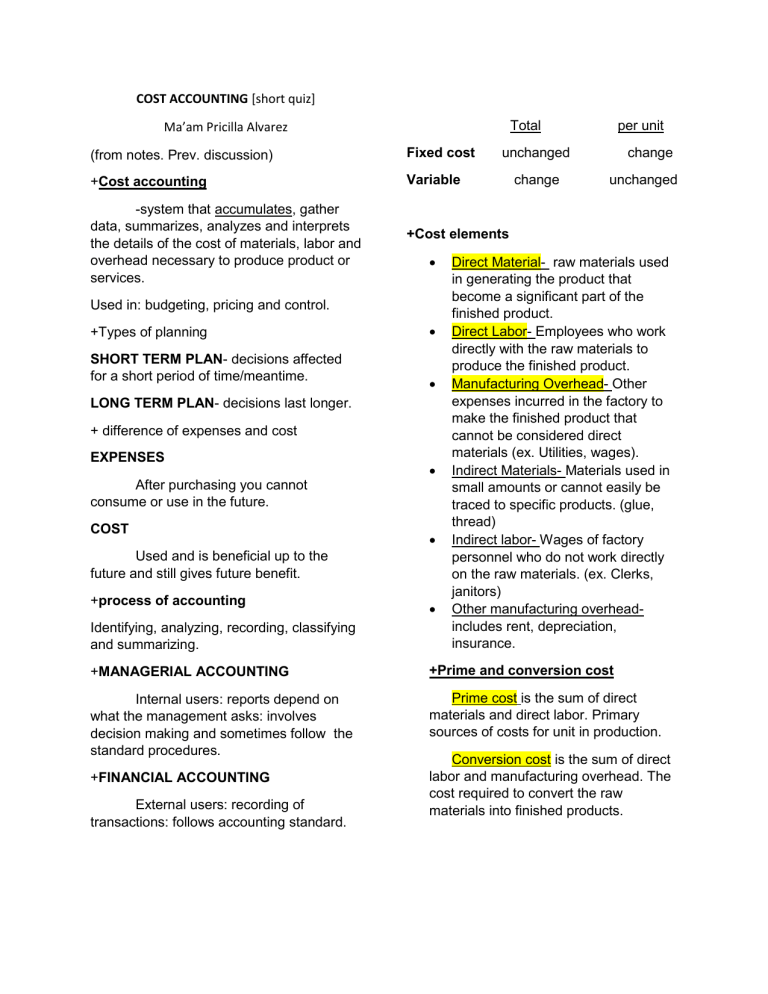

COST ACCOUNTING [short quiz] Total Ma’am Pricilla Alvarez (from notes. Prev. discussion) Fixed cost +Cost accounting Variable -system that accumulates, gather data, summarizes, analyzes and interprets the details of the cost of materials, labor and overhead necessary to produce product or services. SHORT TERM PLAN- decisions affected for a short period of time/meantime. LONG TERM PLAN- decisions last longer. + difference of expenses and cost EXPENSES After purchasing you cannot consume or use in the future. COST Used and is beneficial up to the future and still gives future benefit. +process of accounting Identifying, analyzing, recording, classifying and summarizing. unchanged change change unchanged +Cost elements Used in: budgeting, pricing and control. +Types of planning per unit Direct Material- raw materials used in generating the product that become a significant part of the finished product. Direct Labor- Employees who work directly with the raw materials to produce the finished product. Manufacturing Overhead- Other expenses incurred in the factory to make the finished product that cannot be considered direct materials (ex. Utilities, wages). Indirect Materials- Materials used in small amounts or cannot easily be traced to specific products. (glue, thread) Indirect labor- Wages of factory personnel who do not work directly on the raw materials. (ex. Clerks, janitors) Other manufacturing overheadincludes rent, depreciation, insurance. +MANAGERIAL ACCOUNTING +Prime and conversion cost Internal users: reports depend on what the management asks: involves decision making and sometimes follow the standard procedures. Prime cost is the sum of direct materials and direct labor. Primary sources of costs for unit in production. +FINANCIAL ACCOUNTING External users: recording of transactions: follows accounting standard. Conversion cost is the sum of direct labor and manufacturing overhead. The cost required to convert the raw materials into finished products.