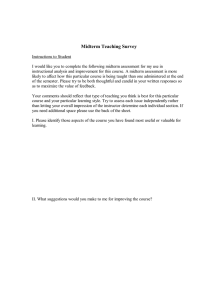

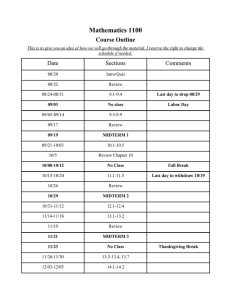

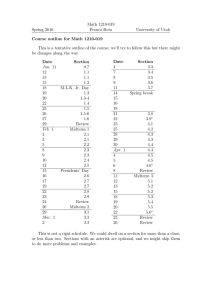

Micro-Founded Models Firm Decisions Consumer Decisions Midterm EC 2220: Lecture 4 Static Model Consumers and Firms Baxter Robinson University of Western Ontario September 2023 1 Micro-Founded Models Firm Decisions Topics Consumer Decisions 1 Introduction to Macroeconomics Williamson Text Chapters 1,2,3 2 3 Economic Growth Agriculture (Malthus) and Capital (Solow) Convergence and Human Capital Chapter 7 Chapter 8 4 5 Static Model Consumers and Firms Governments and Labour Market Equilibrium Chapter 4 Chapter 5 6 7 Dynamic Model Consumption-Savings Imperfect Credit Markets Chapter 9 Chapter 10 8 Investment and General Equilibrium Chapter 11 Midterm 2 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Lecture 4: Static Model Consumers and Firms • Micro-Founded Models • Firm Decisions: ▶ Hire Labour ▶ Graphical Approach ▶ Mathematical Approach • Consumer Decisions: ▶ ▶ ▶ ▶ ▶ Indifference curves Budget constraints Graphical Approach Mathematical Approach Exercises 3 Micro-Founded Models Firm Decisions Consumer Decisions Midterm What We Have Done So Far • Lectures 2 and 3: Three Simple Models of Economic Growth ▶ Malthusian Model ▶ Solow Model ▶ Human Capital Model • Assignment: Comparing theories of economic growth to data • These models were limited in many ways ▶ People behaved a certain way by assumption 4 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Models without Decisions • In all the models so far, we have assumed how people behaved ▶ Malthusian: Assumed how population grows ▶ Solow: Assumed how much people saved ▶ Human Capital: Assumed how much people invested in education • What if we could model these decisions? ▶ Malthusian: Have people decide how the population grows ▶ Solow: Decide how much to save and how much to spend ▶ Human Capital: Decide how much to invest in education 5 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Models with Decisions • In the real world people make these decisions based on incentives ▶ Need models of these incentives and decisions • Micro-Founded Models ▶ Individual agents will make individual decisions ▶ Microeconomics studies these decisions and can help inform ▶ Study how these decisions will change macroeconomic aggregates 6 Micro-Founded Models Firm Decisions Consumer Decisions Midterm A Micro-Founded Theory of Decision Making • Agents have some goal they are trying to maximize ▶ Firms try to maximize profits ▶ People try to maximize their utility • They may be subject to some constraints: ▶ Firms can only produce so much output given their inputs ▶ People can only afford so many goods • We can embed these preferences and constraints in an optimization problem 7 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Why Are Micro-Founded Models Useful? • Is this a perfect description of how people actually behave? ▶ No! People are much more complicated ▶ Not possible to perfectly predict • Is this more useful than just assuming how they react? ▶ Yes! ▶ We can think about how people will respond to changes in: • Government policy • Economic shock 8 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Micro-Founded Models in this Course • Static Model: One time period ▶ Lecture 4 and 5 ▶ Workers and Firms ▶ Labour Market Equilibrium • Dynamic Model: Multiple time periods ▶ Consumers saving ▶ Lecture 6, and 7 • Investment Model ▶ Firm investing ▶ General Equilibrium ▶ Lecture 8 9 Micro-Founded Models Firm Decisions Topics Consumer Decisions 1 Introduction to Macroeconomics Williamson Text Chapters 1,2,3 2 3 Economic Growth Agriculture (Malthus) and Capital (Solow) Convergence and Human Capital Chapter 7 Chapter 8 4 5 Static Model Consumers and Firms Governments and Labour Market Equilibrium Chapter 4 Chapter 5 6 7 Dynamic Model Consumption-Savings Imperfect Credit Markets Chapter 9 Chapter 10 8 Investment and General Equilibrium Chapter 11 Midterm 10 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Lecture 4: Static Model Consumers and Firms • Micro-Founded Models • Firm Decisions: ▶ Hire Labour ▶ Graphical Approach ▶ Mathematical Approach • Consumer Decisions: ▶ ▶ ▶ ▶ ▶ Indifference curves Budget constraints Graphical Approach Mathematical Approach Exercises 11 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Firm Decisions Intuition • Firms are going to choose how many workers to hire ▶ More workers means more output ▶ More workers means higher wage bills • Firms are going to have a fixed stock of capital ▶ Later: Firms will choose the level of capital stock • Firms choose how much labour to hire in order to maximize profits 12 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Firm Decisions • Production function Y = zF (K , N) ▶ Y is the firm’s output ▶ z is total factor productivity ▶ K is capital ▶ N is labour • MPK = ∂Y ∂K is the marginal product of capital • MPN = ∂Y ∂N is the marginal product of labour 13 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Properties of the Production Function: Monotone Production Function, Fixing the Quantity Production Function, Fixing the Quantity More inputs produces more output of of Capital and Varying the Quantity of of Labor and>Varying the Quantity • MP 0 K Labour Capital • MP > 0 N Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 5-31 Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 145-30 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Properties of the Production Function: Decreasing Marginal Products Production Function, Fixing the Quantity Production Function, Fixing the Quantity Adding more of one input produces less the more of that input you have of(holding Capital and Varying the Quantity of of Labor and Varying the Quantity of • MP decreases as K increases N ∗ constant) K Capital • MPN decreases as N increasesLabour (holding K ∗ constant) Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 5-31 Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 15 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Properties of the Production Function: Complements The marginal product of a factor Adding increasesCapital with theIncreases quantity ofthe the Marginal other factor Marginal Product of Labor Schedule for Product of Labor • MPN increases as K increases he Representative Firm • MPK increases as N increases Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 16 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Firm’s Optimization Problem • Firms are trying to maximize their profits • Static Model: K is fixed • Perfect Competition ▶ Firm is a price taker: wage w is given • Monopsony (Future courses) ▶ Firm is a price maker: wage w is chosen • Profits: π = zF (K , N) − wN 17 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Profit Maximization: Perfect Competition Assume perfect competition: Only choice is N π = zF (K , N) − wN Two methods for finding the optimal level of N • Solve this graphically • Solve this mathematically 18 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Profit Maximization: Graphical Approach 500 450 400 350 300 250 200 150 100 50 0 0 10 20 30 40 50 60 70 80 90 100 19 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Profit Maximization: Graphical Approach 500 450 400 350 300 250 200 150 100 50 0 0 10 20 30 40 50 60 70 80 90 100 20 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Profit Maximization: Graphical Approach 500 450 400 350 300 250 200 150 100 50 0 0 10 20 30 40 50 60 70 80 90 100 21 Micro-Founded Models Firm Decisions Consumer Decisions Revenue, Variable Costs, and Profit Profit Maximization: Approach MaximizationGraphical Midterm • MPN = w • Graphical representation 22 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Profit Maximization: Mathematical Approach Assume perfect competition: Only choice is N π = zF (K , N) − wN • The derivative tells us how profits changes when the firm changes the number of workers ∂π = MPN − w ∂N • The Marginal Product of Labour (MPN ) is the amount of output we can get from more labour • The wage w is the cost to hire more labour 23 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Profit Maximization: Mathematical Approach • If MPN − w > 0 ▶ Additional workers will produce more than the wage cost ▶ Want to hire more workers • If MPN − w < 0 ▶ The last worker produces less than the wage cost ▶ Want to hire fewer workers • If MPN − w = 0 ▶ The last worker produces the exact same as the wage cost ▶ Want to hire exactly this many workers! ▶ “Slope of the two function must be equal at the optimum” • MPN is the slope of the production function • w is the slope of the wage bill 24 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Profit Maximization: Mathematical Approach General Mathematical Approach: • Determine the objective function: The function you want to maximize ▶ Here the profit function • Take the derivative of the objective function w.r.t. each choice made ▶ Here the only choice is the number of workers • Set the derivative of the objective function equal to zero ▶ MPN − w = 0 =⇒ MPN = w • Double check the optimum that you have found is a maximum ▶ Check second order condition (the second derivative) 25 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Profit Maximization Example Consider a firm that produces with a Cobb-Douglas Production function: Y = zK α N 1−α Assume z = 2, K = 4, α = 21 , and w = 0.5 Solve for the profit-maximizing number of workers to hire 26 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Profit Maximization Example π =zK α N 1−α − wN ∂π =z(1 − α)K α N −α − w ∂N 0 =z(1 − α)K α N −α − w wN α =z(1 − α)K α z(1 − α)K α Nα = w 1 z(1 − α)K α α N= w 1 1 1 2(1 − 12 )4 2 2 N = 0.5 N =16 27 LaborModels Demand Micro-Founded Curve Firm Decisions of the Profit-Maximizing Firm Consumer Decisions Midterm Labour Demand 28 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Limitations of this Model of Firm Decisions What is this model missing? • No differences in the quality or type of labour • Investment in the capital stock • Market Power What is this model useful for? • Think about firm decisions are affected by changes in: ▶ Wages ▶ Taxes 29 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Lecture 4: Static Model Consumers and Firms • Micro-Founded Models • Firm Decisions: ▶ Hire Labour ▶ Graphical Approach ▶ Mathematical Approach • Consumer Decisions: ▶ ▶ ▶ ▶ ▶ Indifference curves Budget constraints Graphical Approach Mathematical Approach Exercises 30 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Consumer Decisions Intuition A representative consumer: • values consumption and leisure • works and receives a wage • takes time off and enjoys their leisure • pays taxes • receives dividends Question: How does the consumer decide how much to work? How much to consume? 31 Micro-Founded Models Firm Decisions Consumer Decisions Midterm A Utility Function to Represent Preferences U(c, ℓ) • c is consumption of goods and services • ℓ is any time spent enjoying leisure • (c1 , ℓ1 ) is a consumption bundle. • U(c1 , ℓ1 ) > U(c2 , ℓ2 ) ⇒ individual strictly prefers (c1 , ℓ1 ) to (c2 , ℓ2 ). • U(c1 , ℓ1 ) = U(c2 , ℓ2 ) ⇒ individual indifferent between both consumption bundles. 32 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Indifference Curve Definition: An indifference curve connects a set of points, representing consumption bundles, Indifference Curves among which the consumer is indifferent. Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Educa8on Canada 5-5 - Monotone: the more, the better ▶ Implies indifference curves will slope down - Convex: prefers averages to extremes 33 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Strict vs. Weak Monotonicity and Convexity • Strictly monotone: More is always better ▶ ∂U(·) ∂c >0 • Weakly monotone: More is at least as good ▶ ∂U(·) ∂c ≥0 • Strictly convex: Averages are always preferred 2 ℓ1 +ℓ2 ▶ U(c1 , ℓ1 ) = U(c2 , ℓ2 ) < U( c1 +c 2 , 2 ) • Weakly convex: Averages are at least as good 2 ℓ1 +ℓ2 ▶ U(c1 , ℓ1 ) = U(c2 , ℓ2 ) ≤ U( c1 +c 2 , 2 ) 34 Micro-Founded Models Firm Decisions Consumer Decisions Midterm The Marginal Rate of Substitution (MRS) The rate at which you would exchange two goods and remain indifferent • ∂U(·) ∂c = the marginal utility of consumption = MUc = Uc (c, ℓ) • ∂U(·) ∂ℓ = the marginal utility of leisure = MUℓ = Uℓ (c, ℓ) • MRSℓ,c at point (c0 , ℓ0 ) MRSℓ,c = ∂U(·) ∂ℓ ∂U(·) ∂c = MUℓ MUc • The MRSℓ,c is the negative of the slope of the indifference curve at a particular consumption bundle (c0 , ℓ0 ). 35 Micro-Founded Models Firm Decisions Consumer Decisions Properties of Indifference Curves Midterm The Marginal Rate of Substitution (MRS) Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Educa8on Canada 5-6 • Convex: diminishing MRSℓ,c 36 Micro-Founded Models Firm Decisions Consumer Decisions Midterm The Time Constraint • The consumer has a fixed amount of time h • The consumer can choose to spend this time: ▶ Working N s ▶ Enjoying leisure ℓ h = ℓ + Ns 37 Micro-Founded Models Firm Decisions Consumer Decisions Midterm The Budget Constraint • w : Wage per unit of time ▶ Consumer is a price taker: Cannot choose wage ▶ Units of consumption good • π: Dividends ▶ Profits of the firm • T : Taxes • c: Consumption c = wN s + π − T 38 Micro-Founded Models Firm Decisions Consumer Decisions Midterm The Budget Constraint c = wN s + π − T c = w (h − ℓ) + π − T c = −w ℓ + wh + π − T • w , π, T , and h are all given • c and ℓ are chosen • dc dℓ = −w ; The slope of the budget line ▶ This is the rate at which the labour market will transform leisure into consumption • ↑ ℓ ⇒↓ c and ↓ ℓ ⇒↑ c 39 Micro-Founded Models Firm Decisions Consumer Decisions The BudgetRepresentative Constraint: (π − T ) <Consumer’s 0 Midterm Budget Constraint (T > π) c = −w ℓ + wh + π − T 40 Micro-Founded Models Firm Decisions TheRepresentative Budget Constraint: Consumer’s (π − T ) > 0 Constraint (T < π) Consumer Decisions Budget Midterm c = −w ℓ + wh + π − T 41 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Lecture 4: Static Model Consumers and Firms • Micro-Founded Models • Firm Decisions: ▶ Hire Labour ▶ Graphical Approach ▶ Mathematical Approach • Consumer Decisions: ▶ ▶ ▶ ▶ ▶ Indifference curves Budget constraints Graphical Approach Mathematical Approach Exercises 42 Decisions Consumer Firm Optimization Micro-Founded Models Consumer Decisions Midterm Consumer Optimization: Graphical Approach Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Educa8on Canada 1. Point J: inside the budget set ⇒ cannot be optimal 5-16 ▶ You can afford more ▶ Monotone preferences: You prefer more of both goods 43 Decisions Consumer Firm Optimization Micro-Founded Models Consumer Decisions Midterm Consumer Optimization: Graphical Approach Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Educa8on Canada 2. Point F : MRSℓ,c > w 5-16 ▶ You are willing to give up more consumption for a unit of leisure than your wage ▶ E.g. MRSl,c = 2 and w = 1 44 Decisions Consumer Firm Optimization Micro-Founded Models Consumer Decisions Midterm Consumer Optimization: Graphical Approach Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Educa8on Canada 3. Point E : MRSℓ,c < w 5-16 ▶ You are willing to give up less consumption for a unit of leisure than your wage ▶ E.g. MRSl,c = 0.5 and w = 1 45 Decisions Consumer Firm Optimization Micro-Founded Models Consumer Decisions Midterm Consumer Optimization: Graphical Approach Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Educa8on Canada 4. Point H: MRSℓ,c = w ; this is optimal. 5-16 ▶ The amount of consumption you are willing to give up is exactly equal to your wage ▶ E.g. MRSℓ,c = 1 and w = 1 46 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Lecture 4: Static Model Consumers and Firms • Micro-Founded Models • Firm Decisions: ▶ Hire Labour ▶ Graphical Approach ▶ Mathematical Approach • Consumer Decisions: ▶ ▶ ▶ ▶ ▶ Indifference curves Budget constraints Graphical Approach Mathematical Approach Exercises 47 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Consumer Optimization: Setting Up the Mathematical Approach • Preferences: U(c, ℓ) • Budget constraint: c = −wl + wh + π − T • What c and ℓ will maximize preferences? ▶ c = ∞ and ℓ = h will maximize preferences ▶ But this is unaffordable: it violates the budget constraint • Question: How can we choose c and ℓ to maximize preferences while making sure the budget constraint holds? 48 Micro-Founded Models Firm Decisions Consumer Decisions Midterm General Constrained-Optimization Problem max f (x1 , x2 ) = x1 x2 x1 ,x2 subject to x1 + 4x2 = 16 where: • f (x1 , x2 ) is the objective function • x1 + 4x2 = 16 is the constraint • x1 , x2 are the choice variables 49 Micro-Founded Models Firm Decisions Consumer Decisions Midterm General Constrained-Optimization Problem: Lagrangian Construct and maximize the Lagrangian function: max L = x1 x2 − λ(x1 + 4x2 − 16) x1 ,x2 ,λ • Lagrangian gives us the ability to maximize the objective function ▶ While also penalizing us for exceeding the constraint • λ is the Lagrange multiplier ▶ It tells us how much larger the objective function would be if we could relax the constraint 50 Micro-Founded Models Firm Decisions Consumer Decisions Midterm General Constrained-Optimization Problem The necessary first-order conditions (FOC) are: ∂L • ∂x =0 1 • ∂L ∂x2 =0 • ∂L ∂λ =0 51 Micro-Founded Models Firm Decisions Consumer Decisions Midterm General Constrained-Optimization Problem max L = x1 x2 − λ(x1 + 4x2 − 16), x1 ,x2 ,λ 52 Micro-Founded Models Firm Decisions Consumer Decisions Midterm General Constrained-Optimization Problem max L = x1 x2 − λ(x1 + 4x2 − 16), x1 ,x2 ,λ • ∂L ∂x1 = x2 − λ = 0 ▶ λ = x2 52 Micro-Founded Models Firm Decisions Consumer Decisions Midterm General Constrained-Optimization Problem max L = x1 x2 − λ(x1 + 4x2 − 16), x1 ,x2 ,λ • ∂L ∂x1 = x2 − λ = 0 ∂L ∂x2 = x1 − 4λ = 0 ▶ λ = x2 • ▶ λ = 14 x1 52 Micro-Founded Models Firm Decisions Consumer Decisions Midterm General Constrained-Optimization Problem max L = x1 x2 − λ(x1 + 4x2 − 16), x1 ,x2 ,λ • ∂L ∂x1 = x2 − λ = 0 ∂L ∂x2 = x1 − 4λ = 0 ▶ λ = x2 • ▶ λ = 14 x1 • ∂L ∂λ = −(x1 + 4x2 − 16) = 0 ▶ x1 + 4x2 = 16 52 Micro-Founded Models Firm Decisions Consumer Decisions Midterm General Constrained-Optimization Problem From the first two: 1 x2 = λ = x1 4 Substituting in to the third equation: x1 + 4 1 x1 =16 4 2x1 =16 x1 =8 Therefore: x2 = 2 λ=2 53 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Consumer Optimization: Mathematical Approach • Objective function is the preferences: 1 1 u(c, ℓ) = c 2 ℓ 2 • Constraint is the budget constraint: c = w (h − ℓ) + π − T • c and ℓ are the choice variables • Our maximization problem is then: 1 1 max u(c, ℓ) = c 2 ℓ 2 c,ℓ subject to c = w (h − ℓ) + π − T 54 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Consumer Optimization: Mathematical Approach Assume that w = 1, h = 24, and π − T = 0. Then, 1 1 max L = c 2 ℓ 2 − λ(c − 24 + ℓ) c,ℓ,λ 1 1 • ∂L ∂c = 12 c − 2 ℓ 2 − λ = 0 • ∂L ∂ℓ = 12 c 2 ℓ− 2 − λ = 0 • ∂L ∂λ = −(c − 24 + ℓ) = 0 1 1 55 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Consumer Optimization: Mathematical Approach From the first two FOCs: 1 −1 1 1 1 1 c 2 ℓ 2 =λ = c 2 ℓ− 2 2 2 1 − 12 − 12 21 2 c ℓ =c ℓ 1 1 c − 2 ℓ =c 2 ℓ =c Using the third FOC: c = 12 = ℓ λ= 1 2 56 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Consumer Optimization Example Preferences are: U(c, ℓ) = log(c) + Aℓ and assume that w = 300, h = 1, π = 25, and T = 75 Solve for the optimal amount of consumption and leisure. 57 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Consumer Optimization Example The Lagrangian is: L = log(c) + Aℓ − λ(c − w (h − ℓ) − π + T ) Taking the derivatives: ∂L 1 = −λ ∂c c ∂L =A − λw ∂ℓ ∂L = − (c − w (h − ℓ) − π + T ) ∂λ 58 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Consumer Optimization Example Setting the derivatives equal to zero: 1 0= −λ c 0 =A − λw 0 = − (c − w (h − ℓ) + π − T ) Then doing some algebra: 1 0= −λ c 1 λ= c 0 =A − λw A λ= w 59 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Consumer Optimization Example 1 A =λ = c w w =Ac w =c ∗ A Using the budget constraint: c ∗ = w (h − ℓ∗ ) + π − T w = w (h − ℓ) + π − T A w w ℓ = wh + π − T − A π−T 1 ∗ ℓ =h+ − w A 60 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Lecture 4: Static Model Consumers and Firms • Micro-Founded Models • Firm Decisions: ▶ Hire Labour ▶ Graphical Approach ▶ Mathematical Approach • Consumer Decisions: ▶ ▶ ▶ ▶ ▶ Indifference curves Budget constraints Graphical Approach Mathematical Approach Exercises 61 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Exercise 1: A Change in π or T An Increase in π − T for the Consumer. Consider an increase in π (or a decrease in T ) Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Educa8on Canada 5-21 • More is available at ℓ = h (point J) • The slope of the budget line remains unchanged at w • Both c and ℓ increase (as expected since both are normal goods). 62 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Income and Substitution Effects • We can decompose the effect changes in this model into two effects: ▶ Income Effect: Measures the change in the consumption bundle from income changing with prices fixed ▶ Substitution Effect: Measures the change in the consumption bundle from changing relative prices, holding utility fixed • When π or T changes, there is only an income effect • There is no substitution effect because the relative prices of consumption c and leisure w do not change 63 Increase Micro-Founded Models inFirm theDecisions Real Wage Rate— Consumer Decisions Income and Substitution Effects Exercise 2: An Increase in the Wage w Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Educa8on Canada • Initially, we are at point F • The relative price of leisure is w • The price of consumption is 1 Midterm 5-23 64 Increase Micro-Founded Models inFirm theDecisions Real Wage Rate— Consumer Decisions Income and Substitution Effects Exercise 2: An Increase in the Wage w Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Educa8on Canada Midterm 5-23 1. Substitution effect (change relative prices, but keep individuals at the same utility level). The budget line rotates from AB to JK . ▶ ↑ w ⇒ leisure more expensive ▶ ⇒ substitute ℓ for c 65 Increase Micro-Founded Models inFirm theDecisions Real Wage Rate— Consumer Decisions Income and Substitution Effects Exercise 2: An Increase in the Wage w Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Educa8on Canada Midterm 5-23 2. Income effect (The budget line shifts from JK to EB. ▶ ↑ w ⇒ individuals are wealthier ▶ ⇒↑ ℓ and ↑ c 66 Micro-Founded Models Increase Consumer Decisions inFirm theDecisions Real Wage Rate— Substitution Exercise 2: AnIncome Increaseand in the Wage w Effects Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Educa8on Canada Midterm 5-23 • c increases unambiguously • ℓ is ambiguous depending on the strength of the income and substitution effects 67 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Labour Supply • N s (w ) = h − ℓ(w ) Labor Supply Curve • ℓ(w ) : ambiguous • Assume that the substitution effect dominates the income effect Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Educa8on Canada 5-24 68 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Normal Good • Normal Good: if the quantity demanded increases as income increases • Inferior Good: if the quantity demanded decreases as income increases 1 1 • The assumption of Cobb-Douglas preferences U(c, ℓ) = c 2 ℓ 2 implies that c and ℓ are both normal goods 69 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Limitations of this Model of Consumer Decisions What is this model missing? • Some workers cannot choose their hours • Some workers can bargain over their wages • Some workers like working • Workers save What is this model useful for? • Think about consumer decisions are affected by changes in: ▶ Wages ▶ Profits ▶ Taxes 70 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Lecture 4: Static Model Consumers and Firms • Micro-Founded Models • Firm Decisions: ▶ Hire Labour ▶ Graphical Approach ▶ Mathematical Approach • Consumer Decisions: ▶ ▶ ▶ ▶ ▶ Indifference curves Budget constraints Graphical Approach Mathematical Approach Exercises 71 Micro-Founded Models Firm Decisions Topics Consumer Decisions 1 Introduction to Macroeconomics Williamson Text Chapters 1,2,3 2 3 Economic Growth Agriculture (Malthus) and Capital (Solow) Convergence and Human Capital Chapter 7 Chapter 8 4 5 Static Model Consumers and Firms Governments and Labour Market Equilibrium Chapter 4 Chapter 5 6 7 Dynamic Model Consumption-Savings Imperfect Credit Markets Chapter 9 Chapter 10 8 Investment and General Equilibrium Chapter 11 Midterm 72 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Progress So Far: Completed: • Lecture 1, 2, 3 and 4 • Read Williamson Chapters 1, 2, 3, 7, and 8 • Solved Problem Set 1, 2, and 3 To Do: • Read Williamson Chapter 4 • Solve Problem Set 4 • Make Synthesized Notes Next Up: Static Model: Government and Equilibrium 73 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Midterm Exam Logistics • Scheduled on: Monday October 16th during class time • We will be in our normal lecture hall ▶ Sec 001: SSC 2032 ▶ Sec 002: UCC 41 • You will need: ▶ Pencil or pen ▶ Non-graphing Non-programmable calculator 74 Micro-Founded Models Firm Decisions Consumer Decisions Midterm Midterm Structure • Counts for 20% of your course grade • You will have 1 hour and 30 minutes • There will be three questions ▶ They will look very similar to problem set questions ▶ Please do the problem sets! • There is a practice midterm on OWL ▶ Practice doing it timed and without your notes • Covers all of the course material ▶ Lectures 1, 2, 3, and 4 ▶ Williamson Chapters: 1, 2, 3, 7, 8, and 4 75