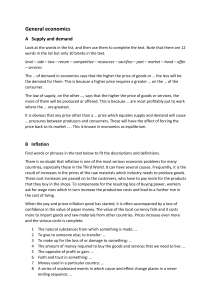

Books Naked Economics Summary Feb 5, 2013 Naked Economics is one of those books that changes the way you see the world. Below I summarize some notes: Chapter 1 - The Power of Markets The free market aligns self interest with improving the overall standard of living for most members of society. Economy is the art of making the most out of life. Economics is the study of how we do that. Economics operates on the assumption that people act to benefit themselves. Maximizing utility does not necessarily mean acting selfishly. Capitalism and communism both ration products. Capitalism uses price while in communism prices are set and products are then allocated on a first come, first serve basis. Utility can be intangible. Intangible utility factors of job opportunities include mental well-being and culture. Decreasing costs, increases demand. As costs increase, demand falls. The average child-per-mother has fallen 45% since 1905. As more professional opportunities become available to women, the costs of having children rise. Firms attempt to maximize profit by taking ‘raw’ materials (steel, knowledge) and combine them in ways that add value. The market economy directs resources to where they can be used most productively. Slight talent advantages can render large profits in large markets. Lebron James’s talents are uniquely suited to outperform others in professional basketball, if only marginally better, he gains an oversized share of the market. Some markets have barriers to entry. Truffles which can only be cultivated from the wild represents a natural barrier while Viagra benefits from patent protection, a legal barrier. Firms consider what is going to make the most money in the long run by employing profit maximization strategies. This includes finding the optimal balance between price and output, as well as charging different customer segments at different rates. Profit inspires some of our greatest work. By innovating to improve our own well-being, we often improve the overall well-being of society. The market it amoral, it does not provide goods that we need but goods that we want. This explains why some of the most talented doctors are performing cosmetic surgery and drug cartels are building one-hundred-foot submarines to traffic drugs. In the market economy, most markets are self-correcting. When OPEC decides to limit the production of oil the response includes: people driving less, buying smaller cars, non-OPEC nations producing more oil and more people researching alternative energy sources. In fixed-price market systems, firms find other ways to compete. The early airline industry which had fixed prices, competed on the basis of providing good food and comfort. Every market transaction makes all parties better off. Firms and consumers act in their own best interest. Workers take unpleasant jobs in sweatshops because it’s the best employment option they have. Behavioral economics studies the intersection of psychology and economics, focusing on how humans make decisions. If a person does not understand the true risk involved in something then they may not be making a rational trade-off. Markets are consistent with human nature and therefore are wildly successful at motivating us to reach our potential. We work much harder when we directly benefit from our work, often yielding significant social gains. Chapter 2 - Incentives Matter People commit crimes because they can make outsized gains relative to the risk. If some firms invest heavily in areas that benefit an entire industry while others in that industry abstain, a free rider problem emerges. The firms who contribute put themselves at a cost disadvantage against their competitors. The tourism industry which includes some agencies who contribute to conservation and others who do not suffer from a free rider problem. Adam Smith noted that “It is not from the benevolence of the butcher, the brewer or the baker that we expect our dinner, but from their regard to their own interest.” Meaning that incentives matter. When we benefit directly from our work, we work harder. In systems that do not rely on markets, personal incentives are usually divorced from productivity. Firms and workers are not rewarded for innovation and hard, nor punished for sloth and inefficiency. Government bankrolled businesses and American public education suffer from personal incentives being divorced from productivity. The pay of teachers is not linked in any way to performance. Whereas in other areas, such as Silicon Valley, if firms do not contribute value to the market, they fail and shut down. The standardized pay of teachers creates a set of incentives referred to as adverse selection. The most talented teachers are likely to be good at other professions where pay is more closely linked to productivity. Studies show that the most talented teachers are the most likely to leave the profession early because incentive structures leads them elsewhere, the least talented teachers incentives are just the opposite. Perverse incentives are inadvertent incentives created when we set out to do something completely different. Also known as the law of unintended consequences. A law in Mexico City once required cars to stay off the road once a week on a rotating basis, using license plate numbers to decide. Policymakers did not anticipate that people would buy new cars and hold on to older cars with poor emissions to continue driving. Good policy directs desired behavior by using incentives while bad policy ignores incentives or fail to predict how individuals might change their behavior to avoid being penalized. A principal agent problem emerges when a principal (such as a firm) employs an agent (such as an employee) who has an incentives to do things that are not necessarily in the best interest of the principal. Executives may be incentivized to boost short term gains while she/he can exercise her stock options. The challenge is to reward good outcomes without creating incentives for employees to game the system in ways that damage the company in the long run. Economics teaches us how to get the incentives right. Rational individuals acting in their own best interest can make themselves worst off. Fishermen who hunt without constraint can deplete a fish population. The only incentive is to kill as many fish as they can when no one trusts anyone else to practice constraint. A market economy rewards winners and crushes losers. The steam engine, spinning wheel, and telephone put an end to the blacksmith, seamstress and telegraph operator, respectively. In a market economy, creative destruction must happen. Government intervention to minimize the pain inflicted by competition slows the process of creative destruction. American automakers could have been made stronger in the long run if they faced foreign competition head-on instead of seeking political protection from Japanese imports in the 70s and 80s. Taxes provide incentive to avoid or reduce activity that is taxed. Raising taxes to provide generous benefits to disadvantaged Americans can simultaneously discourage the kinds of productive investments that might make them better off. Scandinavia has seen high marginal tax rates contribute to growing black market economies. Economists tend to favor taxes which are broad, simple and fair. Deadweight loss refers to taxes which make individuals worse off without making anyone else better off. Regressive taxes are those which fall more heavily on the poor than the rich. Chapter 3 - Government and the Economy Externalities refer to the the private and social costs of one’s behavior being different. When there’s a a huge gap between the private and social costs of behavior then people have an incentive to do things to make themselves better off at the expense of others. The market “fails” to correct this. Although all parties involved in a transaction perform exchanges to make themselves better off, all parties affected by the transaction may not be involved which generates an externality. Companies contributing to global warming and fast food’s impact on nationwide health care costs generate externalities. Positive externalities can have a positive impact on society without a firm or individual being fully compensated for it. Consider a businesses which initiates an economic revitalization in a neighborhood. Governments regulate activities which cause externalities by sometimes taxing the offending behavior rather than banning it. Private costs of driving an SUV do not reflect the social costs. A gas-guzzler tax would limit the behavior. It could be used to pay for some of the costs of global warming and encourage automakers to make more fuel-efficient cars. Every activity generates an externality at some level. Markets left alone fail to close the gap between the private and social costs of activities. Research shows that parties involved in an externality have an incentive to come to private agreements of their own. Government makes a market economy possible through measures such as defining and protecting property rights, yielding confidence in behavior such as investing in your property and expecting to make a return. Authors and musicians produce work with confidence that it will be protected and they can benefit from it. Pharmaceutical companies invest millions in research and development with confidence that a patent will protect their discovery and enable them to profit from their efforts. Government lowers the cost of doing business by circulating currency, providing infrastructure, providing oversight with organizations such as the SEC to enable confidence that companies and traders are not engaging in fraud. Inefficient governments stifle efficient market operations. Government provides public goods. Public goods are considered things that would make us better off but would not otherwise be provided by the private sector. Any system of voluntary payments falls victim to free riders. Government policies that ostensibly serve the poor can be ineffective and/or counterproductive if they damage the broader economy. Chapter 4 - Government and the Economy II Government can deal with significant externalities or regulate an economy into ruin. Government is a monopoly wherein people only have one option when it comes to things such as the Department of Motor Vehicles.There’s little or no incentive for these organizations to operate efficiently. Given the incentive structure, inefficient government operations are completely logical. The government should not be the sole provider of a good or service unless there is a compelling reason to believe that the private sector will fail in that role. Suitable areas include public health, national defense. Governments that run steel mills, coal mines, banks, and airlines lose the benefits of competition. Citizens are made worse off. The private sector allocates resources where they will earn the highest return while governments allocate resources wherever the political process sends them. When government funds are directed by lobbyists the economy does not develop as quickly or efficiently because credit is channeled away from worthwhile projects. Every regulation carries a cost. Sometimes it’s worth it, sometimes not. Regulation can disturb the movement of capital and labor, raise the cost of good and services, inhibit innovation and otherwise shackle the economy. This can all result from regulations with good intentions. At worst, regulation can become a powerful tool for self-interest as firms work the political system to their own benefit. Studies show that compliance in nations with heavy regulation is lower, while the regulation does not reduce pollution or raise health levels. Taxation can discourage productive behavior, in cases where the marginal tax rate on income is 50%, many individuals decide not to work. In this case, everyone is worst off. Taxation can discourage investment. Taxes make investments less attractive because they are a cost. The higher the tax on investments, the less attractive they become. Government has the potential to enhance the productive capacity of the economy and make us much better off as a result. The notion that smaller government is always better is simply wrong. Chapter 5 - Economics of Information Statistical discrimination aka “rational discrimination,” takes place when an individual makes an inference that is defensible based on broad statistical patterns but (1) is likely to be wrong in the specific case at hand; and (2) has a discriminatory effect on some group. Statistical discrimination includes assuming that a female candidate wants a family, will take maternity leave, and may leave shortly after taking leave. Statistical discrimination also includes assuming that a black applicant has served time in prison because blacks are more likely to have been sent to prison than whites (28% vs. 4%). Ways to solve these rational discrimination issues includes: (1) Structuring maternity leave to be paid back if an employee leaves within a certain period of time and (2) doing background checks on all applicants. This helps both parties because the information is now known and statistical discrimination is alleviated, if that was all there was at hand. Markets tend to favor the party that knows more but if the imbalance of information becomes too large then markets can break down entirely. More than anything else, McDonald’s sells predictability. Branding solves a problem for consumers regarding concerns such as quality and safety. Branding helps provide an element of trust that is necessary for a complex economy to function. Modern business requires that we conduct major transactions with people whom we’ve never met before. Producers of branded goods create a monopoly for themselves—and price their products accordingly—by persuading consumers that their products are like no other. Firms will do whatever they can to “signal” their own quality to the market. Racial profiling is an information problem. Information matters. Economists study what we do with it, and, sometimes more important, what we do without it. Chapter 6 - Productivity and Human Capital Human capital is the sum total of skills embodied within an individual including education, intelligence, charisma, creativity, work experience, entrepreneurial vigor, even the ability to throw a baseball fast. It is what you would be left with if someone stripped away all of your assets and left you on a street corner with only the clothes on your back. The labor market is no different from the market for anything else, some kinds of talent are in greater demand than others. The more nearly unique a set of skills, the better compensated their owner will be. The price of a certain skill bears no inherent relation to its social value, only its scarcity. The most insightful way to think about poverty, in this country or anywhere else in the world, is as a dearth of human capital. People are poor in America because they cannot find good jobs. But that is the symptom, not the illness. The underlying problem is a lack of skills, or human capital. Human capital also embodies perseverance, honesty, creativity—virtues that lend themselves to finding work. Highly skilled workers are more mobile than their low-skilled peers. The lump of labor fallacy is the mistaken belief that there is a fixed amount of work to be done in the economy and every new job must come at the expense of a job lost somewhere else. Rising levels of human capital enabled an agrarian nation to evolve into places as rich and complex as Manhattan and Silicon Valley. Technology displaces workers in the short run but does not lead to mass unemployment in the long run. High levels of human capital leads to well-educated parents who invest heavily in the human capital of their children. Low levels of human capital have just the opposite effect. Human capital is inextricably linked to one of the most important ideas in economics: productivity. Productivity is the efficiency with which we convert inputs into outputs. The more productive we are, the richer we are. The day will always be twenty-four hours long; the more we produce in those twenty-four hours the more we consume, either directly or by trading it away for other stuff. America is rich because Americans are productive. We are better off today than at any other point in the history of civilization because we are better at producing goods and services than we have ever been. We work less and produce more. In 1870, the typical household required 1,800 hours of labor just to acquire its annual food supply; today, it takes about 260 hours of work. Productivity growth is what improves our standard of living. If 500 million people in India became more productive and moved from poverty to the middle class, we would become richer in America too. Poor villagers subsisting on $1 a day cannot afford to buy our software, our cars, our music, our books, our agricultural exports. If they were wealthier, they could. Productivity growth depends on investment in physical capital, human capital, research and development, and things like more effective government institutions. Investments require that we give up consumption in the present in order to be able to consume more in the future. High taxes, bad government, poorly defined property rights, or excessive regulation can diminish or eliminate the incentive to make productive investments. The large productivity gains of the Industrial Revolution made parents’ time more expensive. As the advantages of having more children declined, people began investing their rising incomes in the quality of their children, not merely the quantity. One of the most potent weapons for fighting population growth is creating better economic opportunities for women, which starts by educating girls. Technology makes smart workers more productive while making low-skilled workers redundant. The growing wage gap between high school and college graduates will motivate many students to get college degrees. The spectacular wealth earned by entrepreneurs provides an incentive to take the risks necessary for leaps in innovation, many of which have huge payoffs for society. Economics is about incentives, and the prospect of getting rich is a big incentive. Many economists argue that we should not care about the gap between rich and poor as long as everybody is living better. Economic development is not a zero-sum game. The world does not need poor countries in order to have rich countries, nor must some people be poor in order for others to be rich. Economics tells us that there is no theoretical limit to how well we can live or how widely our wealth can be spread. Human capital creates opportunities. It makes us richer and healthier. It enables us to live better while working less. Human capital separates the haves from the have-nots. Marvin Zonis noted that “Complexity will be the hallmark of our age. The demand everywhere will be for ever higher levels of human capital.” Chapter 7 - Financial Markets All financial instruments are based on four simple needs which include: Raising Capital Storing, protecting, making profitable use of excess capital Insuring against risk Speculation Index funds are far cheaper to manage than individual stocks. Basic economics provides us with a basic set of rules to which decent investment advice must conform: Save. Invest. Repeat Capital is scarce. This is the only reason that any kind of investing yields returns. The more you save and the sooner, the more rent you can command from the financial markets. Albert Einstein is said to have called compound interest the greatest invention of all time. Take Risk, earn reward Riskier investments must offer a higher expected return in order to attract capital. Diversify A well-diversified portfolio will significantly lower the risk of serious losses without lowering your expected return. Invest for the long run The odds are stacked in your favor if you are patient and willing to endure the occasional setback. Chapter 8 - The Power of Organized Interests When it comes to interest group politics, it pays to be small. All else equal, small, well-organized groups are most successful in the political process because the costs of favors they get from the system are spread over a large, unorganized segment of the population. The benefits of a $7 billion tax subsidy are bestowed on a small group of farmers, making it quite lucrative for each one of them. The costs are spread over the remaining 98 percent of us. A tax shelter is some kind of investment or behavior that would not make sense in the absence of tax considerations. Capitalism as a process of incessantly destroying the old structure and creating a new one. If policies aimed at protecting weak outdated technologies prevail, they slow the economy. Two percent who care deeply about something are a more potent political force than the 98 percent who feel the opposite but aren’t motivated enough to do anything about it. Chapter 9 - Keeping Score GDP represents the total value of all goods and services produced in an economy. Real GDP is adjusted to account for inflation. If nominal GDP climbs 10 percent in 2012 but inflation is also 10 percent, nothing more has actually been produced. GDP per capita is GDP divided by a nation’s population. “Making money takes time, so when we shop, we’re really spending time. The real cost of living isn’t measured in dollars and cents but in the hours and minutes we must work to live.” Recessions stem from some shock to the economy When consumers sustain a shock to their income, they spend less, which spreads the economic damage. My decision to curtail my advertising budget or to buy a car next year instead of this year—may cost you your job, which will in turn hurt my business! Indeed, if we all believe the economy is likely to get worse, then it will get worse. And if we all believe it will get better, then it will get better. Our decision to spend or not to spend is conditioned on our expectations which can quickly become self-fulfilling. Recessions may be good for long-term growth because they purge the economy of less productive ventures. The government can stimulate the economy by cutting taxes. Vital signs of any economy: Unemployment Poverty Roughly one in five American children is poor as are nearly 35 percent of black children. Income inequality Economists have a tool that collapses income inequality into a single number, the Gini index. Size of the government Budget deficit and surplus Current Account surplus/deficit National Savings Demographics American workers pay into Social Security, that money is used to pay current retirees. The program a pyramid scheme, it works as long as there are enough workers on the bottom to continue paying the retirees at the top. Total national happiness Chapter 10 - The Federal Reserve An “easy money” policy at the Fed can cause consumers to demand more than the economy can produce. The only way to ration that excess demand is with higher prices. The result is inflation. There are only a handful of ways to increase the amount that we can produce more: Work longer hours. Add new workers Add machines and other kinds of capital that help us to produce things. Produce more with what we already have because of an innovation or a technological change. The Fed must facilitate a rate of economic growth that is neither too fast nor too slow. To economists, money is quite distinct from wealth. Wealth consists of all things that have value including houses, cars, commodities, and human capital. Money, a tiny subset of that wealth, is merely a medium of exchange, something that facilitates trade and commerce. Money serves as a means of exchange and unit of account so that the cost of all kinds of goods and services can be measured and compared using one scale. The value of modern currency is that it has purchasing power. Dollars have value because people peddling things will accept them. They accept them because they are confident that other people peddling other real things will accept them, too. A dollar is a piece of paper whose value derives solely from our confidence that we will be able to use it to buy something we need in the future. Inflation means that average prices are rising. The way to think about inflation is not that prices are going up, but that the purchasing power of the dollar is going down. A dollar buys less than it used to. With hyperinflation, fixed-rate loans become impossible because no financial institution will agree to be repaid a fixed quantity of money when that money is at risk of becoming worthless. Moderate inflation can eat away at our wealth if we do not manage our assets properly. Any wealth held in cash will lose value over time. Unexpected bouts of inflation are good for debtors and bad for lenders. Difference between real and nominal interest rates: A nominal rate is used to calculate what you have to pay back, the number you see posted on the bank window. A real interest rate takes inflation into account and reflects the true cost of renting capital. The greater the fear of inflation, the bigger the buffer that will be place in a nominal rate. Inflation is bad. Deflation, steadily falling prices, is much worse. Falling prices cause consumers to postpone purchases. Prices are falling because the economy is depressed, now the economy is depressed because prices are falling. Chapter 11 - International Economics International transactions must still make all parties better off. A government that deliberately keeps its currency undervalued is taxing consumers of imports and subsidizing producers of exports. An overvalued currency does the opposite, making imports artificially cheap and exports less competitive with the rest of the world. A single currency across Europe (and in the fifty states) reduces transaction costs and promotes price transparency. As a nation, we are literally doing what economists call “dissaving.” The goal of global economic policy should be to make it easier for nations to cooperate with one another. The better we do it, the richer and more secure we will all be. Chapter 12 - Trade and Globalization A modern economy is built on trade. We pay others to do or make things that we can’t or choose not to, usually because we have something better to do with our time. Our standard of living is high because we are able to focus on the tasks that we do best and trade for everything else. When different countries are better at producing different things, they can both consume more by specializing at what they do best and then trading. Countries are poor because they are not productive. Productivity is what makes us rich. Specialization is what makes us productive. Trade allows us to specialize. Cutting off trade leaves a country poorer and less productive, which is why we tend to do it to our enemies. Economists reckon that the tariffs on Brazilian oranges and juice limit the supply of imports and therefore add about 30 cents to the price of a gallon of orange juice. Zero-sum thinking is usually wrong when it comes to economics. Individuals do things that make themselves better off. Workers willing to accept a dollar or two a day because it is better than any other option they have. If sweatshops paid decent wages by Western standards, they would not exist. Chapter 13 - Development Economics With less hardship, you have less incentive to help yourself. Human capital is what makes individuals productive, and productivity is what determines our standard of living. All countries that have had persistent growth in income have also had large increases in the education and training of their labor forces. Higher rates of education for women in developing countries are associated with lower rates of infant mortality. Skills are what matter for individuals and for the economy as a whole. Skilled workers usually need other skilled workers in order to succeed. Those who do become skilled find that their talents are more valuable in a region or country with a higher proportion of skilled workers, creating “brain drain.” Not being open to trade is done at great cost. Open economies grow faster than closed economies. Poor countries, like poor people, often have very bad habits. Epilogue - Life in 2050 Productivity growth gives us choices. We can continue to work the same amount while producing more, produce the same amount by working less, or strike some balance. The easiest and most effective way to get something done is to give the people involved a reason to want it done. Although we recognize this as obvious, many of our policies are designed in ways that do the opposite. Our public school system that does not reward teachers and principals when their students do well or punish them when their students do poorly. Markets don’t solve social problems on their own. If we design solutions with the proper incentives, its a lot more like rowing downstream. Overborrowing always ends badly, whether for an individual, a company, or a country. During the first decade of the new millennium, three parties borrowed heavily: consumers, financial firms, and the U.S. government. So far, two have paid a huge price for that leverage. Economics offers insight into areas such as wealth, poverty, gender relations, the environment, discrimination, politics and many more. Naked Economics has given me a greater understanding economics, human nature and the world in general. This book is definitely worth your time.