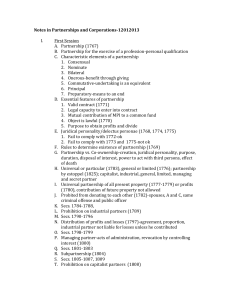

pdfcoffee.com agency-trust-and-partnership-reviewer-pdf-free

advertisement

1 PARTNERSHIP REVIEWER PARTNERSHIP it is a CONTRACT whereby two or more persons (1) bind themselves to CONTRIBUTE money, property, or industry to a COMMON FUND (2) with the intention of dividing the PROFITS among themselves or in order to EXERCISE a PROFESSION CONSEQUENCES OF THE PARTNERSHIP BEING A JURIDICAL ENTITY 1. its juridical personality is SEPARATE and DISTINCT from that of each partner 2. the partnership CAN in GENERAL: A) acquire and possess property of all kinds B) incur obligations C) bring civil and criminal actions D) can be adjudged insolvent even if the individual members be each financially solvent 3. unless he is generally sued, a partner has no right to make a separate appearance in court, if the partnership being sued is already represented a STATUS and a FIDUCIARY RELATION subsisting between persons carrying on a business in common with a view on profit CHARACTERISTICS OF THE CONTRACT OF PARTNERSHIP [C, C, L, I, AS, NP] 1. CONSENSUAL perfected by mere consent 2. CONTRIBUTION of money, property or industry to a COMMON FUND 3. object must be a LAWFUL one 4. INTENTION of DIVIDING the PROFIT among the PARTNERS 5. “AFFECTIO SOCIETATIS” the desire to formulate an ACTIVE UNION, with people among whom there exist a mutual CONFIDENCE and TRUSTS 6. NEW PERSONALITY the object must be for profit and not merely for the common enjoyment otherwise only a co-ownership has been formed. HOWEVER, pecuniary profit need not be the only aim, it is enough that it is the principal purpose BUSINESS TRUSTS when certain persons entrust their property or money to others who will manage the same for the former RULES ON CAPACITY TO BECOME A PARTNER 1. a person capacitated to enter into contractual relations may become a partner 2. 3. an UNEMANCIPATED MINOR CANNOT become a partner UNLESS his parent or guardian consents a MARRIED WOMAN, cannot contribute conjugal funds as her contribution to the partnership UNLESS she is permitted to do so by her husband OR UNLESS she is the administrator of the conjugal partnership, in which the COURT must give its consent authority 4. a PARTNERSHIP being a juridical person by itself can form another partnership 5. a CORPORATION cannot become a partner on grounds of public policy a partner shares not only in profits but also in the losses of the firm RULE: the partnership has a PERSONALITY SEPARATE and DISTINCT from that of each partner LIMITATIONS ON ALIEN PARTNERSHIP 1) if 60% capital is not owned by Filipinos the firm cannot acquire by purchase or otherwise AGRICULTURAL Philippine lands 2) foreign partnership may “lease” lands provided the period does not exceed 99 years 3) foreign partnership may be “MORTGAGEES” of land period of 5 years, renewable for another 5 years they cannot purchase it in a foreclosure sale RULES IN CASE OF ASSOCIATIONS NOT LAWFULLY ORGANIZED AS PARTNERSHIP 1. it possesses NO LEGAL PERSONALITY it cannot sue as such HOWEVER, the partners in their individual capacity CAN 2. one who enters into a contract with a partnership as such cannot when sued later on for recovery of the debt, allege the lack of legal personality on the part of the firm, even if indeed it had no personality ESTOPPEL whether a partnership has a juridical personality or not depends on its PERSONAL LAW of the partnership or the law of the place where the partnership was organized REQUISITES FOR EXISTENCE OF PARTNERSHIP [I, CF, JI] 1. INTENTION to create a partnership 2. COMMON FUND obtained from contributions 3. JOINT INTERESTS in the PROFITS WHAT DO NOT ESTABLISH A PARTNERSHIP 1. mere co-ownership or co-possession even with profit sharing 2. mere sharing of GROSS returns even with joint ownership of the properties involved RULES TO DETERMINE THE EXISTENCE OF A PARTNERSHIP 1. 2. persons who are not partners to each other are not partners as to third persons EXCEPTION: PARTNERSHIP BY ESTOPPEL CO-OWNERSHIP of a property does not itself establish a partnership, even though the co-owners share in the profits derived from the incident of joint ownership 3. SHARING OF GROSS RETURNS ALONE does not indicate a partnership whether or not the persons sharing them have a joint or common right or interest in any property from which the returns are derived 4. the receipt of the share in the profits is a strong presumptive evidence of partnership HOWEVER, no such inference will be drawn if such profits were received in payment A) as a DEBT by installments or otherwise B) as WAGES of an employee C) as RENT to a landlord D) as an ANNUITY to a widow or representative of a deceased partner E) as INTEREST on a LOAN, though the amount of payment vary with the profits of the business F) as the CONSIDERATION for the sale of a GOOD WILL of a business or other property or otherwise creditors are not partners, for their only interest in the sharing of profits is the receipt or payment of their credits in a partnership, the partners are supposed to trust and have confidence in all the partners PARTNERSHIP BY ESTOPPEL IF 2 persons not partners represent themselves as partners to strangers, a partnership by estoppel results WHEN 2 persons, who are partners, in connivance with a friend who is not a partner inform a stranger that said friend is their partner, a partnership by estoppel also result to the end that the stranger should not be prejudiced RULE: LAWFUL OBJECT or PURPOSE a partnership must have LAWFUL OBJECT or PURPOSE, and must be established for the common benefit or interest of the partners it must be within the commence of man, possible and not contrary to law, morals, good customs, public order or public policy IF a partnership has SEVERAL PURPOSES, one of which is UNLAWFUL, the partnership can still validly exist so long as the illegal purpose can be separated from the legal purposes NO need for JUDICIAL DECREE to dissolve an unlawful partnership VOID AB INITIO 2 one of the causes for the dissolution of a partnership is “any event which makes it unlawful for the business of the partnership to be carried on” RULE: when an UNLAWFUL PARTNERSHIP is dissolved by a judicial decree, the PROFITS shall be CONFISCATED in FAVOR of the STATE G. R. a partnership may be constituted in any form EXCEPTION: PUBLIC INSTRUMENT 1. IMMOVABLE PROPERTY is contributed 2. REAL RIGHTS are contributed * need for INVENTORY of IMMOVABLES ** for EFFECTIVITY of the partnership contract insofar as innocent third persons are concerned the same must be REGISTERED if REAL PROPERTIES are INVOLVED a partnership contract is NOT CONVERED by the STATUTE of FRAUDS an AGREEMENT TO FORM a partnership does not itself create a partnership when there are conditions to be fulfilled or when a certain period is to lapse, the partnership is not created till after the fulfillment of the conditions or the arrival of the term and this is true even if one of the parties has already advanced his agreed share of the capital RULE: if CAPITAL is P3,000 or more REQUIRED: 1. PUBLIC INSTRUMENT 2. RECORDED – S.E.C. * FAILURE TO COMPLY – shall not effect the liability of the partnership and its members to third persons ** IF REAL PROPERTIES have been contributed, REGARDLESS of the VALUE, a public instrument is needed for the attainment of legal personality REQUIREMENTS WHERE IMMOVABLE / REAL PROPERTY IS CONTRIBUTED 1. PUBLIC INSTRUMENT 2. INVENTORY – signed and attached to the P.I. * applies regardless of the value of the real property * applies even if only real rights over the real property are contributed * applies if aside from real property, cash or personal property is contributed TRANSFER of land to the partnership must be duly “recorded” in the ROD to make the transfer effective insofar as third persons are concerned RULE: any immovable property or an interest therein maybe acquired in the partnership name title so acquired can be conveyed only in the partnership name IF the partnership has ALIENS, it CANNOT OWN LANDS, whether public or private or whether agricultural or commercial EXCEPT through HEREDITARY SUCCESSION LIMITATIONS ON ACQUISITION 1. AGRICULTURAL LANDS – 1024 HECTARES 2. lease of public lands (GRAZING) – 2000 HAS. RULES 1. 2. 3. 4. 5. IF A) articles are kept secret among the members B) any one of the members may contract in his “own” name with third persons NOT a partnership – NOT a LEGAL PERSON it may be sued by third person under the common name it uses it cannot sue as such and cannot be ordinarily be a party to a civil action insofar as innocent third parties are concerned the parities can be considered as members of a partnership as between themselves or insofar as third persons are prejudiced only the rules of co-ownership must apply EFFECT OF CERTAIN TRANSACTIONS 1. contracts entered into by a “partner” in his own name may be sued upon still by him in his individual capacity, not withstanding the absence of a partnership 2. when two or more individuals, having a common interests in a business bring a court action, it should be presumed that they prosecute the same in their individual capacity as co-owners and not in behalf of a partnership which does not exist in legal contemplation CLASSIFICATION OF PARTNERSHIPS A) ACCORDING TO MANNER OF CREATION 1. ORALLY constituted 2. constituted in a PRIVATE INSTRUMENT 3. constituted in a PUBLIC INSTRUMENT 4. REGISTERED – S.E.C. B) ACCORDING TO OBJECT 1. UNIVERSAL 2. PARTICULAR C) ACCORDING TO LIABILITY 1. LIMITED PARTNERSHIP 2. GENERAL PARTNERSHIP D) ACCORDING TO LEGALITY 1. LAWFUL OR LEGAL 2. UNLAWFUL OR ILLEGAL E) ACCORDING TO DURATION 1. for a SPECIFIC PEIOD or FIXED PERIOD 2. PARTNERSHIP AT WILL F) ACCORDING TO REPRESENTATION TO OTHERS 1. ORDINARY PARTNERSHIP 2. PARTNERSHIP BY ETOPPEL G) AS TO LEGALITY OF EXISTENCE 1. DE JURE PARTNERSHIP 2. DE FACTO PARTNERSHIP H) AS TO PUBLICITY 1. SECRET PARTNERSHIP 2. NOTORIOUS / OPEN PARTNERSHIP I) AS TO PURPSE 1. COMMERCIAL / TRADING 2. PROFESSIONAL / NON-TRADING 3 GENERAL PARTNERSHIP one where all the partners are general partners they are LIABLE even with respect to their individual properties, after the assets of the partnership has been exhausted LIMITED PATNERSHIP one where at least one partner is a general partner and the others are limited partners one whose liability is limited only up to the extent of his contribution a partnership where all the partners are limited partners cannot exist as a limited partnership REFUSED REGISTRATION IF it continuous as such, it will be considered as a general partnership and all the partners will be general partners KINDS OF UNIVERSAL PARTNERSHIP 1. PARTNERSHIP OF ALL PRESENT PROPERTY 2. PARTNERSHIP OF ALL PROFITS *UNIVERSAL PARTNERSHIP OF ALL PRESENT PROPERTY CONTRIBUTION of 1. ALL the properties actually belonging to the partners 2. the PROFITS acquired with said property BECOMES COMMON PROPERTY EXCEPT all FUTURE PROPERTY FRUITS of FUTURE PROPERTY – INCLUDED IF STIPULATED UPON *UNIVERSAL PARTNERSHIP OF PROFITS comprises all that the partners may acquire by the INDUSTRY or WORK of the partners become common property regardless of within said profits were obtained through the usufruct contributed EXCEPT PRIZES and GIFTS RULE: articles of universal partnership, entered without specification of its nature, only constitute a universal partnership of PROFITS RULE: persons who are prohibited from giving each other any donation or advantage cannot enter into universal partnership WHO: 1. HUSBAND and WIFE 2. those guilty of ADULTERY or CONCUBINAGE 3. those guilty of the same criminal offense if the partnership was entered into in consideration of the same while spouses cannot enter into a universal partnership, they can enter into a particular partnership or be members thereof a universal partnership is virtually a donation to each other of the partners properties or at least their usufruct 4 3. the partner must exercise due diligence in preserving the property to be contributed before he actually contributes the same 4. a partner who promises to contribute to the partnership becomes a promissory debtor of the partnership RULES ON THE DUTY TO DELIVER THE FRUITS 1. IF property has been promised, the fruits thereof should also be given 2. the fruits referred to are those arising from the time they should have been delivered, without a need of any demand 3. IF the partner is in BAD FAITH, he is liable not only for the fruits actually produced, BUT also for those that could have been produced IF MONEY HAS BEEN PROMISED, INTEREST and DAMAGES from the time he should have complied with his obligation should be given 4. PARTICULAR PARTNERSHIP a particular partnership has for its OBJECT: 1. DETERNMINATE THINGS – their use or fruits 2. SPECIFIC UNDERTAKING 3. EXERCISE of a PROFESSION or VOCATION OBLIGATIONS OF THE PARTNERS RULE: a PARTNERSHIP BEGINS from the moment of the EXECUTION of the CONTRACT * even if contributions have not yet been made the firm already exists, for partnership is a consensual contract DURATION OF PARTNERSHIP UNLIMITED * MAY BE AGREED UPON 1. EXPRESSLY – definite period 2. IMPLIEDLY – upon achievement of its purpose PARTNERSHIP AT WILL a partnership wherein its continued existence really depends upon the will of the partners or even on the will of any of them 2 KINDS: 1. when there is no term, express or implied 2. when it is continued by the habitual managers although the period has ended or the purpose has been accomplished 3 IMPORTANT DUTIES OF EVERY PARTNER [C, D-F, W] 1. duty to CONTRIBUTE what had been promised 2. duty to DELIVER the FRUITS of what should have been delivered 3. duty to WARRANT RIULES ON THE DUTY TO CONTRIBUTE 1. the contribution must be made at the time the partnership is entered into UNLESS a different period is stipulated 2. no demand is needed to put the partner in default 5. NO DEMAND is needed to put the partner in default 6. it is DELIVERY, actual or constructive that TRANSFERS OWNERSHIP RULES ON THE DUTY TO WARRANT 1. the warranty in case of eviction refers to specific and determinate things already contributed 2. there is EVICTION whenever by a final judgment based on a right prior to the sale or an act imputable to the partner, the partnership is deprived of the whole or a part of the thing purchased RULE WHEN CONTRIBUTION CONSISTS OF GOODS APPRAISAL of VALUE is needed to determine how much was contributed HOW APPRAISAL MADE 1. as PRESCRIBED in the CONTRACT 2. in default, by EXPERTS chosen by the partners, and at CURRENT PRICES * necessity of the INVENTORY – APPRAISAL RULE on RISK of LOSS after goods have been contributed, the partnership bears the risk of subsequent changes in the value RULE: a partner who has undertaken to contribute a sum of money and fails to do so becomes a debtor for the interest and damages from the time he should have complied with his obligation CAPITALIST PARTNER one who FURNISHES CAPITAL * NOT EXEMPTED from LOSSES * he can engage in other business PROVIDED there is no competition between the partnership and his business * share in the profits according to agreements 5 INDUSTRIAL PARTNER one who FURNISHES INDUSTRY or LABOR * he is EXEMPTED from LOSSES as between the partner BUT liable to strangers without prejudice to reimbursement from the capitalist partner * he CANNOT engage in any other BUSINESS WITHOUT the express CONSENT of the other partners, OTHERWISE 1. he can be EXCLUDED from the firm - plus damages OR 2. the BENEFITS he obtains from the other businesses CAN BE AVAILED of by the other partners plus damages whether or not there is COMPETITION * in computing always look for ----- NET PROFITS ----- NET LOSSES CAPITALIST – INDUSTRIALIST PARTNER one who contributes BOTH CAPITAL and INDUSTRY GENERAL PARTNER one who is liable “beyond” the extent of his contribution LIMITED PARTNER one who is liable “only” to the extent of his contribution *** an industrial partner can only be a general partner, never a limited partner MANAGING PARTNER one who manages actively the firms affairs SILENT PARTNER one who does not participate in the management, though he shares in the PROFITS or LOSSES LIQUIDATING PARTNER one who winds up or liquidates the affairs of the firm after it has been dissolved OSTENSIBLE PARTNER one whose connection with the firm is public and open SECRET PARTNER one whose connection with the firm is concealed or kept secret DORMANT PARTNER one who is both a secret (hidden) and silent (not managing) partner NOMINAL PARTNER one who is not really a partner BUT who may become liable as such insofar as third persons are concerned RULE: partners shall CONTRIBUTE EQUAL SHARES to the capital of the partnership * it is permissible to contribute UNEQUAL SHARES IF there is a stipulation to this effect * in the absence of proof, the shares are presumed to be equal CONDITIONS before a capitalist partner is obliged to sell his shares / interest to the other partners [IL, RC, NA] 1. if there is IMMINENT LOSS of the BUSINESS of the partnership 2. he REFUSES to CONTRIBUTE an ADDITIONAL SHARE to the CAPITAL 3. there is no agreement to the contrary * INDUSTRIAL PARTNER IS EXEMPTED *RULE if MANAGING PARTNER COLLECTS A CREDIT REQUISITES: 1. existence of at least 2 debts ---- PARTNERSHIP ---- PARTNER 2. both sums are demandable 3. the collecting partner is the managing partner * the sum thus collected shall be applied to the two credits in proportion to their amounts RULE: * where a partner receives his share in the partnership credit CONDITIONS: 1. a partner has received his share in the partnership credit – in whole or in part 2. the other partners have not collected their part of the credit 3. the debtor subsequently becomes INSOLVENT RULE: - the partner shall be obliged to bring to the partnership capital what he received even though he may have given receipt for his share only * DOES NOT APPLY when debt was collected after dissolution of the partnership RULE: * every partner is responsible to the partnership for damages suffered by it through his fault * he cannot compensate them with the profits and benefits, which he may have earned for the partnership by his industry * the courts may equitably lessen his responsibility “RES PERIT DOMINO” 6 *RULES ON WHO BEARS THE RISK OF LOSS 1. if SPECIFIC and DETERMINATE THINGS NOT FUNGIBLE whose USUFRUCT is enjoyed by a firm the PARTNER who OWNS it bears the loss for ownership was never transferred to the firm 2. FUNGIBLE or DETERIORABLE FIRM bears the loss for it is evident ownership was transferred 3. THINGS CONTRIBUTED to be SOLD FIRM bears the loss for evidently the firm was intended to be the owner 4. CONTRIBUTED under APPRAISAL FIRM bears the loss because this has the effect of an implied sale RULE on RESPONSIBILITY of the FIRM 1. to REFUND amounts disbursed on behalf of the firm plus legal interest from the time expenses where made 2. to ANSWER to each partner for OBLIGATIONS he may have entered into in good faith in the interest of the partnership, as well as the risks in consequence of its management * REFUND must be made even in case of failure of the enterprise entered into, provided the partner is not at fault * AMOUNT DISBURSED – does not refer to the ORIGINAL CAPITAL *HOW PROFITS ARE DISTRIBUTED 1. according to AGREEMENT 2. IF NONE, according to amount of CONTRIBUTION *HOW 1. 2. 3. LOSSES are DISTRIBUTED according to AGREEMENT as to losses IF NONE, according to agreement as to PROFITS IF NONE, according to amount of CONTRIBUTION * an INDUSTRIAL PARTNER shall receive a JUST and EQUITABLE share in the profits *RULE on INDUSTRIAL PARTNERS’ LIABILITIES - may be held liable by third persons BUT he may recover what he has paid from the other capitalist partners *RULE on DESIGNATION by THIRD PERSON of SHARES in PROFITS and LOSSES * third person is NOT a PARTNER -- appointed to only distribute shares * the designation of shares by third persons may be IMPUGNED, IF it is MANIFESTLY INEQUITABLE * the designation of shares by third persons CANNOT be IMPUGNED EVEN IF MANIFESTLY INEQUITABLE IF: 1. the aggrieved partner has already BEGUN to EXECUTE the decision 2. the aggrieved partner has not IMPUGNED the distribution within 3 months he had knowledge *RULE IF APPOINTMENT OTHER THAN in the ARTICLES of PARTNERSHIP 1. power to act may be REVOKED at ANY TIME with or without just cause REMOVAL should be done by the controlling interest 2. EXTENT of POWER as long as he remains manager, he can perform all acts of administration BUT – if others oppose and he persists, he can be removed *RULE WHEN there are 2 or MORE MANAGERS CONDITIONS: 1. 2 or more partners are managers 2. there is no specification of respective duties 3. there is no stipulation requiring UNANIMITY SPECIFIC RULES: 1. each may separately execute all acts of administration UNLIMITED POWER to ADMINISTER 2. IF any of the managers OPPOSE MAJORITY RULE IN CASE OF A TIE - persons owning controlling interest prevail provided they are also managers * right to oppose is not given to NON-MANAGERS * OPPOSITION should be done BEFORE the acts produce legal effects insofar as third persons are concerned RULE WHEN UNANIMITY is REQUIRED 1. the CONCURRENCE of all shall be necessary for the validity of the acts 2. the ABSENCE or DISABILITY of ANYONE of them CANNOT BE ALLEGED UNLESS there is imminent danger of grave or irreparable injury to the partnership RULE ON DUTY of THIRD PERSONS third persons are not required to inquire as to whether or not a partner with whom he transacts has the consent of all the managers *RULES to be observed when the manner of management has not been agreed upon: 1. all the partners are considered AGENTS whatever any one of them may do alone shall not bind the partnership 2. IF the acts of one are opposed by the rest, the majority shall prevail 3. when a partner acts in his OWN NAME, he does not bind the partnership 4. authority to bind the firm does not apply if somebody else has been given authority to manage in the articles of organization or through some other means 5. ALTERATIONS REQUIRE UNANIMITY - IMMOVABLE partnership property - BUT if the refusal to consent by the others is prejudicial to the interest of the partnership - COURTS INTERVENTION may be sought 7 PROPERTY RIGHTS OF PARTNERS [P, I, M] 1. rights in specific PARTNERSHIP PROPERTIES 2. INTERESTS in the PARTNERSHIP 3. right to PARTICIPATE in the MANAGEMENT RULE: * a partner is CO-OWNER with his partners of SPECIFIC PARTNERSHIP PROPERTY * RIGHTS of a PARTNER in SPECIFIC PARTNERSHIP PROPERTY 1. he has equal rights with his partners to POSSESS the property BUT only for PARTNERSHIP PURPOSES he may possess such property for other purposes PROVIDED the other partners expressly or impliedly gives their CONSENT 2. he CANNOT ASSIGN his right to the property partners assign their rights in the same property 3. his right to the property is NOT SUBJECT to ATTACHMENT or EXECUTION, EXCEPT on a claim against partnership 4. his right to the property is NOT SUBJECT to LEGAL SUPPORT RULES on ASSOCIATE of PARTNER 1. every partner may associate another person with him in his share 2. for a partner to have an associate in his share consent of all the other partners is NOT REQUIRED 3. for the associate to become a partner ALL MUST CONSENT RULES on PARTNERSHIP BOOKS 1. kept at the principal place of business of the partnership 2. at any reasonable hour, every partner shall have access to and may inspect and copy any of them DUTY of PARTNERS TO GIVE INFORMATION good faith not only requires that a partner should not make any FALSE CONCEALMENT, BUT he should abstain from all concealment DUTY to ACCOUNT [B, P, U-P] every partner must account to the partnership 1. any benefit acquired 2. any profits received 3. any use of partnership property RIGHT TO DEMAND a FORMAL ACCOUNT any partner shall have the right to a formal account as to partnership affairs 1. if wrongfully excluded from partnership BUSINESS 2. if wrongfully excluded from partnership PROPERTY by his co-partners 3. if the right exists under the terms of agreement 4. if the other partner receives other benefits, profits or uses partnership property 5. whenever other circumstances render it just and reasonable * the right to demand an accounting exists as long as the partnership exists * prescription begins to run only upon the dissolution of the partnership when the final accounting is done EXCEPT if all the other * if there is PARTNERSHIP DEBT, the specific property can be attached RULE: * a PARTNERS INTEREST in the partnership is his SHARE of the PROFITS and SURPLUS IT CAN BE: [A, A, LS] 1. ASSIGNED 2. ATTACHED 3. be subject to LEGAL SUPPORT *EFFECTS of CONVEYANCE by PARTNER of his INTEREST PARTNERSHIP 1. IF he conveys his WHOLE INTEREST A) partnership may still remain B) partnership may be dissolved * mere conveyance does not dissolve the partnership in the 2. the ASSIGNEE does not necessarily become a partner the ASSIGNOR is still the partner, with a right to demand accounting and settlement 3. the ASSIGNEE CANNOT interfere in the MANAGEMENT or ADMINISTRATION of the firm the ASSIGNEE CANNOT also DEMAND [I, A, I] A) INFORMATION B) ACCOUNTING C) INSPECTION of partnership books *** while a partners INTEREST in the firm may be CHARGED or LEVIED upon, his INTEREST in a specific firm PROPERTY CANNOT be attached. RIGHTS of the ASSIGNEE 1. to get whatever profits the assignor-partner would have obtained 2. to avail himself of the usual remedies in case of fraud in the management 3. to ask for ANNULMENT of the contract of assignment IF: A) he was induced to enter into it through any of the vices of consent OR B) he himself was incapacitated to give consent 4. to demand an accounting BUT only if the partnership is dissolved ----- INJURY ----- MISAPPROPRIATION 8 ** while an INDUSTRIAL PARTNER is exempted by law from LOSSES as between the partners, he is NOT EXEMPTED from liability insofar as third persons are concerned he may recover what he has paid from the CAPITALIST partners * under the law the liability of the partners is subsidiary and joint NOT principal and solidary *RULE on LIABILITY of a PARTNER who has WITHDRAWN 1. a partner who withdraws is not liable for liabilities contracted after he has withdrawn 2. if his interest has not yet been paid him his right to the same is that of a mere creditor PREFERENTIAL RIGHTS of PARTNERSHIP CREDITORS * partnership creditors are entitled to PRIORITY over partnership assets, including the partners interest in the profits ** a stipulation exempting liability to third persons is VOID ** SEPARATE or INDIVIDUAL creditors have PREFERENCE in separate or individual properties * any partner may enter into a separate obligation to perform a partnership contract * when the CHARGING ORDER is applied for and granted, the court may appoint a receiver of the partners share in the profits the receiver appointed is entitled to any relief necessary to conserve the partnership assets for partnership purposes * interest charged may be redeemed at any time before foreclosure RULE: * every partner is an “agent” of the partnership for the purpose of its business * AFTER FORECLOSURE the interest may still be redeemed by (without causing dissolution) 1. with separate property, by any one or more of the partners OR 2. with partnership property, by any one or more partners with the consent of all the partners whose interests are not so charged or sold * consent of the delinquent partner not needed RULE: every partnership shall operate under a FIRM NAME * the firm name may or may not include the name of one or more of the partners ** STRANGERS who include their names in the firm are liable as partners because of ESTOPPEL, BUT do NOT have the RIGHTS of partners ** IF a LIMITED PARTNER includes his name in the firm name, he has obligations BUT not the rights of a general partner RULE on LIABILITY for CONTRACTUAL OBLIGATIONS * all partners, including industrial ones, shall be liable pro-rata with all their property and after all the partnership assets have been exhausted * NOT APPLICABLE for TORTS or CRIMES ----- LOSS G.R.- the act of every partner for apparently carrying on in the USUAL WAY the business of the partnership of which he is member binds the partnership EXCEPT: 1. if he has NO AUTHORITY and 2. the person with whom he was dealing with HAS KNOWLEDGE of the fact that he has no such authority RULE: an act of a partner which is not apparently for the carrying on of business of the partnership in the usual way does not bind the partnership UNLESS authorized by the other partners * a partnership is a CONTARCT of MUTUAL AGENCY, each partner acting as a principal on his own behalf and as an agent for his co-partners or the firm REQUISITES on WHEN can a partner BIND the partnership 1. expressly or impliedly AUTHORIZED 2. when he acts in BEHALF AND IN THE NAME of the partnership INSTANCES of IMPLIED AUTHORIZATION 1. when the other partners DO NOT OBJECT, although they have knowledge of the act 2. when the act is for “apparently carrying on in the usual way the business of the partnership * this is binding on the firm even if the partner was not really authorized PROVIDED that the third party is in GOOD FAITH RULE on UNUSUAL ACTS one or more but less than all the partners HAVE NO AUTHORITY TO: [AP, DG, AI, CJ, EC, SA, RC] 1. ASSIGN the PARTNERS PROPERTY 2. DISPOSE of GOODWILL 3. do any other act which would make it impossible to carry on the ordinary business of the partnership 4. CONFESS a judgment 5. ENTER into a COMPROMISE 6. SUBMIT to ARBITRATION 7. RENOUNCE to CLAIM 9 *RULE on ADMISSION or REPRESENTATION MADE by a PARTNER an admission by a partner is an admission against the partnersip,under the following conditions: 1. the admissions must concern partnership affairs 2. must be within the scope of his authority RESTRICTIONS ON THE RULE: 1. admissions made BEFORE DISSOLUTION are binding only when the partner has authority to act on the particular matter 2. admissions made AFTER DISSOLUTION are binding only if the admissions were necessary to WIND UP the business 3. an admission made by a former partner made after he has RETIRED from the partnership is not evidence against the firm *RULES on CONVEYANCE of REAL PROPERTY 1. where title to real property is in the partnership name any partner may convey title to such property by a conveyance executed in the partnership name * PARTNERSHIP MAY RECOVER SUCH PROPERTY EXCEPT: 1. if the firm is engaged in the buying and selling of land (USUAL BUSINESS) 2. if property was conveyed to a HOLDER for VALUE and who had NO KNOWLEDGE of the partners LACK of AUTHORITY 2. where title is in the name of the partnership and partner sold in his OWN NAME IF DONE IN USUAL BUSINESS buyer does not become owner BUT ACQUIRES EQUITABLE INTEREST IF NOT DONE IN USUAL BUSINESS buyer does not become owner and is not even entitled to equitable interest EFFECT of NOTICE to a PARTNER notice to a partner is notice to the partnership *notice to a partner, given while already a partner is a notice to the partnership PROVIDED it relates to partnership affairs EFFECT of KNOWLEDGE ALTHOUGH NO NOTICE WAS GIVEN: * knowledge of the partner is also knowledge of the firm PROVIDED THAT: 1. the knowledge was acquired by a partner who is acting in the particular matter involved;and 2. the partner having knowledge, had reason to believe that the fact related to a matter which had some possibility of being the subject of the partnership business AND he was so situated that he could communicate it to the partner acting on that particular matter * SERVICE of PLEADINGS on the partner in a law firm is also service on the whole firm and the other partners 3. where title is in the name of one or more BUT not all the partners partners in whose name the title is named MAY CONVEY BUT the PARTNERSHIP may RECOVER such property IF done not in its USUAL BUSINESS EXCEPT if he had transferred it to a Holder for value 4. when property “held in trust” by partner a sale only conveys EQUITABLE INTEREST 5. when title is in the name of all partners conveyance executed by all partners possess all rights of such property EQUITABLE INTEREST -BENEFICIAL INTEREST, BUT NOT NAKED OWNERSHIP LOSS OR INJURY RULE on WRONGFUL ACT or OMISSION of a PARTNER (SOLIDARY LIABILITY) * the partnership is solidarily liable with the partner if the wrongful act or omission 1. the partner is acting in the ordinary course of business of the partnership OR 2. with authority of his co-partners * innocent partners have right to recover from the guilty partner * When the firm and other partners not liable: 1. if the wrongful act or omission was NOT DONE A) within scope of partnership business B) 10 with authority of the other co-partners RULE: * he shall be liable for all the obligations of the partnership BUT his liability will extend only to his share in the partnership property 2. if the act or omission is NOT WRONGFUL 3. if the act or omission, although wrongful did not make the partner concern liable - DAMNUN ABSQUE INSURIA 4. if the wrongful act or omission was committed after the firm had been dissolved and the same was not in connection with the process of winding up. LIABILITY of PARTNERSHIP for MISAPPROPRIATION LIABILITY) 1. RECEIVING PARTY MISAPPROPRIATES 2. ANY PARTNER MISAPPPROPRIATES money or property in custody of partnership – (SOLIDARY PARTNER BY ESTOPPEL a person who represents himself or consents to another / others representing him to anyone as a partner either in an existing partnership or in one that is fictitious or apparent PARTNERSHIP BY ESTOPPEL when all the members of the existing partnership consent to such representation of a partner by estoppel RULES AND SITUATIONS: 1. if a third person is misled and acts because of such misrepresentation the deceiver is a partner by estoppel 2. 3. 4. if the partnership consented to such misrepresentation partnership liability results if the firm had not consented no partnership liability results BUT the deceiver is considered still as a “partner by estoppel” with all the obligations but not the rights of a partner when a person represents himself as a partner of a NON-EXISTENT partnership NO partnership liability results BUT the deceiver and all persons who may have aided him in the misrepresentation are still liable liability would be JOINT or PRO-RATA * when although there is misrepresentation, if the third party is not deceived, the doctrine of estoppel does not apply BURDEN of PROOF the creditor or whoever alleges the existence of a partner or partnership by estoppel has the burden of proving the existence of the MISREPRESENTATION AND INNOCENT RELIANCE on it ENTRY OF A NEW PARTNER into an EXISTING PARTNERSHIP * his own individual property shall be excluded * same liability of a limited partner PREFERENCE of PARTNERSHIP CREDITORS RULE: * the creditors of the partnership shall be preferred to those of such partner as regards the partnership property without prejudice to this right the private creditors of each partner may ask the attachment and public sale of the share of the latter in the partnership assets **IF a partner sells his share to a third party, BUT the firm itself still remains SOLVENT, partnership creditors CANNOT assail the validity of the sale by alleging that it is made in fraud of them, since they have not really been prejudiced DISSOLUTION AND WINDING UP the change in the relation of the partners caused by any partner causing to be associated in the carrying on of the business it is the point of time the partners cease to carry on the business together WINDING UP the process settling business affairs after dissolution TERMINATION the point in time after all the partnership affairs have been wound up RULE ON DISSOLUTION * on dissolution the partnership is not terminated BUT continues until the winding up of partnership affairs is completed *EFFECT on OBLIGATIONS 1. just because a partnership is dissolved this does not necessarily mean that a partner can evade previous obligations entered into by the partnership 2. dissolution saves the former partners from new obligations to which they have not expressly or impliedly consented UNLESS the same be essential for winding up *CAUSES OF DISSOLUTION 1. without VIOLATION of the AGREEMENT between the partners A) TERMINATION of the DEFINITE TERM or PARTICULAR UNDERTAKING B) EXPRESS WILL or ANY PARTY in GOOD FAITH (PARTNERSHIP by WILL) C) EXPRESS WILL of ALL of the PARTNERS except those who have (interests) ASSIGNED or whose interests have been (separate debts) CHARGED 2. 3. 4. 5. 6. 7. 8. D) EXPULSION in good faith of a member in CONTRAVENTION of the agreement between the partners by the EXPRESS WILL of ANY PARTNER at any time UNLAWFULNESS of the BUSINESS LOSS – thing promised A) SPECIFIC THING – PERISHES before delivery B) USUFRUCT is lost EXCEPT if ownership had been transferred to the partnership DEATH of ANY partner INSOLVENCY of any partner or of the partnership CIVIL INTERDICTION of any partner DECREE of COURT *** if the cause is not justified or no cause was given, the withdrawing partner is liable for DAMAGES BUT in no case can he be compelled to remain in the firm * the insolvency need not be judicially declared, it is enough that the assets be less than the liabilities DISSOLUTION by JUDICIAL DECREE WHEN ALOWED: (I, UM, I-PP, C, PB, BL, OC) 1. partner declared “insane” in any judicial proceeding or is shown to be of UNSOUND MIND 2. partner becomes INCAPABLE of performing his part of the partnership contract 3. partner has been guilty of such CONDUCT as tends to affect prejudicially the business 4. partners PERSISTENT BREACH of agreement 5. the business of the partnership can only be denied on at a loss 6. other circumstances which render dissolution equitable IN CASE OF PURCHASER of PARTNERS INTEREST 1. after the termination of the specified term or particular undertaking 2. AT ANY TIME, if the partnership was a “partnership at will” when the interest was assigned or when the charging ordered was issued * proof as to the existence of the firm must first be given * even if a partner has not yet been previously declared insane by the court, dissolution may be asked, as long as the insanity is duly proved in court * in a suit for dissolution, the court may appoint a RECEIVER at its discretion EFFECTS OF DISSOLUTION RULE: * when the firm is dissolved, a partner can no longer bind the partnership * a dissolved partnership still has the personality for the winding up of its affairs the firm is still allowed to collect previously acquired credits the firm is still bound to pay of its debts DISSOLUTION CAUSED by A-I-D RULE: (STILL BOUND) – as to each partners 11 G.R. where the dissolution is caused by the ACT, INSOLVENCY or DEATH of a partner, each partner is liable to his co-partners for his share of any liability created by any partner acting for the partnership EXCEPTION: - individual liabilities 1. if dissolution by ACT the partner acting for the partnership HAD KNOWLEDGE of the dissolution OR 2. if dissolution by DEATH or INSOLVENCY the partner acting for the partnership HAD “knowledge or notice” of the death or insolvency * only the partner acting assumes liability *AFTER DISSOLUTION, a partner can still “bind” the PARTNERSHIP (WU, UT, TB) 1. By any ACT appropriate for WINDING UP partnership affairs 2. By COMPLETING transactions UNFINISHED at dissolution 3. By any TRANSACTION which could bind the partnership IF dissolution had not taken place PROVIDED the other party is: A) PREVIOUS CREDITOR and had NO KNOWLEDGE or NOTICE of the dissolution OR B) NOT a PREVIOUS CREDITOR, had NO KNOWLEDGE or NOTICE and dissolution was NOT PUBLISHED * if there was publication of the dissolution it is presumed he already knows, regardless of actual knowledge on non knowledge WHEN is the PARTNERSHIP NOT BOUND 1. new business with third parties who are in bad faith 2. firm dissolved because UNLAWFUL except for acts of winding up 3. partner who acted became INSOLVENT 4. partner not authorized to wind up EXCEPT if customer in good faith * if after dissolution, if a stranger will represent himself as a partner although he is not one he will be a partner by estoppel RULE: * the dissolution of the partnership does not itself discharge the “existing liability” of any partner NEED for an AGREEMENT BETWEEN 1. partner concerned 2. other partners 3. creditors RULE: * the INDIVIDUAL PROPERTY of a DECEASED PARTNER shall be liable for all obligations of the partnership incurred while he was a partner BUT subject to prior payments of his separate debts * IF there be a NOVATION of the OLD PARTNERSHIP DEBTS and such novation is done after one of the partners has “retired” and without the consent of such partner said partner cannot be held liable by creditors who made the novation with knowledge of the firms dissolution EXTRAJUDUCIAL AND JUDICIAL WINDING-UP EXTRAJUDICIAL: 1. by the partners who have not wrongfully dissolved the partnership 2. by the legal representative of the last surviving partners JUDICIAL: under the control and direction of the court, upon proper cause that is shown to the court * profits that will actually enter the firm after dissolution as a consequence of transactions already made before dissolution are included because they are considered as profits existing at the time of dissolution * any other income earned after the time, like interest or dividends on stock owned by the partners or partnership at the time of dissolution should not be distributed as profits BUT as merely additional income to the capital BETTER RIGHTS of INNOCENT PARTNERS innocent partners have better rights than guilty partners and that the guilty partners are required to indemnify for the damages caused * RIGHT of INOCENT PARTNERS TO CONTINUE the BUSINESS in essence this is a new partnership can use the same firm name can ask new members to join BUT shall: for protection of guilty partners 1. give a BOND approved by the court 2. to PAY guilty partners his interests at the time of dissolution MINUS DAMAGES * a guilty partner who is EXCLUDED will be indemnified against all present or future partnership liabilities RIGHT TO GET CASH in case on non-continuance of the business, the interest of the partner should if he desires be given in cash assets may be sold a guilty partner, in ascertaining the value of his interest is not entitled to a proportional share of the value of GOOD WIL RIGHTS OF INNOCENT PARTNERS IN CASE of RESCISSION based on FRAUD AND MISREPRESENTATION 1. Right to LIEN or RETENTION SURPLUS CAPITAL ADVANCES 2. Right of SUBROGATION – as creditor 3. Right of INDEMNIFICATION *ORDER of PAYMENT in WINDING-UP of PARTNERSHIP LIABILITIES GENERAL PARTNERSHIP: [C, R, C, P] 1. those owing to “creditors” other than partners 2. those owing to “partners” other than for capital or profits REIMBURSEMENTS 3. those owing to partners in respect to CAPITAL 4. those owing to partners in respect to PROFITS 12 – * IF the partnership assets are insufficient, the other partners must contribute more money or property PREFERENCE with RESPECT to the ASSETS 1. regarding partnership property partnership creditors have preference 2. regarding individual properties of partners individual creditors are preferred RULE if PARTNER is INSOLVENT - How INDIVIDUAL PROPERTY is DISTRIBUTED ORDER 1. 2. 3. OF PREFERENCE: INDIVIDUAL or SEPARATE CREDITORS PARTNERSHIP CREDITORS those owing to other partners by way of contribution *When creditors of the dissolved partnership are also creditors of the partnership continuing business: 1. new partner is admitted without liquidation 2. a partner retires and assigns his rights IF the business is continued without liquidation of the partnership affairs 3. all but one partner retire without liquidation 4. when all partner assign their right to a person who will assume their debt 5. after wrongful dissolution, remaining partners continue the business without liquidation 6. when partner expelled and remaining partners continue the business without liquidation * liability of third person becoming a partner in the partnership continuing the business to the creditors of the dissolved partnership shall be satisfied out of the partnership property ONLY G.R. – when a partner retires, he is entitled what is due him after liquidation BUT no liquidation is needed if there is already a settlement at the date of dissolution JURISPRUDENCE 13 BASTIDA vs. MENZI * articles of association by which 2 or more persons obligate themselves to place in a common fund any property, industry, or any of these things, in order to obtain profit, shall be COMMERCIAL BORJA vs. ADDISON * a surviving husband may form a partnership with the heirs of the deceased wife for the management and control of the community property BUT in the absence of the formalities prescribed by the Civil Code, knowledge of the existence of the new partnership or community of property must at least be brought home to third persons dealing with the surviving husband in regard to the community real property in order to bind them by the community agreement KIEL vs. SABERT * the declarations of one partner, not made in the presence of his co-partner, are not competent to prove the existence of a partnership between them as against such partner * the existence of a partnership cannot be established by general reputation, rumor or hearsay EVENGELISTA vs. C.I.R. * By the contract of partnership 2 or more persons bind themselves to contribute money, property, or industry to a common fund, with the intention of dividing the profits among themselves ESSENTIAL ELEMENTS of a PARTNERSHIP 1. an agreement to CONTRIBUTE money, property, or industry to a COMMON FUND 2. intent to divide the profits among the contracting parties * when our internal Revenue Code includes “partnerships” among the entities subject to the tax on “corporations”, said code which are not necessarily “partnerships” in the technical sense of the term * PARTNERSHIPS – includes a SYNDICATE, GROUP, POOL, JOINT VENTURE, or other unincorporated organization, through or by the means of which any business, financial operation, or venture is carried on * a joint venture need not be undertaken in any of the standard forms, or in conformity with the usual requirements of the law on partnerships, in order that one could be deemed constituted for purposes of the TAX on corporations PASCUAL vs. C.I.R. * co-ownership or co-possession does not itself establish a partnership, whether such co-owners or co-possessors do or do not share any profits made by the use of the property * the sharing of gross returns does not itself establish a partnership, within the persons sharing them have a joint or common right or interest in any property from which the returns are derived * aside from the circumstances of profit, the presence of other elements constituting partnership is necessary, such as: 1. the clear intent to form a partnership 2. the existence of a juridical personality different from that of the individual partners AND 3. the freedom to transfer or assign any interest in the property by one with the consent of the others * an isolated transaction whereby 2 or more persons contribute funds to buy certain real estate for profit in the absence of other circumstances showing a contrary intention cannot be considered a partnership * persons who contribute property or funds for a common enterprise and agree to share the gross returns of that enterprise in proportion to their contribution, BUT who severally retain the title to their respective contribution, are not thereby rendered partners they have no common stock or capital and no community of interest as principal proprietors in the business itself which the proceeds derived * a joint purchase of land, by two does not constitute a co-partnership in respect thereto, NOR does an agreement to share the profits and losses on the sale of land create a partnership * in order to constitute a PARTNERSHIP INTER SESE there must be: A) an intent to form the same B) generally participating in both profits and losses AND C) such a community of interest, as far as third persons are concerned as enables each party to make a contract, manage the business, and dispose of the whole property * the common ownership of property does not itself create a partnership between the owners, though they may use it for the purpose of making gains AND they may without becoming partners, agree among themselves as to the management and use of such property and the application of the proceeds therefrom * the sharing of returns does not in itself establish a partnership within the persons sharing therein have a joint or common right or interest in the property there must be: 1. clear intent to form a partnership 2. the existence of a juridical personality different from the individual partners AND 3. the freedom of each party to transfer or assign the whole property DUTERTE vs. RALLOS * an agreement between 2 persons to operate a cockpit, by which one is to contribute his services and the other to provide the capital, the profits to be divided between them, constitutes a partnership DELUAO vs. CASTEEL * a contract of partnership to exploit a fishpond pending its award to any qualified party or applicant is VALID BUT a contract of partnership to divide the fishpond after such award is ILLEGAL * one of the causes of dissolution is – any event which make it unlawful for the business of the partnership to be carried on or for the members to carry it on in partnership C.I.R. vs. SUTER * a UNIVERSAL PARTNERSHIP requires either that the object of the association be: 1. all the present property of the partners as contributed by them to the common fund OR 2. all that the partners may acquire by their industry or work during the existence of the partnership * the subsequent marriage of the partners could not operate to dissolve the partnership because it is not one of the causes provided for dissolution by law with regards to limited partnerships * partnership has distinct and separate personality from that of its partners * a husband and wife may not enter into a contract of general co-partnership/ UNIVERSAL partnership ACOAD vs. MABATO * a partnership may be constituted in any form EXCEPT where immovable property or real rights are contributed thereto, in which case a public instrument shall be necessary * A CONTRACT of PARTNERSHIP is VOID whenever immovable property is contributed thereto, if “inventory” of said property is not made, signed by the parties and attached to the public instrument EVANGELISTA vs. ABAD SANTOS * an INDUSTRIAL PARTNER cannot engage in BUSINESS FOR HIMSELF, UNLESS the partnership expressly permits him to do so IF HE SHOULD DO SO, the capitalist partners may either: 1. EXCLUDE him from the firm OR 2. AVAIL themselves of the benefits which he may have obtained in violation of this provision with a right to DAMAGES in either case * the prohibition against an industrial partner engaging in business for himself seeks to prevent any conflict of interest between the industrial partner and the partnership and to ensure faithful compliance by said partner with his prostation 14