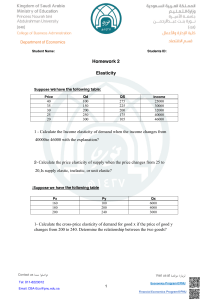

![[2021] HE9091 Lecture 2](http://s2.studylib.net/store/data/027250030_1-8a549db8c22f36b49957b17f0f12efe2-768x994.png)

HE9091 Principles of Economics Lecture 2 Elasticity and Consumer Behaviour Tan Khay Boon Email: khayboon@ntu.edu.sg Topics • • • • • • • • • Price Elasticity of Demand Income Elasticity of Demand Cross-Price Elasticity of Demand Price Elasticity of Supply Total Utility and Marginal Utility The Rational Spending Rule Demand and Consumer Surplus Supply and Producer Surplus Reference: FBAH or FBL, chapters 4, 5 & 6 Price Elasticity of Demand • Price elasticity of demand is defined as the percentage change in quantity demanded from a 1% change in price – Measure of responsiveness of quantity demanded to changes in price • Example: – Price of beef decreases 1% – Quantity of beef demanded increases 2% – Price elasticity of demand is – 2 P Q Calculate Price Elasticity • Symbol for elasticity is ε – Lower case Greek letter epsilon • For small percentage changes in price ε= Percentage change in quantity demanded Percentage change in price Price elasticity of demand is always negative Ignore the sign and consider the absolute value when interpreting price elasticity of demand Elastic Demand Price Elasticity of Demand Unit elastic Elastic Inelastic 0 1 2 3 • If price elasticity is greater than 1 in absolute value, demand is elastic – Percentage change in quantity is greater than percentage change in price – Demand is responsive to price Inelastic Demand Price Elasticity of Demand Unit elastic Elastic Inelastic 0 1 2 3 • If price elasticity is less than 1 in absolute value, demand is inelastic – Percentage change in quantity is less than percentage change in price – Quantity demanded is not very responsive to price Unit Elastic Demand Price Elasticity of Demand Unit elastic Elastic Inelastic 0 1 2 3 • If price elasticity is 1 in absolute value, demand is unit elastic – Price and quantity change by the same percentage Example: Demand for Pizza Price Quantity ε= ε= Old $1.00 400 New $0.97 404 % Change 3% 1% Percentage change in quantity demanded Percentage change in price 1% -3% = -0.33 Demand is inelastic Determinants of Price Elasticity of Demand Substitution Options • More options, more elastic Budget Share • Large share, more elastic Time • Long time to adjust, more elastic Price Elasticity Notation ε= Percentage change in quantity demanded Percentage change in price • ΔQ is the change in quantity – ΔQ / Q is percentage change in quantity • ΔP is change in price – ΔP / P is percentage change in price ε= ΔQ / Q ΔP / P Price Elasticity: Graphical View ε= ε= ε= ΔP / P ΔQ x Q P x P ΔQ ΔP P 1 Q slope A P ΔP Q x Price ε= ΔQ / Q ΔP P–ΔP ΔQ D Q Q+ΔQ Quantity Price Elasticity: Graphical View P=8 Q=3 Slope = 20 / 5 = 4 ε= P x Q ε= 8 3 1 Price • At point A A P ΔP P–ΔP ΔQ D slope x 1 4 = 0.67 Q Q+ΔQ Quantity Price Elasticity and Slope • When two demand curves cross – At the common point demand is less price elastic for the steeper curve Price • P / Q is same for both curves • (1 / slope) is 12 smaller for the steeper curve D1 Less Elastic More Elastic 6 4 D2 4 6 Quantity 12 Price Elasticity on a StraightLine Demand Curve • Price elasticity is different at each point ε= P Q x 1 slope – Slope is the same for the demand curve – P/Q decreases as price goes down and quantity goes up Price Elasticity Pattern • Price elasticity changes systematically as price goes down • At high P and low Q, P / Q is large • Demand is elastic • Demand is inelastic a Price • At the midpoint, demand is unit elastic • At low P and high Q, P / Q is small 1 1 1 a/2 b/2 Quantity b Two Special Cases Perfectly Elastic Demand Perfectly Inelastic Demand • Infinite price elasticity of demand • Zero price elasticity of demand Price Price D D Quantity Quantity Elasticity and Total Expenditure` • When price increases, total expenditure can increase, decrease or remain the same – The change in expenditure depends on elasticity • Terminology: total expenditure = total revenue – Calculate as P Q • Graphing idea: total expenditure is the area of a rectangle with height P and width Q – Example: P = 2 and Q=4 x Price Expenditure = 8 2 D 4 Quantity Price Elasticity and Total Expenditure • Movie ticket price increases from $2 to $4 – A and B are both below the midpoint of the curve • Inelastic portion of the demand curve – Total revenue increases when price increases D 12 Expenditure = $1,000/day Price ($/ticket) Price ($/ticket) 12 A 2 5 6 Quantity (00s of tickets/day) D Expenditure = $1,600/day B 4 4 6 Quantity (00s of tickets/day) Price Elasticity and Total Expenditure • Movie ticket price increases from $8 to $10 – Prices are both above the midpoint of the curve • Elastic portion of the demand curve – Total revenue decreases 8 Y Expenditure = $1,600/day D 2 6 Quantity (00s of tickets/day) Price ($/ticket) Price ($/ticket) 12 12 10 Z Expenditure = $1,000/day D 1 6 Quantity (00s of tickets/day) The Effect of a Price Change on Total Expenditure Price $12 $10 $8 $6 $4 $2 $0 Quantity 0 100 200 300 400 500 600 Expenditure $0 Total expenditure ($/day) $1,000 $1,600 $1,800 $1,600 $1,000 12 Price ($/ticket) 10 8 6 4 2 1 3 4 5 6 2 Quantity (00s of tickets/day) $0 1,800 1,600 1,000 2 6 Price ($/ticket) 10 Elasticity, Price Change, and Expenditure The Midpoint Formula for Elasticity of Demand • Elasticity is different at each point on the demand curve • Compare 2 points and get 2 answers – Depends on which point is the starting point • Start at A and elasticity is 2 • Start at B and elasticity is 1 – A more stable solution is needed • Use the midpoint formula P 4 3 ΔP ΔQ 4 6 Q The Midpoint Formula for Elasticity of Demand • Midpoint formula – Use average quantity in the numerator – Use average price in the denominator ε= ε= ΔQ / [(QA + QB)/2] Δ P / [(PA + PB)/2] Δ Q / (QA + QB) Δ P / (PA + PB) • Elasticity using midpoint formula is 1.40 P 4 3 ΔP ΔQ 4 6 Q Cross-Price Elasticity of Demand • Substitutes and complements affect demand • Cross-price elasticity of demand is defined as the percentage change in quantity demanded of good A from a 1 percent change in the price of good B • Sign of cross-price elasticity shows relationship between the goods – Complements have negative cross-price elasticity – Substitutes have positive cross-price elasticity – Do not ignore the sign when interpreting crossprice elasticity of demand Income Elasticity of Demand • Income elasticity of demand is defined as the percentage change in quantity demanded from a 1 percent change in income • Income elasticity of demand can be positive or negative – Positive income elasticity is a normal good – Negative income elasticity is an inferior good – Do not ignore the sign when interpreting income elasticity of demand Calculate Income and CrossPrice Elasticity • Income elasticity of demand: Percentage change in quantity demanded εI = Percentage change in Income • Cross-price elasticity of demand: Percentage change in quantity demanded of A εAB = Percentage change in Price of B Price Elasticity of Supply • Price elasticity of supply – Percentage change in quantity supplied from a 1 percent change in price ΔQ / Q Price elasticity of supply = Price elasticity of supply = P Q ΔP / P x 1 slope Price Elasticity of Supply • If supply curve has a positive intercept – Price elasticity of supply = (8 / 2) (1 / 2) = 2.00 B 10 8 A Price • Price elasticity of supply decreases as Q increases – Graph shows • Slope = 2 • At A, P = 8 and Q = 2 S 4 • At B, P = 10 and Q = 3 – Price elasticity of supply = (10 / 3) (1 / 2) = 1.67 2 Quantity 3 Price Elasticity of Supply • If supply curve has a zero intercept B 5 4 Price • Price elasticity of supply is 1.00 – Graph shows • Slope = 1 / 3 • At A, P = 4 and Q = 12 S ΔP A ΔQ – Price elasticity of supply = (4 / 12) (3) = 1.00 • At B, P = 5 and Q = 15 – Price elasticity of supply = (5 / 15) (3) = 1.00 12 Quantity 15 Perfectly Inelastic and Elastic Supply • Zero price elasticity of supply Infinite price elasticity of supply • No response to change in price Sell all you can at a fixed price Price Price S S Quantity Quantity Determinants of Price Elasticity of Supply Input Flexibility • Uses adaptable inputs, more elastic • Resources move where Mobility of Inputs needed, more elastic • Alternative inputs easy to find, Produce Substitute Inputs more elastic Time • Long run, more elastic Needs versus Wants • Some goods are required for subsistence – These are needs • Beyond subsistence, behavior is driven by wants – Rice or noodle – Hamburger or chicken sandwich • Wants depend on price • Unlimited wants with limited resources means consumers have to prioritize wants when making choices. Wants and Utility • Utility: the satisfaction people derive from consumption – Well-being, happiness – Measured indirectly • Subjective • Observable – Cannot be compared between people • Individual goal is to maximize utility – Allocate resources accordingly Sarah's Utility from Ice Cream Utils/hour Cones / Hour Total Utility 0 1 2 0 50 90 3 4 5 120 140 150 140 150 140 120 90 50 1 2 6 3 4 Cones/hour 5 6 Sarah's Marginal Utility from Ice Cream Cones / Hour Total Utility Marginal Utility 0 1 2 3 4 5 6 0 50 90 120 140 150 140 50 40 30 20 10 • Marginal utility: the additional utility from consuming one more Change in utility Marginal utility = Change in consumption -10 Diminishing Marginal Utility Law of Diminishing Marginal Utility Tendency for additional utility gained from consuming an additional unit of a good to decrease as consumption increases beyond some point Diminishing Marginal Utility • Marginal utility can increase at low levels of consumption – First unit stimulates your desire for more • First unit of food/drinks • Eventually marginal utility declines – Continue consuming • Apply Cost-Benefit Principle – Consume an additional unit as long as the marginal utility (benefit) is greater than the marginal cost • Law of Diminishing Marginal Utility applies – As you buy more of a single good, its marginal utility decreases – When you buy less of that good, its marginal utility increases Marginal Utility • Assume a fixed budget • Decide how much of each good to buy Marginal Utility Spending on Two Goods Budget Allocation • Maximize utility when the marginal utility per dollar spent is the same for all goods • No Money Left On the Table Principle – Current spending has marginal utility of a dollar spent on one good higher than the marginal utility of a dollar spent on the other good – Take a dollar away from the good with low marginal utility and spend it on the good with high marginal utility • Marginal utilities per dollar begin to equalize Sarah's Ice Cream • Budget = $400, Chocolate = $2 per pint, Vanilla = $1 per pint • Buy 200 pints of vanilla and 100 pints of chocolate Vanilla Ice Cream 12 200 Pints/yr MU (utils/ pint) Marginal utility is 12 for vanilla, 16 for chocolate MU per $ for vanilla = 12/1 = 12 MU per $ for chocolate = 16/2 = 8 Buy more vanilla and buy less chocolate MU (utils/ pint) • • • • Chocolate Ice Cream 16 100 Pints/yr Sarah's Next Step Increase vanilla by 100 and reduce chocolate by 50 Marginal utility of vanilla is 8, MU per $ = 8/1 = 8 Marginal utility of chocolate is 24, MU per $ = 24/2 = 12 Buy more chocolate and buy less vanilla Vanilla Ice Cream MU (utils/ pint) MU (utils/ pint) • • • • 12 8 200 Pints/yr 300 24 Chocolate Ice Cream 16 50 100 Pints/yr Sarah's Equilibrium • Optimal combination: highest total utility • 250 pints vanilla; 75 pints chocolate • Marginal utility / price is the same for all goods Vanilla Ice Cream 10 250 Pints/yr MU (utils/ pint) MU (utils/ pint) • Marginal utility of vanilla = 10, MU per $ = 10/1 = 10 • Marginal utility of , chocolate 20, MU per $ = 20/2 = 10 Chocolate Ice Cream 20 75 Pints/yr Sarah's Choices Scenario 1 Vanilla Chocolate Scenario 2 Vanilla Chocolate Scenario 3 Vanilla Chocolate Price Quantity $1 $2 200 100 Price Quantity $1 $2 300 50 Price Quantity $1 $2 250 75 Marginal Utility 12 16 Marginal Utility 8 24 Marginal Utility 10 20 MU / $ 12 8 MU / $ 8 12 MU / $ 10 10 Rational Spending Rule The Rational Spending Rule Spending should be allocated across goods so that the marginal utility per dollar is the same for each good Rational Spending Rule • Rational Spending Rule can be written algebraically • Notation – – – – MUC is the marginal utility from chocolate MUV is the marginal utility from vanilla PC is the price of chocolate PV is the price of vanilla • Rational Spending Rule MUC / PC = MUV / PV • The marginal utility per dollar spent on chocolate equals the marginal utility per dollar spent on vanilla Substitution Effect • When the price of a good goes up, substitutes for that good are relatively more attractive – At the higher price less is demanded because some buyers switch to the substitute good – If the price of vanilla ice cream goes up, some buyers will buy less vanilla and more chocolate Income Effect • Changes in price affect the buyers' purchasing power – Acts like a change in income • Suppose vanilla ice cream goes from $1 per pint to $2 – If Sarah spends all her income $400 on vanilla, the amount she can buy goes down by half. – Real income in terms of vanilla decreases – At the original prices, she could buy 100 pints of vanilla and 150 pints of chocolate • At new price for vanilla, she buys 100 vanilla and only 100 chocolate Rational Spending and Price Changes • Suppose price of vanilla increases from $1 to $2 • At the original equilibrium MUC / PC = MUV / PV • With the increase in PV, MUV / PV < MUC / PC – If Sarah buys more chocolate, MUC will go down – If Sarah buys less vanilla, MUV will go up – To get to a new optimal spending point, • Buy more chocolate • Buy less vanilla • Stop when the marginal utility per dollar is the same Chocolate Ice Cream Price Goes Down • Originally: $400 budget, $1 per pint for vanilla, and $2 per pint for chocolate – What if chocolate is now $1 per pint? • With the decrease in PC, MUV / PV < MUC / PC – If Sarah buys more chocolate, MUC will go down – If Sarah buys less vanilla, MUV will go up – To get to a new optimal spending point, • Buy more chocolate • Buy less vanilla • Stop when marginal utility per dollar is the same Market and Social Welfare • Market is the aggregation of individual consumer demand and producer supply • Consumers and producers are able to acquire welfare from consumption and production of products in the market • Welfare of the society (Economic surplus) is obtained by the sum of the consumers and producers welfare • Economic surplus = Consumer surplus + producer surplus Individual and Market Demand Curves • The market demand is the horizontal sum of individual demand curves – At each possible price, add up the number of units demanded by individuals to get the market demand Smith Jones Market Consumer Surplus • Consumer surplus is the difference between the buyer's reservation price and the market price • With multiple buyers – Find the consumer surplus for each buyer – Add up the individual surplus for each buyer Consumer Surplus on a Graph • When a product is sold in whole units, the demand curve is a stair-step function – If the market supplied only one unit, the maximum price would be $11 • For the second unit, the price is $10, and so on • The last buyer gets no consumer surplus Price 12 11 10 9 8 7 6 Vanilla Ice Cream 5 4 3 2 1 D 2 4 6 8 Units/day 10 12 Consumer Surplus on a Graph • Market price is $6 for all sales • Total consumer surplus • The first sale generates $5 of consumer surplus – Reservation price of $11 minus the price of $6 • Selling the second unit has $4 of consumer surplus, and so on • Total consumer surplus is the area under the demand curve and above market price Price Vanilla Ice Cream 12 11 10 9 8 7 6 5 4 3 2 1 D 2 4 6 8 Units/day 10 12 Consumer Surplus for Milk • Consider the market demand and supply of milk Price ($/liter) – The equilibrium price is $2 per liter – The equilibrium quantity is 4,000 liters per day • Last customer pays his reservation price and gets no consumer surplus S 3.00 2.00 D 1.00 1 2 3 4 5 6 Quantity (000s of liters/day) Consumer Surplus for Milk • Horizontal intercept of demand • Market price • Market quantity – Remember: area of a right triangle is ½ base times height • The area is ½ (4,000 liter)($1) = $2,000 Consumer Surplus 3.00 Price ($/liter) • Price is $2 and quantity is 4,000 liters per day • Consumer surplus is the area of the triangle between: S 2.00 D 1.00 1 2 3 4 5 6 Quantity (000s of liter/day) Reservation Number of Price (¢) Cans (000s) 1 1.5 2 3 6 6 10 13 15 16 Deposit (cents/can) Individual supplier: Harry's Supply Curve 6 3 2 1 6 10 13 16 Recycled cans (100s of cans/day) Individual and Market Supply Curves • Two suppliers: Harry and Barry Deposit (cents/can) Harry’s Supply Curve 1.5 Barry’s Supply Curve Market Supply Curve 6 6 6 3 3 3 2 2 1.5 1 2 1 10 13 16 15 Recycled cans (00s of cans/day) 6 1.5 10 13 16 15 Recycled cans (00s of cans/day) 6 1 0 12 20 26 Recycled cans (00s of cans/day) 32 30 Producer Surplus • Producer surplus is the difference between the market price and the seller's reservation price • Reservation price = Marginal cost which is the supply curve • Producer surplus is the area above the supply curve and below the market price