SA Tax Advanced Questions: Tutorial & Solutions (2nd Ed, 2017)

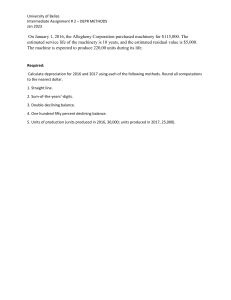

advertisement