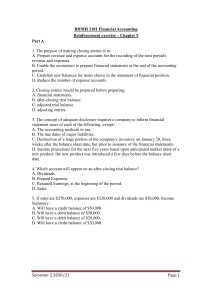

lOMoARcPSD|27025836 QUIZ-8 ADJUSTING ENTRY Management Accounting (Carlos Hilado Memorial State College) Studocu is not sponsored or endorsed by any college or university Downloaded by kevin bachiller (kevin6111993@gmail.com) lOMoARcPSD|27025836 CMU Enrichment Learning Activity Name: Year and Section: Module #: Jerline Rose V. Lirasan BSMA 1A Date: April 26, 2022 Instructor: Mr. Jefferson Cruz Topic: Directions: Items 1 to 6: Multiple Choice 1. Which of the following is incorrect regarding adjusting entries? a. Adjusting entries involve at least one balance sheet account and one income statement account. b. Adjusting entries affect profit or loss. c. In layman’s terms, “to accrue” means to accumulate, while “to defer” means to postpone. d. The process of splitting mixed accounts into their expired and unexpired portions or earned and unearned portions refers to accrual. e. Adjusting entries are typically prepared only when financial statements are prepared. 2. Which of the following is most likely not considered an adjusting entry? a. The accrual of an electricity bill for electricity used but not yet paid b. The recognition of depreciation expense for the period c. The recognition of the used and unused portions of a prepaid rent d. The entry to record the collection of interest receivable 3. Which of the following is most likely considered an adjusting entry? a. The entry to record the payment of interest payable b. The entry to record the collection of accounts receivable c. The entry to record the purchase of equipment d. The entry to record bad debts expense for the period 4. The term “accrual” as used in accounting means a. to record an income that is already earned but not yet collected. b. to record an expense that is already incurred but not yet paid. c. to record the collection of income or the payment of expense. d. a and b 5. The term “deferral” as used in accounting means a. to split the earned and unearned portions of an advanced collection. b. to split the expired and unexpired portions of a prepayment. c. to record the collection of income or the payment of expense. d. a and b 6. These accounts are closed at the end of the accounting period. a. Real accounts b. Mixed accounts c. Nominal accounts SY2021-2022 1st Term Homework Downloaded by kevin bachiller (kevin6111993@gmail.com) lOMoARcPSD|27025836 CMU Enrichment Learning Activity d. Door accounts Items 7 to 20: Journal entries 7. Entity A received a 10%, ₱200,000, one-year, note receivable on July 1, 20x1. Entity A uses a calendar year period. The principal and interest on the note are due on July 1, 20x2. What is the adjusting entry on December 31, 20x1? Interest Receivable Interest Income 10,000 10,000 8. Entity A issued a 12%, ₱200,000, one-year, note payable on November 1, 20x1. Entity A uses a calendar year period. The principal and interest on the note are due on November 1, 20x2. What is the adjusting entry on December 31, 20x1? Interest Expense Interest Payable 4,000 4,000 9. Your business is renting a space. The monthly rental is ₱120,000. On December 31, 20x1, the rent for the months of November and December 20x1 are not yet paid. What is the adjusting entry? Rent Receivable Rent Income 240,000 240,000 10. A business receives its electricity bill for the period amounting to ₱6,000. What is the entry to record the receipt of the bill prior to its payment? Utilities expense Utilities payable 6,000 6,000 11. On January 1, 20x1, your business acquires computer equipment for ₱120,000. You expect to use the computer over the next 3 years. What is the adjusting entry on December 31, 20x1 to take up depreciation expense? Depreciation Expense – Computer Equipment Accumulated Depreciation – Computer Equipment 40,000 40,000 12. Your business has accounts receivable of ₱300,000. You estimated that out of that amount, 10% is doubtful of collection. What is the adjusting entry to record the doubtful accounts? Bad Debt Expense 30,000 Allowance for Bad debts 30,000 SY2021-2022 1st Term Homework Downloaded by kevin bachiller (kevin6111993@gmail.com) lOMoARcPSD|27025836 CMU Enrichment Learning Activity Use the following information for the next four questions: Your business is renting out properties. On June 1, 20x1, your business receives one-year advanced rent of ₱360,000 from one of your tenants. The advanced rent covers the months of June 1, 20x1 to May 31, 20x2. 13. What is the journal entry to record the collection on June 1, 20x1 under the liability method? Cash 360,000 Unearned Rent 360,000 14. What is the journal entry to record the collection on June 1, 20x1 under the income method? Cash Rent Income 360,000 360,000 15. What is the adjusting entry on December 31, 20x1 under the liability method? Unearned Rent Rent Income 210,000 210,000 16. What is the adjusting entry on December 31, 20x1 under the income method? Rent Income 150,000 Unearned Rent 150,000 Use the following information for the next four questions: Your business pays one-year insurance of ₱360,000 on November 1, 20x1. 17. What is the journal entry to record the prepayment on November 1, 20x1 under the asset method? Prepaid Insurance Cash 360,000 360,000 18. What is the journal entry to record the prepayment on November 1, 20x1 under the expense method? Insurance Expense Cash 360,000 360,000 19. What is the adjusting entry on December 31, 20x1 under the asset method? SY2021-2022 1st Term Homework Downloaded by kevin bachiller (kevin6111993@gmail.com) lOMoARcPSD|27025836 CMU Enrichment Learning Activity Insurance Expense Prepaid Insurance 60,000 60,000 20. What is the adjusting entry on December 31, 20x1 under the expense method? Prepaid Insurance Insurance Expense 300,000 300,000 SY2021-2022 1st Term Homework Downloaded by kevin bachiller (kevin6111993@gmail.com)