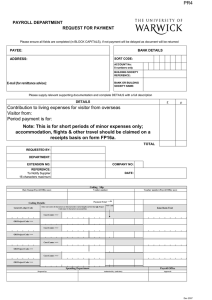

Chapter 6 Payroll Schemes 1 Payroll Schemes Employees Commission Schemes Workers Compensation Falsified Wages 2 Payroll Schemes • Occupational frauds in which a person who works for an organization causes that organization to issue a payment by making a false claim for compensation – Ghost employee – Falsified hours and salary schemes – Commission schemes 3 Ghost Employees • Someone on the payroll who does not actually work for the victim company – – – – fake person Friend or relative Accomplice Other 4 Ghost Employee Schemes • Adding the ghost to the payroll – – – – – Through the personnel department Through the hiring department Through the payroll department Using names similar to real employees Failing to remove terminated employees from the payroll 5 Ghost Employee Schemes • Collecting timekeeping information – – – – Fake timecards Approval of timecards Computerized timekeeping systems Salaried workers vs. hourly workers 6 Ghost Employee Schemes • Issuing the ghost’s paycheck • Delivery of the paycheck – Hand delivered – Mailed to the employees address – Direct deposited 7 Preventing and Detecting Ghost Employee Schemes • Separate the hiring function from the payroll function • Personnel records should be independently maintained from payroll and timekeeping functions • Personnel department should verify any changes to payroll • Background and reference checks should be made in advance of hire 8 Preventing and Detecting Ghost Employee Schemes • Periodically check the payroll records against personnel records for terminated employees and unauthorized wage or deduction adjustments • Periodically run computer reports for employees – With no deductions - withholding taxes or insurance – With no physical address or telephone number • • • • Compare payroll expenses to production schedules Keep signed checks in a secure location Distribuation person is independent of payrol Identification to receive 9 Falsified Hours and Salary • Overpayment of wages is the most common form of misappropriating payroll funds • Increase number of hours or rate of pay • Time clocks • Computer tracking of employee time • Manually prepared timecards 10 Manually Prepared Timecards • Forging a supervisor’s signature • Collusion with a supervisor • Poor internal control procedures 11 Preventing and Detecting Falsified Hours and Salary Schemes • Preparation, authorization, distribution, and reconciliation should be segregated • Transfers of funds from general accounts to payroll accounts should be handled independently • No overtime should be paid unless authorized in advance • Sick leave and vacation time should not be granted without supervisory review and should be monitored for excessive time taken 12 Preventing and Detecting Falsified Hours and Salary Schemes • A designated official should verify all wage rate changes • Timecards should be taken directly to the payroll department after approval • Time cards should be secured and monitored • Run programs to actively seek out fraudulent payroll activity 13 Tests for Fraudulent Payroll Activity • Review employees who have significantly more overtime than similar employees • Trend analysis of budgeted vs. actual expenses • Run exception reports for employees who have had a large increases in wages • Verify payroll taxes equal federal return tax forms • Compare net payroll to payroll checks issued 14 Commission Schemes • Pay is based on an employee’s output rather than hours worked or a set salary • Falsify the amount of sales made – Create fraudulent sales orders, customer purchase orders, credit authorizations, packing slips, invoices, etc. – Ring up a false sale on the cash register • Fraudulently increase the rate of commission 15 Detecting Commission Schemes • Run periodic reports to show an unusual relationship between sales figures and commission figures • Run reports that compare commissions earned among salespersons • Track uncollected sales generated by each salesperson • Conduct random samples of customers to verify that the customer exists 16 17 Chapter 7 Expense Reimbursement Schemes 18 Expense Reimbursement Schemes Mischaracterized Expenses Overstated Expenses Fictitious Expenses Multiple Reimbursements 19 Frequency of Fraudulent Disbursements 20 Median Loss Fraudulent Disbursements 21 Expense Reimbursement Schemes • Employees are reimbursed for expenses paid on behalf of their employer – Hotel bills, business meals, mileage, etc. • Business purpose explained and receipts attached per the organization’s guidelines 22 Mischaracterized Expense Reimbursements • Purpose of reimbursement request is misstated • Fraudster seeks reimbursement for personal expenses – Personal trips listed as a business trips – Non-allowable meals with friends and family • Perpetrators are usually high-level employees, owners, or officers • Common element – lack of detailed expense reports 23 Preventing and Detecting Mischaracterized Expenses • Establish and adhere to a system of controls • Require detailed expense reports with original support documentation(date,time,method of payment, description of purpose of expense • Require direct supervisory review of all travel and entertainment expenses • Establish a policy that clearly states what will and will not be reimbursed and set reasonable limit and publicized to all employees 24 Preventing and Detecting Mischaracterized Expenses • Compare dates of claimed expenses to work schedules • Compare prior year expenses to current year expenses and to budgeted expenses trend analysis • Expenses approved by supervisor inside department 25 Overstated Expense Reimbursements overstate the cost of actual business expense • Altered receipts • Over purchasing • Overstating another employee’s expenses(currency not check) • Orders to overstate expenses(direction of his supervisor) 26 Preventing and Detecting Overstated Expense Reimbursements • Require original receipts for all expense reimbursements • If photocopied receipts are submitted, independently verify the expense • Book travel through company travel agent using designated company credit card • Compare employee’s expense reports with coworkers to identify inconsistencies • Spot check expense reports with customers 27 Fictitious Expenses وھﻣﯾﺔ ﺑﺎﻟﻛﺎﻣل • Producing fictitious receipts create bogus support document ﺑﻌﻣل وﺻل ﻏﻠط • Obtaining blank receipts from vendors • Claiming the expenses of others ﺣدا دﻓﻊ ﻋﻧﻲ اﻻﻛل وﺑﺣط اﻧﺎ دﻓﻌﺗﮫ 28 Preventing and Detecting Fictitious Expense Reimbursements • Look for: – High dollar items that were paid in cash – Expenses that are consistently rounded off, ending with “0” or “5” – Expenses that are consistently for the same amount – Receipts that are submitted over an extended time – Receipts that do not look professional or that lack information about the vendor – reimbursement request from an employee that consistently fall or just below reimbursment limit 29 Multiple Reimbursement Schemes • A single expense item is submitted several times to receive multiple reimbursements – Example: Airline ticket receipt and travel agency invoice • Submit the credit card receipt for items charged to the company’s credit card account • Submitting the same expenses to different budgets 30 Preventing and Detecting Multiple Reimbursement Schemes • Enforce a policy against accepting photocopies • Establish clearly what types of support documentation are acceptable • Require that expense reimbursements be approved by the employee’s direct supervisor • Establish a policy that expenses must be submitted within a certain time limit • Company accounting system should be set to flag duplicate payments 31