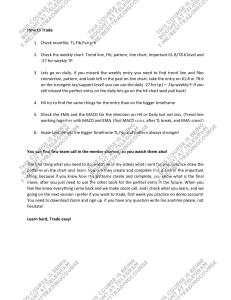

The Dynamic Duo: Mastering MACD and RSI for Powerful Forex Trading In the ever-evolving world of forex trading, technical indicators are your trusty lieutenants, offering valuable insights into market momentum and potential turning points. Among this arsenal, two stand out as particularly effective partners: the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI). Mastering their interplay can unlock powerful trading strategies and boost your confidence in navigating market movements. MACD: The Trend Whisperer Imagine a technical indicator that captures the essence of trend strength and momentum – that's the MACD. It consists of three key elements: • MACD line: This blue line represents the difference between two exponential moving averages (EMAs) of closing prices. • Signal line: This orange line is a slower EMA of the MACD line, acting as a smoothing filter to identify trend direction. • MACD histogram: The vertical bars represent the difference between the MACD and signal lines, visualizing the degree of divergence or convergence. RSI: The Sentiment Seer While MACD excels at gauging momentum, the RSI delves into the realm of market sentiment. It measures the magnitude of recent price changes to assess whether a currency is overbought or oversold. Ranging from 0 to 100, it provides a clear-cut signal: • Values above 70: Indicate an overbought condition, potentially suggesting a correction lower might be due. • Values below 30: Signal an oversold state, hinting at a possible rebound. The Power of Combining MACD and RSI Individually, both MACD and RSI offer valuable insights. However, their true magic lies in their potent synergy. Here's how combining them can elevate your trading game: 1. Confirming Trend Direction: • A rising MACD above its signal line coinciding with an RSI below 70 reinforces an uptrend, suggesting momentum with room to run. • Conversely, a falling MACD crossing below its signal line accompanied by an RSI above 30 strengthens a downtrend signal. 2. Identifying Divergences: • When the price and the MACD diverge (e.g., price keeps rising while MACD falls), it could be a warning sign of an impending trend reversal. • Similarly, RSI divergence (e.g., price falls but RSI stays above 30) might hint at a potential trend bounce. 3. Refining Entry and Exit Points: • MACD crossovers can provide precise entry signals, while RSI levels can help refine your exit strategy to avoid overstaying in potentially overbought or oversold zones. 4. Building a Comprehensive Trading Strategy: By weaving MACD and RSI into your trading framework, you gain a more holistic understanding of market momentum, sentiment, and potential turning points. This allows you to develop data-driven trading strategies with increased confidence and accuracy. Remember: • No indicator is a crystal ball. Always consider market context, fundamental factors, and other technical tools alongside MACD and RSI for well-rounded trading decisions. • Backtest your strategies thoroughly on historical data before deploying them with real capital. • Practice proper risk management to mitigate potential losses, even when indicators suggest favorable opportunities. Conclusion: MACD and RSI, when used in tandem, form a formidable duo in your forex trading toolkit. By understanding their individual strengths and their potent synergy, you can gain valuable insights into market dynamics, refine your trading strategies, and ultimately navigate the ever-changing forex landscape with greater confidence and success. So, unleash the power of this dynamic duo and watch your trading journey take flight!