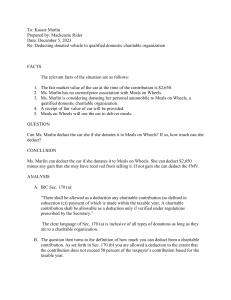

To: Kassie Marlin Prepared by: Mackenzie Rider Date: November 16, 2023 Re: Deducting donated vehicle to qualified domestic charitable organization FACTS The relevant facts of the situation are as follows: 1. The fair market value of the car at the time of the contribution is $2,650. 2. Kassie Marlin has no current/prior association with Meals on Wheels ASSUMPTIONS I have made the following assumptions: 1. A receipt of fair value of car will be provided. 2. Meals on Wheels will use the car to deliver meals. QUESTIONS Can Ms. Marlin deduct the car she donated to Meals on Wheels? ANALYSIS A. The Federal Tax Handbook paragraph which provides secondary authority is: The client inquiry deals with the deductibility of the car she donated to Meals on Wheels, a qualified domestic charitable organization. The Federal Tax Handbook paragraph which deals with this issue is paragraph 2106. B. The primary Code section that deals with this question is: The primary IRC section dealing with this question is section 170A-1. C. The donation of the car is deductible. Client: Kassie Marlin Prepared by: Mackenzie Rider Date: October 10, 2023 IRC: 2 FTH: 2 Tone: 3 Completeness: 2 Relevance: 3 Total: 12/15 1. The Federal Tax Handbook paragraph which provides secondary authority is: The client inquiry deals with the deductibility of the car she donated to Meals on Wheels, a qualified domestic charitable organization. The Federal Tax Handbook paragraph which deals with this issue is paragraph 2106. 2. The primary Code section that deals with this question is: The primary IRC section dealing with this question is section 170A-1. 3. Questions to get the additional facts I will need to respond to this inquiry are: a. Do you have any association with Meals on Wheels other than the donation of your car? (No, she does not.) Reason: If so, does the car really trade hands if you still may be using it. (Question is valid, but reasoning is not.) b. What is the fair market value of the car at the time of the contribution? (The car has a FMV of $2,650.) Reason: This is the measure of the maximum amount that can be deducted Generally on the right track, but missing a few questions. 1. Will they provide a receipt? (Assume they will provide.) 2. Will they use the car or sell it? (Assume they will use it to deliver meals.)