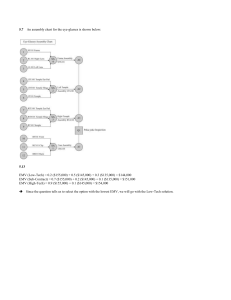

DECISION THEORY Decision Tree Analysis – A decision tree is a physical representation of a decision situation. – It provides an overview of the total process, thereby helping the decision maker examine possible outcomes. – In a decision tree, let a rectangle represent a decision point or a place where a choice must be made; while a circle represents a chance events or expected value. Example 1 Consider the problem of a student who has to decide whether to stop his studies and work for a job paying ₱ 1,500 monthly or continue his studies, after which a job awaits him paying ₱ 4,000 a month, provided he passes his remaining subjects. He feels that the probability that he will pass his remaining subjects is 40%. Which choice is better for the student? ₱ 4,000 ₱ 1600 ₱0 ₱1,600 ₱ 1,500 Example 2 A manager has to decide whether to prepare a bid or not. It costs ₱ 5000 to prepare the bid. If the bid is submitted, the probability that the contract will be awarded is 50%. If the company is awarded the contract, it may earn an income of ₱ 100,000 if it succeeds, or pay a fine of ₱ 8,000 if it fails. The probability of success is estimated to be 80%. Should the manager prepare the bid? Example 3 Assume P: (no outbreak)=P1=95% (small outbreak)=P2=4.5% (pandemic)=P3=0.5% Example 4 Mr. Reyes, the president of the CPA Corporation is faced with deciding whether to purchase a patent to develop a new product or not. If the company purchases the patent, it should develop the product. The selling price of the patent is ₱50,000. There are two ways of developing the product: Modern Method and Traditional Method. It costs ₱20,000 to use the Modern Method and ₱15,000 for the Traditional Method. The probability of success in the Modern Method is 60% while it is 70% for the Traditional Method. If the product is successfully developed, it will give an income of ₱500,000. Should the company purchase the patent? If so, what method of development should be used? Expected Monetary Value – Is how much money you can expect to make from a certain decision. – In statistics, it is the sum of all possible values of a random variable, or any given function of it, multiplied by the respective probabilities of the values of the variable. – EMV = probability * impact Example 1 Katniss identifies an opportunity with a 40% chance of happening. However, if this positive risk occurs it may help her gain ₱ 2,000. Calculate the EMV for this risk event. Given: Probability of risk = 40% Impact of Risk = ₱ 2,000 EMV = probability * impact = 0.4 * ₱ 2,000 = ₱ 800 Example 2 Ellise had identified two risks with a 20% and 15% chance of occurring. If both of these risks occur it will cost her ₱ 1000 and ₱ 2000 respectively. What is the expected monetary value of these risks events? – EMV of two risk events = EMV of the first event + EMV of the second event – EMV of the first event = 0.20 * (-1000) = -200 – EMV of the second event = 0.15 * (-2000) – = -300 The EMV of these two risks events = (-200) + (-300) = -500 Example 3 – Suppose you are leading a construction project. Weather, cost of construction material, and labor turmoil are key project risks found in most construction projects: – Project Risks 1 - Weather: There is a 25 percent chance of excessive snow fall that’ll delay the construction for two weeks which will, in turn, cost the project $80,000. – Project Risks 2 - Cost of Construction Material: There is a 10 percent probability of the price of construction material dropping, which will save the project $100,000. – Project Risks 3 - Labor Turmoil: There is a 5 percent probability of construction coming to a halt if the workers go on strike. The impact would lead to a loss of $150,000. Consider your industry and geographic area to determine whether this risk would have a higher probability. The Expected Monetary Value for the project risks: – Weather: 25/100 * (-$80,000) = - $ 20,000 – Cost of Construction Material: 10/100 * ($100,000) = $ 10,000 – Labor Turmoil: 5/100 * (-$150,000) = - $7,500 The project’s Expected Monetary Value based on these project risks is: -($20,000) + ($10,000) – ($7,500) = - $17,500 Example 4 CONDITIONAL PROFIT Aling Lumen owns a jeepney which she uses to transport lanzones from Laguna which she buys on a wholesale basis at ₱4.50 per kilo. She buys and sells the fruit in the multiple of five number of kilos, and distributes them to sidewalk vendors at ₱12.00 per kilo. The maximum number of kilos she can sell in one day is 120 kilos and the maximum is 100. It has been observed that in the past 100 days, 100 kilos were demanded on 20 days, 105 on 30 days, 110 on 20 days, 115 in 10 days and 120 in 20 days. Her son studying business course advises her to use decision analysis to determine the right number of kilos to purchase daily. The Conditional Profit Table of Aling Lumen STOCK Demand Probability 100 105 110 115 120 100 20 100 ₱750.00 727.50 705.00 682.50 660.00 105 30 100 750.00 787.50 765.00 742.50 720.00 110 20 100 750.00 787.50 825.00 802.50 780.00 115 10 100 750.00 787.50 825.00 862.50 840.00 120 20 100 750.00 787.50 825.00 862.50 900.00 Expected Monetary Value of Aling Lumen (probability times the conditional profit) Possible Stock Demand Probability 100 105 110 115 120 100 .2 ₱150.00 145.50 141.00 136.50 132.00 105 .3 225.00 236.25 229.50 222.75 216.00 110 .2 150.00 157.50 165.00 160.50 156.00 115 .1 75.00 78.75 82.50 86.25 84.00 120 .2 150.00 157.50 165.00 172.50 180.00 Expected Value ₱750.00 775.50 783.00 778.50 768.00 Above the table shows ₱783 as the highest expected value corresponding to stock of 110 kilos. Decision for Aling Lumen: Buy 110 kilos daily Conditional Profit of Aling Lumen with Salvage Value Suppose that the extra number of kilos of lanzones left cannot be sold by Aling Lumen the next day, since the fruit will not be fit for human consumption. Suppose also that a factory manufacturing insecticide and fertilizer buys overripe lanzones at ₱2.00 per kilo. If Aling Lumen can sell her left-over lanzones at the end of the day at a salvage value of ₱2.00 per kilo, construct the conditional profit table of Aling Lumen with salvage value. Computation of Profit with Salvage Value If Aling Lumen has a stock of 120 kilos, but the demand for the day is 100 kilos only, then 20 kilos will be sold at a salvage value of ₱2.00 per kilo which should be added to her profit without the salvage value. Possible Stock Demand Probability 100 105 110 115 120 100 .2 ₱ 750.00 737.50 725.00 712.50 700.00 105 .3 750.00 787.50 775.00 762.50 750.00 110 .2 750.00 787.50 825.00 812.50 800.00 115 .1 750.00 787.50 825.00 862.50 850.00 120 .2 750.00 787.50 825.00 862.50 900.00 EV Table for Aling Lumen with Salvage (probability times conditional profit with salvage) Possible Stock Demand Probability 100 105 110 115 120 100 .2 ₱ 150.00 147.50 145.00 142.50 140.00 105 .3 225.00 236.25 232.50 228.75 225.00 110 .2 150.00 157.50 165.00 162.50 160.00 115 .1 75.00 78.75 82.50 86.25 85.00 120 .2 150.00 157.50 165.00 175.50 180.00 ₱ 750.00 777.50 790.00 792.50 790.00 – The preceding table shows that the highest expected value with salvage is ₱ 792.50, that is if Aling Lumen has stock of 115 kilos. Therefore, the decision of Aling Lumen if there is a salvage value is to have a stock of 115 kilos. – Note that her highest expected profit with salvage is higher by ₱ 9.50 than that without salvage. (₱ 792.50 - ₱ 783.00 = ₱ 9.50) Bayes’ Theorem – Named after 18th Century British mathematician Thomas Bayes, is a mathematical formula for determining conditional probability. – It is a theorem about conditional probabilities: the probability that an event A occurs given that another event B occurred is equal to the probability that event B occurs given that A has already occurred multiplied by the probability of occurrence of event A and divided by the probability of event B. If, P(A ∩ B) = P(A) x P(B) = P(B) x P(A|B) then, P(A|B) = [P(A) x P(B|A)] / P(B) Where P(A) and P(B) are the probabilities of A and B without regard to each other. P(B|A) is the probability that B will occur given A is true. P(A|B) is the conditional probability of A occurring given B is true. Example 1 – Ella is interested in finding out a patient’s probability of having liver disease if they are an alcoholic. “Being an alcoholic” is the test (kind of like a litmus test) for liver disease. – A could mean the event “Patient has liver disease.” Past data tells that 10% of patients entering the clinic have liver disease. P(A) = 0.10. – B could mean the litmus test that “Patient is an alcoholic.” Five percent of the clinic’s patients are alcoholics. P(B) = 0.05. – Among those patients diagnosed with liver disease, 7% are alcoholics. This is our B|A: the probability that a patient is alcoholic, given that they have liver disease, is 7%. Given: P(A) = 0.10 P(B) = 0.05 P(B|A) = 0.07 Bayes’ theorem tells that: P(A|B) = [P(A) x P(B|A)] / P(B) P(A|B) = (0.10 x 0.07) / 0.05 = 0.14 Example 2 In a particular pain clinic, 10% of patients are prescribed narcotic pain killers. Overall, five percent of the clinic’s patients are addicted to narcotics (including pain killers and illegal substances). Out of all the people prescribed pain pills, 8% are addicts. If a patient is an addict, what is the probability that they will be prescribed pain pills? – Given: – P(A) = 0.1 – P(B) = 0.05 – P(B|A) = 0.08 P(A|B) = P(B|A) * P(A) / P(B) = (0.08 * 0.1)/0.05 = 0.16 The probability of a person being prescribed by pain pills given he is an addict is 0.16 (16%). 𝑃(𝐸|𝐻) P(H|E) = (PH) 𝑃(𝐸) – P(H|E) is called the posterior probability – P(E|H)/P(E) is called the likelihood ratio – P(H) is called the prior probability Bayes’ theorem can be rephrased as “posterior probability = likelihood ratio * prior probability” If a single card is drawn from a standard deck of playing cards. Using the Bayes’ theorem what is the probability that the card is a king given it is a face card. P(King|Face) = 𝑃(𝐹𝑎𝑐𝑒|𝐾𝑖𝑛𝑔) 𝑃(𝐹𝑎𝑐𝑒) P(Face|King) = 1 P(Face) = 12 52 P(King) = 4 52 𝑜𝑟 or P(King|Face) = = 1 3 3 13 1 13 1 3/13 x 1 13 P(King) Expected Value of Perfect Information – An amount equal or less than the expected cost of uncertainty the decision maker is willing to pay. – It is defined as the expected profit with perfect information minus the expected profit under uncertainty. Payoff table for Business Sale (Figures in thousands of dollars) Events E1 Contract Awarded E2 Contract not Awarded PROBABILITIES A1 SELL NOW A2 HOLD A YEAR .20 .80 80 80 100 70 The calculation of the expected monetary values of the actions confronted by the business owner who wants to sell her business are performed in the same way. The EMV’s of the actions are: EMV1 = $80(.20) + $80(.80) = $16 + $64 = $80 EMV2 = $100(.20) + $70(.80) = $20 + $56 = $76 It appears that the best decision based on EMV is to sell the business now. – In the previous example, the EVPI for the business owner facing the decision about selling her business was calculated to be $4000. Best Payoffs under Certainty for Business Sale EVENT KNOW TO BE IMMINENT E1 Contract Awarded E2 Contract not Awarded BEST ACTION PAYOFF FOR BEST ACTION A2 Hold A1 Sell 100 80 EPUC = 100(.20) + 80(.80) = 20 + 64 = 84 The EMV was found to be $80,000 so the expected value of perfect information is found to be EVPI = |84 – 80| = 4 Mr. Reyes, the president of the CPA Corporation is faced with deciding whether to purchase a patent to develop a new product or not. If the company purchases the patent, it should develop the product. The selling price of the patent is ₱50,000. There are two ways of developing the product: Modern Method and Traditional Method. It costs ₱20,000 to use the Modern Method and ₱15,000 for the Traditional Method. The probability of success in the Modern Method is 60% while it is 70% for the Traditional Method. If the product is successfully developed, it will give an income of ₱500,000. Should the company purchase the patent? If so, what method of development should be used? Profit with Perfect Information Suppose that there is a man who volunteers to give Aling Lumen information on the actual orders of the sidewalk vendors, what is the right amount Aling Lumen should give him daily? If Aling Lumen had perfect information about the demand of lanzones for the day, she would always purchase exactly the right amount. Thus if the demand for the day is 110 kilos, Aling Lumen would purchase only 110 kilos. Demand Probability Maximum Profit Expected Value 100 .2 ₱ 750.00 ₱ 150.00 105 .3 787.50 236.25 110 .2 825.00 165.00 115 .1 862.50 86.25 120 .2 900.00 180.00 Expected Value with Perfect Information To find the value of perfect information: ₱ 817.50 - ₱ 792.50 = ₱ 25.00 Aling Lumen should give the man a maximum of ₱ 25.00 ₱ 817.50 STOCK Demand Probability 100 105 110 115 120 100 20 100 ₱ 750.00 727.50 705.00 682.50 660.00 105 30 100 750.00 787.50 765.00 742.50 720.00 110 20 100 750.00 787.50 825.00 802.50 780.00 115 10 100 750.00 787.50 825.00 862.50 840.00 120 20 100 750.00 787.50 825.00 862.50 900.00 EV Table for Aling Lumen with Salvage (probability times conditional profit with salvage) Possible Stock Demand Probability 100 105 110 115 120 100 .2 ₱ 150.00 147.50 145.00 142.50 140.00 105 .3 225.00 236.25 232.50 228.75 225.00 110 .2 150.00 157.50 165.00 162.50 160.00 115 .1 75.00 78.75 82.50 86.25 85.00 120 .2 150.00 157.50 165.00 175.50 180.00 ₱ 750.00 777.50 790.00 792.50 790.00 Sensitivity Analysis – Is a technique used to determine how different values of an independent variable impact a particular dependent variable under a given set of assumptions. – Also referred to as what-if or simulation analysis, is a way to predict the outcome of a decision given a certain range of variables. – Determining the range of probability for which an alternative has the best expected payoff. Expected Utility Theory – a branch of decision theory that deals with the issue of measuring the “value” of payoffs to decision makers Utility is a measure of relative satisfaction. We can plot a graph of amount of money spent vs. “utility” on a 0 to 100 scale. Typical shapes for different types of risk takers generally follow the patterns shown below. U(100) U(100) U(0) 0 100 U(0) 0 Risk seeker 100 U(0) 0 Risk averse U(100) U(0) 0 U(100) Risk neutral U(100) 100 U(0) 0 100 U(100) 100 U(0) 0 100 Graphs above show that to achieve 50% utility, risk seekers will pay maximum, risk averse will pay minimum and risk neutral will pay an average amount. Imagine for a moment that a gambler offered two alternatives. He would pay you $10,000 for sure or he would allow you to engage in this game: You toss a coin; if it comes up heads you win $200,000, and if it comes up tails you must pay $160,000. Payoff Table for Gamble Events E1 Heads E2 Tails Probabilities A1 Sure Thing A2 Toss Coin .5 .5 10,000 10,000 200,000 -160,000 EMV1 = 10,000(.5) + 10,000(.5) = 5,000 + 5,000 = 10,000 EMV2 = 200,000(.5) +(-160, 000(.5)) = 100,000 + (-80,000) = 20,000 The decision to toss the coin has the EMV of $20,000 and thus appears to be better than the decision simply to accept the $10,000. Yet you might justifiably feel that you would rather have the $10,000 straight out than toss the coin and run the risk of having to pay the gambler $160,000. That is you prefer the $10,000 to a gamble with an EMV of 20,000. this very natural feeling is based on fact that people make decisions in terms of utility. One person’s utility for an amount of money may be very different from another person’s utility for the same amount. A millionaire might easily choose to engage in the gamble of tossing a coin for a $200,000 gain or a loss of $160,000. This is because millionaire could afford the loss of $160,000 without much difficulty, and the possible gain of $10,000 is peanuts. Suppose you are offered the chance to take $.10 for sure or toss a coin and receive $2.00 for a head and pay $1.60 for a tail. EMV1 = $.10(.5) + $.10(.5) = 0.05 + 0.05 = 0.10 EMV2 = $2.00(.5) +(-1.60(.5)) = 1 + (-0.8) = 0.20 Many people who would not have tossed the coin when the payoffs were $200,000 and $160,000 would not hesitate to do so with the smaller profits. This is because, in general, for small amounts of money the monetary value is good measure of utility. The expected monetary value seems to be good decision-making criterion when the payoffs involved are small relative to the overall wealth, assets, or budget of the decision maker, but when the payoffs are large, the utility criterion must be considered