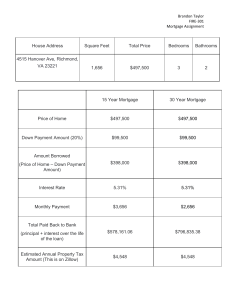

Capstone #6: Major Purchases – Housing 1. There are many advantages and disadvantages to buying or renting a house. An advantage to renting a house could be the overall monthly payment. Mortgage payments generally cost more than renting a house. With a $65,000 salary, a mortgage could be quite pricey. Renting would be a much cheaper option if you find the right place. Another advantage to renting is that you do not have to worry about repairs. When renting it is the landlord's responsibility to fix damages. When owning a house, things that need fixing must be repaired with your own money. A disadvantage to renting is the number of deposits you must pay. These include security and damage deposits. Another disadvantage to renting is that you must sign a lease agreement. This contract is a contract that expresses both the ten rights and responsibilities. These agreements can be removed by either party when given proper notice. This means that a property owner can give you notice and terminate your contract. This can allow the property owner to raise the rent or kick you out of the property. An advantage to owning a house is that you can have your own property, which is a singlefamily dwelling and is not connected to any other housing unit such as an apartment. Another advantage to owning a house is that eventually, it can cost you less than renting. A house has value, and that value can increase over time due to the area's value increasing or the improvements you do the house. 2. The first step of the planned buying process for a home is to get your finances in order. This includes saving money, getting rid of debt, creating a good budget plan, and making sure you have a high credit score. The next step is to pre-qualify for a mortgage. This includes supplying documents including pay stubs, tax records, and proof of assets. The next step is to search for a home online and in person. After finding the houses you want online visit the houses in person to see if you like them. The next step is to agree to terms with the seller. Negotiate with the seller to reach a final selling price. After this, the next step is to apply for a mortgage loan. To do this find a mortgage lender and apply using the right documents. Hire a lawyer to help you go over contracts. The next step is to prepare for the closing. This includes making moving arrangements, changing your address, and activating all utilities. The final step is to sign your name on the closing day. 3. Based on my salary of $65,000 a year I can afford a mortgage of $200,000. The house I chose was a single-family house. After subtracting the down payment for the home, the mortgage would be $124,000. The source of the down payment on this home would be my personal savings. The closing cost of the house would be $1,240. I would choose to pay this upfront with the down payment instead of financing the payment. https://www.realtor.com/realestateandhomes-detail/422-Dillon-St_Sault-SainteMarie_MI_49783_M43859-94267 4. As of today, a 30-year fixed mortgage interest rate is 4.57%. Using a financial calculator, I calculated a monthly mortgage payment of $846. I arrived at this number by entering my full mortgage cost, with a 20% down payment, my credit score, and the number of months I wanted to finance my house which was a 30-year fixed mortgage rate. After entering all these numbers, the website gave me an option for $846 a month. 5. Using the website, the estimated annual property tax for the house would be $1,747.