A.Friedman

ICEF-2022

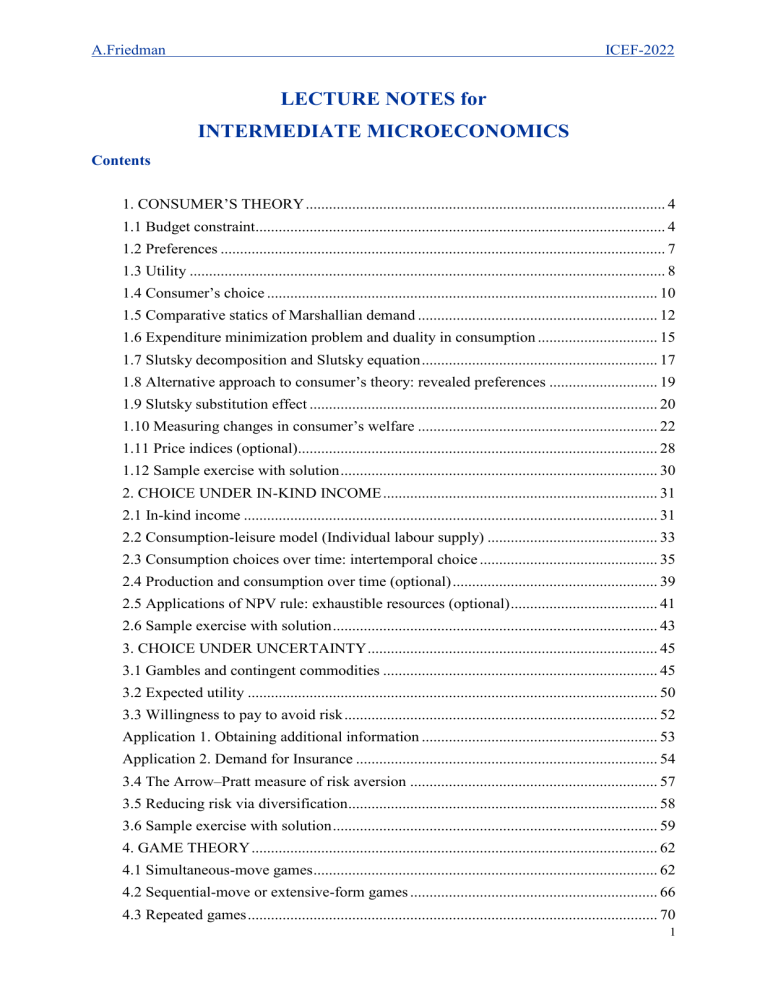

LECTURE NOTES for

INTERMEDIATE MICROECONOMICS

Contents

1. CONSUMER’S THEORY ............................................................................................. 4

1.1 Budget constraint.......................................................................................................... 4

1.2 Preferences ................................................................................................................... 7

1.3 Utility ........................................................................................................................... 8

1.4 Consumer’s choice ..................................................................................................... 10

1.5 Comparative statics of Marshallian demand .............................................................. 12

1.6 Expenditure minimization problem and duality in consumption ............................... 15

1.7 Slutsky decomposition and Slutsky equation ............................................................. 17

1.8 Alternative approach to consumer’s theory: revealed preferences ............................ 19

1.9 Slutsky substitution effect .......................................................................................... 20

1.10 Measuring changes in consumer’s welfare .............................................................. 22

1.11 Price indices (optional)............................................................................................. 28

1.12 Sample exercise with solution .................................................................................. 30

2. CHOICE UNDER IN-KIND INCOME ....................................................................... 31

2.1 In-kind income ........................................................................................................... 31

2.2 Consumption-leisure model (Individual labour supply) ............................................ 33

2.3 Consumption choices over time: intertemporal choice .............................................. 35

2.4 Production and consumption over time (optional) ..................................................... 39

2.5 Applications of NPV rule: exhaustible resources (optional) ...................................... 41

2.6 Sample exercise with solution .................................................................................... 43

3. CHOICE UNDER UNCERTAINTY ........................................................................... 45

3.1 Gambles and contingent commodities ....................................................................... 45

3.2 Expected utility .......................................................................................................... 50

3.3 Willingness to pay to avoid risk ................................................................................. 52

Application 1. Obtaining additional information ............................................................. 53

Application 2. Demand for Insurance .............................................................................. 54

3.4 The Arrow–Pratt measure of risk aversion ................................................................ 57

3.5 Reducing risk via diversification................................................................................ 58

3.6 Sample exercise with solution .................................................................................... 59

4. GAME THEORY ......................................................................................................... 62

4.1 Simultaneous-move games ......................................................................................... 62

4.2 Sequential-move or extensive-form games ................................................................ 66

4.3 Repeated games .......................................................................................................... 70

1

A.Friedman

ICEF-2022

4.4 Sample exercise with solution .................................................................................... 73

5. THE FIRM ................................................................................................................... 75

5.1 Modeling the firm’s technological opportunities ....................................................... 75

5.2 Profit maximization and Cost minimization .............................................................. 77

5.3 Cost minimization ...................................................................................................... 77

5.4 Profit maximization in case of perfect competition ................................................... 85

5.5 Sample exercise with solution .................................................................................... 86

6. PERFECT COMPETITION ......................................................................................... 89

6.1 Perfect competition .................................................................................................... 89

6.2 Equilibrium and efficiency ......................................................................................... 93

Application 1: per unit tax analysis .................................................................................. 96

Application 2: price ceiling .............................................................................................. 98

Application 3: price support program .............................................................................. 98

6.3 Sample exercise with solution .................................................................................... 99

7. GENERAL EQUILIBRIUM AND WELFARE ECONOMICS ................................ 101

7.1 General equilibrium in exchange economy .............................................................. 101

7.2 Pareto optimum in exchange economy .................................................................... 105

7.3 Welfare theorems for exchange economy ................................................................ 108

7.4 Production economy ................................................................................................. 110

7.5 Pareto efficiency in economy with production ........................................................ 114

7.6 Sample exercise with solution .................................................................................. 118

8. MONOPOLY ............................................................................................................. 120

8.1 Pure monopoly ......................................................................................................... 120

8.2 Sources of monopoly and regulatory responses: ...................................................... 122

8.3 Monopolistic price discrimination ........................................................................... 126

8.4 Sample problem with solution.................................................................................. 136

9. OLIGOPOLY ............................................................................................................. 138

9.2 The Stackelberg model ............................................................................................. 140

9.3 Price-setting oligopolists: Bertrand model with homogenous good ........................ 142

9.4 Price leadership or Dominant firm model (optional) ............................................... 143

9.5 Repeated interactions ............................................................................................... 144

9.6 Bertrand model with differentiated goods ................................................................ 147

9.7 Sample exercise with solution .................................................................................. 149

10. FACTOR MARKETS .............................................................................................. 151

10.1 Demand for factors ................................................................................................. 151

10.2 The supply of factors and competitive equilibrium ............................................... 155

10.3 Monopsony and monopoly in factor markets ......................................................... 156

11. ASYMMETRIC INFORMATION .......................................................................... 159

2

A.Friedman

ICEF-2022

11.1 Types of asymmetric information problems .......................................................... 159

11.2 Adverse selection and the market for lemons ........................................................ 159

11.3 Adverse selection at insurance market ................................................................... 162

11.4 Private and Government Response to Adverse Selection Problem........................ 165

11.5 Spence model of job market signaling ................................................................... 166

11.6 Screening ................................................................................................................ 168

11.7 Sample exercise with solution ................................................................................ 177

12. EXTERNALITIES AND PUBLIC GOODS ........................................................... 181

12.1 Simple Model of Consumption Externalities ......................................................... 181

12.3 Government Regulation ......................................................................................... 185

12.4 Efficient Provision of Public Good ........................................................................ 186

12.5 Private Provision of Public Good ........................................................................... 187

12.6 The Commons Problem .......................................................................................... 189

12.7 Sample exercise with solution ................................................................................ 191

3

A.Friedman

ICEF-2022

1. CONSUMER’S THEORY

Economists assume that consumers choose the best bundle of goods they can afford.

Thus we have to describe more precisely what we mean by the “best” and what we mean by

“can afford”. We start with the concept of affordable bundle.

1.1 Budget constraint

Bundle is a vector of commodities. In an economy with N commodities bundle is described by

vector x x1 , x 2 ,, x N , where x i stays for the quantity of good i . Each commodity can

be consumed only in nonnegative amount, i.e. x i 0 .

Key assumption. Consumer is a price taker, i.e. price per unit of a commodity is not affected

by the number of units purchased.

Denote per unit price of commodity i by pi , then p p1 , p2 ,, p N is a price vector. If

consumer

purchases

bundle

x

at

prices

given

by

p,

then

he

spends

p1 x1 p2 x 2 p N x N or simply px .

Suppose that consumer has money income M , then he can afford all bundles that cost no

more than M .

We call the set of all affordable consumption bundles at prices p p1 , p2 ,, p N and

income M the budget set of the consumer. Budget set contains bundles x 0 that satisfy the

following constraint

p1 x1 p2 x 2 p N x N M ,

which is called budget constraint.

In case of two goods we can illustrate budget set graphically using budget line.

x2

M

p2

Budget line slope

p1

p2

Budget set

0

M

p1

x1

4

A.Friedman

ICEF-2022

Budget line is the set of bundles that cost exactly

x 2 ( M p1 x1 ) / p2 , then the slope of budget line is:

M:

p1 x1 p2 x 2 M . As

dx 2

p

1 .

dx1

p2

Note:

1)

vertical and horizontal intercepts represent bundles in which only one of the

commodities is consumed;

2)

the slope is equal to negative of the price ratio and reflects the opportunity cost of

consuming good 1 (in order to consume more of good 1 you have to give up some

consumption of good 2).

Change in the price of good 1 results in rotation of budget line.

x2

~

p1 p1

M

p2

~

p1

p2

p1

p2

M

~

p1

0

M

p1

x1

Change in income brings a parallel shift of budget line.

~

MM

x2

M

p2

p1

p2

~

M

p2

0

~

M

p1

M

p1

x1

5

A.Friedman

ICEF-2022

Non-linear budget constraints

Quantity discount

x2

100

4

M 100, p2 1

p1 4, x1 15 , and

p1 2 for each additional unit

2

0

15

35

x1

In-kind transfer of commodity 1, equal to x1

x2

x1

M / p2

M

p1

M

x1

p1

x1

The numeriare

Budget set is not affected if all prices and income change proportionally. We can divide all

p

M

~

prices and income by the price of the second good: 1 x1 x 2

or ~

p1 x1 x 2 M . In

p2

p2

this case we use second good as a numeriare.

2-good case

There are more than 2 commodities, but we can treat good 2 as a composite commodity with

price equal 1. Then good 2 represents the amount of all other (than good 1) commodities that

agent can purchase by spending $1. Notation: AOG

6

A.Friedman

ICEF-2022

1.2 Preferences

Preferences are defined over bundles, not goods.

Bundle is a vector of commodities: x x1 , x 2 ,, x N

Notation:

weak preference relationship ‘bundle x is at least as good as bundle y’: x

y

strict preference relationship: x y x

x

y but not y

indifference relationship x ~ y x

y and y

x

Assumptions

Completeness: consumer can compare any two bundles and tell, which one he/she prefers

or whether he/she is indifferent between them: for any two bundles x and y we have that

x

y or y

x or both.

Transitivity: for any three bundles x, y, z such that x

y and y

z we have x

z

The set of all bundles that are indifferent to a given bundle is called indifference curve:

IC x x : x ~ x

Implication of transitivity: different indifferent curves do not intersect (prove!).

Non-satiation: more is better

x2

These bundles are

x

preferred to ~

~

x

~

x is preferred

to these

bundles

x1

With non-satiation assumption, indifference curves cannot slope upward.

We will always assume completeness, transitivity and non-satiation if the opposite is not

postulated explicitly. In the second year course we also used the assumption of diminishing

MRS but we are not going to use it as a default assumption this year.

7

A.Friedman

ICEF-2022

Marginal rate of substitution of good 1 for good 2 MRS12 (i.e. putting of good 2 in place of

good 1) is the maximum amount of good 2 a person is willing to give up to obtain one

additional unit of good 1 or (in the limit) it is the rate at which commodity 2 must decrease as

commodity 1 increases by an infinitesimal amount to keep the individual on the same

indifference curve.

Suppose that indifference curve (IC) is described by the function x 2 f x1 . Then MRS 12 is

equal to the absolute value of the slope of IC

x 2

x1 0 x

1

MRS 12 x lim

lim

x

x1 0

f x1 x1 f x1

f x1 x .

x1

x

Implication of diminishing MRS: convex to the origin indifference curves.

x2

x 2 f x1

Diminishing

MRS12

x

MRS12 x

x1

Examples of preferences

Perfect substitutes: goods that can be substituted for each other at a constant rate

Perfect complements: goods that have to be consumed in fixed proportions

“Bads” (violates the assumption of non-satiation)

1.3 Utility

Utility function is a function that assigns a number to every possible consumption bundle such

that more preferred bundles get assigned larger numbers than less preferred bundles and vice

versa, larger numbers are assigned to more preferred bundles.

Denote this function by u .

Note: utility function allows ranking bundles by their amount of utility but it does not allow

precise comparisons of how various bundles are valued relative to each other. Such function

is called ordinal as it only orders the bundles.

8

A.Friedman

ICEF-2022

As a result of its ordinal nature utility function is not unique. We can multiply utility by some

positive number and get different utility function that represents the same preferences.

In fact, we can use any positive monotonic transformation. This can be justified in the

following way. Suppose that u is a utility function that represents preferences of some

consumer and gu is some arbitrary increasing function. Let us demonstrate that

v g u represents the same preferences as u . Consider two arbitrary consumption

bundles x and y . As u is a utility function that represents preferences of considered

consumer then x

y iff ux uy . Since gu is increasing then ux uy implies that

gux guy , which means that vx vy .

Now, let us go in the opposite direction. Suppose that vx gux guy vy . Is it

possible that ux uy ? If ux uy then gux guy as gu is increasing, and

we get a contradiction. Thus ux uy iff vx vy , that is v gu represents the

same preferences as u if gu is increasing.

Construction of utility function by assigning numbers to ICs

x2

ue

x

u ~x e

~

x

ux e

0

45

ux

u ~x

x1

Examples of utility functions

Perfect substitutes: ux1 , x 2 x1 x 2

Perfect complements: ux1 , x 2 minx1 , x 2

Commodity 2 is a “Bad”: ux1 , x 2 x1 x 2

Cobb-Douglas utility function: ux1 , x 2 x1 x 2

Quasiliniar utility function: ux1 , x 2 x1 x 2

9

A.Friedman

ICEF-2022

How to calculate MRS

Marginal utility of commodity i - change in total utility due to an increase in consumption of

u

this commodity by (an infinitely small) additional unit: MU i

.

x i

This concept allows calculating MRS as a ratio of marginal utilities. We start with an

indifference curve ux1 , x 2 u and take a full differential

u1 x1 , x 2 dx1 u2 x1 , x 2 dx 2 du 0 .

Rearranging we get an expression for MRS:

MRS 12 x

dx 2

dx1

u

ux / x1 MU 1

.

ux / x 2 MU 2

Question. Check that MRS for gu is the same as MRS for u if g 0 .

Comment on MRS and convexity

Diminishing MRS (under nonsatiation) implies convex to the origin indifference curves.

Definition: S is a convex set if for any a and b from S a convex combination a 1 b

is also in the set S for any 0 1.

Preferences are convex if for any level of utility u the set of weakly preferred bundles

x : ux u is convex (see the left panel). The right panel illustrates the case of nonconvex

preferences.

x2

x2

x1

x1

1.4 Consumer’s choice

Utility maximization problem

m ax ux1 , , x N

xi 0

p1 x1 p2 x 2 p N x N M

10

A.Friedman

ICEF-2022

Solution of this problem is called x p, M - Marshallian (ordinary) demand and the value of

the problem v p, M ux p, M is called indirect utility function.

Note: non-satiation implies that income is always exhausted, i.e. budget constraint is satisfied

as equality (prove it!).

To solve the problem we setup a Lagrangean:

ℒ ux1, , x N M p1 x1 p2 x 2 pN x N

FOCs for interior solution:

ℒ/xi = ux x i pi 0

ux x i pi

ℒ/ = M p1 x1 p2 x 2 pN x N 0

MRS ij

ux x i pi

p

i

ux x j p j p j

Graphical solution for N=2

x2

Interior optimum

p1 x1 p2 x 2 M ,

MRS 12 x p1 / p2

x1 0, x 2 0.

Increase in

utility

x

0

x1

Question. Consider any bundle with

x1 0, x 2 0

on budget line such that

MRS 12 p1 / p2 . Explain, why this bundle is not optimal.

Other interpretation of interior optimum condition: marginal utility per dollar spent has to be

the same for all goods:

MU 1 x

MU 2 x

.

p1

p2

FOCs are not sufficient to guarantee a maximum: bundles A and B both satisfy the FOC but

only bundle B gives the maximum utility while A violates second order condition (SOC).

Thus we should check SOC. If non-satiated preferences satisfy diminishing MRS then SOC

will hold automatically.

11

A.Friedman

ICEF-2022

x2

B

A

x1

Corner solutions.

x2

x

x2

MRS 12 x

MRS 12 x

0

p1

p2

x1

(a) x1 0, x 2 0 и MRS 12 x

0

p1

p2

p1

p2

x

x1

(b) x1 0, x 2 0 и MRS 12 x

p1

p2

1.5 Comparative statics of Marshallian demand

Comparative statics - comparison of two equilibria.

Marshallian (or ordinary) demand functions x1 p1 , p2 , M and x1 p1 , p2 , M we derive

from utility maximization problem.

Income change

Normal good - a good for which an increase in income increases consumption ceteris paribus.

Inferior good - a good for which an increase in income decreases consumption ceteris paribus.

Neutral good - a good for which an increase in income does not affect consumption ceteris

paribus.

12

A.Friedman

ICEF-2022

Income elasticity of demand- the percentage change in quantity demanded with respect to a

percentage change in income: XM lim

M 0

X M

X / X

M

M / M

X

.

For normal goods XM 0 and for inferior goods XM 0 .

Income

consumption

curve

x2

x1

0

Own price changes: derivation of individual’s demand curve

x2

M

p2

Price-consumption

curve

0

p3

1

p2

p2

1

p2

p11

p2

p10

p2

x1

p1

p13

p12

p11

p10

Demand curve

for good 1

x1

13

A.Friedman

ICEF-2022

Ordinary good - a good for which an increase in its price decreases consumption ceteris

paribus (individual demand curve is downward sloping)

Giffen good - a good for which an increase in its price results in an increase in consumption

ceteris paribus (individual demand curve is upward sloping)

x2

Giffen good

0

x1

Price elasticity of demand - the percentage change in quantity demanded of good X with

respect to a percentage change in its price: Xp lim

p 0

x

x

X p x px

X / X

px / px

X

.

X

X

For ordinary good pX 0 and for Giffen good pX 0 .

Cross price changes (impact of a change in the price of one good on the quantity demanded

of another good)

Substitutes (goods that satisfy similar wants): an increase in the price of one good leads to an

increase in the quantity demanded of the other good.

Complements (goods that tend to be used together): an increase in the price of one good leads

to a decrease in the quantity demanded of the other good.

Unrelated goods: an increase in the price of one good has no impact on the quantity

demanded of other good.

Cross price elasticity of demand - the percentage change in quantity demanded of good X

with respect to a percentage change in price of good Y : Xp lim

p 0

x

Y

X pY pY

X / X

pY / pY

X

.

X

X

X

Substitutes pY 0 , complements pY 0 , unrelated goods pY 0 .

14

A.Friedman

ICEF-2022

1.6 Expenditure minimization problem and duality in consumption

Alternative objective of the consumer: attain a given level of satisfaction in a cheapest way.

Expenditure minimization problem:

m in p1 x1 p2 x 2

x i 0

u x 1 , x 2 u

Solving this problem we get compensated (or Hicksian) demand x p, u . In some textbooks

compensated demand is denoted by h p, u . Plugging it into the objective function we obtain

the corresponding expenditure function e p, u px p, u .

Graphical derivation of compensated demand.

Start with identifying the set of bundles that give desired utility, i.e. draw the desired

IC

Illustrate iso-expenditure lines: p1 x1 p2 x 2 =const

Find the point that lies on IC and on the lowest iso-expenditure line:

u x1 , x2 u ,

for interior solution ( x1 0, x2 0 ) we have

MRS12 x p1 / p2

Note: compensated demand curve reflects only SE, while ordinary demand curve shows both

SE and IE.

15

A.Friedman

ICEF-2022

p1

p1

Negative IE

Positive IE

~

p

~

p

x1 p, u

x1 p, M

x1 p, u

0

x1 p, M

x1

(а) normal good

0

x1

(b) inferior (but not Giffen) good

Duality in consumption

1. From utility-maximization (UMP) to expenditure minimization (EMP)

Let x solves UMP under p, M and u ux v p, M .

Consider EMP under p and u .

If x solves UMP under p, M then x solves EMP under p, u and ep, u M .

2. From expenditure minimization (EMP) to utility-maximization (UMP)

Now, let us start with expenditure minimization problem. Suppose that x solves EMP under

p, u . Let us fix the consumer’s income M e p, u and consider utility maximization

under p, M . Then x solves UMP under p, M and ux u .

16

A.Friedman

ICEF-2022

Summary of duality results:

x p, M x p, v p, M

(1)

M e p, v p, M

(2)

x p, u x p, e p, u

(3)

u v p, e p, u

(4)

1.7 Slutsky decomposition and Slutsky equation

Price change

Substitution effect

the effect of a price change

on quantity demanded due

exclusively to the fact that its

relative price has changed

Income effect

the effect of a price change on

quantity

demanded

due

exclusively to the fact that the

consumer’s real income has

changed

Under Hickes approach constant real income means that consumer can attain the same

indifference curve, i.e. keeps utility constant.

Slutsky decomposition: x i x iSE x iIE x ih x i0 x i x ih

17

A.Friedman

ICEF-2022

x i x iSE x iIE

.

Relative changes:

p1 p1

p1

Sign of Hicksian SE:

x1SE

0.

p1

Derivation of Slutsky equation

Consider the change in quantity of good i demanded due to the change of good j price.

Differentiate (3) with respect to p j :

x i p, u x i p, M x i p, M e p, u

.

p j

p j

M

p j

Expenditure will increase proportionally to the quantity of the good consumed (This result is

e p, u

x j p, u

known as Shephard’s lemma and follows from the envelope theorem):

p j

and due to (3) x j p, u x j p, e p, u x j p, M , where M e p, u .

Plug back and rearrange:

x i p, M x i p, u

x p, M

x j p, M i

.

p j

p j

M

IE

SE

Own price version of Slutsky equation:

Own SE can never be positive:

x i p, M x i p, u

x p, M

x i p, M i

pi

p

M

i

IE

own SE

x i p, u

0 . Prove it!

pi

Substitution effect is zero in case of kinked IC (for example, in case of Leontieff preferences)

Question: illustrate Slutsky decomposition for the case of Leontieff preferences.

Sign of IE depends on the nature of the good (normal or inferior).

Summary: impact of an increase in the price of a good

Type of good

SE

IE

TE=SE+IE

Normal

Inferior but not Giffen

+

Giffen

+

+

Question: illustrate Slutsky decomposition for the case of Giffen good

18

A.Friedman

ICEF-2022

1.8 Alternative approach to consumer’s theory: revealed preferences

Idea: if two bundles x and ~

x are affordable but only x is chosen, then x is revealed

~

preferred to x . Thus, if bundle x x1, x2 is chosen under p1 , p2 , M then it is revealed

preferred to any bundle from the budget set x 0 : p1x1 p2 x2 M

x2

The weak axiom of revealed preference (WARP)

If bundle x is revealed preferred to ~x and the two bundles are not the same, then it cannot

happen that ~x is revealed preferred to x .

x2

M

p2

~

M

~

p2

0

Violation of WARP

~

x~

p, M

x p, M

M

p1

~

M

~

p1

x1

~

x x , then ~

Check WARP: if p1 ~

x1 p2 ~

x 2 M and ~

p1 x1 ~

p2 x 2 M for any p, M and

~

~

p, M .

Application of revealed preferences

Replacement of per unit subsidy on good 1 by the lump sum subsidy of equivalent money cost

19

A.Friedman

ICEF-2022

x2

M sx1

p2

x p, M sx1

M

p2

1

sx

p2

0

x

M

p1

M

p1 s

x1

Question: prove that the vertical red segment gives the cost of subsidy in terms of good 2.

1.9 Slutsky substitution effect

Under Slutsky approach constant real income means that consumer can afford the initial

bundle. Thus we pivot the budget line around the original choice.

Slutsky decomposition with Slutsky SE: x i x iSE x iIE x icomp x i0 x i x icomp

Slutsky substitution effect is derived under the assumption that real income stays constant in a

sense that the old optimal bundle is still affordable under new prices: M comp px 0 or in our

example M comp M p1 x10 .

Observed response= x i x i x i0

Compensated response - the change in quantity demanded resulting from changing the price

while simultaneously compensating the individual with income= x iSE x icomp x i0

x i x iSE x iIE

.

Relative changes:

p1 p1

p1

20

A.Friedman

ICEF-2022

x2

M comp

p2

M

p2

x comp

x

x

0

p1

p2

0

p10

p2

x1

x

IE

1

x

SE

1

Sign of SE

Own substitution effect is always non-positive

x1SE

0 (from revealed preferences).

p1

Sign of IE

x iIE x i x icomp

.

p1

p1

21

A.Friedman

ICEF-2022

Note: M M M comp p1 x10 or p1

IE

x iIE

M

0 x i

x

. As

.

Plug

back:

1

p1

M

x10

x10 0 , then

x iIE

x iIE

0 if

0 , i.e. if good i is inferior,

p1

M

x iIE

x iIE

0 if

0 , i.e. if good i is normal

p1

M

x iIE

x iIE

0 if

0 , i.e. if good i is neutral with respect to income

p1

M

Own price Slutsky decomposition

x1 x1SE

x IE

x10 1 . If p 0 , then Hicksian SE = Slutsky SE.

p1 p1

M

1.10 Measuring changes in consumer’s welfare

Demand curve as a marginal valuation schedule

Consider a quasi-linear utility function ux1 , x 2 vx1 x 2 , where v 0 and v 0 ,

v0 0 . Let p2 1 . In case of interior solution MRS 12 x

v1 p1

or vx1 p1 .

1

1

$

Inverse demand

function

Ordinary (Marshallian) consumer surplus (CS) – the difference between what the consumer

is willing to pay and what he has to pay.

CS gross x10 p1 x1 dx1 vx1 dx1 v x10 v0 v x10 as v0 0 .

x10

x10

0

0

22

A.Friedman

ICEF-2022

$

Inverse demand

function

CS x10 CS gross x10 p10 x10 v x10 p10 x10 u x10 , M p10 x10 M as x 2 M p1 x1 .

Note: the derived equality between CS and utility adjusted for the income is correct for the

quasilinear preferences, do not apply it if preferences are different.

CS is calculated as the area below Marshallian inverse demand function above the market

p x p dx or as an area to the left from Marshallian demand

CS x x p dp , where p is the cut-off price at which the quantity

price CS x10

x10

0

function

0

1

1

0

1

1

1

p

p10

1

1

1

demanded becomes equal to zero.

Application of CS

Suppose the price of good 1 goes up from p10 to p1 . What is the resulting change in

consumer’s welfare? It equals to the change in consumer’s surplus

CS CS x1 CS x10 ux1 , M p1 x1 M u x10 , M p10 x10 M

ux1 , M p1 x1 u x10 , M p10 x10 .

23

A.Friedman

ICEF-2022

$

CS after price

increase

Initial CS

Reduction in CS due to

the price increase

Problems with the concept of CS

In the presence of income effect CS is only an approximate measure of consumer welfare.

Reason: demand curve shows the relationship b/w price and quantity demanded holding other

things fixed, including money income. But with fixed money income the value that an

individual puts on an additional unit of a good may depend on the amount that he has already

spent on previous units of the good. As a result, price is not identical to consumer’s marginal

valuation of the associated unit of output.

Other measures of consumer’s welfare

Compensating variation (CV) - the change in money income just necessary to offset the

change in utility induced by the price change

By definition vp0 , M u0 v p, M CV . From duality: M CV ep, u0 and

M e p 0 , u 0 , which implies CV e p, u0 e p0 , u0 .

24

A.Friedman

ICEF-2022

CV is measured at the new prices.

Equivalent variation (EV) - the change in money income that is equivalent in its effect on the

individual’s utility to a change in the price of a commodity.

M e p, u , which implies EV e p, u ep , u.

By definition: v p, M u v p0 , M EV . From duality: M EV e p0 , u

and

0

EV is measured at the initial prices.

25

A.Friedman

ICEF-2022

Relationships b/w EV, CV, CS

EV and CV can be represented as areas bound by the compensated demand curves.

To measure CV we need a schedule that shows how the quantity demanded varies with price,

assuming that as price changes, the consumer’s money income is adjusted to keep him at

initial level of utility. This is a compensated demand curve that reflects only Hicks SE.

Inverse compensated demand function also can be interpreted as marginal valuation: it gives

marginal valuation for arbitrary preferences (not only quasi-linear one) as marginal valuation

of each dollar is not affected by the price.

Let’s prove that EV and CV can be represented as areas bound by the compensated demand

curves. We start with writing down Shephard’s lemma for good 1 and initial utility level:

e( p, u 0 )

x1 ( p, u 0 ) .

p1

By integrating this function with respect to good 1 price from p10 to p1 , we can find

p1

x1 ( p1 , p 2 , u )dp1

0

p10

p1

e( p1 , p 2 , u0 )

dp1 e( p1 , p2 , u0 ) e( p10 , p2 , u0 ) CV .

0

p

1

p

1

Thus compensating variation can be represented as the area under corresponding compensated

demand curve x1( p1 , p 2 , u0 ) between initial and new prices.

Similarly, from Shephard’s lemma with new utility level we get expression for

equivalent variation:

p1

x ( p ,p

1

p10

1

2

, u)dp1

p1

e( p1 , p 2 , u)

dp1 e( p1 , p2 , u) e( p10 , p2 , u) EV

p

1

p0

1

Thus equivalent variation is represented by the area under another compensated demand curve

that corresponds to the new level of utility x1 ( p1 , p 2 , u) .

26

A.Friedman

ICEF-2022

EV

CS

CV

Finally, we can compare the three measures for the change in consumer’s welfare, resulting

from the considered price increase:

EV CS CV ,

where CS - is the corresponding change in consumer surplus.

We can explain this result intuitively. Consider the relationship between CV and CS . Price

increase reduces the purchasing power of income (real income), which in its turn leads to a

fall in demand for normal good. Due to the negative income effect Marshallian demand (that

includes income effect) lies to the left from corresponding compensated demand curve (that

reflects only substitution effect) for any price above p10 . As a result the area bounded by

Marshallian demand is smaller than area bounded by compensated demand curve x1( p, u0 ) .

Implication: Marshallian CS is only an approximation of the true CS measured as an area

below the compensated demand curve.

Question. Why Marshallian CS is widely used?

If price of normal good goes up then EV< CS <CV.

27

A.Friedman

ICEF-2022

If price of inferior good goes up then EV> CS >CV.

For the case of neutral good EV= CS =CV as Marshallian and compensated demand curves

coincide.

1.11 Price indices (optional)

Ideally, the changes in the cost of living would be measured by the change in money income

that is necessary for the consumer to achieve the same level of utility in the given year as in

the base year (index based on CV)

Then, if the consumer’s money income increases more (less) then this measure of the cost of

living we can infer that he is better (worse) off.

As compensated demand is not observable this ideal measure of cost of living (ICLI) cannot

be used.

Instead we use some approximations: Laspeyras price index (LPI) and Paashe price index

(PPI).

LPI - the ratio of the sum of given year prices weighted by the base year quantities to the sum

N

of base year prices weighted by the base year quantities: LPI t

p x

0

i

p

0

i

t

i

i 1

N

i 1

.

0

i

x

x2

px 0 / p20

u LPI

u0

M LPI

p 20

M ICLI

p 20

x p, u 0

M 0 / p20

x x p ,u

0

x

0

0

p1

p 20

0

p10

p 20

x1

Using base year quantities to weight the prices of goods in a different year, LPI does not

allow for the fact that a consumer tends to substitute away from goods that become relatively

expensive. It implies that an individual whose income is indexed in accordance with LPI can

28

A.Friedman

ICEF-2022

purchase base year bundle, i.e. he can never be worse off. Moreover he could be better off by

substituting away from relatively expensive goods. Thus agent might be better off even if his

income increases slightly less then LPI.

Conclusion: LPI overstates increases in the true cost of living.

Paashe price index (PPI) - the ratio of the sum of given year prices weighted by the given year

quantities to the sum of base year prices weighted by the given year quantities:

N

PPI t

p x

t

i

t

i

p

0

i

t

i

i 1

N

i 1

.

x

PPI understates increases in the true cost of living.

PPI gives a minimum estimate of the increase in the TCL since it assumes (erroneously) that

N

had the consumer received in the base year an amount of income equal to

p

i 1

0

i

x it he would

choose given-year bundle. Instead the consumer would tend to buy relatively more of the

commodities which in base year were cheaper than in given year. This implies that for an

individual whose income is indexed in accordance with PPI, current year bundle was

affordable in the base year. Thus he is never better off. Moreover an agent could be worse off

even if his income rises a bit more than PPI.

x2

px px p, u

p2

p2

p0 x

p2

p 0 x p 0 , u

p2

u0

u

p1

p2

x0

x

x p 0 , u

p10

p2

u PPI

0

x1

What determines the magnitudes of the errors in the LPI and PPI?

the extent to which relative prices change,

the extent to which the consumer substitutes b/w the commodities when relative prices

do change,

individual versus representative agents (average bundle) index.

29

A.Friedman

ICEF-2022

1.12 Sample exercise with solution

Bob uses his monthly income (M) to pay for water services and all other goods (represented

by a composite commodity). The price of the water services is p per m3, and the price of

composite commodity is 1. Bob’s preferences are represented by differentiable utility

function.

The local water company cannot cover its cost and considers two options to solve the

problem. It could raise the price by 10%. In this case Bob’s utility level is reduced from u 0 to

u 1 . Alternatively, the water company may keep per unit price constant but in addition

introduce fixed per month charge that results for Bob exactly in the same utility loss.

Which scheme brings more revenue to the water company? Which scheme results in greater

water conservation? Provide graphical and analytical solution.

Solution

Graphical solution

Let x stays for water consumption and y -for AOG. Revenue of water company is given by

the sum of revenue from sales (price multiplied by quantity) and fixed charge. As his income

is the same, then water expenditure equals M y . Graphically we compare

TR1 p1 x p1 , M M y p1 , M

TR2 F p 0 x p 0 , M F M y p 0 , M F .

and

From the graph we get TR1 TR 2 and x x x x . Thus the second scheme brings

more revenue but the first scheme provides greater water conservation.

0

1

0

2

y

BC1

TR1

1

u0

u

BC2

TR2

BC-initial

x1

x2 x0

x

Algebraic solution

As bundles x 1 , y1 and x 2 , y 2 provide the same utility, then the change in quantity

demanded is due to Hicksian SE only. We know that own SE is nonpositive (proof to be

provided at class). As relative price goes up when we proceed from x 2 to x 1 and ICs are

smooth (due to differentiability of utility function) then x SE x 1 x 2 0 . Thus x 1 x 2 ,

which means that water conservation is higher under the first scheme.

Due to nonsatiation with lower consumption of x we can have the same utility only with

increased consumption of y : ux 1 , y1 ux 2 , y 2 and x1 x 2 implies y1 y 2 . Thus

TR1 M y1 M y 2 TR2 .

30

A.Friedman

ICEF-2022

2. CHOICE UNDER IN-KIND INCOME

2.1 In-kind income

Let us suppose that instead of money income consumer is endowed with commodities bundle:

x1 , x 2 , i.e. he owns

x 1 of the first good and x2 units of the second one. This bundle is

called initial endowment and it is always on the budget line as it can be consumed without

market trade.

If he sells this bundle at market prices, he gets money income M p1 , p2 p1 x1 p2 x 2 .

Note: now income depends on prices.

x2

x2

p1 x1

p2

Agent sells good

1

Initial

endowment

x2

Agent buys good

1

p1

p2

x1

0

x1

p x

x1 2 2

p1

The effect of price change on budget set in case of in-kind income

x2

First good price

increase

Become

affordable

x2

p1 x1

p2

x2

Become

unaffordable

p1

p2

0

x1

p1

p2

p x

x1 2 2

p1

x1

Utility maximization problem with in-kind income

31

A.Friedman

ICEF-2022

m ax ux1 , x 2 ,, x N

xi 0

N

N

p x p x .

i 1

i

i

i 1

i

i

If x - solution of UMP under price vector p , then

we say that consumer is a net buyer of good i if x i x i ,

consumer is said to be a net seller of good i if x i x i .

As income depends on prices, the income effect is different. On the one hand, the monetary

income changes as the same endowment will generate higher monetary income under

increased prices. On the other hand, if we fix the monetary income, its purchasing power is

reduced.

Slutsky equation with in-kind income

Differentiate demand for good i with respect to p j :

dx i p, px

x i p, M

x i p, M px

.

dp j

p j

M

p j

Using Slutsky equation for fixed monetary income and rearranging we get

dx i p, px

x i p, u

x p, M

x i p, M

xj i

xj

dp j

p j

M

M

x i p, u

x p, M

x j x j i

p

M

j

Total IE

SE

Own-price version:

dx i p, px

x i p, u

x p, M

x i x i i

.

dpi

pi

M

Conclusion: in case of in-kind income the sign of IE depends on the type of the good

(normal/inferior) and on the type of the agent (net buyer/net seller). The following table

summarizes the signs of income effect and the overall effect of the own price change taking

into account that own substitution effect can never be positive.

Good type

Agent type

Normal good

Inferior good

Net buyer

Net seller

Net buyer

Net seller

Income effect

+

+

Total effect

+/

+/

32

A.Friedman

ICEF-2022

2.2 Consumption-leisure model (Individual labour supply)

One of the applications of the model with in-kind income deals with labour supply. Assume

that we have only two commodities: leisure l and aggregate consumption c . Initial

endowment is given by T , C . Time endowment is divided between leisure l and labour

L :

l L T . Denoting the prices by w - wage rate (price of leisure) and p -price of

consumption good we get the following budget set:

pc wl pC wT and 0 l L , c 0 .

Assuming that preferences are represented by utility function uc, l that increases in both c

and l , we can find the consumer’s choice from the following utility maximization problem:

max uc, l

s.t. pc wl pC wT

0 l T, c 0 .

Interior solution:

MRS lc w / p and pc wl pC wT .

Reservation wage: w / p MRS lc (l T , c C )

c

Increase in utility

C

wT

p

w/ p

c

C

L

l

0

l

T

Analysis of the wage rate increase

dl w, c wT

dw

l comp

l

l comp

l

T l

L

.

w

M

w

M

SE

IE

SE: leisure becomes more expensive, thus SE reduces leisure and increases consumption of

aggregate commodity

33

A.Friedman

ICEF-2022

IE: Agent is a net seller of labour (he can never be a net buyer). Selling labour time at higher

price raises his real income.

c

w / p

c0

w0 / p

c

l IE

0

T

l SE

l

If leisure is normal, then it goes up due to increase in income and IE>0.

If leisure is inferior, then it goes down and IE<0.

Leisure

Normal good

Inferior good

Substitution effect

Income effect

+

(if SE dominates)

+ (if IE dominates)

Total effect

Derivation of individual labour supply p 1

c

Labour supply

w2

w2

w1

w1

w0

w0

c

L

0

0

L1

L2

(а)

T

l

L0 L1 L2

L

(b)

34

A.Friedman

ICEF-2022

Possibility of backward bending labour supply (if leisure is normal)

c

w

w2

Labour supply

w1

IE dominates

w2

w1

SE dominates

w0

w0

c

L0

0

(а)

L1

L2

T

l

L0 L2 L1

L

(b)

Question. Explain why an increase in the basic wage rate per hour offered to a worker may

decrease the number of hours she wishes to work while an overtime premium offered to the

same worker may increase the number of hours she wishes to work?

2.3 Consumption choices over time: intertemporal choice

Let us assume that there are two periods: current period ( t 0 ) and future period ( t 1 ).

Individual gets income of Y 0 in current period and Y1 in future period. This bundle

corresponds to his endowment point (the bundle of present and future consumption that can be

consumed without market trade). Assume that individual can borrow and lend at the same

market interest rate r .

If individual consumes less than he earns in the current period, then the difference

Y0 c 0 is saved and in the next period the agent gets additional income equal to

Y0 c0 1 r . Thus his future consumption equals

c1 Y1 Y0 c 0 1 r . If currently the

agent wants to consume more than he earns, then he has to borrow c 0 Y0 and in the future

he will repay the debt together with interest payments, thus his future consumption equals

c1 Y1 c 0 Y0 1 r Y1 Y0 c 0 1 r . It means that irrespective of whether agent

borrows or lends, his budget constraint is

c1 Y1 Y0 c 0 1 r .

If we open the brackets and put consumption in the LHS, then the budget constraint can be

rewritten as

c 0 1 r c1 Y0 1 r Y1 .

35

A.Friedman

ICEF-2022

In the LHS we have the future value of the life-time consumption and in the RHS- the future

value of the life-time income. By dividing both sides by 1 r the budget constraint can be

stated in terms of present values

c0

c1

Y

Y0 1 .

1 r

1 r

This budget constraint states that present value of lifetime consumption has to be equal to the

present value of endowment.

Graphically this intertemporal budget constraint can be represented by a straight line that

goes through endowment point and has a slope of 1 r .

c1

Saves in

period 0

Borrows

in period 0

Assume that agent derives utility from consumption in both periods uc 0 , c1 . Let more

consumption in either period be preferred to less, so that utility increases as we move further

from the origin. If we assume diminishing MRS then we get convex indifference curves.

The MRS between current and future consumption reveals the intensity of individual’s

preferences for consumption in different periods of time. If we write down MRS 01 1 ,

then is the rate of time preference.

A person is said to be impatient if when consumption levels are the same in both periods is

positive, meaning that person is willing to forego more than $1 of future consumption to

increase current consumption by $1.

A person is said to be patient if when consumption levels are the same in both periods is

negative, meaning that person is willing to forego less than $1 of future consumption to

increase current consumption by $1.

Intertemporal utility-maximization problem:

m ax uc0 , c1

c 0 0 ,c1 0

c0

c1

Y

Y0 1

1 r

1 r

36

A.Friedman

ICEF-2022

In case of interior solution the point of tangency of budget constraint with IC indicates the

optimal consumption bundle. If c 0 Y0 , then agent is called a net lender (saver), if c 0 Y0 ,

then agent is called a net borrower.

c1

Net lender

1+r

c0

Conclusion: if financial market are perfect (agents can lend and borrow at the same interest

rate), then consumption decision is determined by the present value of life-time income, not

the income in current or future period alone.

Comparative statics

In this model interest rate plays a role of price.

An increase in the interest rate brings two effects: substitution effect and income effect. Due

to substitution effect current consumption falls as it becomes relatively more expensive. The

sign of income effect depends on whether we deal with net lender or net borrower (as

consumption stands for aggregate commodity it is treated as a normal good in each period).

For net borrower an increase in the interest rate decreases wealth and results in a fall in

current consumption. So for net borrower both effects move in the same direction and current

consumption definitely falls.

An increase in the interest rate increases the wealth of net lender and under given prices

results in an increase in current consumption. So for net lender current consumption falls and

saving increases if substitution effect dominates and current consumption rises together with

fall in saving when income effect dominates.

We can get the same results from the analysis of Slutsky equation. Income effect is

proportional to the amount saved (S), that is why it may become dominant if S is large

enough:

c 0 c 0comp

c

(Y 0 c 0 ) 0 .

r

r

M

SE

IE

37

A.Friedman

ICEF-2022

Agent type

Net borrower

Net lender

Substitution effect

-

Income (wealth) effect

+

Total change in c 0

+/

Change in

borrowing/lending

Borrowing=

Lending=

= c0 Y0 c0 0

0 if SE dominates

= Y 0 c 0 c 0

0 if IE dominates

Conclusions. Individual demand for borrowing is downward sloping, so does the aggregate

demand. Individual supply of lending could be backward bending (upward sloping under low

saving).

Lending-borrowing equilibrium.

Note: below we assume that backward bending part of individual supply disappears in process

of aggregation.

r

Supply of

lending

r

0

Demand

for

borrowing

B L

Lending,

borrowing

More than 2 periods and bonds pricing

Consider a bond that pays a fixed coupon amount x each period (starting from the next period)

until a maturity date T and at T the face value F is paid.

If we denote the discount factor by 1/(1 r ) then the price of the bond i

P x 2 x T 1x T F .

Let S 1 2 T 1 T then S 2 T T 1 S 1 T 1 which gives

S

1 T 1

.

1

38

A.Friedman

ICEF-2022

The price of a consol (perpetuity that never matures) we get as a special case, where F=0 and

1

1/(1 r )

x

T=. Thus the price is PCONSOL x 2 x T x x

x

.

1

1 1/(1 r ) r

The price of a bond has an inverse relationship with the rate of interest.

2.4 Production and consumption over time (optional)

Suppose that investment (productive) opportunities are available but consumer has no access

to the financial market. Investment opportunities are described by the PPC.

PPC

In equilibrium ct Qt and I S .

If PPC is given by Q1 F Y0 I , then the consumption and production decision is given by

the solution of the problem

max uc 0 , c1

s.t . Q1 F I , c 0 Q0 Y 0 I , c1 Y1 Q1

.

Suppose that investment (productive) opportunities are available and in addition consumer

can borrow and lend at the same market interest rate.

Consumption

Production

39

A.Friedman

ICEF-2022

c1

W0 . The level of

1 r

wealth is the intercept of budget line with the horizontal axes. The highest attainable budget

line is tangent to the PPC. The corresponding highest level of wealth equals W0 . Then

Each budget line is associated with a specific level of wealth: c 0

consumer chooses the best bundle under given level of wealth.

Investment financing.

Net lender I Y 0 c 0 Q0 c 0 , net borrower I Y 0 c 0 c 0 Q0

own saving

lending

own saving

borrowing

On aggregate lending=borrowing, which implies that aggregate saving equals aggregate

investment.

Separation of consumption and production decisions

m ax uc 0 , c1

c1

Y Q1

Q0 1

1 r

1 r

Q0 Y 0 I , Q1 F I

s.t . c 0

Note that production decision does not depend on consumers preferences.

FOC: F I 1 r .

Investment are chosen to maximize the consumers wealth, i.e.

Y Q1

Y F I

Y

F I

maxW0 max Q0 1

max Y 0 I 1

Y 0 1 max I

.

1 r

1 r

1 r

1 r

Separation theorem

If markets for intertemporal claims are perfect, individuals can separate investment decisions

(aimed at maximizing wealth) and consumption decision (dependent on consumer’s time

preferences).

Present value rule

Due to separation theorem production decision can be delegated to managers. Managers that

maximize the wealth of the firm will be making the correct investment decisions for all the

owners individually regardless of the possibly differing time-preferences of the owners.

Net present value of investment project in two-period model: NPV I I

F I

.

1 r

If we have T periods and Rt I is the net income in period t , then

NPV I R0 I

R1 I R2 I

R I

T 1 T 1

2

1 r 1 r

1 r

40

A.Friedman

ICEF-2022

Discrete case. If the number of investment projects is finite and these projects are mutually

exclusive, then the project with the maximum possible present value should be chosen (given

that it is positive).

If projects are not mutually exclusive then all projects with positive NPVs should be adopted.

2.5 Applications of NPV rule: exhaustible resources (optional)

Consider exhaustible resources industry (minerals or fossil fuels). The stock of the resource

Q is constant. The owner should decide how much of the stock to extract and sell in each

period. Consider two-period model. Assume that demand function is stable over time and

P q - diminishing in q . Let extraction costs per unit of resource be constant and equal to c

in any period.

Competitive industry.

In case of competitive industry any firm is a price taker. Let pt stay for current price and

pt 1 - for future price.

If

pt 1 c

pt c , then it is profitable to postpone extraction and sell in future period

1 r

If

pt 1 c

pt c , then it is profitable to sell now

1 r

If

pt 1 c

pt c , then it is profitable to sell in both periods

1 r

Thus in competitive equilibrium extraction takes place in both periods if and only if

pt 1 c pt c r , i.e. price minus extraction costs (marginal

pt 1 c

pt c or

pt c

1 r

profit) rises at the rate of interest.

The result can be explained intuitively. If marginal profit increases less than market interest

rate, then it is profitable to extract and sell the resource today and put money at bank deposit.

If the opposite is true, it is optimal to postpone extraction. In any case the profit maximizing

company has an incentive to change its production decision, which implies that currently

there is excess supply (if extraction today increases) or excess demand (if extraction is

postponed), which is not compatible with equilibrium. So, in equilibrium marginal profit

should grow at the rate equal to market interest rate.

The result can be derived formally from the profit maximization of representative firm:

m ax

q0 ,q1 0

p0 q0 TC (q0 ) p1q1 TC (q1 ) /(1 r )

s.t . q0 q1 Q

FOC for interior solution implies:

41

A.Friedman

ICEF-2022

p0 TC (q0 ) p1 TC (q1 )/(1 r ) or

p1 c p0 c r .

p0 c

This rule is known as Hotelling rule.

As extraction costs are constant, this implies that price will increase over time while

extraction falls (due to declining demand).

Graphical solution for linear demand functions.

Monopolistic industry

As monopolist is a price maker, marginal profit equals to MR c , thus he will extract in both

MRt 1 c

periods if

MRt c , which implies that marginal revenue less marginal

1 r

MR1 c MR0 c r

extraction costs increases at market interest rate:

.

MR0 c

Analytical derivation of the Hotelling rule for the monopolistic industry.

m ax TR q0 TC (q0 ) TR q1 TC (q1 ) /(1 r )

q0 ,q1 0

s.t . q0 q1 Q

FOC for interior solution implies:

TRq0 TC (q0 ) TRq1 TC (q1 )/(1 r ) or

MRq1 c MRq0 c r

.

MRq0 c

Graphical solution and comparison with competitive case (linear demand functions and zero

marginal extraction costs).

42

A.Friedman

ICEF-2022

Graphical analysis suggests that monopolist would be more conservative: he would extract

less today and more tomorrow. As a result the prices for a monopolized industry would be

initially higher and become lower at later dates.

price

monopoly

Competitive

industry

time

extraction

monopoly

Competitive

industry

time

2.6 Sample exercise with solution

Explain, why an increase in the basic wage rate per hour offered to a worker may decrease the

number of hours she wishes to work while an overtime premium offered to the same worker

may increase the number of hours she wishes to work?

Solution

43

A.Friedman

ICEF-2022

Under overtime premium the initial bundle is just affordable and we observe a pivot of BL

around the previous choice. It means that Slutsky IE=0 and SE works in opposite direction to

the price change: with increased overtime payment leisure is more expensive, thus person will

reduce his consumption of leisure (moves from A to B). Thus, he will work more.

Under an increase in the basic wage rate the budget line becomes steeper and individual’s real

income increases as he can generate higher income supplying the same amount of labour.

Thus in addition to the SE that reduces leisure we observe income effect that increases

demand for leisure (in this case leisure must be a normal good) and it might happen that IE

dominates the SE so that total demand for leisure increases and, as a result, labour supply

decreases as it is demonstrated below.

c

w / p

B

C

c0

w0 / p

A

IE

c

Lpremium

SE

0

leisure

T

LWage _ increase

l0

L0

44

A.Friedman

ICEF-2022

3. CHOICE UNDER UNCERTAINTY

3.1 Gambles and contingent commodities

A state of the world is the outcome of uncertain situation.

Contingent commodity is the amount of consumption, the level of which depends on the state

of the world occurring.

Flipping coin game

Suppose for each dollar you bet in a flipping coin game, you win (and get your bet back) if

a heads comes up and lose your bet when a tail comes up.

States of the world: state 1- tails comes up and state 2- heads comes up.

Contingent commodities: consumption if tails comes up (denote by c1 ) and consumption if

heads comes up ( c 2 ).

Endowment point - consumption bundle of contingent commodities that is available when you

make no trades with the market.

In case of flipping coin game initially person has income of w in either state of the world.

Budget constraint for contingent commodities shows how much of each contingent

commodity you can have in each state of the world.

Let us denote the bet by z and assume that bet can never be negative, then we have the

following system that describes the budget constraint:

c1 w z

c 2 w z

0 z w

If we solve this system with respect to z , then we get the budget constraint of the form:

c 2 w w c1 or c1 c 2 w1 where 0 c1 w .

w1

endowment

1

c1

45

A.Friedman

ICEF-2022

Note that after the state of the world is determined, the person will consume only one

contingent commodity that corresponds to the state of the world that takes place.

Budget constraint does not extend to the right from endowment point as it was assumed that

agent is not allowed to select the other side of the original bet. That is, we do not allow

individual to make a bet in which he wins $1 if tails comes up and lose $ if heads comes up.

If person is allowed to take both sides of the gamble, then his budget constraint will be a

straight line that goes through initial endowment with a slope of .

endowment

1

Budget constraint when both sides of the bet can be taken

Generalisation

Suppose that the terms of the gamble are such that consumption changes by x 1 in the first

state of the world (if tail appears) and by x 2 in the second state of the world (if heads

appears). Then we have the following system that describes the budget constraint:

c1 w x1 z

c 2 w x 2 z

If we solve this system with respect to z , then we get the budget constraint of the form:

c2 w

Then the slope of the budget line equals

x2

w c1 .

x1

dc 2 x 2

.

dc1 x1

Fair odds line

Each state of the world s can occur with some probability p s , where 0 ps 1 and

S

p

s 1

s

1.

46

A.Friedman

ICEF-2022

Expected value of the gamble is the weighed sum of outcomes, where weights are equal to

S

probabilities: EV x p s x s .

s 1

EV of the gain in original flipping coin game is $1 p1 p2 $1 p1 1 p1 . If

coin is symmetric then p1 0.5 and EV gamble = 0.5 1 .

A gamble with zero expected monetary gain is called a fair gamble.

If expected monetary gain is different from zero, then such a gamble is said to be unfair.

Gamble with positive expected gain is said to be favourable; gamble with negative expected

gain is called unfaivourable.

The fair odds line is a budget constraint reflecting the opportunities presented by an

actuarially fair gamble (odds - the ratio of the probabilities of the two events).

With two states of the world fair gamble satisfies the condition x1 p1 x 2 p2 0 , which

implies that

x2

dc 2 x 2

p

p

1 1 . As slope of budget line is

, the absolute value of

x1

dc1 x1

p2

1 p1

the slope of fair odds line equals to the ratio of the probabilities

dc 2 x 2

p

1 .

dc1 x1

p2

Going back to our example of symmetric flipping coin we can illustrate the fair odds line as a

p

1/ 2

1 . If 1 , the initial gamble is favourable

straight line with the slope of 1

p2

1/ 2

and fair odds line would be flatter then budget line.

Expected

gain>0

Expected

gain<0

Fair odds line

c1

Note that expected value of consumption remains constant along fair odds line:

EV c c1 p1 c 2 p2 w x1 z p1 w x 2 z p2 w zx1 p1 x 2 p2 w .

Preferences

Three types of attitude toward risk can be distinguished.

47

A.Friedman

ICEF-2022

A person is said to be risk averse if he prefers a certain prospect with a particular expected

value to an uncertain prospect with the same expected value.

A person is said to be risk neutral if he is indifferent between a certain prospect with a

particular expected value and an uncertain prospect with the same expected value.

A person is said to be risk loving if he prefers an uncertain prospect with a particular expected

value to a certain prospect with the same expected value.

In order to illustrate certain prospects we will draw certainty line – the locus of all possible

certain consumption levels (i.e. the line c 2 c1 ).

Indifference curves for risk neutral agent are given by straight lines parallel to the fair odds

line. Reason: any uncertain prospect for a risk neutral agent is equivalent to certain bundle

with the same EV. Note that along FOL expected value of consumption is constant, thus all

these points lie on the same indifference curve. As more is better, agent becomes better off

while moving along certainty line further from the origin.

Increase in utility

FOL

To illustrate indifference curves for a risk averse agent, let us take two points on fair odds

line: certainty point A and some uncertain prospect B.

FOL

FOL

(1)

(2)

As both bundles (A and B) have the same expected value of consumption but A is certain,

then by definition risk averse agent would prefer certain bundle A to any uncertain prospect

like B that gives the same EV of consumption. It means that all points on FOL would give

lower utility than A. In other words, A belongs to indifference curve that lies further from the

origin. As a result ICs cannot be bowed outward as in diagram (1). Otherwise point B would

bring higher utility than A, which contradicts to risk aversion.

48

A.Friedman

ICEF-2022

ICs cannot cross fair odds line at certainty line as in diagram (2). Otherwise risky prospect

(D) would be equivalent to the certain one (A) with the same EV.

Thus the IC of risk averse agent satisfies the following properties:

absolute value of the slope (MRS) at certainty points is equal to the ratio of probabilities

(absolute value of the slope of FOL);

ICs are bowed in.

c2

FOL

c1

Exercise. Show that indifference curves of a risk lover are bowed out and at certainty points

have slope that is the same as the slope of FOL.

Optimal bet: the case of risk averse agent

By definition, a risk-averse agent will never participate in fair game (i.e. will make zero bet)

as his initial endowment lies on certainty line and is preferred to any risky prospect that

belongs to FOL.

Optimal choice

FOL=Budget line

Fair game

If game is favourable (this is the case if 1 ), then risk averse agent will take some risk and

optimal bet would be positive as risk is compensated by positive expected gain.

49

A.Friedman

ICEF-2022

Budget line

bet

FOL

Unfair favourable game

If game is unfavourable (this is the case if 1 ), then risk averse agent will make zero bet as

expected consumption at any point on budget line is less than at initial endowment and, in

addition, the endowment point is certain.

Optimal choice

Budget

line

FOL

Unfair unfavourable game

3.2 Expected utility

In presence of uncertainty utility depends on the quantities of contingent commodities and

corresponding probabilities. In principle, probabilities can enter utility function in quite

complex ways. Under some additional requirements on preferences utility function takes the

S

form which is linear in probabilities: U c1 , c 2 ,, c S ; p1 , p2 ,, p S ps uc s . A utility

s 1

function that takes this form is called a von Neumann-Morgenstern utility function or expected

utility function (EUF).

It is not entirely an ordinal function as only positive affine transformations are allowed:

aU b , a 0 .

50

A.Friedman

ICEF-2022

EUF and attitude toward risk

Risk-averse person: U c1 , c 2 ; p,1 p puc1 1 puc 2 u pc1 1 pc 2 for any

p 0, 1 and c1 c 2 . This is Jensen inequality which implies that uc is strictly concave. It

implies that the marginal utility of a risk averse agent is decreasing in wealth.

u

Risk averse agent

uc2

uc1

c

0

Risk-neutral person: U c1 , c 2 ; p,1 p puc1 1 puc 2 u pc1 1 pc 2 for any

p 0, 1 , which implies that uc is linear.

u

Risk neutral agent

uc2

uc1

0

c1

c1

c

Risk-loving person: U c1 , c2 ; p, 1 p pu c1 1 p u c2 u pc1 1 p c2 for

any p 0, 1 and c1 c 2 . This is a Jensen inequality which implies that utility function of a

risk-loving person uc is strictly convex so that the marginal utility is an increasing function

of wealth.

51

A.Friedman

ICEF-2022

3.3 Willingness to pay to avoid risk

Certainty equivalent (CE) of a gamble – the certain wealth that would make an agent

indifferent b/w accepting the gamble and accepting the certain wealth:

uCE puc1 1 puc2

Let us show that for risk-averse agent certainty equivalent is less than the expected value of a

gamble. By definition of risk aversion: uCE puc1 1 puc2 u(EV ) . Since uс is

increasing then CE EV .

It means that a risk averse person is ready to pay a risk premium EV CV 0 to avoid the

risk, that is, to exchange a gamble for its expected value.

u

uc2

uc1

Risk

premium

c1

0

c

Example

Consider risk averse individual with initial wealth W . With probability p she can incur

losses of L , 0 L W . Individual is offered to purchase full insurance that will compensate

all the loss in case of accident.

What is the maximum premium that this agent is willing to pay for this insurance? The

maximum premium should make this person indifferent between purchasing insurance and

staying at initial endowment. The expected utility at initial endowment is

EU NO _ INS puW L 1 puW while with full insurance under premium R his utility

equals EU INS uW R . Thus the maximum premium could be derived from the following

equation

uW RMAX puW L 1 puW .

Note that W RMAX CE , which implies that this premium is given by the difference

between initial wealth and certainty equivalent:

RMAX W CE .

52

A.Friedman

ICEF-2022

u

c

Note: insurance premium risk premium since insurance premium is calculated as a change

in wealth, not the change in expected wealth.

u

c

What is the minimum premium that a risk-neutral insurance company is willing to accept? For

a risk neutral agent expected utility is given by expected wealth. Thus, insurance company

will offer insurance iff the resulting expected profit is nonnegative: R pL 0 . Under

minimum premium 0 , which implies

RMIN pL W EV .

Application 1. Obtaining additional information

Mary has a utility function EU economist 50 120 / c , where c is her consumption, measured

in thousands of dollars. If Mary becomes an economist, she will make 30 thousand per year

for certain. If she becomes a pediatrician, she will make $60 thousand if there is a baby boom

and $12 thousand otherwise. The probability of a baby boom is p=0.5.

53

A.Friedman

ICEF-2022

economist

pediatrician

boom

p= ½

30

no

p= ½

30

boom

p= ½

60 u(60)=50-120/60=48

no

p= ½

12 u(12)=50-120/12=40

By comparing utilities, we can find that Mary prefers to become an economist as

EU economist 46 44 EU pediatrician .

Now suppose a consulting firm has prepared demographic projections that indicate which

event will occur. Will she purchase the projection at price of $6000?

economist

30-6=24

pediatrician

60-6=54

boom

p= ½

economist

30-6=24

no

p= ½

pediatrician

12-6=6

As the maximum utility achieved without demographic projection was only 46 Mary would

be willing to purchase this projection.

Application 2. Demand for Insurance

Re-consider an example with insurance but now assume that any amount of insurance (full or

partial) might be purchased at insurance premium r per dollar of insurance coverage.

Insurance is actuarially fair if EV $1 p $r 0 or r p .

If r p , then insurance is unfair. The case of unfair favourable insurance ( r p ) is quite

unrealistic as insurance company incurs loss under this price.