Accounts Receivable $20,000. Solutions Manual 3-70 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5A (CONTINUED) (a) (continued) Transaction 8 Feb. 24: Paid office expenses for the month, $22,000. (1) Basic Analysis The expense account Office Expense is increased by $22,000; the asset account Cash is decreased by $22,000. (2) Equation Analysis Assets Cash -$22,000 (3) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Office Expense -$22,000 Debits increase expenses: debit Office Expense $22,000. Credits decrease assets: credit Cash $22,000. Solutions Manual 3-71 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5A (CONTINUED) (a) (continued) Transaction 9 Feb.27: Recorded salaries due to employees for work performed during the month, $14,000. (1) Basic Analysis The expense account Salaries Expense is increased by $14,000; the liability account Salaries Payable is increased by $14,000. (2) Equation Analysis Assets = Liabilities + Salaries Payable +$14,000 Shareholders’ Equity Salaries Expense -$14,000 (3) Debit−Credit Analysis Debits increase expenses: debit Salaries Expense $14,000. Credits increase liabilities: credit Salaries Payable $14,000. Transaction 10 Feb. 28: Paid interest of $50 on the bank loan signed on Feb. 3. (1) Basic Analysis The expense account Interest Expense is increased by $50; the asset account Cash is decreased by $50. (2) Equation Analysis Assets Cash -$50 (3) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Interest Expense -$50 Debits increase expenses: debit Interest Expense $50. Credits decrease assets: credit Cash $50. Solutions Manual 3-72 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5A (CONTINUED) (b) Feb. 2 Supplies........................................................... Accounts Payable..................................... 600 600 3 Equipment ....................................................... Bank Loan Payable ................................. 10,000 6 Cash ................................................................ Accounts Receivable ...................................... Service Revenue ...................................... 30,000 20,000 13 Dividends Declared ......................................... Cash ......................................................... 500 18 Cash ................................................................ Unearned Revenue .................................. 2,000 20 Accounts Payable ............................................ Cash ......................................................... 600 23 Cash ................................................................ Accounts Receivable ................................ 20,000 24 Office Expense ................................................ Cash ......................................................... 22,000 27 Salaries Expense............................................. Salaries Payable ...................................... 14,000 28 Interest Expense.............................................. Cash ......................................................... 50 10,000 0 50,000 500 2,000 600 20,000 22,000 14,000 50 LO 1,2,3 BT: AN Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-73 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-6A May 1 Cash ................................................................ Common Shares ...................................... 120,000 4 Land ................................................................ Buildings .......................................................... Equipment ....................................................... Cash ......................................................... Mortgage Payable .................................... 125,000 100,000 45,000 4 Prepaid Insurance ........................................... Cash ......................................................... 1,500 5 Advertising Expense ........................................ Cash ......................................................... 800 6 Equipment ....................................................... Accounts Payable .................................... 9,000 18 Cash ................................................................ Fees Earned............................................. 8,800 20 Dividends Declared ......................................... Cash ......................................................... 500 22 Cash ................................................................ Unearned Revenue .................................. 1,200 29 Accounts Payable............................................ Cash ......................................................... 9,000 30 Interest Expense ............................................. Cash ......................................................... 800 120,000 70,000 200,000 1,500 800 9,000 8,800 500 1,200 9,000 800 Solutions Manual 3-74 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-6A (CONTINUED) May 30 Salaries Expense ............................................ Cash ......................................................... 3,400 3,400 (Each journal entry must balance and reflect the actual amount of the transaction) LO 3 BT: AP Difficulty: M Time: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-75 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-7A (a) Apr. 1 Cash ................................................................ Equipment ....................................................... Common Shares....................................... 10,000 6,000 16,000 1 No entry. Not a transaction 2 3 10 13 20 21 23 25 27 Rent Expense .................................................. Cash ......................................................... 950 Supplies ........................................................... Accounts Payable ..................................... 1,900 Accounts Receivable ....................................... Service Revenue ...................................... 1,200 Cash ................................................................ Unearned Revenue .................................. 800 Cash ................................................................ Service Revenue ...................................... 2,500 Cash ................................................................ Accounts Receivable ................................ 600 Utilities Expense .............................................. Accounts Payable ..................................... 135 Dividends Declared ......................................... Cash ......................................................... 160 Accounts Payable ............................................ Cash ......................................................... 950 950 1,900 1,200 800 2,500 600 135 160 950 Solutions Manual 3-76 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-7A (CONTINUED) (a) (continued) Apr., 30 30 Salaries Expense ............................................. Cash ......................................................... 1,900 Income Tax Expense ....................................... Cash ......................................................... 100 1,900 100 (b) Apr. 1 Apr. 13 Apr. 20 Apr. 21 Bal. Apr. 10 Bal. Cash 10,000 Apr. 2 800 Apr. 25 2,500 Apr. 27 600 Apr. 30 Apr. 30 9,840 Accounts Receivable 1,200 Apr. 21 600 Apr. 3 Supplies 1,900 Apr. 1 Equipment 6,000 Apr. 27 Accounts Payable 950 Apr. 3 Apr. 23 Bal. Unearned Revenue Apr. 13 950 160 950 1,900 100 Common Shares Apr. 1 Apr. 25 1,900 135 1,085 16,000 Dividends Declared 160 Service Revenue Apr. 10 Apr. 20 Bal. 600 800 Apr. 30 Salaries Expense 1,900 Apr. 2 Rent Expense 950 Apr. 23 Utilities Expense 135 Apr. 30 Income Tax Expense 100 1,200 2,500 3,700 PROBLEM 3-7A (CONTINUED) (c) This suggestion is not a good idea. Journals are used to record transactions. A general ledger is not intended to be used to capture the recording of transactions, but to tabulate the effects of transactions in separate accounts. The balances arrived at in the ledger are then used to communicate information to the users of the financial statements. If one attempted to omit the use of journal entries, one could not retrace the transactions as they originated in the journal. One would only see one Solutions Manual 3-77 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition side of a transaction at a time by looking at an account in the ledger. It would become very confusing and unruly to try to keep track of transactions. LO 3,4 BT: AP Difficulty: M Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-78 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-8A (a) Mar. 1 Rent Expense .................................................. Accounts Payable ..................................... Cash ......................................................... 2 No entry. 5 No entry. 12 27,000 17,000 10,000 Accounts Payable ........................................... Cash ......................................................... 17,000 Accounts Payable ........................................... Cash ......................................................... 12,000 Cash ................................................................ Fees Earned ............................................. 25,500 Advertising Expense ........................................ Cash ......................................................... 950 20 Rent Expense .................................................. Cash ......................................................... 3,000 23 Salaries Expense ............................................. Cash ......................................................... 4,200 Mortgage Payable ............................................ Interest Expense .............................................. Cash ......................................................... 1,250 750 Income Tax Expense ....................................... Cash ......................................................... 3,000 13 15 19 26 28 17,000 12,000 25,500 950 0 3,000 4,200 2,000 3,000 PROBLEM 3-8A (CONTINUED) (a) (continued) Mar. 30 31 Cash ................................................................ Accounts Receivable ($2,490 × ½) .................. Concession Revenue ................................ 1,245 1,245 Cash ................................................................ 25,800 2,490 0 Solutions Manual 3-79 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Fees Earned ............................................. 25,800 Solutions Manual 3-80 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-8A (CONTINUED) (b) Cash Feb. 28 Bal. 15,000 Mar. 1 Mar. 15 25,500 Mar. 12 Mar. 30 1,245 Mar. 13 Mar. 31 25,800 Mar. 19 Mar. 20 Mar. 23 Mar. 26 Mar. 28 Bal. 15,395 Mar. 30 10,000 17,000 12,000 950 3,000 4,200 2,000 3,000 Buildings Feb. 28 Bal. 77,000 Equipment Feb. 28 Bal. 20,000 Mar. 26 Retained Earnings Feb. 28 Bal. 27,000 Concession Revenue Mar. 30 Land Feb. 28 Bal. 85,000 Mar. 12 Mar. 13 40,000 Fees Earned Mar. 15 Mar. 31 Bal. Accounts Receivable 1,245 Accounts Payable 17,000 Feb. 28 Bal. 12,000 Mar. 2 Bal. Common Shares Feb. 28 Bal. 12,000 17,000 0 Mortgage Payable 1,250 Feb. 28 Bal. 118,000 Bal. 116,750 Mar. 1 Mar. 20 Bal. Rent Expense 27,000 3,000 30,000 Mar. 23 Salaries Expense 4,200 Mar. 19 Advertising Expense 950 Mar. 26 Interest Expense 750 Mar. 28 Income Tax Expense 3,000 25,500 25,800 51,300 2,490 Solutions Manual 3-81 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-8A (CONTINUED) (c) STAR THEATRE INC. Trial Balance March 31, 2018 Cash Accounts receivable Land Buildings Equipment Mortgage payable Common shares Retained earnings Fees earned Concession revenue Rent expense Salaries expense Advertising expense Interest expense Income tax expense Totals Debit $ 15,395 1,245 85,000 77,000 20,000 Credit $116,750 40,000 27,000 51,300 2,490 30,000 4,200 950 750 3,000 $237,540 00 $237,540 [Liabilities (mortgage payable) and shareholders’ equity items such as common shares, retained earnings, and revenue accounts (fees earned and concession revenue) have credit balances] LO 3,4,5 BT: AP Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-82 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-9A (a) May 1 Rent Expense .................................................. Cash ......................................................... 1,000 Accounts Payable ............................................ Cash ......................................................... 1,100 Cash ................................................................ Unearned Revenue ................................... 1,500 Cash ................................................................ Service Revenue ...................................... 2,000 Salaries Expense ............................................. Cash ......................................................... 1,200 Unearned Revenue ......................................... Service Revenue ...................................... 700 18 Accounts Payable ............................................ Cash ......................................................... 1,000 22 Supplies ........................................................... Accounts Payable ..................................... 700 Advertising Expense ........................................ Accounts Payable ..................................... 500 Utilities Expense .............................................. Cash ......................................................... 400 Cash ................................................................ Service Revenue ...................................... 2,100 4 7 15 15 17 24 25 28 1,000 1,100 1,500 2,000 1,200 700 0 1,000 700 500 400 2,100 Solutions Manual 3-83 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-9A (CONTINUED) (a) (continued) May 29 30 31 31 Unearned Revenue ......................................... Service Revenue...................................... 600 Interest Expense ............................................. Cash ........................................................ 50 Salaries Expense ............................................ Cash ........................................................ 1,200 Income Tax Expense ...................................... Cash ........................................................ 150 600 50 1,200 150 Solutions Manual 3-84 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-9A (CONTINUED) (b) Apr. 30 May 7 15 28 Cash 5,000 May 1,500 2,000 2,100 Bal. 4,500 Apr. 30 May 22 Bal. Supplies 500 700 1,200 Apr. 30 Equipment 24,000 May 4 18 May 17 29 1 4 15 18 25 30 31 31 Accounts Payable Apr. 30 1,100 May 22 1,000 24 Bal. Unearned Revenue 700 Apr. 30 600 May 7 Bal. Bank Loan Payable Apr 30 1,000 1,100 1,200 1,000 400 50 1,200 150 Common Shares Apr. 30 5,000 Retained Earnings Apr. 30 11,400 Service Revenue May 15 17 28 29 Bal. 2,000 700 2,100 600 5,400 Salaries Expense May 15 1,200 31 1,200 Bal. 2,400 May 1 2,100 700 500 1,200 1,000 1,500 1,200 10,000 Rent Expense 1,000 Advertising Expense May 24 500 May 25 Utilities Expense 400 May 30 Interest Expense 50 May 31 Income Tax Expense 150 Solutions Manual 3-85 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-9A (CONTINUED) (c) PAMPER ME SALON INC. Trial Balance May 31, 2018 Cash Supplies Equipment Accounts payable Unearned revenue Bank loan payable Common shares Retained earnings Service revenue Salaries expense Rent expense Advertising expense Utilities expense Interest expense Income tax expense Totals Debit $ 4,500 1,200 24,000 Credit $ 1,200 1,200 10,000 5,000 11,400 5,400 2,400 1,000 500 400 50 150 $34,200 $34,200 (Asset and expense accounts have debit balances) LO 3,4,5 BT: AP Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-86 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-10A (a) TAGGAR ENTERPRISES INC. Trial Balance June 30, 2018 Cash Accounts receivable Inventory Prepaid insurance Land Buildings Accumulated depreciation—buildings Equipment Accumulated depreciation—equipment Long-term investments Accounts payable Income tax payable Mortgage payable, due 2025 Common shares Retained earnings Dividends declared Sales Cost of goods sold Office expense Interest expense Income tax expense Totals Debit $ 1,800 3,000 5,100 900 7,400 15,000 Credit $ 4,000 3,000 1,000 3,550 3,500 100 15,000 5,000 6,250 2,000 25,000 13,700 3,300 100 1,000 $59,850 $59,850 (Asset, dividends declared, and expense accounts have debit balances. Liability, common shares, retained earnings, and revenue (sales) accounts have credit balances) Solutions Manual 3-87 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-10A (CONTINUED) (b) When debits equal credits in a trial balance, there is some assurance that certain types of errors were not made. However, there is no guarantee that other types of errors do not exist because entries may have been omitted completely, duplicated, or recorded to incorrect accounts. LO 5 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-88 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-11A TAGGAR ENTERPRISES INC. Income Statement Year Ended June 30, 2018 Sales Expenses Cost of goods sold Office expense Interest expense Total expenses Income before income tax Income tax expense Net income $25,000 $13,700 3,300 100 17,100 7,900 1,000 $ 6,900 TAGGAR ENTERPRISES INC. Statement of Changes in Equity Year Ended June 30, 2018 Balance, July 1, 2017 Issued common shares Net income Dividends declared Balance, June 30, 2018 Common Shares Retained Earnings $3,000 2,000 $ 6,250 __ ___ $5,000 6,900 (2,000) $11,150 Total Equity $ 9,250 2,000 6,900 (2,000) $16,150 Solutions Manual 3-89 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-11A (CONTINUED) TAGGAR ENTERPRISES INC. Statement of Financial Position June 30, 2018 Assets Current assets Cash Accounts receivable Inventory Prepaid insurance Total current assets Long-term investments Property, plant, and equipment Land Buildings Less: Accumulated depreciation Equipment Less: Accumulated depreciation Total property, plant, and equipment Total assets $1,800 3,000 5,100 900 $10,800 3,550 $ 7,400 $15,000 4,000 $3,000 1,000 11,000 2,000 20,400 $34,750 Liabilities and Shareholders’ Equity Current liabilities Accounts payable Income tax payable Current portion of mortgage payable Total current liabilities Non-current liabilities Mortgage payable Total liabilities Shareholders’ equity Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $3,500 100 1,250 $ 4,850 13,750 18,600 $ 5,000 11,150 16,150 $34,750 [Ending retained earnings = Beginning retained earnings ± Net income or (loss) – dividends declared] LO 5 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-90 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-12A (a) (1) General: Three accounts are listed in the wrong columns: Cash (debit), Accumulated Depreciation (credit), and Unearned Revenue (credit). (2) 1. The trial balance totals are not affected, only the amounts appearing on the trial balance are affected. Cash would be understated by $180 ($750 – $570) and Accounts Receivable overstated by the same amount. Note that Cash was one of the accounts listed in the wrong column (credit instead of debit). If Cash had not been corrected and was still in the credit column, then the trial balance would still balance but the total credits would be understated by $180 (since Cash is in the credit column) and total debits would be understated by $180 (because of Accounts Receivable in the debit column). 2. The trial balance totals are not affected, only the accounts and amounts appearing on the trial balance are affected. Equipment would be understated by $360 and Supplies overstated by the same amount. 3. Trial balance is out of balance because of the slide error (wrong number of zeros/position of decimal spot). Service Revenue would be understated by $801 ($890 – $89) and the total for the credit column is lower by the same amount. 4. Trial balance is out of balance because of transposition error. Salaries Expense is understated by $900 ($4,300 – $3,400) and the total for the debit column is lower by the same amount. 5. The trial balance totals are not affected by this omission; only the accounts and amounts appearing on the trial balance are affected. Rent Expense would be understated by $1,000 (should be shown on the trial balance) and Cash overstated by the same amount. Note that Cash is one of the accounts listed in the wrong column (credit instead of debit). Solutions Manual 3-91 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-12A (CONTINUED) (b) CANTPOST LTD. Trial Balance June 30, 2018 Debit Cash ($1,241 + $750 – $570 − $1,000) Accounts receivable ($2,630 – $750 + $570) Supplies ($860 – $360) Equipment ($3,000 + $360) Accumulated depreciation—equipment Accounts payable Unearned revenue Common shares Dividends declared Service revenue ($8,440 – $89 + $890) Salaries expense (given) Rent expense Office expense Depreciation expense Income tax expense Totals $ Credit 421 2,450 500 3,360 $ 600 2,665 1,200 1,000 800 9,241 4,300 1,000 910 600 365 $14,706 0 $14,706 Note that the opening retained earnings balance is zero, as this is the company’s first year of operations. (Asset, dividends declared, and expense accounts have debit balances) LO 5 BT: AN Difficulty: C Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-92 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-1B (a) Assets Trans. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. May 31 Bal. Cash +$8,000 –1,280 –4,000 A/R Supplies = Equipment = Liabilities A/P Bank Loan Payable Shareholders’ Equity Retained Earnings + Unearned Revenue Commo + + n Shares Revenues +$8,000 – Dividends Declared –$1,280 +$16,000 +$12,000 +$700 +$700 +4,200 –700 –200 +$4,200 –700 –200 +$3,600 –2,000 +700 +1,600 –500 –80 –600 $5,140 – Expenses +3,600 –2,000 +$700 –1,600 –$500 +$2,000 + $700 + $16,000 = $0 + $12,000 + $700 + $8,000 Solutions Manual 3-93 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. + $7,800 –80 –600 –$4,160 –$500 Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-1B (CONTINUED) (b) TOTAL ASSETS = $23,840 TOTAL LIABILITIES & SHAREHOLDERS’ EQUITY = ($12,000 + $700) + ($8,000 + $7,800 – $4,160 – $500) = $23,840 NET INCOME = $7,800 – $4,160 = $3,640 LO 1 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-94 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-2B (a) Assets Cash Aug. 31 Bal. Sept. 4 4 5 7 10 12 14 17 20 21 26 27 28 Sep. 30 Bal. + $4,500 –3,200 –1,200 +1,450 +2,300 –700 A/R Shareholders’ Equity Retained Earnings Liabilities + $1,800 Supplies + Equip. = $350 $6,500 A/P Bank Loan Common + Payable + Shares + $3,200 –3,200 $2,500 + Rev. – Exp. Div. $7,450 –$1,200 +2,300 +2,050 +1,350 +$500 –300 +2,500 +1,500 +4,500 –750 –175 +175 –500 –350 $6,750+ – –1,450 +500 –300 +2,500 +3,000 –750 Bal. 0 $2,350 + TOTAL ASSETS = $18,000 0 $350 + 0 $8,550 = 0 $1,525+ 0 $2,500 + 0 $4,800 + 0 0 $7,450 + $5,000 – –350 $2,775 – TOTAL LIABILITIES & SHAREHOLDERS’ EQUITY = $18,00 Note: The transactions on September 6 (hired a part-time office assistant) and 18 (sent a statement) do not affect the accounting equation and are therefore not recorded in the accounting records. Solutions Manual 3-95 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. –$500 0 $500 Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-2B (CONTINUED) (b) CORSO CARE CORP. Income Statement Month Ended September 30, 2018 Service revenue Expenses Rent expense Salaries expense Advertising expense Utilities expense Total expenses Income before income tax Income tax expense Net income Revenues $5,000 $1,200 750 300 175 0 2,425 2,575 350 $2,225 [Revenues – Expenses = Net income or (loss)] CORSO CARE CORP. Statement of Changes in Equity Month Ended September 30, 2018 Common Shares Balance, September 1 Issued common shares Net income Dividends declared Balance, September 30 $2,500 2,300 0 $4,800 Retained Earnings $7,450 2,225 (500) $9,175 Total Equity $ 9,950 2,300 2,225 (500) $13,975 Solutions Manual 3-96 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-2B (CONTINUED) (b) (continued) CORSO CARE CORP. Statement of Financial Position September 30, 2018 Assets Current assets Cash Accounts receivable Supplies Total current assets Property, plant, and equipment Equipment Total assets $6,750 2,350 350 $ 9,450 8,550 $18,000 Liabilities and Shareholders' Equity Current liabilities Accounts payable Bank loan payable Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders' equity $1,525 2,500 $ 4,025 $4,800 9,175 13,975 $18,000 (Assets = Liabilities + Shareholders’ equity) LO 1 BT: AN Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-97 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-3B (a) Transaction Account Debited (1) (2) Specific Basic Type Account (3) (1) Effect Basic Type Account Credited (2) Specific Account (3) Effect Mar. 1 Shareholders’ equity Rent Expense Increase Assets Cash Decrease Mar. 3 Assets Accounts Receivable Increase Shareholders’ equity Service Revenue Increase Mar. 5 Assets Cash Increase Shareholders’ equity Sales Increase Mar. 8 Assets Equipment Increase Liabilities Bank Loan Payable Cash Increase Assets Decrease Mar. 12 Assets Cash Increase Assets Accounts Receivable Decrease Mar. 15 Shareholders’ equity Salaries Expense Increase Assets Cash Decrease Mar. 16 Assets Supplies Increase Liabilities Accounts Payable Increase PROBLEM 3-3B (CONTINUED) (a) (continued) Account Debited Account Credited Solutions Manual 3-98 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley (1) Transaction Basic Type (2) Specific Account Financial Accounting, Seventh Canadian Edition (3) (1) Basic Type (2) Specific Account Effect (3) Effect Mar. 20 Shareholders’ equity Repairs and Maintenance Expense Increase Assets Cash Decrease Mar. 22 Assets Accounts Receivable Increase Shareholders’ equity Sales Increase Mar. 26 Liabilities Bank Loan Payable Decrease Assets Cash Decrease Mar. 28 Assets Cash Increase Liabilities Unearned Revenue Increase Mar. 31 Shareholders’ equity Dividends Declared Increase Assets Cash Decrease Solutions Manual 3-99 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-3B (CONTINUED) (b) Normal Balance debit Date Mar. 1 Account Rent Expense Mar. 3, 12, 22 Accounts Receivable debit Mar. 3 Service Revenue credit Mar. 1, 5, 8, 12, 15, 20, 26, 28, 31 Cash debit Mar. 5, 22 Sales credit Mar. 8 Equipment debit Mar. 8, 26 Bank Loan Payable credit Mar. 15 Salaries Expense debit Mar. 16 Accounts Payable credit Mar. 16 Supplies debit Mar. 20 Repairs and Maintenance Expense debit Mar. 28 Unearned Revenue credit Mar. 31 Dividends Declared debit LO 2 BT: AP Difficulty: M Time: 40 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-100 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-4B (a) Account Accounts payable Accounts receivable Bank loans payable (short-term) Cash Common shares, beginning of year Dividends declared Furniture, fixtures, and production equipment Income taxes expense Income taxes receivable Interest expense Inventories Prepaid expenses Retained earnings, beginning of year Sales Selling, general, and administrative expenses (1) Increases with Credit Debit Credit Debit Credit Debit Debit Debit Debit Debit Debit Debit Credit Credit Debit (2) Normal Balance Credit Debit Credit Debit Credit Debit Debit Debit Debit Debit Debit Debit Credit Credit Debit Solutions Manual 3-101 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-4B (CONTINUED) (b) Account Accounts payable Accounts receivable Bank loans payable (short-term) Cash Common shares, beginning of year Dividends declared Furniture, fixtures, and production equipment Income taxes expense Income taxes receivable Interest expense Inventories Prepaid expenses Retained earnings, beginning of year Sales Selling, general, and administrative expenses Financial Statement Statement of Financial Position Statement of Financial Position Statement of Financial Position Statement of Financial Position Statement of Changes in Equity Statement of Changes in Equity Statement of Financial Position Income Statement Statement of Financial Position Income Statement Statement of Financial Position Statement of Financial Position Statement of Changes in Equity Income Statement Income Statement Note: Beginning-of-the-year equity amounts such as opening common shares or opening retained earnings balances are shown on the statement of changes in equity and do not appear on the statement of financial position as only endof-year amounts for equity accounts would appear on that statement. (c) Account Accounts payable Accounts receivable Bank loans payable (short-term) Cash Furniture, fixtures, and production equipment Income taxes receivable Inventories Prepaid expenses Classification Current liabilities Current assets Current liabilities Current assets Non-current assets Current assets Current assets Current assets LO 2 BT: K Difficulty: S Time: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 3-102 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5B (a) Transaction 1 Jan. 2: Issued $5,000 of common shares for cash. (1) Basic Analysis The asset account Cash is increased by $5,000; the shareholders’ equity account Common Shares account is increased by $5,000. (2) Equation Analysis Assets = Liabilities + Cash +$5,000 Shareholders’ Equity Common Shares +$5,000 (3) Debit−Credit Analysis Debits increase assets: debit Cash $5,000. Credits increase share capital: credit Common Shares $5,000. Transaction 2 Jan. 5: Provided services on account $2,500. (1) Basic Analysis The asset account Accounts Receivable is increased by $2,500; the revenue account Service Revenue is increased by $2,500. (2) Equation Analysis Assets Accounts Receivable +$2,500 (3) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Service Revenue +$2,500 Debits increase assets: debit Accounts Receivable $2,500. Credits increase revenues: credit Service Revenue $2,500. Solutions Manual 3-103 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5B (CONTINUED) (a) (continued) Transaction 3 Jan. 6: Obtained a bank loan for $30,000. (1) Basic Analysis The asset account Cash is increased by $30,000; the liability account Bank Loan Payable is increased by $30,000. (2) Equation Analysis Assets = Liabilities Shareholders’ Equity + Bank Loan Payable +$30,000 Cash +$30,000 (3) Debit−Credit Analysis Debits increase assets: debit Cash $30,000. Credits increase liabilities: credit Bank Loan Payable $30,000. Transaction 4 Jan. 7: Paid $40,000 to purchase a hybrid car. (1) Basic Analysis The asset account Vehicles is increased by $40,000; the asset account Cash is decreased by $40,000. (2) Equation Analysis Assets = Liabilities + Shareholders’ Equity Cash -$40,000 Vehicles +$40,000 (3) Debit−Credit Analysis Debits increase assets: debit Vehicles $40,000. Credits decrease assets: credit Cash $40,000. Solutions Manual 3-104 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5B (CONTINUED) (a) (continued) Transaction 5 Jan. 9: Received a $5,000 deposit from a customer for services to be performed in the future. (1) Basic Analysis The asset account Cash is increased by $5,000; the liability account Unearned Revenue is increased by $5,000. (2) Equation Analysis Assets = Liabilities + Shareholders’ Equity Unearned Revenue +$5,000 Cash +$5,000 (3) Debit−Credit Analysis Debits increase assets: debit Cash $5,000. Credits increase liabilities: credit Unearned Revenue $5,000. Transaction 6 Jan. 12: Billed customers $20,000 for services performed during the month. (1) Basic Analysis The asset account Accounts Receivable is increased by $20,000; the revenue account Service Revenue is increased by $20,000. (2) Equation Analysis Assets Accounts Receivable +$20,000 (3) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Service Revenue +$20,000 Debits increase assets: debit Accounts Receivable $20,000. Credits increase revenues: credit Service Revenue $20,000. Solutions Manual 3-105 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5B (CONTINUED) (a) (continued) Transaction 7 Jan. 19: Paid $500 to purchase supplies. (1) Basic Analysis The asset account Supplies is increased by $500; the asset account Cash is decreased by $500. (2) Equation Analysis Assets = Liabilities + Shareholders’ Equity Cash -$500 Supplies +$500 (3) Debit−Credit Analysis Debits increase assets: debit Supplies $500. Credits decrease assets: credit Cash $500. Transaction 8 Jan 20: Provided $1,500 of services for the customer who paid in advance on January 9. (1) Basic Analysis The liability account Unearned Revenue decreased by $1,500; the revenue account Service Revenue is increased by $1,500. (2) Equation Analysis Assets = Liabilities Unearned Revenue -$1,500 (3) Debit−Credit Analysis + Shareholders’ Equity Service Revenue +$1,500 Debits decrease liabilities: debit Unearned Revenue $1,500. Credits increase revenues: credit Service Revenue $1,500. Solutions Manual 3-106 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5B (CONTINUED) (a) (continued) Transaction 9 Jan. 23: Collected $5,000 owing from customers from the January 12 transaction. (1) Basic Analysis The asset account Cash is increased by $5,000; the asset account Accounts Receivable is decreased by $5,000. (2) Equation Analysis Assets = Liabilities + Shareholders’ Equity Cash +$5,000 Accounts Receivable -$5,000 (3) Debit−Credit Analysis Debits increase assets: debit Cash $5,000. Credits decrease assets: credit Accounts Receivable $5,000. Transaction 10 Jan 26: Received a bill for utilities of $125, due February 26. (1) Basic Analysis The expense account Utilities Expense is increased by $125; the liability account Accounts Payable is increased by $125. (2) Equation Analysis Assets = Liabilities Accounts Payable +$125 (3) Debit−Credit Analysis + Shareholders’ Equity Utilities Expense -$125 Debits increase expenses: debit Utilities Expense $125. Credits increase liabilities: credit Accounts Payable $125. Solutions Manual 3-107 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5B (CONTINUED) (a) (continued) Transaction 11 Jan. 29: Paid rent for the month, $1,500. (1) Basic Analysis The expense account Rent Expense is increased by $1,500; the asset account Cash is decreased by $1,500. (2) Equation Analysis Assets = Liabilities + Cash -$1,500 Shareholders’ Equity Rent Expense -$1,500 (3) Debit−Credit Analysis Debits increase expenses: debit Rent Expense $1,500. Credits decrease assets: credit Cash $1,500. Transaction 12 Jan. 31: Paid $4,000 of salaries to employees. (1) Basic Analysis The expense account Salaries Expense is increased by $4,000; the asset account Cash is decreased by $4,000. (2) Equation Analysis Assets Cash -$4,000 (3) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Salaries Expense -$4,000 Debits increase expenses: debit Salaries Expense $4,000. Credits decrease assets: credit Cash $4,000. Solutions Manual 3-108 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5B (CONTINUED) (a) (continued) Transaction 13 Jan 31: Paid interest of $300 on the bank loan from the January 6 transaction. (1) Basic Analysis The expense account Interest Expense is increased by $300; the asset account Cash is decreased by $300. (2) Equation Analysis Assets = Liabilities + Cash -$300 Shareholders’ Equity Interest Expense -$300 (3) Debit−Credit Analysis Debits increase expenses: debit Interest Expense $300. Credits decrease assets: credit Cash $300. Transaction14 Jan. 31: Paid income tax for the month, $3,600. (1) Basic Analysis The expense account Income Tax Expense is increased by $3,600; the asset account Cash is decreased by $3,600. (2) Equation Analysis Assets Cash -$3,600 (3) Debit−Credit Analysis = Liabilities + Shareholders’ Equity Income Tax Expense -$3,600 Debits increase expenses: debit Income Tax Expense $3,600. Credits decrease assets: credit Cash $3,600. Solutions Manual 3-109 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5B (CONTINUED) (b) Jan. 2 Cash ................................................................ Common Shares ...................................... 5,000 5,000 5 Accounts Receivable ....................................... Service Revenue ...................................... 2,500 6 Cash ................................................................ Bank Loan Payable .................................. 30,000 7 Vehicles ........................................................... Cash ......................................................... 40,000 9 Cash ................................................................ Unearned Revenue .................................. 5,000 12 Accounts Receivable ....................................... Service Revenue ...................................... 20,000 19 Supplies .......................................................... Cash ......................................................... 500 20 Unearned Revenue ......................................... Service Revenue ...................................... 1,500 23 Cash ................................................................ Accounts Receivable ................................ 5,000 26 Utilities Expense .............................................. Accounts Payable .................................... 125 29 Rent Expense .................................................. Cash ......................................................... 1,500 2,500 30,000 40,000 5,000 20,000 500 1,500 5,000 125 1,500 Solutions Manual 3-110 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-5B (CONTINUED) (b) (continued) Jan. 31 Salaries Expense ............................................ Cash ......................................................... 4,000 31 Interest Expense ............................................. Cash ......................................................... 300 31 Income Tax Expense ....................................... Cash ......................................................... 03,600 4,000 300 3,600 LO 1,2,3 BT: AN Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-111 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-6B Apr. 1 Cash ...................................................................... Common Shares ............................................ 100,000 3 Land ...................................................................... Buildings ................................................................ Equipment ............................................................. Cash ............................................................... Bank Loan Payable ........................................ 204,000 121,000 45,000 8 Advertising Expense .............................................. Accounts Payable .......................................... 1,800 10 Salaries Expense .................................................. Cash ............................................................... 2,800 100,000 60,000 310,000 1,800 2,800 13 No entry as the accounting equation is not affected. 14 Prepaid Insurance ................................................ Cash .............................................................. 5,500 17 Dividends Declared .............................................. Cash .............................................................. 600 20 Cash ..................................................................... Fees Earned.................................................. 10,600 30 Accounts Payable................................................. Cash .............................................................. 1,800 30 Interest Expense .................................................. Cash .............................................................. 2,000 5,500 600 10,600 1,800 2,000 Solutions Manual 3-112 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-6B (CONTINUED) Apr. 30 Income Tax Expense ............................................ Cash .............................................................. 800 800 (Each journal entry must balance and reflect the actual amount of the transaction) LO 3 BT: AP Difficulty: M Time: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-113 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-7B (a) May 1 Cash ........................................................................... 20,000 Common Shares .................................................. 1 Rent Expense ............................................................. Cash .................................................................... 20,000 950 950 4 No entry. Not an accounting transaction. 4 Supplies .............................................................. Accounts Payable ........................................ 750 11 Accounts Receivable .......................................... Service Revenue ......................................... 2,725 12 Cash ................................................................... Unearned Revenue...................................... 3,500 15 Cash ................................................................... Service Revenue ......................................... 2,350 20 Cash ................................................................... Accounts Receivable ................................... 1,725 22 Accounts Payable ($750 × 1/3) ........................... Cash ............................................................ 250 25 Utilities Expense ................................................. Accounts Payable ........................................ 275 29 Salaries Expense ................................................ Cash ............................................................ 2,000 750 2,725 3,500 2,350 1,725 , 250 275 2,000 Solutions Manual 3-114 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-7B (CONTINUED) (a) (continued) May 29 29 Income Tax Expense .......................................... Cash ............................................................ 300 Dividends Declared ............................................. Cash ............................................................ 250 300 250 Solutions Manual 3-115 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-7B (CONTINUED) (b) May 1 12 15 20 Bal. Cash 20,000May 1 3,500 22 2,350 29 1,725 29 29 23,825 Accounts Receivable May 11 2,725May 20 Bal. 1,000 May 4 May 22 950 250 2,000 300 250 Unearned Revenue May 12 May 29 750 275 775 May 29 Salaries Expense 2,000 May 1 Rent Expense 950 May 25 Utilities Expense 275 May 29 Income Tax Expense 300 3,500 20,000 Dividends Declared 250 Service Revenue May 11 15 Bal. 1,725 Supplies 750 Accounts Payable 250May 4 25 Bal. Common Shares May 1 2,725 2,350 5,075 Solutions Manual 3-116 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-7B (CONTINUED) (c) This suggestion is a good idea. Most companies use computerized accounting systems, which speed up the process of recording in the journals and subsequently use summarized transactions that are posted to the general ledger. Systems such as these can reduce errors (from posting or calculations) and provide timely information for decision-making. However, computerized accounting systems cannot eliminate human errors nor can they perform the analysis of transactions needed as a first step before entries can be recorded in the accounting system. This aspect of the cycle needs to be performed by a person who can interpret the information and decide which accounts are affected. LO 3,4 BT: AP Difficulty: M Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-117 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-8B (a) Apr. 2 Rent Expense ............................................................. Cash .................................................................... 800 3 Advertising Expense ................................................... Cash .................................................................... 620 800 620 5 No entry, not a transaction. 6 No entry, not a transaction. 15 Cash ........................................................................... Fees Earned ........................................................ 1,950 16 Mortgage Payable....................................................... Interest Expense ......................................................... Cash .................................................................... 2,000 850 17 Accounts Payable ....................................................... Cash .................................................................... 2,800 19 Rent Expense ............................................................. Accounts Payable ................................................ 750 20 Prepaid Rent ............................................................... Cash .................................................................... 700 26 Salaries Expense ........................................................ Cash .................................................................... 2,900 27 Income Tax Expense .................................................. Cash .................................................................... 1,000 1,950 2,850 2,800 750 700 2,900 1,000 Solutions Manual 3-118 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-8B (CONTINUED) (a) (continued) Apr. 30 Cash ........................................................................... Accounts Receivable .................................................. Concession Revenue (20% × $5,600) ................. 560 560 30 Cash ........................................................................... Fees Earned ........................................................ 7,300 1,120 7,300 Solutions Manual 3-119 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-8B (CONTINUED) (b) Cash Mar. 31 Bal. 6,000 Apr. 2 Apr. 15 1,950 Apr. 3 Apr. 30 560 Apr. 16 Apr. 30 7,300 Apr. 17 Apr. 20 Apr. 26 Apr. 27 Bal. 4,140 Apr. 30 Accounts Receivable 560 Apr. 20 Prepaid Rent 700 Land Mar. 31 Bal. 100,000 Equipment Mar. 31 Bal. 25,000 Apr. 17 Apr. 16 Retained Earnings Mar. 31 Bal.31,000 Apr. 26 Buildings Mar. 31 Bal. 80,000 Accounts Payable Mar. 31 Bal. 2,800 Apr. 19 Bal. Common Shares Mar. 31 Bal. 50,000 800 620 2,850 2,800 700 2,900 1,000 5,000 750 2,950 Mortgage Payable 2,000 Mar. 31 Bal. 125,000 Bal. 123,000 Fees Earned Apr. 15 Apr. 30 Bal. 1,950 7,300 9,250 Concession Revenue Apr. 30 1,120 Salaries Expense 2,900 Apr. 2 Apr. 19 Bal. Rent Expense 800 750 1,550 Apr. 3 Advertising Expense 620 Apr. 16 Interest Expense 850 Apr. 27 Income Tax Expense 1,000 Solutions Manual 3-120 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-8B (CONTINUED) (c) LAKE THEATRE INC. Trial Balance April 30, 2018 Debit Cash Accounts receivable Prepaid rent Land Buildings Equipment Accounts payable Mortgage payable Common shares Retained earnings Fees earned Concession revenue Salaries expense Rent expense Advertising expense Interest expense Income tax expense Totals Credit $ 4,140 560 700 100,000 80,000 25,000 $ 2,950 123,000 50,000 31,000 9,250 1,120 2,900 1,550 620 850 1,000 $217,320 0000 000 $217,320 (Liability, common shares, retained earnings, and revenue (fees earned and concession revenue) accounts have credit balances) LO 3,4,5 BT: AP Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-121 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-9B (a) Apr. 2 Rent Expense .............................................................. 5,000 Cash ..................................................................... 5,000 4 No entry. Not a transaction. 6 Advertising Expense .................................................... Cash ..................................................................... 500 9 Accounts Payable ........................................................ Cash ..................................................................... 300 500 300 13 Salaries Expense ........................................................ 1,000 Cash ..................................................................... 1,000 16 Rent Expense .............................................................. 5,000 Cash ..................................................................... 5,000 18 Utilities Expense .......................................................... Accounts Payable................................................. 100 19 Supplies Expense ........................................................ Cash ..................................................................... 200 100 200 24 Cash ............................................................................ 2,200 Unearned Revenue .............................................. 25 Income Tax Expense ................................................... Cash ..................................................................... 880 27 Advertising Expense .................................................... Cash ..................................................................... 300 2,200 880 300 Solutions Manual 3-122 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-9B (CONTINUED) (a) (continued) Apr. 30 Salaries Expense ........................................................ 1,000 Cash ..................................................................... 1,000 30 Unearned Revenue ..................................................... 17,500 Fees Earned ......................................................... 17,500 Solutions Manual 3-123 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-9B (CONTINUED) (b) Cash Mar. 31 Bal. 23,000 Apr. 2 Apr. 24 2,200 Apr. 6 Apr. 9 Apr. 13 Apr. 16 Apr. 19 Apr. 25 Apr. 27 Apr. 30 Bal. 11,020 5,000 500 300 1,000 5,000 200 880 300 1,000 Equipment Mar. 31 Bal. 2,000 Apr. 9 Apr. 30 Accounts Payable Mar. 31 Bal. 300 Apr. 18 Bal. 500 100 300 Unearned Revenue Mar. 31 Bal. 17,500 17,500 Apr. 24 2,200 Bal. 2,200 Common Shares Mar. 31 Bal. 1,000 Retained Earnings Mar. 31 Bal. 6,000 Fees Earned Apr. 30 Apr. 2 Apr. 16 Bal. 17,500 Rent Expense 5,000 5,000 10,000 Apr. 13 Apr. 30 Bal. Salaries Expense 1,000 1,000 2,000 Apr. 6 27 Bal. Advertising Expense 500 300 800 Apr. 19 Supplies Expense 200 Apr. 18 Utilities Expense 100 Apr. 25 Income Tax Expense 880 Solutions Manual 3-124 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-9B (CONTINUED) (c) KG SKATING SCHOOL INC. Trial Balance April 30, 2018 Debit Cash Equipment Accounts payable Unearned revenue Common shares Retained earnings Fees earned Rent expense Salaries expense Advertising expense Supplies expense Utilities expense Income tax expense Totals Credit $11,020 2,000 $ 300 2,200 1,000 6,000 17,500 10,000 2,000 800 200 100 880 $27,000 _ $27,000 (Asset and expenses accounts have debit balances) LO 3,4,5 BT: AP Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-125 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-10B (a) ASIAN IMPORTERS LIMITED Trial Balance January 31, 2018 (thousands) Debit Cash Accounts receivable Inventory Prepaid insurance Land Buildings Accumulated depreciation—buildings Equipment Accumulated depreciation—equipment Goodwill Accounts payable Other current liabilities Bank loan payable (due 2021) Mortgage payable Common shares Retained earnings Dividends declared Sales Cost of goods sold Office expense Interest expense Income tax expense Totals Credit $ 10,000 30,200 74,250 3,950 42,500 39,500 $ 13,000 10,900 3,600 7,600 46,300 12,200 10,050 19,750 32,900 37,050 1,850 370,000 244,200 67,750 2,150 10,000 $544,850 00000 0 $544,850 (Asset, dividends declared, and expense accounts have debit balances. Liability, common shares, retained earnings, and revenue (sales) accounts have credit balances) Solutions Manual 3-126 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-10B (CONTINUED) (b) The following are some steps to help find the error(s) in a trial balance: 1. 2. 3. 4. If the error (difference between the debit and credit totals) is an amount such as $1, $100, or $1,000, re-add the trial balance columns and recalculate the account balances. If the error can be evenly divided by two, scan the trial balance to see if a balance equal to half the error has been entered in the wrong column. If the error can be evenly divided by nine, retrace the account balances on the trial balance to see whether they have been incorrectly copied from the ledger. For example, if a balance was $12 but was listed as $21, a $9 error has been made. Reversing the order of numbers is called a transposition error. A slide, which is adding or deducting one or several zeros in a figure, has the same effect. If the error cannot be evenly divided by two or nine, scan the ledger to see whether an account balance in the amount of the error has been omitted from the trial balance. Scan the journal to see whether a posting in the amount of the error has been omitted. When all else fails, all of the transactions should be carefully traced through the process again. LO 5 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-127 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-11B ASIAN IMPORTERS LIMITED Income Statement Year Ended January 31, 2018 (thousands) Revenues Sales Expenses Cost of goods sold Office expense Interest expense Total expenses Income before income tax Income tax expense Net income $370,000 $244,200 67,750 2,150 314,100 55,900 10,000 $ 45,900 ASIAN IMPORTERS LIMITED Statement of Changes in Equity Year Ended January 31, 2018 Common Shares Balance, February 1, 2017 Issued common shares Net income Dividends declared Balance, January 31, 2018 $20,000 12,900 000 000 $32,900 Retained Earnings $37,050 45,900 (1,850) $81,100 Total Equity $ 57,050 12,900 45,900 (1,850) $114,000 Solutions Manual 3-128 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-11B (CONTINUED) ASIAN IMPORTERS LIMITED Statement of Financial Position January 31, 2018 (thousands) Assets Current assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Land Buildings Less: Accumulated depreciation Equipment Less: Accumulated depreciation Goodwill Total assets $10,000 30,200 74,250 3,950 $118,400 $42,500 $39,500 13,000 $10,900 3,600 26,500 7,300 76,300 7,600 $202,300 Solutions Manual 3-129 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-11B (CONTINUED) (a) (continued) Liabilities and Shareholders' Equity Liabilities Current liabilities Accounts payable Current portion of mortgage payable Other current liabilities Total current liabilities Non-current liabilities Mortgage payable ($19,750 − $6,300) Bank loan payable Total non-current liabilities Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders’ equity $ 46,300 6,300 12,200 64,800 $13,450 10,050 23,500 88,300 $32,900 81,100 114,000 $202,300 [Ending retained earnings = Beginning retained earnings ± Net income or (loss) – dividends declared] LO 5 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-130 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-12B (a) (1) General: Eight accounts are listed in the wrong columns: Accumulated depreciation (credit), Accounts payable (credit), Common Shares (credit), and all five expense accounts (debit). (2) 1. Each of the Prepaid Insurance, Accounts Payable, and Income Tax Expense accounts are understated by $100. Note also that the last two accounts—Accounts Payable and Income Tax Expense—are also listed in the wrong debit/credit column as described above in (1). Before these errors were identified, the Prepaid Insurance account was missing and each of the Accounts Payable and Income Tax Expense accounts were in debit and credit columns, respectively, and each understated $100 so one of the reasons the trial balance did not balance was because the Prepaid Insurance account had been omitted. 2. The trial balance is out of balance by $270 ($14,529 – $14,259) because of the transposition error. Service Revenue is overstated by $270, as is the total for the credit column. 3. The trial balance is not out of balance because of this recording error. The Salaries Expense account is overstated by $750 and the Dividends Declared account understated by the same amount. The Dividends Declared account is not included in the incorrect trial balance, so it needs to be included. 4. The trial balance is out of balance because of this recording error. The total for the debit column is lower by $120 (because the Cash account is understated) and the credit column is lower by $120 (because the Accounts Payable account is understated). Recall that the Accounts Payable account is one of the accounts listed in the wrong column (debit instead of credit). Solutions Manual 3-131 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-12B (CONTINUED) (a) (continued) 5. The trial balance is not out of balance because of this omission; only the accounts and amounts appearing on the trial balance are affected. The Equipment and Bank Loan Payable accounts are each understated by $2,000. Solutions Manual 3-132 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 3-12B (CONTINUED) (b) MESSED UP LTD. Trial Balance May 31, 2018 Debit Cash ($2,997 + $120) Accounts receivable Prepaid insurance (+$100) Equipment ($9,200 + $2,000) Accumulated depreciation—equipment Accounts payable ($4,600 + $100 + $120) Bank loan payable (+$2,000) Common shares Dividends declared (+$750) Service revenue ($14,529 –$14,529 + $14,259) Salaries expense ($8,150 – $750) Advertising expense Depreciation expense Insurance expense Income tax expense ($400 + $100) Totals Credit $ 3,117 2,630 100 11,200 $ 4,200 4,820 2,000 4,250 750 14,259 7,400 1,132 2,100 600 500 $29,529 0 $29,529 (Asset, dividends declared, and expense accounts have debit balances) LO 5 BT: AN Difficulty: C Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-133 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-1 ACCOUNTING CYCLE REVIEW (a) Date Account Titles Ref. Debit Credit Jan. 2 Cash ....................................................................................................................... 100 65,000 Common Shares (1,000 × $65) ...................................................................... 400 65,000 4 Rent Expense ......................................................................................................... 740 3,000 Cash............................................................................................................... 100 3,000 5 Equipment .............................................................................................................. 200 40,000 Cash............................................................................................................... 100 10,000 Bank Loan Payable ........................................................................................ 310 30,000 8 Advertising Expense ............................................................................................... 700 500 Cash............................................................................................................... 100 500 10 Supplies .................................................................................................................. 120 1,000 Accounts Payable .......................................................................................... 300 1,000 11 Advertising Expense ............................................................................................... 700 3,000 Cash............................................................................................................... 100 3,000 12 Salaries Expense .................................................................................................... 710 7,500 Cash............................................................................................................... 100 7,500 15 Accounts Receivable ............................................................................................. 110 15,000 Service Revenue ............................................................................................ 500 15,000 17 Office Expense ...................................................................................................... 730 1,000 Cash ............................................................................................................... 100 1,000 19 Prepaid Insurance .................................................................................................. 130 6,000 Cash ............................................................................................................... 100 6,000 Solutions Manual 3-134 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-1 (CONTINUED) (a) (continued) Date Account Titles Ref. Debit Credit Jan. 24 Cash ...................................................................................................................... 100 10,000 Accounts Receivable ...................................................................................... 110 10,000 25 Dividends Declared ................................................................................................ 490 500 Cash ............................................................................................................... 100 500 26 Salaries Expense .................................................................................................... 710 7,500 Cash ............................................................................................................... 100 7,500 29 Accounts Receivable ............................................................................................... 110 18,000 Service Revenue ............................................................................................ 500 18,000 30 Interest Expense ..................................................................................................... 720 200 Bank Loan Payable ................................................................................................. 310 700 Cash ............................................................................................................... 100 900 31 Income Tax Expense............................................................................................... 900 1,500 Cash ............................................................................................................... 100 1,500 Solutions Manual 3-135 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-1 (CONTINUED) (b) Jan. Cash 65,000 Jan. 10,000 2 24 4 5 8 11 12 17 19 25 26 30 31 Jan. 31 Bal. #100 3,000 10,000 500 3,000 7,500 1,000 6,000 500 7,500 900 1,500 33,600 Accounts Receivable #110 Jan. 15 15,000 Jan. 24 10,000 29 18,000 Jan. 31 Bal. 23,000 Jan. 10 Jan. 19 Jan. 5 Jan. 30 Supplies 1,000 Prepaid Insurance 6,000 Equipment 40,000 #120 Common Shares Jan. 2 Jan. 25 Jan. 8 11 Jan. 31 Bank Loan Payable 700 Jan. 5 Jan 31 Bal. #310 30,000 29,300 Advertising Exepense 500 3,500 Bal. 3,500 Salaries Expense Jan. 12 7,500 26 7,500 Jan. 31 Bal. 15,000 #490 #700 #710 Interest Expense 200 #720 Jan. 30 #730 Jan. 17 Office Expense 1,000 #740 Jan. 4 Rent Expense 3,000 #900 Jan. 31 Income Tax Expense 1,500 #200 $300 1,000 Dividends Declared 500 Service Revenue #500 Jan. 15 15,000 29 18,000 Jan. 31 Bal. 33,000 #130 Accounts Payable Jan. 10 #400 65,000 Solutions Manual 3-136 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-1 (CONTINUED) (c) 100 110 120 130 200 300 310 400 490 500 700 710 720 730 740 900 SOFTWARE ADVISORS LIMITED Trial Balance January 31, 2018 Cash Accounts receivable Supplies Prepaid insurance Equipment Accounts payable Bank loan payable Common shares Dividends declared Service revenue Advertising expense Salaries expense Interest expense Office expense Rent expense Income tax expense Debit $ 33,600 23,000 1,000 6,000 40,000 Credit $ 1,000 29,300 65,000 500 33,000 3,500 15,000 200 1,000 3,000 1,500 $128,300 0 $128,300 (Asset, dividends declared, and expense accounts have debit balances) Solutions Manual 3-137 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-1 (CONTINUED) (d) (1) SOFTWARE ADVISORS LIMITED Income Statement Month Ended January 31, 2018 Revenues Service revenue Expenses Salaries expense Advertising expense Rent expense Office expense Interest expense Total expenses Income before income tax Income tax expense Net income $33,000 $15,000 3,500 3,000 1,000 200 22,700 10,300 1,500 $ 8,800 (d) (2) SOFTWARE ADVISORS LIMITED Statement of Changes in Equity Month Ended January 31, 2018 Balance, January 1 Issued common shares Net Income Dividends declared Balance, January 31 Common Shares $ 0 65,000 0 $65,000 Retained Earnings $ 0 8,800 (500) $8,300 Total Equity $ 0 65,000 8,800 (500) $73,300 Solutions Manual 3-138 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-1 (CONTINUED) (d) (3) SOFTWARE ADVISORS LIMITED Statement of Financial Position January 31, 2018 Assets Current assets Cash Accounts receivable Supplies Prepaid insurance Property, plant, and equipment Equipment Total assets $33,600 23,000 1,000 6,000 $63,600 40,000 $103,600 Liabilities and Shareholders’ Equity Current liabilities Accounts payable Non-current liabilities Bank loan payable Total liabilities Shareholders’ equity Common shares Retained earnings Total liabilities and shareholders’ equity $ 1,000 29,300 30,300 $65,000 8,300 73,300 $103,600 [Ending retained earnings = Beginning retained earnings ± Net income or (loss) – dividends declared] LO 3,4,5 BT: AP Difficulty: M Time: 60 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-139 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-2 ACCOUNTING CYCLE REVIEW (a) Aug. 1 Advertising Expense ........................................ Cash ......................................................... 250 250 2 Unearned Revenue ......................................... Service Revenue ...................................... 1,260 3 Rent Expense .................................................. Cash ......................................................... 980 6 Cash ................................................................ Accounts Receivable ................................ 1,200 1,260 980 1,200 7 No entry, not a transaction 10 Salaries Payable ............................................. Salaries Expense ............................................ Cash ......................................................... 1,420 1,700 13 Cash ................................................................ Service Revenue ...................................... 2,800 15 Equipment ....................................................... Bank Loan Payable .................................. 2,000 20 Accounts Payable ............................................ Cash ......................................................... 2,000 22 Supplies .......................................................... Accounts Payable .................................... 800 3,120 2,800 2,000 2,000 800 Solutions Manual 3-140 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-2 (CONTINUED) (a) (continued) Aug. 24 Salaries Expense ............................................ Cash ......................................................... 2,900 27 Accounts Receivable ....................................... Service Revenue ..................................... 3,760 29 Cash ................................................................ Unearned Revenue.................................. 30 Bank Loan Payable ......................................... Interest Expense ............................................. Cash ......................................................... 780 31 Income Tax Expense ....................................... Cash ......................................................... 380 31 Dividends Declared ......................................... Cash ......................................................... 0400 2,900 3,760 780 500 50 550 380 400 Solutions Manual 3-141 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-2 (CONTINUED) (b) Aug. 31 Cash 8,040 Aug. 1 1,200 3 2,800 10 780 24 30 31 31 2,240 July 31 27 Aug. 31 Accounts Receivable 3,200 Aug. 6 3,960 Bal. 5,760 July 31 Aug. 22 Aug. 31 Supplies 1,030 800 Bal. 1,830 July 31 Aug. 15 Aug. 31 Equipment 10,000 2,000 Bal. 12,000 July 31 Aug. 6 13 29 250 980 3,120 2,900 550 380 400 Aug. 30 Aug. 10 Aug. 31 14,000 Dividends Declared 400 Service Revenue Aug. 2 1,260 Aug. 13 2,800 Aug. 27 3,760 Aug. 31 Bal. 7,820 Vehicles 25,000 Aug. 1 Aug. 3 Accounts Payable July 31 2,300 2,000 Aug. 22 800 Aug. 31 Bal. 1,100 Salaries Payable 1,420 July 31 Aug. 31 4,000 2,000 Bal. 5,500 Retained Earnings June 30 Bal.7,290 Accumulated Depreciation—Vehicles July 31 5,000 Aug. 20 Bank Loan Payable July 31 500 Aug. 15 Aug. 31 Common Shares July 31 1,200 Accumulated Depreciation—Equipment July 31 1,000 July 31 Aug. 2 Unearned Revenue July 31 1,260 1,260 Aug. 29 780 Aug. 29 Bal. 780 1,420 Bal. 0 Advertising Expense 250 Rent Expense 980 Aug. 10 24 Aug. 31 Salaries Expense 1,700 2,9000 4,600 Aug. 30 Interest Expense 50 Aug. 31 Income Tax Expense 380 Solutions Manual 3-142 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-2 (CONTINUED) (c) B&B REPAIR SERVICES LTD. Trial Balance August 31, 2018 Cash Accounts receivable Supplies Equipment Accumulated depreciation—equipment Vehicles Accumulated depreciation—vehicles Accounts payable Unearned revenue Bank loan payable Common shares Retained earnings Dividends declared Service revenue Advertising expense Rent expense Salaries expense Interest expense Income tax expense Debit $ 2,240 5,760 1,830 12,000 Credit $ 2,000 25,000 5,000 1,100 780 5,500 14,000 17,290 400 7,820 250 980 4,600 50 380 $53,490 $53,490 (Asset, dividends declared, and expense accounts have debit balances) Solutions Manual 3-143 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-2 (CONTINUED) (d) B&B REPAIR SERVICES LTD. Income Statement Month Ended August 31, 2018 Revenues Service revenue Expenses Salaries expense Rent expense Advertising expense Interest expense Total expenses Income before income tax Income tax expense Net income $7,820 $4,600 980 250 50 5,880 1,940 380 $1,560 B&B REPAIR SERVICES LTD. Statement of Changes in Equity Month Ended August 31, 2018 Common Shares Balance, July 31 Net income Dividends declared Balance, August 31 $14,000 0 $14,000 Retained Earnings $17,290 1,560 (400) $18,450 Total Equity $31,290 1,560 (400) $32,450 Solutions Manual 3-144 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-2 (CONTINUED) (d) (continued) B&B REPAIR SERVICES LTD. Statement of Financial Position August 31, 2018 Assets Current assets Cash Accounts receivable Supplies Property, plant, and equipment Equipment Accumulated depreciation—equipment Vehicles Accumulated depreciation—vehicles Total assets $2,240 5,760 1,830 $12,000 2,000 $25,000 5,000 $ 9,830 $10,000 20,000 30,000 $39,830 Liabilities and Shareholders’ Equity Current liabilities Accounts payable Unearned revenue Non-current liabilities Bank loan payable Total liabilities Shareholders’ equity Common shares Retained earnings Total liabilities and shareholders’ equity $1,100 780 $ 1,880 5,500 7,380 $14,000 18,450 32,450 $39,830 [Ending retained earnings = Beginning retained earnings ± Net income or (loss) – dividends declared] Solutions Manual 3-145 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR3-2 (CONTINUED) (e) Payments: Cash flow Aug. 1 3 $ 250 Advertising 980 Rent Operating Operating 10 3,120 Salaries Operating 20 2,000 On account to suppliers Operating 24 2,900 Salaries Operating 30 550 Loan principal $500 Loan interest $50 Financing Operating 31 380 Income tax Operating 31 400 Dividends declared and paid Financing Receipts: Aug. 6 13 29 1,200 On account from customers Operating 2,800 Revenue Operating 780 Unearned revenue Operating LO 3,4,5 BT: AP Difficulty: M Time: 70 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-146 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT3-1 (a) $793,795 = Total Liabilities + $436,183 + Shareholder's Equity $167,910 Share capital 156,664 Retained earnings Other equity items (contributed surplus $2,620 and accumulated other 33,038 comprehensive income $30,418) $357,612 Sobeys ($ in millions) Total Assets = $7,960.6 = (c) FINANCIAL REPORTING CASE North West ($ in thousands) Total Assets = (b) Financial Accounting, Seventh Canadian Edition Total Liabilities + $5,230.9 + Shareholder's Equity $ 2,752.9 Capital stock (172.1) Retained earnings (Deficit) Other equity items (contributed surplus $93, accumulated other comprehensive loss $3.2, and non-controlling interest 148.9 $59.1) $2,729.7 Sobeys has about 10 times the assets compared to North West ($7,960.6 million compared to $793.795 million). However, it also has 12 times the liabilities ($5,230.9 million compared to $436.183 million) which is why its shareholders’ equity is proportionately lower. Sobeys’s shareholders’ equity is less than 8 times the equity reported by North West ($2,729.7 million compared to $357.612 million). North West’s share capital comprises about 47% of its total shareholders’ equity whereas Sobeys’s is more than 100% of its total equity. Of course, this comparison is skewed because Sobeys reported a deficit (negative retained earnings) rather than a positive retained earnings for its latest fiscal year. LO 1 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-147 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT3-2 Financial Accounting, Seventh Canadian Edition FINANCIAL REPORTING CASE (a) Uber’s network of riders and drivers are resources available to the business but are not assets owned or controlled by the business. Nor can the company predict the future economic benefits to be contributed by a person or measure the “value” of a person. Consequently, people are not recorded in the accounting records. (b) Uber would likely report current assets such as cash, accounts receivable, and supplies. Its non-current assets likely consist of property, plant, and equipment such as office furniture and equipment and computer systems including hardware and software. It also would report intangible assets such as the software developed to run its ride-sharing app. In addition, this category would include technology the company purchased from Microsoft related to street imaging and 3-D views. (c) The valuation given by the market to Uber Technologies Inc. is not based on the assets on its statement of financial position but on investors’ perception of its ability to produce growth and income in the future. LO 1 BT: AN Difficulty: C Time: 15 min. AACSB: Analytic and Tech. CPA: cpa-t001 CM: Reporting Solutions Manual 3-148 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT3-3 Financial Accounting, Seventh Canadian Edition FINANCIAL ANALYSIS CASE (a) Assets Cash 1. 2. 3. 4. 5. 6. 7. 8. 9. Aug. 31 Bal. Accounts + Receivable = Prepaid + Rent Liabilities Income Accounts Tax = Payable + Payable + Retained Earnings + Unearned Revenue. +$10,000 +190,000 -45,500 -120,000 -32,400 +2,000 + Common Shares + Revenue - Expenses Div. - Declared +$10,000 +$229,400 -190,000 +$229,400 +$3,500 -$42,000 -120,000 -36,400 +$4,000 +$2,000 -1,000 00 0 000 00 000 0 00 00 +$6,200 0 00000 +$3,100 +$39,400 +$3,500 +$4,000 +$6,200 Total assets = $46,000 (b) Shareholders' Equity 0 0 0 00 0 0 0000 +$2,000 +$10,000 0 0 0000 -6,200 00 0000 -$1,000 +$229,400 -$204,600 -$1,000 Total liabilities ($12,200) + shareholders’ equity ($33,800) = $46,000 A spreadsheet can help, in a small business like Bob’s Repairs, to organize information. However, it lacks the date, specific account title for multiple expenses, and explanation for each entry that one would find in a traditional general journal. It could assist in posting, although again it lacks any cross-referencing to allow transactions to be traced back to the source, if required. Finally, use of a spreadsheet, while convenient for very small businesses, would limit growth in the number of accounts and transactions. Solutions Manual 3-149 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT3-3 (CONTINUED) (c) BOB'S REPAIRS LTD. Income Statement Year Ended August 31, 2018 Service revenue Expenses Salaries expense Rent expense Office expense Income before income tax Income tax expense Net income $229,400 $120,000 42,000 36,400 198,400 31,000 6,200 $ 24,800 [Revenues – Expenses = Net income or (loss)] BOB'S REPAIRS LTD. Statement of Changes in Equity Year Ended August 31, 2018 Balance, September 1 Issued common shares Net income Dividends declared Balance, August 31 Common Shares $ 0 10,000 00 0000 $10,000 Retained Earnings $ 0 24,800 (1,000) $23,800 Total Equity $ 0 10,000 24,800 (1,000) $33,800 Solutions Manual 3-150 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT3-3 (CONTINUED) (c) (continued) BOB'S REPAIRS LTD. Statement of Financial Position August 31, 2018 Current assets Cash Accounts receivable Prepaid rent Total assets Current liabilities Accounts payable Income tax payable Unearned revenue Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders’ equity Total liabilities and shareholders’ equity (d) $ 3,100 39,400 3,500 $46,000 $4,000 6,200 2,000 $12,200 $10,000 23,800 33,800 $46,000 Five of the cash transactions relate to operating activities: Cash collected from customers Payments to the landlord Salaries paid Payments for office expenses Customer advances Total effect on cash flow $190,000 (45,500) (120,000) (32,400) 2,000 $ (5,900) Solutions Manual 3-151 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT3-3 (CONTINUED) Uncle Bob would not be pleased to find out that operating cash flows were not positive. This can often happen during the first year that a company operates. The other two cash transactions not shown above are financing activities: the issue of common shares for $10,000 and the declaration and payment of dividends for $1,000. The net increase to cash of $9,000 allowed the company to have a positive cash balance $3,100 (−$5,900 + $9,000) at the end of the year. (e) The bank would want collateral for any loan given to the company. Usually such collateral consists of property, plant, or equipment and this company has none of these. It may be possible to secure a loan with accounts receivable but the company did not have this type of asset when it was first formed. (f) No, the company does not have enough cash to pay the income tax. The company would have to collect some accounts receivable if it hoped to pay the income tax. (g) The government levies income tax on corporations, which are considered legal entities, separate from their shareholders. Uncle Bob would pay income tax only on the dividends he received from the company. LO 3,4,5 BT: E Difficulty: M Time: 55 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-152 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT3-4 (a) Financial Accounting, Seventh Canadian Edition STUDENT VIEW CASE On September 1, 2018, my personal equity would be as follows: Cash ................................................ Cell phone ....................................... Total assets ..................................... Less: student loan ........................... Personal equity, Sept. 1, 2018 ........ (b) $21,000 200 21,200 (9,000) $12,200 Errors in the trial balance: • The cash amount should be the amount in the bank account at December 15. • The computer was recorded at $100 rather than the actual cost of $1,000. • The damage deposit of $400 for the residence has been omitted. • The travel costs are $450, not $540. Solutions Manual 3-153 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT3-4 (CONTINUED) (b) (continued) Personal Trial Balance December 15, 2018 Debit Cash ....................................................................... $ 7,400 Clothes ................................................................... 1,500 Cell phone .............................................................. 200 Computer ............................................................... 1,000 Damage deposit on residence ................................ 400 Student loan ........................................................... Personal equity ...................................................... Residence and meal plan fees ($1,100 per month) 4,400 Tuition for September to December ....................... 3,500 Textbooks .............................................................. 600 Personal costs (personal items, entertainment, eating out) 1,500 Cellphone costs ...................................................... 250 Travel to go home at Christmas ............................. 450 $21,200 Credit $ 9,000 12,200 ____ __ $21,200 (Total of debit account balances = Total of credit account balances) (c) Expenses Clothes..................................................................... Residence and meal plan fees ($1,100 per month) . Tuition for September to December ......................... Textbooks ............................................................... Personal costs (personal items, entertainment, eating out) Cellphone costs ....................................................... Travel to go home at Christmas ............................... Total expenses September to December ................. Personal equity, September 1 .................................. Total expenses......................................................... Personal equity, December 15 ................................. By December 31, 2018, the personal equity is nil. $ 1,500 4,400 3,500 600 1,500 250 450 $12,200 $12,200 (12,200) $ 0 Solutions Manual 3-154 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT3-4 (CONTINUED) (d) Balance of cash December 15, 2018 ....................... Assumed expenses for second term same as first... Shortfall in cash ....................................................... (e) Personal expenses in the first term are far too high. Some expenses that can be reduced in the second term include personal costs for entertainment and eating out. If half as much is spent in the second term, $750 can be saved. In addition, clothes expenses could be reduced to $300, saving another $1,200. Travel to go home can be eliminated. Finally, if the residence room is kept in good condition and with no damages, $400 for the damage deposit will be returned in cash. (f) $ 7,400 (12,200) $ 4,800 Personal expenses savings ..................................... Reduced clothing costs ............................................ Travel costs ............................................................. Return of residence damage deposit ....................... Additional cash made available ............................... $ 750 1,200 450 400 $2,800 Cash shortfall ........................................................... Additional cash from spending changes .................. Ask parents for extra cash ....................................... $4,800 2,800 $2,000 LO 5 BT: AN Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-155 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT3-5 Financial Accounting, Seventh Canadian Edition ETHICS CASE Note to instructors: All of the material supplementing this group activity, including a suggested solution, can be found in the Collaborative Learning section of the Instructor Resource site accompanying this textbook as well as in the Prepare and Present section of WileyPLUS. (a) Ron, here are some tips to help you find the $810 error in the trial balance assuming it is a single error: 1. 2. 3. 4. If the error is an amount such as $1, $100, or $1,000, re-add the trial balance columns and recalculate the account balances. This tip does not apply in this case because the difference between the debit and credit columns is $810. If the error can be evenly divided by two (which it can be in this case $810 ÷ 2 = $405), scan the trial balance to see if a balance equal to half the error has been entered in the wrong column. If the error can be evenly divided by nine (which it can be in this case $810 ÷ 9 = $90), retrace the account balances on the trial balance to see whether they have been incorrectly copied from the ledger. For example, if a balance was $12 but was listed as $21, a $9 error has been made. Reversing the order of numbers is called a transposition error. A slide, which is adding or deducting one or several zeros in a figure, has the same effect. If the error cannot be evenly divided by two or nine, scan the ledger to see whether an account balance in the amount of the error has been omitted from the trial balance. Scan the journal to see whether a posting in the amount of the error has been omitted. Note that these suggestions will not always work, especially if there is more than one error and sometimes, the only way to find an error is to retrace all of the work carefully. Solutions Manual 3-156 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT3-5 (CONTINUED) (b) The stakeholders in this situation are: Ron Hollister The other students in the group who will be graded for Ron’s work The other students in the class The professor The College or University attended by Ron Future employers of the graduates of the school (c) By adding $810 to the Salaries Expense account, the account total has been deliberately misstated. By not locating the error causing the imbalance, some other account or accounts may also be misstated by a net amount of $810. Ron did not advise his fellow team members of the action he has taken to avoid detection. While his motivation was most likely to meet the deadline for handing in the assignment, he also “hoped no one would notice the difference” so he made this change with deliberate intent. It was inappropriate not to offer the other group members an opportunity to find the error in one or more of their parts of the assignment, or to take action without advising them. The entire group will be affected by Ron’s actions and had no means of agreeing to the strategy taken to address the problem. As an aside, it is important for students to agree as a group on “behavioural norms” ahead of time to help reduce the likelihood of unintended consequences affecting one or more of the group. The adding of the $810 to the Salaries Expense account is not by itself unethical in a classroom situation but it does not adhere to the qualitative characteristic of faithful representation of the numbers. The professor would obviously catch this error and grade the assignment accordingly. However, Ron’s failure to inform other group members that he was changing amounts that they had prepared would be considered by many to be both inappropriate and unethical. Solutions Manual 3-157 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT3-5 (CONTINUED) (c) (continued) Although the assignment will not affect external users of a real financial report, it is important to understand that if this had been a real life situation, Ron’s actions—both the changing of an account balance and the failure to inform—would be considered to be unethical because financial information was intentionally altered and done deliberately to mislead users. [See also the answer to part (e).] While Ron is not likely in breach of any rule or directive issued by the school concerning academic integrity, the professor and the other group members will not agree with the strategy used by Ron. They will wonder if this is the type of action Ron would take while at a future job. Such actions would then affect others who are not part of the school community and the reputation of the school would be diminished. This in turn could affect society’s opinion of the past and future graduates of the school. (d) Ron's alternatives are: 1. Discuss the situation with the teammates and reach a consensus that it is better to miss the deadline but find the error causing the imbalance and suffer the corresponding penalty for submitting the assignment late. 2. Discuss the situation with teammates and reach a consensus to tell the professor of the imbalance and ask for an extension of time or suffer the consequences. 3. Discuss the situation with teammates and potentially get their assistance to locate the error causing the imbalance as a team effort so that the assignment can still submitted by the deadline. Solutions Manual 3-158 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT3-5 (CONTINUED) (c) (continued) (e) External users of the financial information prepared by Ron could potentially be affected by the errors that remain undetected. It is highly likely that another account may also be wrong on the financial statements. The consequences are more far reaching and so the behaviour is more serious. Deliberate deception for this purpose would be viewed as unethical. LO 5 BT: S Difficulty: M Time: 20 min. AACSB: Analytic and Ethics CPA: cpa-t001, cpa-e001 CM: Reporting and Ethics Solutions Manual 3-159 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT3-6 Financial Accounting, Seventh Canadian Edition SERIAL CASE (a) June 5 Supplies ........................................................................ 2,500 Accounts Payable .................................................... 2,500 14 Equipment..................................................................... 2,520 Cash ........................................................................ 2,520 16 Cash ............................................................................. 1,000 Unearned Revenue .................................................. 1,000 19 Cash .............................................................................300 Unearned Revenue .......................................................100 Sales ........................................................................ 400 21 Accounts Receivable .................................................... 2,040 Sales ........................................................................ 2,040 27 Utilities Expense ...........................................................200 Accounts Payable .................................................... 200 29 No entry, not a transaction 30 Salaries Expense .......................................................... 3,250 Cash ........................................................................ 3,250 30 Accounts Receivable .................................................... 2,550 Sales ........................................................................ 2,550 Solutions Manual 3-160 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT3-6 (CONTINUED) (b) June Bal. 16 19 Bal. Cash 39,004 June 1 1,000 30 300 34,534 42,520 3,250 Accounts Receivable June Bal. 5,900 21 2,040 30 2,550 Bal. 10,490 June Bal. 14 Bal. Equipment 42,000 2,520 44,520 Accumulated Depreciation—Equipment June Bal. 14,000 June Bal. Vehicles 52,500 Accounts Payable June Bal. 5 27 Bal. 3,540 2,500 200 6,240 Unearned Revenue 100 June Bal. 16 Bal. 100 1,000 1,000 Land June Bal. 100,000 Bank Loan Payable June Bal. 22,500 Buildings June Bal. 165,000 Mortgage Payable June Bal. 53,200 June Bal. Inventory 16,250 June Bal. 5 Bal. Supplies 1,875 2,500 4,375 June Bal. Prepaid Insurance 12,000 Accumulated Depreciation—Buildings June Bal. 137,500 June 19 Common Shares June Bal. 300 Solutions Manual 3-161 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT3-6 (CONTINUED) (b) (continued) Retained Earnings June Bal. 146,788 June Bal. Dividends Declared 30,000 Rent Revenue June Bal. Sales June Bal. 19 21 30 Bal. June Bal. Cost of Goods Sold 102,386 June Bal. 30 Bal. Salaries Expense 387,532 3,250 390,782 June Bal. Office Expense 18,000 June Bal. 27 Bal. Utilities Expense 12,000 200 12,200 6,000 633,768 400 2,040 2,550 638,758 Advertising Expense June Bal. 9,000 Property Tax Expense June Bal. 5,950 June Bal. Interest Expense 5,299 Income Tax Expense June Bal. 13,000 Solutions Manual 3-162 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT3-6 (CONTINUED) (c) ANTHONY BUSINESS COMPANY LTD. Trial Balance June 30, 2017 Cash.................................................................. Accounts receivable .......................................... Inventory ........................................................... Supplies ............................................................ Prepaid insurance ............................................. Land .................................................................. Buildings ........................................................... Accumulated depreciation—buildings ............... Equipment ......................................................... Accumulated depreciation—equipment............. Vehicles ............................................................ Accounts payable .............................................. Unearned revenue ............................................ Bank loan payable ............................................ Mortgage payable ............................................. Common shares................................................ Retained earnings ............................................. Dividends declared ........................................... Rent revenue .................................................... Sales ................................................................. Cost of goods sold ............................................ Salaries expense .............................................. Office expense .................................................. Utilities expense ................................................ Advertising expense .......................................... Property tax expense ........................................ Interest expense ............................................... Income tax expense .......................................... Totals ................................................................ Debit $ 34,534 10,490 16,250 4,375 12,000 100,000 165,000 Credit $ 137,500 44,520 14,000 52,500 6,240 1,000 22,500 53,200 300 146,788 30,000 6,000 638,758 102,386 390,782 18,000 12,200 9,000 5,950 5,299 13,000 $1,026,286 00 $1,026,286 (Liabilities, common shares, retained earnings, and revenue (sales) accounts have credit balances) LO 3,4,5 BT: AN Difficulty: M Time: 60 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 3-163 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Legal Notice Copyright © 2017 by John Wiley & Sons Canada, Ltd. or related companies. All rights reserved. The data contained in these files are protected by copyright. This manual is furnished under licence and may be used only in accordance with the terms of such licence. The material provided herein may not be downloaded, reproduced, stored in a retrieval system, modified, made available on a network, used to create derivative works, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise without the prior written permission of John Wiley & Sons Canada, Ltd. (MMXVII vi F2) Solutions Manual 3-164 Chapter 3 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CHAPTER 4 Accrual Accounting Concepts LEARNING OBJECTIVES 1. 2. 3. 4. 5. Explain the accrual basis of accounting and the reasons for adjusting entries. Prepare adjusting entries for prepayments. Prepare adjusting entries for accruals. Prepare an adjusted trial balance and financial statements. Prepare closing entries and a post-closing trial balance. SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND BLOOM’S TAXONOMY Item LO BT Item LO BT Item LO BT Questions 1. 1 C 6. 2 C 11. 2,3 2. 1 AP 7. 2 C 12. 3. 1 C 8. 2 C 13. 4. 1 C 9. 2 C 5. 2 C 10. 2,3 C Item LO BT Item LO BT C 16. 4,5 C 21. 5 K 2,3 C 17. 4,5 C 22. 5 K 3 AN 18. 5 K 14. 4 C 19. 5 C 15. 2,3,4 C 20. 5 C Brief Exercises 1. 1 K 4. 2 AP 7. 3 AN 10. 3 AP 13. 5 AP 2. 1 AP 5. 2,3 AP 8. 3 AP 11. 4 AP 14. 5 AP 3. 2 AP 6. 3 AP 9. 3 AN 12. 4 AP 15. 5 K Exercises 1. 1 AP 4. 2 AP 7. 2,3 AP 10. 2,3,4 AP 13. 5 AP 2. 1 AP 5. 2 AP 8. 2,3 AP 11. 4 AP 14. 5 AP 3. 1 C 6. 3 AP 9. 2,3 AP 12. 4 AP 13. 5 AP Problems: Set A and B 1. 2 AP 4. 2,3 AP 7. 1 AN 10. 5 AP 2. 3 AP 5. 2,3 AP 8. 2,3,4 AP 11. 4,5 AP 3. 2,3 AP 6. 1,2,3,4 AP 9. 2,3,4 AP 12. 2,3,4 AN 1. 2,3,4,5 AP 2. 2,3,4,5 AP Accounting Cycle Review Cases 1. 1,2 C 3. 2,3 AN 5. 2 C 2. 1 AP 4. 1,2,3 E 6. 2,3,4 AP Solutions Manual 4-1 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Legend: The following abbreviations will appear throughout the solutions manual file. LO Learning objective BT Bloom's Taxonomy K Knowledge C Comprehension AP Application AN Analysis S Synthesis E Evaluation Level of difficulty S Simple M Moderate C Complex Estimated time to prepare in minutes Association to Advance Collegiate Schools of Business Communication Communication Ethics Ethics Analytic Analytic Technology Tech. Diversity Diversity Reflective Thinking Reflec. Thinking CPA Canada Competency Ethics Professional and Ethical Behaviour PS and DM Problem-Solving and Decision-Making Comm. Communication Self-Mgt. Self-Management Team & Lead Teamwork and Leadership Reporting Financial Reporting Stat. & Gov. Strategy and Governance Mgt. Accounting Management Accounting Audit Audit and Assurance Finance Finance Tax Taxation Difficulty: Time: AACSB CPA CM cpa-e001 cpa-e002 cpa-e003 cpa-e004 cpa-e005 cpa-t001 cpa-t002 cpa-t003 cpa-t004 cpa-t005 cpa-t006 Solutions Manual 4-2 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ANSWERS TO QUESTIONS 1. Adjusting entries are made to adjust the accounts at the end of the period to ensure revenues and expenses are recorded when they are earned or incurred. When revenues and expenses should be recognized in the accounting records is dictated by recognition criteria. Revenue is recognized or recorded when an increase in future economic benefits arising from an increase in an asset or a decrease in a liability has occurred in the course of ordinary activities. In general, revenue recognition occurs when or as the performance obligation has been satisfied. In a service company, revenue is considered to be earned when the service is provided. In a merchandising company, revenue is considered to be earned when the merchandise is sold (normally at the point of sale). Expenses are recognized in the accounting records when there is a decrease in future economic benefits related to a decrease in an asset or an increase in a liability in the course of ordinary activities. Expense recognition is linked to revenue recognition in that expenses are recognized, wherever possible, in the period in which a company makes efforts to generate revenues. This gives rise to adjusting entries so that revenues and expenses can be recorded in the proper period. LO 1 BT: C Difficulty: S Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 4-3 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 2. (a) Financial Accounting, Seventh Canadian Edition The five-step process to use to measure and report revenue is: 1. 2. 3. 4. (b) Identify the contract with the client or customer. Identify the performance obligations in the contract. Determine the transaction price. Allocate the transaction price to the performance obligations in the contract. 5. Recognize revenue when (or as) the company satisfies the performance obligations. For the law firm: 1. The contract was created in March between the law firm and the client when the engagement was accepted by the law firm. 2. The performance obligation in the contract is to provide legal services. 3. The transaction price is $8,000. 4. There is a single task and so there are no other obligations in the contract that need to be allocated. 5. The revenue is recognized by the law firm once it satisfies the obligation under the engagement and performs the work for the client in April. LO 1 BT: AP Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting 3. Expenses of $4,500 should be deducted from the revenues in April because that is when the expenses were incurred and the revenues earned. LO 1 BT: C Difficulty: S Time: 2 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-4 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 4. (a) (b) (c) Financial Accounting, Seventh Canadian Edition The accrual-basis financial statements provide reporting of assets, liabilities, and shareholders’ equity as well as revenues and expenses. They include receivables and payables to ensure that revenues are recorded when earned and expenses recorded when incurred in the period revenue is generated. Receivables and payables do not exist under the cash basis of accounting. The cash-basis financial statements provide reliable reporting of cash receipts and cash disbursements. No estimates are required, as is the case with accrual-basis financial statements. Companies using IFRS or ASPE cannot choose between the cash and accrual basis of accounting for financial reporting purposes because generally accepted accounting principles require the accrual basis. In addition, the cash basis could allow for the manipulation of income by delaying or speeding up the timing of cash flow. LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 5. (a) (b) Prepaid expenses are assets because they have a future benefit since they were paid for before they are used or consumed. As the benefit of the prepayment expires, (often with the passage of time) the asset must be reduced and an expense recognized. This requires an adjustment at the end of each accounting period, to expense the portion of the prepaid that has expired (been used up) during the period. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 6. (a) (b) Unearned revenue arises when cash is received for goods or services to be provided in the future. It represents a liability because the cash has not yet been earned—the company has a future obligation to provide the goods or services. Unearned revenues must be adjusted at the end of an accounting period to reflect any revenues that have been earned. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 4-5 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 7. Financial Accounting, Seventh Canadian Edition No. Depreciation is the process of allocating the cost of a long-lived asset to expense over its useful life. Depreciation results in the presentation of the carrying amount (cost less accumulated depreciation) of the asset, not its current value. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 8. (a) Depreciation expense is an expense account with a normal debit balance and is reported on the income statement as part of the operating expenses. This account shows the portion of the cost of a long-lived asset that has expired during the current accounting period. Accumulated depreciation is a contra asset account with a normal credit balance that is reported on the statement of financial position as a reduction of a depreciable asset (such as building and equipment). The balance in the accumulated depreciation account is the total depreciation that has been recognized from the date of acquisition of the depreciable asset to the statement of financial position date. (b) Cost is the original cost of the asset when purchased. The carrying amount is the original cost of the asset less its related accumulated depreciation, and represents the portion of the asset that has not yet been depreciated. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 9. A contra asset account is an account with a credit balance that is deducted from the related asset account on the statement of financial position. Using a contra asset account, such as Accumulated Depreciation, enables disclosure of both the original cost of the asset and the total estimated cost that has expired or been used up to date. This information is useful to the financial statement user who can determine how long until the asset is fully depreciated. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 4-6 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 10. Financial Accounting, Seventh Canadian Edition Yes, I agree. A “simple” adjusting entry affects one statement of financial position account and one income statement account. An adjusting entry reallocates amounts between a statement of financial position account and an income statement account. For example: to record the expiration of insurance the following entry would be recorded; a debit to Insurance Expense (an income statement account) and a credit to Prepaid Insurance (a statement of financial position account). Compound adjusting journal entries are also possible which would affect more accounts, but at least one statement of financial position account and one income statement account are always affected whether a simple adjusting entry or a compound adjusting entry is made. LO 2,3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 11. Disagree. Adjusting entries never involve the Cash account. In making adjusting entries for prepayments, the cash has already been paid or received and recorded. The adjusting journal entry is prepared to reflect the fact that a portion of the unearned revenue or prepaid expense arising in the past when the cash flow occurred is now earned or incurred. In making adjusting entries for accruals, we record the fact that, although the cash has not been paid or received, revenue has been earned or an expense has been incurred. Again, there is no impact on the Cash account because cash has not yet been received or paid but is expected to be subsequently. LO 2,3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 12. To ensure that the adjusting entry is properly calculated and prepared, the preparer of the adjusting entry must first properly understand the original cash payment transaction that lead to the recording of the prepayment. For example, if you are preparing an adjusting entry to record the supplies on hand, you must know first how much is already recorded. On the other hand, in the case of an accrual, there is no cash payment to look up in the accounts. Consequently, there is no original entry to examine in the process of preparing an adjusting entry related to an accrual. LO 2,3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 13. (a) Yes, it does matter whether the adjusting entry is made on December 31. If the interest is not accrued on December 31, then expenses (interest expense) and liabilities (interest payable) will both be understated in that year’s financial statements. In addition, expenses (interest expense) will be overstated in the subsequent year, when the expense is recorded (incorrectly) when paid on January 1. By not making this journal entry, expenses will not be matched with the period in which the loan was available for use. (b) The correct journal entries are as follows: Solutions Manual 4-7 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Dec. 31 Interest Expense .............................. Interest Payable......................... 100 Jan. 1 100 Interest Payable .............................. Cash .......................................... 100 100 If no entry is made on Dec. 31, and interest expense is recorded on January 1 when paid, interest expense will be understated by $100 and interest payable will be understated by the same amount for the year ended December 31, 2018. LO 3 BT: AN Difficulty: C Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting 14. Financial statements can be prepared from an adjusted trial balance because the balances of all accounts have been adjusted to show the effects of all financial events that have occurred during the accounting period. An unadjusted trial balance is not up to date for prepayments and accruals. LO 4 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 4-8 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 15. (a) (b) Financial Accounting, Seventh Canadian Edition Original transaction entries are made throughout the accounting period when transactions arise. Adjusting entries are only recorded at the end of the accounting period, prior to the preparation of the financial statements. As well, adjusting entries never affect the Cash account and always result in an adjustment to a statement of financial position account and an income statement account. Transaction entries often result in a debit or credit to Cash and can affect any account on the statement of financial position or the income statement (or both). Closing entries are required to reset the revenue and expense (income statement) and dividend declared accounts to zero and to update the balance in Retained Earnings to the ending balance as shown in the statement of changes in equity. Unlike adjusting entries, which are prepared before the financial statements are prepared and could be prepared more than once per year (for example, monthly, quarterly), closing entries are only prepared and posted after the year-end financial statements have been completed. LO 2,3,4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 16. The unadjusted, adjusted, and post-closing trial balances are similar in that they prove the equality of the total debit and total credit balances. Another similarity between the unadjusted and adjusted trial balances is that they are prepared at the end of an accounting period. Where trial balances differ is that the unadjusted trial balance is prepared before any adjusting entries have been recorded or posted. An adjusted trial balance is prepared after the adjusting entries have been posted to the accounts. The financial statements are prepared from the adjusted trial balance. After the financial statements have been prepared, closing entries are prepared and posted. The post-closing trial balance is then prepared and used to form the basis of the opening balances for the next accounting period. Unlike the adjusted trial balance which will list temporary (revenue, expense, dividend declared) account balances prior to recording the closing entries, a post-closing trial balance will not list temporary account balances as these have now been closed out to the Retained Earnings account. 16. (b) (continued) Unadjusted and adjusted trial balances are prepared whenever financial statements are prepared but a post-closing trial balance is prepared only at the end of the year. LO 4,5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 17. The retained earnings balance on the unadjusted and adjusted trial balances are the same since the account does not yet reflect the changes that arise from the recording of closing entries. After the adjusted trial balance and financial statements are prepared, closing entries are recorded. These will change the Solutions Manual 4-9 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition retained earnings balance by updating it for the effect of any net income or loss and dividends declared. Consequently, the retained earnings balance on the post-closing trial balance will be different from the balance shown on the adjusted trial balance. LO 4,5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 18. Closing entries are prepared to transfer temporary account balances to retained earnings, a permanent account, so retained earnings will show an up-to-date amount that includes the effect of revenues, expenses, and dividends declared for the year. Secondly, closing entries produce a zero balance in each temporary account so that the temporary accounts are ready for the next accounting period, where only transactions relating to that period are recorded in them. LO 5 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 19. The Dividends Declared account is not closed into the Income Summary account along with the expense accounts because it is not an expense; it was not incurred for the purpose of generating revenue and does not appear on the income statement. Dividends Declared represent a distribution of retained earnings and is reported on the statement of changes in equity. The Dividends Declared account is also a temporary account and therefore requires a closing entry. LO 5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 4-10 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 20. Financial Accounting, Seventh Canadian Edition The Income Summary account is used in the closing process to avoid having too much detail in the Retained Earnings account. Only the net result of the revenues less expenses will be recorded as a closing entry from the Income Summary account to the Retained Earnings account. Before closing the Income Summary account, the net balance is compared to the income statement to ensure that the amounts used in closing the revenue and expense temporary accounts are complete and accurate. LO 5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 21. (a) (1) (2) (3) (4) Net income: (Dr) Individual revenue accounts and (Cr) Income Summary (Dr) Income Summary and (Cr) Individual expense accounts (Dr) Income Summary and (Cr) Retained Earnings (Dr) Retained Earnings and (Cr) Dividends Declared (b) (1) (2) (3) (4) Net loss: (Dr) Individual revenue accounts and (Cr) Income Summary (Dr) Income Summary and (Cr) Individual expense accounts (Dr) Retained Earnings and (Cr) Income Summary (Dr) Retained Earnings and (Cr) Dividends Declared Note that it is only step 3 that differs between the two situations shown in (a) and (b) and the Income Summary is not involved in the fourth closing entry. LO 5 BT: K Difficulty: S Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-11 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 22. Financial Accounting, Seventh Canadian Edition Steps in the accounting cycle that may be done on a daily basis include: 1. Analyzing business transactions 2. Journalizing the transactions Steps in the accounting cycle that are done on a periodic basis include: 3. Posting to the general ledger accounts 4. Preparing a trial balance 5. Journalizing and posting adjusting entries (prepayments and accruals) 6. Preparing an adjusted trial balance 7. Preparing the financial statements: income statement, statement of changes in equity, statement of financial position, and statement of cash flows Steps in the accounting cycle that are usually only done at the end of the company’s accounting period include: 8. Journalizing and posting closing entries 9. Preparing a post-closing trial balance LO 5 BT: K Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 4-12 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 4-1 (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) Cash –$ 100 0 0 +800 –5,000 0 +1,000 0 +500 0 0 Net Income $ 0 –75 +1,000 0 0 –1,000 0 –50 0 +200 –250 LO 1 BT: K Difficulty: S Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 4-13 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-2 (a) Accrual Basis 1. Collected $200 cash from customers for services provided in August. $ (b) Cash Basis 0 $200 2. Collected $500 cash from customers for services provided in September. 500 500 3. Billed customers $600 for services provided in September. 600 0 4. Provided $100 of services to customers who paid in advance in August. 100 0 0 100 $1,200 $800 5. Received $100 from customers in advance for services to be provided in October. Total revenue LO 1 BT: AP Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 4-14 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-3 (a) Jan. 11 Supplies ............................................. Accounts Payable........................ (b) Supplies Used = $1,500 + $1,800 – $1,100 = $2,200 (c) Jan. 31 Supplies Expense .............................. Supplies ...................................... 1,800 1,800 2,200 2,200 (d) Open. Bal. Jan. 11 Jan. 31 Bal. Supplies 1,500 1,800 Jan. 31 Adj. 1,100 Supplies Expense Jan. 31 Adj. 2,200 2,200 LO 2 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-15 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-4 (a) (b) Jan. 2 Vehicles............................................. Cash ............................................ 50,000 50,000 The journal entry for the years 2018 and 2019 will be the same: Dec. 31 Depreciation Expense ........................ 10,000 Accumulated Depreciation—Vehicles ($50,000 ÷ 5 = $10,000 per year) 10,000 (c) CLAYMORE CORPORATION Statement of Financial Position (partial) December 31 2019 Property, plant, and equipment Vehicles Less: Accumulated depreciation Carrying amount $50,000 20,000 $30,000 2018 $50,000 10,000 $40,000 LO 2 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-16 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-5 (a) (1) Bere Ltd. June 1 Prepaid Insurance ....................................... Cash................................................... 6,000 6,000 (2) Safety Insurance Corp. June (b) 1 Cash............................................................ Unearned Revenue ............................ 6,000 6,000 Expired in 2018 = $6,000 × 7/12 = $3,500 Unexpired at December 31, 2018 = $6,000 × 5/12 = $2,500 (c) (1) Bere Ltd. Dec. 31 Insurance Expense ....................................... Prepaid Insurance ................................ 3,500 3,500 (2) Safety Insurance Corp. Dec. 31 Unearned Revenue ..................................... Insurance Revenue ............................ 3,500 3,500 Solutions Manual 4-17 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-5 (CONTINUED) (d) Bere Ltd. Prepaid Insurance 6,000 Dec. 31 Adj. 3,500 Dec. 31 Bal. 2,500 June 1 Insurance Expense Dec. 31 Adj. 3,500 Safety Insurance Corp. Unearned Revenue June 1 Dec. 31 Adj. 3,500 Dec. 31 Bal. 6,000 Insurance Revenue Dec. 31 Adj. 3,500 2,500 LO 2,3 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-18 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-6 (a) (b) (c) Oct. 27 Oct. 31 Nov. 3 Salaries Expense .............................................. Cash ......................................................... 5,000 Salaries Expense (Oct. 29-31: $1,000 × 3 days) Salaries Payable ...................................... 3,000 Salaries Expense (Nov. 1-2: $1,000 × 2 days) .. Salaries Payable ............................................... Cash ......................................................... 2,000 3,000 5,000 3,000 5,000 LO 3 BT: AP Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 4-7 (a) Nov. 30 Accounts Receivable......................................... Service Revenue ...................................... 375 375 (b) No, Zieborg will not have to make a journal entry on December 1 when it prepares the invoice because the November 30 adjusting entry already recorded the amount. (c) Jan. 10 Cash ................................................................. Accounts Receivable ................................ 375 375 LO 3 BT: AN Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-19 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-8 (a) (b) 2018 July 1 2018 Dec. 31 2019 Dec. 31 (c) 2020 Jan. 1 Vehicles ................................................... Bank Loan Payable ......................... Cash ............................................... 50,000 Interest Expense ($40,000 × 6% × 6/12) Interest Payable .............................. 1,200 Interest Expense ($40,000 × 6%) ............. Interest Payable .............................. 2,400 Bank Loan Payable .................................. Interest Payable ($1,200 + $2,400) .......... Cash ................................................ 40,000 3,600 40,000 10,000 1,200 2,400 43,600 LO 3 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-20 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-9 (a) (b) 2018 July 1 2018 Dec. 31 2019 Dec. 31 (c) (d) 2020 Jan. 1 Bank Loan Receivable ................................. Cash ................................................... 40,000 Interest Receivable ($40,000 × 6% × 6/12) Interest Revenue ................................. 1,200 Interest Receivable ($40,000 × 6%) ............. Interest Revenue ................................. 2,400 Cash ............................................................ Interest Receivable ($1,200 + $2,400) Bank Loan Receivable ........................ 43,600 40,000 1,200 2,400 3,600 40,000 The total amount collected by the Canada Bank corresponds to the total paid by Nahkooda. The total amount of interest revenue earned by the Canada Bank is the same as the total interest expense incurred by Nahkooda. The primary differences are that the Canada Bank records an asset (bank loan receivable and interest receivable) and revenue (interest revenue) while Nahkooda records a liability (bank loan payable and interest payable) and expense (interest expense). LO 3 BT: AN Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-21 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-10 (a) $400 = $2,600 – $2,200 (b) $3,500 = $400 (2016 payable balance) + $3,600 – $500. Notice how the change in the payable each year indicates the difference between the expense and the cash paid. In other words, in this year, the company had to pay off last year’s tax of $400 but did not pay off $500 of this year’s tax. Since this year’s tax was $3,600, only $3,100 of this was paid off. This $3,100 along with the $400 relating to last year totals $3,500. (c) $4,400 = $4,200 – $500 (2017 payable balance) + $700 (2018 payable balance). The $4,200 that was paid would have included $500 relating to the prior year so the remainder of $3,700 would have related to the current year. Since $700 of the current year’s tax is unpaid, the total tax expense for this year must have been $3,700 + $700. LO 3 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-22 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-11 OROMOCTO CORPORATION Adjusted Trial Balance February 28, 2018 Cash .................................................................................. Accounts receivable ........................................................... Supplies ............................................................................. Prepaid insurance .............................................................. Equipment .......................................................................... Accumulated depreciation—equipment .............................. Accounts payable ............................................................... Salaries payable................................................................. Income tax payable ............................................................ Common shares ................................................................. Retained earnings .............................................................. Dividends declared............................................................. Fees earned ....................................................................... Salaries expense ................................................................ Rent expense ..................................................................... Depreciation expense ........................................................ Supplies expense ............................................................... Insurance expense ............................................................. Utilities expense ................................................................. Income tax expense........................................................... Totals ............................................................................ Debit $ 18,000 28,000 1,000 2,500 23,450 Credit $ 5,400 13,000 3,000 4,550 10,000 21,000 2,000 89,500 46,400 6,000 4,400 4,000 3,500 2,400 4,800 $146,450 0000 000 $146,450 (Total debits = Total credits) LO 4 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-23 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-12 (a) OROMOCTO CORPORATION Income Statement Year Ended February 28, 2018 Revenues Fees earned .................................................... .................... $89,500 Expenses Salaries expense ................................................. ... $46,400 Rent expense ...................................................... ..... 6,000 Depreciation expense ......................................... ....... 4,400 Supplies expense ................................................ ... 4,000 Insurance expense .............................................. ... 3,500 Utilities expense .................................................. .... 2,400 Total expenses ....................................... Income before income tax ........................................ Income tax expense ................................................. Net income ............................................................... 66,700 22,800 4,800 $18,000 [Revenues – Expenses = Net income or (Loss)] Solutions Manual 4-24 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-12 (b) OROMOCTO CORPORATION Statement of Changes in Equity Year Ended February 28, 2018 Common Shares Retained Earnings Balance, March 1, 2017 ................................................................. $ 5,000 $21,000 Issued common shares .................................................................. 5,000 Net income ..................................................................................... 18,000 Dividends declared......................................................................... 000 000 (2,000) Balance, February 28, 2018 ........................................................... $10,000 $37,000 Total Equity $26,000 5,000 18,000 (2,000) $47,000 (Beginning equity ± Changes to equity = Ending equity) Solutions Manual 4-25 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-12 (CONTINUED) (c) OROMOCTO CORPORATION Statement of Financial Position February 28, 2018 Assets Current Assets Cash ....................................................................... Accounts receivable ............................................... Supplies .................................................................. Prepaid insurance .................................................. Total current assets ....................................... Property, plant, and equipment Equipment .............................................................. Less: Accumulated depreciation—equipment........ Total assets .................................................................... $ 18,000 28,000 1,000 2,500 49,500 $23,450 5,400 18,050 $67,550 Liabilities and Shareholders’ Equity Current liabilities Accounts payable ................................................... Salaries payable ..................................................... Income tax payable ................................................ Total current liabilities .................................... Shareholders’ equity Common shares ..................................................... Retained earnings .................................................. Total shareholders’ equity .............................. Total liabilities and shareholders’ equity ......................... $13,000 3,000 4,550 20,550 $10,000 37,000 47,000 $67,550 (Assets = Liabilities + Shareholders’ equity) LO 4 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-26 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-13 2018 Feb. 28 Fees Earned ................................................. Income Summary ................................... 89,500 28 Income Summary .......................................... Salaries Expense ................................... Rent Expense......................................... Depreciation Expense ............................ Supplies Expense .................................. Insurance Expense ................................ Utilities Expense..................................... Income Tax Expense ............................. 71,500 28 Income Summary .......................................... Retained Earnings.................................. 18,000 28 Retained Earnings ........................................ Dividends Declared ................................ 2,000 89,500 46,400 6,000 4,400 4,000 3,500 2,400 4,800 18,000 2,000 (Income statement accounts are closed to the Income Summary account) LO 5 BT: AP Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-27 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-14 (a) Service revenue ............................................ Expenses Salaries expense.................................... Repairs and maintenance expense ........ Supplies expense ................................... Utilities expense ..................................... Income tax expense ............................... Net income.................................................... $126,000 $65,000 15,000 6,000 2,000 5,700 93,700 $ 32,300 (Revenues increase net income and expenses decrease net income) (b) Nov. 30 Service Revenue .................................... Income Summary ................................... 126,000 30 Income Summary .......................................... Salaries Expense ................................... Repairs and Maintenance Expense ....... Supplies Expense .................................. Utilities Expense..................................... Income Tax Expense ............................. 93,700 30 Income Summary .......................................... Retained Earnings.................................. 32,300 30 Retained Earnings ........................................ Dividends Declared ................................ 5,000 126,000 65,000 15,000 6,000 2,000 5,700 32,300 5,000 (Income statement accounts are closed to the Income Summary account) Solutions Manual 4-28 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-14 (CONTINUED) (c) Service Revenue Nov 30 Bal. 126,000 Nov 30 CE1 126,000 Nov 30 Bal. 0 Salaries Expense Nov 30 Bal. 65,000 Nov 30 CE2 65,000 Nov 30 Bal. 0 Supplies Expense Nov 30 Bal. 6,000 Nov 30 CE2 Nov 30 Bal. 0 Utilities Expense 2,000 Nov 30 CE2 Nov 30 Bal. 0 6,000 Nov 30 Bal. 2,000 Income Tax Expense Nov 30 Bal 5,700 Nov 30 CE2 Nov 30 Bal. 5,700 0 Dividends Declared 5,000 Nov 30 CE4 Nov 30 Bal. 5,000 0 Nov 30 Bal Income Summary Nov 30 CE2 93,700 Nov 30 CE1 126,000 Bal. 32,300 Nov 30 CE3 32,300 Nov 30 Bal. 0 Retained Earnings Dec. 1 50,000 Nov 30 CE4 5,000 Nov 30 CE3 32,300 Nov 30 Bal. 77,300 Repairs and Maintenance Expense Nov 30 Bal. 15,000 Nov 30 CE2 15,000 Nov 30 Bal. 0 LO 5 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-29 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 4-15 (a) (c) (e) (g) (i) (k) (m) Yes Yes Yes Yes No Yes No (b) (d) (f) (h) (j) (l) Yes Yes No No Yes No LO 5 BT: K Difficulty: S Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 4-30 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO EXERCISES EXERCISE 4-1 1. Since the performance by WestJet is not complete until the flight actually occurs, revenue should not be recognized until December. WestJet should recognize the revenue in December when the customer has been provided with the flight. 2. Revenue should be recognized as each magazine is delivered (on a monthly basis). 3. Revenue should be recognized on a per game basis over the season from April to October, since that is when the games are provided to the fans. 4. Interest revenue should be accrued and recognized by RBC Financial Group evenly over the term of the loan. 5. Revenue should be recognized when the sweater is shipped to the customer in September. (Revenues are recognized when they are earned and expenses are recognized when they are incurred.) LO 1 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-31 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-2 Service revenue Expenses Operating expenses Insurance expense Income before income tax Income tax expense Net income (c) (a) Accrual Basis $52,000 (b) Cash Basis $44,000 31,000 1,000 32,000 27,500 2,000 29,500 20,000 3,000 $17,000 14,500 $14,500 The accrual basis of accounting provides more useful information for decision makers because it recognizes revenue when earned and expenses when incurred. This provides a better measurement of performance because it records what has happened regardless of the movement of cash. This also enhances the predictive ability of the income statement. LO 1 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-32 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-3 (a) Transaction Cash Basis Accrual Basis 1 Revenue from services Revenues are recorded when they are collected Revenues are recorded when they are earned 2 Purchase equipment Equipment is expensed when the cash is paid out Equipment is an asset that is depreciated over its useful life 3 Pay insurance Full amount expensed when cash is paid Insurance is a prepayment until consumed and expensed 4 Employee salaries Expensed when paid Accrued when owed to employees The proper accrual accounting would include: 1. 2. 3. 4. The recognition of revenue from providing consulting services when earned. The recognition of equipment in the accounts when purchased, followed by recording depreciation expense over the years of use of the equipment. The recognition of the payment for insurance as Prepaid Insurance which will then be allocated to Insurance Expense during the periods of benefit, over the next two years. Any unpaid salaries at the end of the accounting period are recognized as expenses and as salaries payable. Solutions Manual 4-33 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-3 (CONTINUED) (b) Due to the terms of payment offered to customers (90 days) and the timing of payments for operating expenses, it is not surprising that the business has experienced delays in cash inflows compared to cash outflows. In addition, when prepayments are involved, large sums of cash are paid out for things like equipment or for prepaid insurance, which require immediate payment but will become expenses over several years. Consequently, it is highly probable, particularly at the start of a new business, that net income is realized, while at same time, cash resources are scarce. Quite often, new businesses require financing to cover cash shortfalls until they have been able to accumulate sufficient cash to cover their business activities. LO 1 BT: C Difficulty: M Time: 25 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 4-34 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-4 (a) 2018 June Aug. Sept. Nov. Dec. (b) 2018 Dec. 1 31 4 30 5 31 31 31 . 31 31 Prepaid Insurance ................................. Cash ............................................ 1,800 Prepaid Rent ......................................... Cash ............................................ 6,500 Cash ..................................................... Unearned Revenue ..................... 3,600 Prepaid Services ................................... Cash ............................................ 2,000 Cash...................................................... Unearned Revenue ..................... 1,500 Insurance Expense ............................... Prepaid Insurance........................ ($1,800 × 7/12 months = $1,050) 1,050 Rent Expense........................................ Prepaid Rent ................................ ($6,500 × 4/5 months = $5,200) 5,200 Unearned Revenue ............................... Sponsorship Revenue ................. ($3,600 × 4/9 games = $1,600) 1,600 Repairs and Maintenance Expense ...... Prepaid Services.......................... 1,000 1,800 6,500 3,600 2,000 1,500 1,050 5,200 1,600 Unearned Revenue ............................... 1,025 Sponsorship Revenue ................. ($1,500 – $475 not played = $1,025 played) 1,000 1,025 Solutions Manual 4-35 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-4 (CONTINUED) (c) Prepaid Insurance June 1 1,800 Dec. 31 Adj. Dec. 31 Bal. 750 Aug. 31 Dec. 31 Bal. Prepaid Rent 6,500 Dec. 31 Adj. 1,300 Unearned Revenue Sept. 4 Dec. 5 Dec. 31 Adj. 1,600 Dec. 31 Adj. 1,025 Dec. 31 Bal. Prepaid Services 2,000 Dec. 31 Adj. Dec. 31 Bal. 1,000 Insurance Expense Dec. 31 Adj. 1,050 1,050 Dec. 31 Adj. Rent Expense 5,200 5,200 3,600 1,500 Sponsorship Revenue Dec. 31 Adj. Dec. 31 Adj. 1,600 1,025 Dec. 31 Bal. 2,625 2,475 Repairs and Maintenance Expense Dec. 31 Adj. 1,000 Nov . 30 1,000 Note: The Cash account has not been included in this solution, as per the instructions. LO 2 BT: AP Difficulty: M Time: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-36 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-5 (a) 2018 Dec. 31 31 Depreciation Expense .......................................... Accumulated Depreciation—Vehicles ............ ($33,000 ÷ 3 = $11,000 per year) 11,000 Depreciation Expense .......................................... Accumulated Depreciation—Equipment ........ ($15,000 ÷ 5 × 6/12 = $1,500) 1,500 11,000 1,500 (b) Cost Accumulated depreciation $33,000 ÷ 3 × 2 $15,000 ÷ 5 × 6/12 Carrying amount Vehicles $33,000 Equipment $15,000 22,000 000 000 $11,000 1,500 $13,500 LO 2 BT: AP Difficulty: S Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-37 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-6 (a) 2018 Dec. 31 31 31 31 31 (b) 2019 Jan. 21 7 1 4 2 Utilities Expense................................................... Accounts Payable ....................................... 425 Salaries Expense ................................................. Salaries Payable ......................................... ($3,500 × 1/7 days = $500) 500 Interest Expense .................................................. Interest Payable .......................................... ($45,000 × 5% × 1/12 months = $188 (rounded)) 188 Accounts Receivable............................................ Fees Earned ............................................... 300 Accounts Receivable............................................ Rent Revenue ............................................ 6,000 Accounts Payable ................................................ Cash ........................................................... 425 Salaries Payable .................................................. Salaries Expense ................................................. Cash ........................................................... 500 3,000 Interest Payable ................................................... Cash ........................................................... 188 Cash..................................................................... Accounts Receivable .................................. 300 Cash..................................................................... Accounts Receivable .................................. 6,000 425 500 188 300 6,000 425 3,500 188 300 6,000 LO 3 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-38 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-7 (a) July 2 7 14 15 21 28 (b) July 31 31 31 31 Prepaid Rent ........................................................ Cash ........................................................... 1,500 Supplies ............................................................... Accounts Payable ....................................... 200 Cash .................................................................... Accounts Receivable .................................. ($6,550 2) 3,275 Cash .................................................................... Bank Loan Payable..................................... 1,000 Cash .................................................................... Unearned Revenue..................................... 1,000 Accounts Receivable............................................ Service Revenue ........................................ 1,500 Accounts Receivable............................................ Service Revenue ........................................ 800 Rent Expense....................................................... Prepaid Rent ............................................... ($1,500 ÷ 2 = $750) 750 Supplies Expense ................................................ Supplies ...................................................... ($1,200 + $200 − $500 = $900) 900 Depreciation Expense .......................................... Accumulated Depreciation—Equipment ..... ($15,000 ÷ 5 x 1/12) 250 1,500 200 3,275 1,000 1,000 1,500 800 750 900 250 Solutions Manual 4-39 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-7 (CONTINUED July 31 31 31 Interest Expense .................................................. Interest Payable .......................................... ($1,000 × 5% × ½ x 1/12 months) 2 Salaries Expense ................................................. Salaries Payable.......................................... 2,500 Unearned Revenue ............................................. Service Revenue ......................................... 2,000 2 2,500 2,000 LO 2,3 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-40 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-8 1. 2. 3. 4. 5. 6. Mar. 031 31 31 31 31 31 Depreciation Expense .......................................... Accumulated Depreciation—Equipment ...... ($21,600 ÷ 4 × 3/12 months) 1,350 Unearned Revenue .............................................. Rent Revenue ($9,600 × 2/3) ...................... 6,400 Interest Expense .................................................. Interest Payable .......................................... ($20,000 × 6% × 1/12 months) 100 Supplies Expense ................................................. Supplies ($2,800 – $850) ............................ 1,950 Insurance Expense .............................................. Prepaid Insurance ....................................... ($14,400 × 3/12) 3,600 Income Tax Expense ............................................ Income Tax Payable .................................... 3,200 1,350 6,400 100 1,950 3,600 3,200 LO 2,3 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-41 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-9 Net Income Total Assets Incorrect balances $90,000 $170,000 Adjustments: 1. Salaries 2. Rent 3. Depreciation (10,000) 4,000 (9,000) (9,000) Correct balances $75,000 $161,000 Total Liabilities $70,000 10,000 (4,000) 00000 0 $76,000 Total Shareholders’ Equity $100,000 (10,000) 4,000 (9,000) $ 85,000 LO 2,3 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-42 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-10 (a) December entry: Cash ..................................................... Unearned Revenue ...................... 1,600 January entry: 1,600 Unearned Revenue.............................. Service Revenue .......................... Adj. Unearned Revenue Jan. 1 Bal. 1,600 Jan. 31 Bal. 1,600 1,600 2,350 750 The balance in Unearned Revenue on January 1, 2018 was $2,350 ($750 + $1,600). (b) Journal entry to record depreciation: Depreciation Expense........................... Accumulated Depreciation ........... 120 120 1 month = $120; Annual depreciation = $1,440 ($120 × 12) Number of months depreciated = accumulated depreciation ($3,000) monthly depreciation ($120) = 25 months or 2 years, 1 month Therefore, the equipment is 2 years, 1 month old. It would have been purchased on January 1, 2016. Solutions Manual 4-43 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-10 (CONTINUED (c) Journal entry to adjust insurance: Insurance Expense..... Prepaid Insurance . 400 400 Since the prepaid insurance is $1,200, we can assume that 3 months ($1,200 ÷ $400 = 4) of the policy remain. Consequently, if it expires at $400 per month, then the policy is $3,600 ÷ $400 = 9 months old and it was purchased on May 1, 2017. Prepaid Insurance May 1, 2017 4,800 May 1 to Dec. 31 Adj. Dec. 31, 2017 Bal. 1,600 Jan. 31 Adj. Jan. 31, 2018 Bal. 1,200 3,200 400 The original insurance policy premium was $4,800 ($400 × 12). The monthly adjustments made May 1 through December 31 totalled $3,200 ($400 × 8). Solutions Manual 4-44 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-10 (CONTINUED) (d) Journal entry to adjust supplies: Supplies Expense ...................... Supplies .............................. Supplies Expense Adj. Jan. 31 Bal. 950 950 Jan. 1 Bal. Purchase Jan. 31 Bal. 950 950 Supplies 900 750 Adj. 700 950 Derive the balance by working backward up through the T account. Therefore, the balance in Supplies on January 1 was $900 ($700 + $950 – $750). (e) Journal entry to record income tax payable: Income Tax Expense ................ Income Tax Payable........... Income Tax Expense Adj. Jan. 31 Bal. 100 100 150 Income Tax Payable Jan. 1 Bal. Payment 100 Adj. Jan. 31 Bal. 150 150 100 150 Derive the balance by working backward up through the T account. The balance in Income Tax Payable on January 1 was $150 ($150 − $100 + $100). It is assumed that income tax instalments are paid monthly and that the balance owing at December 31 (January 1) was the adjustment required at year-end after the income tax return was prepared. This balance owing must be paid within three months of the company’s yearend. LO 2,3,4 BT: AP Difficulty: C Time: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-45 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-11 FRASER VALLEY SERVICES LTD. Adjusted Trial Balance August 31, 2018 Debit Cash ................................................................................................. $ 11,430 Accounts receivable ......................................................................... 18,225 Supplies ............................................................................................ 3,400 Prepaid insurance............................................................................. 3,450 Equipment ........................................................................................ 25,600 Accumulated depreciation—equipment ............................................ Accounts payable ............................................................................. Salaries payable ............................................................................... Interest payable ................................................................................ Rent payable .................................................................................... Income tax payable .......................................................................... Unearned revenue ............................................................................ Bank loan payable, due 2021 ........................................................... Common shares ............................................................................... Retained earnings ............................................................................ Dividends declared ...........................................................................600 Service revenue................................................................................ Salaries expense .............................................................................. 19,200 Rent expense ................................................................................... 15,000 Depreciation expense ....................................................................... 2,275 Supplies expense ............................................................................. 1,750 Interest expense ............................................................................... 1,500 Insurance expense ........................................................................... 1,100 Income tax expense ......................................................................... 2,000 Totals ..................................................................... $105,530 Credit $ 5,905 2,800 2,200 1,500 1,250 1,500 700 25,000 5,000 5,400 54,275 000 0000 $105,530 (Total debits = Total credits) LO 4 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-46 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-12 (a) FRASER VALLEY SERVICES LTD Income Statement Year Ended August 31, 2018 Revenues Service revenue .................................................................... Expenses Salaries expense .................................................................. Rent expense ....................................................................... Depreciation expense ........................................................... Supplies expense ................................................................. Interest expense ................................................................... Insurance expense ............................................................... Total expenses ............................................................ Income before income tax ............................................................. Income tax expense ...................................................................... Net income .................................................................................... $54,275 $19,200 15,000 2,275 1,750 1,500 1,100 40,825 13,450 2,000 $11,450 [Revenues – Expenses = Net income or (Loss)] Solutions Manual 4-47 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-12 (CONTINUED (b) FRASER VALLEY SERVICES LTD. Statement of Changes in Equity Year Ended August 31, 2018 Balance, September 1, 2017......................... Issued common shares ................................. Net income .................................................... Dividends declared ....................................... Balance, August 31, 2018 ............................. Common Shares $4,000 1,000 00 000 $5,000 Retained Earnings $ 5,400 11,450 (600) $16,250 Total Equity $ 9,400 1,000 11,450 (600) $21,250 (Beginning equity ± Changes to equity = Ending equity) Solutions Manual 4-48 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-12 (CONTINUED) (c) FRASER VALLEY SERVICES LTD. Statement of Financial Position August 31, 2018 Assets Current assets Cash .............................................................................................. Accounts receivable....................................................................... Supplies ......................................................................................... Prepaid insurance .......................................................................... Total current assets .............................................................. Property, plant, and equipment Equipment .................................................................. $25,600 Less: Accumulated depreciation—equipment............ 5,905 Total assets ............................................................................................ $11,430 18,225 3,400 3,450 36,505 19,695 $56,200 Liabilities and Shareholders’ Equity Current liabilities Accounts payable .......................................................................... Salaries payable ............................................................................ Interest payable ............................................................................. Rent payable ................................................................................. Income tax payable........................................................................ Unearned revenue ......................................................................... Total current liabilities ........................................................... Non-current liabilities Bank loan payable ......................................................................... Total liabilities ....................................................................... Shareholders’ equity Common shares ......................................................... $ 5,000 Retained earnings ...................................................... 16,250 Total shareholders’ equity ..................................................... Total liabilities and shareholders’ equity ................................................. $ 2,800 2,200 1,500 1,250 1,500 700 9,950 25,000 34,950 21,250 $56,200 (Assets = Liabilities + Shareholders’ equity) LO 4 BT: AP Difficulty: M Time: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-49 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-13 (a) Dec. 31 31 31 31 Service Revenue .............................................. Interest Revenue .............................................. Income Summary .................................... 396,000 9,000 Income Summary.............................................. Salaries Expense ..................................... Office Expense ........................................ Depreciation Expense .............................. Utilities Expense ...................................... Interest Expense ...................................... Income Tax Expense ............................... 330,400 Income Summary.............................................. Retained Earnings ................................... 74,600 Retained Earnings ............................................ Dividends Declared .................................. 10,500 405,000 240,000 21,500 20,000 19,000 11,250 18,650 74,600 10,500 (Income statement accounts are closed to the Income Summary account) Solutions Manual 4-50 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-13 (CONTINUED (b) Income Summary Dec. 31 CE2 330,400 Dec. 31 CE1 Bal. Dec. 31 CE3 74,600 Dec. 31 Bal. Retained Earnings Jan. 1 Bal. Dec. 31 CE4 10,500 Dec. 31 CE3 Dec. 31 Bal. Dividends Declared Dec. 31 Bal. 10,500 Dec. 31 CE4 Dec. 31 Bal. 0 Salaries Expense Dec.31 Bal. 240,000 405,000 Dec. 31 CE2 240,000 74,600 Dec. 31 Bal. 0 Office Expense 0 Dec. 31 Bal. 21,500 Dec. 31 CE2 21,500 Dec. 31 Bal. 0 185,000 Depreciation Expense 74,600 Dec. 31 Bal. 20,000 249,100 Dec. 31 CE2 20,000 Dec. 31 Bal. 0 Dec. 31 Bal. Service Revenue Dec.31 Bal. 396,000 Dec. 31 CE1 396,000 Dec.31 Bal. 0 Interest Revenue Dec. 31 Bal. Dec 31 CE1 9,000 Dec.31 Bal. Utilities Expense 10,500 19,000 Dec. 31 CE2 Dec. 31 Bal. 0 Interest Expense Dec. 31 Bal. 11,250 Dec. 31 CE2 9,000 19,000 Dec. 31 Bal. 11,250 0 Income Tax Expense 0 Dec. 31 Bal. 18,650 Dec. 31 CE2 Dec. 31 Bal. 18,650 0 LO 5 BT: AP Difficulty: S Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-51 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-14 (a) 2018 Aug. 31 31 031 31 Service Revenue ...................................... Income Summary ............................ 54,275 Income Summary ...................................... Salaries Expense ............................. Rent Expense .................................. Depreciation Expense ...................... Supplies Expense ............................ Interest Expense .............................. Insurance Expense .......................... Income Tax Expense ....................... 42,825 Income Summary ...................................... Retained Earnings ........................... 11,450 Retained Earnings .................................... Dividends Declared .......................... 600 54,275 19,200 15,000 2,275 1,750 1,500 1,100 2,000 11,450 600 (Income statement accounts are closed to the Income Summary account) Solutions Manual 4-52 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 4-14 (CONTINUED (b) FRASER VALLEY SERVICES LTD. Post-Closing Trial Balance August 31, 2018 Cash .................................................................................. Accounts receivable .......................................................... Supplies ............................................................................ Prepaid insurance ............................................................. Equipment ......................................................................... Accumulated depreciation—equipment ............................. Accounts payable .............................................................. Salaries payable ................................................................ Interest payable ................................................................. Rent payable ..................................................................... Income tax payable ............................................................ Unearned revenue ............................................................. Bank loan payable ............................................................. Common shares ................................................................ Retained earnings ............................................................. Totals ............................................................................ Debit $11,430 18,225 3,400 3,450 25,600 00000 0 $62,105 Credit $ 5,905 2,800 2,200 1,500 1,250 1,500 700 25,000 5,000 16,250 $62,105 (Total debits = Total credits) LO 5 BT: AP Difficulty: S Time: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-53 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO PROBLEMS PROBLEM 4-1A 1. (a) (b) 2. (a) (b) 3. (a) (b) 4. (a) (b) 5. (a) (b) Jan. 2 Supplies.................................................. Cash ................................................. 4,100 Dec. 31 Supplies Expense ($4,100 – $700) ........ Supplies ............................................ 3,400 Apr. 4,100 3,400 1 Vehicles .................................................. Cash ................................................. Bank Loan Payable ........................... 45,000 Dec. 31 Depreciation Expense ............................ Accumulated Depreciation—Vehicles ($45,000 ÷ 5 years × 9/12 months) 6,750 Aug. 3,600 1 Prepaid Insurance .................................. Cash ................................................. 5,000 40,000 6,750 3,600 Dec. 31 Insurance Expense ($3,600 × 5/12 months) Prepaid Insurance ............................. 1,500 Nov. 9 Cash ....................................................... Unearned Revenue ........................... 1,600 Dec. 31 Unearned Revenue ($1,600 × ½) ........... Service Revenue .............................. 800 Dec. 1,500 1,600 800 1 Prepaid Rent .......................................... Cash ................................................. 2,400 Dec. 31 Rent Expense ......................................... Prepaid Rent ..................................... 1,200 2,400 1,200 LO 2 BT: AP Difficulty: S Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-54 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-2A 1. (a) (b) 2. (a) (b) 3. (a) (b) 4. (a) (b) 5. (a) (b) Mar. 31 Interest Expense .................................... Interest Payable ................................ ($12,000 × 6% × 1/12 months) 60 Apr. 1 Interest Payable ..................................... Cash................................................... 60 Mar. 31 Interest Receivable ................................ Interest Revenue .............................. 250 Apr. 1 Cash ...................................................... Interest Receivable ........................... 250 Mar. 31 Salaries Expense .................................. Salaries Payable (5 × $200 × 5 days) 5,000 Apr. 2 Salaries Payable ................................... Cash.................................................. 5,000 Mar. 31 Utilities Expense .................................... Accounts Payable ............................ 750 Apr. 10 Accounts Payable .................................. Cash.................................................. 750 Mar. 31 Accounts Receivable ............................. Service Revenue ............................... 3,000 60 60 250 250 5,000 5,000 750 750 3,000 Apr. 4 No entry required Apr. 30 Cash ...................................................... Accounts Receivable......................... 2,000 2,000 LO 3 BT: AP Difficulty: S Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-55 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-3A 1. (a) June 1, 2017 (b) Nov. 30, 2018 2. (a) Oct. 1, 2018 (b) Nov. 30, 2018 3. (a) Feb. 16, 2018 (b) Nov. 30, 2018 4. (a) June 1, 2018 (b) Nov. 30, 2018 (c) Dec. 1, 2018 5. (a) Nov. 2, 2018 Vehicles ..................................................... Cash .................................................. 80,000 Depreciation Expense................................ Accumulated Depreciation—Vehicles . ($80,000 ÷ 5 years × 6/12) 8,000 Cash (400 × $320) ..................................... Unearned Revenue ........................... Unearned Revenue.................................... Ticket Revenue ($128,000 × 2/8 plays) 80,000 8,000 128,000 128,000 32,000 32,000 Supplies ..................................................... Cash .................................................. 2,100 Supplies Expense ($1,000 + $2,100 – $500) Supplies ............................................ 2,600 2,100 2,600 Cash .......................................................... Bank Loan Payable ........................... 100,000 Interest Expense ........................................ Interest Payable ................................ ($100,000 × 6% × 1/12 months) 500 Interest Payable ........................................ Cash .................................................. 500 Cash .......................................................... Unearned Revenue ........................... 40 100,000 500 500 Solutions Manual 4-56 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. 40 Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-3A (CONTINUED) 5. (b) Nov. 30, 2018 (c) Dec. 4, 2018 6. (b) Nov. 30, 2018 (c) Dec. 3, 2018 7. (b) Nov. 30, 2018 (c) Dec. 14, 2018 Unearned Revenue.................................... Accounts Receivable ................................. Rent Revenue ................................... 40 360 Cash .......................................................... Accounts Receivable ......................... 360 Salaries Expense ....................................... Salaries Payable [$7,000 × 6/7 days (Sunday through Friday)]................ 6,000 Salaries Payable (Sunday through Friday) Salaries Expense (Saturday) ..................... Cash .................................................. 6,000 1,000 Income Tax Expense ................................. Income Tax Payable ......................... 1,250 Income Tax Payable .................................. Cash .................................................. 1,250 400 360 6,000 7,000 1,250 1,250 LO 2,3 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-57 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-4A (a) 1. June 30 2. 3. 4. 5. 6. 7. 30 30 30 30 30 30 Rent Revenue.......................................................... Unearned Rent Revenue ................................. 57,000 Supplies Expense ($8,200 - $800) ......................... Supplies.......................................................... 7,400 Insurance Expense ($14,400 x 3/12) ...................... Prepaid Insurance .......................................... 3,600 Advertising Expense ............................................... Repairs and Maintenance Expense ........................ Utilities Expense ..................................................... Accounts Payable ........................................... 110 4,450 215 Salaries Expense ($300 x 4) .................................. Salaries Payable............................................. 1,200 Interest Expense..................................................... Interest Payable ............................................. 1,875 Income Tax Expense .............................................. Income Tax Payable ....................................... 8,000 57,000 7,400 3,600 4,775 1,200 1,875 8,000 Solutions Manual 4-58 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-4A (CONTINUED) (b) ROADSIDE TRAVEL COURT LTD. Income Statement Quarter Ended June 30, 2018 Revenues Rent revenue ($212,000 – $57,000) ............................... Expenses Salaries expense ($80,500 + $1,200) ............................. Repair and maintenance expense ($4,300 + $4,450) ..... Supplies expense ........................................................... Advertising expense ($3,800 + $110) ............................. Insurance expense ......................................................... Depreciation expense ..................................................... Interest expense ............................................................. Utilities expense ($900 + $215) ...................................... Total expenses ...................................................... Income before income tax ....................................................... Income tax expense ................................................................ Net income .............................................................................. $155,000 $81,700 8,750 7,400 3,910 3,600 2,700 1,875 1,115 111,050 43,950 8,000 $ 35,950 [Revenues – Expenses = Net Income or (Loss)] LO 2,3 BT: AP Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-59 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-5A (a) Prepaid Insurance 1. After 8 months of insurance coverage the balance in the Prepaid Insurance account is $9,600. The remaining balance is for 16 months of coverage (24 months less 8 used in the previous fiscal year). $9,600 divided by 16 months equals $600 per month. 2. The policy was taken out on December 1, 2016. When the company made adjusting entries at the end of the prior fiscal year, on July 31, 2017, insurance expense for the period December 1, 2016 to July 31, 2017, which covers 8 months, would have been recorded. The entry would have been in the amount of $600 × 8 = $4,800. This would have reduced the Prepaid Insurance account to $9,600 ($14,400 – $4,800). During this past fiscal year ended July 31, 2018, this balance would have remained unchanged as no adjusting entries would have been prepared and recorded. 3. The insurance policy cost $14,400 and covers a 24-month period. The original purchase price of the policy was $14,400 ($600 per month part 1. above X 24 months). 4. By July 31, 2018, the adjusted balance in the Prepaid Insurance account will be $2,400 representing 4 months of insurance coverage from August 1 to November 30, 2018, the end of the term of the insurance policy. Remaining Months of Original Period of (3) Monthly Policy at Prepaid Cost Coverage Cost July 31, 2018 Insurance (1) (2) (1) ÷ (2) (4) (3) × (4) $14,400 24 months (Dec. 1, 2016 to Nov. 30, 2018) $600 4 months $2,400 Solutions Manual 4-60 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-5A (CONTINUED) (b) Depreciation Expense 1. The annual depreciation expense on the building is calculated as follows: ($252,000 ÷ 30 years) = $ 8,400 2. The purchase date of the building was September 1, 2014. From September 1, 2014 to July 31, 2015, the depreciation expense recorded would have been $8,400 x 11/12 or $7,700. For the fiscal years 2016 and 2017, the depreciation expense recorded would have been $16,800 ($8,400 x 2). Consequently, the balance of the Accumulated Depreciation – Buildings account (unadjusted) at July 31, 2018 would be $24,500 ($7,700 + $16,800). 3. After an additional year’s depreciation expense ($8,400) is recorded, the adjusted balance of the Accumulated Depreciation–Buildings account (unadjusted) at July 31, 2018 would be $32,900 ($24,500 + $8,400). (c) Unearned Revenue 1. The amount of monthly revenue earned on digital magazine subscriptions is calculated as follows: 1,000 subscriptions x $60 divided by 24 months = $2,500 2. By July 31, 2017, the company has earned 7 of the 24 months of subscription revenue. This covers the period from January 1, 2017 to July 31, 2017. Initially the Unearned Revenue account received $60,000 from the sale of subscriptions. Of this amount 7/24 had been earned and an adjustment was made to reduce the balance by $17,500 ($2,500 x 7) and so the adjusted balance of Unearned Revenue at July 31, 2017 was $42,500, ($60,000 - $17,500). This balance represents 17 months at $2,500 per month of subscription service remaining. During this past fiscal year ended July 31, 2018, this balance would have remained unchanged since adjusting entries are only made annually. Solutions Manual 4-61 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-5A (CONTINUED) (c) (continued) 3. By July 31, 2018, the company has earned a further 12 of the 24 months of subscription revenue or $30,000. Consequently, the adjusted balance in the Unearned Revenue account is $12,500 ($42,500 - $30,000). This balance represents 5 months of subscription service remaining at $2,500 per month for the period August 1 - December 31. (d) Salaries Payable 1. The total salary paid on the last payday, Monday July 30 was in the amount of: 6 × $625 = $3,750 3 × $750 = 2,250 $6,000 2. The amount of salaries expense to be accrued at July 31, 2018 for two days (Monday and Tuesday) is: 6 × $625 × 2/5 = $1,500 [3 × $750 × 2/5 = 900 $2,400 3. The total salary that will be paid on Monday, August 6 will be the same as that of Monday July 30, $6,000. Solutions Manual 4-62 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-5A (CONTINUED) (e) 1. 2. 3. 4. 2018 July 31 31 31 31 Insurance Expense ($600 x 12)......................... Prepaid Insurance .................................... 7,200 Depreciation Expense ....................................... Accumulated Depreciation—Buildings...... 8,400 Unearned Revenue ........................................... Subscription Revenue .............................. 30,000 Salaries Expense .............................................. Salaries Payable....................................... 2,400 7,200 8,400 30,000 2,400 LO 2,3 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-63 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-6A Cash Balance, December 31, 2018 = $177,600 cash receipts – $150,440 cash payments = $27,160. (a) (b) (1) CREATIVE DESIGNS LTD. Income Statement Year Ended December 31, 2018 Revenues Fees earned ($157,600 + $2,400) ........................... Expenses Salaries expense ($59,800 + $3,050) ...................... Rent expense ($20,000 – $2,000) ........................... Supplies expense ($8,600 – $1,260) ....................... Advertising expense ................................................ Depreciation expense ($35,400 ÷ 6) ........................ Insurance expense ($3,840 × 11/12) ...................... Total expenses ............................................... Income before income tax ................................................ Income tax expense ($6,000 + $7,000) ............................ Net income ....................................................................... $160,000 $62,850 18,000 7,340 6,800 5,900 3,520 104,410 55,590 13,000 $ 42,590 [Revenues – Expenses = Net income or (Loss)] Solutions Manual 4-64 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-6A (CONTINUED) (b) (2) CREATIVE DESIGNS LTD. Statement of Changes in Equity Year Ended December 31, 2018 Common Shares Retained Earnings Balance, January 1 ........................................................................ $ 0 $ 0 Issued common shares ................................................................. 20,000 Net income ........................................................ 42,590 Dividends declared ........................................................................ 000 000 (10,000) Balance, December 31 .................................................................. $20,000 $32,590 Total Equity $ 0 20,000 42,590 (10,000) $52,590 (Beginning equity ± Changes to equity = Ending equity) Solutions Manual 4-65 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-6A (CONTINUED) (b) (3) CREATIVE DESIGNS LTD. Statement of Financial Position December 31, 2018 Assets Current assets Cash .................................................................. Accounts receivable ......................................... Supplies ............................................................ Prepaid rent....................................................... Prepaid insurance ($3,840 – $3,520) ................ Total current assets ................................... Property, plant, and equipment Equipment .......................................................... Less: Accumulated depreciation—equipment .... Total assets ................................................................. $27,160 2,400 1,260 2,000 320 33,140 $35,400 5,900 Liabilities and Shareholders’ Equity Current liabilities Salaries payable ................................................. Income tax payable ............................................ Total current liabilities ................................ Shareholders’ equity Common shares ................................................. $20,000 Retained earnings .............................................. 32,590 Total shareholders’ equity .......................... Total liabilities and shareholders’ equity ...................... 29,500 $62,640 $ 3,050 7,000 10,050 52,590 $62,640 (Assets = Liabilities + Shareholders’ equity) LO 1,2,3,4 BT: AP Difficulty: C Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-66 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-7A (a) Revenue (total fees collected) ...................... Expenses Salaries expense ................................... Equipment............................................... Rent expense ......................................... Supplies expense .................................. Advertising expense ............................... Insurance expense ................................. Income tax expense ................................ Cash-based net income ................................. $157,600 $59,800 35,400 20,000 8,600 6,800 3,840 6,000 140,440 $ 17,160 (b) Cash-based net income .................................................. Accrual-based net income (from P4-6A) ......................... Difference ....................................................................... $ 17,160 42,590 $(25,430) (c) I recommend the accrual basis of reporting because the accrual-based income statement fairly portrays the performance of the business, with revenues and expenses measured in the financial period they were earned and incurred. LO 1 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-67 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-8A (a) 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 2018 Nov. 30 30 30 30 30 30 30 30 30 30 Insurance Expense .................................................. Prepaid Insurance ($7,320 ÷ 12 × 8) .............................................. 4,880 Depreciation Expense ............................................. Accumulated Depreciation—Equipment ($13,440 ÷ 8 yrs). .......................................... Accumulated Depreciation—Vehicles ($140,400 ÷ 6 yrs) ........................................ 25,080 Supplies Expense ($965 – $300). ........................... Supplies. ......................................................... 665 Interest Expense ($54,000 × 7% × 1/12 months) .... Interest Payable.............................................. 315 Unearned Revenue ................................................. Fees Earned ($1,400 × 10 tours) .................... 14,000 Salaries Expense..................................................... Salaries Payable............................................. 500 Accounts Receivable ............................................... Fees Earned ................................................... 1,250 Advertising Expense ................................................ Accounts Payable ........................................... 260 Rent Expense .......................................................... Prepaid Rent ($2,400 ÷ 2) ............................. 1,200 Income Tax Expense ............................................... Income Tax Payable ....................................... 300 4,880 1,680 23,400 665 315 14,000 500 1,250 260 1,200 300 Solutions Manual 4-68 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-8A (CONTINUED) (b) Cash Nov. 30 Bal. 15,800 Accumulated Depreciation – Equipment Nov. 30 Bal. 3,360 Nov. 30 Adj. 1,680 Nov. 30 Bal. 5,040 Accounts Receivable Nov. 30 Bal. 7,640 Nov. 30 Adj. 1,250 Nov. 30 Bal. 8,890 Nov. 30 Bal. Nov. 30 Bal. Nov. 30 Bal. Nov. 30 Bal. Supplies 965 Nov. 30 Adj. 300 Prepaid Rent 2,400 Nov. 30 Adj. 1,200 Prepaid Insurance Nov. 30 Bal. 7,320 Nov. 30 Adj. Nov. 30 Bal. 2,440 Equipment Nov. 30 Bal. 13,440 Vehicles Nov. 30 Bal. 140,400 665 1,200 Accumulated Depreciation—Vehicles Nov. 30 Bal. 46,800 Nov. 30 Adj. 23,400 Nov. 30 Bal. 70,200 Accounts Payable Nov. 30 Bal. Nov. 30 Adj. Nov. 30 Bal. 1,925 260 2,185 Bank Loan Payable Nov. 30 Bal. 54,000 4,880 Interest Payable Nov. 30 Adj. 315 Salaries Payable Nov. 30 Adj. 500 Solutions Manual 4-69 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-8A (CONTINUED) (b) (continued) Income Tax Payable Nov. 30 Adj. 300 Unearned Revenue Nov. 30 Bal. 14,000 Nov. 30 Adj. 14,000 Nov. 30 Bal. 0 Common Shares Nov. 30 Bal. 10,000 Retained Earnings Nov. 30 Bal. 27,225 Fees Earned Nov. 30 Bal. 130,575 Nov. 30 Adj. 14,000 Nov. 30 Adj. 1,250 Nov. 30 Bal. 145,825 Salaries Expense Nov. 30 Bal. 69,560 Nov. 30 Adj. 500 Nov. 30 Bal. 70,060 Repairs and Maintenance Expense Nov. 30 Bal. 11,170 Rent Expense Nov. 30 Bal 13,200 Nov. 30 Adj. 1,200 Nov. 30 Bal 14,400 Interest Expense Nov. 30 Bal 3,465 Nov. 30 Adj. 315 Nov. 30 Bal 3,780 Advertising Expense Nov. 30 Bal. 825 Nov. 30 Adj. 260 Nov. 30 Bal 1,085 Depreciation Expense Nov. 30 Adj. 25,080 Supplies Expense Nov. 30 Adj. 665 Insurance Expense Nov. 30 Adj. 4,880 Income Tax Expense Nov. 30 Bal 1,700 Nov. 30 Adj. 300 Nov. 30 Bal. 2,000 Solutions Manual 4-70 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9A (CONTINUED) (b) and (d) Cash Nov. 1 Bal. 15,580 Nov. 13 5,000 Nov. 9 Nov. 13 12,400 Nov. 21 Nov. 19 11,400 Nov. 23 Nov. 30 1,100 Nov. 23 Nov. 28 Nov. 30 Bal. 35,180 2,200 4,600 600 2,400 500 Nov. 21 Nov. 9 Accounts Receivable Nov. 1 Bal. 15,820 Nov. 27 3,800 Nov. 13 Nov. 30 Bal. 7,220 Nov. 1 Bal. Nov. 20 Nov. 30 Bal. Nov. 30 Bal. Nov. 1 Bal. Supplies 4,000 600 4,600 Nov. 30 Adj. 1,000 12,400 Accounts Payable Nov. 1 Bal. 4,600 Nov. 20 Nov. 30 Bal. Salaries Payable Nov. 1 Bal. 1,000 Nov. 30 Bal. Nov. 30 Adj. Nov. 30 Bal. Income Tax Payable Nov. 30 Adj. 3,600 Equipment 18,000 Accumulated Depreciation— Equipment Nov. 1 Bal. 3,600 Nov. 30 Adj. 300 Nov. 30 Bal. 3,900 Unearned Revenue Nov. 1 Bal. Nov. 30 Nov. 30 Bal. Nov. 30 Adj. 800 Nov. 30 Bal. 4,600 600 600 1,000 0 1,000 1,000 1,100 1,000 1,100 2,100 1,300 Common Shares Nov. 1 Bal. 10,000 Nov. 13 5,000 Nov. 30 Bal. 15,000 Solutions Manual 4-71 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9A CONTINUED) (b) and (d) (Continued) Retained Earnings Nov. 1 Bal. Nov. 28 33,200 Dividends Declared 500 Service Revenue Nov. 19 11,400 Nov. 27 3,800 Nov. 30 Bal. 15,200 Nov. 30 Adj. 800 Nov. 30 Bal. 16,000 Nov. 23 Rent Expense 600 Income Tax Expense Nov. 30 Adj. 1,100 Salaries Expense Nov. 9 1,200 Nov. 23 2,400 Nov. 30 Bal. 3,600 Nov. 30 Adj. 1,000 Nov. 30 Bal. 4,600 Supplies Expense Nov. 30 Adj. 3,600 Depreciation Expense Nov. 30 Adj. 300 Solutions Manual 4-72 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9A (CONTINUED) (c) ALOU EQUIPMENT REPAIR CORP. Trial Balance November 30, 2018 Cash............................................................................ Accounts receivable .................................................... Supplies ...................................................................... Equipment ................................................................... Accumulated depreciation—equipment....................... Accounts payable ........................................................ Unearned revenue ...................................................... Common shares ......................................................... Retained earnings ...................................................... Dividends declared ..................................................... Service revenue .......................................................... Salaries expense ........................................................ Rent expense .............................................................. Totals .................................................................... Debit $35,180 7,220 4,600 18,000 500 Credit $ 3,600 600 2,100 15,000 33,200 15,200 3,600 600 $69,700 0000 00 $69,700 (Total debits = Total credits) Solutions Manual 4-73 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9A (CONTINUED) (d) 2018 1. Nov. 30 2. 3. 4. 5. 30 30 30 30 Supplies Expense .................................. Supplies ($4,600 – $1,000) ........... 3,600 Salaries Expense ................................... Salaries Payable ........................... 1,000 3,600 1,000 Depreciation Expense ............................ 300 Accumulated Depreciation—Equipment ($18,000 ÷ 5 years x 1/12 months) Unearned Revenue ................................ Service Revenue ........................... 800 Income Tax Expense ............................. Income Tax Payable ..................... 1,100 300 800 1,100 Solutions Manual 4-74 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9A (CONTINUED) (e) ALOU EQUIPMENT REPAIR CORP. Adjusted Trial Balance November 30, 2018 Debit Cash............................................................................. Accounts receivable ..................................................... Supplies ....................................................................... Equipment .................................................................... Accumulated depreciation—equipment........................ Accounts payable ......................................................... Salaries payable........................................................... Income tax payable ...................................................... Unearned revenue ....................................................... Common shares ........................................................... Retained earnings ........................................................ Dividends declared....................................................... Service revenue ........................................................... Salaries expense.......................................................... Rent expense ............................................................... Supplies expense ......................................................... Income tax expense ..................................................... Depreciation expense .................................................. Totals ........................................................................ Credit $35,180 7,220 1,000 18,000 $ 3,900 600 1,000 1,100 1,300 15,000 33,200 500 16,000 4,600 600 3,600 1,100 300 $72,100 0,0 0 $72,100 (Total debits = Total credits) Solutions Manual 4-75 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9A (CONTINUED) (f) (1) ALOU EQUIPMENT REPAIR CORP. Income Statement Month Ended November 30, 2018 Revenues Service revenue ................................................ Expenses Salaries expense .............................................. Supplies expense ............................................. Rent expense.................................................... Depreciation expense ....................................... Total expenses ........................................ Income before income tax ......................................... Income tax expense................................................... Net income ................................................................ $16,000 $4,600 3,600 600 300 9,100 6,900 1,100 $ 5,800 [Revenues – Expenses = Net income or (Loss)] (f) (2) ALOU EQUIPMENT REPAIR CORP. Statement of Changes in Equity Month Ended November 30, 2018 Common Shares Retained Earnings Balance, November 1 .................................................................... $10,000 $33,200 Issued common shares.................................................................. 5,000 Net income ................................................. 5,800 Dividends declared ........................................................................ 000000 (500) Balance, November 30 .................................................................. $15,000 $38,500 Total Equity $43,200 5,000 5,800 (500) $53,500 (Beginning equity ± Changes to equity = Ending equity) Solutions Manual 4-76 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9A (CONTINUED) (f) (3) ALOU EQUIPMENT REPAIR CORP. Statement of Financial Position November 30, 2018 Assets Current assets Cash ............................................................................. Accounts receivable ...................................................... Supplies ........................................................................ Total current assets ............................................. Property, plant, and equipment Equipment................................................. $18,000 Less: Accumulated depreciation .............. 3,900 Total assets ........................................................................... $35,180 7,220 1,000 43,400 14,100 $57,500 Liabilities and Shareholders’ Equity Current liabilities Accounts payable ......................................................... Salaries payable ........................................................... Income tax payable ....................................................... Unearned revenue ........................................................ Total current liabilities .......................................... Shareholders’ equity Common shares ....................................... $15,000 Retained earnings..................................... 38,500 Total shareholders’ equity .................................... Total liabilities and shareholders’ equity ................................ $ 600 1,000 1,100 1,300 4,000 53,500 $57,500 (Assets = Liabilities + Shareholders’ equity) LO 2,3,4 BT: AP Difficulty: M Time: 80 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-77 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-10A (a) 2018 Nov. 30 30 30 30 Service Revenue .................................. Income Summary ........................ 16,000 Income Summary ................................. Salaries Expense ........................ Supplies Expense ....................... Rent Expense.............................. Depreciation Expense ................. Income Tax Expense................... 10,200 Income Summary ................................. Retained Earnings ....................... 5,800 Retained Earnings................................ Dividends Declared ..................... 500 16,000 4,600 3,600 600 300 1,100 5,800 500 (Income statement accounts are closed to the Income Summary account) Solutions Manual 4-78 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-10A (CONTINUED) (b) Cash Nov. 1 Bal. 15,580 Nov. 13 5,000 Nov. 9 Nov. 13 12,400 Nov. 21 Nov. 19 11,400 Nov. 23 Nov. 30 1,100 Nov. 23 Nov. 28 Nov. 30 Bal. 35,180 Accounts Receivable Nov. 1 Bal. 15,820 Nov. 27 3,800 Nov. 13 Nov. 30 Bal. 7,220 Supplies 4,000 600 4,600 Nov. 30 Adj. 1,000 Nov. 1 Bal. Nov. 20 Nov. 30 Bal. Nov. 30 Bal. Nov. 1 Bal. 2,200 4,600 600 2,400 500 Nov. 21 Nov. 9 Accounts Payable Nov. 1 Bal. 4,600 Nov. 20 Nov. 30 Bal. Salaries Payable Nov. 1 Bal. 1,000 Nov. 30 Bal. Nov. 30 Adj. Nov. 30 Bal. 4,600 600 600 1,000 0 1,000 1,000 12,400 Income Tax Payable Nov. 30 Adj. 3,600 Equipment 18,000 Accumulated Depreciation— Equipment Nov. 1 Bal. 3,600 Nov. 30 Bal. 3,600 Nov. 30 Adj. 300 Nov. 30 Bal. 3,900 Unearned Revenue Nov. 1 Bal. Nov. 30 Nov. 30 Bal. Nov. 30 Adj. 800 Nov. 30 Bal. 1,100 1,000 1,100 2,100 1,300 Common Shares Nov. 1 Bal. 10,000 Nov. 13 5,000 Nov. 30 Bal. 15,000 Retained Earnings Nov. 1 Bal. 33,200 Nov. 30 CE4 500 Nov. 30 CE3 5,800 Nov. 30 Bal. 38,500 PROBLEM 4-10A (CONTINUED) (b) (Continued) Nov. 30 CE4 Nov. 28 Dividends Declared 500 Nov. 30 Bal. 500 0 Solutions Manual 4-79 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Service Revenue Salaries Expense Nov. 19 11,400 Nov. 9 1,200 Nov. 27 3,800 Nov. 23 2,400 Nov. 30 Bal. 15,200 Nov. 30 Bal. 3,600 Nov. 30 Adj. 800 Nov. 30 Adj. 1,000 Nov. 30 Bal. 16,000 Nov. 30 Bal. 4,600 Nov. 30 CE1 16,000 Nov. 30 CE2 Nov. 30 Bal. 0 Nov. 30 Bal. 0 Rent Expense Nov. 23 600 Nov. 30 CE2 Nov. 30 Bal. 0 Income Tax Expense Nov. 30 Adj. 1,100 Nov. 30 CE2 Nov. 30 Bal. 0 Supplies Expense Nov. 30 Adj. 3,600 600 Nov. 30 CE2 Nov. 30 Bal. 0 Depreciation Expense Nov. 30 Adj. 300 Nov. 30 CE2 1,100 Nov. 30 Bal. 0 4,600 3,600 300 Income Summary Nov. 30 CE2 10,200 Nov. 30 CE1 16,000 Bal. 5,800 Nov. 30 CE3 5,800 Nov. 30 Bal. 0 Solutions Manual 4-80 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-10A (CONTINUED) (b) ALOU EQUIPMENT REPAIR CORP. Post-Closing Trial Balance November 30, 2018 Debit Cash............................................................. Accounts receivable ..................................... Supplies ....................................................... Equipment .................................................... Accumulated depreciation—equipment........ Accounts payable ......................................... Salaries payable .......................................... Income tax payable ...................................... Unearned revenue ....................................... Common shares ........................................... Retained earnings ........................................ Totals ...................................................... Credit $35,180 7,220 1,000 18,000 00 0000 $61,400 $ 3,900 600 1,000 1,100 1,300 15,000 38,500 $61,400 (Total debits for permanent accounts = Total credits for permanent accounts) LO 5 BT: AP Difficulty: S Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-81 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-11A (a) OZAKI CORP. Adjusted Trial Balance September 30, 2018 Debit Cash ........................................................................................... $ 3,250 Accounts receivable ................................................................... 8,435 Supplies...................................................................................... 1,265 Equipment .................................................................................. 15,040 Accumulated depreciation—equipment ...................................... Accounts payable ....................................................................... Salaries payable ......................................................................... Interest payable .......................................................................... Income tax payable .................................................................... Unearned revenue ...................................................................... Bank loan payable ...................................................................... Common shares ......................................................................... Retained earnings ...................................................................... Dividends declared ..................................................................... 700 Fees earned ............................................................................... Depreciation expense ................................................................. 750 Interest expense ......................................................................... 105 Rent expense ............................................................................. 1,500 Salaries expense ....................................................................... 13,840 Supplies expense ....................................................................... 485 Utilities expense ......................................................................... 820 Income tax expense ................................................................... 600 Totals ................................................................................... $46,790 Credit $ 750 4,460 840 105 200 550 7,800 7,000 2,600 22,485 $46,790 (Total debits = Total credits) Solutions Manual 4-82 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-11A (CONTINUED) (b) 2018 Sept. 30 30 30 30 Fees Earned ................................................. Income Summary ................................. 22,485 Income Summary ........................................... Salaries Expense .................................. Rent Expense ....................................... Utilities Expense ................................... Depreciation Expense ........................... Supplies Expense ................................. Interest Expense ................................... Income Tax Expense ............................ 18,100 Income Summary ........................................... Retained Earnings ................................ 4,385 Retained Earnings ......................................... Dividends Declared ............................... 700 22,485 13,840 1,500 820 750 485 105 600 4,385 700 (Income statement accounts are closed to the Income Summary account) Solutions Manual 4-83 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-11A (CONTINUED) (c) OZAKI CORP. Post-Closing Trial Balance September 30, 2018 Debit Cash ................................................................................... Accounts receivable ........................................................... Supplies ............................................................................. Equipment .......................................................................... Accumulated depreciation—equipment .............................. Accounts payable ............................................................... Salaries payable ................................................................. Interest payable.................................................................. Income tax payable ............................................................ Unearned revenue ............................................................. Bank loan payable .............................................................. Common shares ................................................................. Retained earnings .............................................................. Totals............................................................................. Credit $ 3,250 8,435 1,265 15,040 $ 0000 0 $27,990 750 4,460 840 105 200 550 7,800 7,000 6,285 $27,990 (Total debits for permanent accounts = Total credits for permanent accounts) LO 4,5 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-84 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12A (a) 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 2018 May 31 31 31 31 31 31 31 31 31 31 31 Insurance Expense .................................... Prepaid Insurance............................. ($10,920 ÷ 12 months) 910 Supplies Expense ...................................... Supplies ($4,880 – $1,340)............... 3,540 910 3,540 Depreciation Expense................................ ($168,000 ÷ 20 years × 1/12 months) Accumulated Depreciation—Buildings 700 Depreciation Expense................................ ($33,600 ÷ 5 years × 1/12 months Accumulated Depreciation—Furniture 560 700 560 Unearned Revenue (25 × $100) ................ Rent Revenue ................................... 2,500 Rent Revenue............................................ Unearned Revenue........................... 2,800 Accounts Receivable ................................. Rent Revenue ................................... 1,780 Salaries Expense ....................................... Salaries Payable ............................... 1,590 Interest Expense ........................................ Interest Payable ................................ 735 Utilities Expense ........................................ Accounts Payable ............................. 2,240 Income Tax Expense ................................. Income Tax Payable ......................... 1,000 2,500 2,800 1,780 1,590 735 2,240 1,000 Solutions Manual 4-85 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12A (CONTINUED) (b) May 31 Bal. Cash 6,400 Accounts Receivable May 31 Bal. 11,800 May 31 Adj. 1,780 May 31 Bal. 13,580 May 31 Bal. May 31 Bal. Supplies 4,880 May 31 Adj. 1,340 Prepaid Insurance May 31 Bal. 4,550 May 31 Adj. May 31 Bal. 3,640 3,540 Accounts Payable May 31 Bal. May 31 Adj. May 31 Bal. 8,140 2,240 10,380 Salaries Payable May 31 Adj. 1,590 Interest Payable May 31 Adj. 735 Income Tax Payable May 31 Adj. 1,000 910 Land May 31 Bal. 106,370 Buildings May 31 Bal. 168,000 Accumulated Depreciation—Buildings May 31 Bal. 24,500 May 31 Adj. 700 May 31 Bal. 25,200 Furniture May 31 Bal. 33,600 Accumulated Depreciation—Furniture May 31 Bal. 19,600 May 31 Adj. 560 May 31 Bal. 20,160 Solutions Manual 4-86 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12A (CONTINUED) (b) (continued) Unearned Revenue May 31 Bal. May 31 Adj. 2,500 May 31 Adj. May 31 Bal. 17,500 2,800 17,800 Mortgage Payable May 31 Bal. 126,000 Common Shares May 31 Bal. 60,000 Retained Earnings May 31 Bal. 41,580 Dividends Declared May 31 Bal. 2,000 May 31 Adj. Rent Revenue May 31 Bal. 200,320 2,800 May 31 Adj. 2,500 May 31 Adj. 1,780 May 31 Bal. 201,800 Salaries Expense May 31 Bal. 98,700 May 31 Adj. 1,590 May 31 Bal. 100,290 Utilities Expense May 31 Bal. 23,870 May 31 Adj. 2,240 May 31 Bal. 26,110 Interest Expense May 31 Bal. 9,240 May 31Adj. 735 May 31 Bal. 9,975 Insurance Expense May 31 Bal. 6,370 May 31 Adj. 910 May 31 Bal. 7,280 Advertising Expense May 31 Bal. 1,000 Supplies Expense May 31 Adj. 3,540 Depreciation Expense May 31 Bal. 13,860 May 31 Adj. 700 May 31 Adj. 560 May 31 Bal. 15,120 Income Tax Expense May 31 Bal. 7,000 May 31 Adj. 1,000 May 31 Bal. 8,000 Solutions Manual 4-87 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12A (CONTINUED) (c) RAINBOW LODGE LTD. Adjusted Trial Balance May 31, 2018 Debit $ 6,400 13,580 1,340 3,640 106,370 168,000 Cash .................................................................................. Accounts receivable........................................................... Supplies ............................................................................. Prepaid insurance .............................................................. Land ................................................................................... Buildings ............................................................................ Accumulated depreciation—buildings ................................ Furniture ............................................................................ 33,600 Accumulated depreciation—furniture ................................. Accounts payable .............................................................. Salaries payable ................................................................ Interest payable ................................................................. Income tax payable............................................................ Unearned revenue ............................................................. Mortgage payable, due 2021 ............................................. Common shares ................................................................ Retained earnings.............................................................. Dividends declared ............................................................ 2,000 Rent revenue ..................................................................... Salaries expense ............................................................... 100,290 Utilities expense................................................................. 26,110 Interest expense ................................................................ 9,975 Insurance expense ............................................................ 7,280 Advertising expense .......................................................... 1,000 Supplies expense .............................................................. 3,540 Depreciation expense ........................................................ 15,120 Income tax expense ........................................................... 8,000 Totals ............................................................................ $506,245 Credit $ 25,200 20,160 10,380 1,590 735 1,000 17,800 126,000 60,000 41,580 201,800 000000 0 $506,245 (Total debits = Total credits) Solutions Manual 4-88 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12A (CONTINUED) (d) (1) RAINBOW LODGE LTD. Income Statement Year Ended May 31, 2018 Revenues Rent revenue ............................................ Expenses Salaries expense ...................................... Utilities expense........................................ Depreciation expense ............................... Interest expense ....................................... Insurance expense ................................... Supplies expense ..................................... Advertising expense ................................ Total expenses ................................ Income before income tax ................................. Income tax expense........................................... Net income ........................................................ $201,800 $100,290 26,110 15,120 9,975 7,280 3,540 1,000 163,315 38,485 8,000 $ 30,485 [Revenues – Expenses = Net income or (Loss)] Solutions Manual 4-89 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12A (CONTINUED) (d) (2) RAINBOW LODGE LTD. Statement of Changes in Equity Year Ended May 31, 2018 Common Shares Balance, June 1, 2017 ................................................................... $56,000 Issued common shares .................................................................. 4,000 Net income ........................................................ Dividends declared ........................................................................ 00 0000 Balance, May 31, 2018 .................................................................. $60,000 Retained Earnings $41,580 30,485 (2,000) $70,065 Total Equity $ 97,580 4,000 30,485 (2,000) $130,065 (Beginning equity ± Changes to equity = Ending equity) Solutions Manual 4-90 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12A (CONTINUED) (d) (3) RAINBOW LODGE LTD. Statement of Financial Position May 31, 2018 Assets Current assets Cash ............................................................. Accounts receivable ...................................... Supplies ........................................................ Prepaid insurance ......................................... Total current assets ................................... Property, plant, and equipment Land .............................................................. Buildings ....................................................... Less: Accumulated depreciation .................. Furniture ....................................................... Less: Accumulated depreciation .................. Total property, plant, and equipment ......... Total assets ........................................................... $ 6,400 13,580 1,340 3,640 $ 24,960 $106,370 $168,000 25,200 $33,600 20,160 142,800 13,440 262,610 $287,570 Solutions Manual 4-91 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12A (CONTINUED) (d) (3) (continued) Liabilities and Shareholders’ Equity Current liabilities Accounts payable .......................................... Salaries payable ........................................... Interest payable ............................................ Income tax payable ....................................... Unearned revenue ........................................ Total current liabilities ................................ Non-current liabilities Mortgage payable ......................................... Total liabilities ............................................ Shareholders’ equity Common shares............................................ Retained earnings ......................................... Total shareholders’ equity ........................ Total liabilities and shareholders’ equity ................ $10,380 1,590 735 1,000 17,800 $ 31,505 126,000 157,505 $60,000 70,065 130,065 $287,570 (Assets = Liabilities + Shareholders’ equity) Solutions Manual 4-92 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12A (CONTINUED) (e) The financial position and performance of a company can be evaluated in terms of its liquidity, profitability, and solvency. Liquidity Rainbow Lodge does not appear at first glance to have a healthy liquidity position. Although it has a positive cash balance of $6,400, the company has a current ratio of only 0.8:1 ($24,960 ÷ $31,505). This seems to indicate that there are insufficient current assets to repay the company’s current liabilities. It should be noted that simply looking at the current ratio does not tell the whole story and more investigation is required. For example, accounts receivable comprise a substantial amount of current assets—you would want to know if they are all expected to be collected. More importantly, of the total current liabilities, 56% ($17,800 ÷ $31,505) is made up of unearned revenue, which will not require the payment of cash. Consequently, the current ratio is stronger than it first appears in terms of measuring the company’s ability to repay its current liabilities. Profitability According to the income statement, Rainbow Lodge was profitable in 2018 with net income of $30,485. The lodge also has a positive balance in retained earnings, which indicates it has been profitable in the past. The company also declared dividends of $2,000 in the past year, which may be of interest to your friend if your friend is considering an income investment. Solutions Manual 4-93 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12A (CONTINUED) (e) (continued) Solvency The company has a large mortgage, which is in line with the cost of the property, plant, and equipment. Its total debt to assets is 54.8% ($157,505 ÷ $287,570). One would want to determine if that ratio is comparable to Rainbow Lodge’s competitors and industry. Overall, Rainbow Lodge appears to have a good financial position. Its liquidity and profitability appear reasonable, but its solvency is not significantly high. However, a more complete analysis should be performed. Reviewing prior years’ financial statements and some industry information would enable us to perform some comparative analysis to better evaluate Rainbow’s financial health. LO 2,3,4 BT: AN Difficulty: M Time: 80 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-94 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-13A (a) May 31 31 31 31 Rent Revenue ................................................ Income Summary .................................. 201,800 Income Summary ........................................... Salaries Expense .................................. Utilities Expense ................................... Interest Expense ................................... Insurance Expense ............................... Supplies Expense ................................. Depreciation Expense ........................... Advertising Expense ............................. Income Tax Expense ............................ 171,315 Income Summary........................................... Retained Earnings ................................ 30,485 Retained Earnings ......................................... Dividends Declared ............................... 2,000 201,800 100,290 26,110 9,975 7,280 3,540 15,120 1,000 8,000 30,485 2,000 (Income statement accounts are closed to the Income Summary account) Solutions Manual 4-95 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-13A (CONTINUED) (b) May 31 Bal. Furniture May 31 Bal. 33,600 Cash 6,400 Accounts Receivable May 31 Bal. 11,800 May 31 Adj. 1,780 May 31 Bal. 13,580 May 31 Bal. May 31 Bal. Supplies 4,880 May 31 Adj. 1,340 Prepaid Insurance May 31 Bal. 4,550 May 31 Adj. May 31 Bal. 3,640 Accumulated Depreciation—Furniture May 31 Bal. 19,600 May 31 Adj. 560 May 31 Bal. 20,160 3,540 Accounts Payable May 31 Bal. May 31 Adj. May 31 Bal. 8,140 2,240 10,380 Salaries Payable May 31 Adj. 1,590 Interest Payable May 31 Adj. 735 Income Tax Payable May 31 Adj. 1,000 Unearned Revenue May 31 Bal. May 31 Adj. 2,500 May 31 Adj. May 31 Bal. 17,500 2,800 17,800 910 Land May 31 Bal. 106,370 Buildings May 31 Bal. 168,000 Accumulated Depreciation—Buildings May 31 Bal. 24,500 May 31 Adj. 700 May 31 Bal. 25,200 Mortgage Payable May 31 Bal. 126,000 Solutions Manual 4-96 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-13A (CONTINUED) (b) (b) (continued) (b) Common Shares May 31 Bal. May 31 CE4 May 31 Bal. May 31 Bal. Retained Earnings May 31 Bal. 2,000 May 31 CE3 May 31 Bal. Dividends Declared 2,000 May 31CE4 0 Rent Revenue May 31 Bal. May 31 Adj. 2,800 ay 31 Adj. May 31 Adj. May 31 Bal. May31CE1 201,800 May 31 Bal. Salaries Expense May 31 Bal. 98,700 May 31 Adj. 1,590 May 31 Bal. 100,290 May 31 CE2 May 31 Bal. 0 May 31 Bal. May 31 Adj. May 31 Bal. 60,000 41,580 30,485 70,065 2,000 200,320 2,500 1,780 201,800 0 May 31 Bal. Utilities Expense 23,870 2,240 26,110 May 31 CE2 26,110 0 Interest Expense 9,240 735 9,975 May 31 CE2 May 31 Bal. 0 May 31 Bal. May 31 Adj. May 31 Bal Insurance Expense May 31 Bal. 6,370 May 31 Adj. 910 May 31 Bal. 7,280 May 31 CE2 May 31 Bal. 0 Advertising Expense May 31 Bal. 1,000 May 31 CE2 May 31 Bal. 0 100,290 Supplies Expense May 31 Adj. 3,540 May 31 CE2 May 31 Bal. 0 9,975 7,280 1,000 3,540 Solutions Manual 4-97 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-13A (CONTINUED) (b) (b) (continued) Depreciation Expense May 31 Bal. 13,860 May 31 Adj. 700 May 31 Adj. 560 May 31 Bal. 15,120 May 31 CE2 15,120 May 31 Bal. 0 Income Tax Expense May 31 Bal. 7,000 May 31 Adj. 1,000 May 31 Bal. 8,000 May 31 CE2 May 31 Bal. 0 8,000 Income Summary May 31 CE2 171,315 May 31 CE1 201,800 Bal. 30,485 May 31 CE3 30,485 May 31 Bal. 0 Solutions Manual 4-98 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-13A (CONTINUED) (c) RAINBOW LODGE LTD. Post-Closing Trial Balance May 31, 2018 Debit Cash .................................................................................. Accounts receivable .......................................................... Supplies ............................................................................. Prepaid insurance.............................................................. Land .................................................................................. Buildings ............................................................................ Accumulated depreciation—buildings................................ Furniture ............................................................................ Accumulated depreciation—furniture................................. Accounts payable .............................................................. Salaries payable ................................................................ Interest payable ................................................................. Income tax payable ........................................................... Unearned revenue ............................................................. Mortgage payable .............................................................. Common shares ................................................................ Retained earnings ............................................................. $ 6,400 13,580 1,340 3,640 106,370 168,000 Totals ........................................................................ $332,930 Credit $ 25,200 33,600 20,160 10,380 1,590 735 1,000 17,800 126,000 60,000 70,065 $332,930 (Total debits for permanent accounts = Total credits for permanent accounts) LO 5 BT: AP Difficulty: S Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-99 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-1B 1. (a) Jan. 2 Supplies ................................................. Cash ................................................. 2,100 (b) Dec. 31 Supplies Expense ($2,100 – $550) ........ Supplies ........................................... 1,550 2. (a) Mar. 1 Equipment .............................................. Cash ................................................. (b) Dec. 31 Depreciation Expense ............................ Accumulated Depreciation—Equipment ($20,000 ÷ 5 years × 10/12 months) 3. (a) June 1 Prepaid Insurance .................................. Cash ................................................. (b) Dec. 31 Insurance Expense ($4,200 × 7/12 months) Prepaid Insurance ............................ 2,100 1,550 20,000 20,000 3,333 3,333 4,200 4,200 2,450 2,450 4. (a) Nov. 15 Cash ....................................................... Unearned Revenue .......................... 1,275 (b) Dec. 31 Unearned Revenue ($425 × 2) ............... Revenue ........................................... 850 5. (a) Dec. 15 Prepaid Rent .......................................... Cash ................................................. 2,500 1,275 850 2,500 (b) Dec. 31 No entry required LO 2 BT: AP Difficulty: S Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-100 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-2B 1. (a) Nov. 30 Salaries Expense....................................... . 3,000 Salaries Payable ($6,000 × 5/10 days) .......... 3,000 (b) Dec. 10 Salaries Payable........................................ . 3,000 Salaries Expense ...................................... . 3,000 Cash ..................................................... .......... 6,000 2. (a) Nov. 30 Interest Expense........................................ .... 117 Interest Payable ................................... .......... ($20,000 × 7% × 1/12 months) (b) 3. (a) (b) 4. (a) (b) Dec. 1 Interest Payable......................................... .... 117 Cash ..................................................... .......... 117 117 Nov. 30 Accounts Receivable ................................. . 1,000 Service Revenue ................................. .......... 1,000 Dec. No entry required 1 Dec. 21 Cash .......................................................... . 1,000 Accounts Receivable............................ .......... 1,000 Nov. 30 Interest Receivable .................................... ...... 10 Interest Revenue ................................. .......... 10 Cash .......................................................... ...... 10 Interest Receivable .............................. .......... 10 Dec. 1 5. (a) Nov. 30 Income Tax Expense ................................. . 1,000 Income Tax Payable ........................... .......... 1,000 (b) Dec. 18 Income Tax Payable .................................. . 1,000 Cash ..................................................... .......... 1,000 LO 3 BT: AP Difficulty: S Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-101 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-3B 1. (a) (b) 2. (a) (b) 3. (a) (b) 4. (a) (b) (c) 5. (b) (c) Mar. 1, 2018 Dec. 31, 2018 Jan. 2, 2018 Dec. 31, 2018 Aug. 2, 2018 Dec. 31, 2018 June 1, 2018 Dec. 31, 2018 Jan. 1, 2019 Dec. 31, 2018 Jan. 4, 2019 Supplies................................................... Cash ................................................. Supplies Expense ($1,500 + $4,250 – $1,000) ..................... Supplies ............................................ 4,250 4,250 4,750 4,750 Vehicles ................................................... Cash ................................................. 120,000 Depreciation Expense ............................ Accumulated Depreciation—Vehicles ($120,000 ÷ 4 years) 30,000 Cash ........................................................ Unearned Revenue (600 × $360) ..... 216,000 120,000 30,000 216,000 Unearned Revenue ($216,000 × 4/9) ...... 96,000 Ticket Revenue ................................. 96,000 Cash ........................................................ 30,000 Bank Loan Payable ........................... 30,000 Interest Expense...................................... Interest Payable ($30,000 × 6% × 1/12) 150 Interest Payable....................................... Cash ................................................. 150 150 150 Salaries Expense..................................... 4,500 Salaries Payable ($9,000 × 3/6) ....... 4,500 Salaries Expense..................................... 4,500 Salaries Payable...................................... 4,500 Cash ................................................. 9,000 Solutions Manual 4-102 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-3B (CONTINUED) 6. (b) (c) 7. (b) (c) Dec. 31, 2018 Jan. 7, 2019 Dec. 31, 2018 Jan. 11, 2019 Accounts Receivable ............................... Rent Revenue ................................... 600 Cash ........................................................ Accounts Receivable ........................ Unearned Revenue ........................... 1,200 Utilities Expense ...................................... Accounts Payable ............................. 1,125 Accounts Payable .................................... Cash ................................................. 1,125 600 600 600 1,125 1,125 LO 2,3 BT: AP Moderate: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-103 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-4B (a) 1. Mar. 31 2. 3. 4. 5. 6. 7. Service Revenue ........................................................ Unearned Revenue ............................................ 20,000 Supplies Expense ($2,900 - $800) .............................. Supplies ............................................................. 2,100 Insurance Expense ($3,360 x 3/12) ............................ Prepaid Insurance .............................................. 840 Utilities Expense ......................................................... Accounts Payable .............................................. 210 Salaries Expense ($100 x 4 x 2) ................................. Salaries Payable ................................................ 800 Interest Expense ($12,000 x 7% x 3/12) .................... Interest Payable ................................................. 210 Income Tax Expense .................................................. Income Tax Payable .......................................... 1,990 20,000 2,100 840 210 800 210 1,990 Solutions Manual 4-104 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-4B (CONTINUED) (b) FLY RIGHT TRAVEL AGENCY LTD. Income Statement Quarter Ended March 31, 2018 Revenues Service revenue ($50,000 - $20,000) ................................... Expenses Salaries expense ($11,000 + $800) ...................................... Office expense ...................................................................... Supplies expense ................................................................. Advertising expense ............................................................. Insurance expense ............................................................... Utilities expense ($400 + $210) ............................................ Interest expense ................................................................... Depreciation expense ........................................................... Total expenses ............................................................ Income before income tax ............................................................. Income tax expense....................................................................... Net income .................................................................................... $30,000 $11,800 2,600 2,100 1,700 840 610 210 400 20,260 9,740 1,990 $ 7,750 [Revenues – Expenses = Net Income or (Loss)] LO 2,3 BT: AP Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-105 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-5B (a) 1. Prepaid Advertising The monthly amount of advertising is calculated based on the annual contract amount paid of $8,400 divided by 12 months = $700. 2. The advertising contract for one year was paid by the business on Feb. 1, 2018, for a period of 12 months starting March 1. The Prepaid Advertising account was debited at that date for $8,400. The unadjusted balance would have remained unchanged on October 31, 2018 as no adjusting entries would have been prepared and recorded. 3. By October 31, 2018, after adjusting entries are prepared and posted to recognize the expiration of 8 months (8 ads running March 1 – October 1) of the contract ($8,400 x 8/12 = $5,600), the Prepaid Advertising account should have an adjusted balance of $2,800 ($8,400 – $5,600). This balance represents 4 months at $700 per month covering the period Nov. 1, 2018 to Feb. 1, 2019. (b) 1. Unearned Revenue The Unearned Revenue account has a balance of $135,000 because all amounts received during the year for leasing contracts were recorded into this account as follows: Month Term (in months) Sept 1, 2018 6 Monthly Rent $4,500 Number of Leases Unearned Revenue 5 $135,000 This balance would have remained unchanged as no adjusting entries would have been prepared and recorded. 2. By October 31, 2018, the company has earned $45,000 ($4,500 x 5 x 2). Consequently, the adjusted balance in the Unearned Revenue account is $90,000 ($135,000 - $45,000). This balance represents 4 months x 5 tenants at $4,500 per month. Solutions Manual 4-106 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-5B (CONTINUED) (c) Interest Expense 1. The monthly interest incurred on the bank loan is calculated as follows: $90,000 x 8% x 1/12 = $600 2. Since the interest is payable at maturity, 7 months of interest have accrued to October 31, 2018. The total is $4,200 ($600 x 7). 3. By April 1, 2019 a full year of interest will have accrued and will be payable in the amount of $7,200 ($600 x 12). (d) Depreciation Expense 1. The annual depreciation expense on the vehicles is calculated as follows: ($39,000 ÷ 5 years) = $ 7,800 2. The purchase date of the vehicles was April 1, 2017. From April 1, 2017 to October 31, 2017, the depreciation expense recorded would have been $7,800 x 7/12 or $4,550. Consequently, the balance of the Accumulated Depreciation– Vehicles account (unadjusted) at October 31, 2018 would be $4,550. During this past fiscal year ended October 31, 2018, this balance would have remained unchanged as no adjusting entries would have been prepared and recorded. 3. An annual amount of $7,800 would be recorded to Depreciation Expense for the year ended October 31, 2018. The adjusted balance of the Accumulated Depreciation–Vehicles account at October 31, 2018 would be $12,350 ($4,550 + $7,800). Solutions Manual 4-107 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-5B (CONTINUED) (e) 1. 2. 3. 4. 2018 Oct. 31 31 31 31 Advertising Expense ($700 x 8) ..................... Prepaid Advertising .............................. 5,600 5,600 Unearned Revenue ($4,500 x 5 x 2).............. 45,000 Rent Revenue..................................... Interest Expense ($90,000 × 8% × 7/12) .......... Interest Payable.................................. 4,200 Depreciation Expense ($39,000 ÷ 5) ............. Accumulated Depreciation—Vehicles . 7,800 45,000 4,200 7,800 LO 2,3 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-108 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-6B Cash Balance, April 30, 2018 = $86,500 cash receipts – $80,920 cash payments = $5,580. (a) (b) (1) THE SHARP EDGE LTD. Income Statement Six Months Ended April 30, 2018 Revenues Service revenue ($66,500 + $1,440).............................. Expenses Salaries expense ($14,200 + $4,240) ............................ Rent expense ($9,100 – $1,300) ................................... Depreciation expense ($47,040 ÷ 8 × 6/12) ................... Utilities expense ............................................................. Insurance expense ($2,760 × 6/12) ............................... Advertising expense ...................................................... Total expenses...................................................... Income before income tax....................................................... Income tax expense ($5,000 + $800) ..................................... Net income.............................................................................. $67,940 $18,440 7,800 2,940 1,900 1,380 920 33,380 34,560 5,800 $28,760 [Revenues – Expenses = Net income or (Loss)] (b) (2) THE SHARP EDGE LTD. Statement of Changes in Equity Six Months Ended April 30, 2018 Common Shares Balance, November 1, 2017 ............................................... $ 0 Issued common shares ...................................................... 20,000 Net income ............................................... 0000 00 Balance, April 30, 2018 ...................................................... $20,000 Retained Earnings $ 0 28,760 $28,760 Total Equity $ 0 20,000 28,760 $48,760 (Beginning equity ± Changes to equity = Ending equity) Solutions Manual 4-109 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-6B (CONTINUED) (b) (3) THE SHARP EDGE LTD. Statement of Financial Position April 30, 2018 Assets Current assets Cash .............................................................. Accounts receivable ...................................... Prepaid insurance ($2,760 – $1,380) ............. Prepaid rent ................................................... Total current assets .............................. Property, plant, and equipment Equipment...................................................... Less: Accumulated depreciation ................... Total assets ............................................................ $ 5,580 1,440 1,380 1,300 9,700 $47,040 2,940 44,100 $53,800 Liabilities and Shareholders’ Equity Current liabilities Salaries payable ............................................ Income tax payable ........................................ Total current liabilities ........................... Shareholders’ equity Common shares ............................................ Retained earnings .......................................... Total shareholders’ equity ..................... Total liabilities and shareholders’ equity ................. $ 4,240 800 5,040 $20,000 28,760 48,760 $53,800 (Assets = Liabilities + Shareholders’ equity) LO 1,2,3,4 BT: AP Difficulty: C Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-110 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-7B (a) Total service revenue ...................................... Total expenses: Repair equipment ..................................... Salaries expense ...................................... Rent expense ............................................ Utilities expense ........................................ Insurance expense .................................. Advertising expense ................................. Income tax expense .................................. Net loss on a cash basis .................................. $ 66,500 $47,040 14,200 9,100 1,900 2,760 920 5,000 80,920 $(14,420) (b) Cash-based net loss ....................................... Accrual-based net income (from P4-6B) ......... Difference........................................................ $(14,420) 28,760 $ 43,180 (c) I recommend the accrual basis of reporting because the accrual-based income statement fairly portrays the performance of the business, with revenues and expenses recorded in the period they were earned and incurred. LO 1 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-111 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-8B (a) 2018 1. Dec. 31 2. 3. 4. 5. 6. 7. 8. 9 10. 31 31 31 31 31 31 31 31 31 Insurance Expense ................................................. Prepaid Insurance ......................................... ($3,600 × 10/12 months) 3,000 Supplies Expense ................................................... Supplies ($2,500 – $570) .............................. 1,930 Depreciation Expense ............................................ Accumulated Depreciation—Vehicles............. ($58,000 ÷ 4 years) 14,500 Depreciation Expense ............................................ Accumulated Depreciation—Furniture ($16,000 ÷ 10) 1,600 Accounts Receivable .............................................. Service Revenue ........................................... 1,750 Interest Expense..................................................... Interest Payable.............................................. ($27,475 × 7% × 3/12 months) 481 Unearned Revenue ................................................ Service Revenue ........................................... ($600 × 2 months) 1,200 Salaries Expense (3 × $200) .................................. Salaries Payable ............................................ 600 Rent Expense ...................................................... Prepaid Rent .............................................. Income Tax Expense ............................................. Income Tax Payable ($2,850 – $2,000) 3,000 1,930 14,500 1,600 1,750 481 1,200 600 1,150 1,150 850 850 Solutions Manual 4-112 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-8B (CONTINUED) (b) Dec. 31 Bal. Cash 4,600 Furniture Dec. 31 Bal. 16,000 Accounts Receivable Dec. 31 Bal. 8,220 Dec. 31 Adj. 1,750 Dec. 31 Bal. 9,970 Dec. 31 Bal. Dec. 31 Bal. Supplies 2,500 Dec. 31 Adj. 570 Prepaid Insurance Dec. 31 Bal. 3,600 Dec. 31 Adj. Dec. 31 Bal. 600 Dec. 31 Bal. Dec. 31 Bal. Prepaid Rent 2,300 Dec. 31 Adj. 1,150 Accumulated Depreciation— Furniture Dec. 31 Bal. 4,000 Dec. 31 Adj. 1,600 Dec. 31 Bal. 5,600 1,930 3,000 1,150 Vehicles Dec. 31 Bal. 58,000 Accumulated Depreciation— Vehicles Dec. 31 Bal. 14,500 Dec. 31 Adj. 14,500 Dec. 31 Bal. 29,000 Salaries Payable Dec. 31 Adj. 600 Interest Payable Dec. 31 Adj. 481 Income Tax Payable Dec. 31 Adj. 850 Unearned Revenue Dec. 31 Bal. Dec. 31 Adj. 1,200 Dec. 31 Bal. 3,600 2,400 Bank Loan Payable Dec. 31 Bal. 27,475 Common Shares Dec. 31 Bal. 5,000 Retained Earnings Dec. 31 Bal. 7,600 Solutions Manual 4-113 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-8B (CONTINUED) (b) (continued) Dividends Declared Dec. 31 Bal. 3,800 Service Revenue Dec. 31 Bal.125,600 Dec. 31 Adj. 1,750 Dec. 31 Adj. 1,200 Dec. 31 Bal.128,550 Salaries Expense Dec. 31 Bal. 67,000 Dec. 31 Adj. 600 Dec. 31 Bal. 67,600 Rent Expense Dec. 31 Bal. 12,650 Dec. 31 Adj. 1,150 Dec. 31 Bal. 13,800 Repairs and Maintenance Expense Dec. 31 Bal. 4,690 Interest Expense Dec. 31 Bal. 2,415 Dec. 31 Adj. 481 Dec. 31 Bal. 2,896 Supplies Expense Dec. 31 Adj. 1,930 Depreciation Expense Dec. 31 Adj. 14,500 Dec. 31 Adj. 1,600 Dec. 31 Bal. 16,100 Insurance Expense Dec. 31 Adj. 3,000 Income Tax Expense Dec. 31 Bal. 2,000 Dec. 31 Adj. 850 Dec. 31 Bal. 2,850 Solutions Manual 4-114 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-8B (CONTINUED) (c) ORTEGA LIMO SERVICE LTD. Adjusted Trial Balance December 31, 2018 Debit Cash .....................................................................................$ 4,600 Accounts receivable .............................................................. 9,970 Supplies ................................................................................ 570 Prepaid insurance ................................................................. 600 Prepaid rent .......................................................................... 1,150 Vehicles ................................................................................ 58,000 Accumulated depreciation—vehicles .................................... Furniture ............................................................................... 16,000 Accumulated depreciation—furniture .................................... Salaries payable ................................................................... Interest payable .................................................................... Income tax payable ............................................................... Unearned revenue ................................................................ Bank loan payable, due September 1, 2021 ......................... Common shares.................................................................... Retained earnings ................................................................. Dividends declared ............................................................... 3,800 Service revenue .................................................................... Salaries expense .................................................................. 67,600 Depreciation expense ........................................................... 16,100 Rent expense ........................................................................ 13,800 Repairs and maintenance expense....................................... 4,690 Insurance expense................................................................ 3,000 Supplies expense.................................................................. 1,930 Interest expense ................................................................... 2,896 Income tax expense .............................................................. 2,850 Totals................................................................................. $207,556 Credit $ 29,000 5,600 600 481 850 2,400 27,475 5,000 7,600 128,550 $207,556 (Total debits = Total credits) LO 2,3,4 BT: AP Difficulty: M Time: 60 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-115 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9B (a) 2018 Sept. 4 6 11 12 17 21 24 25 26 Salaries Payable ........................................................ 1,400 Salaries Expense .............................................................................. 800 Cash ......................................................................................... 2,200 Cash .......................................................................... Accounts Receivable ......................................... 5,400 5,400 Cash .......................................................................... Service Revenue ............................................... 8,800 Cash .......................................................................... Common Shares ............................................... 5,000 Supplies ..................................................................... Accounts Payable .............................................. 2,000 Accounts Payable....................................................... Cash .................................................................. 7,000 Rent Expense ............................................................. Prepaid Rent .............................................................. Cash .................................................................. 1,000 1,000 Salaries Expense ....................................................... Cash .................................................................. 2,200 Accounts Receivable .................................................. Service Revenue ............................................... 1,600 8,800 5,000 2,000 7,000 2,000 2,200 1,600 Solutions Manual 4-116 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9B (CONTINUED) (a) (continued) Sept. 27 28 28 Cash .......................................................................... Unearned Revenue ........................................... 1,300 Dividends Declared .................................................... Cash .................................................................. 500 Income Tax Expense .................................................. Cash .................................................................. 600 1,300 500 600 (b) and (d) Cash Sept. 1 Bal. 9,760 Sept. 6 5,400 Sept. 4 Sept. 11 8,800 Sept. 21 Sept. 12 5,000 Sept. 24 Sept. 27 1,300 Sept. 25 Sept. 28 Sept. 28 Sept. 30 Bal. 15,760 Accounts Receivable Sept. 1 Bal. 7,440 Sept. 26 1,600 Sept. 6 Sept. 30 Bal. 3,640 Sept. 30 Adj. 600 Sept. 30 Bal. 4,240 2,200 7,000 2,000 2,200 500 600 Supplies Sept. 1 Bal. 1,600 Sept. 17 2,000 Sept. 30 Bal. 3,600 Sept. 30 Adj. 2,800 Sept. 30 Bal. 800 Sept. 24 Prepaid Rent 1,000 Equipment Sept. 1 Bal. 30,000 5,400 Accumulated Depreciation - Equipment Sept. 1 Bal. 3,000 Sept. 30 Adj. 250 Sept. 30 Bal. 3,250 Solutions Manual 4-117 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9B (CONTINUED) (b) and (d) (continued) Sept. 21 Accounts Payable Sept. 1 Bal. 7,000 Sept. 17 Sept. 30 Bal. Unearned Revenue Sept. 1 Bal. Sept. 27 Sept. 30 Bal. Sept. 30 Adj. 800 Sept. 30 Bal. Sept. 4 800 1,300 2,100 1,300 Salaries Payable Sept. 1 Bal. 1,400 1,400 Sept. 30 Bal. 0 Sept. 30 Adj. 1,600 Sept. 30 Bal. 1,600 Common Shares Sept. 1 Bal. 20,000 Sept. 12 5,000 Sept. 30 Bal. 25,000 Retained Earnings Sept. 1 Bal. 17,400 Sept. 28 Service Revenue Sept. 11 8,800 Sept. 26 1,600 Sept. 30 Bal. 10,400 Sept. 30 Adj. 600 Sept. 30 Adj. 800 Sept. 30 Bal. 11,800 6,200 2,000 1,200 Depreciation Expense Sept. 30 Adj. 250 Supplies Expense Sept. 30 Adj. 2,800 Salaries Expense Sept. 4 800 Sept. 25 2,200 Sept. 30 Bal. 3,000 Sept. 30 Adj. 1,600 Sept. 30 Bal. 4,600 Sept. 24 Rent Expense 1,000 Sept. 28 Income Tax Expense 600 Dividends Declared 500 Solutions Manual 4-118 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9B (CONTINUED) (c) RIJO EQUIPMENT REPAIR CORP. Trial Balance September 30, 2018 Cash ........................................................... Accounts receivable.................................... Supplies ...................................................... Prepaid rent ................................................ Equipment .................................................. Accumulated depreciation—equipment ...... Accounts payable ....................................... Unearned revenue ...................................... Common shares ......................................... Retained earnings....................................... Dividends declared ..................................... Service revenue .......................................... Salaries expense ........................................ Rent expense ............................................. Income tax expense.................................... Totals ................................................... Debit $15,760 3,640 3,600 1,000 30,000 Credit $ 3,000 1,200 2,100 25,000 17,400 500 10,400 3,000 1,000 600 $59,100 000 000 $59,100 (Total debits = Total credits) Solutions Manual 4-119 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9B (CONTINUED) (d) 1. 2. 3. 4. 5. 2018 Sept. 30 30 30 30 30 Supplies Expense ..................................... Supplies ($3,600 – $800) ................. 2,800 2,800 Salaries Expense ...................................... Salaries Payable .............................. 1,600 Accounts Receivable................................. Service Revenue .............................. 600 Depreciation Expense ............................... Accumulated Depreciation—Equipment ($30,000 ÷ 10 years ÷ 12 months) 250 Unearned Revenue ................................... Service Revenue .............................. 800 1,600 600 250 800 Solutions Manual 4-120 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9B (CONTINUED) (e) RIJO EQUIPMENT REPAIR CORP. Adjusted Trial Balance September 30, 2018 Cash .......................................................................... Accounts receivable .................................................. Supplies .................................................................... Prepaid rent ............................................................... Equipment ................................................................. Accumulated depreciation—equipment ..................... Accounts payable ...................................................... Unearned revenue..................................................... Salaries payable ........................................................ Common shares ........................................................ Retained earnings ..................................................... Dividends declared .................................................... Service revenue ........................................................ Salaries expense ....................................................... Supplies expense ...................................................... Rent expense ............................................................ Depreciation expense ................................................ Income tax expense .................................................. Totals .................................................................. Debit $15,760 4,240 800 1,000 30,000 Credit $ 3,250 1,200 1,300 1,600 25,000 17,400 500 11,800 4,600 2,800 1,000 250 600 $61,550 000 000 $61,550 (Total debits = Total credits) Solutions Manual 4-121 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9B (CONTINUED) (f) (1) RIJO EQUIPMENT REPAIR CORP. Income Statement Month Ended September 30, 2018 Service revenue ....................................................... Expenses Salaries expense ............................................ Supplies expense............................................ Rent expense .................................................. Depreciation expense ..................................... Total expenses ....................................... Income before income tax ........................................ Income tax expense ................................................. Net income .............................................................. $11,800 $4,600 2,800 1,000 250 8,650 3,150 600 $ 2,550 [Revenues – Expenses = Net Income or (Loss)] (f) (2) RIJO EQUIPMENT REPAIR CORP. Statement of Changes in Equity Month Ended September 30, 2018 Common Shares Balance, September 1 ............................................... $20,000 Issued common shares ............................................. 5,000 Net income ................................................................ Dividends declared.................................................... 00 0000 Balance, September 30 ............................................. $25,000 Retained Earnings $17,400 2,550 (500) $19,450 Total Equity $37,400 5,000 2,550 (500) $44,450 (Beginning equity ± Changes to equity = Ending equity) Solutions Manual 4-122 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-9B (CONTINUED) (f) (3) RIJO EQUIPMENT REPAIR CORP. Statement of Financial Position September 30, 2018 Assets Current assets Cash ............................................................................. Accounts receivable ...................................................... Supplies ........................................................................ Prepaid rent .................................................................. Total current assets.............................................. Property, plant, and equipment Equipment .................................................. $30,000 Less: Accumulated depreciation ............... 3,250 Total assets ........................................................................... $15,760 4,240 800 1,000 21,800 26,750 $48,550 Liabilities and Shareholders’ Equity Current liabilities Accounts payable .......................................................... Salaries payable ........................................................... Unearned revenue ........................................................ Total current liabilities .......................................... Shareholders’ equity Common shares......................................... $25,000 Retained earnings ...................................... 19,450 Total shareholders’ equity .................................... Total liabilities and shareholders’ equity ................................ $ 1,200 1,600 1,300 4,100 44,450 $48,550 (Assets = Liabilities + Shareholders’ equity) LO 2,3,4 BT: AP Difficulty: M Time: 80 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-123 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-10B (a) 2018 Sept. 30 30 30 30 Service Revenue ..................................... Income Summary ........................... 11,800 Income Summary .................................... Salaries Expense ........................... Supplies Expense ........................... Rent Expense ................................. Depreciation Expense .................... Income Tax Expense ...................... 9,250 Income Summary .................................... Retained Earnings .......................... 2,550 Retained Earnings ................................... Dividends Declared .......................... 11,800 4,600 2,800 1,000 250 600 2,550 500 500 (Income statement accounts are closed to the Income Summary account) Solutions Manual 4-124 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-10B (CONTINUED (b) Sept. 1 Bal. Sept. 6 Sept. 11 Sept. 12 Sept. 27 Sept. 30 Bal. Cash 9,760 5,400 8,800 5,000 1,300 Sept. 4 Sept. 21 Sept. 24 Sept. 25 Sept. 28 Sept. 28 Sept. 30 Bal. Sept. 21 15,760 Accounts Receivable Sept. 1 Bal. 7,440 Sept. 26 1,600 Sept. 6 Sept. 30 Bal. 3,640 Sept. 30 Adj. 600 Sept. 30 Bal. 4,240 Sept. 1 Bal. Sept. 17 Sept. 30 Bal. 2,200 7,000 2,000 2,200 500 600 5,400 Supplies 1,600 2,000 3,600 Sept. 30 Adj. 2,800 800 Sept. 24 Prepaid Rent 1,000 Sept. 1 Bal. Equipment 30,000 Accumulated Depreciation - Equipment Sept. 1 Bal. 3,000 Sept. 30 Adj. 250 Sept. 30 Bal. 3,250 Accounts Payable Sept. 1 Bal. 7,000 Sept. 17 Sept. 30 Bal. Unearned Revenue Sept. 1 Bal. Sept. 27 Sept. 30 Bal. Sept. 30 Adj. 800 Sept. 30 Bal. Sept. 4 Salaries Payable Sept. 1 Bal. 1,400 Sept. 30 Bal. Sept. 30 Adj. Sept. 30 Bal. 6,200 2,000 1,200 800 1,300 2,100 1,300 1,400 0 1,600 1,600 Common Shares Sept. 1 Bal. 20,000 Sept. 12 5,000 Sept. 30 Bal. 25,000 Solutions Manual 4-125 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-10B (CONTINUED) (b) (continued) Retained Earnings Sept. 1 Bal. Sept. 30 Bal. Sept. 30 CE4 500 Sept. 30 CE3 Sept. 30 Bal. Dividends Declared Sept. 28 500 Sept. 30 CE4 Sept. 30 Bal. 0 17,400 17,400 2,550 19,450 500 Service Revenue Sept. 11 8,800 Sept. 26 1,600 Sept. 30 Bal. 10,400 Sept. 30 Adj. 600 Sept. 30 Adj. 800 Sept. 30 Bal. 11,800 Sept. 30 CE1 11,800 Sept. 30 Bal. 0 Depreciation Expense Sept. 30 Adj. 250 Sept. 30 CE2 Sept. 30 Bal. 0 250 Income Tax Expense 600 Sept. 30 CE2 Sept. 30 Bal. 0 Sept. 28 600 Rent Expense Sept. 24 1,000 Sept. 30 CE2 1,000 Sept. 30 Bal. 0 Salaries Expense Sept. 4 800 Sept. 25 2,200 Sept. 30 Bal. 3,000 Sept. 30 Adj. 1,600 Sept. 30 Bal. 4,600 Sept. 30 CE 2 4,600 Sept. 30 Bal. 0 Income Summary Sept. 30 CE2 9,250 Sept. 30 CE1 11,800 Bal. 2,550 Sept. 30 CE3 2,550 Sept. 30 Bal. 0 Supplies Expense Sept. 30 Adj. 2,800 Sept. 30 CE2 2,800 Sept. 30 Bal. 0 Solutions Manual 4-126 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-10B (CONTINUED) (c) RIJO EQUIPMENT REPAIR CORP. Post-Closing Trial Balance September 30, 2018 Cash ............................................................. Accounts receivable ..................................... Supplies ....................................................... Prepaid rent.................................................. Equipment .................................................... Accumulated depreciation—equipment ........ Accounts payable ......................................... Unearned revenue ....................................... Salaries payable ........................................... Common shares ........................................... Retained earnings ........................................ Totals..................................................... Debit $15,760 4,240 800 1,000 30,000 00 0000 $51,800 Credit $ 3,250 1,200 1,300 1,600 25,000 19,450 $51,800 (Total debits for permanent accounts = Total credits for permanent accounts) LO 5 BT: AP Difficulty: S Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-127 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-11B (a) GRANT ADVERTISING AGENCY LIMITED Adjusted Trial Balance December 31, 2018 Cash .................................................................................... Held for trading investments................................................ Accounts receivable ............................................................ Supplies ............................................................................. Prepaid insurance ............................................................... Equipment ........................................................................... Accumulated depreciation—equipment ............................... Accounts payable ............................................................... Salaries payable.................................................................. Interest payable................................................................... Unearned revenue .............................................................. Income tax payable ............................................................. Bank loan payable ............................................................... Common shares ................................................................. Retained earnings ............................................................... Dividends declared.............................................................. Fees earned ........................................................................ Salaries expense ................................................................. Depreciation expense ......................................................... Rent expense ..................................................................... Supplies expense ............................................................... Insurance expense .............................................................. Interest expense.................................................................. Income tax expense ............................................................ Totals ......................................................................... Debit $ 11,000 10,850 19,750 1,265 800 66,000 Credit $ 39,600 4,800 1,625 700 6,200 4,000 10,000 20,000 10,400 2,000 60,600 13,625 13,200 7,200 5,935 1,600 700 4,000 $157,925 000 0 00 $157,925 (Total debits = Total credits) Solutions Manual 4-128 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-11B (CONTINUED) (b) 2018 Dec. 31 31 031 31 Fees Earned ............................................. Income Summary............................. 60,600 Income Summary ..................................... Salaries Expense ............................. Depreciation Expense ...................... Rent Expense .................................. Supplies Expense ............................ Insurance Expense .......................... Interest Expense .............................. Income Tax Expense ....................... 46,260 Income Summary ..................................... Retained Earnings ........................... 14,340 Retained Earnings .................................... Dividends Declared.......................... 2,000 60,600 13,625 13,200 7,200 5,935 1,600 700 4,000 14,340 2,000 (Income statement accounts are closed to the Income Summary account) Solutions Manual 4-129 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-11B (CONTINUED) (c) GRANT ADVERTISING AGENCY LIMITED Post-Closing Trial Balance December 31, 2018 Debit Credit Cash ..................................................................................$ 11,000 Held for trading investments .............................................. 10,850 Accounts receivable........................................................... 19,750 Supplies ............................................................................. 1,265 Prepaid insurance .............................................................. 800 Equipment ......................................................................... 66,000 Accumulated depreciation—equipment ............................. Accounts payable .............................................................. Salaries payable ................................................................ Interest payable ................................................................. Unearned revenue ............................................................. Income tax payable............................................................ Bank loan payable ............................................................. Common shares ................................................................ Retained earnings.............................................................. 00 000 0 Totals ............................................................................ $109,665 $ 39,600 4,800 1,625 700 6,200 4,000 10,000 20,000 22,740 $109,665 (Total debits = Total credits) LO 4,5 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-130 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12B (a) 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 2018 Aug. 31 31 31 31 31 31 31 31 31 31 Insurance Expense ($12,720 × 3/12)............. Prepaid Insurance ................................ 3,180 Supplies Expense ($6,990 – $1,380)............. Supplies ................................................ 5,610 Depreciation Expense ................................... ($290,000 ÷ 50 years) Accumulated Depreciation—Buildings . 5,800 Depreciation Expense ................................... ($57,200 ÷ 10 years) Accumulated Depreciation—Furniture .. 5,720 Unearned Revenue ....................................... Rent Revenue ....................................... [(355 – 45) × $200] 62,000 Salaries Expense ........................................... Salaries Payable ................................... 1,680 Utilities Expense ............................................ Accounts Payable ................................. 3,120 Rent Revenue................................................ Unearned Revenue............................... 6,000 Interest Expense............................................ Interest Payable .................................... 700 Income Tax Expense ..................................... Income Tax Payable ............................. 2,000 3,180 5,610 5,800 5,720 62,000 1,680 3,120 6,000 700 2,000 Solutions Manual 4-131 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12B (CONTINUED) (b) Cash Aug. 31 Bal. 38,820 Supplies Aug. 31 Bal. 6,990 Aug. 31 Adj. 5,610 Aug. 31 Bal. 1,380 Prepaid Insurance Aug. 31 Bal. 12,720 Aug. 31 Adj. 3,180 Aug. 31 Bal. 9,540 Land Aug. 31 Bal. 70,000 Buildings Aug.31 Bal. 290,000 Accumulated Depreciation— Buildings Aug. 31 Bal. 87,000 Aug. 31 Adj. 5,800 Aug. 31 Bal. 92,800 Furniture Aug. 31 Bal. 57,200 Accumulated Depreciation— Furniture Aug. 31 Bal. 22,880 Aug. 31 Adj. 5,720 Aug. 31 Bal. 28,600 Accounts Payable Aug. 31 Bal. 13,000 Aug. 31 Adj. 3,120 Aug. 31 Bal. 16,120 Unearned Revenue Aug. 31 Bal. 71,000 Aug. 31 Adj. 62,000 Aug. 31 Adj. 6,000 Aug. 31 Bal. 15,000 Salaries Payable Aug. 31 Adj. 1,680 Interest Payable Aug. 31 Adj. 700 Income Tax Payable Aug. 31 Adj. 2,000 Mortgage Payable Aug. 31 Bal. 120,000 Common Shares Aug. 31 Bal. 40,000 Solutions Manual 4-132 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12B (CONTINUED) (b) (continued) Retained Earnings Aug. 31 Bal. 72,000 Dividends Declared Aug. 31 Bal. 10,000 Rent Revenue Aug. 31 Adj. 6,000 Aug.31 Bal. 497,000 Aug. 31 Adj. 62,000 Aug. 31 Bal. 553,000 Salaries Expense Aug. 31 Bal. 306,000 Aug. 31 Adj. 1,680 Aug. 31 Bal. 307,680 Utilities Expense Aug. 31 Bal. 75,200 Aug. 31 Adj. 3,120 Aug. 31 Bal. 78,320 Repairs and Maintenance Expense Aug. 31 Bal. 28,250 Insurance Expense Aug. 31 Adj. 3,180 Supplies Expense Aug. 31 Adj. 5,610 Depreciation Expense Aug. 31 Adj. 5,800 Aug. 31 Adj. 5,720 Aug. 31 Bal. 11,520 Interest Expense Aug. 31 Bal. Aug. 31 Adj. Aug. 31 Bal. 7,700 700 8,400 Income Tax Expense Aug. 31 Bal. 20,000 Aug. 31 Adj.0 2,000 Aug. 31 Bal. 22,000 Solutions Manual 4-133 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12B (CONTINUED) (c) ROCKY MOUNTAIN RESORT INC. Adjusted Trial Balance August 31, 2018 Cash ........................................................................ Supplies ....................................................................... Prepaid insurance ........................................................ Land............................................................................. Buildings ...................................................................... Accumulated depreciation—buildings .......................... Furniture ...................................................................... Accumulated depreciation—furniture ........................... Accounts payable ........................................................ Salaries payable .......................................................... Interest payable ........................................................... Income tax payable...................................................... Unearned revenue ....................................................... Mortgage payable, due 2021 ....................................... Common shares .......................................................... Retained earnings........................................................ Dividends declared ...................................................... Rent revenue ............................................................... Salaries expense ......................................................... Utilities expense........................................................... Repairs and maintenance expense ............................. Depreciation expense .................................................. Interest expense .......................................................... Supplies expense ........................................................ Insurance expense ...................................................... Income tax expense..................................................... Totals ............................................................... Debit $ 38,820 1,380 9,540 70,000 290,000 Credit $ 92,800 57,200 28,600 16,120 1,680 700 2,000 15,000 120,000 40,000 72,000 10,000 553,000 307,680 78,320 28,250 11,520 8,400 5,610 3,180 22,000 $941,900 , 000000 0 $941,900 (Total debits = Total credits) Solutions Manual 4-134 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12B (CONTINUED) (d) (1) ROCKY MOUNTAIN RESORT INC. Income Statement Year Ended August 31, 2018 Revenues Rent revenue ........................................... Expenses Salaries expense ..................................... Utilities expense....................................... Repairs and maintenance expense ......... Depreciation expense .............................. Interest expense ...................................... Supplies expense .................................... Insurance expense .................................. Total expenses ............................... Income before income tax ................................ Income tax expense.......................................... Net income ...................................................... $553,000 $307,680 78,320 28,250 11,520 8,400 5,610 3,180 442,960 110,040 22,000 $ 88,040 [Revenues – Expenses = Net income or (Loss)] (d) (2) ROCKY MOUNTAIN RESORT INC. Statement of Changes in Equity Year Ended August 31, 2018 Common Shares Retained Earnings Balance, September 1, 2017 .......................................................... $35,000 $ 72,000 Issued common shares .................................................................. 5,000 Net income ........................................................ 88,040 Dividends declared......................................................................... 0000 00 (10,000) Balance, August 31, 2018 .............................................................. $40,000 $150,040 Total Equity $107,000 5,000 88,040 (10,000) $190,040 (Beginning equity ± Changes to equity = Ending equity) Solutions Manual 4-135 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12B (CONTINUED) (d) (3) ROCKY MOUNTAIN RESORT INC. Statement of Financial Position August 31, 2018 Assets Current assets Cash ........................................................ Supplies ................................................... Prepaid insurance .................................... Total current assets ........................... Property, plant, and equipment Land ......................................................... $ 70,000 Buildings .................................................. $290,000 Less: Accumulated depreciation ............. 92,800 197,200 Furniture .................................................. $57,200 Less: Accumulated depreciation ............. 28,600 28,600 Total property, plant, and equipment Total assets ........................................................ Liabilities and Shareholders’ Equity Current liabilities Accounts payable ...................................... Salaries payable ........................................ Interest payable ......................................... Income tax payable .................................... Unearned revenue ..................................... Total current liabilities ....................... Non-current liabilities Mortgage payable ...................................... Total liabilities ................................... Shareholders’ equity Common shares ........................................ Retained earnings...................................... Total shareholders’ equity ................. Total liabilities and shareholders’ equity ............. $ 38,820 1,380 9,540 49,740 295,800 $345,540 $16,120 1,680 700 2,000 15,000 $ 35,500 120,000 155,500 $ 40,000 150,040 190,040 $345,540 (Assets = Liabilities + Shareholders’ equity) Solutions Manual 4-136 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12B (CONTINUED) (e) The financial position and performance of a company can be evaluated in terms of its liquidity, profitability, and solvency. Liquidity Rocky Mountain Resort seems to being enjoying a strong liquidity position. It has a large cash balance of $38,820. The company has a positive current ratio of 1.4:1 ($49,740 ÷ $35,500) which would indicate that there are more than enough current assets on hand to meet currently maturing liabilities. It is also notable that current liabilities include a large amount (42.3%) of unearned revenue, which will not require a cash payment in future. Profitability According to the income statement, Rocky Mountain Resort was profitable in 2018 with net income of $88,040. The resort also has a positive balance in retained earnings, which indicates it has been profitable in the past. The company also declared dividends of $10,000 in the past year, which may be of interest to your friend if your friend is considering an income investment. Solvency The company has a large mortgage, but this represents less than half of the value of the property, plant, and equipment so the bank should not be worried about security for the loan. The company’s debt to assets ratio is 45% ($155,500 ÷ $345,540), so the level of debt held by the company is not extremely high which mitigates the risk of not being able to make interest payments. This, combined with strong liquidity and positive income, indicates that the company is not experiencing any solvency problems. Solutions Manual 4-137 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-12B (CONTINUED) (e) (Continued) Overall, Rocky Mountain Resort appears to have a healthy financial position. However, a more complete analysis should be performed before investing. Reviewing prior years’ financial statements and industry information would enable us to perform some comparative analysis to better evaluate Rocky’s financial health. LO 2,3,4 BT: AN Difficulty: M Time: 80 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-138 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-13B (a) 2018 Aug. 31 31 031 31 Rent Revenue ............................................. Income Summary ............................... 553,000 Income Summary ........................................ Salaries Expense ............................... Utilities Expense ................................ Repairs and Maintenance Expense ... Depreciation Expense ........................ Interest Expense ................................ Supplies Expense .............................. Insurance Expense ............................ Income Tax Expense ......................... 464,960 Income Summary ........................................ Retained Earnings ............................. 88,040 Retained Earnings ...................................... Dividends Declared ............................ 10,000 553,000 307,680 78,320 28,250 11,520 8,400 5,610 3,180 22,000 88,040 10,000 (Income statement accounts are closed to the Income Summary account) Solutions Manual 4-139 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-13B (CONTINUED (b) Cash Aug. 31 Bal. 38,820 Aug. 31 Bal. Aug. 31 Bal. Supplies 6,990 Aug. 31 Adj. 1,380 Prepaid Insurance Aug. 31 Bal. 12,720 Aug. 31 Adj. Aug. 31 Bal. 9,540 Accounts Payable Aug. 31 Bal. 13,000 Aug. 31 Adj. 3,120 Aug. 31 Bal. 16,120 5,610 Unearned Revenue Aug. 31 Bal. 71,000 Aug. 31 Adj. 62,000 Aug. 31 Adj. 6,000 Aug. 31 Bal. 15,000 3,180 Land Aug. 31 Bal. 70,000 Buildings Aug. 31 Bal.290,000 Accumulated Depreciation— Buildings Aug. 31 Bal. 87,000 Aug. 31 Adj. 5,800 Aug. 31 Bal. 92,800 Furniture Aug. 31 Bal. 57,200 Accumulated Depreciation— Furniture Aug. 31 Bal. 22,880 Aug. 31 Adj. 5,720 Aug. 31 Bal. 28,600 Salaries Payable Aug. 31 Adj. 1,680 Interest Payable Aug. 31 Adj. 700 Income Tax Payable Aug. 31 Adj. 2,000 Mortgage Payable Aug. 31 Bal. 120,000 Common Shares Aug. 31 Bal. 40,000 Retained Earnings Aug. 31 Bal. 72,000 Aug. 31 CE4 10,000 Aug. 31 CE3 88,040 Aug. 31 Bal. 150,040 Dividends Declared Aug. 31 Bal. 10,000 Aug. 31 CE4 10,000 Aug. 31 Bal. 0 Solutions Manual 4-140 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 4-13B (CONTINUED) (b) (continued) Rent Revenue Aug. 31 Bal. 497,000 Aug. 31 Adj. 6,000 Aug. 31 Adj. 62,000 Aug. 31 Bal. 553,000 Aug.31 CE1 553,000 Aug. 31 Bal. 0 Salaries Expense Aug. 31 Bal. 306,000 Aug. 31 Adj. 1,680 Aug. 31 Bal. 307,680 Aug.31 CE2 Aug. 31 Bal. 0 Aug. 31 Bal. Aug. 31 Adj. Aug. 31 Bal. Aug. 31 Bal. Utilities Expense 75,200 3,120 78,320 Aug. 31 CE2 0 5,610 Depreciation Expense Aug. 31 5,800 Aug. 31 Adj. 5,720 Aug. 31 Bal. 11,520 Aug. 31 CE2 11,520 Aug. 31 Bal. 0 307,680 Interest Expense Aug. 31 Bal. Aug. 31 Adj. Aug. 31 Bal. 7,700 700 8,400 Aug. 31 CE2 Aug. 31 Bal. 8,400 0 78,320 Repairs and Maintenance Expense Aug. 31 Bal. 28,250 Aug. 31 CE2 28,250 Aug. 31 Bal. 0 Insurance Expense 3,180 Aug. 31 CE2 Aug. 31 Bal. 0 Supplies Expense 5,610 Aug. 31 CE2 Aug. 31 Bal. 0 Aug. 31 Adj. Income Tax Expense Aug. 31 Bal. 20,000 Aug. 31 2,000 Aug. 31 Bal. 22,000 Aug. 31 CE2 22,000 Aug. 31 Bal. 0 Income Summary Aug. 31 Adj. 3,180 Aug.31 CE2 464,960 Aug.31 CE1 553,000 Bal. 88,040 Aug.31 CE3 88,040 Aug. 31 Bal. 0 PROBLEM 4-13B (CONTINUED (c) ROCKY MOUNTAIN RESORT INC. Post-Closing Trial Balance August 31, 2018 Debit Cash...............................................................................$ 38,820 Credit Solutions Manual 4-141 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Supplies ............................................................................. 1,380 Prepaid insurance .............................................................. 9,540 Land ...................................................................................70,000 Buildings ............................................................................ 290,000 Accumulated depreciation—buildings ................................ Furniture.............................................................................57,200 Accumulated depreciation—furniture ................................. Accounts payable ............................................................... Salaries payable................................................................. Interest payable ................................................................. Income tax payable ............................................................ Unearned revenue ............................................................. Mortgage payable .............................................................. Common shares ................................................................. Retained earnings .............................................................. 00 00000 Totals ......................................................................... $466,940 $ 92,800 28,600 16,120 1,680 700 2,000 15,000 120,000 40,000 150,040 $466,940 (Total debits for permanent accounts = Total credits for permanent accounts) LO 5 BT: AP Difficulty: S Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-142 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-1 ACCOUNTING CYCLE REVIEW (a) Aug. 1 3 6 10 13 15 17 22 24 27 29 31 Prepaid Advertising ................................................... Cash ................................................................. 400 Prepaid Rent ............................................................. Cash ................................................................. 380 Cash ......................................................................... Accounts Receivable ........................................ 3,200 Salaries Expense ...................................................... Salaries Payable ....................................................... Cash ................................................................. 1,700 1,420 Cash ......................................................................... Service Revenue .............................................. 3,800 Equipment ................................................................. Accounts Payable ............................................. 2,000 Accounts Payable ...................................................... Cash ................................................................. 2,000 Supplies .................................................................... Accounts Payable ............................................. 800 Salaries Expense ...................................................... Cash ................................................................. 2,900 Accounts Receivable ................................................ Service Revenue .............................................. 4,760 Cash ......................................................................... Unearned Revenue .......................................... 780 Dividends Declared ................................................... Cash ................................................................. 500 400 380 3,200 3,120 3,800 2,000 2,000 800 2,900 4,760 780 500 Solutions Manual 4-143 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-1 (CONTINUED) (b), (d), and (g) Cash Aug Aug. 1 Bal. 6,020 Aug. 1 400 6 3,200 380 13 3,800 29 780 3 1 0 1 7 2 4 3 1 31 Bal. Note Receivable 4,00 Aug. 1 Bal. 0 Interest Receivable 3,120 2,000 2,900 Aug. 1 Bal. 20 Aug. 31 Adj. 20 Aug. 31 Bal. 40 500 Equipment 4,500 Aug. 1 Bal. 10,000 Aug. 15 Accounts Receivable Aug. 1 Bal. 4,310 Aug. 6 27 Aug. 3,200 2,000 Aug. 31 Bal. 12,000 4,760 Accumulated Depreciation—Equipment 31 Bal. 5,870 Aug. 1 Bal. Aug. 31 Adj. Prepaid Advertising Aug. Aug. 1 31 Bal. 400 Aug. 31 Adj. 20 0 Aug. 31 Bal 200 Supplies Aug. 1 Bal. Adj 87 1,030 Aug. 31 . 0 22 800 31 Bal. 960 Aug. 3 380 Aug. 31 Adj. 380 Aug. 31 Bal. 0 2,000 Aug. 1 Bal. 2,200 2,300 15 2,000 22 800 Aug. 31 Bal. Aug. 10 Prepaid Rent 200 Accounts Payable Aug. 17 Aug. 2,000 Salaries Payable 1,420 Aug. 1 Bal. 3,100 1,420 Aug. 31 Adj. 1,540 Aug. 31 Bal. 1,540 Solutions Manual 4-144 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-1 (CONTINUED) (b), (d), and (g) (continued) Interest Revenue Income Tax Payable Aug. Aug. 31 Adj. 31 Adj. 300 Aug. 31 CE 20 20 Aug.31 Bal. Unearned Revenue Aug. 31 Adj. 800 Aug. 1 Bal. 29 Salaries Expense 1,260 Aug. 10 1,700 24 2,900 780 Aug. 31 Bal. 1,240 Common Shares Aug. 1 Bal. Aug. 31 Adj. 1,540 Aug. 31 Bal. 6,140 Aug. 31 CE2 12,000 Aug. 31 Bal. Retained Earnings 0 6,400 1,290 Aug. 31 Adj. 380 Aug. 31 CE2 500 Aug. 31 Bal. 7,190 Aug. 31 Bal. 500 Aug. 31 CE4 Aug. 31 Bal. 380 0 Supplies Expense Dividends Declared Aug. 31 6,140 Rent Expense Aug. 1 Bal. Aug. 31 CE3 Aug. 31 CE4 0 500 Aug. 31 Adj. 870 Aug. 31 CE2 0 Aug. 31 Bal. 870 0 Service Revenue Aug. 31 CE Aug. 13 3,800 27 4,760 31 Adj. 800 Aug. 31 Bal. 9,360 Aug. 31 Bal. 0 Depreciation Expense Aug. 31 Adj. 200 July 31 CE2 Aug. 31 Bal. 200 0 19,360 Solutions Manual 4-145 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-1 (CONTINUED) (b), (d), and (g) (continued) Income Tax Expense Aug. 31 Adj. 300 Aug. 31 CE 2 Aug 31 CE2 Aug. 31 Bal. Income Summary 8,090 Aug. 31 CE1 9,380 Aug. 31 Bal. 1,290 Aug. 31 Bal. 0 300 0 Aug. 31 CE 3 1,290 Advertising Expense Aug. 31 Adj. 200 Aug 31 Aug. 31 Bal. CE2 200 0 Solutions Manual 4-146 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-1 (CONTINUED) (c) TOBIQUE LTD. Trial Balance August 31, 2018 Cash ...................................................... Accounts receivable ............................. Prepaid advertising ............................... Supplies ................................................ Prepaid rent ........................................... Note receivable ...................................... Interest receivable ................................. Equipment ............................................. Accumulated depreciation—equipment . Accounts payable ................................. Unearned revenue ................................ Common shares ................................... Retained earnings ................................. Dividends declared ................................ Service revenue ..................................... Salaries expense .................................. Totals .............................................. Debit $ 4,500 5,870 400 1,830 380 4,000 20 12,000 Credit $ 2,000 3,100 2,040 12,000 6,400 500 8,560 4,600 $34,100 $34,100 (Total debits = Total credits) Solutions Manual 4-147 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-1 (CONTINUED) (d) Aug. 31 31 31 31 31 31 31 31 Advertising Expense .................................................. Prepaid Advertising ................................................... ($400 × 1/2) 200 Rent Expense ............................................................ Prepaid Rent .................................................... 380 Salaries Expense ...................................................... Salaries Payable .............................................. 1,540 Depreciation Expense ............................................... Accumulated Depreciation—Equipment .................... Supplies Expense...................................................... Supplies ($1,830 - $960) .................................. 200 Unearned Revenue ................................................... Service Revenue .............................................. 800 Interest Receivable.................................................... Interest Revenue .............................................. ($4,000 × 6% × 1/12) 20 Income Tax Expense ................................................. Income Tax Payable ......................................... 300 200 380 1,540 200 870 870 800 20 300 Solutions Manual 4-148 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-1 (CONTINUED) (e) TOBIQUE LTD. Adjusted Trial Balance August 31, 2018 Cash Accounts receivable ....................................... Prepaid advertising ......................................... Supplies .......................................................... Note receivable ................................................ Interest receivable ........................................... Equipment ....................................................... Accumulated depreciation—equipment ........... Accounts payable ........................................... Salaries payable ............................................. Income tax payable ........................................ Unearned revenue .......................................... Common shares ............................................. Retained earnings .......................................... Dividends declared .......................................... Service revenue .............................................. Interest revenue .............................................. Salaries expense ............................................ Rent expense ................................................. Supplies expense ........................................... Depreciation expense ..................................... Advertising expense ....................................... Income tax expense ....................................... Totals ........................................................ Debit $ 4,500 5,870 200 960 4,000 40 12,000 Credit $ 2,200 3,100 1,540 300 1,240 12,000 6,400 500 9,360 20 6,140 380 870 200 200 300 $36,160 $36,160 (Total debits = Total credits) Solutions Manual 4-149 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-1 (CONTINUED) (f) (1) TOBIQUE LTD. Income Statement Month Ended August 31, 2018 Revenues Service revenue .............................................. Interest revenue .............................................. Expenses Salaries expense ............................................ Supplies expense ............................................ Rent expense .................................................. Advertising expense ........................................ Depreciation expense ..................................... Total expenses ....................................... Income before income tax ........................................ Income tax expense ................................................. Net income ............................................................... $9,360 20 $9,380 $6,140 870 380 200 200 7,790 1,590 300 $1,290 [Revenues – Expenses = Net Income or (Loss)] (f) (2) TOBIQUE LTD. Statement of Changes in Equity Month Ended August 31, 2018 Common Retained Shares Earnings Balance, Aug. 1 ...................................................................... $12,000 $6,400 Net income.............................................................................. 1,290 00 0000 Dividends declared ................................................................. __ ____ (500) Balance, Aug. 31 .................................................................... $12,000 $7,190 Total Equity $18,400 1,290 (500) $19,190 (Beginning equity ± Changes to equity = Ending equity) Solutions Manual 4-150 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-1 (CONTINUED) (f) (3) TOBIQUE LTD. Statement of Financial Position August 31, 2018 Assets Current assets Cash........................................................... Accounts receivable ................................... Note receivable, due October 31, 2018...... Interest receivable ...................................... Prepaid advertising .................................... Supplies ..................................................... Total current assets........................... Property, plant, and equipment Equipment .................................................. Less: Accumulated depreciation ................ Total assets......................................................... $ 4,500 5,870 4,000 40 200 960 15,570 $12,000 2,200 9,800 $25,370 Liabilities and Shareholders’ Equity Current liabilities Accounts payable ....................................... Salaries payable ........................................ Income tax payable .................................... Unearned revenue ..................................... Total liabilities ....................................... $3,100 1,540 300 1,240 Shareholders’ equity Common shares ......................................... Retained earnings ...................................... Total shareholders’ equity ................. Total liabilities and shareholders’ equity ............. $12,000 7,190 $ 6,180 19,190 $25,370 (Assets = Liabilities + Shareholders’ equity) Solutions Manual 4-151 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-1 (CONTINUED) (g) Aug. 31 Service Revenue ....................................................... Interest Revenue ....................................................... Income Summary ............................................. 9,360 20 31 Income Summary ...................................................... Salaries Expense ............................................. Rent Expense ................................................... Supplies Expense ............................................. Depreciation Expense ...................................... Advertising Expense .................................................. Income Tax Expense ........................................ 8,090 31 Income Summary ...................................................... Retained Earnings ............................................ 1,290 31 Retained Earnings ..................................................... Dividends Declared .......................................... 500 9,380 6,140 380 870 200 200 300 1,290 500 (Income statement accounts are closed to the Income Summary account) Solutions Manual 4-152 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-1 (CONTINUED) (h) TOBIQUE LTD. Post-closing Trial Balance August 31, 2018 Cash ................................................................ Accounts receivable ........................................ Prepaid advertising ......................................... Supplies .......................................................... Note receivable ................................................ Interest receivable ........................................... Equipment Accumulated depreciation—equipment ........... Accounts payable ........................................... Salaries payable ............................................. Income tax payable ......................................... Unearned revenue .......................................... Common shares ............................................. Retained earnings ........................................... Totals.......................................................... Debit $ 4,500 5,870 200 960 4,000 40 12,000 000 000 $27,570 Credit $ 2,200 3,100 1,540 300 1,240 12,000 7,190 $27,570 (Total debits for permanent accounts = Total credits for permanent accounts) LO 2,3,4,5 BT: AP Difficulty: M Time: 80 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-153 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-2 ACCOUNTING CYCLE REVIEW (a) July 3 4 5 6 6 Cash .......................................................................... Common Shares .............................................. 10,000 Prepaid Insurance ..................................................... Cash ................................................................. 3,600 Prepaid Rent ............................................................. Cash ................................................................. 8,000 Supplies .................................................................... Cash ................................................................. 3,800 Equipment ................................................................. Cash ................................................................. Bank Loan Payable .......................................... 24,000 10,000 3,600 8,000 3,800 4,000 20,000 10 No entry required (consulting agreement) 12 Cash ......................................................................... Accounts Receivable ........................................ 1,200 Unearned Revenue ................................................... Fees Earned ..................................................... 1,120 Salaries Expense ...................................................... Cash ................................................................. 11,000 Accounts Payable...................................................... Cash ................................................................. 400 13 16 17 1,200 1,120 11,000 400 Solutions Manual 4-154 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-2 (CONTINUED) (a) (continued) July 18 19 20 23 25 27 30 Cash ......................................................................... Unearned Revenue .......................................... 12,000 Accounts Receivable ................................................ Fees Earned ..................................................... 28,000 Professional Fees Expense ....................................... Accounts Payable ............................................. Unearned Revenue ................................................... Fees Earned ..................................................... 2,200 12,000 28,000 2,200 10,000 10,000 Income Tax Expense ................................................. Income Tax Payable .................................................. Cash ................................................................. 1,200 500 Cash ......................................................................... Accounts Receivable ........................................ 15,000 Dividends Declared ................................................... Cash ................................................................. 5,000 1,700 15,000 5,000 Solutions Manual 4-155 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-2 (CONTINUED) (b), (d), and (g) Cash July July Equipment 1 Bal. 15,230 July 4 3,600 3 10,000 5 8,000 12 1,200 6 3,800 18 12,000 6 4,000 27 15,000 16 11,000 17 400 25 1,700 30 5,000 31 Bal. July 6 24,000 Accumulated Depreciation—Equipment July 31 Adj. 500 Accounts Payable July 17 400 July 1 Bal. 20 15,930 400 2,200 31 Adj. 800 July 31 Bal. 3,000 Accounts Receivable July July 1 Bal. 1,200 July 12 19 28,000 31 Bal. 13,000 27 1,200 Interest Payable 15,000 July 31 Adj. Prepaid Insurance July July 4 31 Bal. 3,600 July 31 Adj. 100 Salaries Payable 300 July 31 Adj. 11,000 3,300 Income Tax Payable Supplies July July 1 Bal. 690 6 3,800 31 Bal. 3,240 July 25 July 5 31 Bal. 500 July 31 Bal. 0 July 31 Adj. 1,250 Unearned Revenue Prepaid Rent July 500 July 1 Bal. 8,000 July 31 Adj. 4,000 July 13 1,120 23 10,000 July 1 Bal. 1,120 18 12,000 July 31 Bal. 2,000 4,000 Solutions Manual 4-156 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-2 (CONTINUED) (b), (d), and (g) (continued) Rent Expense Bank Loan Payable 20,000 July July 6 31 Adj. 4,000 July 31 CE2 Common Shares July 31 Bal. July 1 Bal. 3,600 3 10,000 July 31 Bal. 0 Professional Fees Expense 13,600 July 20 2,200 July 31 CE2 Retained Earnings July 1 Bal. 5,000 July 31 CE3 July 31 CE4 11,500 July 31 Bal. Supplies Expense July 31 Adj. 1,250 July 31 CE2 Dividends Declared 5,000 July July 31 Bal. 31 CE4 5,000 July 31 Bal. 0 1,250 0 Utilities Expense July 31 Adj. Fees Earned July July 13 1,120 19 28,000 23 10,000 800 July 31 CE2 July 31 Bal. Depreciation Expense 31 Bal. 39,120 July 31 Adj. 500 July 31 July 31 Bal. 0 July 31 Bal. Salaries Expense 11,000 CE2 500 0 Insurance Expense July 31 Adj. 300 July 31 Adj. 11,000 July 31 July 31 Bal. 22,000 800 0 July 31 CE1 39,120 July 16 2,200 0 6,770 July 31 Bal. 13,270 July 30 4,000 July 31 Bal. CE2 300 0 July 31 CE2 22,000 July 31 Bal. 0 Solutions Manual 4-157 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-2 (CONTINUED) (b), (d), and (g) (continued) Income Summary Interest Expense July 31 Adj. 100 July 31 CE2 July 31 July 31 Bal. CE2 32,350 July 31 CE1 39,120 100 0 Bal. July 31 CE3 6,770 6,770 July 31 Bal. 0 Income Tax Expense July 25 1,200 July 31 CE2 July 31 Bal. 1,200 0 Solutions Manual 4-158 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-2 (CONTINUED) (c) RIVER CONSULTANTS LTD. Trial Balance July 31, 2018 Cash ........................................................ Accounts receivable ................................ Prepaid insurance .................................... Supplies .................................................. Prepaid rent ............................................. Equipment ............................................... Accounts payable ................................... Unearned revenue .................................. Bank loan payable ................................... Common shares ..................................... Retained earnings ................................... Dividends declared .................................. Fees earned............................................. Salaries expense ..................................... Professional fees expense ....................... Income tax expense ................................. Totals............................................... Debit $15,930 13,000 3,600 4,490 8,000 24,000 Credit $ 2,200 2,000 20,000 13,600 11,500 5,000 39,120 11,000 2,200 1,200 $88,420 $88,420 (Total debits = Total credits) Solutions Manual 4-159 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-2 (CONTINUED) (d) July 31 31 31 31 31 31 31 Insurance Expense.................................................... Prepaid Insurance ............................................ ($3,600 × 1/12) 300 Rent Expense ............................................................ Prepaid Rent .................................................... 4,000 Supplies Expense...................................................... Supplies............................................................ 1,250 Depreciation Expense ............................................... Accumulated Depreciation—Equipment ........... ($24,000 ÷ 4 × 1/12) 500 Interest Expense ....................................................... Interest Payable ............................................... ($20,000 × 6% × 1/12) 100 Salaries Expense ...................................................... Salaries Payable .............................................. 11,000 Utilities Expense ........................................................ Accounts Payable ............................................. 800 300 4,000 1,250 500 100 11,000 800 Solutions Manual 4-160 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-2 (CONTINUED) (e) RIVER CONSULTANTS LTD. Adjusted Trial Balance July 31, 2018 Cash ............................................................. Accounts receivable ...................................... Prepaid insurance ......................................... Supplies ....................................................... Prepaid rent .................................................. Equipment ..................................................... Accumulated depreciation—equipment ........ Accounts payable ......................................... Interest payable ........................................... Salaries payable .......................................... Unearned revenue ....................................... Bank loan payable ........................................ Common shares ........................................... Retained earnings ........................................ Dividends declared ....................................... Fees earned ................................................. Salaries expense ......................................... Rent expense ............................................... Professional fees expense ........................... Supplies expense ......................................... Utilities expense ........................................... Depreciation expense .................................. Insurance expense ....................................... Interest expense .......................................... Income tax expense ..................................... Totals ........................................................ Debit $ 15,930 13,000 3,300 3,240 4,000 24,000 Credit $ 500 3,000 100 11,000 2,000 20,000 13,600 11,500 5,000 39,120 22,000 4,000 2,200 1,250 800 500 300 100 1,200 $100,820 $100,820 (Total debits = Total credits) Solutions Manual 4-161 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-2 (CONTINUED) (f) (1) RIVER CONSULTANTS LTD. Income Statement Month Ended July 31, 2018 Revenues Fees earned .................................................... Expenses Salaries expense ............................................ Rent expense .................................................. Professional fees expense .............................. Supplies expense ............................................ Utilities expense .............................................. Depreciation expense ..................................... Insurance expense .......................................... Interest expense ............................................. Total expenses ....................................... Income before income tax ........................................ Income tax expense ................................................. Net income ............................................................... $39,120 $22,000 4,000 2,200 1,250 800 500 300 100 31,150 7,970 1,200 $ 6,770 [Revenues – Expenses = Net income or (Loss)] Solutions Manual 4-162 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-2 (CONTINUED) (f) (2) RIVER CONSULTANTS LTD. Statement of Changes in Equity Month Ended July 31, 2018 Common Retained Shares Earnings Balance, July 1 ............................................................................... $ 3,600 $11,500 Issued common shares .................................................................. 10,000 Net income ..................................................................................... 6,770 00 0000 Dividends declared ......................................................................... __ ____ (5,000) Balance, July 31 ............................................................................. $13,600 $13,270 Total Equity $15,100 10,000 6,770 (5,000) $26,870 (Beginning equity ± Changes to equity = Ending equity) Solutions Manual 4-163 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-2 (CONTINUED) (f) (3) RIVER CONSULTANTS LTD. Statement of Financial Position July 31, 2018 Assets Current assets Cash........................................................... Accounts receivable ................................... Prepaid rent ............................................... Prepaid insurance ...................................... Supplies ..................................................... Total current assets........................... Property, plant, and equipment Equipment .................................................. Less: Accumulated depreciation ................ Total assets......................................................... $15,930 13,000 4,000 3,300 3,240 39,470 $24,000 500 23,500 $62,970 Liabilities and Shareholders’ Equity Current liabilities Accounts payable ....................................... Salaries payable ........................................ Interest payable ......................................... Unearned revenue ..................................... Total current liabilities ........................... Non-current liabilities Bank loan payable ..................................... Total liabilities.................................... Shareholders’ equity Common shares ......................................... Retained earnings ...................................... Total shareholders’ equity ................. Total liabilities and shareholders’ equity ............. $ 3,000 11,000 100 2,000 $16,100 20,000 36,100 $13,600 13,270 26,870 $62,970 (Assets = Liabilities + Shareholders’ equity) Solutions Manual 4-164 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR4-2 (CONTINUED) (g) July 31 31 31 31 Fees Earned .............................................................. Income Summary ............................................. 39,120 Income Summary ...................................................... Salaries Expense ............................................. Rent Expense ................................................... Professional Fees Expense .............................. Supplies Expense ............................................. Utilities Expense ............................................... Depreciation Expense ...................................... Insurance Expense ........................................... Interest Expense .............................................. Income Tax Expense ........................................ 32,350 Income Summary ...................................................... Retained Earnings ............................................ 6,770 Retained Earnings ..................................................... Dividends Declared .......................................... 5,000 39,120 22,000 4,000 2,200 1,250 800 500 300 100 1,200 6,770 5,000 (Income statement accounts are closed to the Income Summary account) (h) Current ratio $39,470 $16,100 = 2.5:1 River Consultants has exceeded the benchmark of 2:1 for its current ratio. LO 2,3,4,5 BT: AP Difficulty: M Time: 80 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-165 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT4-1 (a) Financial Accounting, Seventh Canadian Edition FINANCIAL REPORTING CASE Accounts appearing on North West’s balance sheet that may have been used in an adjusting entry for prepayments include: Prepaid expenses Property and equipment The related statement of earnings accounts that most likely include adjusting entries at the end of the year for prepayments include: (b) Selling, operating, and administrative expenses o Depreciation expense (which North West calls amortization expense) which would be part of selling, operating, and administrative expenses o Insurance expense included would be part of selling, operating, and administrative expenses o Other choices are also possible Accounts appearing on North West’s balance sheet that may have been used in an adjusting entry for accruals include: Accounts payable and accrued liabilities Income tax payable The related statement of earnings accounts that most likely include adjusting entries at the end of the year for accruals include: Salaries expense which would be part of selling, operating, and administrative expenses Income tax expense Other choices are also possible Solutions Manual 4-166 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT4-1 (CONTINUED) (c) The five-step process of revenue recognition includes: 1. 2. 3. 4. Identify the contract with the client or customer. Identify the performance obligations in the contract. Determine the transaction price. Allocate the transaction price to the performance obligations in the contract. 5. Recognize revenue when (or as) the company satisfies the performance obligation. For North West: 1. The contract is created when the customer selects goods in the stores. 2. The performance obligation is the provision of goods. 3. The transaction price is labelled for each item in the stores. 4. The per item price fulfils the total performance obligation in the contract. 5. The revenue is recognized when the customer goes though the cash register system and pays for the purchase. LO 1,2 BT: C Difficulty: M Time: 20 min. AACSB: Communication and Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-167 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT4-2 Financial Accounting, Seventh Canadian Edition FINANCIAL REPORTING CASE Revenue and expense criteria require that revenue be recognized when earned and expenses when incurred. At the time of signing the three-year maintenance contact, the customer has not received any services and no revenue has been earned. Although $100,000 was collected at the time of signing the contract, the full amount should be recorded to the Unearned Revenue account. As the performance obligations of the contract (maintenance service) are delivered, revenue from the services provided can be recognized and the related unearned revenue reduced. This will ensure that the expenses incurred in the performance of the contract will be matched to the revenues recognized. The financial statements for 2017, 2018, and 2019 will be affected as follows: For 2017, only statement of financial position accounts will be affected. Cash and Unearned Revenue will increase. For 2018, the income statement will be affected. Revenue earned from the provision of the maintenance services will be recognized and there will be a corresponding entry to reduce the unearned revenue created when the cash was collected on Dec. 29, 2017. Related expenses will be recognized and matched to the revenues in the same accounting period. The second collection of $100,000 on Dec. 29, 2018 will affect the statement of financial position. Cash and Unearned Revenue will increase. For 2019, the same effect for the income statement and the statement of financial position will occur as is described for 2018. LO 1 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-168 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT4-3 Financial Accounting, Seventh Canadian Edition PROFESSIONAL JUDGEMENT CASE Note to instructors: All of the material supplementing this group activity, including a suggested solution, can be found in the Collaborative Learning section of the Instructor Resource site accompanying this textbook as well as in the Prepare and Present section of WileyPLUS. (a) 1. To record the additional depreciation, the following would be recorded: Depreciation Expense Accumulated Depreciation—Furniture 2. 400,000 400,000 To increase the accrual for operating expenses by $80,000 ($230,000 – $150,000) the following entry would be made: Office Expense Accounts Payable (b) 300,000 To accrue the additional salary expense, the following would be recorded: Salaries Expense Salaries Payable 3. 300,000 80,000 Income before income tax as originally determined Additional depreciation expense Additional salaries expense Additional office expense Income before income tax revised 80,000 $2,800,000 (300,000) (400,000) (80,000) $2,020,000 Solutions Manual 4-169 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT4-3 (CONTINUED) (c) Anna suggested that the useful life of the furniture be lowered to increase the amount of depreciation recorded in each year. This would lower income before income tax and strengthen management’s argument that the company could not afford to increase salaries. (d) In order to accrue an expense such as severance pay, it must have been incurred. Since the decision to shut down the stores has not yet been made, it would be inappropriate to record such an expense. (e) It is not unusual for a company to have to accrue amounts for utilities prior to the invoice being received in order to record the expense in the appropriate period. The company should be able to make a reasonable estimate by calling the utility company and looking at past history. However, increasing the estimate from $150,000 to $230,000 appears to have been done without any adequate support or justification. This seems like an attempt to lower the net income of the company prior to negotiations with the union. LO 2,3 BT: AN Difficulty: M Time: 30 min. AACSB: Ethics and Analytic CPA: cpa-t001, cpa-e001 CM: Reporting and Ethics Solutions Manual 4-170 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT4-4 (a) Financial Accounting, Seventh Canadian Edition ETHICS CASE The stakeholders in this situation are: Sundream’s controller Sundream’s Chief Executive Officer Sundream’s shareholders Sundream’s creditors. (b) By adding $12,000 to sales revenue and reducing interest expense by $3,000, net income increases by $15,000. Unearned revenue reduces by $12,000 and interest payable reduces by $3,000. Consequently, the current and total liabilities would reduce by $15,000 and the shareholders’ equity would increase by $15,000 on the statement of financial position. The Sundream Travel Agency’s liquidity improves as a result of the changes suggested by the CEO. The current ratio should be 1.9:1 ($400,000 ÷ $210,000) but it is now increased to 2.1:1 [($400,000 ÷ ($210,000 – $12,000 – $3,000)]. (c) Intentionally misrepresenting the company’s financial condition and its results of operations is unethical and is also illegal. It is obvious from the request that the CEO’s intention is to manipulate the amount of the current liabilities, to ensure that the current ratio conforms to the 2:1 requirement of the bank loan. (d) Accounting standards are known and understood by the users and the preparers of the financial statements. Those who prepare the financial statements are bound by the accounting standards. An intentional breach of these standards, as is suggested by the CEO in this case, cannot be passed off as an oversight or ignorance of the fundamental rules of accounting. Consequently, the CEO is aware of the breach in the accounting standards when he suggests the changes to the controller. He knows that his behaviour is unethical and his suggestions should be challenged by his controller. LO 1,2,3 BT: E Difficulty: M Time: 20 min. AACSB: Ethics and Analytic CPA: cpa-t001, cpa-e001 CM: Reporting and Ethics Solutions Manual 4-171 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT4-5 (a) Financial Accounting, Seventh Canadian Edition FINANCIAL REPORTING CASE Since First Capital Realty Inc. is required to release financial statements quarterly, it would need to post adjusting entries at least quarterly. Since Skyline Group of Companies only releases financial statements annually, it will need to prepare adjusting entries at least annually. Although external financial statements are released on a quarterly basis for First Capital and on an annual basis for Skyline, it is likely that management of both companies would need monthly financial statements so that they can assess the company’s performance on a timely basis. For this reason, it is likely that the adjusting entries are prepared on a monthly basis for each of the companies and that there are no significant differences in the accounting cycle for each company. (b) The criteria for, and timing of, revenue recognition may differ between the two companies, depending on their source of revenue. This is not likely though given that the two companies are both REITs, but it is possible depending on the terms of specific performance contracts. In terms of financial reporting, Skyline would not be required to prepare a statement of changes in equity, but rather would prepare a statement of retained earnings. Skyline would also not report other comprehensive income in the shareholders’ equity section of its statement of financial position and it would not prepare a statement of comprehensive income (we will learn more about comprehensive income in a later chapter). First Capital Realty would prepare a statement of changes in equity and a statement of comprehensive income (if it had any other comprehensive income). Otherwise, the remaining financial statements would be the same for each company. Compared with ASPE, additional disclosure is required by companies reporting under IFRS in the notes to the financial statements. LO 2 BT: C Difficulty: M Time: 15 min. AACSB: Communication CPA: cpa-t001 CM: Reporting Solutions Manual 4-172 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT4-6 Financial Accounting, Seventh Canadian Edition SERIAL CASE (a) 1. 2. 3. 4. 5. 6. 7. 8. June 30 Advertising Expense ................................................ Supplies ......................................................... 600 30 Depreciation Expense ............................................. Accumulated Depreciation—Buildings ($165,000 ÷ 30 years) 5,500 30 Depreciation Expense ............................................. Accumulated Depreciation—Equipment. ......... 7,070 30 Depreciation Expense ............................................. Accumulated Depreciation—Vehicles 4,200 30 Interest Expense ..................................................... Interest Payable .............................................. 50 30 Insurance Expense ($12,000 × 6/12 months) .......... Prepaid Insurance .......................................... 6,000 30 Utilities Expense ...................................................... Accounts Payable .......................................... 1,025 30 Accounts Receivable ............................................... Sales ............................................................... 1,600 30 Salaries Expense (2 × 20 × $25) ............................. Salaries Payable ............................................. 1,000 30 Income Tax Expense ............................................... Income Tax Payable ....................................... 5,000 600 5,500 7,070 4,200 50 6,000 1,025 1,600 1,000 5,000 Solutions Manual 4-173 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT4-6 (CONTINUED) (b) June Bal. Note: June balances were taken from the answer to CT3-6. Cash 34,534 June Bal. Accounts Receivable June Bal. 10,490 30 Adj. 1,600 June Bal. 12,090 June Bal. June Bal. June Bal. June Bal. June Bal. Accumulated Depreciation-Equipment June Bal. 14,000 30 Adj. 7,070 June Bal. 21,070 Vehicles June Bal. 52,500 Inventory 16,250 Supplies 4,375 June 30 Adj. 3,775 Prepaid Insurance 12,000 June 30 6,000 Equipment 44,520 Accumulated Depreciation-Vehicles June 30 Adj. 4,200 600 Accounts Payable June Bal. 30 Adj. June Bal. 6,240 1,025 7,265 6,000 Land June Bal. 100,000 Buildings June Bal. 165,000 Accumulated Depreciation-Buildings June Bal. 137,500 30 Adj. 5,500 June Bal. 143,000 Unearned Revenue June Bal. 1,000 Salaries Payable June 30 Adj. 1,000 Interest Payable June 30 Adj. 50 Income Tax Payable June 30 Adj. 5,000 Bank Loan Payable June Bal. 22,500 CT4-6 (CONTINUED) (b) (continued) Mortgage Payable June Bal. 53,200 Common Shares Solutions Manual 4-174 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley June Bal. Financial Accounting, Seventh Canadian Edition 300 Retained Earnings June Bal. 146,788 Dividends Declared June Bal. 30,000 Rent Revenue June Bal. June Bal. 30 Adj. June Bal. 9,600 Insurance Expense June 30 Adj. 6,000 Property Tax Expense June Bal. 5,950 6,000 Sales June Bal. 638,758 30 Adj. 1,600 June Bal. 640,358 Cost of Goods Sold June Bal. 102,386 June Bal. June Bal. 30 Adj. June Bal. Interest Expense 5,299 50 5,349 Income Tax Expense June Bal. 13,000 30 Adj. 5,000 June Bal. 18,000 Salaries Expense 390,782 1,000 391,782 Depreciation Expense June 30 Adj. 5,500 30 Adj. 7,070 30 Adj. 4,200 June Bal. 16,770 June Bal. Office Expense 18,000 Utilities Expense June Bal. 12,200 30 Adj. 1,025 June Bal. 13,225 Advertising Expense June Bal. 9,000 30 Adj. 600 Solutions Manual 4-175 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT4-6 (CONTINUED) (c) ANTHONY BUSINESS COMPANY LTD. Adjusted Trial Balance June 30, 2017 Debit Cash ......................................................................... Accounts receivable .................................................. Inventory ................................................................... Supplies .................................................................... Prepaid insurance ..................................................... Land .......................................................................... Buildings ................................................................... Accumulated depreciation—buildings ........................ Equipment ................................................................. Accumulated depreciation—equipment ..................... Vehicles .................................................................... Accumulated depreciation—vehicles ......................... Accounts payable ...................................................... Unearned revenue..................................................... Salaries payable ........................................................ Interest payable ......................................................... Income tax payable ................................................... Bank loan payable ..................................................... Mortgage payable ..................................................... Common shares ........................................................ Retained earnings ..................................................... Dividends declared .................................................... Rent revenue............................................................. Sales ......................................................................... Cost of goods sold..................................................... Salaries expense ....................................................... Depreciation expense................................................ Office expense .......................................................... Utilities expense ........................................................ Advertising expense .................................................. Insurance expense .................................................... Property tax expense ................................................ Interest expense ........................................................ Income tax expense .................................................. Totals ..................................................................... (Total debits = Total credits) $ Credit 34,534 12,090 16,250 3,775 6,000 100,000 165,000 $ 143,000 44,520 21,070 52,500 4,200 7,265 1,000 1,000 50 5,000 22,500 53,200 300 146,788 30,000 6,000 640,358 102,386 391,782 16,770 18,000 13,225 9,600 6,000 5,950 5,349 18,000 $1,051,731 000 0000 $1,051,731 Solutions Manual 4-176 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT4-6 (CONTINUED) (d) Revenues: Sales Rent revenue Expenses Cost of goods sold Salaries expense Depreciation expense Office expense Utilities expense Advertising expense Insurance expense Property tax expense Interest expense Income tax expense Net income Net income Cash Difference $640,358 6,000 $102,386 391,782 16,770 18,000 13,225 9,600 6,000 5,950 5,349 18,000 $646,358 587,062 $ 59,296 $59,296 34,534 $24,762 LO 2,3,4 BT: AP Difficulty: M Time: 70 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 4-177 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Legal Notice Copyright © 2017 by John Wiley & Sons Canada, Ltd. or related companies. All rights reserved. The data contained in these files are protected by copyright. This manual is furnished under licence and may be used only in accordance with the terms of such licence. The material provided herein may not be downloaded, reproduced, stored in a retrieval system, modified, made available on a network, used to create derivative works, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise without the prior written permission of John Wiley & Sons Canada, Ltd. (MMXVII vi F2) Solutions Manual 4-178 Chapter 4 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CHAPTER 5 MERCHANDISING OPERATIONS LEARNING OBJECTIVES 1. 2. 3. 4. 5. 6. Identify the differences between service and merchandising companies. Prepare entries for purchases under a perpetual inventory system. Prepare entries for sales under a perpetual inventory system. Prepare a single-step and a multiple-step income statement. Calculate the gross profit margin and profit margin. Account and report inventory in a periodic inventory system (Appendix 5A). SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND BLOOM’S TAXONOMY Item LO 1. 2. 3. 4. 5. 1 1 1 1 1 BT Item LO BT C C C C C 6. 7. 8. 9. 10. 2 2 2,3 2,3 2,3 C AP C C C Item LO BT Questions 11. 12. 13. 14. 15. 2,3 3 3 3 4 C C C C C Item LO BT Item LO BT 16. 17. 18. 19. 20. 4 4 4 4 5 K C C C C 21. 22. 23. 24. 25. 5 5 6 6 6 C C C C C Brief Exercises 1. 2. 1 1 C AN 5. 6. 2 3 AP AP 9. 10. 4 4,5 C AN 13. 14. 6 6 AP AP 3. 4. 2 2,3 AP AP 7. 8. 4 4 AP C 11. 12. 5 6 AN AP 15. 16. 6 6 AP AP 1. 2. 3. 4. 1 2,3 2,3 2 C AN AP AP 5. 6. 7. 8. 2 2 2,3,5 4 AP AN AP C 9. 10. 11. 12. 13. 14. 15. 16. 5 6 2,3,6 6 AN AP AP AN 17. 6 AN 1. 2. 3. 1 1,2,3 2,3 AN AN AP 4. 5. 6. 2,3 2,3,4 4 AP AP AN 5 1,6 6 AN AN AP 13. 14. 15. 6 5,6 6 AP AP AP Exercises 4 4,5 4,5 4,6 AP AN AN AN Problems: Set A and B 7. 8. 9. 4 5 4,5 AP AN AN 10. 11. 12. Accounting Cycle Review 1. 2,3,4 AP 1. 2. 1,4,5 5 AN AN Cases 3. 4. 4,5 2,3,5 E E 5. 6. 2 4,5 C AN Solutions Manual 5-1 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Legend: The following abbreviations will appear throughout the solutions manual file. LO Learning objective BT Bloom's Taxonomy K Knowledge C Comprehension AP Application AN Analysis S Synthesis E Evaluation Level of difficulty S Simple M Moderate C Complex Estimated time to prepare in minutes Difficulty: Time: AACSB Association to Advance Collegiate Schools of Business Communication Communication Ethics Ethics Analytic Analytic Technology Tech. Diversity Diversity Reflec. Thinking Reflective Thinking CPA CM cpa-e001 cpa-e002 cpa-e003 cpa-e004 cpa-e005 cpa-t001 cpa-t002 cpa-t003 cpa-t004 cpa-t005 cpa-t006 CPA Canada Competency Ethics Professional and Ethical Behaviour PS and DM Problem-Solving and Decision-Making Comm. Communication Self-Mgt. Self-Management Team & Lead Teamwork and Leadership Reporting Financial Reporting Stat. & Gov. Strategy and Governance Mgt. Accounting Management Accounting Audit Audit and Assurance Finance Finance Tax Taxation Solutions Manual 5-2 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ANSWERS TO QUESTIONS 1. (a) The operating cycle is the time it takes to go from cash to cash in producing revenues. (b) The normal operating cycle for a merchandising company is likely to be longer than that of a service company because, in a merchandising company, inventory must first be purchased and sold, and then the receivables must be collected whereas, in a service company, the services only need to be provided (not purchased first and then stored until sold) and then the receivables must be collected. LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 2. (a) The income measurement process of a merchandising company is the same as the service company in that net income is arrived at by deducting expenses from revenues. (b) The income measurement process of a merchandising company differs from that of a service company in that its revenue is derived from sales revenue, not service revenue. In addition, cost of goods sold is deducted from sales revenue to determine gross profit, before operating and other expenses, similar to both types of companies, are deducted (or other revenues are added). LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 3. The company needs to compare the cost of the detailed record keeping required in a perpetual inventory system to the benefits of having the additional information about the inventory. One of the benefits of a perpetual inventory system is the ability to answer questions from customers about merchandise availability. In a used clothing business, this may not be of much benefit unless each inventory item is unique. Another benefit is the monitoring of inventory quantities in order to avoid running out of stock. Again, this may not be of benefit since the company does not order recurring or similar merchandise, and may not have a supplier to order from. But if the company is selling used clothing on consignment, it will need to track each item in order to determine which consignor to pay when an item is sold. Solutions Manual 5-3 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition 3. (continued) The company should carefully determine the cost of the detailed record keeping required, in particular for a new company. A perpetual inventory system requires more record keeping and therefore is more expensive to use. For example, a perpetual inventory system usually requires an investment in a point-of-sale system that is integrated with the inventory system. LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 4. A physical count is an important control feature. By using a perpetual inventory system, a company knows what should be on hand. Performing a physical count and checking it to the perpetual records is necessary to detect any errors in record keeping and/or shortages in stock. LO 1 BT: C Difficulty: M Time: 2 min. AACSB: None CPA: cpa-t001 CM: Reporting 5. The key distinction between a periodic inventory system and a perpetual inventory system is whether or not information on inventory and cost of goods sold (units and dollars) are always (perpetually) available or only known when inventory counts are conducted (periodically). Because information on the cost of goods sold is only known after an inventory count has been carried out under the periodic system, no entry is made for the cost of goods sold at the time of each sale. Instead, cost of goods sold is a residual number, determined by subtracting ending inventory (as determined by the inventory account) from cost of goods available for sale. This means that any goods not included in ending inventory are assumed to have been sold. In order to arrive at the cost of goods available for sale, separate accounts are set up in the general ledger to keep track of the purchases, freight-in, purchase returns and allowances, and purchase discounts. Under the periodic inventory system, management is not able to look up in the general ledger accounts for the balance of inventory at a particular point in time. In order to arrive at the inventory value, a physical count of the inventory must be performed. LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 5-4 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 6. Financial Accounting, Seventh Canadian Edition The reason for recording the purchase of merchandise for resale in a separate account is to enable a company to determine its cost of goods sold and gross profit. This information is useful in managing costs and setting prices. LO 2 BT: C Difficulty: M Time: 2 min. AACSB: None CPA: cpa-t001 CM: Reporting 7. (a) The value of the purchase discount to Butler’s Roofing is $480 ($48,000 × 1%). (b) Failing to take advantage of the discount terms is like paying the supplier an extra $480 in order to settle a $47,520 invoice 20 days later. This works out to 1.01% [$480 ÷ $47,520] every 20 days. On an annual basis this amounts to 18.4% [($480 ÷ $47,520 × (365 ÷ 20)]. Butler’s should take advantage of the cash discount offered. LO 2 BT: AP Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance 8. (a) Lebel Ltée should record the sale as revenue in June, when it is sold to a customer. When the merchandise was purchased in April, it should be recorded as an asset, inventory. It should be recorded as cost of goods sold (an expense) in June when the inventory is sold and the revenue is recognized. This is necessary in order to match the cost with the related revenue (b) Lebel’s customer should recognize the purchase in June, when the inventory is received. LO 2,3 BT: C Difficulty: C Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 5-5 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 9. Financial Accounting, Seventh Canadian Edition (a) FOB shipping point means that the goods are placed free on board by the seller at the point of shipping. The buyer pays the freight costs from the point of shipping to the buyer’s destination because title passes at shipping point. FOB destination means the goods are delivered by the seller to their destination, where the title passes. The seller pays for shipping to the buyer’s destination. (b) FOB shipping point will result in a debit to the Inventory account by the buyer because title has transferred at shipping point and the inventory is now owned by the buyer. FOB destination will result in a debit to Freight Out by the seller because they are paying for the freight. LO 2,3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 10. In a perpetual inventory system, purchase returns are credited to Inventory because the items purchased have been returned to the vendor and are no longer available to be sold to customers. Sales returns are not debited directly to the Sales account because this would not provide information about the goods returned. This information can be useful in making decisions. Debiting returns directly to sales may also cause problems in comparing sales for different periods. LO 2,3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 11. (a) A quantity discount gives a reduction in the price according to the volume of the purchase. A purchase discount is offered by a seller to a buyer for early payment of an invoice. When the buyer pays the invoice within the discount period, the amount of the discount decreases the Inventory account. A sales discount is the same as a purchase discount but from the seller’s point of view. (b) Quantity discounts are not recorded or accounted for separately but become part of the recorded sales price. Buyers record purchase discounts taken as a credit to Inventory under the perpetual system or to Purchase Discounts when using the periodic system. The seller records a sales discount as a debit to the Sales Discounts account, which is a contra revenue account to Sales, when the invoice is paid within the discount period. LO 2,3 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 5-6 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 12. Financial Accounting, Seventh Canadian Edition Contra accounts are used to reduce the account they are contra to, such as accumulated depreciation reducing equipment. A debit (decrease) recorded directly to Sales would make it more difficult for management to determine the percentage of total sales that ends up being lost through sales returns and allowances, so a contra revenue account (sales returns and allowances) is used. Another example of a contra revenue account is sales discounts. This account keeps track of the costs incurred for discounts taken by customers for paying early, in accordance with the discount terms offered. The contra revenue accounts reduce sales to net sales, reported on the income statement. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 13. If the merchandise is not resaleable, it cannot be included in inventory since it cannot be resold and it has no value. The cost remains in cost of goods sold since it is a cost of doing business. If the merchandise is resaleable, it still has value to the company. In this case, the cost of the merchandise is debited to inventory again and cost of goods sold is credited. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 14. The sales taxes are collected on behalf of the federal and provincial governments, and must be periodically remitted to these authorities. Sales taxes that are collected from selling a product or service are not recorded as revenue, instead they are recorded as a liability until they are paid to the government. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 5-7 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 15. Financial Accounting, Seventh Canadian Edition In a single-step income statement, all data are classified into two categories: (1) revenues and (2) expenses. It is referred to as a single-step income statement because only a single step—subtracting expenses from revenues— is needed to determine income before income tax. A multiple-step income statement requires several steps to determine income before income tax. First, cost of goods sold is deducted from net sales to determine gross profit. Operating expenses are then deducted to calculate income from operations. Finally, other revenues and expenses are added or deducted to determine income before income tax. The deduction of income tax to calculate net income (loss) is the same under both formats. In addition, both formats produce the same profit amount for the period. LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 16. North West Company uses a multiple-step income statement. LO 4 BT: K Difficulty: S Time: 2 min. AACSB: None CPA: cpa-t001 CM: Reporting 17. (a) When classifying expenses by their nature, they are reported in accordance with their natural classification (for example, salaries, deprecation, and so on). When classifying expenses by their function, they are reported according to the activity (business function) for which they were incurred (for example, cost of goods sold, administrative, selling). (b) It does not matter whether a single-step or multiple-step income statement is prepared, expenses must be classified either by nature or by function. LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 18. Because the Overwaitea is a private enterprise, it can follow Accounting Standards for Private Enterprises (ASPE). Companies following ASPE can classify their expenses in whatever manner is useful to them. Loblaws, which follows IFRS, must classify its expenses by their nature or their function. LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 5-8 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 19. Financial Accounting, Seventh Canadian Edition Interest expense is a non-operating expense because it relates to how a company’s operations are financed, not to the company’s main operations. LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 20. The difference between gross profit margin and profit margin is that the gross profit margin measures the amount by which the selling price exceeds the cost of goods sold while the profit margin measures the extent to which sales cover all expenses (including the cost of goods sold). LO 5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 21. Factors affecting a company’s gross profit margin include the selling price and the cost of the merchandise. Recall that gross profit = net sales cost of goods sold. Selling products with a higher price or “mark-up” or selling products with a lower cost would result in an increased gross profit margin. Selling products with a lower price (perhaps due to increased competition that results in lower selling prices) or selling products with a higher cost (perhaps due to price increases from suppliers and shippers) would result in a lower gross profit margin. LO 5 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 22. High gross profit Computer services and such as software companies Pharmaceutical manufacturers Luxury goods retailers Low gross profit Low-price retail companies Walmart Grocery stores Forestry and wood products LO 5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 5-9 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *23. Accounts Purchase Returns and Allowances Purchase Discounts Freight In (a) Added/Deducted Deducted Deducted Added (b) Normal Balance Credit Credit Debit LO 6 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting *24. Periodic System Cost of Goods Sold = Beginning Inventory + Cost of Goods Purchased (Purchases – Purchase Discounts – Purchase Returns and Allowances + Freight In) – Ending Inventory Ending inventory and cost of goods sold for the period are calculated at the end of the period. Perpetual System Cost of Goods Sold = the cost of the item(s) sold Cost of goods sold is calculated at the time of each sale and recorded as an increase (debit) to the Cost of Goods Sold account and a decrease (credit) to the Inventory account. LO 6 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 5-10 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley *25. Financial Accounting, Seventh Canadian Edition The calculation of cost of goods sold is shown in detail in the income statement of a company using the periodic system. In a perpetual system, it is one line and amount only. Periodic System Cost of Goods Sold = 1. Add the cost of goods purchased (where the cost of goods purchased is equal to purchases less purchases discounts, and purchases returns and allowances plus freight in) to the cost of goods on hand at the beginning of the period (beginning inventory). The result is the cost of goods available for sale. 2. Subtract the cost of goods on hand at the end of the period (ending inventory) from the cost of goods available for sale. The result is the cost of goods sold. Perpetual System Cost of Goods Sold = one number, which is the total of cost of goods sold as previously determined and recorded for all sales. LO 6 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 5-11 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 5-1 (a) The company with the most efficient operating cycle is Company A as it uses the fewest number of days in its cycle to obtain cash. (b) The company which is most likely a service company is Company A as it does not have to manufacture or deliver inventory and consequently takes the fewest number of days to obtain cash. Company C, with the highest number of days in its operating cycle, is likely the manufacturing company, and the merchandising company would be in the middle (Company B), with neither the highest nor the lowest number of days in its operating cycle. LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 5-2 (a) [1] Income before tax = $100 – $65 = $35 [2] Net income = $35 (from [1]) – $9 = $26 [3] Cost of goods sold = $100 – $60 = $40 [4] Operating expenses = $60 – $35 = $25 [5] Income tax expense = $35 – $26 = $9 (b) Company A is the service company, since it has no cost of goods sold. Company B is the merchandising company, since it has cost of goods sold. LO 1 BT: AN Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-12 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 5-3 Beginning Balance Purchases Inventory 55,000 220,000 26,000 Purchase returns 9,700 Purchase discounts Freight in 2,700 218,000 Cost of goods sold Ending Balance 24,000 Although not required, the following are the journal entries of the transactions. Purchases Inventory .................................................................. 220,000 Accounts Payable ............................................... 220,000 Purchase Returns Accounts Payable .................................................... Inventory ............................................................. Purchase Discounts Accounts Payable ($220,000 – $26,000) ................. 194,000 Inventory ($194,000 × 5%) ................................. 9,700 Cash ................................................................... 184,300 Freight In Inventory .................................................................. Accounts Payable ............................................... Cost of Sales 26,000 26,000 2,700 2,700 Cost of Goods Sold .................................................. 218,000 Inventory ............................................................. 218,000 LO 2 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-13 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 5-4 Pocras Corporation (Buyer): Aug. 24 Inventory ................................................................. Accounts Payable ............................................... 32,000 Wydell Inc. (Seller): Aug. 24 Accounts Receivable ................................................ Sales ................................................................... 32,000 24 Cost of Goods Sold .................................................. Inventory ............................................................. 32,000 32,000 14,400 14,400 LO 2,3 BT: AP Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 5-5 Jan. 2 Inventory ................................................................. Accounts Payable ............................................... 45,000 45,000 5 No entry necessary – Freight costs paid by Fundy Corp. 6 Accounts Payable .................................................... Inventory ............................................................. 6,000 Accounts Payable ($45,000 - $6,000) ...................... Inventory ($39,000 × 2%) ................................... Cash ................................................................... 39,000 11 6,000 780 38,220 LO 2 BT: AP Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-14 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 5-6 Jan. 2 2 5 6 6 11 Accounts Receivable ................................................ Sales ................................................................... 45,000 Cost of Goods Sold .................................................. Inventory ............................................................. 25,200 Freight Out ............................................................... Cash ................................................................... 900 Sales Returns and Allowances................................. Accounts Receivable .......................................... 6,000 Inventory .................................................................. Cost of Goods Sold ............................................. 3,360 Cash ......................................................................... Sales Discounts ($39,000 × 2%) .............................. Accounts Receivable ($45,000 - $6,000) ............ 38,220 780 45,000 25,200 900 6,000 3,360 39,000 LO 3 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-15 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 5-7 (a) Sales .................................................................... Less: Sales returns and allowances ................... Sales discounts ......................................... Net sales .............................................................. $1,110,000 $22,000 18,000 40,000 $1,070,000 (b) Net sales ..................................................................... Less: Cost of goods sold ........................................... Gross profit ................................................................. $1,070,000 658,000 $ 412,000 (c) Gross profit ................................................................. Less: Administrative expenses .................................. Selling expenses .............................................. Income from operations .............................................. $412,000 $160,000 110,000 270,000 $142,000 (d) Income from operations .............................................. Add: Other revenues ................................................ Less: Other expenses ................................................ Income before income tax........................................... $142,000 $26,000 (35,000)_ (9,000) $133,000 (e) Income before income tax........................................... Less: Income tax expense ......................................... Net income ................................................................. $133,000 27,000 $106,000 LO 4 BT: AP Difficulty: S Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-16 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 5-8 As the name suggests, numerous steps are required in determining net income in a multiple-step statement. (a) (b) Item Single-Step Multiple-Step Depreciation expense Cost of goods sold Freight out Income tax expense Interest expense Interest revenue Rent revenue Salaries expense Sales Sales discounts Sales returns and allowances Expenses Expenses Expenses Income tax expense Expenses Revenues Revenues Expenses Revenues Revenues Revenues Operating expenses Cost of goods sold Operating expenses Income tax expense Other revenues and expenses Other revenues and expenses Other revenues and expenses Operating expenses Sales revenue Sales revenue Sales revenue LO 4 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 5-9 (a) The company is using a multiple-step form of income statement. (b) The company is classifying its expenses by their function. They are reported according to the activity (business function) for which they were incurred (for example, cost of goods sold, administrative, selling). LO 4 BT: C Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-17 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 5-10 (a) Sales Cost of goods sold Gross profit Operating expenses Income from operations Other revenues Income before income taxes Income tax expense Net income 2018 $250,000 137,500 112,500 50,000 62,500 ______ 62,500 20,000 $42,500 2017 $200,000 114,000 86,000 40,000 46,000 10,000 56,000 15,000 $41,000 (b) 2018 Gross profit margin Profit margin (c) 2017 $112,500 $250,000 = 45.0% $86,000 $200,000 = 43.0% $42,500 $250,000 = 17.0% $41,000 = 20.5% $200,000 Modder Corporation’s gross profit margin increased in 2018 indicating an increase in the percentage mark-up, or a reduction in the cost of goods sold, or both. On the other hand, in 2018, the company’s profit margin dropped. The decrease in profit margin is caused by the other revenues in 2017 that were not available in 2018. Operating expenses were 20% of sales in both years. LO 4,5 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 and : cpa-t005CM: Reporting and Finance Solutions Manual 5-18 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 5-11 (a) ($ in millions) Gross profit margin Profit margin (b) 2015 2014 $12,279.6 – $7,747.1 $12,279.6 = 36.9% $12,462.9 – $8,033.2 $12,462.9 = 35.5% $735.9 $12,279.6 = 6.0% $639.3 $12,462.9 = 5.1% Canadian Tire Corporation’s gross profit margin increased in 2015. Although sales dropped 1.5%, [($12,279.6 - $12,462.9) ÷ $12,462.9] cost of goods sold dropped 3.6% [($7,747.1 - $8,033.2) ÷ $8,033.2] which lead to the increased gross profit margin. The profit margin also increased in 2015, but not as much. Operating expenses or interest or income tax expense must have increased as a percentage of sales. LO 5 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and Finance *BRIEF EXERCISE 5-12 Jan. 2 Purchases ................................................................ Accounts Payable ............................................... 45,000 45,000 5 No entry necessary - Freight costs paid by Fundy Corp. 6 Accounts Payable .................................................... Purchase Returns and Allowances ..................... 6,000 Accounts Payable ($45,000 - $6,000) ...................... Purchase Discounts ($39,000 × 2%) .................. Cash ................................................................... 39,000 11 6,000 780 38,220 LO 6 BT: AP Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-19 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *BRIEF EXERCISE 5-13 Jan. 2 Accounts Receivable ................................................ Sales ................................................................... 45,000 45,000 2 No cost of goods sold entry at time of sale 5 Freight Out ............................................................... Cash ................................................................... 900 Sales Returns and Allowances................................. Accounts Receivable .......................................... 6,000 6 6 11 900 6,000 No cost of goods sold entry at the time of sale Cash ......................................................................... Sales Discounts ($39,000 × 2%) .............................. Accounts Receivable ($45,000 - $6,000) ............ 38,220 780 39,000 LO 6 BT: AP Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-20 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *BRIEF EXERCISE 5-14 (a) Sales ............................................................................. $1,860,000 Less: Sales returns and allowances ............................ $124,000 Sales discounts .................................................. 28,000 152,000 Net Sales ...................................................................... $1,708,000 (b) Purchases ..................................................................... Less: Purchase returns and allowances ...................... Purchase discounts ............................................ Net purchases ............................................................... $880,000 $13,000 14,000 27,000 $853,000 (c) Net purchases ............................................................... Add: Freight in ............................................................ Cost of goods purchased .............................................. $853,000 16,000 $869,000 (d) Beginning inventory ...................................................... Add: Cost of goods purchased ................................... Cost of goods available for sale .................................... Less: Ending inventory ................................................ Cost of goods sold ........................................................ $ 96,000 869,000 965,000 82,000 $883,000 (e) Net sales ....................................................................... Less: Cost of goods sold ............................................... Gross profit ................................................................... $1,708,000 883,000 $825,000 LO 6 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-21 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *BRIEF EXERCISE 5-15 (a) (b) Cost of goods sold Beginning inventory ........................................... $105,000 Purchases .......................................................... Less: Purchase returns and allowances ............ Purchase discounts .................................. Net purchases .................................................... Add: Freight In ................................................... Cost of goods purchased ................................... Cost of goods available for sale ......................... Ending inventory ................................................ Cost of goods sold ............................................. $195,000 $ 6,600 20,400 27,000 168,000 5,250 173,250 278,250 120,000 $158,250 There would be no difference in the remainder of the income statement for Halifax Limited whether the periodic or perpetual inventory systems were used. Purchases – Purchase returns and allowances – Purchase discounts + Freight-in = Cost of goods purchased (Beginning inventory+ Cost of goods purchased – Ending inventory = Cost of goods sold) LO 6 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-22 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *BRIEF EXERCISE 5-16 Dec. 31 Inventory (ending) .................................................... 68,000 Cost of Goods Sold .................................................. 401,000* Purchase Discounts ................................................. 6,000 Inventory (beginning) .......................................... 75,000 Purchases ........................................................... 388,000 Freight In............................................................. 12,000 * Cost of goods sold = Beginning inventory + Purchases Purchase discounts Purchase returns and allowances + Freight in – Ending inventory Cost of goods sold = $75,000 + $388,000 $6,000 + $12,000 – $68,000 = $401,000 LO 6 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-23 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO EXERCISES EXERCISE 5-1 (a) Toys “R” Us, Inc. is a merchandiser (retailer), Fasken Martineau LLP is a service company, and Atlantic Grocery Distributors Ltd. is a merchandiser (wholesaler). (b) The operating cycle of these three businesses will be different. The longest operating cycle will be experienced by the retailer, as the sales of merchandise will be the slowest. The organization with the shortest operating cycle will be the service firm that does not sell inventory. The third company, the distributing wholesaler, will have an operating cycle between that of the retailer and the law firm because its inventory is more likely to sell faster and the law firm has no inventory to sell. LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 5-24 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-2 Item (a) 1. Asset Account Debited (b) Inventory (c) (a) +$3,500 Asset Account Credited (b) (c) Cash –$3,500 –$750 Asset Inventory –$750 3. Asset Accounts Payable Inventory +$4,000 Liability +$4,000 4. Asset Inventory +$400 Asset Accounts Payable Cash 5. Liability Accounts Payable Accounts Receivable –$3,500 Asset Asset +$10,000 Revenue Cash Inventory Sales –$3,430 –$70 +$10,000 Inventory –$4,000 2. Liability 6. Asset Expense Cost of Goods Sold 7. Contra Sales Returns Sales and Allowances 8. Expense Freight Out 9. Contra Sales Asset 10. Asset Sales Returns and Allowances Inventory Cash +$4,000 Asset –$400 +$750 Asset Cash –$750 +$600 Asset Cash –$600 +$1,000 Asset +$400 Expense +$6,000 Asset Accounts Receivable –$1,000 Cost of Goods Sold Accounts Receivable –$400 –$6,000 LO 2,3 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-25 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-3 (a) Sept. 2 Inventory (750 × $20).................................................. Accounts Payable .................................................. 15,000 10 Accounts Payable (10 × $20) ...................................... Inventory................................................................ 200 11 Accounts Receivable (260 × $30) ............................... Sales ..................................................................... 7,800 Cost of Goods Sold (260 × $20) ................................. Inventory................................................................ 5,200 14 Sales Returns and Allowances (10 × $30) .................. Accounts Receivable ............................................. 300 Inventory (10 × $20).................................................... Cost of Goods Sold ............................................... 200 21 Accounts Receivable (300 × $30) ............................... Sales ..................................................................... 9,000 Cost of Goods Sold (300 × $20) ................................. Inventory................................................................ 6,000 29 Accounts Payable ($15,000 – $200) ........................... Cash ...................................................................... 14,800 30 Cash ($9,000 – $90) ................................................... Sales Discounts ($9,000 × 1%)................................... Accounts Receivable ............................................. 8,910 90 15,000 200 7,800 5,200 300 200 9,000 6,000 14,800 9,000 Solutions Manual 5-26 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-3 (CONTINUED) (b) Sept. 1 Bal. 2 14 Sept. 30 Bal. Inventory 2,000 Sept.10 15,000 11 200 21 5,800 Sept. 11 21 Sept. 30 Bal. Cost of Goods Sold 5,200 Sept. 14 6,000 11,000 200 5,200 6,000 200 (c) Ending Inventory: Number of calculators at September 30: 100 + 750 – 10 – 260 + 10 – 300 = 290 Cost of calculators at September 30: 290 × $20 = $5,800 Cost of Goods Sold: Number of calculators sold in September: 260 – 10 + 300 = 550 Cost of calculators sold in September: 550 x $20 = $11,000 LO 2,3 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-27 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-4 (a) April 3 6 7 8 30 (b) April 12 Inventory........................................................ Accounts Payable .................................... 28,000 Inventory........................................................ Cash......................................................... 700 Supplies......................................................... Accounts Payable .................................... 5,000 Accounts Payable .......................................... Inventory .................................................. 3,500 Accounts Payable ($28,000 – $3,500) .......... Cash ........................................................ 24,500 Accounts Payable ($28,000 – $3,500) .......... Cash ($24,500 – $245) ............................ Inventory ($24,500 × 1%) ......................... 24,500 28,000 700 5,000 3,500 24,500 24,255 245 LO 2 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-28 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-5 (a) April 3 April 28,000 Cost of Goods Sold ....................................... Inventory .................................................. 19,000 28,000 19,000 6 No entry necessary - Freight costs paid by Olaf. 7 No entry necessary. 8 Sales Returns and Allowances ...................... Accounts Receivable................................ 3,500 Inventory........................................................ Cost of Goods Sold .................................. 2,300 Cash .............................................................. Accounts Receivable ($28,000 – $3,500) 24,500 Cash ($28,000 $3,500 – $245) ................... Sales Discounts [($28,000 – $3,500) × 1%] .. Accounts Receivable ($28,000 – $3,500) 24,255 245 30 (b) Accounts Receivable ..................................... Sales ........................................................ 12 3,500 2,300 24,500 24,500 LO 2 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-29 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-6 Boyle should choose to borrow cash at 8% 10 days from the date of the invoice. The amount borrowed could be as little as the amount of the invoice less the purchase discount. This is the amount needed to settle the payment 10 days from the date of the invoice and earn the purchase discount of 1%. The loan can then be repaid after 20 days, which would be the date the invoice would have been paid if the loan had not been obtained. The relevant period is 20 days because this is the amount of time a loan would be outstanding in order to make the choice to pay within the discount period. Converting a 1% discount for 20 days equals an annualized interest rate of 18.25% calculated as follows (1% × 365 ÷ 20) = 18.25%. Paying 8% to the bank to receive 18.25% from the supplier is the more favourable procedure to follow. LO 2 BT: AP Difficulty: C Time: 15 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-30 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-7 (a) Dec. 3 Accounts Receivable .......................................... Sales ............................................................. 68,000 3 Cost of Goods Sold ............................................. Inventory........................................................ 36,000 68,000 36,000 7 No entry necessary. (b) Dec. 8 Sales Returns and Allowances ........................... Accounts Receivable ..................................... 2,100 Inventory ............................................................. Cost of Goods Sold ....................................... 1,150 11 Cash ($65,900 – $1,318) .................................... Sales Discounts [($68,000 – $2,100) × 2%]........ Accounts Receivable ($68,000 – $2,100) ...... 64,582 1,318 3 Inventory ............................................................. Accounts Payable .......................................... 68,000 7 Inventory ............................................................. Cash .............................................................. 900 8 Accounts Payable ............................................... Inventory........................................................ 2,100 11 Accounts Payable ($68,000 – $2,100) ................ Inventory [($68,000 - $2,100) × 2%] .............. Cash ($65,900 – $1,318) ............................... 65,900 2,100 1,150 65,900 68,000 900 2,100 1,318 64,582 Solutions Manual 5-31 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-7 (CONTINUED) (c) Sales ................................................................................... Less: Sales returns and allowances ................................... Sales discounts ........................................................ Net sales ............................................................................. Cost of goods sold ($36,000 – $1,150) ............................... Gross profit ......................................................................... $68,000 $2,100 1,318 3,418 64,582 34,850 $29,732 LO 2,3,5 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-32 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-8 Account Statement Classification Accounts payable Accounts receivable Accumulated depreciation Statement of financial position Current liabilities Statement of financial position Current assets Statement of financial position Property, plant, and equipment (contra account) Administrative expenses Income statement Operating expenses Buildings Statement of financial position Property, plant, and equipment Cash Statement of financial position Current assets Common shares Statement of financial position Shareholders’ equity Equipment Statement of financial position Property, plant, and equipment Income tax expense Income statement Income tax expenses Interest expense Income statement Other revenues and expenses Interest payable Statement of financial position Current liabilities Inventory Statement of financial position Current assets Land Statement of financial position Property, plant, and equipment Mortgage payable Statement of financial position Non-current liabilities Prepaid insurance Statement of financial position Current assets Property tax payable Statement of financial position Current liabilities Salaries payable Statement of financial position Current liabilities Sales Income statement Revenue Sales discounts Income statement Revenue (contra account) Sales returns and allowances Income statement Revenue (contra account) Unearned revenue Statement of financial position Current liabilities LO 4 BT: C Difficulty: S Time: 20 min. AACSB: Analytic CPA:cpa-t001 CM: Reporting Solutions Manual 5-33 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-9 (a) BLUE DOOR CORPORATION Income Statement (Single-Step) Year Ended December 31, 2018 Revenues Sales ......................................................................... $2,650,000 Less: Sales returns and allowances ............ $41,000 Sales discounts .................................. 19,500 60,500 Net sales ................................................................... 2,589,500 Interest revenue ....................................................... 30,000 Rent revenue ............................................................ 24,000 Expenses Cost of goods sold .................................................... $1,172,000 Salaries expense ....................................................... 705,000 Depreciation expense................................................ 125,000 Interest expense ........................................................ 62,000 Advertising expense .................................................. 55,000 Freight out ................................................................. 25,000 Insurance expense .................................................... 23,000 ............................................................................. Income before income tax .............................................. ............................. Income tax expense ..................................................................................... Net income ................................................................................................... $2,643,500 2,167,000 476,500 70,000 $ 406,500 Solutions Manual 5-34 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-9 (CONTINUED) (b) BLUE DOOR CORPORATION Income Statement (Multiple-Step) Year Ended December 31, 2018 Sales ........................................................................................................ Less: Sales returns and allowances ................................. $41,000 Sales discounts ....................................................... 19,500 Net sales................................................................................................... Cost of goods sold .................................................................................... Gross profit ............................................................................................... Operating expenses Salaries expense .......................................................... $705,000 Depreciation expense................................................... 125,000 Advertising expense ..................................................... 55,000 Freight out .................................................................... 25,000 Insurance expense ....................................................... 23,000 Total operating expenses ............................................................... Income from operations ............................................................................ Other revenues and expenses Interest revenue .......................................................... $30,000 Rent revenue................................................................ 24,000 Interest expense ........................................................... (62,000) Income before income tax ........................................................................ Income tax expense ................................................................................. Net income ............................................................................................... $2,650,000 60,500 2,589,500 1,172,000 1,417,500 933,000 484,500 (8,000) 476,500 70,000 $ 406,500 (Revenues – Contra revenues – Cost of goods sold – Operating expenses = Income from operations) (c) Blue Door Corporation is classifying its expenses by nature, such as salaries, depreciation, and advertising. There is no classification of expenses into administrative or selling as would be the case if classifying expenses by functional areas. For smaller companies such as this one, the difference between classification of items on the income statement by function or nature is not significant. LO 4 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-35 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-10 (a) Young Ltd. Sales ....................................................................................... $99,000 *Less: Sales returns and allowances [1] ................................. 10,000 Net sales ................................................................................. $89,000 Net sales ................................................................................. $89,000 Less: Cost of goods sold ......................................................... 58,750 *Gross profit [2] ....................................................................... $30,250 Gross profit.............................................................................. $30,250 Less: Operating expenses ...................................................... 19,500 *Income from operations [3] .................................................... $10,750 Income from operations .......................................................... $10,750 Add: Other revenues ............................................................... 750 *Income before income tax [4]................................................. $11,500 Income before income tax ....................................................... $11,500 Less: Income tax expense ...................................................... 2,300 *Net income [5]........................................................................ $ 9,200 Rioux Ltée *Sales [6] ................................................................................. $105,000 Less: Sales returns and allowances ........................................ 5,000 Net sales ................................................................................. $100,000 Net sales ................................................................................. $100,000 *Less: Cost of goods sold [7]................................................... 60,000 Gross profit.............................................................................. $ 40,000 Gross profit.............................................................................. $40,000 *Less: Operating expenses [8] ................................................ 22,000 Income from operations .......................................................... $18,000 Solutions Manual 5-36 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-10 (CONTINUED) (a) (continued) Income from operations .......................................................... $18,000 Less: Other expenses ............................................................. 2,000 *Income before income tax [9]................................................. $16,000 Income before income tax ....................................................... $16,000 *Less: Income tax expense [10] .............................................. 3,200 Net income .............................................................................. $12,800 * Indicates missing amount (b) Young Rioux Gross profit margin $30,250 ÷ $89,000 = 34.0% Profit margin $9,200 ÷ $89,000 = 10.3% $40,000 ÷ $100,000 = 40.0% $12,800 ÷ $100,000 = 12.8% LO 4,5 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-37 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-11 (a) Marchant Ltd. Sales ..................................................................................... $1,460,000 Less: Sales returns and allowances ..................................... 28,000 *Net sales [1] ......................................................................... $1,432,000 Net sales ............................................................................... $1,432,000 Less: Cost of goods sold ....................................................... 657,000 *Gross profit [2] ..................................................................... $ 775,000 Gross profit............................................................................ $775,000 Less: Operating expenses .................................................... 580,000 *Income from operations [3] .................................................. $195,000 Income from operations ........................................................ $195,000 Add: Other revenues ............................................................. 3,600 *Income before income tax [4]............................................... $198,600 Income before income tax ..................................................... $198,600 Less: Income tax expense .................................................... 38 600 *Net income [5]...................................................................... $160,000 Dueck Ltd. *Sales [6] ............................................................................... $2,178,000 Less: Sales returns and allowances ...................................... 48,000 Net sales ............................................................................... $2,130,000 Net sales ............................................................................... $2,130,000 *Less: Cost of goods sold [7]................................................. 1,172,000 Gross profit............................................................................ $ 958,000 Gross profit............................................................................ $958,000 *Less: Operating expenses [8] .............................................. 648,000 Income from operations ........................................................ $310,000 Solutions Manual 5-38 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-11 (CONTINUED) (a) (continued) Income from operations ........................................................ $310,000 Less: Other expenses ........................................................... _ 4,100 *Income before income tax [9]............................................... $305,900 Income before income tax ..................................................... $305,900 *Less: Income tax expense [10] ............................................ 55,000 Net income ............................................................................ $250,900 * Indicates missing amount (b) Marchant Dueck Gross profit margin $775,000 ÷ $1,432,000 = 54.1% $958,000 ÷ $2,130,000 = 45.0% Profit margin $160,000 ÷ $1,432,000 = 11.2% $250,900 ÷ $2,130,000 = 11.8% LO 4,5 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-39 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-12 (a) MONTMORENCY LTÉE Income Statement (Multiple-step) Year Ended August 31, 2018 Sales ............................................................................... $7,200,000 Less: Sales discounts ....................................................... 110,000 Net sales................................................................................................... $7,090,000 Cost of goods sold .................................................................................... 4,030,000 Gross profit ............................................................................................... 3,060,000 Operating expenses Administrative expenses .............................................. $670,000 Selling expenses .......................................................... 260,000 Total operating expenses ............................................................... 930,000 Income from operations ............................................................................ 2,130,000 Other revenues and expenses Interest expense .................................................................................. 270,000 Income before income tax ........................................................................ 1,860,000 Income tax expense ................................................................................. 560,000 Net income ............................................................................................... $1,300,000 (Revenues – Contra revenues – Cost of goods sold – Operating expenses = Income from operations) (b) Expenses are classified by function (cost of goods sold, administrative, selling). (c) Gross profit margin $3,060,000 ÷ $7,090,000 = 43.2% Profit margin $1,300,000 ÷ $7,090,000 = 18.3% LO 4,6 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-40 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-13 (in USD millions) (a) Gross profit margin 2016: ($39,528 – $30,334) ÷ $39,528 = 23.3% 2015: ($40,339 – $31,292) ÷ $40,339 = 22.4% 2014: ($40,611 – $31,212) ÷ $40,611 = 23.1% Profit margin 2016: 2015: 2014: (using net income) $807 ÷ $39,528 = 2.0% $1,246 ÷ $40,339 = 3.1% $695 ÷ $40,611 = 1.7% (b) The gross profit margin has been holding steady, with a slight deterioration in 2015. The trend is the opposite for the profit margin, where the results of 2015 exceeded those of 2014 and 2016. (c) Profit margin (using income from operations) 2016: $1,375 ÷ $39,528 = 3.5% 2015: $1,450 ÷ $40,339 = 3.6% 2014: $1,144 ÷ $40,611 = 2.8% The profit margin using income from operations has followed the same trend in 2014 and 2016 when compared to profit margin. On the other hand, profit margin using net income increased dramatically in 2015 while profit margin using income from operations increased only slightly for the same year. The major elements that are in the calculation of the profit margin ratio but are not in the profit margin using income from operations are other revenues and expenses, and income tax expense. In 2015, there must have been a significant other revenue, or possibly a gain that caused a substantial increase in profit margin compared to the year before and after 2015. LO 5 BT: AN Difficulty: C Time: 20 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-41 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *EXERCISE 5-14 Olaf Corp. (Buyer) (a) Apr. 3 Purchases ................................................................... Accounts Payable .................................................. 28,000 6 Freight In..................................................................... Cash ...................................................................... 700 7 Supplies ...................................................................... Accounts Payable .................................................. 5,000 8 Accounts Payable ....................................................... Purchase Returns and Allowances ........................ 3,500 30 Accounts Payable ($28,000 – $3,500) ........................ Cash ..................................................................... 24,500 (b) Apr. 12 Accounts Payable ($28,000 – $3,500) ........................ Cash ($24,500 – $245) .......................................... Purchase Discounts ($24,500 × 1%) ..................... 24,500 28,000 700 5,000 3,500 24,500 24,255 245 DeVito Ltd. (Seller) (a) Apr. 3 Accounts Receivable .................................................. Sales ..................................................................... 28,000 8 Sales Returns and Allowances ................................... Accounts Receivable ............................................. 3,500 30 Cash .......................................................................... Accounts Receivable ($28,000 – $3,500) .............. 24,500 (b) Apr. 12 Cash ($24,500 – $245) ............................................... Sales Discounts [($28,000 – $3,500) × 1%]................ Accounts Receivable ($28,000 – $3,500) .............. 24,255 245 28,000 3,500 24,500 24,500 LO 6 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-42 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *EXERCISE 5-15 (a) Duvall Ltd. (Seller) (1) Perpetual Inventory System June 10 Accounts Receivable ........................................ Sales ........................................................... Cost of Goods Sold ........................................... Inventory...................................................... 5,000 5,000 3,000 3,000 11 No entry 12 Sales Returns and Allowances ......................... Accounts Receivable ................................... 500 19 Cash ($4,500 – $45) ......................................... Sales Discounts ($4,500 × 1%) ........................ Accounts Receivable ($5,000 – $500) ......... 4,455 45 (2) Periodic Inventory System June 10 Accounts Receivable ........................................ Sales ........................................................... 5,000 500 4,500 5,000 11 No entry 12 Sales Returns and Allowances ......................... Accounts Receivable ................................... 500 19 Cash ($4,500 – $45) ......................................... Sales Discounts ($4,500 × 1%) ........................ Accounts Receivable ($5,000 – $500) ......... 4,455 45 500 4,500 Solutions Manual 5-43 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *EXERCISE 5-15 (CONTINUED) (b) Pele Ltd. (Buyer) (1) Perpetual Inventory System June 10 Inventory ............................................................. Accounts Payable .......................................... 5,000 5,000 11 Inventory (freight) ................................................ Cash .............................................................. 250 12 Accounts Payable ............................................... Inventory (returns) ......................................... 500 19 Accounts Payable ($5,000 – $500) ..................... Inventory ($4,500 × 1%) ................................ Cash ($4,500 – $45) ...................................... 4,500 (2) Periodic Inventory System June 10 Purchases ......................................................... Accounts Payable ........................................ 250 500 45 4,455 5,000 5,000 11 Freight In........................................................... Cash ............................................................ 250 12 Accounts Payable ............................................. Purchase Returns and Allowances .............. 500 19 Accounts Payable ($5,000 – $500) ................... Purchase Discounts ($4,500 × 1%) ............. Cash ($4,500 – $45) .................................... 4,500 250 500 45 4,455 LO 2,3,6 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-44 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *EXERCISE 5-16 [1] [2] [3] [4] [5] [6] [7] [8] [9] $1,420 = $1,550 = $1,750 = $270 = $270 = $1,950 = $230 = $2,030 = $1,950 = ($1,500 – $50 – $30) ($1,420 + $130) ($1,550 + $200) ($1,750 – $1,480) [4] (same as ending, Yr 1) ($100 + $50 + $1,800) ($2,030 [8] – $1,800) ($2,300 – $270 [5]) ($2,300 – $350) [10] [11] [12] [13] [14] [15] [16] [17] [18] $7,560 = $590 = $8,800 = $7,550 = $1,250 = $8,050 = $8,600 = $9,850 = $8,350 = ($7,210 + $150 + $200) ($7,800 – $7,210) ($1,000 + $7,800) ($8,800 [12]) – $1,250) given (same as ending, Yr 1) ($8,550 – $400 – $100) ($8,050 [15] + $550) ($1,250 [14] + $8,600 [16]) ($9,850 [17] – $1,500) LO 6 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-45 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *EXERCISE 5-17 (a) LIVELY LIMITED Income Statement Year Ended February 28, 2018 Sales revenue Sales Less: Sales discounts Sales returns and allowances Net sales Cost of goods sold Inventory, beginning Purchases $273,000 Less: Purchase discounts 39,000 Purchase returns and allowances 20,800 Net purchases 213,200 Add: Freight in 8,450 Cost of goods purchased Cost of goods available for sale Less: Inventory, ending Cost of goods sold Gross profit Operating expenses Administrative expenses Selling expenses Total operating expenses Income from operations Other revenues and expenses Interest expense Income before income tax Income tax expense Net income $435,500 $27,300 15,600 42,900 392,600 $ 54,600 221,650 276,250 79,300 196,950 195,650 $120,900 9,100 130,000 65,650 7,800 57,850 9,300 $ 48,550 (Beginning inventory + Net purchases + Freight-in = Cost of goods purchased) Solutions Manual 5-46 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 5-17 (CONTINUED) (b) Feb. 28 Inventory (ending) .................................................... 79,300 Cost of Goods Sold .................................................. 196,950 Purchase Returns and Allowances .......................... 20,800 Purchase Discounts ................................................. 39,000 Inventory (beginning) .......................................... 54,600 Purchases ........................................................... 273,000 Freight In............................................................. 8,450 LO 6 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-47 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO PROBLEMS PROBLEM 5-1A (a) A company’s operating cycle is the average time it takes to go from cash to cash in producing revenues. The operating cycle for a merchandising company covers the period of time between when you purchase your inventory, to when you sell it, and to when you eventually collect the accounts receivable from a sale. The hair salon is having problems paying for its products because it purchases a two-month supply, paying for it immediately, with cash flow from the current month’s operations. There is an insufficient cash float available to purchase two months of supply at one time, and to pay immediately rather than taking advantage of the 30-day payment period. The hair salon’s inventory is contributing to the problem of reduced cash flow and gross profit because some items have been in stock for a long period of time. This further extends the operating cycle for those items. (b) The physical inventory count comparison with the perpetual inventory record has flagged discrepancies. There is an issue concerning the way in which the perpetual record is being maintained and updated because staff members sometimes forget to scan the products that they use on customers. There may also be a possibility that goods are being stolen by customers or employees. Accounting errors could also be the source of the discrepancy, in which case the company’s procedures should be reviewed, and if necessary, internal controls should be strengthened. Possible solutions could be having the system require that items be scanned before a product sale can be rung in. In addition, the procedures taken to perform the physical inventory count should be reviewed to determine if the count is the source of the discrepancies. The count should be performed more frequently, not necessarily for all inventory items but particularly for those items that had discrepancies from the count performed at the end of six months. The results of the more frequent counts should be monitored to see if the discrepancies with the perpetual inventory records are diminishing. Solutions Manual 5-48 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-1A (CONTINUED) (b) (continued) The hair salon should use the perpetual inventory system to help determine which inventory items are out-of-stock and which items are taking a long time to sell. By managing what inventory is purchased, fewer markdowns of the selling price will be required, and sales should increase as there will be less chance for a stock-out. Finally, the full 30 days should be taken on the terms with your supplier, in order to have more cash on hand when needed. (c) For control reasons, a physical inventory count must always be taken at least once a year, and ideally more often under the perpetual inventory system. By using a perpetual inventory system, a company knows what inventory should be on hand. Performing a physical count and checking it to the perpetual records is necessary to detect any errors in record keeping and/or shortages in stock. The staff may be forgetting to scan intentionally. Enforcing the scanning procedure will strengthen internal control over cash receipts. If staff can avoid scanning product, they may also attempt to avoid recording a cash sale altogether, pocketing the extra cash. This theft would lead to unrecorded revenues and would reduce the gross profit performance of the salon. LO 1 BT: AN Difficulty: C Time: 40 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 5-49 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-2A (a) (b) June Phantom Book Warehouse Ltd. is a wholesaler. Its suppliers are publishers and its customers are book stores. 1 3 5 8 9 11 12 17 Inventory (180 × $16) ............................................... Accounts Payable .......................................... 2,880 Accounts Receivable (220 × $25) ............................ Sales ............................................................. 5,500 Cost of Goods Sold (220 × $17)............................... Inventory........................................................ 3,740 Accounts Payable .................................................... Inventory (10 × $16) ...................................... 160 Accounts Receivable (80 × $22) .............................. Sales ............................................................. 1,760 Cost of Goods Sold (80 × $17)................................. Inventory........................................................ 1,360 Sales Returns and Allowances................................. Accounts Receivable (12 × $22).................... 264 Inventory (130 × $15) ............................................... Accounts Payable .......................................... 1,950 Cash ($5,500 – $110) .............................................. Sales Discounts ($5,500 × 2%) ................................ Accounts Receivable .................................... 5,390 110 Cash ($1,496 – $30) ................................................ Sales Discounts ($1,496 × 2%) ................................ Accounts Receivable ($1,760 – $264) .......... 1,466 30 2,880 5,500 3,740 160 1,760 1,360 264 1,950 5,500 1,496 Solutions Manual 5-50 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-2A (CONTINUED) (b) (continued) June 22 25 29 Accounts Receivable (125 × $25) ............................ Sales ................................................................ 3,125 Cost of Goods Sold (125 × $17)............................... Inventory .......................................................... 2,125 Sales Returns and Allowances................................. Accounts Receivable (15 × $25) ...................... 375 Inventory (15 × $17) ................................................. Cost of Goods Sold .......................................... 255 Accounts Payable ($2,880 – $160) .......................... Cash................................................................. 2,720 3,125 2,125 375 255 2,720 (c) May 31* June 1 11 25 June 30 Bal. * (250 × $18) (d) Inventory 4,500 June 3 7 720 2,880 5 1,950 8 255 22 2,200 3,740 160 1,360 2,125 Books on hand at June 30 = 250 + 180 – 220 – 10 – 80 + 130 – 125 + 15 = 140 Average cost per book = $2,200 140 = $16 LO 1,2,3 BT: AN Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-51 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-3A (a) Sept. 2 Equipment ............................................................ Accounts Payable ...................................... 65,000 65,000 3 No entry necessary. 4 Supplies ............................................................... Cash .......................................................... 4,000 Inventory .............................................................. Accounts Payable ...................................... 65,000 Inventory .............................................................. Cash .......................................................... 1,600 Accounts Payable ................................................ Inventory.................................................... 5,000 Accounts Receivable ............................................ Sales ......................................................... 20,000 Cost of Goods Sold .............................................. Inventory.................................................... 15,000 Freight Out ........................................................... Cash .......................................................... 375 6 65,000 7 8 9 10 17 20 4,000 1,600 5,000 20,000 15,000 375 Cash ($20,000 – $400) .......................................... Sales Discounts ($20,000 × 2%) ............................ Accounts Receivable ................................... 19,600 Accounts Payable ($65,000 – $5,000) ................... Cash ($60,000 – $600) ................................ Inventory ($60,000 × 1%) ............................ 60,000 400 20,000 59,400 600 Solutions Manual 5-52 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-3A (CONTINUED) (a) (continued) Sept. 21 22 23 28 Inventory ................................................................ Cash ............................................................ 6,000 Accounts Receivable .............................................. Sales ........................................................... 27,000 Cost of Goods Sold ................................................ Inventory...................................................... No entry necessary. 20,000 Sales Returns and Allowances............................... Accounts Receivable ................................... 10,000 Inventory ................................................................ Cost of Goods Sold ..................................... 7,500 Accounts Payable ($65,000 – $5,000) ................... Cash ........................................................... 60,000 6,000 27,000 20,000 10,000 7,500 (b) Oct. 3 60,000 The cost of missing this purchase discount is the amount recorded as a reduction to the Inventory account when the payment was made within the discount period. ($60,000 × 1%) = $600. Expressing this in terms of an annual interest rate, it would be the equivalent of paying 24.6% ($600 ÷ $59,400 × 365/15) for the use of the money for 15 days. LO 2,3 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-53 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-4A (a) April 3 5 7 9 11 14 16 17 20 Inventory .................................................................. Accounts Payable ........................................... 3,200 Inventory .................................................................. Cash ............................................................... 286 Accounts Receivable ............................................... Sales ............................................................... 9,750 Cost of Goods Sold.................................................. Inventory ......................................................... 5,850 Accounts Payable .................................................... Inventory ......................................................... 320 Accounts Payable ($3,200 – $320) .......................... Inventory ($2,880 × 1%) ................................. Cash ($2,880 – $29) ....................................... 2,880 Cash ........................................................................ Accounts Receivable ...................................... 4,150 Inventory .................................................................. Accounts Payable ........................................... 1,300 Accounts Payable .................................................... Inventory ......................................................... 100 3,200 286 9,750 5,850 320 29 2,851 4,150 1,300 100 Accounts Receivable ............................................... 11,100 Sales ............................................................... Cost of Goods Sold.................................................. Inventory ......................................................... 11,100 6,200 6,200 PROBLEM 5-4A (CONTINUED) 24 25 Accounts Payable ($1,300 – $100).......................... Inventory ($1,200 × 2%) ................................. Cash ($1,200 – $24) ....................................... 1,200 Cash ........................................................................ Accounts Receivable ...................................... 4,375 24 1,176 4,375 Solutions Manual 5-54 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 27 Financial Accounting, Seventh Canadian Edition Sales Returns and Allowances ................................ Accounts Receivable ...................................... 85 85 (b) Apr. 1 Bal. Apr. 14 Apr. 25 Apr. 30 Bal. Cash 4,200 Apr. 5 4,150 Apr. 11 4,375 Apr. 24 8,412 Accounts Receivable Apr. 7 9,750 Apr. 14 Apr. 20 11,100 Apr. 25 Apr. 27 Apr. 30 Bal. 12,240 Apr. 1 Bal. Apr. 3 Apr. 5 Apr. 16 Apr. 30 Bal. Inventory 19,500 Apr. 7 3,200 Apr. 9 286 Apr. 11 1,300 Apr. 17 Apr. 20 Apr. 24 11,763 Common Shares Apr. 1 Bal. Apr. 30 Bal. 286 2,851 1,176 Apr. 9 Apr. 11 Apr. 17 Apr. 24 Accounts Payable 320 Apr. 3 2,880 Apr. 16 100 1,200 Apr. 30 Bal. 12,000 12,000 0 Sales Apr. 7 9,750 Apr. 20 11,100 Apr. 30 Bal. 20,850 4,150 4,375 85 5,850 320 29 100 6,200 24 3,200 1,300 Sales Returns and Allowances Apr. 27 85 Apr. 30 Bal. 85 Cost of Goods Sold Apr. 7 5,850 Apr. 20 6,200 Apr. 30 Bal. 12,050 Retained Earnings Apr. 1 Bal. Apr. 30 Bal. 11,700 11,700 (c) IN THE PINES GOLF SHOP Trial Balance April 30, 2018 Debit Cash .................................................................................. $ 8,412 Accounts receivable .......................................................... 12,240 Inventory ........................................................................... 11,763 Accounts payable .............................................................. Common shares ................................................................ Retained earnings ............................................................. Sales ................................................................................. Sales returns and allowances ........................................... 85 Cost of goods sold ............................................................ 12,050 $44,550 Credit $12,000 11,700 20,850 00 0 00 $44,550 (Total debit account balances = Total credit account balances) Solutions Manual 5-55 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition LO 2,3 BT: AP Difficulty: M Time: 60 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-56 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-5A (a) May 1 3 4 7 8 9 11 14 15 18 Inventory ......................................................... Accounts Payable .................................. 5,800 Inventory ......................................................... Cash....................................................... 145 Accounts Receivable....................................... Sales ...................................................... 3,500 Cost of Goods Sold ......................................... Inventory ................................................ 2,100 Freight Out ...................................................... Cash....................................................... 90 Accounts Payable ........................................... Inventory ................................................ 200 Accounts Payable ($5,800 – $200) ................. Inventory ($5,600 × 1%) ......................... Cash....................................................... 5,600 Supplies .......................................................... Cash....................................................... 400 Cash ($3,500 – $70) ....................................... Sales Discounts ($3,500 × 2%) ....................... Accounts Receivable.............................. 3,430 70 Cash ............................................................... Accounts Receivable.............................. 1,000 Inventory ......................................................... Accounts Payable .................................. 2,000 5,800 145 3,500 2,100 90 200 56 5,544 400 3,500 1,000 2,000 PROBLEM 5-5A (CONTINUED) (a) (continued) May 21 No entry required (freight paid by Harlow) 22 Cash ............................................................... Sales ...................................................... 6,500 6,500 Solutions Manual 5-57 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 29 31 Financial Accounting, Seventh Canadian Edition Cost of Goods Sold ......................................... Inventory ................................................ 3,900 Sales Returns and Allowances ....................... Cash....................................................... 100 Inventory ......................................................... Cost of Goods Sold ................................ 60 Cost of Goods Sold ......................................... Inventory ................................................ ($5,249* – $5,100 = $149 shortage) 149 3,900 100 60 149 * Unadjusted balance in Inventory account: $3,500 + $5,800 + $145 – $2,100 – $200 – $56 + $2,000 – $3,900 + $60 = $5,249 Solutions Manual 5-58 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-5A (CONTINUED) (b) May 1 Bal. May 14 May 15 May 22 May31 Bal. Cash 7,000 May 3 3,430 May 7 1,000 May 9 6,500 May 11 May 29 11,651 Accounts Receivable May 1 Bal. 1,500 May 14 May 4 3,500 May 15 May 31 Bal. 500 May 1 Bal. May 1 May 3 May 18 May 29 May 31 Bal. May 11 May 31 Bal. May 8 May 9 Inventory 3,500 May 4 5,800 May 8 145 May 9 2,000 May 22 60 May 31 5,100 Sales May 4 May 22 May 31 Bal. 145 90 5,544 400 100 3,500 6,500 10,000 Sales Returns and Allowances May 29 100 May 31 Bal. 100 3,500 1,000 2,100 200 56 3,900 149 Supplies 400 400 Common Shares May 1 Bal. May 31 Bal. 8,000 8,000 Accounts Payable 200 May 1 5,600 May 18 May 31 Bal. 5,800 2,000 2,000 Sales Discounts May 14 70 May 31 Bal. 70 May 7 May 31 Bal. Freight Out 90 90 Cost of Goods Sold May 4 2,100 May 29 May 22 3,900 May 31 149 May 31 Bal. 6,089 Retained Earnings May 1 Bal. May 31 Bal. 60 4,000 4,000 Solutions Manual 5-59 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-5A (CONTINUED) (c) EAGLE HARDWARE STORE LTD. Income Statement (Partial) Month Ended May 31, 2018 Sales .......................................................................... Less: Sales returns and allowances ............................ Sales discounts ................................................. Net sales ...................................................................... Cost of goods sold ....................................................... Gross profit .................................................................. $10,000 $100 70 170 9,830 6,089 $ 3,741 (d) EAGLE HARDWARE STORE LTD. Statement of Financial Position (Partial) May 31, 2018 Assets Current assets Cash .................................................................. Accounts receivable .......................................... Inventory............................................................ Supplies............................................................. Total current assets ................................ $11,651 500 5,100 400 $17,651 LO 2,3,4 BT: AP Difficulty: M Time: 60 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-60 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-6A (a) CLUB CANADA WHOLESALE INC. Income Statement (Single-step) Year Ended December 31, 2018 Revenues Sales ........................................................................................ Less: Sales returns and allowances ...................... $23,560 Sales discounts ........................................... 14,265 Net sales ................................................................................. Interest revenue ...................................................................... Expenses Cost of goods sold................................................................... Administrative expenses ......................................................... Selling expenses ..................................................................... Interest expense ...................................................................... Income before income tax........................................................... Income tax expense .................................................................... Net income.................................................................................. $1,099,200 37,825 1,061,375 2,400 $806,240 88,515 42,100 12,350 $1,063,775 949,205 114,570 17,200 $ 97,370 Solutions Manual 5-61 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-6A (CONTINUED) (b) CLUB CANADA WHOLESALE INC. Income Statement (Multiple-step) Year Ended December 31, 2018 Sales ..................................................................................... Less: Sales returns and allowances ............................... Sales discounts ..................................................... Net sales ........................................................................... Cost of goods sold .................................................................. Gross profit ............................................................................. Operating expenses Administrative expenses .............................................. Selling expenses .......................................................... Total operating expenses ........................................ Income from operations .......................................................... Other revenues and expenses Interest revenue ................................................................ Interest expense ................................................................ Income before income tax....................................................... Income tax expense ................................................................ Net income.............................................................................. $1,099,200 $23,560 14,265 37,825 1,061,375 806,240 255,135 $88,515 42,100 0 130,615 124,520 $(2,400) 12,350 9,950 114,570 17,200 $ 97,370 (Revenues – Contra revenues – Cost of goods sold – Operating expenses = Income from operations) (Income from operations + Other revenues – Other expenses = Income before income taxes) (c) Both income statements result in the same amount of net income. The multiple-step income statement provides the user with more information than does the single-step income statement. The multiple-step income statement provides information on gross profit and income from operations, which is not included on the single-step income statement. (d) Club Canada Wholesale Inc. is classifying its expenses by their function. They are reported according to the activity (business function) for which they were incurred (for example, cost of goods sold, administrative, selling). LO 4 BT: AN Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-62 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7A (a) Dec. 31 31 31 31 31 31 31 31 Insurance Expense ($3,000 × 11/12) ............................. Prepaid Insurance ................................................. 2,750 Supplies Expense ........................................................... Supplies ($2,940 – $750) ...................................... 2,190 Depreciation Expense ..................................................... Accumulated Depreciation—Buildings .................. Accumulated Depreciation—Equipment ............... 10,500 Salaries Expense ............................................................ Salaries Payable .................................................. 750 Interest Expense ............................................................. Interest Payable .................................................... 735 Unearned Revenue ($4,000 – $975) ............................... Sales ..................................................................... 3,025 Cost of Goods Sold ......................................................... Inventory ............................................................... 2,000 Income Tax Expense ...................................................... Income Tax Payable.............................................. 500 2,750 2,190 6,000 4,500 750 735 3,025 2,000 Cost of Goods Sold ......................................................... 2,950 Inventory ............................................................... ($28,750 – $2,000 = $26,750 – $23,800 = $2,950 shortage) 500 2,950 Solutions Manual 5-63 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7A (CONTINUED) (b) Dec. 31 Dec.31 Bal. Dec. 31 4,500 Dec. 31 Bal. 22,500 Cash 17,000 17,000 Accounts Payable Dec. 31 Dec.31 Bal. Accounts Receivable Dec. 31 31,700 Dec.31 Bal. 31,700 Dec. 31 2,000 2,950 Dec. 31 Bal. Inventory 28,750 Dec. 31 Dec. 31 23,800 Dec. 31 Dec. 31 Bal. Supplies 2,940 Dec. 31 750 2,190 Dec.31 Dec. 31 Dec. 31 Bal. Prepaid Insurance 3,000 Dec. 31 250 Dec. 31 Dec.31 Bal. Land 30,000 30,000 Dec. 31 Dec.31 Bal. Buildings 150,000 150,000 2,750 Unearned Revenue 3,025 Dec. 31 Dec.31 Bal. 33,735 33,735 4,000 975 Salaries Payable Dec. 31 Dec. 31 Bal. 750 750 Interest Payable Dec. 31 Dec. 31 Bal. 735 735 Income Tax Payable Dec. 31 Dec. 31 Bal. 500 500 Bank Loan Payable Dec. 31 Dec.31 Bal. 147,100 147,100 Accumulated Depreciation— Buildings Dec. 31 24,000 Dec. 31 6,000 Dec. 31 Bal.30,000 Dec. 31 Dec.31 Bal. Equipment 45,000 45,000 Accumulated Depreciation— Equipment Dec. 31 18,000 Solutions Manual 5-64 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7A (CONTINUED) Depreciation Expense Dec. 31 10,500 Dec. 31 Bal. 10,500 (b) continued) Common Shares Dec. 31 Dec.31 Bal. Retained Earnings Dec. 31 Dec.31 Bal. Dividends Declared Dec. 31 2,000 Dec. 31 Bal. 2,000 Utilities Expense 13,000 5,100 13,000 Dec. 31 Dec. 31 Bal. 5,100 Insurance Expense 31,425 Dec. 31 2,750 31,425 Dec. 31 Bal. 2,750 Supplies Expense Dec. 31 2,190 Dec. 31 Bal. 2,190 Sales Dec. 31 Dec. 31 Dec.31Bal. Interest Expense 265,770 8,090 3,025 Dec. 31 Dec. 31 735 268,795 Dec. 31Bal. 8,825 Sales Returns and Allowances Income Tax Expense Dec. 31 2,500 Dec.31 5,500 Dec. 31 Bal. 2,500 Dec. 31 500 Dec.31 Bal. 6,000 Sales Discounts Dec. 31 3,275 Dec. 31 Bal. 3,275 Dec. 31 Dec. 31 Dec. 31 Dec.31Bal. Cost of Goods Sold 171,225 2,000 2,950 176,175 Salaries Expense Dec. 31 30,950 Dec. 31 750 Dec. 31 Bal. 31,700 Solutions Manual 5-65 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7A (CONTINUED) (c) MESA INC. Adjusted Trial Balance December 31, 2018 Cash........................................................................ Accounts receivable ............................................... Inventory ................................................................. Supplies .................................................................. Prepaid insurance ................................................... Land ........................................................................ Buildings ................................................................. Accumulated depreciation—buildings ..................... Equipment ............................................................... Accumulated depreciation—equipment................... Accounts payable .................................................... Uearned revenue .................................................... Salaries payable ..................................................... Interest payable ...................................................... Income tax payable ................................................. Bank loan payable .................................................. Common shares...................................................... Retained earnings ................................................... Dividends declared ................................................. Sales ....................................................................... Sales returns and allowances ................................. Sales discounts ....................................................... Cost of goods sold .................................................. Salaries expense .................................................... Depreciation expense ............................................. Utilities expense ...................................................... Insurance expense .................................................. Supplies expense .................................................... Interest expense ..................................................... Income tax expense ................................................ Totals ..................................................................... Debit $ 17,000 31,700 23,800 750 250 30,000 150,000 Credit $ 30,000 45,000 22,500 33,735 975 750 735 500 147,100 13,000 31,425 2,000 268,795 2,500 3,275 176,175 31,700 10,500 5,100 2,750 2,190 8,825 6,000 $549,515 0000 000 $549,515 (Total debit account balances = Total credit account balances) Solutions Manual 5-66 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7A (CONTINUED) (d) MESA INC. Income Statement Year Ended December 31, 2018 Sales revenue Sales.................................................................. Less: Sales returns and allowances ................. Sales discounts ....................................... Net sales............................................................ Cost of goods sold ...................................................... Gross profit ................................................................. Operating expenses Salaries expense ............................................... Depreciation expense ........................................ Utilities expense ................................................. Insurance expense ............................................. Supplies expense .............................................. Total operating expenses ................................... Income from operations .............................................. Other revenues and expenses Interest expense ................................................ Income before income tax .......................................... Income tax expense ................................................... Net income ................................................................. $268,795 $2,500 3,275 5,775 263,020 176,175 86,845 $31,700 10,500 5,100 2,750 2,190 52,240 34,605 8,825 25,780 6,000 $ 19,780 (Revenues – Contra revenues – Cost of goods sold – Operating expenses = Income from operations) (Income from operations + Other revenues – Other expenses = Income before income tax) Solutions Manual 5-67 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7A (CONTINUED) (d) (continued) MESA INC. Statement of Changes in Equity Year Ended December 31, 2018 Common Shares Balance, January 1 Issued common shares Net income Dividends declared Balance, December 31 $10,000 3,000 0000 00 $13,000 Retained Earnings $31,425 19,780 (2,000) $49,205 Total Equity $41,425 3,000 19,780 (2,000) $62,205 (Ending retained earnings = Beginning retained earnings ± Changes to retained earnings) MESA INC. Statement of Financial Position December 31, 2015 Assets Current assets Cash ................................................................................................ $17,000 Accounts receivable .................................................................. 31,700 Inventory ..................................................................................... 23,800 Supplies ...................................................................................... 750 Prepaid insurance ...................................................................... 250 Total current assets ........................................................... 73,500 Property, plant, and equipment Land........................................................ $ 30,000 Buildings ................................................. $150,000 Less: Accumulated depreciation ............. 30,000 120,000 Equipment .............................................. $45,000 Less: Accumulated depreciation ............. 22,500 22,500 Total property, plant, and equipment 172,500 Total assets ............................................................................... $246,000 Solutions Manual 5-68 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7A (CONTINUED) (d) (continued) Liabilities and Shareholders’ Equity Current liabilities Accounts payable ...................................................................... Unearned revenue ..................................................................... Salaries payable ........................................................................ Interest payable ......................................................................... Income tax payable ................................................................... Current portion of bank loan payable ......................................... Total current liabilities ...................................................... Non-current liabilities Bank loan payable ($147,100 – $9,800) .................................... Total liabilities ................................................................... Shareholders’ equity Common shares ..................................................... $13,000 Retained earnings .................................................. 49,205 Total shareholders’ equity ................................................. 62,205 Total liabilities and shareholders’ equity .................................... $ 33,735 975 750 735 500 9,800 46,495 137,300 183,795 $246,000 LO 4 BT: AP Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-69 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-8A (a) Gross profit margin $255,135 ÷ $1,061,375 = 24.0% Profit margin $97,370 ÷ $1,061,375 = 9.2% (b) Net Sales Existing balances Increase sales ($1,061,375 × 15%) $1,061,375 Gross Profit Net Income $255,135 $97,370 27,000 27,000 159,206 Increase in gross profit Increase in operating expenses (13,500) Increase in income tax expense (2,700) Revised amounts (c) Revised gross profit margin Revised profit margin $1,220,581 $282,135 $282,135 ÷ $1,220,581 = $108,170 23.1% $108,170 ÷ $1, 220,581 = 8.9% Both the gross profit margin and the profit margin have decreased, but the end result is an increase in net income, so the plan has merit. LO 5 BT: AN Difficulty: C Time: 25 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-70 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-9A (a) [1] [8] Sales Accounts receivable = $540,000 (given) = Sales × 30% = $540,000 × 30% = $162,000 (b) [2] Cost of goods sold [9] Inventory = 90% × inventory purchased = 90% × $300,000 = $270,000 = 10% × inventory purchased = 10% × $300,000 = $30,000 or purchases less cost of goods sold = $300,000 less $270,000 = $30,000 = 20% × inventory purchased = 20% ×$300,000 = $60,000 [10] Accounts payable (c) [3] Gross profit [4] [5] Operating expenses Income before income taxes (d) [6] Income tax expense [7] Net income [11] Income tax payable = Sales – Cost of goods sold = $540,000 – $270,000 = $270,000 = $120,000 (given) = Gross profit – Operating expenses = $270,000 – $120,000 = $150,000 = Income before income taxes × 30% = $150,000 × 30% = $45,000 = Income before income taxes – Income tax expense = $150,000 – $45,000 = $105,000 = given as equal to income tax expense = $45,000 Solutions Manual 5-71 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-9A (CONTINUED) (e) Gross profit margin Profit margin (e) = $270,000 ÷ $540,000 = 50.0% = $105,000 ÷ $540,000 = 19.4% If Psang Inc. has a higher than average gross profit margin, it is either because it is selling products at a higher price, (which is not the case), or because its cost of goods sold as a percentage of sales is smaller than its competitors. The resulting higher gross profit will be a contributing factor to a higher than average profit margin ratio. Other factors that could contribute to a higher than average profit margin ratio include lower than average operating expenses. LO 4,5 BT: AN Difficulty: C Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-72 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-10A (a) (in $ millions) 2015 Current ratio $990.8 $635.1 Gross profit margin ($3,925.3 – $2,780.8) $3,925.3 Profit margin $91.9 $3,925.3 (b) 2014 = 1.6:1 = 29.2% = 2.3% $902.6 $425.9 ($3,347.6 – $2,201.9) $3,347.6 $221.8 $3,347.6 2013 = $752.4 $440.5 2.1:1 = 34.2% = 6.6% ($3,194.9 – $2,036.8) $3,194.9 $250.5 $3,194.9 = 1.7:1 = 36.2% = 7.8% Canfor’s current ratio increased (improved) in 2014 but then decreased (deteriorated) in 2015. Canfor’s gross profit experienced a constant decrease (deterioration) over the three-year period as did the profit margin. (c) Current ratio Gross profit margin Profit margin 2015 Industry Average 1.2:1 20.8% 2.6% 2015 Canfor Corporation 1.6:1 29.2% 2.3% Canfor’s current ratio and gross profit margin are both better than those of the industry, and the profit margin is slightly worse than the industry. LO 5 BT: AN Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-73 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-11A (a) June 1 3 5 8 9 11 12 17 22 25 29 Purchases (180 × $16) ............................................ Accounts Payable ........................................... 2,880 Accounts Receivable (220 × $25) ............................ Sales ............................................................... 5,500 Accounts Payable (10 × $16) ................................... Purchase Returns and Allowances ................. 160 Accounts Receivable (80 × $22) .............................. Sales ............................................................... 1,760 Sales Returns and Allowances ................................ Accounts Receivable (12 × $22) ..................... 264 Purchases (130 × $15) ............................................ Accounts Payable ........................................... 1,950 Cash ($5,500 – $110) ........................................... Sales Discounts ($5,500 × 2%) .............................. Accounts Receivable ............................................. 5,390 110 Cash ($1,496 – $30) ........................................... Sales Discounts ($1,496 × 2%) .............................. Accounts Receivable ($1,760 – $264) .................. 1,466 30 Accounts Receivable (125 × $25) .......................... Sales ........................................................... 3,125 Sales Returns and Allowances............................... Accounts Receivable (15 × $25).................. 375 Accounts Payable ($2,880 – $160) ........................ Cash ............................................................ 2,720 2,880 5,500 160 1,760 264 1,950 5,500 1,496 3,125 375 Solutions Manual 5-74 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. 2,720 Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-11A (CONTINUED) (b) The advantages of the periodic inventory system are that it is simpler and cheaper (in terms of equipment and systems) compared to a perpetual inventory system. There are fewer accounting entries and cash registers do not need to be able to read bar codes to apply the appropriate cost as is required in the perpetual inventory system. However, a perpetual inventory system enables management to monitor purchases and sales to make the optimum use of the money available for stocking inventory. Fewer stock-outs are experienced when using the perpetual system as reductions in inventory levels can be quickly identified and restocking done, possibly automatically, before the business runs out of inventory. With the perpetual system, cost of goods sold can be reported at any time and consequently, timely reporting of results can be achieved. Perpetual systems allow management to quantify the cost of goods lost to theft. When customers make inquiries concerning the availability of stock from a merchant, a quick reply can be obtained and provided when a perpetual inventory system is used. Finally, fewer inventory counts are required, saving salary costs and minimizing lost sales from having to close the business for inventory counts. LO 1,6 BT: AN Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-75 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-12A (a) Sept. 2 Equipment ............................................................ Accounts Payable ....................................... 65,000 65,000 3 No entry necessary. 4 Supplies ............................................................... Cash ............................................................ 4,000 Purchases ............................................................ Accounts Payable ....................................... 65,000 Freight In .............................................................. Cash ............................................................ 1,600 Accounts Payable ................................................ Purchase Returns and Allowances ............. 5,000 Accounts Receivable............................................ Sales ........................................................... 20,000 Freight Out ........................................................... Cash ............................................................ 375 Cash ($20,000 – $400) ........................................ Sales Discount ($20,000 × 2%)............................ Accounts Receivable ................................... 19,600 400 Accounts Payable ($65,000 – $5,000) ................. Cash ($60,000 – $600) ............................... Purchase Discounts ($60,000 × 1%) ........... 60,000 Purchases ............................................................ Cash ............................................................ 6,000 6 7 8 9 10 17 20 21 4,000 65,000 1,600 5,000 20,000 375 20,000 59,400 600 Solutions Manual 5-76 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. 6,000 Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-12A (CONTINUED) (a) (continued) 22 Accounts Receivable................................................ Sales ............................................................... 27,000 27,000 23 No entry necessary. 28 Sales Returns and Allowances................................. Accounts Receivable ....................................... 10,000 Accounts Payable ($65,000 – $5,000) ..................... Cash ............................................................. 60,000 10,000 (b) Oct. 3 60,000 The cost of missing this purchase discount is the amount recorded in the Purchase Discounts account when the payment was made within the discount period ($60,000 × 1%) = $600. Expressing this in terms of an annual interest rate, it would be the equivalent of paying 24.6% ($600 ÷ $59,400 × 365/15) for the use of the money for 15 days. LO 6 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 M: Reporting and Finance Solutions Manual 5-77 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-13A (a) Apr. 3 5 7 9 11 14 16 17 20 24 Purchases ...................................................................... Accounts Payable ................................................. 3,200 Freight In ........................................................................ Cash ...................................................................... 286 Accounts Receivable ...................................................... Sales ..................................................................... 9,750 Accounts Payable .......................................................... Purchase Returns and Allowances ....................... 320 Accounts Payable ($3,200 – $320) ................................ Purchase Discounts ($2,880 × 1%) ....................... Cash ($2,880 – $29) ............................................. 2,880 Cash .............................................................................. Accounts Receivable............................................. 4,150 Purchases ...................................................................... Accounts Payable ................................................. 1,300 Accounts Payable .......................................................... Purchase Returns and Allowances ....................... 100 Accounts Receivable ...................................................... Sales ..................................................................... 11,100 Accounts Payable ($1,300 – $100) ................................ Purchase Discounts ($1,200 × 2%) ....................... Cash ($1,200 – $24) ............................................. 1,200 3200 286 9,750 320 29 2,851 4,150 1,300 100 11,100 24 1,176 *PROBLEM 5-13A (CONTINUED) (a) (continued) 25 Cash…………………………………………………………. Accounts Receivable………………………………... 4,375 4,375 Solutions Manual 5-78 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 27 Financial Accounting, Seventh Canadian Edition Sales Returns and Allowances ...................................... Accounts Receivable............................................. 85 85 Solutions Manual 5-79 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-13A (CONTINUED) (b) Apr. 1 Bal. Apr. 14 Apr. 25 Apr. 30 Bal. Cash 4,200 Apr. 5 4,150 Apr. 11 4,375 Apr. 24 8,412 Accounts Receivable Apr. 7 9,750 Apr. 14 Apr. 20 11,100 Apr. 25 Apr. 27 Apr. 30 Bal. 12,240 4,150 4,375 85 Accounts Payable 320 Apr. 3 2,880 Apr. 16 100 1,200 Apr. 30 Bal. Sales Returns and Allowances Apr. 27 85 Apr. 30 85 Apr. 3 Apr. 16 Apr. 30 Bal. Inventory Apr. 1 Bal. 19,500 Apr. 30 Bal. 19,500 Apr. 9 Apr. 11 Apr. 17 Apr. 24 Sales Apr. 7 9,750 Apr. 20 11,100 Apr. 30 Bal. 20,850 286 2,851 1,176 3,200 1,300 0 Common Shares Apr. 1 Bal. 12,000 Apr. 30 Bal. 12,000 Retained Earnings Apr. 1 Bal. 11,700 Apr. 30 Bal. 11,700 Purchases 3,200 1,300 4,500 Purchase Returns and Allowances Apr. 9 320 Apr. 17 100 Apr. 30 Bal. 420 Purchase Discounts Apr. 11 Apr. 21 Apr. 30 Bal. Apr. 5 Apr. 30 Bal. 29 24 53 Freight In 286 286 Solutions Manual 5-80 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-13A (CONTINUED) (c) IN THE PINES GOLF SHOP Trial Balance April 30, 2018 Cash ............................................................................ Accounts receivable ..................................................... Inventory ...................................................................... Accounts payable………………………………………………… Common shares ........................................................... Retained earnings ........................................................ Sales ............................................................................ Sales returns and allowances ...................................... Purchases .................................................................... Freight in ...................................................................... Purchase returns and allowances ................................ Purchase discounts ...................................................... (Total debit account balances = Total credit account balances) Debit $ 8,412 12,240 19,500 Credit $ 12,000 11,700 20,850 85 4,500 286 00 000 $45,023 420 53 $45,023 (d) Apr. 30 Inventory (ending) .................................................... Cost of Goods Sold .................................................. Purchase Returns and Allowances .......................... Purchase Discounts ................................................. Inventory (beginning) .......................................... Purchases ........................................................... Freight In............................................................. 11,763 12,050* 420 53 19,500 4,500 286 *Cost of goods sold = Beginning inventory + Purchases Purchase discounts Purchase returns and allowances + Freight in – Ending inventory Cost of goods sold = $19,500 + $4,500 – $53 – $420 + $286 – $11,763 = $12,050 LO 6 BT: AP Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-81 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-14A (a) FEISTY LTD. Income Statement (Partial) Year Ended April 30, 2018 Sales revenue Sales .................................................................................. Less: Sales returns and allowances.................................. Net sales ............................................................................ Cost of goods sold Inventory, May 1, 2017 ...................................................... Purchases ................................................... $5,900,000 Less: Purchase discounts ........................... 40,000 Net purchases ............................................. 5,860,000 Add: Freight in ........................................... 120,000 Cost of goods purchased ................................................... Cost of goods available for sale ......................................... Inventory, April 30, 2018 .................................................... Cost of goods sold ..................................................... Gross profit ............................................................................ $9,300,000 250,000 9,050,000 $ 600,000 5,980,000 6,580,000 700,000 5,880,000 $3,170,000 (Beginning inventory + Net purchases + Freight-in = Cost of goods purchased) (b) Apr. 30 Inventory (ending) .................................................... Cost of Goods Sold .................................................. Purchase Discounts ................................................. Inventory (beginning) .......................................... Purchases ........................................................... Freight In............................................................. 700,000 5,880,000 40,000 600,000 5,900,000 120,000 Solutions Manual 5-82 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-14A (CONTINUED) (c) Gross profit margin: $3,170,000 $9,050,000 = 35.0% Feisty’s gross profit margin of 35% is better than the industry average of 30%. This indicates that Feisty is making a higher gross profit from each dollar of sales than the industry average, due to higher selling prices or lower costs for its inventory. LO 5,6 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-83 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-15A ACTIVE ATHLETIC WEAR INC. Income Statement Year Ended December 31, 2018 Sales revenue Sales ......................................................................................... Less: Sales discounts .............................................................. Sales returns and allowances ......................................... Net sales ................................................................................... Cost of goods sold Inventory, January 1 .................................................................. Purchases .......................................................... $602,400 Less: Purchase discounts .................................... 33,750 Purchase returns and allowances ............... 9,600 Net purchases ...................................................... 559,050 Add: Freight in ...................................................... 8,400 Cost of goods purchased .......................................................... Cost of goods available for sale ................................................ Less: Inventory, December 31 .................................................. Cost of goods sold .............................................................. Gross profit ...................................................................................... Operating expenses Administrative expenses ............................................................ Selling expenses........................................................................ Total operating expenses ................................................... Income from operations ................................................................... Other revenues and expenses Interest expense ........................................................................ Income before income tax ............................................................... Income tax expense ........................................................................ Net Income ..................................................................................... $955,500 $22,500 12,000 34,500 921,000 $ 60,750 567,450 628,200 108,900 519,300 401,700 $271,350 11,250 282,600 119,100 15,600 103,500 24,000 $ 79,500 (Beginning inventory + Net purchases + Freight-in = Cost of goods available for sale) Solutions Manual 5-84 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-15A (CONTINUED) ACTIVE ATHLETIC WEAR INC. Statement of Changes in Equity Year Ended December 31, 2018 Common Shares Balance, January 1 Issued common shares Net income Dividends declared Balance, December 31 $ 75,000 37,500 000 0000 $112,500 Retained Earnings $102,900 79,500 (12,000) $170,400 Total Equity $177,900 37,500 79,500 (12,000) $282,900 (Ending retained earnings = Beginning retained earnings ± Changes to retained earnings) ACTIVE ATHLETIC WEAR INC. Statement of Financial Position December 31, 2018 Assets Current assets Cash ............................................................................................................ Accounts receivable ................................................................................... Inventory ...................................................................................................... Prepaid insurance ...................................................................................... Total current assets ............................................................................ Property, plant, and equipment Land..................................................................... $112,500 Buildings .............................................................. $285,000 Less: Accumulated depreciation .......................... 77,700 207,300 Equipment ........................................................... $165,000 Less: Accumulated depreciation .......................... 64,350 100,650 Total property, plant, and equipment ......... Total assets ............................................................................................... $ 25,500 66,300 108,900 3,600 204,300 420,450 $624,750 Solutions Manual 5-85 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-15A (CONTINUED) Liabilities and Shareholders’ Equity Current liabilities Accounts payable ..................................................................... Salaries payable ....................................................................... Property tax payable ................................................................. Unearned revenue .................................................................... Current portion of mortgage payable ........................................ Total current liabilities ..................................................... Non-current liabilities Mortgage payable ($187,500 – $18,750) ................................. Total liabilities .................................................................. Shareholders’ equity Common shares .................................................... $112,500 Retained earnings ................................................. 170,400 Total shareholders’ equity ................................................ Total liabilities and shareholders’ equity .................................... $ 129,450 5,250 7,200 12,450 18,750 173,100 168,750 341,850 282,900 $624,750 LO 6 BT: AP Difficulty: M Time: 60 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-86 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-1B (a) A company’s operating cycle is the average time it takes to go from cash to cash in producing revenues. The operating cycle for a merchandising company covers the period of time between when you purchase your inventory, to when you sell it, and to when you eventually collect the accounts receivable from a sale. The Fashion Palace is having problems paying its bills because the period of time between sales and collection of accounts receivable is lengthened because many customers take more than one month to pay. The company’s inventory is contributing to the problem because some items have been in stock for a long period of time, which means a long operating cycle for those items. (b) The Fashion Palace should consider switching to a perpetual inventory system where detailed records of each inventory purchase and sale are maintained. This system continuously—perpetually—shows the quantity and cost of the inventory purchased, sold, and on hand. This system will help the company see which inventory items are out-of-stock, which items are taking a long time to sell, and provide management with the total inventory on hand each month to prepare its monthly financial statements, eliminating the need for a monthly count. The company will still need to perform at least one annual inventory count to ensure its accounting records agree with the physical inventory count. (c) For control reasons, a physical inventory count must always be taken at least one a year, and ideally more often under the perpetual inventory system. By using a perpetual inventory system, a company knows what inventory should be on hand. Performing a physical count and checking it to the perpetual records is necessary to detect any errors in record keeping and/or shortages in stock. LO 1 BT: AN Difficulty: C Time: 40 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 5-87 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-2B (a) (b) July Travel Warehouse Ltd. is a wholesaler. Its suppliers are suitcase manufacturers and its customers are stores. 2 3 6 7 9 11 13 Inventory (75 × $60) .......................................... Accounts Payable ................................... 4,500 Accounts Payable ............................................. Inventory (4 × $60) ................................. 240 Accounts Receivable (55 × $90) ....................... Sales ...................................................... 4,950 Cost of Goods Sold (55 × $50).......................... Inventory................................................. 2,750 Sales Returns and Allowances.......................... Accounts Receivable (3 × $90) .............. 270 Inventory ........................................................... Cost of Goods Sold (3 × $50) ................. 150 Accounts Receivable (3 × $100) ....................... Sales ...................................................... 300 Cost of Goods Sold (3 × $60)............................ Inventory................................................. 180 Accounts Payable ($4,500 – $240) ................... Inventory ($4,260 × 2%) ......................... Cash ($4,260 – $85) ............................... 4,260 Accounts Receivable (25 × $100) ..................... Sales ...................................................... 2,500 4,500 240 4,950 2,750 270 150 300 180 85 4,175 2,500 Solutions Manual 5-88 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-2B (CONTINUED) (b) (continued) July 13 16 17 July 20 27 Cost of Goods Sold (25 × $60).......................... Inventory................................................. 1,500 Inventory (70 × $62) .......................................... Accounts Payable ................................... 4,340 Sales Returns and Allowances.......................... Accounts Receivable (5 × $100)............. Cash ($4,980 – $100) ..................................... Sales Discounts ($4,980 × 2%) ......................... Accounts Receivable ($4,950 – $270 + $300) .......................... 500 4,880 100 Cash ($2,000 – $40) ......................................... Sales Discounts ($2,000 × 2%) ......................... Accounts Receivable ($2,500 – $500).... 1,960 40 1,500 4,340 500 4,980 2,000 (c) July 1* 2 7 16 July 31 *(60 × $50) (d) Inventory 3,000 4,500 150 4,340 Bal. July 3 6 9 11 13 240 2,750 180 85 1,500 7,235 Number of suitcases on hand at July 31 = 60 + 75 – 4 – 55 + 3 – 3 – 25 + 70 = 121 $7,235 121 = $60 LO 1,2,3 BT: AN Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-89 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-3B (a) Oct. 1 1 2 6 8 9 10 12 15 17 Inventory ........................................................................... Accounts Payable ................................................... 86,000 Inventory ........................................................................... Cash ....................................................................... 1,400 Accounts Payable ............................................................. Inventory................................................................. 4,000 Supplies ............................................................................ Cash ....................................................................... 2,800 Accounts Receivable......................................................... Sales ...................................................................... 140,000 Cost of Goods Sold ........................................................... Inventory ($86,000 + $1,400 – $4,000) .................. 83,400 Freight Out ........................................................................ Cash ....................................................................... 2,300 Equipment ......................................................................... Accounts Payable ................................................... 62,000 Sales Returns and Allowances.......................................... Accounts Receivable .............................................. 3,500 Inventory ........................................................................... Cash ....................................................................... 36,300 Cash ($136,500 – $2,730) ................................................ Sales Discounts [($140,000 – $3,500) × 2%] .................... Accounts Receivable ($140,000 – $3,500) ............. 133,770 2,730 86,000 1,400 4,000 2,800 140,000 83,400 2,300 62,000 3,500 36,300 136,500 PROBLEM 5-3B (CONTINUED) (a) (continued) Oct. 28 Accounts Receivable......................................................... Sales ...................................................................... 30,000 Cost of Goods Sold ........................................................... Inventory................................................................. 18,000 30,000 18,000 Solutions Manual 5-90 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 29 30 31 Financial Accounting, Seventh Canadian Edition No entry necessary. Accounts Payable ($86,000 – $4,000) .............................. Cash ....................................................................... 82,000 82,000 Sales Returns and Allowances.......................................... Accounts Receivable .............................................. 5,000 Inventory ........................................................................... Cost of Goods Sold ................................................ 3,000 5,000 3,000 (b) Oct. 14 Accounts Payable ($86,000 – $4,000) ........................... Inventory ($82,000 × 1%) .................................... Cash ($82,000 – $820) ........................................ 82,000 820 81,180 The cost of missing this purchase discount is the amount recorded as a reduction to the Inventory account when the payment was made within the discount period ($820). Expressing this in terms of an annual interest rate, it would be the equivalent of paying 24.6% ($820 ÷ $81,180 × 365/15) for the use of the money for 15 days. LO 2,3 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-91 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-4B (a) April 2 3 5 9 11 13 16 18 20 Inventory ................................................................. Accounts Payable ........................................... 5,800 Inventory ................................................................. Cash ............................................................... 160 Accounts Payable.................................................... Inventory ........................................................ 100 Supplies .................................................................. Cash ............................................................... 1,130 Accounts Payable ($5,800 – $100) ........................ Inventory ($5,700 × 2%) ................................. Cash ($5,700 – $114) .................................... 5,700 Inventory ................................................................. Cash ............................................................... 1,560 Inventory ................................................................. Cash ............................................................... 115 Cash ....................................................................... Inventory......................................................... 110 Accounts Receivable ............................................... Sales .............................................................. 11,100 Cost of Goods Sold ................................................. Inventory......................................................... 6,660 5,800 160 100 1,130 114 5,586 1,560 115 110 11,100 6,660 Solutions Manual 5-92 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-4B (CONTINUED) (a) (continued) April 21 23 25 27 28 Sales Returns and Allowances ................................ Accounts Receivable ...................................... 1,000 Inventory .................................................................. Cost of Goods Sold ........................................ 600 1,000 600 Equipment ............................................................... 11,700 Accounts Payable ........................................... Accounts Receivable ............................................... Sales ............................................................... 9,800 Cost of Goods Sold.................................................. Inventory ......................................................... 5,880 Cash ........................................................................ Accounts Receivable ...................................... 9,800 Sales Returns and Allowances ............................... Accounts Receivable ...................................... 150 11,700 9,800 5,880 9,800 150 Solutions Manual 5-93 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-4B (CONTINUED) (b) Apr. 1 Bal. Apr. 18 Apr. 27 Apr. 30 Bal. Cash 16,400 Apr. 3 110 Apr. 9 9,800 Apr. 11 Apr. 13 Apr. 16 17,759 Accounts Receivable Apr. 20 11,100 Apr. 21 Apr. 27 9,800 Apr. 27 Apr. 28 Apr. 30 Bal. 9,950 Inventory Apr. 1 Bal. 16,200 Apr. 5 Apr. 2 5,800 Apr. 11 Apr. 3 160 Apr. 18 Apr. 13 1,560 Apr. 20 Apr. 16 115 Apr. 25 Apr. 21 600 Apr. 30 Bal. 11,571 Apr. 9 Apr. 30 Bal. Supplies 1,130 1,130 Equipment Apr. 23 11,700 Apr. 30 Bal. 11,700 160 1,130 5,586 1,560 115 Apr. 5 Apr. 11 1,000 9,800 150 100 114 110 6,660 5,880 Accounts Payable 100 Apr. 2 5,700 Apr. 23 Apr. 30 Bal. 5,800 11,700 11,700 Common Shares Apr. 1 Bal. Apr. 30 Bal. 20,000 20,000 Retained Earnings Apr. 1 Bal. Apr. 30 Bal. 12,600 12,600 Sales Apr. 20 Apr. 25 Apr. 30 Bal. 11,100 9,800 20,900 Sales Returns and Allowances Apr. 21 1,000 Apr. 28 150 Apr. 30 Bal. 1,150 Apr. 20 Apr. 25 Apr. 30 Bal. Cost of Goods Sold 6,660 Apr. 21 5,880 11,940 600 Solutions Manual 5-94 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-4B (CONTINUED) (c) GRAND SLAM TENNIS SHOP Trial Balance April 30, 2018 Debit Cash ................................................................................. $ 17,759 Accounts receivable .......................................................... 9,950 Inventory ........................................................................... 11,571 Supplies ............................................................................ 1,130 Equipment......................................................................... 11,700 Accounts payable ............................................................. Common shares ............................................................... Retained earnings ............................................................. Sales ................................................................................. Sales returns and allowances ........................................... 1,150 Cost of goods sold ............................................................ 11,940 $65,200 Credit $ 11,700 20,000 12,600 20,900 0 0000 $65,200 (Total debit account balances = Total credit account balances) LO 2,3 BT: AP Difficulty: M Time: 60 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-95 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-5B (a) Apr. 2 3 5 9 10 11 Inventory .................................................................. Accounts Payable ........................................... 8,900 Inventory .................................................................. Cash ............................................................... 225 8,900 225 Accounts Receivable ............................................... 11,600 Sales ............................................................... Cost of Goods Sold.................................................. Inventory ......................................................... 7,540 Freight Out ............................................................... Cash ............................................................... 290 Sales Returns and Allowances ................................ Accounts Receivable ...................................... 1,600 Inventory .................................................................. Cost of Goods Sold ......................................... 1,030 Inventory .................................................................. Accounts Payable ........................................... 4,200 7,540 290 1,600 1,030 4,200 12 No entry necessary 13 Accounts Payable .................................................... Inventory ......................................................... 300 Cash ($10,000 – $200) ............................................ Sales Discounts ($10,000 × 2%) ............................. Accounts Receivable ($11,600 – $1,600) .......... 9,800 200 14 11,600 300 10,000 Solutions Manual 5-96 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-5B (CONTINUED) (a) (continued) Apr. 17 20 23 24 27 30 Accounts Payable .................................................... Inventory ($8,900 × 1%) ................................. Cash ............................................................... 8,900 Accounts Payable ($4,200 – $300)………… Inventory ($3,900 × 1%) ................................. Cash ($3,900 – $39) ....................................... 3,900 Cash ........................................................................ Sales............................................................... 6,400 Cost of Goods Sold.................................................. Inventory ......................................................... 5,200 Sales Returns and Allowances ................................ Cash ............................................................... 400 Inventory .................................................................. Cash ............................................................... 6,100 Cash ........................................................................ Inventory ......................................................... 500 89 8,811 39 3,861 6,400 5,200 400 6,100 500 Solutions Manual 5-97 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-5B (CONTINUED) (b) Apr. 1 Bal. Apr. 14 Apr. 23 Apr. 30 Apr. 30 Bal. Cash 4,000 Apr. 3 9,800 Apr. 9 6,400 Apr. 17 500 Apr. 20 Apr. 24 Apr. 27 1,013 Accounts Receivable Apr. 1 Bal. 3,500 Apr. 10 Apr. 5 11,600 Apr. 14 Apr. 30 Bal. 3,500 Apr. 1 Bal. Apr. 2 Apr. 3 Apr. 10 Apr. 11 Apr. 27 Apr. 30 Bal. Inventory 2,500 Apr. 5 8,900 Apr. 13 225 Apr. 17 1,030 Apr. 20 4,200 Apr. 23 6,100 Apr. 30 9,287 Common Shares Apr. 1 Bal. Apr. 30 Bal. Apr. 13 Apr. 17 Apr. 20 Accounts Payable 300 Apr. 2 8,900 Apr. 11 3,900 Apr. 30 Bal. 225 290 8,811 3,861 400 6,100 1,600 10,000 7,540 300 89 39 5,200 500 Sales Apr. 5 Apr. 23 Apr. 30 Bal. Sales Returns and Allowances Apr. 10 1,600 Apr. 24 400 Apr. 30 Bal. 2,000 Sales Discounts Apr. 14 200 Apr. 30 Bal. 200 Apr. 9 Apr. 30 Bal. Apr. 5 Apr. 23 Apr. 30 Bal. 5,000 5,000 11,600 6,400 18,000 Freight Out 290 290 Cost of Goods Sold 7,540 Apr. 10 5,200 1,030 11,710 Retained Earnings Apr. 1 Bal. Apr. 30 Bal. 5,000 5,000 8,900 4,200 0 Solutions Manual 5-98 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-5B (CONTINUED) (c) NISSON DISTRIBUTING LTD. Income Statement Month Ended April 30, 2018 Sales ...................................................................... Less: Sales returns and allowances ..................... Sales discounts .......................................... Net sales .................................................................. Cost of goods sold ................................................... Gross profit .............................................................. $18,000 $2,000 200 2,200 15,800 11,710 $ 4,090 (d) NISSON DISTRIBUTING LTD. Statement of Financial Position (Partial) April 30, 2018 Assets Current assets Cash..................................................................................... Accounts receivable ............................................................. Inventory .............................................................................. Total current assets ....................................................... $ 1,013 3,500 9,287 $13,800 LO 2,3,4 BT: AP Difficulty: M Time: 60 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-99 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-6B (a) BRIGUS WHOLESALE LTD. Income Statement (Single-step) Year Ended November 30, 2018 Revenues Sales ........................................................................................ Less: Sales returns and allowances ....................... $12,800 Sales discounts ............................................. 11,400 Net sales ................................................................................. Interest revenue ...................................................................... Expenses Cost of goods sold .................................................................. Administrative expenses ......................................................... Selling expenses ..................................................................... Interest expense ..................................................................... Income before income tax .......................................................... Income tax expense ................................................................... Net income ................................................................................. $2,234,800 24,200 2,210,600 2,800 $1,387,200 366,000 286,000 12,300 $2,213,400 2,051,500 161,900 32,400 $ 129,500 Solutions Manual 5-100 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-6B (CONTINUED) (b) BRIGUS WHOLESALE LTD. Income Statement (Multiple-step) Year Ended November 30, 2018 Sales ..................................................................................... Less: Sales returns and allowances ............................... Sales discounts..................................................... Net sales ........................................................................... Cost of goods sold .................................................................. Gross profit ............................................................................. Operating expenses Administrative expenses .............................................. Selling expenses.......................................................... Total operating expenses........................................ Income from operations .......................................................... Other revenues and expenses Interest revenue ............................................................... Interest expense ................................................................ Income before income tax ...................................................... Income tax expense ............................................................... Net income ............................................................................. $2,234,800 $12,800 11,400 24,200 2,210,600 1,387,200 823,400 $366,000 286,000 652,000 171,400 ($2,800) 12,300 9,500 161,900 32,400 $ 129,500 (Revenues – Contra revenues – Cost of goods sold – Operating expenses = Income from operations) (Income from operations + Other revenues – Other expenses = Income before income taxes) (c) Both income statements result in the same amount of net income. The multiple-step income statement provides the user with more information than the single-step income statement does. The multiple-step income statement provides information on gross profit and income from operations which is not included on the single-step income statement. (d) Brigus is classifying its expenses by their function. They are reported according to the activity (business function) for which they were incurred (for example, cost of goods sold, administrative, selling). LO 4 BT: AN Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-101 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7B (a) Nov. 30 30 30 30 30 30 30 30 Insurance Expense ($1,800 × 4/12) ................................... Prepaid Insurance ...................................................... 600 Supplies Expense .............................................................. Supplies ($1,650 – $950) ........................................... 700 Depreciation Expense ........................................................ Accumulated Depreciation—Equipment .................... 5,360 Salaries Expense ............................................................... Salaries Payable ........................................................ 1,210 Interest Expense ................................................................ Interest Payable ......................................................... 175 Unearned Revenue ............................................................ Sales.......................................................................... 2,400 Cost of Goods Sold ............................................................ Inventory .................................................................... 1,560 Income Tax Expense ......................................................... Income Tax Payable .................................................. 1,100 600 700 5,360 1,210 175 2,400 1,560 Cost of Goods Sold .............................................................. 940 Inventory .................................................................... ($27,500 – $1,560 = $25,940; $25,940 – $25,000 = $940 shortage) 1,100 940 Solutions Manual 5-102 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7B (CONTINUED) (b) Nov. 30 Nov. 30 Bal. Cash 22,000 22,000 Accounts Receivable Nov. 30 30,600 Nov. 30 Bal. 30,600 1,560 940 Nov. 30 Bal. Inventory 27,500 Nov. 30 Nov. 30 25,000 Nov. 30 Nov. 30 Bal. Supplies 1,650 Nov. 30 950 700 Nov. 30 Nov. 30 Nov. 30 Bal. Prepaid Insurance 1,800 Nov. 30 1,200 Equipment Nov. 30 26,800 Nov. 30 Bal. 26,800 Accumulated Depreciation— Equipment Nov. 30 10,720 Nov. 30 5,360 Nov. 30 Bal. 16,080 34,400 34,400 Salaries Payable Nov. 30 Nov. 30 Bal. 1,210 1,210 Interest Payable Nov. 30 Nov. 30 Bal. 175 175 Income Tax Payable Nov. 30 Nov. 30 Bal. 600 Long-term Investments Nov. 30 37,000 Nov. 30 Bal. 37,000 Accounts Payable Nov. 30 Nov. 30 Bal. Nov. 30 1,100 1,100 Unearned Revenue 2,400 Nov. 30 Nov. 30 Bal. 3,000 600 Bank Loan Payable Nov. 30 Nov. 30 Bal. 35,000 35,000 Common Shares Nov. 30 Nov. 30 Bal. 16,400 16,400 Retained Earnings Nov. 30 Nov. 30 Bal. 30,000 30,000 Solutions Manual 5-103 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7B (CONTINUED) Dividends Declared Nov. 30 10,000 Nov. 30 Bal. 10,000 Sales Nov. 30 248,500 Nov. 30 2,400 Nov. 30 Bal. 250,900 Sales Returns and Allowances Nov. 30 4,600 Nov. 30 Bal. 4,600 Sales Discounts Nov. 30 4,520 Nov. 30 Bal. 4,520 Cost of Goods Sold Nov. 30 157,000 Nov. 30 1,560 Nov. 30 940 Nov. 30 Bal. 159,500 Nov. 30 Nov. 30 Nov. 30 Bal. Salaries Expense 32,600 1,210 33,810 Depreciation Expense Nov. 30 5,360 Nov.30 Bal. 5,360 Nov. 30 Nov. 30 Bal. Rent Expense 13,850 13,850 Advertising Expense Nov. 30 2,100 Nov. 30 Bal. 2,100 Nov. 30 Nov. 30 Bal. Supplies Expense 700 700 Insurance Expense Nov. 30 600 Nov. 30 Bal. 600 Interest Expense Nov. 30 4,000 Nov. 30 175 Nov. 30 Bal. 4,175 Income Tax Expense Nov. 30 2,000 Nov. 30 1,100 Nov. 30 Bal. 3,100 Solutions Manual 5-104 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7B (CONTINUED) (c) FASHION CENTRE LTD. Adjusted Trial Balance November 30, 2018 Cash ........................................................................... Accounts receivable .................................................... Inventory ..................................................................... Supplies ...................................................................... Prepaid insurance ....................................................... Long-term investments ............................................... Equipment................................................................... Accumulated depreciation—equipment ...................... Accounts payable ....................................................... Salaries payable ......................................................... Interest payable .......................................................... Income tax payable ..................................................... Unearned revenue ...................................................... Bank loan payable ...................................................... Common shares ......................................................... Retained earnings ....................................................... Dividends declared ..................................................... Sales ........................................................................... Sales discounts........................................................... Sales returns and allowances ..................................... Cost of goods sold ...................................................... Salaries expense ........................................................ Rent expense.............................................................. Depreciation expense ................................................. Supplies expense ....................................................... Insurance expense ..................................................... Interest expense ......................................................... Advertising expense ................................................... Income tax expense .................................................... Totals ................................................................... Debit $ 22,000 30,600 25,000 950 1,200 37,000 26,800 Credit $ 16,080 34,400 1,210 175 1,100 600 35,000 16,400 30,000 10,000 250,900 4,520 4,600 159,500 33,810 13,850 5,360 700 600 4,175 2,100 3,100 $385,865 0000 000 $385,865 (Total debit account balances = Total credit account balances) Solutions Manual 5-105 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7B (CONTINUED) (d) FASHION CENTRE LTD. Income Statement Year Ended November 30, 2018 Sales revenue Sales........................................................................................... Less: Sales returns and allowances ........................ $4,600 Sales discounts .............................................. 4,520 Net sales..................................................................................... Cost of goods sold .............................................................................. Gross profit .......................................................................................... Operating expenses Salaries expense ..................................................... $33,810 Rent expense ............................................................ 13,850 Depreciation expense ............................................... 5,360 Advertising expense .................................................. 2,100 Supplies expense ...................................................... 700 Insurance expense ................................................... 600 Total operating expenses ................................................... Income from operations ....................................................................... Other revenues and expenses Interest expense ......................................................................... Income before income tax ................................................................... Income tax expense ............................................................................ Net income .......................................................................................... $250,900 9,120 241,780 159,500 82,280 56,420 25,860 4,175 21,685 3,100 $ 18,585 (Revenues – Contra revenues – Cost of goods sold – Operating expenses = Income from operations) (Income from operations + Other revenues – Other expenses = Income before income tax) Solutions Manual 5-106 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7B (CONTINUED) (d) (continued) FASHION CENTRE LTD. Statement of Changes in Equity Year Ended November 30, 2018 Common Shares Balance, December 1, 2017 Issued common shares Net income Dividends declared Balance, November 30, 2018 Retained Earnings $ 11,400 5,000 _______ $ 16,400 $30,000 18,585 (10,000) $ 38,585 Total Equity $41,400 5,000 18,585 (10,000) $ 54,985 FASHION CENTRE LTD. Statement of Financial Position November 30, 2018 Assets Current assets Cash .................................................................................. $22,000 Accounts receivable .......................................................... 30,600 Inventory ............................................................................. 25,000 Supplies .............................................................................. 950 Prepaid insurance .............................................................. 1,200 Total current assets ................................................... $ 79,750 Long-term investments ................................................................ .......................... 37,000 Property, plant, and equipment Equipment .......................................................................... $26,800 Less: Accumulated depreciation ......................................... 16,080 ..........................Total property, plant, and equipment 10,720 Total assets ........................................................................ $127,470 Solutions Manual 5-107 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-7B (CONTINUED) (d) (continued) Liabilities and Shareholders’ Equity Current liabilities Accounts payable ............................................................... Salaries payable ................................................................. Interest payable .................................................................. Income tax payable ............................................................ Unearned revenue .............................................................. Current portion of bank loan payable .................................. Total current liabilities ............................................... Non-current liabilities Bank loan payable* ............................................................. Total liabilities ............................................................ Shareholders’ equity Common shares ...................................................... ...... $16,400 Retained earnings ................................................... ........... 38,585 Total shareholders’ equity ............................... ....................... Total liabilities and shareholders’ equity .................. ....................... $ 34,400 1,210 175 1,100 600 5,000 42,485 30,000 72,485 54,985 $127,470 *($35,000 – $5,000) LO 4 BT: AP Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-108 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-8B (a) Gross profit margin $823,400 ÷ $2,210,600 = 37.2% Profit margin $129,500 ÷ $2,210,600 = 5.9% (b) Existing balances Increase sales ($2,210,600 × 10%) Increase in gross profit Net Sales Gross Profit Net Income $2,210,600 $823,400 $129,500 60,000 60,000 221,060 Increase in operating expenses Increase in income tax expense Revised amounts (c) Revised gross profit margin Revised profit margin (32,000) (4,000) $2,431,660 $883,400 $883,400 ÷ $2,431,660 = $153,500 ÷ $2,431,660 = $153,500 36.3% 6.3% While the gross profit margin decreases slightly, the profit margin increases from 5.9% to 6.3%. The plan has increased net income, so it has merit. LO 5 BT: AN Difficulty: C Time: 25 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-109 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-9B (a) [1] [8] Sales = $400,000 (given) Accounts receivable = Sales × 20% = $400,000 × 20% = $80,000 (b) [2] Cost of goods sold [9] Inventory [10] Accounts payable (c) [3] Gross profit [4] [5] Operating expenses Income before income taxes (d) [6] Income tax expense [7] Net income [11] Income tax payable (e) Gross profit margin Profit margin = 80% × inventory purchased = 80% × $200,000 = $160,000 = 20% × inventory purchased = 20% × $200,000 = $40,000 or purchases less cost of goods sold = $200,000 less $160,000 = $40,000 = 25% × inventory purchased = 25% × $200,000 = $50,000 = Sales – Cost of goods sold = $400,000 – $160,000 = $240,000 = $140,000 (given) = Gross profit – Operating expenses = $240,000 – $140,000 = $100,000 = Income before income taxes × 30% = $100,000 × 30% = $30,000 = Income before income taxes – Income tax expense = $100,000 – $30,000 = $70,000 = given as equal to income tax expense = $30,000 = $240,000 ÷ $400,000 = 60.0% = $70,000 ÷ $400,000 = 17.5% Solutions Manual 5-110 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-9B (CONTINUED) (e) Although Tsang Inc. may sell its product at the same price as other companies in the industry, its cost of goods sold percentage may be higher compared with other companies in the industry. Because the business is new, it might not yet enjoy the economies of scale and have strong relationships with suppliers that allow them to buy at competitive prices. Tsang may be unable to negotiate lower purchase prices for merchandise and therefore experiences lower gross profit margins compared to its competitors. Similarly, other competitors are likely larger businesses that enjoy cost savings through economies of scale. Tsang is a new business and does not enjoy this advantage and experiences higher operating costs yielding a lower profit margin. LO 4,5 BT: AN Difficulty: C Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-111 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-10B (a) [in SEK (Swedish krona) millions] 2015 Current ratio Gross profit margin Profit margin (b) 2014 2013 170,687 ÷ 155,860 177,302 ÷ 136,393 163,612 ÷ 140,316 = 1.1:1 = 1.3:1 = 1.2:1 (312,515 – 240,653) 312,515 (282,948 – 220,012) 282,948 (272,622 – 212,504) 272,622 = 23.0% = 22.2% = 22.1% 15,099 ÷ 312,515 2,235 ÷ 282,948 3,802 ÷ 272,622 = 4.8% = 0.8% = 1.4% Volvo’s current ratio increased (improved) from 2013 to 2014 but decreased (deteriorated) in 2015. Volvo’s gross profit margin increased slightly in 2014 and experienced another increase (improvement) in 2015. On the other hand, the company’s profit margin was very low in 2013 and 2014, but then improved dramatically in 2015. (c) Current ratio Gross profit margin Profit margin 2015 Industry Average 1.2:1 16.3% 2.5% 2015 Volvo 1.1:1 23.0% 4.8% Volvo’s 2015 current ratio is slightly lower (worse) and its gross profit margin considerably higher (better) than the industry averages, indicating that the company is performing much better than other companies in the industry. Its 2015 profit margin is also substantially higher (better) than the average company in the industry. LO 5 BT: AN Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-112 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-11B (a) July 2 3 6 7 9 11 13 16 17 20 27 Purchases (75 × $60) ............................................ Accounts Payable ........................................ 4,500 Accounts Payable (4 × $60) .................................. Purchase Returns and Allowances ............... 240 Accounts Receivable (55 × $90) ........................... Sales ............................................................ 4,950 Sales Returns and Allowances .............................. Accounts Receivable (3 × $90) .................... 270 Accounts Receivable (3 × $100) ........................... Sales ............................................................ 300 4,500 240 4,950 270 300 Accounts Payable ($4,500 – $240) ........................ Purchase Discounts ($4,260 × 2%) ............. Cash ($4,260 – $85) .................................... 4,260 Accounts Receivable (25 × $100)........................... Sales ........................................................... 2,500 Purchases (70 × $62) ............................................. Accounts Payable ........................................ 4,340 Sales Returns and Allowances ............................... Accounts Receivable (5 × $100).................. 500 Cash ($4,980 – $100) .......................................... Sales Discounts $4,980 × 2%) ............................... Accounts Receivable ($4,950 – $270 + $300) .............................. 4,880 100 Cash ($2,000 – $40) ............................................... Sales Discounts ($2,000 × 2%) .............................. Accounts Receivable ($2,500 – $500)......... 1,960 40 85 4,175 2,500 4,340 500 4,980 2,000 Solutions Manual 5-113 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-11B (CONTINUED) (b) The advantages of the periodic inventory system are that it is simpler and cheaper (in terms of equipment and systems) compared to a perpetual inventory system. There are fewer accounting entries and cash registers do not need to be able to read bar codes to apply the appropriate cost, as is required in the perpetual inventory system. However, a perpetual inventory system enables management to monitor purchases and sales to make the optimum use of the money available for stocking inventory. Fewer stock-outs are experienced when using the perpetual system as reductions in inventory levels can be quickly identified and restocking done, possibly automatically, before the business runs out of inventory. With the perpetual system, cost of goods sold can be reported at any time and consequently, timely reporting of results can be achieved. Perpetual systems allow management to quantify the cost of goods lost to theft. When customers make inquiries concerning the availability of stock from a merchant, a quick reply can be obtained and provided when a perpetual inventory system is used. Finally, fewer inventory counts are required, saving salary costs and minimizing lost sales from having to close the business for inventory counts. LO 1,6 BT: AN Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-114 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-12B (a) Oct. 1 1 2 6 8 9 10 12 15 17 28 Purchases............................................................................. Accounts Payable ........................................................ 86,000 Freight In .............................................................................. Cash ............................................................................ 1,400 Accounts Payable ................................................................. Purchase Returns and Allowances .............................. 4,000 Supplies ................................................................................ Cash ............................................................................ 2,800 86,000 1,400 4,000 2,800 Accounts Receivable ............................................................ 140,000 Sales............................................................................ Freight Out............................................................................ Cash ............................................................................ 2,300 Equipment ............................................................................ Accounts Payable ........................................................ 62,000 Sales Returns and Allowances ............................................. Accounts Receivable ................................................... 3,500 Purchases............................................................................. Cash ............................................................................ 36,300 2,300 62,000 3,500 36,300 Cash ($136,500 – $2,730) .................................................... 133,770 Sales Discounts [($140,000 – $3,500) × 2%] ....................... 2,730 Accounts Receivable ($140,000 – $3,500) ................. Accounts Receivable ............................................................ Sales ........................................................................... 140,000 136,500 30,000 30,000 Solutions Manual 5-115 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-12B (CONTINUED) (a) (continued) Oct. 29 30 31 (b) Oct. 14 No entry necessary. Accounts Payable ($86,000 – $4,000) .................................. Cash............................................................................ 82,000 Sales Returns and Allowances ............................................. Accounts Receivable................................................... 5,000 Accounts Payable ($86,000 – $4,000) ........................... Purchase Discounts ($82,000 × 1%) ................... Cash ($82,000 – $820) ........................................ 82,000 5,000 82,000 820 81,180 The cost of missing this purchase discount is the amount recorded as a purchase discount when the payment was made within the discount period ($820). Expressing this in terms of an annual interest rate, it would be the equivalent of paying 24.6% ($820 ÷ $81,180 × 365/15) for the use of the money for 15 days. LO 6 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-116 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-13B (a) Apr. 2 3 5 9 11 13 16 18 20 21 Purchases .................................................................. Accounts Payable .............................................. 5,800 Freight In .................................................................... Cash .................................................................. 160 Accounts Payable ....................................................... Purchase Returns and Allowances .................... 100 Supplies...................................................................... Cash .................................................................. 1,130 Accounts Payable ($5,800 – $100) ............................ Purchase Discounts ($5,700× 2%) .................... Cash ($5,700 – $114) ........................................ 5,700 Purchases .................................................................. Cash .................................................................. 1,560 Freight In .................................................................... Cash .................................................................. 115 Cash .......................................................................... Purchase Returns and Allowances .................... 110 Accounts Receivable .................................................. Sales ................................................................. 11,100 Sales Returns and Allowances .................................. Accounts Receivable ........................................ 1,000 5,800 160 100 1,130 114 5,586 1,560 115 110 11,100 1,000 Solutions Manual 5-117 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-13B (CONTINUED) (a) (continued) Apr. 23 25 27 28 Equipment ................................................................. Accounts Payable ............................................. 11,700 Accounts Receivable ................................................. Sales ................................................................. 9,800 Cash .......................................................................... Accounts Receivable 9,800 Sales Returns and Allowances .................................. Accounts Receivable ........................................ 150 11,700 9,800 9,800 150 Solutions Manual 5-118 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 5-13B (CONTINUED) (b) Apr. 1 Bal. Apr. 18 Apr. 27 Apr. 30 Bal. Cash 16,400 Apr. 3 110 Apr. 9 9,800 Apr. 11 Apr. 13 Apr. 16 17,759 Accounts Receivable Apr. 20 11,100 Apr. 21 Apr. 25 9,800 Apr. 27 Apr. 28 Apr. 30 Bal. 9,950 160 1,130 5,586 1,560 115 1,000 9,800 150 Inventory Apr. 1 Bal. 16,200 Apr. 30 Bal. 16,200 Apr. 9 Apr. 30 Bal. Apr. 2 Apr. 13 Apr. 30 Bal. Equipment Apr. 23 11,700 Apr. 30 Bal. 11,700 Apr. 5 Apr. 11 20,000 20,000 Retained Earnings Apr. 1 Bal. Apr. 30 Bal. 12,600 12,600 Sales Apr. 20 Apr. 25 Apr. 30 Bal. 11,100 9,800 20,900 Sales Returns and Allowances Apr. 21 1,000 Apr. 28 150 Apr. 30 Bal. 1,150 Supplies 1,130 1,130 Accounts Payable 100 Apr. 2 5,700 Apr. 23 Apr. 30 Bal. Common Shares Apr. 1 Bal. Apr. 30 Bal. 5,800 11,700 11,700 Purchases 5,800 1,560 7,360 Purchase Returns and Allowances Apr. 5 100 Apr. 18 110 Apr. 30 Bal. 210 Solutions Manual 5-119 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-13B (CONTINUED) (b) (continued) Purchase Discounts Apr. 11 Apr. 30 Bal. Apr. 3 Apr. 16 Apr. 30 Bal. 114 114 Freight In 160 115 275 (c) GRAND SLAM TENNIS SHOP Trial Balance April 30, 2018 Cash....................................................................................... Accounts receivable ............................................................... Inventory ................................................................................ Supplies ................................................................................. Equipment .............................................................................. Accounts payable ................................................................... Common shares..................................................................... Retained earnings .................................................................. Sales ...................................................................................... Sales returns and allowances ................................................ Purchases .............................................................................. Purchase returns and allowances .......................................... Purchase discounts ................................................................ Freight in ................................................................................ Debit $ 17,759 9,950 16,200 1,130 11,700 590 Credit $11,700 20,000 12,600 20,900 1,150 7,360 275 $65,524 210 114 00 000 $65,524 (Total debit account balances = Total credit account balances) Solutions Manual 5-120 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-13B (CONTINUED) (d) Apr. 30 Inventory (ending) .................................................... Cost of Goods Sold .................................................. Purchase Returns and Allowances .......................... Purchase Discounts ................................................. Inventory (beginning) .......................................... Purchases ........................................................... Freight In............................................................. 11,571 11,940* 210 114 16,200 7,360 275 *Cost of goods sold = Beginning inventory + Purchases – Purchase discounts – Purchase returns and allowances + Freight in – Ending inventory Cost of goods sold = $16,200 + $7,360 – $114 – $210 + $275 – $11,571 = $11,940 LO 6 BT: AP Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-121 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-14B (a) SEVERN LIMITED Income Statement (Partial) Year Ended June 30, 2018 Sales revenue Sales ............................................................................. $7,800,000 Less: Sales discounts .................................................. 100,000 Net sales ....................................................................... Cost of goods sold Inventory, July 1, 2017 .................................................. $ 520,000 Purchases .................................................. $6,280,000 Less: Purchase returns and allowances .... . 240,000 Net purchases ............................................ .. 6,040,000 Add: Freight in .......................................... 80,000 Cost of goods purchased .............................................. 6,120,000 Cost of goods available for sale .................................... 6,640,000 Inventory, June 30, 2018 .............................................. 600,000 Cost of goods sold ................................................ Gross profit ....................................................................... $7,700,000 6,040,000 $1,660,000 (Beginning inventory + Net purchases + Freight-in = Cost of goods purchased) (b) June 30 Inventory (ending) .................................................... Cost of Goods Sold .................................................. Purchase Returns and Allowances .......................... Inventory (beginning) .......................................... Purchases ........................................................... Freight In............................................................. 600,000 6,040,000 240,000 520,000 6,280,000 80,000 Solutions Manual 5-122 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-14B (CONTINUED) (c) Gross profit margin: $1,660,000 $7,700,000 = 21.6% Severn’s gross profit margin of 21.6% is less than the industry average of 26%. This indicates that Severn is making less gross profit than the industry average on its sales. LO 5,6 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-123 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-15B THE GOODY SHOP LTD. Income Statement Year Ended November 30, 2018 Sales revenue Sales ......................................................................................... Less: Sales discounts .............................................................. Sales returns and allowances ......................................... Net sales ................................................................................... Cost of goods sold Inventory, December 1, 2017 .................................................... Purchases .......................................................... $684,700 Less: Purchase discounts .................................... 16,000 Purchase returns and allowances .............. 3,315 Net purchases ...................................................... 665,385 Add: Freight in ...................................................... 5,060 Cost of goods purchased .......................................................... Cost of goods available for sale ................................................ Inventory, November 30, 2018 .................................................. Cost of goods sold .............................................................. Gross profit ...................................................................................... Operating expenses Administrative expenses ............................................................ Selling expenses....................................................................... Total operating expenses ................................................... Income from operations ................................................................... Other revenues and expenses Interest expense ....................................................................... Income before income tax .............................................................. Income tax expense ....................................................................... Net income ..................................................................................... $989,000 $15,000 10,000 25,000 964,000 $ 34,360 670,445 704,805 37,350 667,455 296,545 $230,100 8,200 238,300 58,245 11,315 46,930 10,000 $ 36,930 (Beginning inventory + Net purchases + Freight-in = Cost of goods purchased) Solutions Manual 5-124 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-15B (CONTINUED) THE GOODY SHOP LTD. Statement of Changes in Equity Year Ended November 30, 2018 Common Shares Balance, December 1, 2017 Issued common shares Net income Dividends declared Balance, November 30, 2018 $ 1,000 25,000 000000 $26,000 Retained Earnings $ 82,800 36,930 (5,000) $114,730 Total Equity $ 83,800 25,000 36,930 (5,000) $140,730 (Ending retained earnings = Beginning retained earnings ± Changes to retained earnings) THE GOODY SHOP LTD. Statement of Financial Position November 30, 2018 Assets Current assets Cash ...................................................................................................... Accounts receivable ............................................................................. Inventory ................................................................................................ Prepaid insurance .................................................................................. Total current assets ...................................................................... Property, plant, and equipment Land.................................................................................. $ 85,000 Buildings ..................................................... $175,000 Less: Accumulated depreciation ................. 61,200 113,800 Equipment .................................................. $57,000 Less: Accumulated depreciation ................. 19,880 ...... 37,120 Total property, plant, and equipment ........................................... Total assets ........................................................................................... $ 8,500 13,770 37,350 4,500 64,120 235,920 $300,040 Solutions Manual 5-125 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 5-15B (CONTINUED) Liabilities and Shareholders’ Equity Current liabilities Accounts payable ............................................................................ Unearned revenue ........................................................................... Salaries payable .............................................................................. Property tax payable ........................................................................ Income tax payable ......................................................................... Current portion of mortgage payable ............................................... Total current liabilities ............................................................ Non-current liabilities Mortgage payable ($106,000 – $5,300) ......................................... Total liabilities ......................................................................... Shareholders’ equity Common shares ........................................................ $ 26,000 Retained earnings ..................................................... 114,730 Total shareholders’ equity ....................................................... Total liabilities and shareholders’ equity .......................................... $ 32,310 3,000 8,500 3,500 6,000 5,300 58,610 100,700 159,310 140,730 $300,040 LO 6 BT: AP Difficulty: M Time: 60 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-126 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley ACR5-1 Financial Accounting, Seventh Canadian Edition ACCOUNTING CYCLE REVIEW (a) Date Account Titles March 1 2 5 6 7 Debit Cash ............................................................... Accounts Receivable .............................. 125,000 Accounts Payable ............................................ Inventory ................................................ Cash ($200,000 – $4,000) ...................... 200,000 Inventory.......................................................... Accounts Payable ................................... 300,000 Cash ............................................................... Sales....................................................... 285,000 Cost of Goods Sold ......................................... Inventory ................................................. 200,000 Accounts Payable ............................................ Inventory ................................................. 25,000 125,000 4,000 196,000 300,000 285,000 200,000 25,000 8 No entry necessary 9 Accounts Receivable ....................................... Sales....................................................... 200,000 Cost of Goods Sold ......................................... Inventory ................................................. 140,000 Freight Out ...................................................... Cash ....................................................... 5,000 9 Credit 200,000 140,000 5,000 Solutions Manual 5-127 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (a) (continued) Date Account Titles March 12 13 14 16 19 20 27 Debit Cash ............................................................... Unearned Revenue ................................ 12,500 Sales Returns and Allowances ........................ Accounts Receivable .............................. 20,000 Inventory .......................................................... Cost of Goods Sold................................. 14,000 Accounts Payable ($300,000 – $25,000)......... Inventory ($275,000 × 2%) ..................... Cash ($300,000 – $25,000 – $5,500) 275,000 Salaries Expense............................................. Cash ....................................................... 45,000 Cash ($200,000 – $20,000 – $3,600) ............. Sales Discounts ($180,000 × 2%) .................. Accounts Receivable ($200,000 – $20,000) ...................... 176,400 3,600 Cash .............................................................. Sales ..................................................... 255,000 Cost of Goods Sold ........................................ Inventory ................................................ 179,000 Salaries Expense............................................ Cash ...................................................... 50,000 Credit 12,500 20,000 14,000 5,500 269,500 45,000 180,000 255,000 179,000 50,000 Solutions Manual 5-128 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (a) (continued) Date Account Titles March 30 31 31 31 31 31 Debit Rent Expense ................................................. Cash ...................................................... 5,000 Utilities Expense ............................................. Accounts Payable .................................. 10,000 Salaries Expense............................................ Salaries Payable.................................... 10,000 Interest Expense............................................. Interest Payable ..................................... 9,000 Depreciation Expense..................................... Accumulated Depreciation—Equipment ($145,000 ÷ 10 years = $14,500) 14,500 Income Tax Expense ...................................... Income Tax Payable .............................. 50,000 Credit 5,000 10,000 10,000 9,000 14,500 50,000 Solutions Manual 5-129 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (b), (d), and (g) CE = Closing entry Cash Feb. 28 Bal. Mar. Supplies 65,000 Feb. 28 Bal. 7,500 Mar. 31 Bal. 7,500 1 125,000 Mar. 2 196,000 6 285,000 9 5,000 12 12,500 14 269,500 19 176,400 16 45,000 Feb. 28 Bal. 5,000 20 255,000 27 50,000 Mar. 31 Bal. 5,000 30 5,000 Prepaid Rent Mar. 31 Bal. 348,400 Equipment Accounts Receivable Feb. 28 Bal. 350,000 Mar. 9 200,000 Mar. 1 125,000 13 20,000 19 180,000 Feb. 28 Bal. 145,000 Mar. 31 Bal. 145,000 Accumulated Depreciation —Equipment Mar. 31 Bal. 225,000 Feb. 28 Bal. 29,000 Mar. 31 14,500 Mar. 31 Bal. 43,500 Accounts Payable Inventory Feb. Feb. 28 Bal. 2,750,000 Mar. 5 13 300,000 Mar. 14,000 Mar. 31 Bal. 2,510,500 Mar. 2 200,000 Mar. 2 4,000 7 25,000 6 200,000 14 275,000 7 25,000 9 140,000 14 5,500 20 179,000 Mar. 28 Bal. 1,550,000 5 300,000 31 10,000 31 Bal. 1,360,000 Salaries Payable Mar. 31 10,000 Mar. 31 Bal. 10,000 Solutions Manual 5-130 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (b), (d), and (g) (continued) Interest Payable Sales Mar. 31 9,000 Feb. 28 Bal. 5,479,400 Mar. 31 Bal. 9,000 Mar. Unearned Revenue Feb. 28 Bal. 35,000 Mar. 12 12,500 Mar. 31 Bal. 47,500 Mar. 31 CE Feb. 28 Bal. 107,000 Mar. 31 Bal. 450,000 Mar. 13 255,000 0 20,000 Mar. 31 Bal. 127,000 Mar. 31 50,000 Mar. 31 Bal. 50,000 Mar. 31 Mar. 31 Bal. Feb. 28 Bal. 200,000 Mar. 31 Bal. 200,000 0 Feb. 28 Bal. Mar. 19 65,000 3,600 68,600 Mar. 31 CE Feb. 28 Bal. 550,500 50,000 Mar. 31 CE 570,900 Mar. 31 Bal. 1,071,400 Mar. 31 50,000 50,000 50,000 Bal. 68,600 0 Cost of Goods Sold Feb. 28 Bal. 3,843,900 Mar. Dividends Declared Mar. 31 CE CE 127,000 Sales Discounts Retained Earnings 0 20 Sales Returns and Allowances 28 Bal. 450,000 Mar. 31 Bal. Mar. 31 Bal. 200,000 Mar. 31 Bal. Common Shares Mar. 31 Bal. 9 6,219,400 Feb. Income Tax Payable Feb. 28 Bal. 285,000 Mar. 31 Bal. 6,219,400 Bank Loan Payable Mar. 31 CE 6 6 200,000 Mar. 9 140,000 20 179,000 13 14,000 Mar. 31 Bal. 4,348,900 Mar. 31 CE 4,348,900 Mar. 31 Bal. 0 Solutions Manual 5-131 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (b), (d), and (g) (continued) Advertising Expense Feb. 28 Bal. 75,000 Mar. 31 Bal. 75,000 Feb. 28 Bal. Bal. 75,000 5,000 Mar. 31 Bal. Mar. 31 CE 60,000 Mar. 31 Bal. Feb. 28 Bal. 180,000 9 Mar. 31 CE Bal. 185,000 0 Depreciation Expense Feb. 28 Bal. 14,500 Mar. 31 Bal. 14,500 Bal. 360,000 Mar. 16 45,000 27 50,000 31 10,000 Mar. 31 Bal. 465,000 Mar. 31 CE 465,000 Mar. 31 Mar. 31 CE Bal. Feb. 28 0 Mar. 31 Mar. 31 0 Salaries Expense 5,000 Mar. 31 Bal. 185,000 Mar. 31 60,000 0 Freight Out Mar. 55,000 Mar. 30 Mar. 31 CE Mar. 31 Rent Expense 14,500 0 Bal. 0 Travel Expense Feb. 28 Bal. 12,500 Mar. 31 Bal. 12,500 Interest Expense Feb. 28 Bal. Mar. 31 27,000 Mar. 31 Bal. 0 Utilities Expense 36,000 Mar. 31 CE Bal. 36,000 Feb. 28 Bal. Mar. 31 0 Mar. 31 20,000 10,000 Bal. 30,000 Office Expense Feb. 28 Bal. 26,000 Mar. 31 Bal. 26,000 Bal. Mar. 31 CE Mar. 31 Mar. 31 CE Mar. 31 12,500 9,000 Mar. 31 Bal. Mar. 31 Mar. 31 CE Bal. 30,000 0 6,000 0 Solutions Manual 5-132 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (b), (d), and (g) (continued) Income Tax Expense Feb. 28 Bal. 150,000 Mar. 31 50,000 Mar. 31 Bal. 200,000 Mar. 31 CE Mar. 31 Bal. 200,000 0 Income Summary Mar. 31 CE 5,648,500 Mar. 31 CE CE Bal. 6,219,400 570,900 0 Solutions Manual 5-133 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (c) HERITAGE FURNITURE LIMITED Trial Balance March 31, 2018 Cash Accounts receivable Inventory Supplies Prepaid rent Equipment Accumulated depreciation—equipment Accounts payable Unearned revenue Bank loan payable—non-current Common shares Retained earnings Dividends declared Sales Sales returns and allowances Sales discounts Advertising expense Cost of goods sold Freight out Office expense Rent expense Salaries expense Travel expense Utilities expense Interest expense Income tax expense Debit $ 348,400 225,000 2,510,500 7,500 5,000 145,000 Credit $ 29,000 1,350,000 47,500 450,000 200,000 550,500 50,000 6,219,400 127,000 68,600 75,000 4,348,900 185,000 26,000 60,000 455,000 12,500 20,000 27,000 150,000 $8,846,400 000000v 0 $8,846,400 (Total debit account balances = Total credit account balances) Solutions Manual 5-134 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (e) HERITAGE FURNITURE LIMITED Adjusted Trial Balance March 31, 2018 Debit Cash $ 348,400 Accounts receivable 225,000 2,510,500 Inventory Supplies 7,500 5,000 Prepaid rent Equipment 145,000 Accumulated depreciation—equipment Accounts payable Salaries payable Interest payable Unearned revenue Bank loan payable Income tax payable Common shares Retained earnings Dividends declared 50,000 Sales Sales returns and allowances 127,000 68,600 Sales discounts Cost of goods sold 4,348,900 Advertising expense 75,000 Freight out 185,000 Depreciation expense 14,500 26,000 Office expense Rent expense 60,000 465,000 Salaries expense Travel expense 12,500 Utilities expense 30,000 Interest expense 36,000 Income tax expense 200,000 $8,939,900 Credit $ 43,500 1,360,000 10,000 9,000 47,500 450,000 50,000 200,000 550,500 6,219,400 000000v 0 $8,939,900 (Total debit account balances = Total credit account balances) Solutions Manual 5-135 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (f) HERITAGE FURNITURE LIMITED Income Statement Year Ended March 31, 2018 Sales revenue Sales Less: Sales returns and allowances Sales discounts Net sales Cost of goods sold Gross profit Operating expenses Salaries expense Freight out Advertising expense Rent expense Utilities expense Office expense Depreciation expense Travel expense Total operating expenses Income from operations Other revenues and expenses Interest expense Income before income tax Income tax expense Net income $6,219,400 $127,000 68,600 195,600 6,023,800 4,348,900 1,674,900 $465,000 185,000 75,000 60,000 30,000 26,000 14,500 12,500 868,000 806,900 36,000 770,900 200,000 $ 570,900 (Revenues – Contra revenues – Cost of goods sold – Operating expenses = Income from operations) (Income from operations + Other revenues – Other expenses = Income before income taxes) Solutions Manual 5-136 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (f) (continued) HERITAGE FURNITURE LIMITED Statement of Changes in Equity Year Ended March 31, 2018 Common Shares Balance, April 1, 2017 Issued common shares Net income Dividends declared Balance, March 31, 2018 $199,000 1,000 00 00000 $200,000 Retained Earnings $ 550,500 570,900 (50,000) $1,071,400 Total Equity $ 749,500 1,000 570,900 (50,000) $1,271,400 (Ending retained earnings = Beginning retained earnings ± Changes to retained earnings) Solutions Manual 5-137 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (f) (continued) HERITAGE FURNITURE LIMITED Statement of Financial Position March 31, 2018 Assets Current assets Cash Accounts receivable Inventory Supplies Prepaid rent Property, plant and equipment Equipment Less: Accumulated depreciation Total assets $ 348,400 225,000 2,510,500 7,500 5,000 $145,000 43,500 $3,096,400 101,500 $3,197,900 Liabilities and Shareholders’ Equity Current liabilities Accounts payable Salaries payable Interest payable Unearned revenue Income tax payable Current portion of bank loan payable Total current liabilities Non-current liabilities* Bank loan payable Total liabilities Shareholders’ equity Common shares Retained earnings Total liabilities and shareholders’ equity *($450,000 - $45,000 current) $1,360,000 10,000 9,000 47,500 50,000 45,000 1,521,500 405,000 1,926,500 $ 200,000 1,071,400 1,271,400 $3,197,900 Solutions Manual 5-138 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (g) Date Account Titles March 31 Debit Sales .............................................................. Income Summary ................................... 6,219,400 31 Income Summary ............................................. Sales Returns and Allowances ................ Sales Discounts ....................................... Advertising Expense ................................ Cost of Goods Sold.................................. Freight out ............................................... Depreciation Expense .............................. Interest Expense ...................................... Office Expense ........................................ Rent Expense .......................................... Salaries Expense ..................................... Travel Expense ........................................ Utilities Expense ...................................... Income Tax Expense ............................... 5,648,500 31 Income Summary ............................................. Retained Earnings .................................. 570,900 31 Retained Earnings ........................................... Dividends Declared.................................. 50,000 Credit 6,219,400 127,000 68,600 75,000 4,348,900 185,000 14,500 36,000 26,000 60,000 465,000 12,500 30,000 200,000 570,900 50,000 Solutions Manual 5-139 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR5-1 (CONTINUED) (h) HERITAGE FURNITURE LIMITED Post-Closing Trial Balance March 31, 2018 Cash Accounts receivable Inventory Supplies Prepaid rent Equipment Accumulated depreciation—equipment Accounts payable Salaries payable Interest payable Unearned revenue Bank loan payable Income tax payable Common shares Retained earnings Debit $ 348,400 225,000 2,510,500 7,500 5,000 145,000 000000000 $3,241,400 Credit $ 43,500 1,360,000 10,000 9,000 47,500 450,000 50,000 200,000 1,071,400 $3,241,400 (Total debit account balances = Total credit account balances) LO 2,3,4 BT: AP Difficulty: M Time: 90 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-140 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT5-1 Financial Accounting, Seventh Canadian Edition FINANCIAL REPORTING CASE (a) The North West Company is a merchandising company because it buys products and resells them to the public. (b) The North West Company classifies its operating expenses by function since captions include titles like “selling, operating and administrative expenses.” (c) Other non-operating expenses reported include interest expense totalling $6,210,000 for the fiscal year ended January 31, 2016. (d) and (e) ($ in thousands) 2016 2015 Gross profit margin $522,614 $1,796,035 = 29.1% $464,218 $1,624,400 = 28.6% Profit margin $69,779 $1,796,035 = 3.9% $62,883 $1,624,400 = 3.9% (f) The company’s profitability has remained relatively constant for the fiscal year ended January 31, 2016, with a slight increase in gross profit margin. With an increase in the gross profit margin and an unchanged profit margin, we can conclude that North West either had increased operating expenses or interest expenses. In fact, it was the result of increased operating expenses. LO 1,4,5 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-141 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT5-2 (a) 1 Percentage 1. . change in sales 2. Gross profit margin Financial Accounting, Seventh Canadian Edition FINANCIAL REPORTING CASE The North West Company (in millions) Sobeys (in millions) ($1,796.0 – $1,624.4) $1,624.4 ($24,618.8 – $23,928.8) $23,928.8 = 10.6% = 2.9% ($1,796.0 – $1,273.4) $1,796.0 (24,618.8 - $18,661.2) $24,618.8 = 29.1% = 24.2% (b) North West had the bigger increase in sales. In fiscal 2015, North West’s gross profit was 28.6% ($464,218 ÷ $1,624,400). North West was able to increase its gross profit margin. We can conclude that North West is doing well managing its purchasing and pricing policies. (c) Sobeys experienced an increase in sales but had a decreased gross margin. Gross margin was $5,962.5 (23,928.8 – 17,966.3) in 2015 and dropped slightly to $5,957.6 (24,618.8 – 18,661.2) in 2016. This could have been caused by mismanagement of inventory, lower selling prices, or purchasing price constraints. LO 5 BT: AN Difficulty: C Time: 30 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-142 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT5-3 Financial Accounting, Seventh Canadian Edition FINANCIAL REPORTING CASE (a) The main difference between these two income statements is that Happy Coffee presents its expense items by function (such as general and administrative expenses) while Country Coffee presents its expenses by nature of the expense item. Under IFRS, Happy Coffee is required to also disclose the total depreciation expense and salaries and benefits expense in the notes to the financial statements. (b) Under IFRS both formats of expense presentation, by nature or by function, are acceptable. ASPE does not have a requirement on how to report expenses. Expenses under ASPE can be classified in any manner that would be useful to the key stakeholders. The method that classifies expenses by function can require a higher degree of judgement since expenses have to be allocated to each of the functional categories (depending on how many functional categories are present). In the case of Happy Coffee, there are three categories—cost of goods sold, selling expenses, and administrative expenses. This method provides better information to the reader despite the requirement for increased judgement. (c) The difference in format could make it difficult to compare expense items. For example, expense items as a percentage of sales would not be comparable. However, Country Coffee can still easily compare the key profitability measures of gross profit margin and profit margin. These profitability ratios are not dependent on the expense classifications. (d) No, comparability of the gross profit margin and profit margin will not be impacted. The definitions of gross profit and net income do not change when preparing the income statements with a different format. Solutions Manual 5-143 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT5-3 (CONTINUED) (e) Country Coffee can change the presentation of its income statement and begin classifying its expenses by function. This would be an acceptable presentation under ASPE. Under IFRS, if a company chooses to report its expenses by function it must still disclose total depreciation and salaries and benefit expense in the note disclosures. Country Coffee could use this additional information from the notes of Happy Coffee for improved comparability. LO 4,5 BT: E Difficulty: C Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 5-144 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT5-4 Financial Accounting, Seventh Canadian Edition ETHICS CASE Note to instructors: All of the material supplementing this group activity, including a suggested solution, can be found in the Collaborative Learning section of the Instructor Resource site accompanying this textbook as well as in the Prepare and Present section of WileyPLUS. (a) The CEO asked for three inappropriate adjustments to be made to the financial statements. By recording a purchase return as an increase in sales revenue, the sales revenue is now overstated and cost of goods sold is also overstated. By recording freight-in relating to inventory that has now been sold as an operating expense, it overstates operating expense while understating cost of goods sold. Finally by recording a sales return as an operating expense, it overstates sales and overstates operating expenses. All of these adjustments were designed to boost gross profit in order to increase the bonus of the CEO. If we reverse the adjustments made, we get: Net sales Cost of goods sold Gross profit Operating expenses Income from operations Income tax expense Net income Gross profit margin: $51,000 ÷ $113,000 Gross profit margin: $40,000 ÷ $100,000 2018 Draft Adjustments 2018 Revised $(7,000) $113,000 (6,000) $100,000 5,000 62,000 (7,000) 60,000 51,000 (11,000) 40,000 (6,000) 21,000 (5,000) 10,000 30,000 0 30,000 9,000 0 9,000 $ 21,000 $ 0 $ 21,000 45.1% 40.0% When we calculate the gross profit margin using the revised amounts, we can see that it has not risen by more than 3% compared to the prior year of 40% ($32,000 ÷ $80,000) and because of this, the CEO will not eligible for his bonus. Solutions Manual 5-145 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT5-4 (CONTINUED) (b) The profit margin in 2018 is 21.0% ($21,000 ÷ $100,000) which is unchanged from the prior year ($16,800 ÷ $80,000). However, in the first draft of the income statement, the profit margin was 18.6% ($21,000 ÷ $113,000), which is lower than the 21.0% determined using the correct amounts. This is because net sales were overstated even though overall profit was not. (c) Harm was done to the users of the financial statements. Assuming no corrections were made, the income statement would have been adjusted for the bonus given to the CEO. Many of the elements except for income tax expense reported in the statement are false and misleading. Users of the financial statements would not have obtained a true reflection of the performance trends of Peshawar Inc. and may have made inappropriate decisions based on misleading financial statements. Furthermore, the CEO would have been awarded a bonus that he did not deserve, thereby taking assets away from the company and its shareholders. LO 2,3,5 BT: E Difficulty: C Time: 40 min. AACSB: Analytic and Ethics CPA: cpa-t001, cpa-e001, cpat005 CM: Reporting, Ethics, and Finance Solutions Manual 5-146 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT5-5 Financial Accounting, Seventh Canadian Edition ETHICS CASE (a) Rita Pelzer, as a new employee, is placed in a position of responsibility and is pressured by her supervisor to continue an unethical practice previously performed by him. The unethical practice is taking unearned cash discounts. Her dilemma is either to follow her boss’s unethical instructions or offend her boss and maybe lose the job she just assumed. (b) The stakeholders (affected parties) are: Rita Pelzer, the assistant controller Jamie Caterino, the controller (he looks good to superiors because of increased income) Zaz Stores Ltd., the company benefited Creditors of Zaz Stores Ltd. (suppliers harmed) Canada Post employees (those blamed harmed) (c) Ethically Rita should not continue the practice started by Jamie. She has several choices in that she could: 1. Tell the controller (her boss) that she will attempt to take every allowable cash discount by preparing and mailing cheques within the discount period—the ethical thing to do. This will offend her boss and may jeopardize her continued employment. 2. Comply with Jamie’s directions and continue the unethical practice of taking unearned cash discounts. Solutions Manual 5-147 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT5-5 (CONTINUED) (c) (continued) 3. Go over her boss’s head and take the chance of receiving just and reasonable treatment from an officer superior to Jamie. The company may not condone this practice. Rita definitely has a choice, but probably not without consequences. To continue the practice is definitely unethical. If Rita submits to this request, she may be asked to perform other unethical tasks. If Rita stands her ground and refuses to participate in this unethical practice, she probably won’t be asked to do other unethical things—if she isn’t fired. Maybe nobody has ever challenged Jamie’s unethical behaviour and his reaction may be one of respect rather than anger and retribution. Being ethically compromised is no way to start a new job. LO 2 BT: C Difficulty: M Time: 30 min. AACSB: Ethics CPA: cpa-t001, cpa-e001 CM: Reporting and Ethics Solutions Manual 5-148 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley CT5-6 (a) June 30 Financial Accounting, Seventh Canadian Edition SERIAL CASE Inventory...................................................................... 1,750 Cost of Goods Sold ............................................ ($18,000 physical count – $16,250 perpetual record = $1,750 overage) 1,750 Note to instructors: June balances were taken from the answer to CT4-6. Solutions Manual 5-149 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT5-6 (CONTINUED) June Bal. Cash 34,534 (Ch. 4) Accounts Receivable June Bal. 12,090 (Ch. 4) Inventory June Bal. 16,250 (Ch. 4) 30 AJE 1,750 June Bal. 18,000 June Bal. Supplies 3,775 (Ch. 4) June Bal. Prepaid Insurance 6,000 (Ch. 4) June 100,000 June 165,000 Land Bal. (Ch. 4) Buildings Bal. (Ch. 4) (Ch. 4) Unearned Revenue June Bal. 1,000 (Ch. 4) Salaries Payable June Bal. 1,000 (Ch. 4) Interest Payable June Bal. 50 (Ch. 4) Income Tax Payable June 30 AJE 5,000 (Ch. 4) Bank Loan Payable June Bal. (Ch. 4) Mortgage Payable June Bal. 53,200 (Ch. 4) Common Shares June Bal. 300 (Ch. 4) 22,500 Retained Earnings June Bal. 146,788 Accumulated Depreciation—Buildings (Ch. 4) June Bal. 143,000 June 44,520 Equipment Bal. (Ch. 4) Accumulated Depreciation—Equipment (Ch. 4) Bal. 21,070 June Bal. Vehicles 52,500 (Ch. 4) Accumulated Depreciation—Vehicles (Ch. 4) June Bal. 4,200 (Ch. 4) Accounts Payable June Bal. 7,265 Solutions Manual 5-150 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT5-6 (CONTINUED) (a) (continued) Dividends Declared June Bal. 30,000 (Ch. 4) (Ch. 4) Rent Revenue June Bal. (Ch. 4) Sales June Bal. 6,000 640,358 Cost of Goods Sold June Bal. 102,386 (Ch. 4) June 30 AJE 1,750 June Bal. 100,636 June Bal. Salaries Expense 391,782 (Ch. 4) June Bal. Depreciation Expense 16,770 (Ch. 4) June Bal. Office Expense 18,000 (Ch. 4) June Bal. Utilities Expense 13,225 (Ch. 4) June Bal. Advertising Expense 9,600 (Ch. 4) Insurance Expense June Bal. 6,000 (Ch. 4) June Bal. Property Tax Expense 5,950 (Ch. 4) June Bal. Interest Expense 5,349 (Ch. 4) June Bal. Income Tax Expense 18,000 Solutions Manual 5-151 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT5-6 (CONTINUED) (b) ANTHONY BUSINESS COMPANY LTD. Adjusted Trial Balance June 30, 2017 Debit Cash .............................................................................. Accounts receivable....................................................... Inventory........................................................................ Supplies......................................................................... Prepaid insurance.......................................................... Land .............................................................................. Buildings ........................................................................ Accumulated depreciation—buildings ............................ Equipment ..................................................................... Accumulated depreciation—equipment ......................... Vehicles ......................................................................... Accumulated depreciation—vehicles ............................. Accounts payable .......................................................... Unearned revenue ......................................................... Salaries payable ............................................................ Interest payable ............................................................. Income tax payable ....................................................... Bank loan payable ......................................................... Mortgage payable .......................................................... Common shares ............................................................ Retained earnings ......................................................... Dividends declared ........................................................ Rent revenue ................................................................. Sales ............................................................................. Cost of goods sold ......................................................... Salaries expense ........................................................... Depreciation expense .................................................... Office expense............................................................... Utilities expense ............................................................ Advertising expense ...................................................... Insurance expense ........................................................ Property tax expense ..................................................... Interest expense ............................................................ Income tax expense....................................................... Totals ..................................................................... $ Credit 34,534 12,090 18,000 3,775 6,000 100,000 165,000 $ 143,000 44,520 21,070 52,500 4,200 7,265 1,000 1,000 50 5,000 22,500 53,200 300 146,788 30,000 6,000 640,358 100,636 391,782 16,770 18,000 13,225 9,600 6,000 5,950 5,349 18,000 $1,051,731 000 0000 $1,051,731 (Total debit account balances = Total credit account balances) Solutions Manual 5-152 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT5-6 (CONTINUED) (c) ANTHONY BUSINESS COMPANY LTD. Income Statement Year Ended June 30, 2017 Sales ............................................................................................................ Cost of goods sold ....................................................................................... Gross profit .................................................................................................. $640,358 100,636 539,722 Operating expenses Salaries expense ............................................................ $391,782 Depreciation expense ...................................................... 16,770 Office expense................................................................. 18,000 Utilities expense .............................................................. 13,225 Advertising expense ........................................................ 9,600 Insurance expense .......................................................... 6,000 Property tax expense ...................................................... 5,950 Total operating expenses ........................................................... Income from operations ................................................................................ 461,327 78,395 Other revenues and expenses Rent revenue ................................................................... $6,000 Interest expense.............................................................. 5,349 Income before income tax ............................................................................. Income tax expense ...................................................................................... Net income ................................................................................................... 651 79,046 18,000 $ 61,046 (Income from operations + Other revenues – Other expenses = Income before income taxes) ANTHONY BUSINESS COMPANY LTD. Statement of Changes in Equity Year Ended June 30, 2017 Common Shares Balance, July 1, 2016 Net income Dividends declared Balance, June 30, 2017 $300 0000 $300 Retained Earnings $146,788 61,046 (30,000) $177,834 Total Equity $147,088 61,046 (30,000) $178,134 Note to instructors: Although ABC would most likely prepare a statement of retained earnings rather than a statement of changes in equity since it has been assumed that it is using ASPE, the statement of retained earnings is not explained in detail until Ch. 11, which is why we chose to require a statement of changes in equity here instead. Solutions Manual 5-153 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT5-6 (CONTINUED) (c) (continued) ANTHONY BUSINESS COMPANY LTD. Statement of Financial Position June 30, 2017 Assets Current assets Cash ................................................................................................................. Accounts receivable ......................................................................................... Inventory ........................................................................................................... Supplies ............................................................................................................ Prepaid insurance ............................................................................................. Total current assets ............................................................................... $34,534 12,090 18,000 3,775 6,000 74,399 Property, plant, and equipment Land ........................................................................ $100,000 Buildings ................................................................. $165,000 Less: Accumulated depreciation.............................. 143,000 22,000 Equipment ............................................................... $44,520 Less: Accumulated depreciation.............................. 21,070 23,450 Vehicles .................................................................. $52,500 Less: Accumulated depreciation.............................. 4,200 48,300 Total property, plant, and equipment ..................................................... Total assets ............................................................................................................... 193,750 $268,149 Liabilities and Shareholders’ Equity Current liabilities Accounts payable .............................................................................................. Unearned revenue ............................................................................................ Salaries payable ............................................................................................... Interest payable ................................................................................................ Income tax payable ........................................................................................... Current portion of bank loan payable................................................................. Current portion of mortgage payable ................................................................. Total current liabilities ............................................................................ $ 7,265 1,000 1,000 50 5,000 7,500 5,000 26,815 Non-current liabilities Bank loan payable ($22,500 – $7,500) ............................................................. Mortgage payable ($53,200 – $5,000) .............................................................. Total liabilities ......................................................................................... 15,000 48,200 90,015 Common shares ............................................................................... $ 300 Retained earnings ............................................................................ . 177,834 Total shareholders’ equity....................................................................... Total liabilities and shareholders’ equity ..................................................................... 178,134 $268,149 Shareholders’ equity Solutions Manual 5-154 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CT5-6 (CONTINUED) (d) ABC Competitor Current ratio $74,399 = 2.8:1 $26,815 2.5:1 Gross profit margin $539,722 = 84.3% $640,358 Profit margin $61,046 = 9.5% $640,358 75% 8% (1) Compared to its competitor, ABC’s ratios are better in every respect. ABC has better liquidity and profitability than its competitor. (2) We must recall that ABC is a small, family company while its competitor is a large, publicly-traded company. They likely have different product lines, cost structures, and other differences affecting its financial results. LO 4,5 BT: AN Difficulty: M Time: 50 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 5-155 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Legal Notice Copyright © 2017 by John Wiley & Sons Canada, Ltd. or related companies. All rights reserved. The data contained in these files are protected by copyright. This manual is furnished under licence and may be used only in accordance with the terms of such licence. The material provided herein may not be downloaded, reproduced, stored in a retrieval system, modified, made available on a network, used to create derivative works, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise without the prior written permission of John Wiley & Sons Canada, Ltd. (MMXVII vi F2) Solutions Manual 5-156 Chapter 5 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition CHAPTER 6 REPORTING AND ANALYZING INVENTORY LEARNING OBJECTIVES 1. 2. Describe the steps in determining inventory quantities. Apply the cost formulas using specific identification, FIFO, and average cost under a perpetual inventory system. 3. Explain the effects on the financial statements of choosing each of the inventory cost formulas. 4. Identify the effects of inventory errors on the financial statements. 5. Demonstrate the presentation and analysis of inventory. 6.* Apply the FIFO and average cost inventory cost formulas under a periodic inventory system (Appendix 6A). Solutions Manual 6-1 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND BLOOM’S TAXONOMY Item LO BT Item LO BT Item LO BT Questions Item LO BT Item LO BT 1. 1 C 6. 2 C 11. 2 C 16. 5 C 21. 2,6 C 2. 1 C 7. 2 K 12. 4 C 17. 5 K 22. 2,6 C 2 C 13. 4 C 18. 5 C 3 C 14. 4 C 19. 2,6 C C 15. C 20. 6 C C 10. 5 AP 13. 6 AP 3. 1 K 8. 4. 1 C 9. 5. 2 C 10. 3 5 Brief Exercises 1. 1 K 4. 2 AN 7. 3 2. 1 AP 5. 2 AN 8. 4 C 11. 5 AP 14. 2,6 AN 3. 2 AP 6. 2 AP 9. 4 AN 12. 5 AN 15. 2,6 AP AN 13. 3,6 AP Exercises 1 C 5. 2 AN 9. 4 2. 1 AN 6. 2,3 AN 10. 5 AP 14. 6 AN 3. 2,3 AN 7. 2,3 AN 11. 5 AN 15. 2,6 AP 4. 2,3 AN 8. 4 AN 12. 3,5 AN 16. 2,6 AP 1. 1 AP 5. 2,3 AN 9. 5 AN 13. 6 AP 2. 2 AP 6. 2,5 AP 10. 5 AP 14. 5,6 AP 3. 2,3 AP 7. 4,5 AN 11. 5 AP 15. 2,6 AN 4. 2,4 AN 8. 4,5 AN 12. 5 AN 16. 2,6 AN 2,3 AN 1. Problems: Set A and B Accounting Cycle Review 1. 2 AN 1. 3 AN 3. 1,2,3,6 E 5. 2,3 AN 2. 5 AN 4. 4,5 E 6. 1,2 E Cases 7. Solutions Manual 6-2 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition Legend: The following abbreviations will appear throughout the solutions manual file. LO Learning objective BT Bloom's Taxonomy K Knowledge C Comprehension AP Application AN Analysis S Synthesis E Evaluation Level of difficulty S Simple M Moderate C Complex Estimated time to prepare in minutes Difficulty: Time: AACSB CPA CM cpa-e001 cpa-e002 cpa-e003 cpa-e004 cpa-e005 cpa-t001 cpa-t002 cpa-t003 cpa-t004 cpa-t005 cpa-t006 Association to Advance Collegiate Schools of Business Communication Communication Ethics Ethics Analytic Analytic Technology Tech. Diversity Diversity Reflective Thinking Reflec. Thinking CPA Canada Competency Ethics Professional and Ethical Behaviour PS and DM Problem-Solving and Decision-Making Comm. Communication Self-Mgt. Self-Management Team & Lead Teamwork and Leadership Reporting Financial Reporting Stat. & Gov. Strategy and Governance Mgt. Accounting Management Accounting Audit Audit and Assurance Finance Finance Tax Taxation Solutions Manual 6-3 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ANSWERS TO QUESTIONS 1. Taking a physical inventory involves actually counting, weighing or measuring each kind of inventory on hand. Retailers, such as hardware stores, generally have thousands of different items to count. This is normally done when the store is closed to minimize errors due to the movement of merchandise. Tom will probably count items and mark the quantity, description, and inventory number on pre-numbered inventory tags (unless the company has more advanced technology that can read bar codes on inventory products – we will assume that they do not). He should only include items in the inventory that are in saleable condition. Ideally, strong internal control should be exerted over the physical inventory count. For example, Tom should not have responsibility for the custody or record-keeping for the inventory. He should also count in teams of two, or there should be a second counter checking the accuracy of the count. Adjustments may also have to be made to the physical inventory count for any goods in transit. For example, inventory purchased FOB shipping point that is still in transit will have to be included in inventory. Inventory that has been shipped by Kikujiro to customers FOB destination and not received by the customer before year-end will also have to be included in the count. Finally, any of Kikujiro’s inventory held by other retailers on consignment will have to be included in the count as well. LO 1 BT: C Difficulty: M Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting 2. In a consignment agreement, the consignor is the business that owns the goods, and the consignee is the business that will sell the goods, without having to purchase and own the goods before they are sold. The consignee will sell the goods for the consignor for a fee or a percentage of the sales price. Only the owner of goods, the consignor, includes the goods in its inventory even though the goods are physically located on the consignee’s premises. LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 3. (a) The goods will be included in Janine Ltd.’s (the seller’s) inventory if the terms of sale are FOB destination. (b) The goods will be included in Fastrak Corporation’s (the buyer’s) inventory if the terms of sale are FOB shipping point. LO 1 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 6-4 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 4. Financial Accounting, Seventh Canadian Edition (a) Include: the inventory items belong to Kingsway as Kingsway is the consignor. (b) Include: the inventory items belong to Kingsway while in transit because the terms are FOB shipping point. (c) Exclude: the customer has purchased the inventory item and legal ownership has passed to the customer. LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 5. (a) The unit cost of an inventory item is needed for the entry to record the cost of goods sold and remove the cost of the items sold from inventory. Because units of the same inventory item are typically purchased at different prices, it is necessary to determine which unit costs to use in the calculation of the cost of the goods sold. (b) When using the perpetual system, an entry to record the cost of goods sold and remove the cost of the items sold from inventory is recorded at the same time as the sales transaction. The information from the perpetual system is updated, using the cost formula adopted by the business. The cost formula is also used in the detailed perpetual records for every increase in inventory caused by purchases, freightin, etc. transactions. On the other hand, since a record is not kept of the individual inventory item transactions under the periodic system, the entry to record the cost of goods sold and remove the cost of the items sold from inventory can only be made at the end of a reporting period, when ending inventory is determined by a physical count. LO 2 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 6-5 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 6. (a) (b) Financial Accounting, Seventh Canadian Edition The specific identification formula tracks the physical flow of individual inventory items, matching the cost of the actual item sold against the revenue from that item. The FIFO inventory cost formula assumes the first inventory purchased is the first inventory sold. The most recent purchases are assumed to remain in ending inventory. The average cost formula assumes that all goods available for sale are indistinguishable or homogeneous. An example of inventory where the specific identification would be appropriate would be for goods that are not ordinarily interchangeable, such as automobiles with unique vehicle identification numbers. Inventory such as groceries could be accounted for using the FIFO cost formula as older items are normally sold first. Inventory such as hardware could be accounted for using an average cost formula. LO 2 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 7. (a) Average cost or FIFO can be used if the goods available for sale are identical. Specific identification cannot be used if the goods are not specifically identifiable. (b) FIFO assumes that the first goods purchased are the first to be sold. (c) Specific identification merchandise. matches the actual physical flow of LO 2 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 8. A new weighted average unit cost must be calculated after each purchase because a new cost amount is added to the “cost pool”. This changes the total dollars in the cost pool and the quantity of units on hand in the cost pool. A sale withdraws units and total dollars from the cost pool at the weighted average cost. This does not affect the weighted average cost of the remaining units. That is, the weighted average cost of the remaining units is unchanged after a sale. LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 6-6 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 9. Financial Accounting, Seventh Canadian Edition A company should consider: • Whether the goods are interchangeable or not, or whether they are produced or segregated for specific projects; • Whether the formula corresponds most closely to the physical flow of goods; • Whether the formula reports inventory on the statement of financial position that is close to the inventory’s most recent cost; and • Whether the formula is used for other inventories with a similar nature and usage. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 10. Average cost produces the better income statement valuation because the cost of goods sold is determined using more recent inventory prices. This better matches current costs with current revenues. FIFO produces the better valuation on the statement of financial position because the ending inventory is determined using the most recent prices. Since the normal intent is to replace the inventory after it is sold, the most recent prices are more relevant for decision-making. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 6-7 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 11. Financial Accounting, Seventh Canadian Edition (a) No effect – cash is not affected by the choice of inventory cost formulas. (b) In a period of declining prices, FIFO will produce a lower ending inventory as inventory is determined using the most recent (lower) prices. Average cost will produce a higher ending inventory as ending inventory incorporates the higher older prices. (c) The cost of goods sold effect is opposite to that of ending inventory. Hence, cost of goods sold will be higher under FIFO and lower under the average cost formula. (d) Because of the effect on the cost of goods sold as outlined in (c), net income will be lower under FIFO and higher under average cost. (e) The impact on retained earnings will be the same as the impact on net income and ending inventory—lower in a period of declining prices using FIFO and higher using average cost. LO 2 BT: C Difficulty: C Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 12. The error should be corrected if it will change the figures presented on the financial statements. While retained earnings may not change, other financial statement items and comparative figures may change. This information may impact a user’s decision. LO 4 BT: C Difficulty: C Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 6-8 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 13. (a) (b) (c) (d) (e) (f) Financial Accounting, Seventh Canadian Edition Mila Ltd.’s 2018 income before tax will be understated by $43,000. This is because an understatement of ending inventory will result in an overstatement of cost of goods sold. If cost of goods sold is overstated, then income before tax will be understated. 2018 retained earnings will be understated by $43,000 because net income is understated (see (1) above). 2018 total shareholders’ equity will be understated by $43,000 because the retained earnings balance is understated (see (b) above). 2019 net income will be overstated $43,000. This is because beginning inventory is understated by $43,000, which will result in an understatement of cost of goods sold (recognizing that 2018 ending inventory is 2019 beginning inventory). If cost of goods sold is understated, then income before tax will be overstated. 2019 retained earnings will be correct because the understatement in net income in 2018 and overstatement in 2019 will cancel each other. 2019 total shareholders’ equity will be correct because the retained earnings balance is correct. LO 4 BT: C Difficulty: C Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-9 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 14. Financial Accounting, Seventh Canadian Edition (a) At the end of the fiscal year, before the inventory is adjusted to the inventory count, Shediac’s assets (Inventory) would be overstated and its liabilities would be overstated (Accounts Payable). There would be no effect on shareholders’ equity. (b) Since the merchandise is not on hand at the time of the inventory count, the shipment from Bathurst would not be counted. This in turn would cause the inventory count to be lower than the perpetual inventory record. Normally when such a discrepancy arises, the Inventory account will be adjusted downward with a credit to reflect the amount of merchandise actually on hand. The corresponding debit in this adjusting entry would be to Cost of Goods Sold. The summary effect of the initial error and the count adjustment would be an overstatement in Cost of Goods Sold and Accounts Payable. Because Cost of Goods Sold is overstated, gross profit and net income are understated as well as Retained Earnings. At the end of Shediac’s current year, after the adjustment is made for the results of the inventory count, the overall impact on the accounting equation is no effect on assets, an overstatement of liabilities (Accounts Payable), and an understatement of shareholders’ equity (Retained Earnings). LO 4 BT: C Difficulty: C Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting 15. (a) Cost refers to the original cost of inventory as determined by using specific identification, FIFO, or average cost formulas. Net realizable value is the selling price less any costs required to make the goods ready for sale. (b) The lower of cost and net realizable value rule should be applied at the end of the accounting period, before financial statements are prepared. LO 5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 6-10 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley 16. Financial Accounting, Seventh Canadian Edition (a) Cost of Goods Sold is debited when recording a decline in inventory value under the lower of cost and net realizable value rule and the asset account Inventory is credited. (b) These declines are usually considered part of the risk associated with carrying inventory and part of the costs of carrying a variety and quantity of goods on hand. Since the inventory has specifically been purchased for resale, the net realizable value becomes the most relevant measure of the asset on the statement of financial position. LO 5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 17. An increase in the days in inventory ratio from one year to the next would be seen as a deterioration in the company’s efficiency in managing inventory. It means that the inventory is being held for a longer period of time, which increases the risk of spoilage and obsolescence. LO 5 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 cpa-t005 CM: Reporting 18. (a) An inventory turnover ratio that is too high may indicate that the company is losing sales opportunities because of inventory shortages. Inventory shortages may also cause customer ill will and result in lost future sales. (b) If the inventory turnover is too low, it may indicate that the company is having difficulty selling its inventory, and the inventory may become obsolete. LO 5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 and cpa-t005. CM: Reporting and Finance Solutions Manual 6-11 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley *19. Financial Accounting, Seventh Canadian Edition Periodic and perpetual inventory systems differ in the accounting treatment for inventories. Under a perpetual inventory system, inventory records are updated for every purchase and sale transaction. The cost of goods sold is recorded each time a sale is made. Under a periodic system, the inventory is only updated at the end of the period when a physical inventory count is performed. Inventory purchases throughout the year are debited to a Purchases account in a periodic inventory system rather than an Inventory account. When a sale is recorded in a periodic inventory system, no entry is made to record the cost of the sale. Cost of goods sold is calculated separately, after the physical inventory count is performed. LO 2,6 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting *20. Ending inventory is known from the physical inventory count. The total amount of inventory available for sale needs to be determined first in order to determine what inventory has been sold (goods available for sale – ending inventory = cost of goods sold). Goods sold are not tracked separately in a periodic inventory system. LO 6 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting *21. In both systems, the first (oldest) costs are the costs assigned to the goods sold. No matter what system is used, the cost of goods sold will always consist of the oldest units and these units are assumed to be on hand when using either formula. LO 2,6 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting *22. In a perpetual system, the average cost per item is recalculated every time a purchase transaction takes place. In a periodic system, the average cost is determined based on the total goods available for sale during the period. If there are cost changes during the period, the average cost per item will differ in a perpetual and periodic inventory system. LO 2,6 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 6-12 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 6-1 (a) Ownership of the goods belongs to the consignor (Helgeson). Thus, these goods should be included in Helgeson’s inventory. (b) Goods held on consignment belong to the other company and should not be included in Helgeson’s inventory. (c) The goods in transit belong to Helgeson because ownership does not transfer until the customer receives the goods. They should be included in Helgeson’s inventory. (d) The goods purchased belong to the buyer, Helgeson as the terms of shipment are FOB shipping point. Title transferred to Helgeson as soon as the goods were shipped, so even though they have not been received, they should be included in Helgeson’s inventory. (e) The goods in transit belong to the customer as the terms of shipment are FOB shipping point. They should not be included in Helgeson’s inventory because title transferred to the customer as soon as the goods were shipped. (f) The goods in transit should not be included in the inventory count because ownership by Helgeson does not occur until the goods reach the buyer. (Legal title determines if an item should be included in inventory) LO 1 BT: K Difficulty: S Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 6-13 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 6-2 $95,000 (7,500) (1,000) 5,000 Count Held on consignment Sold August 28 shipment plus freight, FOB shipping point ($4,750 + $250) $91,500 Correct inventory cost LO 1 BT: AP Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 6-3 (a) Cost of Goods Available for Sale 3 electric pianos @ $600 = $1,800 2 electric pianos @ $475 = 950 $2,750 Ending Inventory (a) Specific Identification (b) 2 pianos @ $600 = 1 piano @ $475 = $1,200 475 $1,675 Cost of Goods Sold $2,750 – $1,675 = $1,075 (Proof: 1 piano @ $600 + 1 piano @ $475 = $1,075) If management wished higher net income, it could have sold two pianos from the last shipment, that had a lower cost. If it wished lower net income, it could have sold two of the first pianos purchased. LO 2 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-14 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 6-4 [1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] $450 30 = $15 15 (from April 1) $18 (from April 1) 30 (from April 6) $15 (from April 6) (15 @ $18) + (30 @ $15) = $720 $18 (from April 1) $15 (from April 6) (15 @ $18) + (10 @ $15) = $420 15 + 30 – 15 – 10 = 20 $15 20 @ $15 = $300 $144 ÷ 12 = $12 20 $15 12 $12 (20 @ $15) + (12 @ $12) = $444 LO 2 BT: AN Difficulty: C Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-15 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 6-5 [1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] $200 ($6,000 30) 45 (15 + 30) $8,700 ($2,700 + $6,000) $193.3333 ($8,700 (from [3]) ÷ 45 (from [2])) $193.33 (from [4]) 25 x $193.3333 = $4,833.33 45 (from [2]) – 25 sold = 20 $8,700.00 (from [3]) – $4,833.33 (from [6]) = $3,866.67 $3,866.67 (from [8]) 20 (from [7]) = $193.3333 rounded to equal [4]. Notice how the average cost does not change after a sale. $2,460 $205 = 12 20 (from [7]) + 12 (from [10]) = 32 $3,866.67 (from [8]) + $2,460.00 = $6,326.67 $6,326.67 (from [12]) 32 (from [11]) = $197.708 rounded to $197.71 LO 2 BT: AN Difficulty: C Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-16 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 6-6 (a) FIFO cost formula Date Description Purchases Purchase 250 $ 70 Purchase 500 Cost of Goods Sold Ending Inventory $ 17,500 250 $ 70 $ 17,500 50,000 250 500 70 100 17,500 50,000 450 450 900 100 100 120 45,000 45,500 108,000 100 120 12,500 108,000 Aug. 2 3 100 10 Sale 15 Purchase 900 120 $70 100 $22,500 325 100 32,500 125 900 $55,000 1,025 108,000 25 Sale 1,650 250 50 $175,500 625 $120,500 Check: $55,000 + $120,500 = $175,500 (b) Date Average cost formula Description Aug. 2 Purchase 3 Purchase Purchases 250 $ 70.00 $17,500.00 500 100.00 300 $90.00 $27,000.00 900 120.00 108,000.00 25 Sale Ending Inventory 250 50,000.00 10 Sale 15 Purchase Cost of Goods Sold 750 90.00 67,500.00 450 90.00 040,500.00 1,350 325 110.00 35,750.00 1,025 1,650 $175,500.00 625 $ 70.00 $ 17,500.00 $62,750.00 1,025 110.00 5148,500.00 110.00 112,750.00 $112,750.00 Check: $62,750 + $112,750 = $175,500 LO 2 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-17 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 6-7 (a) Average cost. The ending inventory is valued at the average of the cost of the product, including earlier costs. Since this cost formula yields a higher ending inventory than FIFO when prices are falling, the result will not be closer to replacement cost. This result is achieved with the FIFO cost formula. (b) FIFO. The cost of goods is valued using the earlier, higher costs. Since the revenue reflects current lower prices, the FIFO cost formula does not match current costs against revenue when prices are falling. This result is better achieved by the average cost formula. (c) One of the guidelines that management should consider is choosing an inventory cost formula that corresponds as closely to the physical flow of goods as possible. A cost formula that provides an ending inventory cost close to the inventory’s recent cost is also preferable. LO 3 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 6-8 Total assets in the statement of financial position will be overstated by the amount that ending inventory is overstated, $25,000. When the purchase of inventory was recorded, an account payable would have been created, so total liabilities will also be overstated by $25,000 (assuming the “supplier” was not paid). Shareholders’ equity will not be affected. LO 4 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 6-18 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 6-9 When items are not counted, an adjustment would be made to lower the balance in the Inventory account to reflect the difference between the amount counted (which is lower) and the amount recorded in the account. This would be done by crediting Inventory. The offsetting debit would be to Cost of Goods Sold, thereby overstating this account and reducing net income. In the following year, assuming these goods are sold, their cost is zero so cost of goods sold would be understated and net income overstated. Assuming there are no errors when counting inventory at the end of next year, this net income overstatement when combined with the previous year’s net income understatement, would cancel each other out and make retained earnings correctly stated at the end of next year. These effects are summarized below. Assets Liabilities Shareholders’ equity Current Year Understated $7,000 No impact Understated $7,000 Next Year No impact No impact No impact LO 4 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-19 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 6-10 (a) Inventory Categories Desktops Tablets and readers Laptops Accessories and parts Total valuation Cost $347,000 168,700 221,020 97,400 $834,120 NRV $326,000 224,000 285,000 94,300 $929,300 LCNRV $326,000 168,700 221,020 94,300 $810,020 The lower of cost and net realizable value is $810,020. (b) Cost of Goods Sold ........................................................... 24,100 Inventory ................................................................ $834,120 – $810,020 = $24,100 24,100 LO 5 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting BRIEF EXERCISE 6-11 (a) Cost of Goods Sold ........................................................ 2,200 Inventory .................................................................. $54,700 – $52,500 = $2,200 2,200 (b) $54,700 LO 5 BT: AP Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-20 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition BRIEF EXERCISE 6-12 (a) Inventory Turnover (2015) Days in Inventory (2015) Inventory Turnover (2014) $7,747.1 = 4.6 times ($1,764.5 + $1,623.8) ÷ 2 365 = 79 days 4.6 $8,033.2 = 5.2 times ($1,623.8 + $1,481.0) ÷ 2 365 Days in Inventory (2014) 5.2 = 70 days (b) The inventory management deteriorated in 2015 as evidenced by the increase in number of days in inventory from 70 days in 2014 to 79 days in 2015. This was corroborated by the declining inventory turnover. This deterioration signifies that it took longer to sell the inventory in 2015. LO 5 BT: AN Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 cpa-t005 CM: Reporting and Finance Solutions Manual 6-21 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *BRIEF EXERCISE 6-13 Beginning inventory Purchases (370 @ $9) + (700 @ $12) + (800 @ $11) Goods available for sale Ending inventory Goods sold (a) Units 0 Dollars $ 0 1,870 1,870 (600) 1,270 20,530 $20,530 FIFO Ending inventory: (600 units @ $11) = $6,600 Cost of goods sold = Goods available for sale – ending inventory $20,530 – $6,600 = $ 13,930 Proof: Cost of goods sold = (370 × $9) + (700 × $12) + (200 x $11) = $ 13,930 (b) Average cost Note: Unrounded numbers have been used in the average cost calculations, although the numbers have been rounded to the nearest cent for presentation purposes. Because of this, some amounts may not appear to multiply exactly because of the rounding in the presentation. Weighted average cost = $20,530 ÷ 1,870 = $10.98 Ending inventory: 600 × $10.98 = $ 6,587.17 Cost of goods sold = Goods available for sale – ending inventory $20,530 – $ 6,587.17 = $ 13,942.83 Proof: Cost of goods sold = 1,270 × ($20,530 ÷ 1,870) = $ 13,942.83 LO 6 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-22 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *BRIEF EXERCISE 6-14 (a) Ending Inventory: (1,300 × $45.00) + (200 × $50.00) = $68,500 Cost of goods sold = Goods available for sale – ending inventory $216,000 – $68,500 = $147,500 Proof: Cost of goods sold = (1,500 × $45.00) + (1,600 × $50.00) = $147,500 (b) No, the answer under a perpetual system would be the same, since the first goods purchased are assumed to be the first goods sold. LO 2,6 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-23 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *BRIEF EXERCISE 6-15 (a) Jan. FIFO Perpetual 3 3 9 15 15 Accounts Receivable ............................................ Sales (700 × $12)......................................... 8,400 Cost of Goods Sold (700 × $5) ............................. Inventory ...................................................... 3,500 Inventory (1,000 × $6) .......................................... Accounts Payable ........................................ 6,000 Cash ..................................................................... Sales (800 x $11) ......................................... 8,800 Cost of Goods Sold [(200 × $5) + (600 × $6)] ...... Inventory ...................................................... 4,600 8,400 3,500 6,000 8,800 4,600 (b) FIFO Periodic Jan. 3 9 15 Accounts Receivable ............................................. Sales ............................................................ 8,400 Purchases ............................................................. Accounts Payable ......................................... 6,000 Cash ...................................................................... Sales ............................................................. 8,800 8,400 6,000 8,800 LO 2,6 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-24 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO EXERCISES EXERCISE 6-1 1. Do not include – Shippers Ltd. does not own items held on consignment. These goods will be recorded in the owner’s inventory. 2. Include in inventory – Shipping terms FOB destination means that Shippers Ltd. owns the items until they reach the customer. 3. Include in inventory – Shippers Ltd. still owns the items as they were only shipped on consignment. 4. Do not include in inventory. Freight costs on goods shipped to customers are included in Freight Out or Delivery Expense. 5. Do not include in inventory – The shipping terms are FOB destination point so ownership has not transferred to the buyer. Shippers Ltd. should not record anything until the goods arrive. 6. Include in inventory – Shipping terms FOB shipping point means that ownership transferred at the time of shipping and therefore, Shippers Ltd. owns the goods in transit. 7. Do not include in inventory. The shipping terms are FOB shipping point, so Shippers Ltd. no longer owns the goods. They will be part of cost of sales on the income statement. (Legal title determines if an item should be included in inventory.) LO 1 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting Solutions Manual 6-25 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-2 (a) Ending inventoryphysical count ............................................................ 1. Add to inventory. Title remains with Novotna until purchaser receives goods ..................................................................................... 2. Add to inventory. Title passed to Novotna when goods were shipped . 3. Add to inventory. Title passed to Novotna when goods were shipped . 4. No effect. Title passes to purchaser upon shipment when terms are FOB shipping point .............................................................................. 5. Add to inventory. Novotna owns the goods out on consignment ......... 6. Deduct from inventory. Obsolete inventory should be written off to cost of goods sold. ............................................................................... Correct inventory ...................................................................................... $285,000 35,000 95,000 28,000 0 30,500 (15,000) $458,500 (Legal title determines if an item should be included in inventory) (b) Since inventory is usually the largest current asset on a company’s statement of financial position, errors can have a significant impact. In deciding to grant a short-term bank loan, the bank will be looking at Novotna’s liquidity by calculating the current ratio as well as the inventory turnover and days sales in inventory. Any error in the inventory count will affect these ratios. In addition, the errors will also affect Novotna’s profitability by impacting the cost of goods sold on the income statement. LO 1 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-26 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-3 (a) The company would identify, by serial number, the items remaining in inventory. The sum of the cost of the items remaining in inventory would become the ending inventory balance. Then, the company would identify the cost of the items sold, again by using serial numbers to determine the cost of each item sold. The total cost of items sold would become the cost of goods sold. (b) It could choose to sell specific units purchased at specific costs if it wished to impact net income selectively. If it wished to minimize net income it would choose to sell the units purchased at higher costs–in which case the cost of goods sold would be $4,300 ($2,400 + $1,900) and gross profit would be $900 [($2,600 x 2) – $4,300]. If it wished to maximize net income it would choose to sell the units purchased at lower costs; in which case the cost of goods sold would be $3,580 ($1,900 + $1,680) and gross profit would be $1,620 [($2,600 x 2) – $3,580]. (c) Discount Electronics should consider the nature of the inventory items. The specific identification system is best suited to inventory items are clearly identified from each other and that are not ordinarily interchangeable, or to products that are produced and segregated for specific projects. The specific identification system produces the most accurate measure of ending inventory and matching of cost of goods sold to sales. It is however more time-consuming and expensive to apply. If the inventory items are interchangeable, Discount Electronics would not be able to use specific identification and would have to use either the FIFO or average cost flow formulas. LO 2,3 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-27 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-4 (a) Date Description Purchases Cost of Goods Sold Apr. 1 Beg. inventory 50 $210 100 225 $33,000 50 $210 25 225 $ 16,125 3 Sale 10 Purchase 75 75 200 225 225 275 16,875 25 25 300 275 275 290 6,875 93,875 57,625 125 290 36,250 200 $275 $ 55,000 17 Sale 24 Purchase 300 290 500 75 175 225 275 25 175 275 290 65,000 87,000 30 Sale 30 Balance Ending Inventory $142,000 525 $138,750 125 71,875 290 $36,250 Check: $138,750 + $36,250 = $175,000 ($33,000 + $142,000) (b) Sales Apr. 3 Units 75 Sales Price/Unit $400 Total $ 30,000 17 250 400 100,000 30 200 400 80,000 $210,000 Gross profit = $210,000 – $138,750 = $71,250 Gross profit margin = $71,250 $210,000 = 33.9% Solutions Manual 6-28 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-4 (CONTINUED) (c) The gross profit is higher than if the average cost formula had been used in a perpetual inventory system because cost of goods sold is lower under FIFO in a period of rising prices than it would be using the average cost formula. Under FIFO, ending inventory is higher, cost of goods sold is lower and gross profit is higher. LO 2,3 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-29 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-5 (a) Note: Unrounded numbers have been used in the average cost calculations, although the numbers have been rounded to the nearest cent for presentation purposes. Because of this, some amounts may not appear to multiply exactly because of the rounding in the presentation. Description Date Purchases Cost of Goods Sold June 1 Beginning Ending Inventory 500 $125.00 $ 62,500.00 Purchase 6 1,200 $127.00 $152,400.00 10 Sale 1,000 $126.41 $126,411.76 1,700 126.41 214,900.00 700 126.41 88,488.24 2,500 127.56 318,888.24 900 127.56 114,799.77 1,900 128.31 243,799.77 Purchase 14 1,800 128.00 ‘230,400.00 16 Sale 26 Purchase 1,600 1,000 129.00 127.56 204,088.47 129,000.00 Balance 30 4,000 $511,800.00 2,600 $330,500.23 1,900 $243,799.77 Check: $330,500.23 + $243,799.77 = $574,300 ($62,500 + $511,800) (b) Sales = (1,000 @ $200) + (1,600 @ $205) = $528,000 Gross profit = $528,000 – $330,500 = $197,500 Gross profit margin = $197,500 $528,000 = 37.4% (c) The gross profit is lower than it would be using the FIFO cost formula because the cost of the product being purchased is rising. LO 2 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-30 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-6 (a) (1) FIFO Date Purchases Cost of Goods Sold June 1 Beginning inventory 12 2,300 @ $6 = $13,800 15 16 23 27 Total Balance 1,500 @ $5 = $ 7,500 1,500 @ $5 2,300 @ $6 = 21,300 1,500 @ $5 1,000 @ $6 = $13,500 1,300 @ $6 = 7,800 4,500 @ $7 = 31,500 1,300 @ $6 4,500 @ $7 = 39,300 1,500 @ $8 = 12,000 1,300 @ $6 4,500 @ $7 1,500 @ $8 = 51,300 1,300 @ $6 100 @ $7 4,400 @ $7 = 38,600 1,500 @ $8 = 12,700 $57,300 $52,100 $12,700 Check: $52,100 + $12,700 = $64,800 ($7,500 + $57,300) (a) (2) Average cost Note: Unrounded numbers have been used in the average cost calculations, although the numbers have been rounded to the nearest cent for presentation purposes. Because of this, some amounts may not appear to multiply exactly because of the rounding in the presentation. Date June 1 12 15 16 23 27 Total Purchases Beginning inventory 2,300 @ $6 = $13,800.00 Cost of Goods Sold 2,500 @ $5.61 = $14,013.16 4,500 @ $7 = 31,500.00 1,500 @ $8 = 12,000.00 $57,300.00 5,700 @ $6.96 = 39,655.48 $53,668.64 Balance 1,500 @ $5.00 = $ 7,500.00 3,800 @ $5.61 = 21,300.00 1,300 @ $5.61 = 7,286.84 5,800 @ $6.69 = 38,786.84 7,300 @ $6.96 = 50,786.84 1,600 @ $6.96 = 11,131.36 $11,131.36 Check: $53,668.64 + $11,131.36 = $64,800 ($7,500 + $57,300) (b) The average cost formula results in a higher cost of goods sold because the cost of inventory is rising. Solutions Manual 6-31 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-6 (CONTINUED) (c) The FIFO cost formula results in a higher net income because it produces the lower cost of goods sold when prices are rising, as the lower costs from earlier units are assigned to cost of goods sold, while the higher costs are assigned to ending inventory. (d) The FIFO cost formula results in a higher ending inventory because the cost of inventory is rising and these higher unit prices are used to determine ending inventory. (e) Both cost formulas result in the same pre-tax cash flow. The cost formulas do not change the pre-tax cash flows of a company. LO 2,3 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-32 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-7 (a) Date Oct. 2 15 FIFO cost formula Units 9,000 15,000 Purchases Cost Total $12 $108,000 14 210,000 29 Cost of Goods Sold Units Cost Total 9,000 13,000 (b) Date Oct. 2 15 29 $12 14 $290,000 Units 9,000 9,000 15,000 2,000 Balance Cost Total $12 $108,000 12 14 318,000 14 28,000 Average cost formula Units 9,000 15,000 Purchases Cost Total $12 $108,000 14 210,000 Cost of Goods Sold Units Cost Total 22,000 $13.25 $291,500 Units 9,000 24,000 2,000 Balance Cost Total $12.00 $108,000 13.25 318,000 13.25 26,500 (c) Sales Cost of goods sold (from above) Gross profit Operating expenses Income before income tax Income tax expense (30%) Net income FIFO $525,000 290,000 235,000 200,000 35,000 10,500 $ 24,500 Average Cost $525,000 291,500 233,500 200,000 33,500 10,050 $ 23,450 Solutions Manual 6-33 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-7 (CONTINUED) (d) (1) Currently, as shown in (a) above, FIFO results in a higher net income than the average cost formula. This is anticipated when costs are rising, as is the case above. If instead costs fall, the use of the FIFO cost formula will result in a lower net income compared to the average cost formula. The cost of goods sold will then be composed of higher costs than the average cost formula and this will generate lower net incomes. (2) If costs remain stable, the two cost formulas will produce the same net incomes. LO 2,3 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-34 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-8 (a) Corrected inventory 2017 = $30,000 + $4,000 = $34,000 2018 = $37,000 – $2,000 = $35,000 Corrected cost of goods sold 2017 = $154,000 – $4,000 = $150,000 2018 = $168,000 + $2,000 + $4,000 = $174,000 (b) (1) and (2) Cost of goods sold and income before income tax: The inventory error for 2017 will cause the cost of goods sold to be overstated by $4,000, which will cause net income and retained earnings to be understated by the same amount. Assuming the error was not corrected, when it reverses in 2018, cost of goods sold will be understated and net income will be overstated by $4,000. Over the two years the error will reverse and therefore the retained earnings balance will be correct at the end of 2018 (with respect to this particular error, taken alone). The $2,000 overstatement of inventory in 2018 will cause the cost of goods sold to be understated and the net income and retained earnings to be overstated by $2,000. When the two errors are taken together, in 2018 cost of goods sold will be understated by $6,000 ($4,000 for 2017 error and $2,000 for 2018 error). Net income will be overstated by $6,000 in 2018. (3) The inventory error for 2017 will cause the inventory—an asset account—to be understated by $4,000. The inventory error for 2018 will cause the inventory (asset) account to be overstated by $2,000. Solutions Manual 6-35 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-8 (CONTINUED) (b) (continued) (4) The errors will not affect liabilities. (5) As explained above in (1) and (2), retained earnings is understated by $4,000 in 2017. In 2018, retained earnings is overstated by $2,000. Because of this, shareholders’ equity will be understated by $4,000 in 2014 and overstated by $2,000 in 2018. 2017 2018 (c) A U$4,000 O$2,000 = = = L NE NE + + + SE U$4,000 O$2,000 Errors should be corrected as soon as they are discovered so that users have a more accurate account of inventory on hand, gross profit and net income. LO 4 BT: AN Difficulty: C Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-36 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-9 (a) Sales ........................................................................... Cost of goods sold (see 1 and 2) ................................ Gross profit .............................................................. 2018 $265,000 213,000 $ 52,000 2017 $250,000 186,000 $ 64,000 (1) $194,000 – $8,000 = $186,000 (2) $205,000 + $8,000 = $213,000 (b) The cumulative effect on total gross profit for the two years is zero as shown below: Incorrect gross profits: Correct gross profits: Difference (c) Gross profit margin $56,000 + $60,000 = $64,000 + $52,000 = 2018 $116,000 116,000 $ 0 2017 Before correction $60,000 ÷ $265,000 = 22.6% $56,000 ÷ $250,000 = 22.4% After correction $52,000 ÷ $265,000 = 19.6% $64,000 ÷ $250,000 = 25.6% LO 4 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-37 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-10 Units Cost/Unit Cameras: Sony Canon Light Meters: Gossen Sekonic Total (b) Dec. 31 (c) Dec. 31 Total Cost NRV/Unit Total NRV (a) LCNRV 4 8 $175 150 $ 700 1,200 $160 152 $ 640 1,216 $ 640 1,200 12 10 135 115 1,620 1,150 $4,670 139 110 1,668 1,100 $4,624 1,620 1,100 $4,560 Cost of Goods Sold ($4,670 – $4,560) ............................... Inventory .................................................................... 110 Cost of Goods Sold (2 $150) ........................................... Inventory .................................................................... 300 110 300 LO 5 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-38 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-11 (a) Inventory Turnover (2016): $2,229,130 = 2.7 times ($851,033 + $779,407)÷2 Days in Inventory (2016): 365 = 135 days 2.7 Gross Profit Margin (2016): ($2,959,238 - $2,229,130) = 24.7% $2,959,238 Inventory Turnover (2015): $1,701,311 = 2.5 times (779,407 + $595,794)÷2 Days in Inventory (2015): 365 = 146 days 2.5 Gross Profit Margin (2015): ($2,359,994 - $1,701,311) = 27.9% $2,359,994 (b) In 2016, Gildan Activewear experienced an improvement in liquidity but a deterioration in profitability. The liquidity has been improved due to the decrease in time required to turn over its inventory, from 146 days to 135 days. The company has experienced deteriorated profitability due to a significant drop in its gross profit margin from 27.9% to 24.7%. LO 5 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 cpa-t005 CM: Reporting and Finance Solutions Manual 6-39 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-12 (a) Inventory turnover (FIFO) $750,000 = 3.4 times $222,500 Inventory turnover (Average Cost) $735,000 = 3.2 times $227,500 (b) Current ratio (FIFO) ($450,000 + $222,500) = 1.9 times $350,000 Current ratio (Average Cost) ($450,000 + $227,500) = 1.9 times $350,000 (c) The FIFO cost formula appears to show a slightly better turnover ratio because it has a lower ending inventory. The current ratios are the same. The two cost formulas will generally yield the same overall assessment of liquidity when combining the inventory turnover ratio and the current ratio. The trend analysis for the inventory turnover and the current ratio produced by either formula will be the same since the formulas involve allocating the same costs. In reality, there is no economic difference between the two formulas and any differences in ratios are artificial ones caused solely by the different cost formulas. Consequently, there is no real difference in liquidity. LO 3,5 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005. CM: Reporting and Finance Solutions Manual 6-40 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *EXERCISE 6-13 (a),(b)(1) FIFO Beginning inventory ($2,000 ×$20) ........................................ Purchases Oct. 9 (5,000 × $21) ..................................................... $105,000 Oct. 12 (4,000 × $20.50) .............................................. 82,000 Oct. 25 (4,000 × $20.80) .............................................. 83,200 Cost of goods available for sale (15,000 units) ....................... Less: Ending inventory (4,000 × $20.80) ............................... Cost of goods sold (11,000 units) ........................................... $ 40,000 270,200 310,200 83,200 $ 227,000 (a),(b)(2) Average cost Beginning inventory ($2,000 ×$20) ........................................ Purchases Oct. 9 (5,000 × $21) ..................................................... $105,000 Oct. 12 (4,000 × $20.50) .............................................. 82,000 Oct. 25 (4,000 × $20.80) .............................................. 83,200 Cost of goods available for sale (15,000 units) ....................... Less: Ending inventory (4,000 × $20.68*) .............................. Cost of goods sold (11,000 units) ........................................... $ 40,000 270,200 310,200 82,720 $ 227,480 *$310,200 ÷ 15,000 units = $20.68/unit (c) FIFO would result in a slightly higher gross profit, since its cost of goods sold is lower. LO 3,6 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-41 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley *EXERCISE Financial Accounting, Seventh Canadian Edition 6-14 (a) (1) FIFO Beginning inventory (1,500 × $5) ..................................................... Purchases June 12 (2,300 × $6) .................................................................... $13,800 June 16 (4,500 × $7) .................................................................... 31,500 June 23 (1,500 × $8) .................................................................... 12,000 Cost of goods available for sale (9,800 units) .................................. Less: Ending inventory [(1,500 × $8) + (100 × $7)] .......................... Cost of goods sold (8,200 units) ...................................................... (2) $ 7,500 57,300 64,800 12,700 $52,100 Average cost Note: Unrounded numbers have been used in the average cost calculation, although the numbers have been rounded to the nearest cent for presentation purposes. Because of this, some amounts may not appear to multiply exactly because of the rounding in the presentation. Cost of Goods Available for Sale $64,800 Total Units Available for Sale 9,800 = Weighted Average Unit Cost $6.612245 Ending inventory = 1,600 × $6.612245 = $10,579.59 Cost of goods sold = $64,800.00 – $10,579.59 = $54,220.41 Proof: (9,800 – 1,600) × ($64,800 ÷ 9,800) = $54.220.41 (b) The average unit cost is not $6.50 because the average unit cost is not a simple straight average but is a weighted average based on the number of units purchased at each price. (c) (1) FIFO – The perpetual system will give the same ending inventory and cost of goods sold as the periodic system. (2) Average cost – The perpetual system will have a different ending inventory and cost of goods sold because the cost of goods sold is calculated based on the weighted average at the time of each sale under the perpetual system. LO 6 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-42 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *EXERCISE 6-15 (a) (1) Date FIFO Purchases Nov. 1 Sales Beginning inventory (30 @ $295) = $8,850 5 25 @ $300 = $7,500 12 (30 @ $295) + (25 @ $300) = $16,350 (30 @ $295) + (12 @ $300) = $12,450 19 40 @ $305 = $12,200 22 Balance (13 @ $300) = $3,900 (13 @ $300) + (40 @ $305) = $16,100 (13 @ $300) + (37 @ $305) = $15,185 25 30 @ $310 = $9,300 (3 @ $305) = $915 (3 @ $305) + (30 @ $310) = $10,215 Cost of Goods Sold: $12,450 + $15,185 = $27,635 Ending Inventory: $10,215 Check: $27,635 + $10,215 = $37,850 ($8,850 + $7,500 + $12,200 + $9,300) Solutions Manual 6-43 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *EXERCISE 6-15 (CONTINUED) (a) (2) Average cost Note: Unrounded numbers have been used in the average cost calculations, although the numbers have been rounded to the nearest cent for presentation purposes. Because of this, some amounts may not appear to multiply exactly because of the rounding in the presentation. Date Purchases Nov. 1 Sales Beginning inventory 30 @ $295 = $8,850.00 5 25 @ $300 = $7,500 12 55 @ $297.27 = $16,350.00 42 @ $297.27 = $12,485.45 19 40 @ $305 = $12,200 22 Balance 13 @ $297.27 = $3,864.55 53 @ $303.10 = $16,064.55 50 @ $303.10 = $15,155.23 25 30 @ $310 = $9,300 3 @ $303.10 = $909.31 33 @ $309.37 = $10,209.31 Cost of Goods Sold: $12,485.45 + $15,155.24 = $27,640.69 Ending Inventory: $10,209.31 Check: $27,640.69 + $10,209.31 = $37,850 ($8,850 + $7,500 + $12,200 + $9,300) Solutions Manual 6-44 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition EXERCISE 6-15 (CONTINUED) (b) FIFO Beginning inventory (30 × $295) ........................................................ Purchases Nov. 5 (25 × $300) ......................................................................... Nov. 19 (40 × $305) ....................................................................... Nov. 25 (30 × $310) ....................................................................... Cost of goods available for sale (125 units) ....................................... Less: Ending inventory (3 × $305) + (30 × $310) .............................. Cost of goods sold ............................................................................. $ 8,850 $ 7,500 12,200 9,300 29,000 37,850 10,215 $27,635 AVERAGE COST Cost of goods available for sale (125 units) ....................................... $37,850.00 Less: Ending inventory (33 × $302.801)............................................. 9,992.40 Cost of goods sold ............................................................................. $27,857.60 1 $37,850 ÷ 125 = $302.80 LO 2,6 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-45 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *EXERCISE 6-16 (a) Nov. 5 Inventory Accounts Payable 12 Cash Sales 12 Cost of Goods Sold Inventory 19 Inventory Accounts Payable 22 Cash Sales 22 Cost of Goods Sold Inventory 25 Inventory Accounts Payable (1) FIFO Dr. Cr. 7,500 7,500 19,320 19,320 12,450 12,450 12,200 12,200 23,500 23,500 15,185 15,185 9,300 9,300 (2) Average Cost Dr. Cr. 7,500.00 7,500.00 19,320.00 19,320.00 12,485.45 12,485.45 12,200.00 12,200.00 23,500.00 23,500.00 15,155.23 15,155.23 9,300.00 9,300.00 (1) FIFO Dr. Cr. 7,500 7,500 19,320 19,320 12,200 12,200 23,500 23,500 9,300 9,300 (2) Average Cost Dr. Cr. 7,500 7,500 19,320 19,320 12,200 12,200 23,500 23,500 9,300 9,300 (b) Nov. 5 Purchases Accounts Payable 12 Cash Sales 19 Purchases Accounts Payable 22 Cash Sales 25 Purchases Accounts Payable LO 2,6 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-46 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition SOLUTIONS TO PROBLEMS PROBLEM 6-1A (a) 1. The unsold consignment inventory should be included in Kananaskis’ inventory. Include $900 ($1,800 – $900) in inventory. 2. The sale will be recorded on February 19. The goods (cost, $980) should be excluded from Kananaskis’ inventory at the end of February. 3. The inventory has been sold to the customer so the customer has ownership. Exclude. 4. Exclude the items from Kananaskis’ inventory. Craft Producers Ltd. still owns the inventory. 5. Kananaskis owns the goods once they are shipped on February 26. Include inventory of $1,445 ($1,350 + $95). 6. Title of the goods does not transfer to Kananaskis until March 4. Exclude this amount from the February 28 inventory. 7. Title to the goods does not transfer to the customer until March 7. Include the $1,900 in ending inventory. The freight charge is a delivery expense. 8. Include $1,950 in inventory. (Legal title determines if an item should be included in inventory) Solutions Manual 6-47 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-1A (CONTINUED) (b) The revised ending inventory is: Unadjusted inventory Adjustments 1. February 1 5. February 25 7. February 27 8. February 28 Adjusted inventory $218,000 $ 900 1,445 1,900 1,950 6,195 $224,195 LO 1 BT: AP Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-48 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-2A (a) Cost of Goods Sold Model Apr. 8 Focus Mustang 18 Mustang F-150 Flex Escape Ending Inventory VIN # Cost/ Unit $ Sales price/ Unit $ C81362 G62313 G71891 F1921 X3892 E21202 24,000 29,000 28,000 29,000 31,000 29,000 26,000 32,000 33,000 32,500 34,000 32,000 Model Apr. VIN # 1 F-150 F1883 12 Mustang G71811 Flex X4214 Flex X4212 23 Focus C81528 Escape E28268 170,000 189,500 Cost/ Unit $ 25,000 30,000 31,000 30,000 27,000 30,000 173,000 = $189,500 – $170,000 = $19,500 (b) Gross profit (c) The specific identification formula is likely the most appropriate formula for Dean’s Sales Ltd. because the vehicles are large dollar value items that are specifically identifiable by vehicle identification number. LO 2 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-49 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-3A (a) (1) FIFO Date Description May 1 Purchase Purchases 120 $100 $12,000 3 Sale 8 Purchase 100 110 11,000 40 40 60 115 Ending Inventory 120 80 13 Sale 15 Purchase Cost of Goods Sold 6,900 $100 $ 8,000 040 40 100 100 110 8,400 60 60 60 $100 $12,000 100 100 110 4,000 15,000 110 110 115 6,600 13,500 20 Sale 60 110 6,600 60 115 6,900 27 Sale 40 115 4,600 20 115 2,300 $27,600 20 31 Balance 280 $29,900 260 $ 2,300 Check: $27,600 + $2,300 = $29,900 Solutions Manual 6-50 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-3A (CONTINUED) (a) (2) Average cost Note: Unrounded numbers have been used in the average cost calculations, although the numbers have been rounded to the nearest cent for presentation purposes. Because of this, some amounts may not appear to multiply exactly because of the rounding in the presentation. Date Description May 1 Purchase Purchases Cost of Goods Sold 120 $100.00 $12,000.00 3 Sale 120 $100.00 $12,000.00 80 $100.00 $8,000.00 8 Purchase 100 110.00 11,000.00 13 Sale 60 115.00 40 140 80 107.14 15 Purchase Ending Inventory 8,571.43 6,900.00 60 120 100.00 4,000.00 107.14 15,000.00 107.14 6,428.57 111.07 13,328.57 20 Sale 60 111.07 6,664.29 60 111.07 6,664.29 27 Sale 40 111.07 4,442.86 20 111.07 2,221.43 $27,678.57 20 31 Balance 280 $29,900.00 260 $2,221.43 Check: $27,678.57 + $2,221.43 = $29,900.00 (b) Save-Mart should consider the physical flow of its goods, the amount to be reported on the statement of financial position, and the nature and use of its goods. (c) The FIFO cost formula produces a slightly higher gross profit and net income as results in cost of goods sold being lower during periods of rising prices. Solutions Manual 6-51 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-3A (CONTINUED) (d) FIFO produces a higher ending inventory during periods of rising prices. (e) The pre-tax cash flows are the same no matter which cost formula is used. LO 2,3 BT: AP Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-52 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-4A (a) Date Description Purchases Cost of Goods Sold Beg. Apr. 1 inventoInventory 6 Purchase 15 $45 $ 675 30 5 9 Sale 14 Purchase 20 40 10 15 20 30 Total 55 35 $1,725 800 20 Sale 28 Purchase 50 45 45 40 1,050 700 $2,175 60 $2,775 Ending Inventory 30 $50 $1,500 30 15 50 45 2,175 10 10 20 45 45 40 5 5 20 40 40 35 200 25 , $ 900 450 1,250 900 Check: $2,775 + $900 = $3,675 ($1,500 + $2,175) (b) It needs to consider whether the change will result in more relevant and reliable presentation in the financial statements. This may only occur if the physical flow, or nature and use, of the inventory changes. (c) I would expect the ending inventory under the average cost formula to be higher when prices are falling as the inventory will be valued at an average cost. Under FIFO, ending inventory would be lower when prices are falling as the inventory will be valued at the last (and lowest) price. Cost of goods sold under the average cost formula would be lower. LO 2,4 BT: AN Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-53 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-5A (a) Date Note: Unrounded numbers have been used in the average cost calculations, although the numbers have been rounded to the nearest cent for presentation purposes. Because of this, some amounts may not appear to multiply exactly because of the rounding in the presentation. Description Purchases Cost of Goods Sold Beg. Apr. 1 inventoInventory 6 Purchase 30 $50.00 $1,500.00 15 $45 $ 675.00 9 Sale 35 $48.33 $1,691.67 14 Purchase Ending Inventory 20 40 800.00 20 Sale 25 28 Purchase 20 30 Balance 55 35 42.78 1,069.44 700.00 $2,175.00 60 $2,761.11 45 48.33 2,175.00 10 48.33 30 42.78 1,283.33 483.33 5 42.78 213.89 25 36.56 913.89 25 $ 913.89 Check: $2,761.11 + $913.89 = $3,675.00 ($1,500.00 + $2,175.00) (b) Cost of Goods Sold .................................................. Inventory (1 × $36.56) .................................. 36.56 36.56 Solutions Manual 6-54 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-5A (CONTINUED) (c) Three accounts would be affected—Inventory, Cost of Goods Sold, and Retained Earnings. The Inventory account would be overstated by $36.56. This would result in the statement of financial position sub-totals of current assets and total assets also being overstated. The Cost of Goods Sold account would be understated by $36.56. This would lead to the income statement sub-totals of gross profit and net income being overstated by $36.56. The Retained Earnings account would also be overstated by $36.56. LO 2,3 BT: AN Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-55 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-6A (a) April 1 No entry 6 Inventory (110 × $90) ............................................ Cash ............................................................. 9,900.00 Cash (130 × $120)................................................. Sales ............................................................. 15,600.00 Cost of Goods Sold (130 × $86.88*)...................... Inventory ....................................................... 11,293.75 Inventory (120 × $70) ........................................... Cash ............................................................. 8,400.00 Cash (120 × $100)................................................. Sales ............................................................. 12,000.00 Cost of Goods Sold (120 × $73.38*)...................... Inventory ....................................................... 8,805.00 Inventory (20 × $60) .............................................. Cash ............................................................. 1,200.00 8 15 20 27 9,990.00 15,600.00 11,293.75 8,400.00 12,000.00 8,805.00 1,200.00 * These numbers have been rounded to the nearest cent for presentation purposes, but not for calculation purposes. See detailed calculations in part (b). Solutions Manual 6-56 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-6A (CONTINUED) (b) Note: Unrounded numbers have been used in the average cost calculations, although the numbers have been rounded to the nearest cent for presentation purposes. Because of this, some amounts may not appear to multiply exactly because of the rounding in the presentation. Date Description Purchases Cost of Goods Sold Apr. 1 Beginning 6 Purchase 50 $80.00 $ 4,000.00 110 $90 $ 9,900 8 Sale 15 Purchase 30 Balance 160 130 $86.88 $11,293.75 120 70 8,400 20 Sale 27 Purchase Ending Inventory 150 120 20 250 60 30 73.38 8,805.00 1,200 $19,500 250 $20,098.75 86.88 13,900.00 86.88 2,606.25 73.38 11,006.25 30 73.38 2,201.25 50 68.03 3,401.25 50 $ 3,401.25 Check: $20,098.75 + $3,401.25 = $23,500 ($4,000 + $19,500) (c) Ending inventory should be valued at $2,500 (50 x $50) which is the lower of cost and net realizable value. Cost = $3,401.25 (50 units @ 68.025) NRV = $2,500.00 (50 units @ $50) LO 2,5 BT: AP Difficulty: M Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-57 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-7A (a) (b) (c) (d) (e) (f) (g) 2018 Cash No effect Cost of goods sold Overstated Net income Understated Retained earnings No effect Ending inventory No effect Gross profit margin ratio Understated Inventory turnover ratio Understated* 2017 No effect Understated Overstated Overstated Overstated Overstated Understated *Although the cost of goods sold is overstated in 2018, this is not as significant (in percentage terms) as the overstatement in average inventory, which is the denominator in the inventory turnover ratio so this ratio remains understated in 2018. LO 4,5 BT: AN Difficulty: C Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-58 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-8A (a) (INCORRECT) Sales Cost of goods sold Gross profit Operating expenses Income before income tax Statement of financial position: Inventory KMETA INC. Income Statement Year Ended July 31 2018 $340,000 233,000 107,000 68,000 $ 39,000 2017 $320,000 220,000 100,000 64,000 $ 36,000 2016 $300,000 209,000 91,000 64,000 $ 27,000 $40,000 $40,000 $24,000 KMETA INC. Income Statement Year Ended July 31 2018 $340,000 233,000 107,000 68,000 $ 39,000 2017 $320,000 229,0002 91,000 64,000 $ 27,000 2016 $300,000 200,0001 100,000 64,000 $ 36,000 $40,000 $55,0004 $33,0003 (CORRECT) Sales Cost of goods sold Gross profit Operating expenses Income before income tax Statement of financial position: Inventory $209,000 – $9,000 = $200,000 $220,000 + $9,000 (2016 error) + $0* (2017 error) = $229,000 3 $24,000 + $9,000 = $33,000 4 $40,000 + $15,000 = $55,000 * - Purchases understated by $15,000 and inventory understated by $15,000, so nil effect on cost of goods sold. 1 2 Solutions Manual 6-59 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-8A (CONTINUED) (b) Retained earnings before correction = $27,000 + $36,000 + $39,000 = $102,000 Retained earnings after correction = $36,000 + $27,000 + $39,000 = $102,000 The retained earnings balance at the end of 2018 is unaffected and remains at $102,000 because by that time, all errors have been corrected. (c) Inventory turnover (INCORRECT) Inventory turnover (2018) $233,000 = 5.8 times ($40,000 + $40,000) ÷ 2 Inventory turnover (2017) $220,000 = 6.9 times ($40,000 + $24,000) ÷ 2 (CORRECT) Inventory turnover (2018) $233,000 = 4.9 times ($40,000 + $55,000) ÷ 2 Inventory turnover (2017) $229,000 = 5.2 times ($55,000 + $33,000) ÷ 2 LO 4,5 BT: AN Difficulty: C Time: 10 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 6-60 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-9A (a) Type of Bean Coffea arabica Coffea robusta (b) (c) Dec. 31 Quantity 13,000 bags 5,000 bags Unit Cost $5.60 3.40 Total Cost $72,800 17,000 $89,800 NRV $5.55 3.50 Total NRV $72,150 17,500 $89,650 Cost of Goods Sold ($89,800 – $89,150)........... Inventory ..................................................... LCNRV $72,150 17,000 $89,150 650 650 Tascon’s operations involve the sale of coffee beans. The users of the financial information are aware of the volatility of the cost of the beans due to weather conditions in the countries where the beans are grown. Users expect and appreciate that the lower of cost and net realizable value (LCNRV) requirement in accounting because they know that inventory and income are not overstated. Adjustments Tascon would need to make by applying the item-by-item approach of the LCNRV would not be minor in amount. The item-by-item is always the more conservative method (that is, lower inventory amount reported) because net realizable values above cost are never included in the calculations. Under these circumstances, Tascon should apply the LCNRV rule on an item-by-item basis for coffee beans. One argument in support of both types of coffee beans being considered as part of one inventory grouping is that the accounting values that are reported under LCNRV on an item-by-item basis are not neutral and unbiased measures of income and inventory. Recognizing net realizable values only when they are lower than cost, is an inconsistent treatment that can lead to distortions in reported net income. Another argument can be made on the basis of the cost versus benefit constraint of accounting. Although not appropriate in this case, due to the type of inventory, the costs incurred in arriving at the net realizable value on an item-by-item basis may far outweigh the benefit derived by applying LCNRV on an item-by-item basis. LO 5 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-61 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-10A (a) (1) June 30 (2) July 31 (3) August 31 Total Cost $12,640,0001 14,195,0002 12,632,5003 Total NRV $13,600,0004 13,610,5005 12,245,0006 LCNRV $12,640,000 13,610,500 12,245,000 116,000 x $790 = $12,640,000 x $850 = $14,195,000 315,500 x $815 = $12,632,500 416,000 x $850 = $13,600,000 516,700 x $815 = $13,610,500 615,500 x $790 = $12,245,000 216,700 (b) (1) June 30 No entry (2) July 31 Cost of Goods Sold .......................................... Inventory ........................................... ($14,195,000 – $13,610,500 = $584,500) 584,500 Cost of Goods Sold ........................................ Inventory ............................................ ($12,632,500– $12,245,000 = $387,500) 387,500 (3) Aug. 31 584,500 387,500 LO 5 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-62 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-11A (a) (in USD millions) Inventory Turnover Days In Inventory Current Ratio 2015 $17,482 = 5.8 times ($2,902 + $3,100)÷2 365 = 63 days 5.8 times $33,395 = 1.2 : 1 $26,930 2014 $17,889 = 5.6 times ($3,100 + $3,277)÷2 365 = 65 days 5.6 times $32,986 = 1.0 : 1 $32,374 Coca-Cola’s current ratio improved in 2015 and is slightly below the industry average of 1.3:1. This ratio indicates that the company has fewer current assets to cover its current liabilities compared to other companies in the industry. Coca-Cola’s inventory turnover has improved but continues to be significantly worse than the rest of the industry. (b) Coca-Cola has different types of inventory that likely have different physical flows of inventory. For example, beverages likely flow on a FIFO basis (especially for beverages with “best before” dates). Other components of inventory including raw materials such as sugar may be accounted for on an average basis. LO 5 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 6-63 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-12A (a) Both companies have current ratios that exceed the industry average and therefore enjoy greater liquidity. Wendy’s has a lower current ratio and higher inventory turnover ratio than McDonald’s, so it may be more liquid than McDonald’s. McDonald’s has a lower inventory turnover than the industry. Since inventory is a large component of current assets, an inventory turnover ratio lower than the industry means that more inventory is kept on hand and therefore increases current assets and the current ratio. As a result, the higher than average current ratio may not translate into higher liquidity. (b) Both companies’ gross profit margin exceeds the industry average, with McDonald’s having the better ratio of the two companies. Where the differences in ratios is more noticeable is in the profit margin. In the case of Wendy’s, its profit margin is well below the industry average. For McDonald’s, the profit margin is double that of Wendy’s and well above the industry average. This indicates that McDonald’s has succeeded in translating a higher gross profit margin into a higher profit margin by controlling its expenses. LO 5 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-64 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-13A (a) Cost Of Goods Available For Sale Date Jan. 1 Mar. 15 July 20 Sept. 4 Dec. 2 (b) (1) Explanation Beginning inventory Purchase Purchase Purchase Purchase Total Units 250 700 500 450 100 2,000 Unit Cost $160 150 145 135 125 Total Cost $ 40,000 105,000 72,500 60,750 12,500 $290,750 FIFO Step 1: Ending Inventory Date Units Unit Cost Sept. 4 100 $135 Dec. 2 100 125 200 Step 2: Cost of Goods Sold Cost of goods available for sale Less: Ending inventory Cost of goods sold Total Cost $13,500 12,500 $26,000 $290,750 26,000 $264,750 Proof: Cost of Goods Sold Unit Total Units Cost Cost 250 $160 $ 40,000 700 150 105,000 500 145 72,500 350 135 47,250 1,800 $264,750 Solutions Manual 6-65 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-13A (CONTINUED) (b) (2) Average Cost Step 1: Ending Inventory Weighted Average Units Unit Cost 200 $145.38* = Total Cost $29,075.00 *$290,750 2,000 = $145.38 (rounded) Step 2: Cost of Goods Sold Cost of goods available for sale Less: Ending inventory (200 x $145.38 rounding) Cost of goods sold $290,750 29,075 $261,675 Proof: Cost of goods sold 1,800 × ($290,750 ÷ 2,000) = $261,675 LO 6 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-66 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-14A (a) KANE LTD. Partial Income Statements FIFO Sales (1,800 × $200) ....................................... Cost of goods sold Beginning inventory ................................. Cost of goods purchased ........................ Cost of goods available for sale .............. Ending inventory ..................................... Cost of goods sold .................................. Gross profit ...................................................... Average Cost $360,000 $360,000 40,000 250,750 290,750 26,000 264,750 95,250 40,000 250,750 290,750 29,075 261,675 98,325 (b) KANE LTD. Partial Statement of Financial Position Assets Current assets Inventory .................................................... (c) FIFO Average Cost $26,000 $29,075 FIFO uses the most recent inventory prices to value the ending inventory. Since prices are declining, FIFO results in the lower cost for ending inventory. FIFO results in the higher cost of goods sold, lower gross profit, and lower net income because FIFO values the cost of goods sold at the older, higher prices. LO 5,6 BT: AP Difficulty: M Time: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-67 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-15A (a) (1)Periodic Inventory System COST OF GOODS AVAILABLE FOR SALE Date Aug. 1 4 18 28 Explanation Beginning inventory Purchase Purchase Purchase Total Units 50 180 70 40 340 Unit Cost $90 92 94 95 Total Cost $ 4,500 16,560 6,580 3,800 $31,440 Units Sold = 160 + 100 = 260 Units in Ending inventory = 340 – 260 = 80 Step 1: Ending Inventory Unit Total Units Cost Cost 40 $95 $3,800 40 94 3,760 80 $7,560 Step 2: Cost of Goods Sold Cost of goods available for sale Less: Ending inventory Cost of goods sold $31,440 7,560 $23,880 Proof: Cost of Goods Sold Units 50 180 30 260 Unit Cost $90 92 94 Total Cost $ 4,500 16,560 2,820 $23,880 Solutions Manual 6-68 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-15A (Continued) (a) (2) Perpetual Inventory System Date Description Purchases Cost of Goods Sold Aug 1 Beginning inventory 4 Purchase 18 Purchase 50 50 180 180 $92 $16,560 50 110 10 Sale 70 94 70 30 31 Balance 40 95 290 $90 92 $14,620 6,580 25 Sale 28 Purchase Ending Inventory 92 94 9,260 3,800 $26,940 260 $23,880 $90 $ 4,500 90 92 21,060 70 70 70 92 92 94 40 40 40 94 94 95 80 6,440 13,020 3,760 7,560 , $ 7,560 Check: $23,880 + $7,560 = $31,440 ($4,500 + $26,940) (b) Cost of goods sold Ending inventory Cost of goods available for sale Perpetual $23,880 7,560 $31,440 Periodic $23,880 7,560 $31,440 The results under FIFO in a perpetual system are the same as in a periodic system. Under both inventory systems, the first costs in inventory are the ones assigned to the cost of goods sold. LO 2,6 BT: AN Difficulty: M Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-69 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-16A (a) (1) Perpetual Inventory System Note: Unrounded numbers have been used in the average cost calculations, although the numbers have been rounded to the nearest cent for presentation purposes. Because of this, some amounts may not appear to multiply exactly because of the rounding in the presentation. Date Description Purchases Cost of Goods Sold Nov. 1 Beginning inventory 4 Purchase 500 $42 $21,000 11 Sale 16 Purchase 450 750 44 33,000 20 Sale 27 Purchase 30 Balance 800 600 1,850 46 $41.67 $18,750.00 43.61 34,888.89 27,600 $81,600 1,250 $53,638.89 Ending Inventory 100 $40.00 $ 4,000.00 600 41.67 25,000.00 150 41.67 6,250.00 900 43.61 39,250.00 100 43.61 4,361.11 700 45.66 31,961.11 700 $31,961.11 Check: $53,638.89 + $31,961.11 = $85,600 ($4,000 + $81,600) Solutions Manual 6-70 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-16A (CONTINUED) (a) (2) Periodic Inventory System COST OF GOODS AVAILABLE FOR SALE Date Nov 1 4 16 27 Explanation Beginning inventory Purchase Purchase Purchase Total Units 100 500 750 600 1,950 Unit Cost $40 42 44 46 Total Cost $ 4,000 21,000 33,000 27,600 $85,600 Average cost per unit = $85,600 1,950 = $43.90 Units Sold = 450 + 800 = 1,250 Units in Ending inventory = 1,950 – 1,250 = 700 Step 1: Ending Inventory 700 units @ $43.90 = $30,728.21 Step 2: Cost of Goods Sold Cost of goods available for sale Less: Ending inventory Cost of goods sold $85,600.00 30,728.21 $54,871.79 Proof: Cost of Goods Sold 1,250 × ($85,600 ÷ 1,950) = $54,871.79 Solutions Manual 6-71 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-16A (CONTINUED) (b) Average Cost Periodic Perpetual Cost of goods sold $54,871.79 $53,638.89 Ending inventory Cost of goods available for sale 30,728.21 $85,600.00 31,961.11 $85,600.00 The results are different because the perpetual system recalculates (changes) the average unit cost after each purchase where the average cost is calculated only once, at the end of the period, in the periodic system. LO 2,6 BT: AN Difficulty: M Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-72 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-1B (a) 1. The goods on consignment belong to Kananaskis and should not be included in Banff’s ending inventory. 2. $2,650 ($2,500 + $150) should be included in inventory as the goods were shipped FOB shipping point on February 21st. 3. The goods should not be included in inventory as they were shipped FOB shipping point and shipped before February 28. Title to the goods transfers to the customer at shipping. Banff should have recorded the transaction in the Sales and Accounts Receivable accounts. Freight charges are paid by the customer. 4. Include $1,100 ($2,200 ÷ 2) in inventory as Banff has title to this inventory. 5. The amount should not be included in inventory as the goods were shipped FOB destination and not received until March 2. The seller still owns the inventory. No entry is recorded. The seller is responsible for the freight costs. 6. The sale will be recorded on March 3. The goods should be included in inventory at the end of February at their cost of $1,800. The freight is a selling expense. 7. Include $2,100 in inventory as it has not been sold. 8. Inventory should be decreased by $800 to record these goods at lower of cost and net realizable value, which is zero. (Legal title determines if an item should be included in inventory) Solutions Manual 6-73 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-1B (CONTINUED) (b) The revised ending inventory is: Unadjusted inventory Adjustments 2. February 19 4. February 23 6. February 26 7. February 27 8. February 28 Adjusted inventory $161,000 $ 2,650 1,100 1,800 2,100 (800) 6,850 $167,850 LO 1 BT: AP Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-74 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-2B (a) Cost of Goods Sold Aug. 10 18 Ending Inventory Supplier Suzuki Serial # SZ5828 Cost/ Sales price/ Unit Unit $ $ 1,900 3,000 Kawai KG1268 1,800 Yamaha YH4418 Steinway ST8411 26 Supplier Kawai Serial # KG1520 Cost/ Unit $ 900 2,100 Suzuki SZ5716 1,400 1,600 2,400 Steinway ST0944 2,500 2,900 4,000 Suzuki SZ6148 1,900 Suzuki SZ6132 2,100 3,200 Yamaha YH6318 1,800 2,800 Yamaha YH5632 1,900 2,900 14,000 20,400 (b) (c) Aug. 1 22 6,700 Gross profit = $20,400 – $14,000 = $6,400 The specific identification formula is likely the most appropriate formula for the Piano Studio Ltd. because the pianos are large dollar value items that are specifically identifiable by serial number. LO 2 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-75 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-3B (a) (1) FIFO Date Description May 1 Purchase 6 Purchase Purchases 110 $190 $20,900 140 220 110 $190 90 220 $40,700 80 230 18,400 50 50 21 Sale 27 Purchase 31 Balance 50 380 250 Ending Inventory 110 110 140 30,800 11 Sale 14 Purchase Cost of Goods Sold 220 230 22,500 12,500 $82,600 300 $63,200 $190 $20,900 190 220 51,700 50 50 80 220 220 230 11,000 30 30 50 230 230 250 6,900 80 29,400 19,400 $19,400 Check: $63,200 + $19,400 = $82,600 Solutions Manual 6-76 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-3B (CONTINUED) (2) Average Cost Note: Unrounded numbers have been used in the average cost calculations, although the numbers have been rounded to the nearest cent for presentation purposes. Because of this, some amounts may not appear to multiply exactly because of the rounding in the presentation. Date Description Purchases Cost of Goods Sold Ending Inventory May 1 Purchase 110 $190 $20,900 110 $190.00 $20,900.00 6 Purchase 140 220 30,800 250 206.80 51,700.00 11 Sale 14 Purchase 200 $206.80 $41,360.00 80 230 18,400 21 Sale 27 Purchase 50 206.80 10,340.00 130 221.08 28,740.00 100 221.08 22,107.69 50 250 12,500 31 Balance 380 $82,600 300 Check: $63,467.69 + $19,132.31 = $82,600 30 221.08 80 239.15 19,132.31 $63,467.69 80 (b) Family Appliance Mart should select the formula that: • corresponds most closely to the physical flow of goods • results in a cost on the statement of financial position that is close to the inventory’s most recent cost (c) Because prices are rising, FIFO produces the higher gross profit and net income. (d) Because the ending inventory is determined using the most recent prices, the FIFO cost formula produces the higher ending inventory. (e) 6,632.31 $19,132.31 Pre-tax cash flow will be the same under both cost formulas. LO 2,3 BT: AP Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-77 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-4B (a) FIFO Date Description April 1 Beg. inventory 6 Purchase Purchases 35 $240 $ 8,400 50 $230 5 240 $12,700 9 Sale 14 Purchase 40 245 9,800 30 20 20 Sale 28 Purchase 30 Balance Cost of Goods Sold 30 105 250 240 245 12,100 7,500 $25,700 105 $24,800 Ending Inventory 50 $230 $11,500 50 230 35 240 19,900 30 30 40 240 240 245 20 20 30 245 245 250 50 7,200 17,000 4,900 12,400 $12,400 Check: $24,800 + $12,400 = $37,200 ($11,500 + $25,700) (b) It needs to consider whether the change will result in more relevant and reliable presentation in the financial statements. This may only occur if the physical flow, or nature and use of the inventory changes. (c) When prices are rising, I would expect that, under the average cost formula, the ending inventory would be lower. Under FIFO, the ending inventory consists of the units purchased recently. Under average cost, ending inventory includes some lower cost from goods purchased earlier. I would expect cost of goods sold to be higher under average cost since the average cost would include the cost of more recently purchased goods. Notice that average cost will give higher cost of goods sold while having ending inventory that is lower than under FIFO. LO 2,4 BT: AN Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-78 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-5B (a) Date Note: Unrounded numbers have been used in the average cost calculations, although the numbers have been rounded to the nearest cent for presentation purposes. Because of this, some amounts may not appear to multiply exactly because of the rounding in the presentation. Description Purchases Cost of Goods Sold April 1 Beg. inventory 6 Purchase 50 $230.00 $11,500.00 35 $240 $ 8,400 9 Sale 14 Purchase 55 $234.12 $12,876.47 40 245 9,800 20 Sale 28 Purchase 30 Ending Inventory 50 30 105 250 240.34 12,016.81 7,500 $25,700 105 $24,893.28 85 234.12 19,900.00 30 234.12 7,023.53 70 240.34 16,823.53 20 240.34 4,806.72 50 246.13 12,306.72 50 $12,306.72 Check: $24,893.28 + $12,306.72 = $37,200 ($11,500 + $25,700) Solutions Manual 6-79 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-5B (CONTINUED) (b) It should write-off the rod: April 30 (c) Cost of Goods Sold ............................... Inventory .................................... 246.13 246.13 Three accounts would be affected—Inventory, Cost of Goods Sold, and Retained Earnings. The Inventory account would be overstated by $246.13. This would result in the statement of financial position sub-totals of current assets and total assets also being overstated. The Cost of Goods Sold account would be understated by $246.13. This would lead to the income statement sub-totals of gross profit and net income being overstated by $246.13. The Retained Earnings account would also be overstated by $246.13. LO 2,3 BT: AN Difficulty: M Time: 35 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-80 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-6B (a) Oct. 1 No entry required 5 Inventory (100 × $130) .......................................... Accounts Payable ........................................ 13,000 Accounts Receivable ............................................. Sales (120 × $200)........................................ 24,000 Cost of Goods Sold ............................................... Inventory [(60 × $140) + (60 × $130)] ........... 16,200 Inventory (35 × $120) ............................................ Accounts Payable ......................................... 4,200 Accounts Receivable ............................................. Sales (60 × $160).......................................... 9,600 Cost of Goods Sold ............................................... Inventory [(40 × $130) + (20 × $120)] ........... 7,600 Inventory (15 × $110) ............................................ Accounts Payable ........................................ 1,650 8 15 20 26 13,000 24,000 16,200 4,200 9,600 7,600 Solutions Manual 6-81 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. 1,650 Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-6B (CONTINUED) (b) Date Oct. 31 Ending Inventory Unit Units Cost 15 @ $110 15 @ $120 30* Total Cost $1,650 1,800 $3,450 *60 + 100 – 120 + 35 – 60 + 15 = 30 (c) The inventory should be valued at $3,240. This is the lower of cost and net realizable value. Cost = $3,450.00 (see (b)) NRV = $3,240.00 (30 @ $108) LO 2,5 BT: AP Difficulty: M Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-82 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-7B 2018 2017 (a) Cash No effect No effect (b) Cost of goods sold Understated Overstated (c) Net income Overstated Understated (d) Retained earnings No effect Understated (e) Ending inventory No effect Understated (f) Gross profit margin ratio Overstated Understated (g) Inventory turnover ratio Overstated* Overstated * Although the cost of goods sold is understated in 2018, this is not as significant (in percentage terms) as the understatement in average inventory, which is the denominator in the inventory turnover ratio so this ratio remains overstated in 2018. LO 4,5 BT: AN Difficulty: C Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-83 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-8B (a) (INCORRECT) PELLETIER INC. Income Statement Year Ended July 31 Sales Cost of goods sold Gross profit Operating expenses Income before income tax Statement of financial position: Inventory 2018 $320,000 187,000 133,000 52,000 $ 81,000 2017 $312,000 203,000 109,000 52,000 $ 57,000 2016 $300,000 170,000 130,000 50,000 $ 80,000 $37,000 $24,000 $37,000 2017 $312,000 193,0002 119,000 52,000 $ 67,000 2016 $300,000 180,0001 120,000 50,000 $ 70,000 (CORRECT) PELLETIER INC. Income Statement Year Ended July 31 Sales Cost of goods sold Gross profit Operating expenses Income before income tax Statement of financial position: Inventory 2018 $320,000 187,000 133,000 52,000 $ 81,000 $37,000 $29,0004 $27,000 3 1 $170,000 + $10,000 = $180,000 – $10,000 (2016 error) + $0* (2017 error) = $193,000 3 $37,000 – $10,000 = $27,000 4 $24,000 + $5,000 = $29,000 * Purchases understated by $5,000 and inventory understated by $5,000, so nil effect on cost of goods sold. 2 $203,000 Solutions Manual 6-84 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-8B (CONTINUED) (b) Before correction = $81,000 + $57,000 + $80,000 = $218,000 After correction = $81,000 + $67,000 + $70,000 = $218,000 (c) Inventory turnover (INCORRECT) Inventory turnover (2018) $187,000 = 6.1 times ($37,000 + $24,000)÷2 Inventory turnover (2017) $203,000 = 6.7 times ($24,000 + $37,000)÷2 (CORRECT) Inventory turnover (2018) $187,000 = 5.7 times ($37,000 + $29,000)÷2 Inventory turnover (2017) $193,000 = 6.9 times ($29,000 + $27,000)÷2 LO 4,5 BT: AN Difficulty: C Time: 10 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 6-85 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-9B (a) Product A B C (b) Quantity 25 30 60 Unit Cost $7 6 11 Total Cost $ 175 180 660 $1,015 Net Realizable Value $7 8 10 Total NRV $ 175 240 600 $1,015 March 31 Cost of Goods Sold ................................................... Inventory ...................................................... ($1,015 - $955 = $60) Lower of Cost and NRV $175 180 600 $955 60 60 LO 5 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-86 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-10B (a) (1) (2) (3) March 31 April 30 May 31 Tonnes Total Cost Total NRV LCNRV 30,000 $21,750,0001 $22,200,0004 $21,750,000 25,000 28,000 17,875,0002 20,300,0003 17,750,0005 20,300,0006 17,750,000 20,300,000 130,000 x $725 = $21,750,000 x $715 = $17,875,000 328,000 x $725 = $20,300,000 430,000x $740 = $22,200,000 525,000 x $710 = $17,750,000 628,000 x $725 = $20,300,000 225,000 (b) (1) March 31 No entry (2) April 30 (3) May 31 Cost of Goods Sold ...................................... Inventory ................................................. ($17,875,000 – $17,750,000 = $125,000) 125,000 125,000 No entry LO 5 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-87 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-11B (a) (in USD millions) Inventory Turnover Days In Inventory Current Ratio 2015 $28,384 = 9.7 times ($2,720 + $3,143)÷2 365 = 38 days 9.7 times $23,031 = 1.3 : 1 $17,578 2014 $30,884 = 9.4 times ($3,143 + $3,409)÷2 365 = 39 days 9.4 times $20,663 = 1.1 : 1 $18,092 PepsiCo’s current ratio improved in 2015 and is equal to the industry average of 1.3:1. This ratio indicates that the company has the same proportion of current assets to cover its current liabilities as does the average company in this industry. The increase in the current ratio follows the trend experienced by the industry and may be due to the same economic factors as experienced by other companies in the same industry. PepsiCo’s inventory turnover has improved, and is above the industry average. This trend is opposite to the industry trend which declined from 2014 to 2015. (b) PepsiCo has different types of inventory that likely have different physical flows. For example, drinks with “best before dates” likely flow first-in, firstout, which make the FIFO inventory cost formula an appropriate choice. Other components of inventory, including raw materials such as sugar, may be accounted for on an average cost basis. LO 5 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance Solutions Manual 6-88 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition PROBLEM 6-12B (a) Magna’s inventory turnover outpaces its industry counterparts by a large margin while Dana is below the industry standard in this respect. On the other hand, Dana has a much stronger current ratio compared to its industry counterparts while Magna is slightly under industry average for this measure of liquidity. (b) While the gross profit margins are similar between Magna and Dana, their gross profit margins fall well short of the industry average. This could be due in part to the product mix for each company compared to its industry peers. As for profit margin, Magna does a better job than Dana controlling costs as its gross profit is 1.9% less than Dana’s, but its profit margin is only 0.1% less. Both Magna and Dana are below the industry average for profit margin. (c) Since inventory is a large component of current assets, a higher inventory turnover as is the case for Magna would normally decrease its current ratio, which appears to be case. Dana experienced the opposite trend as it has a lower inventory turnover than Magna. Dana should have a higher current ratio, which also appears to be the case. One can therefore conclude: other factors remaining equal, the more inventory kept on hand, the greater the current assets and the current ratio. LO 5 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-89 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-13B (a) (b) Cost Of Goods Available For Sale Date Jan. Feb. May Aug. Dec. 1 20 5 12 8 (1) FIFO Explanation Beginning inventory Purchase Purchase Purchase Purchase Total Step 1: Ending Inventory Date Units Unit Cost Dec. 8 400 22 Step 2: Cost of Goods Sold Cost of goods available for sale Less: Ending inventory Cost of goods sold Units 400 1,200 1,000 1,200 600 4,400 Unit Cost $18 19 21 20 22 Total Cost $ 7,200 22,800 21,000 24,000 13,200 $88,200 Total Cost $ 8,800 $88,200 8,800 $79,400 Proof: Cost of Goods Sold Units 400 1,200 1,000 1,200 200 4,000 Unit Cost $18 19 21 20 22 Total Cost $ 7,200 22,800 21,000 24,000 4,400 $79,400 Solutions Manual 6-90 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-13B (CONTINUED) (b) (2) Average Cost Step1: Ending Inventory Units 400 Weighted Average Unit Cost $20.05* = Total Cost $8,018.18 *$88,200 4,400 = $20.05 Step 2: Cost of Goods Sold Cost of goods available for sale Less: Ending inventory Cost of goods sold $88,200.00 8,018.18 $80,181.82 Proof: 4,000 × ($88,200 ÷ 4,400) = $80,181.82 LO 6 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-91 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-14B (a) STEWARD INC. Partial Income Statements FIFO Sales (4,000 × $40) ......................................... Cost of goods sold Beginning inventory ................................. Cost of goods purchased ........................ Cost of goods available for sale .............. Ending inventory ..................................... Cost of goods sold .................................. Gross profit ...................................................... Average Cost $160,000 $160,000 7,200 81,000 88,200 8,800 79,400 80,600 7,200 81,000 88,200 8,018 80,182 79,818 (b) STEWARD INC. Partial Statement of Financial Position FIFO Average Cost $8,800 $8,018 Assets Current assets Inventory .................................................. (c) FIFO uses the latest inventory prices to determine the cost of the ending inventory and, therefore, results in the higher amount for ending inventory in periods of rising prices. FIFO results in the lowest cost of goods sold and higher net income because FIFO values the cost of goods sold at the earliest and lowest prices. LO 5,6 BT: AP Difficulty: M Time: 25 min. AACSB: Analytic CPAL cpa-t001 CM: Reporting Solutions Manual 6-92 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-15B (a) (1) Perpetual Date Description Purchases Cost of Goods Sold May 1 Beg. inventory 6 Purchase 14 Purchase 50,000 2.40 120,000 21 Sale 27 Purchase 31 Balance 15,000 $2.30 $ 34,500 15,000 2.30 40,000 2.35 128,500 40,000 $2.35 $ 94,000 11 Sale 40,000 2.45 130,000 98,000 Ending Inventory 15,000 $2.30 15,000 2.35 $ 69,750 25,000 25,000 50,000 25,000 2.35 40,000 2.40 154,750 10,000 10,000 40,000 $312,000 95,000‘ $224,500 50,000 2.35 2.35 2.40 2.40 2.40 2.45 58,750 178,750 24,000 122,000 $122,000 Check: $224,500 + $122,000 = $346,500 ($34,500 + $312,000) (2) Periodic Step 1: Ending Inventory Date Units Unit Cost May 14 10,000 $2.40 May 27 40,000 2.45 50,000 Step 2: Cost of Goods Sold Cost of goods available for sale Less: Ending inventory Cost of goods sold Total Cost $ 24,000 98,000 $122,000 $346,500 122,000 $224,500 Solutions Manual 6-93 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-15B (CONTINUED) (a) (continued) Proof: Cost of Goods Sold Unit Total Units Cost Cost 15,000 $2.30 $ 34,500 40,000 2.35 94,000 40,000 2.40 96,000 95,000 $224,500 (b) Cost of goods sold Ending inventory Cost of goods available for sale Perpetual $224,500 122,000 $346,500 FIFO Periodic $224,500 122,000 $346,500 Both the periodic and perpetual systems result in the same ending inventory and cost of goods sold under the FIFO cost formula because the most recently purchased goods remain in inventory. LO 2,6 BT: AN Difficulty: M Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-94 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-16B (a) Note: Unrounded numbers have been used in the average cost calculations, although the numbers have been rounded to the nearest cent for presentation purposes. Because of this, some amounts may not appear to multiply exactly because of the rounding in the presentation. (1) Date Average Cost – Perpetual Description Purchases Cost of Goods Sold Oct. 1 Beg. inventory 9 Purchase 50 $240.00 $12,000.00 125 $260 $32,500 15 Sale 20 Purchase 175 150 $254.29 $38,142.86 55 195 $51,400 205 265.86 254.29 44,500.00 25 254.29 95 265.86 25,257.14 14,622.56 40 265.86 10,634.59 $52,765.41 40 $10,634.59 70 270 18,900 29 Sale 30 Balance Ending Inventory 6,357.14 Check: $52,765.41 + $10,634.59 = $63,400 ($12,000 + $51,400) Solutions Manual 6-95 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition *PROBLEM 6-16B (CONTINUED) (a) (2) Average Cost – Periodic Cost of Goods Available for Sale Date Oct. Explanation Beginning inventory Purchase Purchase 1 9 20 Total Ending Inventory Date Oct. 31 *$63,400 Unit Total Units Cost Cost 40 $258.78* $10,351.02 Units 50 125 70 245 Unit Cost $240 260 270 Total Cost $12,000 32,500 18,900 $63,400 Cost of Goods Sold Cost of goods available for sale Less: Ending inventory Cost of goods sold $63,400.00 10,351.02 $53,048.98 245 = $258.78 Proof: Cost of Goods Sold 205 × ($63,400 245) = $53,048.98 (b) Average Cost Perpetual Periodic Cost of goods sold $52,765.41 $53,048.98 Ending inventory Cost of goods available for sale 10,634.59 $63,400.00 10,351.02 $63,400.00 The results for the average cost formula differ depending on whether a perpetual or periodic system is used. This is because, using a perpetual system, the average cost is recalculated (changes) after each purchase. In a periodic system, it is calculated only once, at the end of the period. LO 2,6 BT: AN Difficulty: M Time: 45 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting Solutions Manual 6-96 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley ACR6-1 (a) Dec. 1 4 6 Financial Accounting, Seventh Canadian Edition ACCOUNTING CYCLE REVIEW Cash ................................................................. Accounts Receivable................................. 315,000 Rent Expense.................................................... Cash.......................................................... 14,000 Accounts Payable ............................................. Cash.......................................................... 375,000 315,000 14,000 375,000 Accounts Receivable......................................... 2,121,000 Sales ......................................................... Cost of Goods Sold (4,200 x $278)*.................. 1,167,600 Inventory ................................................... *Dec. 1 balance ÷ Dec. 1 units = $2,780,000 ÷ 10,000 = $278 15 18 21 Inventory (6,000 x $290) ................................... 1,740,000 Accounts Payable ..................................... Salaries Expense .............................................. Cash.......................................................... 27 1,740,000 125,000 Accounts Receivable ........................................ 4,092,000 Sales ......................................................... Advertising Expense ......................................... Cash.......................................................... 1,167,600 125,000 Cost of Goods Sold ........................................... 2,250,400 Inventory (5,800* x $278) + (2,200** x $290) * remaining units (10,000 – 4,200 Dec. 6) ** additional (8,000 – 5,800 = 2,200) 24 2,121,000 4,092,000 2,250,400 32,000 Inventory (5,000 x $300) ................................... 1,500,000 Accounts Payable ..................................... 32,000 1,500,000 (b) Part (b) is combined with part (d). Solutions Manual 6-97 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR6-1 (CONTINUED) (c) RETRO PRODUCTIONS LIMITED Unadjusted Trial Balance December 31, 2018 Debit Cash Accounts receivable Inventory Supplies Prepaid rent Equipment Accumulated depreciation—equipment Accounts payable Unearned revenue Bank loan payable—non-current Common shares Retained earnings Dividends declared Sales Sales returns and allowances Sales discounts Cost of goods sold Advertising expense Freight out Office expense Rent expense Salaries expense Travel expense Utilities expense Interest expense Income tax expense Credit $ 190,100 7,288,000 2,602,000 39,000 14,000 1,350,000 $ 35,625 4,095,000 96,000 1,240,000 600,000 1,239,275 120,000 22,893,000 56,000 166,800 12,592,000 437,000 980,000 78,000 168,000 3,561,000 46,000 61,000 70,000 380,000 $30,198,900 $30,198,900 Solutions Manual 6-98 Chapter 6 Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition ACR6-1 (CONTINUED) (d) Adjusting journal entries (AJE) Dec. 31 31 31 31 31 31 Utilities Expense................................................ Accounts Payable ..................................... 6,000 Salaries Expense ..............................................