.1. Kamani Ltd. is planning torais

y the issu

noo each at 10% discount. The underw ri tmg expenses are

nd out the cost of debenhues in each of the following cases

I. H debentmes are irredeemable.

IT. If debentures are redeemable at

10111 year a

,\(p ::

D( \ +CDT) 'RV-NP

N

~,~-

.·

------:-.

Q. 2. Keenam Ltd. is planning to raise n crore by the issue o 12% preferen

shares of noo each at 10'1/o discount. The underwriting expenses arc expecte

to be 2%. Finclout the cost of preference share capital in each of the following

.,,--

If p reference shares are ined eema b le

.!f...P.refer~n,f! shares are redeemable at the end

premium. Use short-cut method .

~

ey:,it 15%

'

(2009 E)

Q. 3. Calculate the Cost of

(1) A com an isst1e 10

r cent irredeemable preference shares at ~95

each (face value :. U0O) .

(i1) The cuuent market price of a share is Z90 and the expected dividend at

•11t end_o.filig gm:t..n t year is Z4.5 with a growth rate of 8At,cent.

,, rornp any issue~ U0,00,000© er cent debentures of~

each at 10

per cent discount. The debentures are redeemable after the expiry of

fixed period o£_7 ~ s. The company is in 35 per cent tax bracket.

-

12-(1 - 0 3s +IC,\)-90

1-

Assumin that the firm

ate, compute the

after tax cost of capi tal in the following cases :.

( i) A 14.596 preference shares sold at par. ( f:V ' JI,()

!) , A perpetual bond sold at par, coupon rate bein 13.5%.

0Jcn ye~( si);>r,ooo per bond sold at 950. (Np q,5q) '

(i11) A common share selling at a market price of ~

and ..

paying a current dividen o

9 er share which is;

. expecte to grow at a rate 896 - .»D, As,s14m2 '·•~

, (ii0

I .1

.

- 'Dv

<s ,

,,,'\

l£::]/ I~96 Preference Shares of I00 each, issued

,,,~~

· m, red eemable a t par after 6 years. Flolat1on cost 1s ·,

and Dividend Distribution Tax i 15, . Use both '

hod. .

·

~ ! 2 96 Debentures of fac e value oft!O00 each redeemable';~

· at par after 5 years, flotation cost bei~

Use both ·, ·

methods given the tax rat @30 .

,~'.

\·1

\

• :

Esc..

?SC

Deb -

I

't '

.. .

C-'..-.

\

b-ft\C\_"'- COS.-+ f- 'MraJ1A.cA~OL 0·15 r.looooo IN AC<- =- z._~I

2oL O· I

-EioL

O·O:t-

z..

2000<:P

,41..0000

--

, lboL

1~2..oow

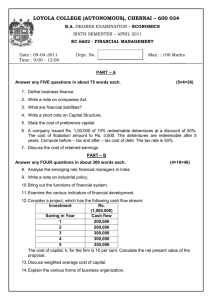

co m pan y has the following capital structun:: on 1 July

20 1S:

f-,wtd .,\\

Equity Shares (4,00,000)

I096 Preference

20,00,000

(l~ De~entures

60,00,000

1¤ 2 v<J <A? X11.Q

f6o

1

'j

00000

l \·3-=1-5'1/o

.

a:\' ~ '' '

ro

-=-

1,60,00,000

e o[ a com

It is expected

company_-'-,:;..;.."'----share which

at 7 per cent forever . Assume a 3_Qf~nt tax rate.

',

_01;1r company s s / , 'i

, , . .,,, ,, ,

,,,

, at :

l 20 cur

rently. The compauy}{aslp'aidld'i-vid~n~,' ',

t share and th

investor's market expects a growth

o,f 5 per cent per year

•

'

I 11!

,l 11 1

\!1 1 iii

You are ~equired to compute :

·r~te

~ It. 1 ' 1

1

1

1

'' •\' :~\ ·,

/\

I1 '

11n1

, ,I,,

\,•' • " .. · ·,

1\ ,11

\ .1,

1) The company's Equity Cost of Ca~:ital:~

i0 If

'

·

the company's cost of capital is 8 per cent and the

anticipated growth rate is 5 per cent per annum, calculate

market price if the dividend of~ 1 is to be paid at the end

of one year.

\/'