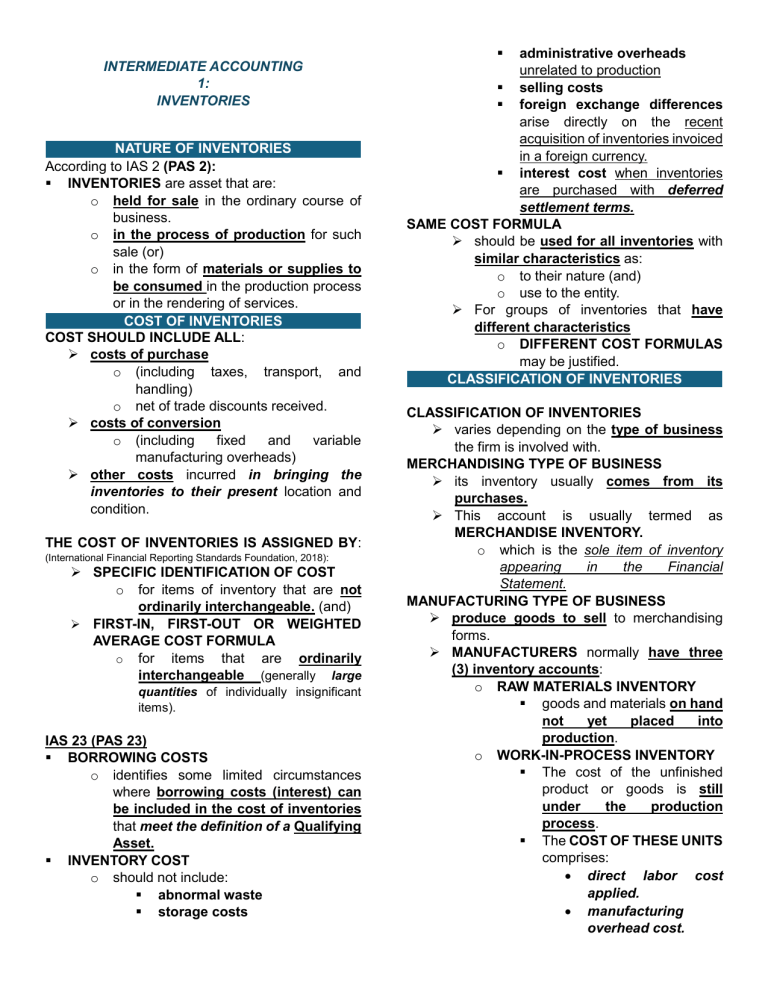

INTERMEDIATE ACCOUNTING 1: INVENTORIES NATURE OF INVENTORIES According to IAS 2 (PAS 2): INVENTORIES are asset that are: o held for sale in the ordinary course of business. o in the process of production for such sale (or) o in the form of materials or supplies to be consumed in the production process or in the rendering of services. COST OF INVENTORIES COST SHOULD INCLUDE ALL: costs of purchase o (including taxes, transport, and handling) o net of trade discounts received. costs of conversion o (including fixed and variable manufacturing overheads) other costs incurred in bringing the inventories to their present location and condition. THE COST OF INVENTORIES IS ASSIGNED BY: (International Financial Reporting Standards Foundation, 2018): SPECIFIC IDENTIFICATION OF COST o for items of inventory that are not ordinarily interchangeable. (and) FIRST-IN, FIRST-OUT OR WEIGHTED AVERAGE COST FORMULA o for items that are ordinarily interchangeable (generally large quantities of individually insignificant items). IAS 23 (PAS 23) BORROWING COSTS o identifies some limited circumstances where borrowing costs (interest) can be included in the cost of inventories that meet the definition of a Qualifying Asset. INVENTORY COST o should not include: abnormal waste storage costs administrative overheads unrelated to production selling costs foreign exchange differences arise directly on the recent acquisition of inventories invoiced in a foreign currency. interest cost when inventories are purchased with deferred settlement terms. SAME COST FORMULA should be used for all inventories with similar characteristics as: o to their nature (and) o use to the entity. For groups of inventories that have different characteristics o DIFFERENT COST FORMULAS may be justified. CLASSIFICATION OF INVENTORIES CLASSIFICATION OF INVENTORIES varies depending on the type of business the firm is involved with. MERCHANDISING TYPE OF BUSINESS its inventory usually comes from its purchases. This account is usually termed as MERCHANDISE INVENTORY. o which is the sole item of inventory appearing in the Financial Statement. MANUFACTURING TYPE OF BUSINESS produce goods to sell to merchandising forms. MANUFACTURERS normally have three (3) inventory accounts: o RAW MATERIALS INVENTORY goods and materials on hand not yet placed into production. o WORK-IN-PROCESS INVENTORY The cost of the unfinished product or goods is still under the production process. The COST OF THESE UNITS comprises: direct labor cost applied. manufacturing overhead cost. o FINISHED GOODS INVENTORY completed but unsold units on hand. GOODS INCLUDED IN INVENTORY 1. GOODS IN TRANSIT Companies purchase merchandise that remains in transit at the end of the fiscal period. Proper accounting for these goods depends on who has the control over the goods. The PASSAGE OF TITLE RULE is applicable in this situation. 2. SHIPPING TERMS essential in identifying the legal title over the goods: 3. A. FOB SHIPPING POINT a. The title passes to the BUYER the moment: seller DELIVERS THE GOODS to the common carrier, (acts as an agent for the buyer.) B. FOB DESTINATION a. The title passes to the BUYER only when: it RECEIVES THE GOODS from the common carrier. C. FREE ALONGSIDE (FAS) a. The risk of loss is transferred FROM THE SELLER TO THE BUYER at a named port alongside a vessel designated by the buyer. D. COST, INSURANCE, AND FREIGHT a. Under this shipping contract, the BUYER agrees to pay all the cost of goods, insurance cost, and freight. b. The risk of loss is transferred to the buyer. upon delivery of goods to the carrier. 4. 5. 6. a. carrier will collect the cost of transporting the goods to the BUYER. B. FREIGHT PREPAID a. freight cost on the goods shipped is already paid by the SELLER. CONSIGNED GOODS Goods under CONSIGNMENT ARRANGEMENT. o Under this arrangement, a COMPANY (THE CONSIGNOR) ships various art merchandise to ANOTHER COMPANY (THE CONSIGNEE), who acts as agent in selling the consigned goods. o These goods remain the property of the consignor. SEGREGATED GOODS Specially ordered or manufactured goods o based on the customer’s preference. Once completed, shall be considered sold and excluded from the inventory of the seller. CONDITIONAL SALE AND INSTALLMENT SALE The title has already passed to the buyer. GOODS SOLD WITH BUYBACK AGREEMENT Goods are still part of the inventory of the seller. GOODS SOLD WITH REFUND OFFERS If returns are predictable o goods are excluded from the inventories of the seller If not o retained as part of the inventory. SYSTEMS OF RECORDING INVENTORIES Companies usually use one of the TWO (2) TYPES OF SYSTEMS. for maintaining inventory records for the cost of inventories o PERPETUAL SYSTEM o PERIODIC SYSTEM FREIGHT TERMS A. FREIGHT COLLECT PERPETUAL PERIODIC RECORDING Inventory Records – updated REGULARLY. Determination of ENDING INVENTORY STOCK COUNT Ending Inventory – basis of INVENTORY RECORDS. Done to CONFIRM – if units held as PER RECORD. HIGH LEVEL OF CONTROL as management knows the quantity at any given time. CONTROL ON INVENTORY TEMPORARY ACCOUNTS Inventory Records – updated PERIODICALLY. Ending Inventory – basis of PHYSICAL STOCK COUNT. Done to DETERMINE – the COST OF GOODS SOLD NO CONTROL management is unaware of quantity until the end of the period. NO TEMPORARY ACCOUNTS Recording – done directly in INVENTORY ACCOUNT. TEMPORARY ACCOUNTS (ex. Purchases, returns and sales) Maintained that are CLOSED at the PERIOD END. EXPENSIVE to maintain. Need DEDICATED, TRAINED personnel. CHEAPER to maintain. Requires LESS WORK and WORKFORCE. COST INVENTORY COSTING METHODS UNDER PERIODIC AND PERPETUAL SYSTEMS A. SPECIFIC IDENTIFICATION a method of tracking inventory items by assigning a specific cost associated to it. o from the point of purchase to the point of sale. B. FIFO METHOD termed as first in, first out method. This method implies that the ENDING INVENTORY o comprises the later purchases/production made by the company. C. LIFO METHOD Although the IAS 2 does not permit the use of this method. This Last in, First Out method implies that the ENDING INVENTORY o comprises the earlier purchases/ production. D. WEIGHTED AVERAGE METHOD uses the mixture of methods stated above. INVENTORY VALUATIONS IAS 2 guides in determining the: o cost of inventories o subsequent recognition of the cost as an expense. including any write-down to net realizable value. It also provides guidance on the COST FORMULAS o that are used to assign costs to inventories. INVENTORIES measured at the lower of cost and net realizable value (LCNRV). NET REALIZABLE VALUE estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale (International Financial Reporting Standards Foundation, 2018). COST OF INVENTORIES includes: o all costs of purchase o costs of conversion (direct labor and production overhead) o other costs incurred in bringing the inventories to their present location and condition. When inventories are sold, the CARRYING AMOUNT OF THOSE INVENTORIES is: o recognized as an expense in the period in which the related revenue is recognized. The amount of ANY WRITE-DOWN OF INVENTORIES to net realizable value and ALL LOSSES OF INVENTORIES are: o recognized as an expense in the period the write-down or loss occurs (International Financial Reporting Standards Foundation, 2018).