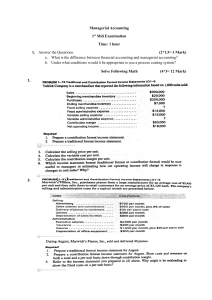

Introductory Managerial Accounting COMM 294, Sections 201 & 202 Course Outline & Syllabus, January, 2020 COURSE INFORMATION Course title: Course code: Session and term: Section(s): Course duration: Division: Course email CCCCCC Managerial Accounting COMM 294 2019W2 201 202 Jan 6 – April 8, 2020 Accounting and Information Systems Credits: 3.0 Class location: M/W: HA098 Class times: M/W: 10:00am – 11:30am M/W: 11:30am – 1:00pm Tutorials: Fridays (optional) Pre-requisites: COMM 293 C294@sauder.ubc.ca INSTRUCTOR INFORMATION Instructor: Course website: Email: Robert Jackes BA, LA, CPA, CA canvas.ubc.ca Office location: HA 376 Office hours: TH 1-3 pm or by appointment rjackes@sauder.ubc.ca COURSE DESCRIPTION This course focuses on the use of accounting information in efficiently operating an organization. The concepts are sufficiently general to be applicable in both profit and not-for-profit organizations, but most of our discussion will deal with profit-oriented firms. Management accounting has two major roles: Decision-Facilitating role: Managers have the responsibility and authority for making decisions with respect to the use of the firm’s resources. To do this effectively they must identify the alternative actions and strategies available to them, predict the possible consequences of those actions or strategies, and then choose the strategy course of action that has the most preferred predicted outcome. Management accounting systems can be effective tools both in providing financial information that is useful in predicting the possible consequences of alternative actions and to identify where corrective action may be required. Decision-Influencing role: A manager is sometimes the sole owner of a firm, but more generally managers are employees or own the firm jointly with others. The choices made by a manager will depend on the predicted consequences that are of personal concern to her/him and her/his preferences with respect to those consequences. Consequently, the manager may not make the choices most preferred by the owners. To mitigate this problem, the firm’s owners (or higher level managers) frequently establish formal or informal incentive systems that are designed to motivate the manager to choose the actions that they prefer. An organization's accounting records must provide the information necessary to prepare the financial statements reported to investors, bankers, unions and others who are not part of the firm's management. These statements must be prepared in accordance with generally accepted accounting principles (GAAP), particularly if the statements are audited. However, the information reported to management need not be prepared in accordance with GAAP. Management wants the information that is most useful in operating their organization, and that may differ from the information used to satisfy GAAP. 1 Introductory Managerial Accounting COMM 294, Sections 201 & 202 Course Outline & Syllabus, January, 2020 COURSE FORMAT 1. Lectures Class time will be used for a combination of lectures and solving sample problems. Attendance is expected to accomplish the learning objectives below. Lectures and sample problems will assume that students having pre-read the corresponding chapters as listed in the course schedule below. 2. iClicker We will use the iClicker regularly in class lectures to answer sample problems. Please ensure that you bring your iClicker to class. 3. Tutorials (Fridays) Friday tutorials are not a required activity for this course. Experience has shown that within these large class formats, student who attend tutorials will do much better in the course than if they did not attend. Please refer to the final page of this course syllabus for the dates, time, location and topics. LEARNING OBJECTIVES By the end of this course, students will be able to: • Define and classify cost accounting concepts used by managers. • Calculate and analyze costs incurred by organizations using various costing methods. • Distinguish between types of cost behaviour and investigate the relationships between costs, volume and profit. • Apply techniques to prepare a budget and evaluate actual results compared to the budget. • Identify standard costs and evaluate variances. • Describe how management accounting utilizes financial accounting information for the measurement of performance of individuals and business segments. • Apply management accounting principles to facilitate the analysis of information that is relevant in decision making. ASSESSMENTS Summary Chapter Pre-test (before class) Online assignments (after class) Midterm examination Final examination 5% 15% 35% 45% 100% Total: 2 Introductory Managerial Accounting COMM 294, Sections 201 & 202 Course Outline & Syllabus, January, 2020 Details of Assessments 1. Examinations • Exams contain between 15-25% conceptual/qualitative materials. • To pass the course you must achieve a passing grade on the combined average of the mid-term and final examinations. [(MT%x35% + FINAL%x45%) >= 40% (i.e. 50% of the 80% allocated to the exam component]. Regardless of your average marks in the course, if you do not achieve a passing grade on the combined average of the mid-term and final examinations, the highest mark attainable for the course is 47%. • There will be one midterm exam held in the evening. See course schedule for details. • The midterm and final are both blended exams. The paper components of the exams are marked by the instructor and/or teaching assistants. Electronic components of the exams are marked automatically on CANVAS. • The final exam will focus on content after the midterm cut-off and will not include directly cumulative questions. 3 Introductory Managerial Accounting COMM 294, Sections 201 & 202 Course Outline & Syllabus, January, 2020 2. Chapter pre-tests Prior to class delivery, there will be a chapter pre-test for each chapter on CANVAS (“Chapter pretests” tab). These are designed to introduce upcoming content, encourage students to read before classes, and attend classes with questions. These are generally (but not always) assigned once per week and typically (but not always) due the night before the introduction of a new chapter. Each test has 10-15 multiple choice questions. These tests are generally not difficult. Late chapter pre-tests will not be accepted. 3. Assignments Assignments will be on-line using WileyPlus and will be presented on CANVAS (“Modules” tab) about a week before they are due. On-line assignments will be given an exact time and date when they must be completed and submitted. Late assignments will not be accepted. Students will receive three attempts for each assignment. Assignments are not group assignments, so be sure to submit individual work. The purpose of the assignments is to keep you current with the material that we are covering. It is unwise to leave the material to study the night before the examinations. The assignments and chapter pre-tests will help you prepare for the examinations as they are primarily a self-study component where you practice your knowledge and receive immediate feedback. Students will receive a notification as marks get updated in Canvas after the assignment due date. WileyPlus assignments are each worth an equal percentage even where the number of points for each assignment differs. Late assignments will not be accepted. 4. Attendance and Participation Although you are not graded for attendance or participation, participating enriches the learning experience and provides you with an opportunity to share your thoughts and questions with the class. We will be using the iClicker to participate in certain problem-solving exercises. Based on past experience, students that attend lectures and are engaged during the lecture tend to achieve a significantly better mark in the course. LEARNING MATERIALS Reading Materials: 1. Required Textbook: “Financial & Managerial Accounting, Third Edition” by Weygandt, Kimmel and Kieso (Wiley) (ISBN 9781119532415), (ISBN 9781119647737 / (print version)) Note: There are different formats available. Any of the following are acceptable: • FINANCIAL & MANAGERIAL ACCOUNTING (BINDER READY) W/ ETEXT + WILEYPLUS • FINANCIAL & MANAGERIAL ACCOUNTING W/ ETEXT + WILEYPLUS ACCESS • ETEXT + ACCESS CODE: FINANCIAL & MANAGERIAL ACCOUNTING 3/E (WILEYPLUS) 4 Introductory Managerial Accounting COMM 294, Sections 201 & 202 Course Outline & Syllabus, January, 2020 • If you need to purchase text materials for this term, you must do this via the bookstore at UBC otherwise you will NOT have integration with Canvas. This course requires the use of the publisher’s “Wiley Plus” on-line course resources, so make sure you have an access code for WileyPlus with the book you’re purchasing (or have purchased). Once purchased, you must access WileyPlus through Canvas ONLY. The Text that you purchased for Comm293 will automatically grant access to Comm294 material. Older versions of the textbook are not acceptable, as page references and problem assignments & solutions used in this course will only refer to the Third Edition. If you took the course with another edition or without the Canvas integration, but did purchase WileyPLUS access to some form of this text, please send me an email and I will provide your name and student number to Wiley to ensure that you are added to WileyPlus through Canvas. 2. Slides + In-class problems (posted on CANVAS, tab “Modules”): The slides and in-class problems are used throughout the course. You should have these documents for each lecture with you starting the second day of class. We will use this package to collaboratively develop an understanding of managerial accounting and its key decision-making tools. These documents are designed for you to fill them in during the lectures, so please make sure to bring a hardcopy that you can write on. You will be responsible for filling them in during lectures, and filled-in copies will not be provided afterwards. Plan to attend lectures. Other Learning Resources: • canvas.ubc.ca: The CANVAS site will contain the critical files for the course, including slides, in-class problems, assignments, and chapter pre-tests. Students are advised to check CANVAS prior to every class for updates and announcements. • Review/Supplementary Problems: Completing as many exercises and problems as possible is an integral part of the course requirements. The exercises and problems provide examples of procedural and conceptual issues and are intended to assist you in understanding and responding to technical and discussion/essay-type questions encountered during the course and on examinations. WileyPlus provides a significant number of problems for you to practice. I will provide a list of recommended textbook problems on CANVAS. • "Practice" Examinations: There will be one practice midterm and one practice final examination with solutions posted on the CANVAS site. The assignments and supplementary review problems, in conjunction with your reading and class discussions, will equip you to successfully complete the examinations. The examination questions will be comprehensive in nature, requiring you to thoughtfully integrate your knowledge providing quantitative and qualitative responses. 5 Introductory Managerial Accounting COMM 294, Sections 201 & 202 Course Outline & Syllabus, January, 2020 COURSE-SPECIFIC POLICIES AND RESOURCES Missed or late assignments, and regrading of assessments • • • Except as described below, missed or late assignments and chapter pre-tests will receive a mark of zero. Students that miss a chapter tests prior to joining the course (i.e. during the add/drop period) will have the related test weighting allocated to the other tests. Assignment, chapter pre-tests or exam marks: If you feel you have been wrongly assessed, please review your work against the suggested solution with a TA. Prepare a written request indicating why you feel the marking was not appropriate. Submit your request within one week of receiving the mark for your assignment, chapter pre-tests or for the midterm exam, or it will not be considered. Your work will be re-marked, as well as the entire document. This may result in an increase, decrease or no change in your total mark. You are also encouraged to keep the “magnitude” of marks in context. Any one question on an exam, assignment or on-line assessment will only account for a very small percentage of your overall grade. Please note that I do not discuss assignment, on-line assessment or exam marks in-person with students. Academic Concessions Midterm Exam Class members must make every effort to inform the instructor of any absence prior to missing the midterm exam and supply appropriate documentation relating to their absence to the Sauder Undergraduate Office (UGO) within the UGO’s specified time frame of any examination. Should the UGO accept the documentation, the student may be given a “makeup exam” toward the end of the term or, at the discretion of the instructor, the MT marks may be allocated to the final exam. If the documentation is not provided or is not accepted, the student will receive a mark of zero on the midterm exam. Final Exam Class members who miss the final examination will have their standing in the course evaluated by the Sauder Undergraduate Office (UGO). If a deferred standing is granted by the UGO, these members will be advised of their writing date set by the Registrar. Assignments and chapter pre-tests Students that receive an academic concession through the Sauder Undergraduate Office (UGO) for a missed assignment (chapter pre-test) will have the related assignment (chapter pre-test) weighting allocated to the other assignments (chapter pre-test) completed. Other Course Policies Please treat each class as a business meeting. As such, it is important to act professionally: • • Be on time Be prepared and attentive • • Be courteous and attentive to fellow students Turn off all electronics, except as needed for class (no social media 6 Introductory Managerial Accounting COMM 294, Sections 201 & 202 Course Outline & Syllabus, January, 2020 • • Be ready to engage Be open to ideas • • permitted during class) Communicate in advance via CANVAS inbox if you are unable to attend Prepare for each class (advance readings, course notes) • Lectures may NOT be recorded • Please arrive on time for class. Lateness is a major disruption to the class. If I have begun speaking when you enter the room, you are late – something that is not tolerated within the business world. If you are late, please sit in the back row to minimize your disruption of the class. It is disrespectful to the entire class to be regularly late. Please be aware that chatter is heard clearly at the front of the room. Please do not talk while I am speaking as it is rude and disruptive. I may ask you to stop or even to leave the room. Talking on cell phones, texting and cell phone alerts of any type are all considered disruptions – cell phones must be turned off and put away. Repeated disruption may affect your mark. • We will be using the iClicker often during class. • • • This is an accounting course involving quantitative problems and analysis. Therefore, you should always have paper to write on, a pen or pencil and a calculator with you for class or, you may use a tablet or laptop for taking notes. Listening, observing, participating and writing are the keys to internalizing the material for this course. So, for instance, writing what is put on the screen / whiteboard (not taking pictures of the screen with your smartphone) is the best way to learn. And you should always plan to have a working calculator with you for exams! (WE DO NOT KEEP EXTRAS) UNIVERSITY POLICIES AND RESOURCES UBC provides resources to support student learning and to maintain healthy lifestyles but recognizes that sometimes crises arise and so there are additional resources to access including those for survivors of sexual violence. UBC values respect for the person and ideas of all members of the academic community. Harassment and discrimination are not tolerated nor is suppression of academic freedom. UBC provides appropriate accommodation for students with disabilities and for religious observances. UBC values academic honesty and students are expected to acknowledge the ideas generated by others and to uphold the highest academic standards in all of their actions. Details of the policies and how to access support are available on the UBC Senate website at https://senate.ubc.ca/policies-resources-support-student-success. 7 Introductory Managerial Accounting COMM 294, Sections 201 & 202 Course Outline & Syllabus, January, 2020 Academic Integrity The academic enterprise is founded on honesty, civility, and integrity. As members of this enterprise, all students are expected to know, understand, and follow the codes of conduct regarding academic integrity. At the most basic level, this means submitting only original work done by you and acknowledging all sources of information or ideas and attributing them to others as required. This also means you should not cheat, copy, or mislead others about what is your work. Violations of academic integrity (i.e., misconduct) lead to the breakdown of the academic enterprise, and therefore serious consequences arise and harsh sanctions are imposed. For example, incidences of plagiarism or cheating may result in a mark of zero on the assignment or exam and more serious consequences may apply if the matter is referred to the President’s Advisory Committee on Student Discipline. Careful records are kept in order to monitor and prevent recurrences. COPYRIGHT All materials of this course (course handouts, lecture slides, assessments, course readings, etc.) are the intellectual property of the instructor or licensed to be used in this course by the copyright owner. Redistribution of these materials by any means without permission of the copyright holder(s) constitutes a breach of copyright and may lead to academic discipline. Audio or video recording of classes are not permitted and no photos are permitted of course content. 8 Introductory Managerial Accounting COMM 294, Sections 201 & 202 Course Outline & Syllabus, January, 2020 COMM 294, Section 201/202(AS Lect. # AT 1/05/20) Schedule (subject to change without notice) General Nature of the Topics Managerial accounting and the business env. Cost Terms, Concepts and Classifications To Read* CH14 CH18 L01** 1 1 2 Date Mon. Jan. 6 Wed. Jan. 8 2 3 4 Mon. Jan. 13 Wed. Jan. 15 Cost Terms, Concepts and Classifications Job-Order Costing CH20 L01 3 5 6 Mon. Jan. 20 Wed. Jan. 22 Job-Order Costing Activity Based Costing/Management CH15 CH17 4 7 8 Wed. Jan. 27 Mon. Jan. 29 Activity Based Costing/Management Cost Behaviour: Analysis and use CH17 CH18 L01, 02 5 9 10 Wed. Feb. 3 Mon. Feb. 5 Cost Behaviour: Analysis and use Cost-Volume-Profit Analysis CH18 L01, 02 CH18 L03, 04, 05 6 11 12 Wed. Feb. 10 Mon. Feb. 12 Cost-Volume-Profit Analysis Budgeting Ch19 L01, 02, 04 CH22 Mon. Feb. 17 Wed. Feb. 19 NO CLASSES: Mid-term Break 13 14 Mon. Feb. 24 Wed. Feb. 26 Thu. Feb. 27 Budgeting CH23 L01, 02 No lecture in lieu of midterm *Midterm Exam: 7pm – 9:30pm, location TBA 15 16 Mon. Mar. 2 Wed. Mar. 4 Standard Costing & Variance Analysis 17 Mon. Mar. 9 18 Wed. Mar. 11 Variable vs. Absorption costing 19 Mon. Mar. 16 Reporting for Control: Segmented Reporting 20 Wed. Mar. 18 Reporting for Control: Segmented Reporting Week # 7 8 9 10 12 13 14 Mon. Mar. 23 CH15 #1 #2 #3 #4 CH24 MT review Appendix 21A 11 21 Assignment due week of CH23 L04 Appendix 23A CH23 Appendix 23A Reporting for Control: ROI & RI CH23 Appendix 23A 22 Wed. Mar. 25 Transfer Pricing CH21 L04 23 24 Mon. Mar. 30 Transfer Pricing Wed. Apr. 1 Relevant Costs for Decision Making CH21 L04 CH20 25 Mon. Apr 6 Relevant Costs for Decision Making CH20 26 Wed. Apr. 8 TBD Relevant Costs for Decision Making FINAL EXAM – during exam period CH20 9 #5 #6 #7 Introductory Managerial Accounting COMM 294, Sections 201 & 202 Course Outline & Syllabus, January, 2020 * The outline specifies dates on which each topic will be started. You should read the relevant material before the topic is discussed in class so that you can maximize your in-class learning experience. Failure to prepare for class will reduce the quality of your learning experience and will cause you to feel that the pace of the course is too fast. ** L01, L02, etc., refers to “Learning Objective 1”, “Learning Objective 2”, etc. They refer to sections within the chapters (instead of page numbers). If a Learning Objective is not specified, then you are responsible for the entire chapter. TUTORIAL INFORMATION Friday tutorials are entirely optional. During each tutorial, our TAs will cover about three questions related to the topics just covered. One-hour tutorials will be offered most Fridays throughout the term. This is an excellent way to practice problems and receive any help where needed from exceptional fourth year students. Week # Wk 1 Wk 2 Wk 3 Wk 4 Wk 5 Wk 6 Wk 7 Wk 8 Wk 9 Wk 10 Wk 11 Wk 12 Wk 13 Friday Tutorial Topics (subject to change) Date Tutorial # Topic Jan. 10 No Tutorial Jan. 17 1 Cost Terms, Concepts and Classifications Jan. 24 2 Job Order Costing Jan. 31 3 Activity-Based Costing Feb. 07 Cost Behaviour: Analysis and use; Cost 4 volume profit analysis Feb. 14 5 Budgeting Feb. 21 Mid-term break, no Tutorial Feb. 28 6 Cost volume profit analysis Mar. 06 7 Standard Costing & Variances Mar. 13 8 Reporting for Control Mar. 20 9 Transfer Pricing Mar. 27 10 Relevant Costs for Decision Making Apr. 03 11 Relevant Costs for Decision Making Topics subject to change. Students will be informed of any changes prior to the tutorial. 10