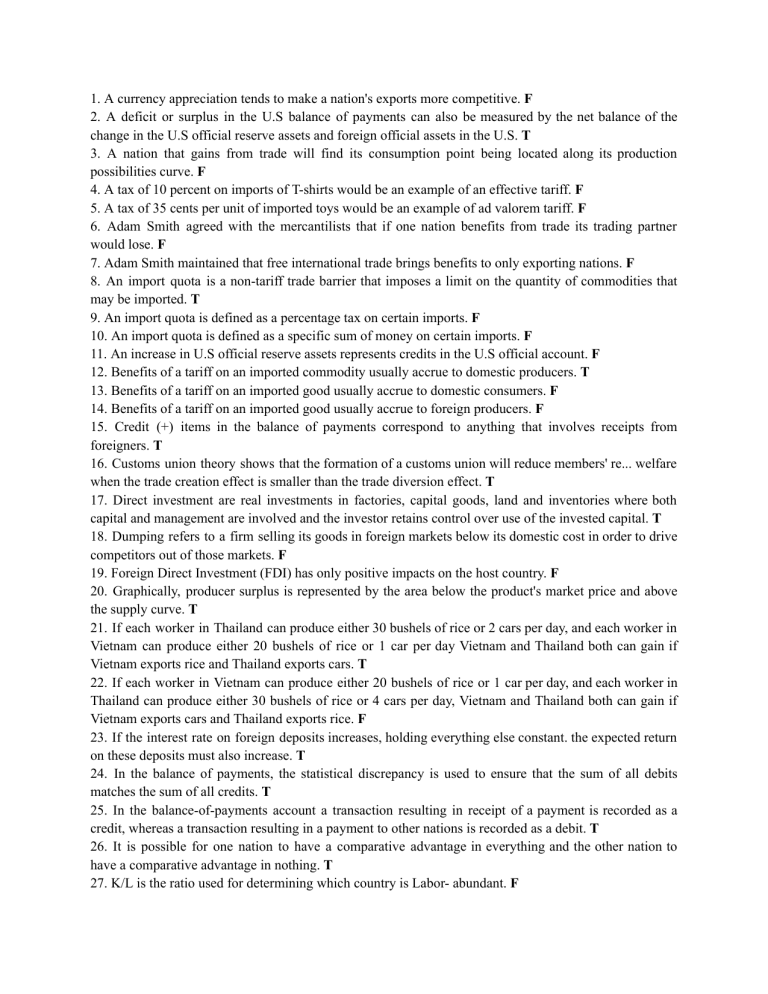

1. A currency appreciation tends to make a nation's exports more competitive. F 2. A deficit or surplus in the U.S balance of payments can also be measured by the net balance of the change in the U.S official reserve assets and foreign official assets in the U.S. T 3. A nation that gains from trade will find its consumption point being located along its production possibilities curve. F 4. A tax of 10 percent on imports of T-shirts would be an example of an effective tariff. F 5. A tax of 35 cents per unit of imported toys would be an example of ad valorem tariff. F 6. Adam Smith agreed with the mercantilists that if one nation benefits from trade its trading partner would lose. F 7. Adam Smith maintained that free international trade brings benefits to only exporting nations. F 8. An import quota is a non-tariff trade barrier that imposes a limit on the quantity of commodities that may be imported. T 9. An import quota is defined as a percentage tax on certain imports. F 10. An import quota is defined as a specific sum of money on certain imports. F 11. An increase in U.S official reserve assets represents credits in the U.S official account. F 12. Benefits of a tariff on an imported commodity usually accrue to domestic producers. T 13. Benefits of a tariff on an imported good usually accrue to domestic consumers. F 14. Benefits of a tariff on an imported good usually accrue to foreign producers. F 15. Credit (+) items in the balance of payments correspond to anything that involves receipts from foreigners. T 16. Customs union theory shows that the formation of a customs union will reduce members' re... welfare when the trade creation effect is smaller than the trade diversion effect. T 17. Direct investment are real investments in factories, capital goods, land and inventories where both capital and management are involved and the investor retains control over use of the invested capital. T 18. Dumping refers to a firm selling its goods in foreign markets below its domestic cost in order to drive competitors out of those markets. F 19. Foreign Direct Investment (FDI) has only positive impacts on the host country. F 20. Graphically, producer surplus is represented by the area below the product's market price and above the supply curve. T 21. If each worker in Thailand can produce either 30 bushels of rice or 2 cars per day, and each worker in Vietnam can produce either 20 bushels of rice or 1 car per day Vietnam and Thailand both can gain if Vietnam exports rice and Thailand exports cars. T 22. If each worker in Vietnam can produce either 20 bushels of rice or 1 car per day, and each worker in Thailand can produce either 30 bushels of rice or 4 cars per day, Vietnam and Thailand both can gain if Vietnam exports cars and Thailand exports rice. F 23. If the interest rate on foreign deposits increases, holding everything else constant. the expected return on these deposits must also increase. T 24. In the balance of payments, the statistical discrepancy is used to ensure that the sum of all debits matches the sum of all credits. T 25. In the balance-of-payments account a transaction resulting in receipt of a payment is recorded as a credit, whereas a transaction resulting in a payment to other nations is recorded as a debit. T 26. It is possible for one nation to have a comparative advantage in everything and the other nation to have a comparative advantage in nothing. T 27. K/L is the ratio used for determining which country is Labor- abundant. F 28. The foreign exchange market is a grouping, by electronic means, of banks and traders who work at banks that conduct foreign exchange trades. T 29. The foreign exchange market is a single gathering place where traders shout buy and sell orders at each other. F 30. The Heckscher-Ohlin theory predicts that a capital-abundant country will export relatively labor intensive products. F 31. The Heckscher-Ohlin theory predicts that a labor-abundant country will export relatively labor-intensive products. T 32. The mercantilists believed that when each nation specializes in the production of the commodity of its absolute advantage and exchanges parts of its output for the commodity of its absolute disadvantage, both nations end up consuming more of both commodities. F 33. The most important type of trade restriction is the tariff in the globalization. T 34. The principal function of foreign exchange markets is the transfer of purchasing power from on nation and currency to another. T 35. The statement "Labor is not moved freely among countries" is one of the theory assumptions on comparative advantage developed by D. Ricardo T 36. The statement "Both nations use the different technology in production" is one of the assumptions of Heckscher-Ohlin theory on the comparative advantage. F 37. The statement "The technology is unchanged" is one of Heckscher-Ohlin's theory assumptions on the comparative advantage. E 38. The theory of purchasing power parity is a theory of how exchange rate are determined in the long run. T 39. The thought on comparative advantage is developed by A. Ricardo. F 40. Under the managed float system of exchange rates, a fall in the market price of a currency is called devaluation. F