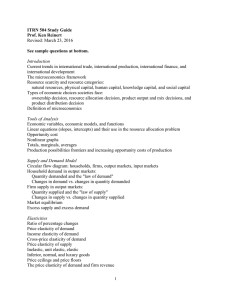

REVISION Microeconomic Principles Economic Problem • Scarce/limited resources • Unlimited wants • Choices need to be made, e.g.: • What to produce • How to produce • How much to produce • Who gets the goods and services • Every choice involves OPPORTUNITY COST= the value of the next best alternative foregone Resources • Resources are categorised into 4 groups: • Land (Natural Resources) • Labour • Capital • Entrepreneurial Ability PRODUCTION POSSIBILITIES FRONTIER (PPF) 50 A PPF shows all the maximum PPF C 43 combinations of rice and computers that can be produced if all available resources are fully employed and used efficiently. U Q of Rice PPF is concave to the origin. I 20 PPF separates attainable from E unattainable output combinations. Attainable = combinations on & underneath PPF Points ON the PPF are efficient. F 0 2 4 5 Points inside the PPF are Q of Tractors INEFFICIENT. 2 50 48 A PPF B 1 5 * The negative slope shows the opportunity cost when production of one of the goods in the diagram is increased. C 43 1 9 D 34 • The opportunity cost of producing 1 more Tractor is amount of Rice forgone. 1 Q of Rice 14 E 20 • The concave shape of the PPF reflects the law of increasing opportunity cost. 1 • Law states as more of a 20 1 0 1 2 3 4 particular good is produced, a successively larger quantity of the other good must be sacrificed. F 5 • Due to resources not being Q of Tractors equally adaptable in production of both goods Shifts in the PPF (Growth) Q of Rice Q of Rice A change in resources or technology may cause both a change in the slope and location of the PPF. The change does not have to affect both goods equally. 0 0 Q of Tractors Q of Tractors PRODUCER THEORY Accounting vs Economic Profit • Accounting profit: = total revenue (TR) – explicit costs • Economic profit: = total revenue (TR) – total costs (TC) • Total costs = explicit costs + implicit costs = opportunity cost of all resources Normal Profit • Is the minimum profit required by the entrepreneur/s • Is equal to the opportunity cost of entrepreneurship Production in the Short-Run • Short-run (SR) = period too brief to permit firms to alter all of its inputs/resources SR has at least 1 fixed input/resource • Long-run (LR) = period long enough to allow firm to vary all inputs/resources LR has no fixed inputs/resources Law of Diminishing Marginal Returns • The Law of Diminishing Marginal Returns (L of DMR) states “As more variable resource is added to a given amount of another resource (i.e. fixed resource), marginal product will eventually decline.” • L of DMR explains the shape of the MP curve and therefore our product and costs curves. MPh TPh at increasing rate MPi TPh at decreasing rate Total Product and Marginal Product of Labour MP negative TPi Production Costs in the SR • Marginal Cost = extra or additional cost associated with the production of 1 extra unit of output. TC TVC TFC MC Q Q Q • However, since TFC/Q = 0, then MC = TVC/Q • MC = slope of both the TC and TVC curves Production Costs in the SR • Total Cost (TC) $ TC = TFC + TVC • Total cost is parallel to TVC TVC, vertical distance between TC and TVC = TFC TFC 0 Q Law of DMR determines shapes of all product and cost curves I 350 II Costs Output 400 III TC 700 I II 600 TP 300 800 TVC 500 250 400 200 TVC1 = L1 x Cost of Labour (wage) 300 150 200 100 100 50 0 0 50 100 150 200 250 300 350 400 0 0 2 4 6 8 10 12 14 Output 16 Labour 10 Law of DMR MC 9 I 60 III II 50 Costs MP 70 I 8 7 II Q at max MP = Q at min MC 6 40 5 30 4 20 3 10 2 0 1 MP -10 0 0 -20 0 2 4 6 8 10 12 14 16 Labour 50 100 150 200 250 300 350 400 Output MC Cost per ton $150 125 100 Min ATC Min AVC AFC ATC 75 AVC AFC 50 25 Q 0 5 10 15 Tons per day © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Summary of Relationship between Marginal and Average • MC > average cost the marginal pulls up the average cost • MC < average cost the marginal pulls down the average • U-shape of average costs curves • Law of DMR • Therefore MC intersects AVC and ATC at their minimum points Long Run Average Cost (LRAC) • LRAC curve shows the least costly way of producing any given level of output. Cost per unit SRAC curves LRAC Q The LRAC is a planning curve. A firm’s long run average cost curve COMPARISON OF MARKET STRUCTURES Perfect Competition Monopolistic Competition Oligopoly Monopoly Number of firms Many Many A few large One Barriers to entry None None/low High Very High Type of Product Identical (Homogeneous) Differentiated, similar but different to competitors Identical or Differentiated Unique, no close substitutes Control over price Price TAKER Price MAKER Examples Bananas, foreign exchange Shampoo, toothpaste PRICE MAKER PRICE MAKER Banks, Supermarkets, Airlines Sydney Water, Australia Post Perfect Competition Monopolistic Competition Monopoly Pricing decision P = MR = MC MR = MC MR = MC Allocative Efficiency Yes P = MC No P > MC No P > MC Minimum Efficient Scale Yes Min LRAC No Q < min LRAC, Excess capacity No Q < min LRAC, Excess capacity LR economic profit possible? No Normal profit only P=ATC No Normal profit only P=ATC Yes Economic profit able to be earned in the LR PERFECT COMPETITION Perfect Competition MARKET P INDIVIDUAL FIRM Smarket P P = MR = Demand P* P* Dmarket Q* Q (‘000s) Q Profit Maximisation/Loss Minimisation in SR • Set MR = MC • Find profit maximising P* and Q* • Compare P* and ATC • If P* > ATC firm is making an ECONOMIC PROFIT • If P* < ATC firm is making an ECONOMIC LOSS and need to decide whether to shut down or stay in production in the SR • If economic loss, compare P* and AVC • If P* > AVC STAY In PRODUCTION as firm is able to cover all its TVC and loss will be < TFC • If P* < AVC SHUT DOWN (temporarily) as unable to cover all its TVC and loss will be smaller if shutdown (loss = TFC if shutdown) Perfect Competition – Profit Maximisation in SR P > ATC Perfect Competition – Loss Minimisation in SR P > AVC Summary of a perfectly competitive firm’s short-run output decisions Break-even point 5 p5 Dollars per unit Marginal cost 4 p4 d5 Average total cost d4 Average variable cost 3 p3 2 p2 p1 Firm’s short run S curve 1 d = Dfirm d3 d2 d1 0 q1 q2 q3 q4 q5 Quantity per period Shutdown point © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Aggregating individual supply curves of perfectly competitive firms to form the market supply curve Price per unit (a) Firm A (b) Firm B sA (c) Firm C sB (d) Industry, or market, supply sC sA + sB + sC = S p’ p’ p’ p’ p p p p 0 10 20 0 10 20 Quantity per period 0 10 20 0 Quantity per period 30 60 Quantity per period At price p, each firm supplies 10 units of output & market supplies 30 units. In general, the market supply curve in panel (d) is the horizontal sum of the individual firm supply curves sA, sB, and sC. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Profit Maximisation/Loss Minimisation in LR • Losses are not acceptable in the LR • Remember all resources are variable in the LR • So if unable to reorganise production to make at least a normal profit then will EXIT THE INDUSTRY Long Run Adjustment Loss FIRM MKT S2 MC P P ATC S1 P2 P2 P1 P1 MR2 MR1 D Q Q1 Q2 Q Long Run Adjustment Supernormal profit P MKT S1 P FIRM MC S2 P1 P1 P2 P2 ATC MR1 MR2 D Q Q2 Q1 Q Long-run equilibrium for a firm & industry in perfect competition (a) Firm (b) Industry, or market MC S ATC e p LRAC D firm Price per unit Dollars per unit Minimising LRAC therefore is at MES Allocative Efficiency p P = MC, Allocative Efficiency 0 q Quantity per period D 0 Q Quantity per period © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. MONOPOLISTIC COMPETITION Monopolistic Competitor in the Short Run (b) Minimizing short-run loss MC b P* ATC* Profit ATC Dollars per unit Dollars per unit (a) Maximizing short-run profit MC ATC* Loss P* AVC b c D e Q* Quantity per period D e MR 0 ATC c MR 0 Q* Quantity per period 38 Transition to the Long Run • IF – Short Run Supernormal (Economic) Profit • New firms enter the market • Draw customers away from other firms • Reduce demand facing other firms • Demand Curves of existing firms shift to the left • Economic Profit disappears in long run • Zero economic profit (P = ATC in the long run) Transition to the Long Run P MC At P2, economic profit = 0 ATC P1 P2= ATC2 ATC1 D1 D2 Q2 Q1 MR2 MR1 Q 40 Transition to the Long Run • IF – Short Run Economic Loss • Some firms exit the market • Their customers switch to other firms • Increases the demand for the remaining firms • Demand Curves for remaining firms shift to the right • Loss is erased in the long run • Zero economic profit (P = ATC in the long run) Transition to the Long Run P MC At P2, economic profit = 0 ATC ATC1 P2= ATC2 P1 D2 economic loss D1 Q1 Q2 MR1 MR2 Q 42 Long Run Equilibrium in Monopolistic Competition 43 Comparison • Monopolistic competition • Downward sloping demand curve • Not producing at minimum average cost • Excess capacity • Price above marginal cost • Mark-up • Produces less, charges more • Than a perfect competitor… • … in the long run • Spend more to differentiate their products MONOPOLISTIC COMPETITION & EFFICIENCY P=MC Deadweight Loss therefore not Allocatively Efficient QPC © 2015 Cengage 44 Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. MONOPOLY Monopoly – demand curve and economic profit P TR = 0P*AQ* TC = 0CBQ* MC ATC A P* Economic profit = P*ABC B C D MR 0 Q* Q Comparing Monopoly and Perfect Competition P P* MC A P = MC B PPC C D MR 0 Q* QPC Q • P > MR always, and so P > MC (allocative inefficiency) • Consumers always pay a higher price under Monopoly and a lower output is produced, compared to Perfect Competition • Under Monopoly output is restricted to maximise profit. • Because of barriers to entry a Monopoly can continue to earn supernormal profit in the LR. MONOPOLY – ALLOCATIVE INEFFICIENCY 49 Price Discrimination • Price discrimination • Increasing profit • Charging different groups of consumers • Different prices • For the same product 50 Price Discrimination • Conditions for price discrimination • Downward sloping demand curve • Some market power • At last two groups of consumers • With different price elasticity of demand • Ability to charge different prices • At low cost • Prevent reselling of the product Price Discrimination Example – Train Travel MC drawn horizontal for simplicity Adults P P1 Children P A F P2 B C MR 0 Q1 MC C D Q of trips MC G MR 0 Q2 D Q of trips OLIGOPOLY Oligopoly • A few firms. • Barriers to entry. • Therefore, firms are interdependent. • Products may be identical or differentiated.. Game Theory • Allows us to analyse the strategic interaction between firms who have market power • A dominant strategy is a strategy that is best for a player in a game regardless of the strategies chosen by the other players. • The Nash equilibrium is a situation in which economic actors interacting with one another each choose their best strategy given the strategies that all the other actors have chosen. Prisoners Dilemma Game • Shows that the Nash Equilibrium leaves both parties worse off, than the cooperative outcome • Also illustrates why cooperation is difficult to maintain even when it is mutually beneficial. Prisoners Dilemma Game Nash Equilibrium Virgin Australia Low price High price $25,000 $8,000 Low price $20,000 $45,000 Qantas $40,000 $35,000 High price $10,000 $30,000 Collusive Equilibrium DEMAND AND SUPPLY • Demand • The quantity consumers are willing and able to buy at each possible price during a given time period, other things constant • Law of demand Price per unit – Quantity demanded varies inversely with price, other things constant – Higher price: lower quantity demanded D Quantity per unit of time Law of Demand • When the price changes, two factors are at work, causing quantity demanded to change…. (1) the substitution effect of a price change (2) the income effect of a price change Demand • Movement along the demand curve • Change in quantity demanded • Due to a change in price • Shift in the demand curve (CHANGE IN DEMAND) due to change in a non-price factor: Money income of consumers Prices of Substitutes Prices of Complements Consumer expectations The number or composition of consumers in the market Consumer tastes Change in Quantity Demanded Increase in quantity demanded P Decrease in quantity demanded P $10 $8 $6 $5 D 3 7 Q D 2 4 Q Change in Demand • A shift of the entire D curve is called a change in demand = creation of a brand new D curve via the relaxation of ceteris paribus condition P P Decrease in demand Increase in demand D1 D2 Q D2 D1 Q • Supply • How much producers are willing and able to offer for sale per period at each possible price, other things constant Price per unit • Law of supply • Quantity supplied is directly related to its price, other things constant • Higher price: higher quantity supplied S Quantity per unit of time Supply • Movement along the supply curve • Change in quantity supplied • Due to a change in price • Shift in the supply curve (CHANGE IN SUPPLY) due to change in non-price factor: State of technology Prices of Factors of Production Resources with Alternative Uses Goods in Joint Production Producer expectations Number of producers in the market Change in Quantity Supplied Increase in Q Supplied Decrease in Q Supplied P P S P2 P1 S P2 P1 Q1 Q2 Q Q2 Q1 Q Change in Supply S1 P S2 Shift from S1 to S2 is an increase in supply P1 Q1 Q2 Q • It is an increase in supply because at a given price (say P1) we have a greater willingness and ability of producers to make the product available. • Decrease in supply shifts S curve to the left. Equilibrium in the Pizza Market (b) S Price per pizza $15 Surplus 12 c 9 6 Shortage 3 0 D 14 16 20 24 26 Millions of pizzas per week © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Price per pizza Effects of an Increase in Demand S g $12 c 9 D’ D 0 20 24 30 Millions of pizzas per week © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Effects of an Increase in Supply Price per pizza S S’ c $9 6 d D 0 20 26 30 Millions of pizzas per week © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Effect on Equilibrium of Increases in Demand & Supply at the same time Sorig S3 P S1 S2 P3 P* = P1 P2 Dnew Dorig Q* Q3 Q1 Q2 Q • We should note that if there is a change in demand and a change in supply, the result may be indeterminate. • Consider Dh plus Sh Qh (for certain) but what about price? P may h or i or remain unchanged. • Depends on the relative size of the shifts of the curves. ELASTICITY Price Elasticity of Demand The price elasticity of demand is a units-free measure of the responsiveness of the quantity demanded of a good to a change in its price when all other influences on buying plans remain the same. = %Q __________________ %P The elasticity of demand for a good depends on: The closeness of substitutes The proportion of income spent on the good The time elapsed since a price change Formulas for Price Elasticity of Demand Q Pn E P Qn Point Formula 1 ______________ slope MidPoint Formula Position on D Curve Q Qaverage %Q P %P Paverage Qn Qo Qn Qo / 2 Pn Po Q x Pn Po Qn Qo P Pn Po / 2 Summary of Impact of P on TR E>1 Elastic (%Q > %P) E=1 Unit Elastic (%Q = %P) E<1 Inelastic (%Q < %P) Ph TRi TR no change TRh Pi TRh TR no change TRi Cross Elasticity of Demand The cross elasticity of demand is a measure of the responsiveness of demand for a good to a change in the price of a substitute or a complement, other things remaining the same. The formula for calculating the cross elasticity is: Percentage change in quantity demanded Percentage change in price of substitute or complement The cross elasticity of demand for a substitute is positive. a complement is negative. Unrelated goods is zero. Income Elasticity of Demand The income elasticity of demand (εY)measures how the quantity demanded of a good responds to a change in income, other things remaining the same. The formula for calculating the income elasticity of demand is: Percentage change in quantity demanded Percentage change in income εY > 1 then demand is income elastic and the good is a normal good (is a luxury). 0 < εY < 1 then demand is income inelastic and the good is a normal good (is a necessity). εY < 0, the good is an inferior good. Calculating the Elasticity of Supply The elasticity of supply is calculated by using the formula: Percentage change in quantity supplied Percentage change in price The elasticity of supply depends on: 1. Resource Substitution Possibilities The easier it is to substitute among the resources used to produce a good or service, the greater is its elasticity of supply. 2. Time Frame for Supply Decision The more time that passes after a price change, the greater is the elasticity of supply. EXTERNALITIES EXTERNALITY • Externality is the uncompensated impact of one person’s actions on the wellbeing of a bystander. • A positive externality makes the bystander better off. • A negative externality makes the bystander worse off. NEGATIVE EXTERNALITIES IN PRODUCTION (MXC) MSC = MXC + MC P Sprivate cost = MC MXC Allocative Efficiency DWL Peff Market equilibrium Pmkt D = MB = MSB Qeff Qmkt Q NEGATIVE EXTERNALITIES IN CONSUMPTION (MXC) P S = MC = MSC Market equilibrium Pmkt Peff DWL Allocative Efficiency MXC D = MB MSB = MB - MXC Qeff Qmkt Q POSITIVE EXTERNALITIES IN PRODUCTION (MXB) Sprivate cost = MC P MSC = MC - MXB Market equilibrium MXB Pmkt Peff Allocative Efficiency DWL D = MB = MSB Qmkt Qeff Q POSITIVE EXTERNALITIES IN CONSUMPTION (MXB) P S = MC = MSC Allocative Efficiency Peff DWL Pmkt Market equilibrium MXB MSB = MB + MXB D = MB Qmkt Qeff Q SOLUTIONS TO EXTERNALITIES 4 solutions 1. Private Solutions via the Coase Theorem 2. Government Regulation 3. Market-based Solutions via Price (e.g. Pigovian tax) 4. Market-based Solutions via Quantity (e.g. permits) GOVERNMENT ACTIONS IN MARKETS PRICE CONTROLS • A price ceiling is a legal maximum on the price at which a good can be sold. • A price floor is a legal minimum on the price at which a good can be sold. TAX INCIDENCE • Tax incidence - who bears the burden of taxation, i.e. how the burden of the tax is shared between consumers and producers. A TAX ON SELLERS A TAX ON BUYERS ELASTICITY AND TAX INCIDENCE ELASTICITY AND TAX INCIDENCE ELASTICITY AND TAX INCIDENCE • The more ELASTIC is demand – more of the tax paid by the producer (seller) • The more INELASTIC is demand – more of the tax paid by the consumer (buyer) • The more ELASTIC is supply – more of the tax paid by the consumer (buyer) • The more INELASTIC is supply – more of the tax paid by the producer (seller) THE WELFARE EFFECTS OF A TAX Tax per unit = vertical distance between the supply curves = E1G P S + tax Tax Revenue = Tax per unit x Qtax Tax creates a wedge between price consumers pay and amount producers receive. Both the consumer surplus (CS) and producer surplus (PS) are reduced. A deadweight loss (DWL) is created. PB P* CS Tax Revenue E1 DWL S E* PS PS 0 G Qtax D Q* Q THE DETERMINANTS OF THE DEADWEIGHT LOSS A tax has a deadweight loss because it induces buyers and sellers to change their behaviour. The tax raises the price paid by buyers, so they consume less. At the same time, the tax lowers the price received by sellers, so they produce less. Hence, the equilibrium quantity in the market shrinks below the optimal quantity. The more responsive buyers and sellers are to changes in the price, the more the equilibrium quantity shrinks, and the greater the deadweight loss. THE DETERMINANTS OF THE DEADWEIGHT LOSS Supply + tax Supply + tax PB PB P* P* PS PS Qtax Q* Qtax Q* THE DETERMINANTS OF THE DEADWEIGHT LOSS Supply + tax Supply + tax PB PB P* P* PS PS Qtax Q* Qtax Q* Subsidy • A subsidy is a payment from government, to consumers or sellers, for each unit of a good that is bought or sold. • Subsidies can be regarded as negative taxes. A SUBSIDY TO SELLERS THE WELFARE EFFECTS OF A SUBSIDY Amount of the subsidy per unit = vertical distance between the supply curves = E1G Cost of the subsidy = Subsidy per unit x Qsubsidy Both the consumer surplus (CS) and producer surplus (PS) are increased. P S PS G E* S + subsidy P* PB Cost of the subsidy E1 A deadweight loss (DWL) is created. D 0 Q* Qsubsidy Q THE WELFARE EFFECTS OF A SUBSIDY Amount of the subsidy per unit = vertical distance between the supply curves = E1G Cost of the subsidy = Subsidy per unit x Qsubsidy Both the consumer surplus (CS) and producer surplus (PS) are increased. P PS S G CS E* S + subsidy P* E1 PB A deadweight loss (DWL) is created. D 0 Q* Qsubsidy Q THE WELFARE EFFECTS OF A SUBSIDY Amount of the subsidy per unit = vertical distance between the supply curves = E1G Cost of the subsidy = Subsidy per unit x Qsubsidy Both the consumer surplus (CS) and producer surplus (PS) are increased. P S PS G E* S + subsidy P* PS E1 PB A deadweight loss (DWL) is created. D 0 Q* Qsubsidy Q THE WELFARE EFFECTS OF A SUBSIDY Amount of the subsidy per unit = vertical distance between the supply curves = E1G Cost of the subsidy = Subsidy per unit x Qsubsidy Both the consumer surplus (CS) and producer surplus (PS) are increased. P S PS G E* P* S + subsidy DWL E1 PB A deadweight loss (DWL) is created. D 0 Q* Qsubsidy Q CONSUMER THEORY Budget Line PSQS + PMQM = Y 𝑌 ∴ 𝑄𝑆 = 𝑃𝑆 Real income - 𝑃𝑀 × 𝑄𝑀 𝑃𝑆 Relative price = opportunity cost = slope of BL Budget Line Indifference Curve An indifference curve (IC) is a line that shows combinations of goods among which a consumer is indifferent. (Or equal satisfaction /utility /happiness). MRS = Δ𝑦 Δ𝑥 = slope of an indifference curve A B Indifference Curves Marginal Rate of Substitution • The marginal rate of substitution (MRS) measures the rate at which a person is willing to give up good y to get an additional unit of good x while at the same time remaining indifferent (remaining on the same indifference curve). Diminishing Marginal Rate of Substitution B As we move along the IC, MRS falls. D E Best Affordable Choice The best affordable choice (or point of Utility Maximisation) is found where the BL just touches the IC. Where slope of the IC = slope of the BL i.e. MRS = relative price Deriving the Demand Curve Substitution Effect of a Price Change The substitution effect is the effect of a change in price on the quantity bought when the consumer remains on the same indifference curve. Income Effect of a Price Change Effect of a change in price on the quantity bought due to change in real income. TRADE Absolute vs Comparative Advantage •A person has an absolute advantage if that person is more productive than others – this just means that a person can produce more than another. •A person has a comparative advantage in an activity if that person can perform the activity at a lower opportunity cost than anyone else. •Specialise in producing the good that have a comparative advantage in Toshiba can make 50 computers or 10 TVs in an hour Sony can make 20 computers or 40 TVs in an hour 1. Who has absolute advantage in which product? 2. Who has comparative advantage in which product? 3. Who will specialise in producing computers? Who will specialise in producing TVs? 4. Find the terms of trade that the two companies would be willing to trade at. 5. Draw the PPFs and CPFs for both companies. (Put TVs on the xaxis and computers on the y-axis.) Toshiba can make 50 computers or 10 TVs in an hour Sony can make 20 computers or 40 TVs in an hour 1. Who has absolute advantage in which product? Toshiba has absolute advantage in Computers and Sony has absolute advantage in TVs. Toshiba can make 50 computers or 10 TVs in an hour Sony can make 20 computers or 40 TVs in an hour 2. Who has comparative advantage in which product? TOSHIBA 50C : 10TV 1C : 1/5TV or 1TV : 5C has comparative advantage in computers SONY 20C : 40TV 1C : 2TV or 1TV : 1/2C has comparative advantage in TVs 3. Who will specialise in producing computers? Who will specialise in producing TVs? Toshiba will make Computers. Sony will make TVs. Toshiba can make 50 computers or 10 TVs in an hour Sony can make 20 computers or 40 TVs in an hour 4. Find the terms of trade that the two companies would be willing to trade at. Price of a computer 1/5TV < ToT < 2TV MINIMUM amount Toshiba would want to receive as payment = cost to Toshiba of producing Computers MAXIMUM amount Sony would want to pay = cost to Sony of producing Computers itself Price of a TV 1/2C < ToT < 5C MINIMUM amount Sony would want to receive as payment = cost to Sony of producing TVs MAXIMUM amount Toshiba would want to pay = cost to Toshiba of producing TVs itself • Lets say for example that the ToT is: 1C = 1/2TV OR (alternatively, the inverse…..) • 1TV = 2C • (Remember that other ToT are possible) Thus: • If Sony sold all its TVS to Toshiba it could buy a maximum of 80 Computers. • If Toshiba sold all its Computers to Sony it could buy a maximum of 25 TVs. Toshiba can make 50 computers or 10 TVs in an hour Sony can make 20 computers or 40 TVs in an hour 5. Draw the PPFs and CPFs for both companies. (Put TVs on the x-axis and computers on the y-axis.) … there is a dashed line (limit) here since Toshiba cannot make more than 50 Computers for Sony to buy. CPF CPF PPF PPF