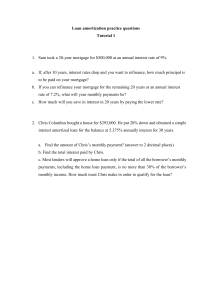

Debt Repayment: Amortization, Sinking Funds, Refinancing

advertisement