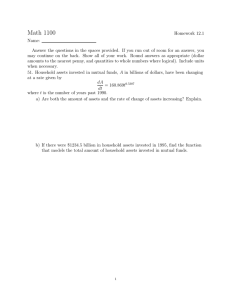

Capital Investment Analysis Review A Company is comparing 2 investment proposals. The company's desired rate of return is 6%. The present value factors for $1 at compound interest of 6% for years 1 through 3 are 0.943, 0.890, and 0.840, respectively. In addition to the foregoing information, use the following data in determining the acceptability in this situation: Year Amount to be invested Project A $426,511 Project B $227,690 Annual Net Cash Flows: 1 2 3 189,000 170,000 151,000 130,000 90,000 65,000 Calculate the following: (round all answers to 2 decimal places) Place your answers on the lines provided and show your work! Project A Cash Payback Period Net Present Value Present Value Index Is the Internal Rate of Return of Project A greater than 6% or less than 6%? How can you tell? Which is the better investment and why? Project B Year 1 2 3 Total Amount to be invested Net present value Year 1 2 3 Total Amount to be invested Net present value 2. Present Value Index = Project A: Project B: Project A Present Value Net Cash Present Value of of $1 at 6% Flow Net Cash Flow 0.943 $189,000 $178,227 0.890 170,000 151,300 0.840 151,000 126,840 $510,000 $456,367 (426,511) $29,856 Project B Present Value Net Cash Present Value of of $1 at 6% Flow Net Cash Flow 0.943 $ 130,000 $122,590 0.890 90,000 80,100 0.840 65,000 54,600 $285,000 $257,290 (227,690) $29,600 Total Present Value of Net Cash Flow Amount to Be Invested $456,367 $426,511 $257,290 $227,690 = 1.07* = 1.13* * Rounded 3. Project B has the largest present value index. Although Project A has the largest net present value, it returns less present value per dollar invested than does Project B, as revealed by the present value indexes (1.13 compared to 1.07).