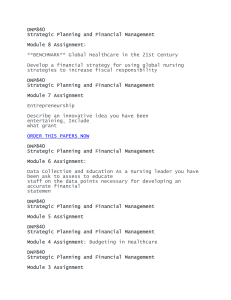

Healthcare Market Overview ___________________________________________________________________ Table of Contents 1 Healthcare Market Overview .......................................................................................................... 5 1.1 Introduction .................................................................................................................................... 5 1.2 What is an HMO? ........................................................................................................................... 5 1.3 The Industry Outlook...................................................................................................................... 5 1.3.1 Trends in Healthcare – Provider Space....................................................................................... 6 1.3.2 Trends in Healthcare – Payer Space ........................................................................................... 7 1.4 Key Players ..................................................................................................................................... 7 1.5 References ...................................................................................................................................... 8 2 Healthcare Overview ........................................................................................................................ 9 2.1 Unit Objectives ............................................................................................................................... 9 2.2 Genesis Of Healthcare .................................................................................................................... 9 2.3 How the industry Works? ..............................................................................................................10 2.4 Healthcare pillars. ..........................................................................................................................12 2.4.1 Members. ...................................................................................................................................12 2.4.2 Providers. ...................................................................................................................................12 2.4.3 Benefits. .....................................................................................................................................13 2.4.4 Claims. .......................................................................................................................................14 2.4.5 Sales...........................................................................................................................................15 2.4.6 External Agents. ........................................................................................................................15 2.5 Healthcare workflow. ....................................................................................................................16 2.6 Summary........................................................................................................................................17 2.7 Review Questions. .........................................................................................................................18 2.8 References. ....................................................................................................................................18 3 Members ...........................................................................................................................................20 3.1 Unit Objective ...............................................................................................................................20 3.2 Introduction ...................................................................................................................................20 3.2.1 Insurance Business: An Overview. ............................................................................................21 3.3 Individual and Group Insurance in detail ......................................................................................22 3.3.1 Individual Insurance ..................................................................................................................22 3.3.2 How to get individual insurance? ..............................................................................................22 3.3.3 Group Insurance ........................................................................................................................23 3.3.4 Company Paid Groups ...............................................................................................................25 3.3.5 Affinity Groups .........................................................................................................................26 3.3.6 Self Insured Group.....................................................................................................................26 3.3.7 Self-Employed Members ...........................................................................................................26 3.3.8 Exercise .....................................................................................................................................28 3.4 Member’s enrollment ....................................................................................................................29 3.4.1 What is Enrollment? ..................................................................................................................29 3.4.2 How is enrollment carried out? ..................................................................................................29 3.4.3 Output of enrollment process.....................................................................................................30 3.4.4 Enrollment: Overall Picture .......................................................................................................31 3.4.5 Exercise .....................................................................................................................................31 3.5 Member’s and Dependent’s eligibility ..........................................................................................32 3.5.1 Eligibility ...................................................................................................................................32 3.5.2 Eligibility Process ......................................................................................................................32 3.5.3 How a member should approach right provider? .......................................................................33 3.5.4 Eligibility Data Transfer ............................................................................................................34 3.5.5 Eligible Dependents ...................................................................................................................34 3.5.6 Exercise .....................................................................................................................................34 3.6 Member Services ...........................................................................................................................35 3.6.1 Means of services ......................................................................................................................35 3.6.2 Services provided by the insurer ................................................................................................35 3.7 Premium Collection .......................................................................................................................37 3.8 Member Group Maintenance .........................................................................................................37 __________________________________________________________________________________ 40793118 Ver. 1.0 Page 1 of 130 Healthcare Market Overview ___________________________________________________________________ 3.8.1 What are Groups? ......................................................................................................................37 3.8.2 Groups Formation ......................................................................................................................37 3.8.3 Groups Maintenance ..................................................................................................................38 3.9 Disability Benefits .........................................................................................................................39 3.9.1 Member’s concern .....................................................................................................................39 3.9.2 Exercise .....................................................................................................................................39 4 Provider ............................................................................................................................................42 4.1 Provider types ................................................................................................................................42 4.2 Provider Participation ....................................................................................................................43 4.3 Provider Contract ...........................................................................................................................43 4.3.1 Provider Contract Process ................................................................................................................43 4.3.2 Credentialing Criteria .......................................................................................................................43 4.3.3 Verification of Provider Credentialing Information .........................................................................44 4.3.4 Types of Contracts ............................................................................................................................44 4.3.5 Provider Reimbursement ..................................................................................................................44 4.4 Exercise .........................................................................................................................................45 4.5 Provider Referral ...........................................................................................................................45 4.5.1 Referrals processing .........................................................................................................................45 4.5.2 Referral types ....................................................................................................................................46 4.6 Provider Network ..........................................................................................................................46 4.6.1 Quality Provider Networks ...............................................................................................................46 4.6.2 Network Adequacy ...........................................................................................................................46 4.6.3 Rental networks ................................................................................................................................47 4.6.4 Network Hospital Standards .............................................................................................................47 4.7 Provider maintenance ....................................................................................................................47 4.7.1 some common information of Providers ..........................................................................................47 4.8 Exercise .........................................................................................................................................48 4.9 Review Questions ..........................................................................................................................48 4.10 References .................................................................................................................................49 5 Sales ..................................................................................................................................................51 5.1 Unit Objectives ..............................................................................................................................51 5.2 Introduction ...................................................................................................................................51 5.3 Brokers ..........................................................................................................................................51 5.3.1 Calculation for Brokers .............................................................................................................51 5.4 Quote Creation ...............................................................................................................................52 5.4.1 What is a quote? ........................................................................................................................52 5.4.2 The Process Of Quote Creation .................................................................................................52 5.5 Actuaries ........................................................................................................................................56 5.6 Underwriters ..................................................................................................................................57 5.7 Insurance Payer’s Sales Department..............................................................................................58 5.7.1 External Agents that deal with Sales Department of Insurance Payers .....................................59 5.8 Review Questions ..........................................................................................................................60 6 Benefits .............................................................................................................................................62 6.1 Unit Objectives ..............................................................................................................................62 6.2 Introduction ...................................................................................................................................62 6.3 Indemnity Plans .............................................................................................................................62 6.4 Managed Care Plans ......................................................................................................................63 6.4.1 Health Maintenance Organization (HMO) ................................................................................64 6.4.2 Preferred Provider Organization (PPO) .....................................................................................66 6.4.3 Point Of Service (POS).............................................................................................................67 6.4.4 Exclusive Provider Organization (EPO) ....................................................................................69 6.5 Which plan is the best? ..................................................................................................................69 6.5.1 Exercise .....................................................................................................................................70 6.6 Other Plans ....................................................................................................................................71 6.6.1 Vision Plans ...............................................................................................................................71 6.6.2 Dental Plans ...............................................................................................................................71 __________________________________________________________________________________ 40793118 Ver. 1.0 Page 2 of 130 Healthcare Market Overview ___________________________________________________________________ 6.6.3 Pharmacy Plans .........................................................................................................................72 6.6.4 Medicare Plans ..........................................................................................................................73 6.6.5 Medigap .....................................................................................................................................73 6.6.6 Medicaid ....................................................................................................................................73 6.6.7 Long Term Care.........................................................................................................................74 6.6.8 Disability Income Insurance ......................................................................................................74 6.6.9 Catastrophic Coverage Plans .....................................................................................................74 6.6.10 Exercise .....................................................................................................................................74 6.7 Individual Insurance and Group Insurance. ...................................................................................75 6.8 Laws and Legislations ...................................................................................................................75 6.8.1 Consolidated Omnibus Budget Reconciliation Act of 1986 (COBRA) .....................................76 6.8.2 Health Insurance Portability and Accountability Act (HIPAA) ................................................76 6.9 Review Questions. .........................................................................................................................76 6.10 References .................................................................................................................................77 7 Claims ...............................................................................................................................................79 7.1 Claim generation and submission to Providers ..............................................................................79 7.1.1 Claims Intake Process ................................................................................................................79 7.1.2 Claims Intake : Diagrammatic ...................................................................................................80 7.2 Claim Adjudication Process ..........................................................................................................81 7.2.1 Claim Preparation and determining eligibility ...........................................................................81 7.2.2 Determine payment....................................................................................................................84 7.2.3 Update Claim .............................................................................................................................86 7.2.4 Claim adjudication outputs ........................................................................................................86 7.3 Claim Payments .............................................................................................................................89 7.3.1 Provider Payments .....................................................................................................................89 7.3.2 Member Re-imbursement ..........................................................................................................90 7.4 Claim Adjustments ........................................................................................................................90 7.4.1 Refund Adjustment ....................................................................................................................90 7.4.2 Minus Debit Adjustment ...........................................................................................................91 7.4.3 Manual Check Adjustment ........................................................................................................91 7.4.4 Void Adjustment........................................................................................................................91 7.4.5 Stop Adjustment ........................................................................................................................91 7.5 Government reporting....................................................................................................................91 7.6 Explanation of Benefits (EOB) ......................................................................................................93 7.7 Accumulators .................................................................................................................................93 7.7.1 7.7.1 What are Accumulators? ...................................................................................................93 7.7.2 7.7.2 Function/Purpose of Accumulators ..................................................................................93 7.7.3 What is accumulated? ................................................................................................................93 7.7.4 Types of Accumulator ...............................................................................................................94 7.8 Overall Claims system diagram : ...................................................................................................94 7.9 Review Questions. .........................................................................................................................95 7.10 References .................................................................................................................................96 8 External Agents ...............................................................................................................................98 8.1 Unit Objectives ..............................................................................................................................98 8.2 Introduction ...................................................................................................................................98 8.3 Government Agencies ...................................................................................................................98 8.3.1 Centers for Medicare & Medicaid Services (CMS) ...................................................................98 8.3.2 DEPARTMENT OF HEALTH AND HUMAN SERVICES (DHSS) ......................................99 8.3.3 Centers for Disease Control and Prevention (CDC) ................................................................100 8.3.4 Agency for Health Care Research and Quality (AHRQ) .........................................................100 8.3.5 National Information Center on Health Services Research and Health Care Technology (NICHSR) ................................................................................................................................................100 8.3.6 Health Resources and Services Administration (HRSA) .........................................................101 8.3.7 Exercise ...................................................................................................................................101 8.4 Government Acts and Regulations ..............................................................................................101 8.4.1 HIPAA .....................................................................................................................................101 __________________________________________________________________________________ 40793118 Ver. 1.0 Page 3 of 130 Healthcare Market Overview ___________________________________________________________________ ELECTRONIC HEALTH TRANSACTIONS STANDARDS ...............................................................103 8.4.2 CORBA ...................................................................................................................................104 8.4.3 Exercise ...................................................................................................................................110 8.5 Clearing Houses ...........................................................................................................................111 8.5.1 Benefits Of A Clearinghouse ...................................................................................................111 8.5.2 Clearinghouse versus Direct Filing..........................................................................................111 8.5.3 Clearinghouse Income .............................................................................................................112 8.5.4 Exercise ...................................................................................................................................113 8.6 Third Party Administrators ..........................................................................................................113 8.7 Specialized Adjudication Engines/Companies ............................................................................114 8.8 General Agents ............................................................................................................................114 8.9 Accreditation Agencies ................................................................................................................115 8.9.1 The Accreditation Process .......................................................................................................115 8.10 Drug Manufacturers .................................................................................................................117 8.11 Review Questions ....................................................................................................................118 8.12 References ...............................................................................................................................118 9 Summary ........................................................................................................................................120 9.1 Unit Objectives ............................................................................................................................120 9.2 Workflow.....................................................................................................................................120 9.2.1 The Beginning: Member wants to purchase insurance ............................................................121 9.2.2 Getting a provider ....................................................................................................................121 9.2.3 An Enrolled member wants to seek medical services. .............................................................121 9.2.4 Member has filed a claim ........................................................................................................122 9.2.5 Effect of external agencies.......................................................................................................122 9.3 Review Questions. .......................................................................................................................122 9.4 References. ..................................................................................................................................122 10 Appendices .....................................................................................................................................124 10.1 Appendix A: Total E-Business Services Forecast for Healthcare ...........................................124 10.2 Appendix B: The world Healthcare market and Healthcare IT spending ................................124 10.3 Appendix C: The Cash Flux of the US Healthcare Industry ....................................................125 (Source: Gartner Research, Inc) ..............................................................................................................125 10.4 Appendix C: Sample Quote Sheet ...........................................................................................126 11 Glossary ..........................................................................................................................................129 __________________________________________________________________________________ 40793118 Ver. 1.0 Page 4 of 130 Healthcare Market Overview ___________________________________________________________________ UNIT - I 1 1.1 Healthcare Market Overview Introduction This unit provides a brief idea of the Health Care Industry in the United States. It aims in providing the brief idea of the Industry and it’s the key players. Managed Health Care is provided by HMOs (Health Maintenance Organizations). Historically, Health Insurance in the United States was through Indemnity Plans. The HMO concept has evolved over the last 15 years as a way to provide less expensive health coverage. The concept has gained in popularity mainly from employers who provide health insurance to their employees in the 1990s. The industry has grown quickly and at present about 25% of all health insurance members are in some sort of Managed Health Care program. Traditionally insurance has been one of the largest users of Information Technology. This Industry is highly regulated and captures high volume of data. To process this high volume of data collected and maintain them for stipulated time, a high computing power becomes imminent. Though the primary information system is the OLTP system that runs the daily business, there are also support systems like the Data Warehousing System that helps in decision support, the Imaging system that scans all incoming documents for storage and retrieval. Also, since these companies are service oriented, response times become a crucial factor both to reduce cost and improve performance 1.2 What is an HMO? HMO stands for “Health Maintenance Organization”. Their primary function is to provide Health Insurance to Employer Groups and Individuals. The basic idea behind this is that the HMO ties up with a group of Doctors and Hospitals (Providers of Health Care) and allows the members enrolled to visit one of the Providers within their list. Members enrolled in an HMO are expected to choose one of the Providers as a PCP (Primary Care Physician). The member should always visit the chosen PCP and on his referral can visit other doctors. All visits to any Doctor or Hospital have to be authorized by the HMO. When a member follows this rule, he ends up paying a small fixed payment. On the other hand, violating this rule will make the member liable for the full amount. In case of Indemnity Plans, the member is free to visit any Provider. In these plans, there is a Deductible, which means the first few hundred or so dollars is fully paid by the Member. After that, for the next few thousand dollars, a certain percentage will be paid by the Member and the rest by the Insurance Company (co-insurance). Any amount over the Deductible and the Co-insurance will be fully paid by the Insurance Company. HMOs typically interact with two types of customers: Employer Groups – These are companies that provide health coverage for their employees and dependents, and Individuals who look for coverage for themselves and their dependents. Also state mandated programs like Medicare and Medicaid also allow the recipients to be enrolled in HMOs. 1.3 The Industry Outlook The concept of Managed Health Care gained popularity in the last 80s and the early 90s. The concept has gained acceptance in the 90s and the Industry has grown rapidly and it cater to over 25% of all Insured members in USA. The Industry is made up of both “For-profit” HMOs and “Non-Profit” HMOs. The “Forprofit” companies control 60% of the Managed Health Care Industry. The trend is still continuing and the growth is expected to continue. Initially small players focused on local markets dominated the Industry. In __________________________________________________________________________________ 40793118 Ver. 1.0 Page 5 of 130 Healthcare Market Overview ___________________________________________________________________ the last few years there has been an increasing number of acquisitions and the industry is moving into the consolidation phase. In the last few years, due to increasing health care costs, there has been a tremendous pressure on the bottom line of these companies. Also, the members participating in these plans feel that the HMOs squeeze the patients to maximize their profit. This has resulted in more government involvement in this industry and there has been lots of debate on how to make this industry more transparent and patient friendly. The US Congress is currently debating on a “Patients bill of rights” that will allow the patient to get better care under this system. The world market for Healthcare is USD 3 Trillion presently, and is estimated to grow to a huge USD 4 Trillion by the end of 2003 (Dataquest, See Appendix A). However, investment in IT in global Healthcare sector is as low as 3% as compared to an overall average of 6% and 12% for financial services. But the Healthcare market, which is a core focus for most governments around the world, will continue to grow as newer technologies and sciences (Genomics, Proteomics and Bio technology) revolutionize health care. (Refer Appendix B). The US is the largest player in the Healthcare market and is worth $ 1,310 Billion annually (2001) and is growing at 7%. US is the largest spender in this market, accounting for 43% of the world spending. Furthermore, US also leads in the IT development of this market. The total health care spending (by private and public in the US) is 1.3 Trillion, 70% of the Federal budget of the US- a whopping number by any standards. (Refer Appendix C). 1.3.1 Trends in Healthcare – Provider Space There are two major regulations, which are coming into place, which are going to have a major impact in the way healthcare providers operate presently. These two regulations are: BBA (Balanced Budget Act) The Balanced Budget Act of 1997 (BBA-1997) is designed to lower Medicare expenditures by about $112 billion over the five-year period 98-02. HIPAA (Health Insurance Portability and Accountability Act) This act impacts all segments of healthcare industry with focus on standardization, privacy and security. The past few years has seen a consolidation in the hospital and health sectors. This trend has slowed considerably and can be considered to be over for now. The last major merger happened in Feb 1, 1999 when CHRISTUS Health was formed. However, struggling independent facilities in rural markets, will seek acquisition by larger chains- but low activity expected. The last few years have seen smaller provider sub segments face financial challenges. At present, it is estimated that about 13% of the overall industry bed capacity are operating in bankruptcy. Before BBA, skilled nursing providers were slated to receive $83 billion during 98-02, however as a result of the BBA, they will now receive $74 billion over the same period, a decrease of about 11%. The last few years have seen a rise in the Assisted Living Centers. Individuals aged 85 and older (3.6 million) represents the largest number of users of long-term healthcare services, also the fastest-growing segment of the U.S. population. Industry sources project expenditures for senior living of $18 billion in 2000, reaching $30 billion by 2005. As a reciprocative step, Provider Organizations are adopting some Cost Cutting measures. Cap on spending by government (BBA) is focusing efforts on cost cutting in this space. Large corporations want see employee health insurance costs to reduce overheads. Furthermore, labor costs (typically 40 -50 % of hospital operating costs) are steadily rising (specialized skills shortage). __________________________________________________________________________________ 40793118 Ver. 1.0 Page 6 of 130 Healthcare Market Overview ___________________________________________________________________ 1.3.2 Trends in Healthcare – Payer Space There has been a rise in Regulations & Lawsuits against payers. More than 35 class-action suits have been filed against managed care companies to date; the number continues to climb. HIPAA is going to have sweeping effect on HMO, which requires them to re-look at their transactions. The last few years have seen Rising Costs for the MCO (Managed Care Organization). Medical costs rose 7.5% in 1999. Pharmaceutical costs are rising about 15 %, on average. Prescription drug coverage has increased (95% of all members), resulting in more people covered. And this has resulted in higher costs. Furthermore Managed Care Consolidation has seen larger companies acquiring smaller, undercapitalized players. Ongoing pressure to reduce healthcare costs will prolong the merger trend in coming years. Recent times have seen HMOs exiting Medicare Choice plans. Numerous companies have exited Medicare Choice markets following implementation of the BBA in 1997. E.g. HMOs cut 400,000 members in 1999 and another 327,000 in 2000. Large HMOs are notifying the HCFA of their intent to exit Medicare + Choice market in 2001, including Aetna (affecting 355,000 members), among others. Managed Care Market Still Top-Heavy in the sense the managed care sector is fairly concentrated, with the top 10 HMO chains accounting for close to 2/3 of total HMO enrollment in the US. The largest privately held chain is the Blue Cross/Blue Shield Association, which collectively serves 21.6 million Americans. Aging Population Poses New Challenge for the Healthcare organizations. People older than 65 years (currently 14%) are estimated to rise to 18.5% in 2025. Aging of the baby boom generation (born between 1946-1964), the rapid expansion of the elderly segment of the population is presenting HMOs with a new set of challenges. 1.4 Key Players At present the Managed Health Care Industry is made of a few large Insurance companies that operate across the country and lots of small HMOs that operate in local markets. These companies cater to small and large Employer Groups, Individuals, and also provide coverage for members participating in government programs like Medicare and Medicare. Aetna, Hartford, CT www.aetna.com Leading provider of health and retirement benefit plans. Provides both Indemnity and HMO based Health insurance plans 21 million subscribed members in various health plans, 10.3 million of those are Managed Health Care Members includes 5.3 members of Prudential Health Care recently acquired. Cigna, Hartford, CT www.cigna.com Into Health Care, Retirement and Investment Services, Property and Casualty, Group Insurance etc. Provides both Indemnity and HMO based Health insurance plans 6.5 Million members enrolled in Medical HMO Plans. Plans available across the country United Health Care Minneapolis, MN www.unitedhealthgroup.com Primarily into Managed Health Care, operates in many markets. About 5.8 million Fully Insured Managed Care Members, 1.8 million self-insured members (fee basis, no risk), 445,000 Medicare members and 530,000 Medicaid Members In addition to the above companies there are two large Non-profit Managed Care entities: Blue Cross Blue Shield Kaiser Permanente These operate in various states by having separate HMOs set up in each state. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 7 of 130 Healthcare Market Overview ___________________________________________________________________ 1.5 References AETNA Intranet http://www.aetna.com/ http://www.gartner.com/ http://www.gartnerg2.com/ http://www.jup.com/ http://www.gigaweb.com/ __________________________________________________________________________________ 40793118 Ver. 1.0 Page 8 of 130 Healthcare Overview ___________________________________________________________________ UNIT - II 2 2.1 Healthcare Overview Unit Objectives This unit will present an overview of the healthcare industry to the reader. 2.2 Genesis Of Healthcare Until the early 20th Century, physicians in private practice almost always billed patients directly on a feefor-service basis. In 1929 Dr. Michael Shadid started a rural farmers' cooperative health plan in Elk City, Oklahoma 1929. These members paid a predetermined fee and Dr. Shadid rendered care to his patients. In the 1930s, during the Great Depression, hospitals began to suffer from patients’ inability to pay their bills. Over the initial objections of physicians, financially stressed hospitals prevailed on state legislatures to legalize the insurance schemes that became known as Blue Cross which were created as non-profit, provider-oriented insurance organizations. “Provider-oriented” meant that, Blue Cross (and later, Blue Shield) did not try to tell physicians how to practice medicine. Physicians were free to practice as they saw fit, and the Blues would simply pay the bills on a fee-for-service basis. Thus early insurance was restricted to Indemnity insurance. During World War II, Henry Kaiser whose name became synonymous with prepaid healthcare set up two medical programs on the West Coast to provide comprehensive health services to workers in his shipyards and steel mills. When the war ended, Kaiser opened his plans to the public. Kaiser believed he could reorganize medical care to provide millions of Americans with prepaid and comprehensive services at prices they could afford. Ten years after the war, the Kaiser Permanente health plan had a growing network of hospitals and clinics and a half million people enrolled. In some locations prepaid group practice plans were quite successful at attracting members. Other local physicians became concerned about their own patient base. In 1954, the San Joaquin County (California) Medical Society formed the San Joaquin Medical Foundation in response to competition from Kaiser. The foundation accepted capitation (fixed) payments from subscribers, and it paid the affiliated independent physicians and hospitals according to a relative value-based fee schedule. The foundation heard grievances against physicians, developed peer review procedures, and monitored quality of care. This plan is considered the earliest example of an independent practice association (IPA) model prepaid health plan. However, prepaid health care remained a minor phenomenon until the 1970s. In the late 1960s and early 1970s, politicians and interest groups promoted various proposals for reforming the healthcare system. Issues of cost containment, coverage for the uninsured, access to services for the poor and minorities, consumer rights, efficient delivery systems and more, were all on the agenda. In 1971, President Nixon’s Administration announced a new national health strategy; the development of health maintenance organizations (HMOs). The HMO Act of 1973 authorized $375 million in federal funds to help develop HMOs. In adopting this policy, the Administration was influenced by Dr. Paul Ellwood of Minneapolis, who argued that the structural incentives of traditional fee-for-service medicine had to be reversed in order to achieve positive reform. Dr. Ellwood coined the phrase “health maintenance organization” to refer to prepaid health plans that enrolled members and arranged for their care from a designated provider network. Managed care, as it came to be called, (HMO is a subset of managed care) continued to grow throughout the 1970s, 1980s and 1990s. Employers came to look upon managed care as a less expensive yet __________________________________________________________________________________ 40793118 Ver. 1.0 Page 9 of 130 Healthcare Overview ___________________________________________________________________ comprehensive and high quality form of insurance to offer to their employees. State governments turned to managed care to help with the Medicaid program, and the federal government implemented Medicare. By the end of 20th century, there were over 600 HMOs in operation, enrolling about 65 million members (close to a quarter of the population of U.S.A). Overall, the managed care segment had 181 million members, thereby dominating the healthcare market. 2.3 How the industry Works? Managed care market dominates the healthcare industry. The workflow for this model can be depicted as shown in the following figure. This workflow is specific to Aetna-USHC (a leading provider of healthcare services), however, the nature of this information being very generic, the figure can be said to portray the actual workflow for any managed care organization. The major players in this flow, or, what can be said to be the ‘five pillars of healthcare’ are – Member Provider Benefits Claims Sales In addition ‘External agents’ (agencies not directly involved with providing insurance) also form a major component. We will see each of these in greater details in the next section. After the five pillars have been introduced, we will be better equipped to understand the workflow as depicted in the following figure. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 10 of 130 Healthcare Overview ___________________________________________________________________ Request Quotes Quotes Customer Aetna Sales Under writing Policy maint and billing Policy Entry Admin Provider Claim/Elig Inq Member Provider Help Desk Providers Claim Claim Medical Service Policy Claim Routing/ Adjudication Claim Office Benefit/ Provider Inquiry EOB ERA EFT Claim Reporting Members To Provider Bank Actuaries Figure 1: Managed care workflow __________________________________________________________________________________ 40793118 Ver. 1.0 Page 11 of 130 Healthcare Overview ___________________________________________________________________ 2.4 2.4.1 Healthcare pillars. Members. A member is a person who purchases insurance from (or enrolls with) an insurance company. He can purchase this insurance coverage for himself and his family (also called his dependents). This is known as Individual Insurance. In most cases, his employer will pay for his insurance coverage. In such a case the employer becomes his plan sponsor and the insurance is known as Group Insurance. Both individual and group insurance, have their advantages and disadvantages. The main advantage with group insurance is the freedom of choice for a member. He is free to choose any of the services offered by the insurance company. However, he has to pay for those services. Reduction in this cost to the member is a great advantage with group insurance. A group has much more bargaining power due to the simple fact that group insurance is less risky for the insurer. Group insurance allows the insurer to spread the risk over a larger number of people, while in case of individual insurance the risk is concentrated on a single member and his dependents. Due to its bargaining power, group insurance schemes are able to get better deals for their members than in case of individual insurance. A variant of this is the Company Paid Groups, in which the employers pay for the healthcare subscription (in case of normal group insurance, the members have to pay for healthcare coverage). This is a powerful perk used to retain good staff, and is a very good illustration of the amount of importance that is attached to health insurance in U.S.A. In case of some large corporations like AT&T or IBM the company itself provides insurance to its employees. Such groups are known as self-insured groups. They offer a great flexibility to the company in providing insurance of choice to the employees. However, these companies do not have the infrastructure to perform as an insurance company. So, they outsource the administrative part to the insurance companies while retaining the money reimbursement part with themselves. This way, they are able to achieve a balance between providing desirable healthcare coverage to their employees without causing administrative overheads. Though self-insured schemes are quite popular, they are feasible only in case of very large organizations. There are other variants of insurance in the market, but the trend is towards group insurance due to its basic advantage of reduced cost and enhanced services. Individual insurance is restricted to people who need to have specific coverage not offered in their group scheme, or to those who do not have a employee sponsored group insurance scheme. 2.4.2 Providers. A Provider is that entity which offers actual medical services to the members. A doctor, a pharmacy or hospitals are all referred to as providers. The providers enter into an agreement (contract) with the insurance company. Under this agreement they provide medical care at reduced rates to the members, in return they are offered monetary benefits by the insurance company. These monetary benefits are offered in various forms. One of the most popular of these forms is a fixed monthly fee (capitation fee). The providers get this fee irrespective of the number of encounters (a visit by a member to a provider is known as an encounter) they had in that month. While on one hand capitation ensures a fixed monthly income for the provider, it also restricts his earnings. So, from the provider’s point of view it’s a choice between a fixed income and a varying income (which may be more, or less, depending on his popularity with the patients). For insurance company, capitation helps them to forecast their spending, as the total expenditure remains constant irrespective of the number of members having to seek medical services. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 12 of 130 Healthcare Overview ___________________________________________________________________ Sometimes, individual providers form a group, which contracts with the insurance company. Such a group is called an IPA or an individual practice association. Formation of an IPA gives the providers more bargaining powers with the insurance company and assures them of an increased patient volume. In turn the insurance company is able to offer a range of providers to the members at a single source, i.e. the IPA. In some cases, the insurance company may directly employ providers. This constitutes the Staff Model of managed care. Staff model is beneficial from the insurance companies point of view, as they are in a better position to regulate the expenses. This staff model however is feasible only in case of very large insurance companies. In case of certain large hospitals with a significant patient base, the hospital itself may function as the insurer. As with self-insured groups, they may outsource the administrative functions to an insurance company while keeping the money reimbursement part with themselves. In general, a group of providers in a designated area are contracted by the insurance company to form a network (a group of contracted providers within a designated area is said to constitute a network) of providers. The insurance company offers a better deal to its members for using a provider within this network. The providers themselves have an increased patient volume and hence offer services at reduced rates. This is one of the most stable models of managed healthcare. 2.4.3 Benefits. Benefits can be described in two ways 1. The right of a member to receive services from the insurance company as per their mutual agreement, or, 2. The major line of coverage provided by the insurance company. The insurance company may provide medical/dental/vision coverage. Then depending on the choice of coverage the member is said to have medical benefits or dental benefits or vision benefits. The general agreement between the Insurance Company and the member that details the benefits that can be provided to the plan holders i.e. the member is called a Plan. While the actual legal document issued by the insurance company to the member, whom sets forth the terms and conditions of this agreement is called a Policy. Thus, we can say that a plan is the general range of benefits offered by the insurance company. These when customized as per the member’s requirements and put down on paper as a legal document forms a policy. There has been a gradual shift in the choice of members from Indemnity (traditional fee-for-service) plans towards Managed Care (prepaid) plans. In case of Indemnity plans, the members visit a provider and pay him for his services. After that, they file a claim (a request to refund the expenses incurred) with the insurance company. If the claim is found to be valid, the insurance company pays a part (usually 80%) of the expenses. Though they offer great flexibility to members in their choice of providers, they are very expensive. In case of managed care, the insurance company contracts with providers and form a network of such providers. The members pay a fixed monthly fee and need to choose a provider within the network as their primary care physician or a PCP.The PCP manages their complete healthcare, right from providing services to filing claims. Due to the control over the choice of provider, the insurance company is able to offer healthcare at reduced rates. The reduced cost of a managed care plan is the main reason for members preferring them to indemnity plans. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 13 of 130 Healthcare Overview ___________________________________________________________________ The model of managed care as described above is known as a HMO or a health maintenance organization. It has a major disadvantage that it limits the choice of providers to a network. Members cannot avail services from a provider not contracted with the insurance company. Members who wish to have a greater flexibility in the choice of providers have the option of going for other managed care plans POS or point of service plans and PPO or preferred provider organization plans. POS provides the member with the option of having HMO type coverage at a lower fee, while having the option of Indemnity type coverage at a higher fee. PPO is also similar to POS with the added advantage that in the HMO type coverage the member is not needed to have a PCP.EPO or exclusive provider organization, a hybrid of HMO and POS plans, is a recent addition to the stable of managed care plans. The recent trend has been to go for PPO plans, as it offers the best of both Indemnity and Managed care plans. 2.4.4 Claims. As explained earlier, a Claim is a request filed by the member (or his PCP) for the refund of medical expense incurred by him. Claim is either filed on paper or sent electronically .The claim is received by the insurance company, validated for necessary information and then loaded into a database. The claim is then adjudicated (or tested for authenticity) as per the company’s business rules and policies. The checks can include, amongst other things Whether the member has satisfied his deductible (a deductible is a fixed dollar amount the member has to pay each year before be can claim benefits) Whether he has satisfied his copay (a fixed dollar amount the member pays every time he visits a provider) Whether he has satisfied his coinsurance (a percentage of the total cost which the member has to pay) Whether he had the necessary referral (or permission from the PCP) to visit the specialist. On completion of claims adjudication, member receives a check for payment of the expenses. The member is also sent a letter called the explanation of benefits (EOB). EOB gives the details of the services rendered to him by the providers and the amount of expenses to be borne by the member for the services he has used. It also gives the amounts applicable to him. Complex or ambiguous claims, also claims with any missing information are resolved manually by Adjudication experts, also know as Claim Examiners. Sometimes, members may be enrolled with multiple carriers (insurance companies). In such cases the claim is first processed by the primary payer (there are standard rules to determine which insurer is the primary payer) and then sent to the secondary payer. This is known as coordination of benefits (COB). Claims adjudication is a very complex process and requires information of almost all the entities associated with health care such as members, providers, benefits, referrals, policy etc. In addition the claim turn around (time from a claim being filed to the final check being issued) is a major issue for members and providers while choosing an insurer. Hence, nowadays there is a major emphasis on automated claims adjudication. Apart from speeding up the process, it also reduces the necessity for claim examiners, thereby making the process more cost effective. Also, the nature of claims processing being highly situation specific, it’s not possible for an insurance company to have a rule engine (or a software that adjudicates a claim) for all types of claims. So in case of very specific claims (such as processing of vision claims), the process of adjudication may be outsourced to __________________________________________________________________________________ 40793118 Ver. 1.0 Page 14 of 130 Healthcare Overview ___________________________________________________________________ another organization that has the necessary rule engine in place. These organizations are known as specialized adjudication companies (Magellan and ADESSO are two such organizations). 2.4.5 Sales. Sales and Marketing form an important activity in the health insurance industry, as there is stiff competition in the market. An insurance company has its own marketing workforce and also a pool of agents (brokers). Together they use various methods and strategies to sell the plans to as many customers as possible. In return for their services the brokers are paid a commission (broker commission) User groups called actuaries and underwriters play key roles in deciding the policy rates and thus in selling the products even though they do not interact directly with customers. The role of the actuary is to decide the rates for the various services offered by the insurance company. These rates are based on a variety of factors and involve statistical and mathematical computations. Based on these rates the marketing department creates a Quote (or a draft outlining the services to be offered to the members and the rates for those services). Meanwhile, the underwriter’s function is to approve/ validate the group specific factors added to rates by marketing people and apply mark-up or discount based on their judgment. 2.4.6 External Agents. All the services and management activities cannot be carried by the insurance company itself on it's own. It requires some help from some external sources or agencies. Health care is a highly regulated area in U.S.A. Government agencies such as Department Of Health And Human Services (DHSS), Center for Medicare & Medicaid Services (CMS), Center for Disease Control and Prevention (CDC), Agency for Health Care Research and Quality (AHRQ), Health Care Financing Administration (HCFA) along with others are responsible for regulating the healthcare industry.In addition, laws such as Health Insurance Portability & Accountability Act of 1996 (HIPAA) and Consolidated Omnibus Budget Reconciliation Act of 1986(COBRA) ensure the protection of consumer interests. Apart from these regulating agencies, there are agencies that aid the insurance company on various other fronts. Following are some examples of such agencies. Clearinghouses perform auditing services on insurance claims. If a claim is determined to be free of typographical, syntax, and logistical content errors, it is forwarded to the insurance company responsible for payment. If errors are detected, it is returned to the Provider/Member along with an explanation of what was wrong. This helps reduce the cycle time for claims adjudication. After that come the Specialized Adjudication Engines/Companies who offer help on adjudication of claims. Since claim adjudication is a complex process, it is not possible for an insurance company to have a rule engine for adjudication of every type of claim, Usually, claims which require very specific processing are sent to these specialized adjudication companies. Third Party Administrators are responsible for making payments on behalf of a group health plan. They are especially useful in case of small insurance companies who may not have the necessary infrastructure to take care of claim payments. General agents provide end-to-end connectivity that allows brokers and their clients to shop, purchase, enroll, serve and renew policies. They are the people who work behind the scenes to reduce administrative hassles and resolve complex service issues. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 15 of 130 Healthcare Overview ___________________________________________________________________ Accreditation agencies are responsible for providing accreditation to organizations, which permits them to sell their healthcare services in the market. Health insurance companies also enter into contracts with drug manufacturers to provide preferred services to their members. The insurance company promotes the drug manufacturer’s drugs amongst its members. Providers in the insurer’s network are given a list of preferred drugs, which then prescribe the same to the members. In return, the drug manufacturer provides discounts to the members. All these external agents help the correct regulation and effective functioning of the Healthcare industry. 2.5 Healthcare workflow. Now that we have a fair idea of major players involved in the business, we are in a better position to understand the managed care workflow. Referring back to Figure 1, the major steps in this flow are Quotes creation: The plan sponsor contacts the insurance company and expresses a need to buy health insurance. The insurer then collects data like number of members, dependents, location of members, average age etc for preparing a quote. The quotes are based on the health industry statistics, census data or demographic details Underwriting: After the acceptance of quotes by the plan sponsor the underwriting department underwrites the actual policies in terms of plan coverage and commercial agreements. Once the underwriting is done an OP (Offer presentation) is generated and sent to the quote requester. OP explains the rating calculation done for the benefits selected by the Plan sponsor and also the terms and conditions under which the group is accepted for coverage. Policy creation: After underwriting, the policy department of the insurer creates a policy by assigning group policy number, adding beneficiary to the policy, adding beneficiary dependents to the policy etc. The schedule for premium payments is also defined at this stage. ID cards are issued to the members that display the policy number, PCP address and contact info, claim posting address etc. Provider access: A member seeking medical service contacts the organization to get the list of providers in the geographical area of the member. The member sets up an appointment with the provider and receives the medical service on a pre-defined basis described in the policy agreement. Typically, the members pay either a deductible or copay. The member also specifies the primary and secondary MC organizations to the provider. Claim filing: The provider prepares a claim that describes the services rendered to the member, cost of the service, and primary and secondary MC organization and submits it to the insurance company. The claims are either sent by mail (paper claims) or electronically. Claim processing: The insurance company validates the member and provider information in the claim and makes payment to the provider for the services that are covered under the policy. An Explanation of benefits (EOB) is sent to the member describing the payments made and indicates the share that the member has to pay. In case of multiple MC (primary and secondary) the primary MC coordinates the benefits between the two MC and sends a COB (Coordination of benefits) to the member. Actuarial: This involves analyzing the trends, contingency matters and prior details to come up with factors to alleviate risks. E.g. Analysis of claims from a particular geographic location may reveal an increase in claims in that region due to reasons related to environment. Actuarial decides the factor to be applied to renewal rates of benefits offered in that region. It’s the area responsible __________________________________________________________________________________ 40793118 Ver. 1.0 Page 16 of 130 Healthcare Overview ___________________________________________________________________ for setting rating algorithm and the pricing factors to be used in rate calculation, future liabilities, arranging for reinsurance, new products introduction etc 2.6 Summary. This unit gave a brief overview of the healthcare industry to the reader. It started with the genesis of healthcare in the U.S.A and then introduced the five pillars of healthcare. In the end the reader was given a brief overview of the managed care workflow. The details about the pillars and the other topics mentioned in this unit will be presented in the subsequent units. The workflow shown in figure 1 represented the workflow of a managed care organization. The more accurate and detailed representation of the workflow of the healthcare industry is given the following figure. We shall analyze this figure at the end, after a detailed description of all pillars has been given. Figure 2: Detailed Workflow __________________________________________________________________________________ 40793118 Ver. 1.0 Page 17 of 130 Healthcare Overview ___________________________________________________________________ 2.7 Review Questions. 1. 2. 3. 4. 2.8 Give a brief account of the development of the health insurance industry? What are the five pillars of healthcare industry? Explain the terms Member Provider Benefits Claims Explain in brief the workflow of a managed care organization. References. www.insurance.com www.yourdoctorinthefamily.com http://trochim.human.cornell.edu/ “History of managed care” by Tufts managed care institute. “Future of managed care” by Tufts managed care institute. “Managed care overview” by Amit Shukla __________________________________________________________________________________ 40793118 Ver. 1.0 Page 18 of 130 Healthcare Overview ___________________________________________________________________ __________________________________________________________________________________ 40793118 Ver. 1.0 Page 19 of 130 Members ___________________________________________________________________ UNIT - III 3 3.1 Members Unit Objective This unit will acquaint the reader with the role played by the member in the Healthcare Industry. 3.2 Introduction Member is a person who is the actual beneficiary of the healthcare plan. A person purchasing plans can cover himself as a member (commonly referred to as "Subscriber") and his/her family members as dependent members (commonly referred to as "Dependent"). Some employers sponsor healthcare plans to its employees and its dependents. Once enrolled, an insurer provides ID cards to its members. These will be used to show the validity of the policy taken. Member can go to a service provider (hospital, doctor) to avail the service. Provider will check the eligibility of the member for that service. The provider/ member then will file a claim to insurance company. Claim will be validated and the insurer will reimburse the amount to the provider/member. The pictorial view of the process is as shown in figure 1. Member's data Asks for Service Member's Enrollment Providers Files Claims Check Eligibility Files Claims Claim's Adjudicatio n Payment Insurer Payment Fig 1: Member Overview __________________________________________________________________________________ 40793118 Ver. 1.0 Page 20 of 130 Members ___________________________________________________________________ 3.2.1 Insurance Business: An Overview. For the pictorial representation of insurance business and the member's interaction with other systems please refer to figure 2. Fig 2. Insurance: An Overall Picture. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 21 of 130 Members ___________________________________________________________________ 3.3 3.3.1 Individual and Group Insurance in detail Individual Insurance Individual members are those who purchase insurance directly from an insurance company. When an individual apply for insurance, he/she is evaluated in terms of how much risk he/she present to the insurance company. This is generally done through a series of medical questions and/or a physical exam. The risk potential will determine whether person qualifies for insurance and how much the insurance will cost. Individual insurance is somewhat more risky for insurers than group insurance, because group insurance allows the insurer to spread the risk over a larger number of people. For this reason, individual insurance is generally more difficult to obtain and more costly than group insurance. 3.3.2 How to get individual insurance? To get individual insurance, a person can either contact the insurer directly, or get in touch with the insurance agent. He/She will probably want to get quotes from several insurance companies before choosing one, just to make sure that he/she is getting the best coverage for his/her money. Before issuing an individual insurance policy, the insurer will want to know everything about his/her personal health history. It is unwise to try to hide a pre-existing condition from the insurer, since many insurers use information from the Medical Information Bureau to determine whether an applicant is insurable. If the insurer doesn't want to cover a particular health condition, a person may still be able to get a policy with an exclusion rider. But, if it is later discovered that he/she withheld information from the insurer, his/her coverage could be canceled altogether. Advantages of individual coverage If available, group insurance is generally a better option, since it is usually more comprehensive and less expensive than individual insurance. However, individual coverage is infinitely better than being uninsured in the event of illness or injury. Although someone may think he/she can do without health insurance, he/she is taking a major risk by choosing not to get coverage. An unexpected illness or serious injury can put him/her and his/her family in financial peril. In a group insurance situation, the provisions of the policy are negotiated between the insurer and master policy owner (usually an employer or association). With individual insurance, a person is directly in control of his/her policy. He/She can negotiate to have certain provisions included or excluded, and can often choose his/her deductible amount and co-payment percentage. Deductible and co-payment affect the premium. Disadvantages of individual coverage Often, the employer or association pays at least part of the cost of group insurance. In case of individual insurance, however, a member is responsible for 100% of the cost. Individual insurance often doesn't provide as much coverage as group insurance policies in the same price range. Moreover, individual insurance is often more expensive to make up for the insurer's increased risk exposure. Individual insurance coverage is, ironically, much easier to come by when someone is healthy. If he/she is already sick or have a history of health problems, he/she may find it difficult to obtain coverage. Group insurance, by contrast, is usually available without taking a medical examination or answering health questions. What to look for in an individual policy? __________________________________________________________________________________ 40793118 Ver. 1.0 Page 22 of 130 Members ___________________________________________________________________ If someone can find one that offers individual insurance, an HMO, PPO, or POS plan can often give the most cost-effective insurance coverage. However, if someone is getting individual insurance from a traditional insurer, here are some things he/she should look for: Financial stability An insurer with an "A" or "A+" rating from A.M. Best, Moody's, or Standard & Poor's. It does no good to have guaranteed renewable insurance if the insurance company goes belly-up. "Guaranteed renewable" provision This means the insurer can't cancel the coverage if someone becomes ill. As long as he/she continues paying premiums, his/her insurance coverage continues. The premiums may go up over the years, but they will rise for all policies in the class (not just individual’s). Coverage of pre-existing conditions Many insurance companies impose a waiting period before covering preexisting conditions. The shorter this period is better. Three months to one year is standard. Anything over a year is extremely undesirable. Major medical coverage Major medical coverage (which covers all hospital costs including rooms, emergency-room care, anesthesia, tests, x-rays, and drugs) is preferable to hospital-surgical coverage (which covers only hospital and surgical services). Many policies do cover outpatient treatment, although cosmetic and other truly "elective" surgeries are rarely covered. High benefit ceiling Policies with unlimited payouts are rare in this day and age. However, someone will want to find a policy with the highest lifetime payout possible. Anything less than $1 million may be insufficient to cover you in the event of a catastrophic illness. Out-of-pocket maximum Also called a "stop-loss," this limits out-of-pocket costs. Choosing an out-of-pocket maximum is a personal matter, since it really depends on how much someone can afford to pay. Lower out-of-pocket maximums can mean substantially higher premiums, and if someone might never have to worry about his/her out-of-pocket costs unless he/she becomes seriously ill. Waiver-of-premium provision This allows a member to skip the premium payments if he/she becomes seriously ill. The provision can be very important if the person is unable to work for an extended period of time. The highest deductible and co-payment someone can reasonably afford Lower deductibles and co-payments mean the costs will be lower if someone actually ever gets sick, but he/she pays dearly for this protection. By agreeing to a higher deductible and/or co-payment, he/she can cut his/her insurance premiums dramatically. And as long as he/she retains a reasonable out-of-pocket maximum, he/she shouldn't have to worry about medical costs getting out of hand. Providers who will offer individual insurance Most people purchase individual health insurance coverage through traditional insurers. Some managed healthcare systems provide coverage on an individual basis as well. In fact, some states require HMOs to offer coverage to individuals during a special open enrollment period each year. 3.3.3 Group Insurance Group insurance is coverage of a number of individuals under single contract. The most common "group" is employees of the same employer. Employers pay healthcare subscriptions for some or all of their staff. With group health insurance, a single policy covers the medical expenses of many different people, instead of covering just one person. Unlike individual insurance, where each person's risk potential is evaluated to __________________________________________________________________________________ 40793118 Ver. 1.0 Page 23 of 130 Members ___________________________________________________________________ determine insurability, all eligible people can be covered by a group policy, regardless of age or physical condition. The premium for group insurance is calculated based on the characteristics of the group as a whole, such as average age and degree of occupational hazard. Each member of the group provided a group certificate. It shows the benefits provided under the group contract issued to the employer or other insured. In general, the only real disadvantage of group insurance is limited or no freedom to customize the policy to individual needs. The policy is typically negotiated between the insurer and the "master" policy owner (employer or association) with no input from the member. The specific policy provisions are all determined in advance, as are deductible amount and co-payment percentage. How to get group health insurance? Find out the eligibility Many employers offer group health insurance as part of their employee benefits package. Other groups that may offer insurance coverage include churches, clubs, trade associations, chambers of commerce, and special-interest groups. Apply for coverage although one’s individual health is generally not evaluated when he/she apply for group health insurance, he/she must apply during the specified eligibility period. For employer-sponsored health insurance, this is often the first 30 days of his/her employment, or the first 30 days following his/her initial probationary period. For associational insurance, this may be the first 30 days of his/her membership in the group. If a person fails to enroll during this period, the insurance company has the right to treat him/her as though he/she was applying for individual insurance. This means he/she will probably have to answer extensive health questions, and go through a physical examination. The insurance company can then decide whether or not to insure him/her. The purpose of the eligibility period is to reduce insurance costs by preventing people from waiting until after they discover a health problem to sign up for coverage. Both employers and associations may also have an open enrollment period each year, during which one may sign up for coverage, modify his/her existing coverage, or add dependents to his/her coverage. Advantages of group coverage Easy to obtain Under a group health insurance arrangement; the insurance company agrees to insure all members of the group, regardless of current physical condition or health history. The only condition is that the group members must apply for insurance within the specified eligibility period. Clearly, this is better for those with chronic health conditions, who might be unable to get individual insurance. Cost Effective Because only one policy is issued for the entire group; the initial cost of establishing group coverage is lower than the cost of issuing a separate policy to each person. Also, group insurance is somewhat less risky for insurers than individual insurance, since the risk is spread out among a larger number of people. Within a fairly large group, it is almost certain that the good insurance risks will equal or exceed the bad insurance risks. Since group insurance costs less for the insurance companies to establish and administer, it generally costs less to purchase. Break on premiums In many cases, the employer or association will pick up some or the entire group insurance premium. This can make group insurance even more affordable. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 24 of 130 Members ___________________________________________________________________ Disadvantages of group insurance One can't customize the policy. In a group insurance situation, the provisions of the policy are negotiated between the insurer and master policy owner (usually an employer or association). An individual member does not have the freedom to have provisions included or excluded, and his/her deductible amount and copayment percentage are determined in advance. In some situations, however, he/she may be able to choose between two or more insurance plans. What to look for in a group policy? Financial stability Look for an insurer with an "A" or "A+" rating from A.M. Best, Moody's, or Standard & Poor's. High lifetime payout Find a policy with the highest lifetime payout possible. Anything less than $1 million may be insufficient to cover in the event of a catastrophic illness. A "stop-loss" provision This limits the out-of-pocket costs. Choosing an out-of-pocket maximum is a personal matter. Lower out-of-pocket maximums can mean substantially higher premiums. A waiver-of-premium provision This allows one to skip the premium payments if he/she becomes ill. The provision can be very important if he/she is unable to work for an extended period of time. The highest deductible and co-payment one can afford Lower deductibles and co-payments mean the costs will be lower if one actually ever get sick, but he/she pays dearly for this protection. By agreeing to a higher deductible and/or co-payment, he/she can cut his/her insurance premiums dramatically. And as long as he/she retains a reasonable out-ofpocket maximum, one shouldn't have to worry about medical costs getting out of hand. 3.3.4 Company Paid Groups In these groups, employers pay Healthcare subscriptions for some or all of their staff. An increasingly powerful "perk" useful for both attracting and keeping good staff, the company-paid group healthcare scheme offers benefits for employer and employee alike. In the increasingly tight labor market conditions prevailing in Ireland at the moment, company-paid schemes are the fastest-growing segment of the market at present. Advantage of company-paid groups Deduction Schemes A salary-deduction scheme comes into effect when a company or group organizes deductions from each employee’s salary and forwards them to Healthcare. This scheme makes things easier for the employees and encourages employee loyalty. Fast access to the best in modern healthcare Members can choose admission dates to fit in with work and family commitments, leading to less stress for them and their employees. Flexible cover options Once employer chooses a particular level of cover, staff members can select a higher plan and simply have the balance deducted from their salary. Benefit in the premium amount Some group schemes qualify reduction in the premium amount. Ease of Payment __________________________________________________________________________________ 40793118 Ver. 1.0 Page 25 of 130 Members ___________________________________________________________________ Payments can be made by direct debit through company bank account. Alternatively, a payment can be made directly on a yearly, half-yearly, quarterly or monthly basis. Tax Relief for employees Employees are liable for Benefit-in-Kind (BIK) taxation on the paid Healthcare premium at their top rate of tax, they are entitled to claim tax relief on the full premium, thereby reducing their effective rate of BIK to the standard rate of income tax. Benefits to the company Introducing a Healthcare group scheme for employees, one can provide his/her company with significant benefits in terms of employee recruitment, retention and goodwill. In a company-paid scheme, the company can claim healthcare payments under the Corporation Tax shelter. 3.3.5 Affinity Groups An Affinity scheme is appropriate for members of business organizations, professional bodies, sports clubs and interest groups. (Examples are the Irish Farmers’ Association, the Credit Unions and the Small Firms Association.) 3.3.6 Self Insured Group Plan Sponsors / Companies who pay the Claims' amount of their employees themselves are called SI (Self Insured) Groups. SI Groups pay "Service Charges" to insurer for administration / management of medical insurance (adjudicating claims etc.) for their employees. The SI group also has to maintain certain bank balance at all times to ensure the continuance of medical benefits to their employees. The financial risk is borne by the Plan Sponsor. But these figures are much lower than paying premium to cover all the employees. Plan Sponsor is profited by: They get the Health Insurance plan at a cheaper rate. Their Work will be given higher priority by the insurance company, as it is helpful in growing their relationship. Self-Insured People are Profited by: Getting more benefits for the same plan which an insurance company will not provide for others at low cost. They will be given more priority for processing of their claims then others get. Insurance Company is profited by: Getting a fixed sum of money for adjudication of claims. Risk is moved to the Insurance Company. 3.3.7 Self-Employed Members Health insurance need of a self-insured person is probably greater than the average person, because an extended illness or hospitalization could easily deplete his/her personal assets and endanger his/her business. Most people get their health insurance through their employers. This option is not available to selfemployed. In terms of health insurance, his/her options may be limited to: __________________________________________________________________________________ 40793118 Ver. 1.0 Page 26 of 130 Members ___________________________________________________________________ Individual health insurance coverage purchased directly from a provider Group coverage purchased through a professional association or civic group (i.e., trade group, chamber of commerce) Deductibility of un-reimbursed medical expenses In general If someone itemizes deductions and his/her un-reimbursed medical expenses exceed 7.5 percent of his/her adjusted gross income (AGI) in any tax year, he/she may deduct the amount by which his/her unreimbursed medical expenses exceed this 7.5 percent threshold. Un-reimbursed medical expenses include premiums paid for major medical, hospital, surgical, and physician's expense insurance, and amounts paid out of his/her pocket for treatment not covered by his/her health insurance. Special rules for the self-employed In addition to the general rule of deducting premiums as medical expenses, self-employed individuals can deduct a percentage of their health insurance premiums as business expenses. These deductions aren't limited to amounts over 7.5 percent of AGI as are medical expense deductions. The definition of selfemployed individuals includes partners and 2 percent S corporation shareholders. If someone meets the definition of a self-employed individual, he/she can deduct the following percentages of premiums for insuring himself/herself, his/her spouse, and his/her dependents: First Year 60% Second Year 70% Third Year and thereafter 100% This deduction is limited to amounts less than the earned income. Also, if the spouse of a self employed person, were eligible for an employer-sponsored health plan for any part of the tax year, then health insurance costs paid during that time cannot be used to calculate this deduction. Archer MSA--a way to save for health-care expenses Archer MSAs (previously called medical savings accounts) are tax-advantaged individual savings accounts that work much like an IRA. However, instead of saving for retirement, funds in an Archer MSA are used to cover health-care expenses. A self-employed individual (or the spouse of a self-employed individual) may be eligible to open an Archer MSA if he/she currently has a high-deductible health insurance plan. A high-deductible plan is defined as one in which: The deductible is between $1,600 and $2,400 for individuals ($3,200 to $4,800 for families), and The annual out-of-pocket expenses do not exceed $3,200 for individuals ($5,850 for families). Someone, having additional coverage under a health plan that is not a high deductible, is not eligible to open an MSA. This includes Medicare coverage. However, there are exceptions to this rule. The biggest challenge in setting up an Archer MSA may be finding a company that offers them. Many insurance companies are still developing qualified high-deductible insurance plans and products with a savings component. In fact, in some states, insurers are running into problems with state laws that prohibit __________________________________________________________________________________ 40793118 Ver. 1.0 Page 27 of 130 Members ___________________________________________________________________ such high-deductible plans. Many financial institutions are also still in the development stage with their Archer MSA account products. 3.3.8 Exercise 1. 2. 3. 4. 5. are those who purchase insurance directly from an insurance company in case of an individual insurance. are those who purchase insurance in an employer sponsored insurance. are those who pay the Claims' amount of their employees are Self Insured Groups. For Self-insured groups insurance company may provide the services. Enlist advantages and disadvantages of individual and group insurance. Answers: 1. Individual Members 2. Employers 3. Plan sponsors/ Employers 4. Administrative /Management of medical insurance 5. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 28 of 130 Members ___________________________________________________________________ Member’s enrollment 3.4 3.4.1 What is Enrollment? The enrollment process comprises of collecting, verifying, and making available all necessary eligibility information for enrollee membership, product issuance, billing, and claim adjudication. Member will provide all necessary data to the insurance company that will include personal information, benefit information that he/she has opted for. Collecting and updating the systems with the data completes the enrollment process. Once the enrollment is over, a member can start filling up the claims. 3.4.2 How is enrollment carried out? Traditional Paper Enrollment Enrollment forms would be available on the web sites or situated office outlets of the company. Member can fill up the forms and send it to the respective postal addresses. Member will receive membership letter once the enrollment is over. Enrollment in the office outlets of the insurance company There will be city-based office outlets set up by the company. Member has to approach the office. There will be online systems set up there. Data entry operators will make you enroll online. Membership letters and other details will be sent to the member once the process is over. Enrollment through the employer based systems Employers do have employees data maintenance systems. Required data will be captured and sent to the insurance company electronically. The data will be received and formatted fed to the systems. The enrollment process will then be automated. This is most commonly used methodology for large employers having more than 300 employees. Web-based applications For an individual web based application will facilitate online registration/ enrollment to get enrolled. This is the most commonly used approach. For an employer ID numbers and passwords for its employees will be provided. Employees are allowed to select the benefits they wanted to opt for. Employer then validates and sends the information to the insurance companies electronically. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 29 of 130 Members ___________________________________________________________________ Enrollment Data Flow is shown in figure 3. Member Member Employer Member Associations Insurance Company Fig 3: Enrollment Data Flow 3.4.3 Output of enrollment process ID Cards A person insured under an insurance company is given an identity card. Member has to show his/her identity card when he/she approaches a service provider (doctor, hospital, pharmacist). ID card would have details about the member's SSN, Name, membership number and other details. Membership letters Once the enrollment process is complete, membership letters will be sent explaining the benefits he/she has opted, eligibility information. Employer Report A report will be sent to the employer giving the details of its employees enrolled and their details. Provider Report Providers are made aware of the new members enrolled under his/her name. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 30 of 130 Members ___________________________________________________________________ 3.4.4 Enrollment: Overall Picture Please refer to figure 4 for the pictorial view of enrollment process. Fig. 4 Enrollment Process 3.4.5 Exercise 1. Enlist the means of enrollment. 2. Employers having own member's database provide data to the insurer via _________. 3. Member needs to show _______ as a token of its membership in the insurance company. Answers 1. Means of enrollment are a. Traditional Paper transfer b. Direct enrollment in the field offices c. Electronic data transfer from employers d. Web-based applications. 2. Electronic data transfer. 3. ID card __________________________________________________________________________________ 40793118 Ver. 1.0 Page 31 of 130 Members ___________________________________________________________________ Member’s and Dependent’s eligibility 3.5 3.5.1 Eligibility Eligibility is the ability of a person to use any kind of service. Taking insurance business into consideration, a member’s eligibility for a service will be decided upon the benefits that he/she has opted for. Every service-provider is bound to check the eligibility when a member asks for any kind of service except for indemnity plans. Provider need not do any eligibility checks when member is having indemnity plans. Insurers will set-up systems by which eligibility information will be available to the provider. Provider gives basic information about the member (Member's identification number, Social Security Number) along with service he/she is asking for. The system will crosscheck the eligibility for the service and inform the provider back. If the member is not eligible to avail the service the service provided will not be insured. If member is eligible, the service will be provided and provider will file the claim for the payment of the service. 3.5.2 Eligibility Process Provider will query on a member for getting a particular service. The system will run eligibility checks and returns the data to the provider. Data sent to and from the provider to validate the eligibility: Member's information: The provider will send the identification information as SSN (Social Security Number), member number (Identification number given by insurer); Last name will be fed to the online system as input. This data will be validated with the database of the insurer to make sure that the person is a valid member. Subscriber's information. Provider will send subscriber's information only if the member is a dependent. Subscriber's name, Identification number etc. will be given to the system. Again this will be validated against the insurer's database to make sure that the subscriber is a valid member. Employers Information. Provider will also provide employer's data if the plan is sponsored by member's employer. Every employer when signs a contract with the insurer are given identification number. Employer Name, ID number is validated with the insurer's database. Policy Dates. The data will be sent from the insurer that will contain duration for which the policy will hold true for a member is defined in the contract. So the policy effective date, termination date will be sent back to the provider. Service related information. There are different services that could be covered by the insurer. Not all could be applicable for a member. Member when purchases a policy selects the services that we would want to be covered. Depending on that various terms like rates, premium will be decided. So every time a service is given a provider asks the system if member is eligible to get that service or not. In case of prescription drugs there is a cap held on the quantity drug to be consumed by the member in a period of time. These validations are also carried away when the eligibility is validated. A member is also allowed to monitor its own/ dependent's eligibility status. Even an employer is given access to this data so that it can monitor eligibility status of its employees. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 32 of 130 Members ___________________________________________________________________ Eligibility data flows as shown in the figure 5. Insurer Member's Policy information Employer Member's Policy information Member Member's Policy information Provider Fig 5: Eligibility Data Flow The Insurer Insurance companies provide member eligibility information to the service providers, employers and to its members. Insurance companies set online systems through which providers can query for the eligibility data for the member approached to him. After getting confirmation from the insurer, provider will give service to the member. The Provider Healthcare providers need vital information related to member eligibility and claim status. Every time a member visits a provider, the information needs to be validated before giving any kind of service. By permitting healthcare providers to access this information directly, providers and their administrative staff to quickly and easily get detailed information regarding submitted claim status and eligibility status of employees and their family members. The Employer Eligibility information will be maintained and accessed by the employers. Employer groups normally use online administrative system that will provide eligibility status of a member. The Member Member may be interested in looking for their benefit data, the deductible and all other information. Some employers provide an online eligibility status inquiry similar to that given for employers. 3.5.3 How a member should approach right provider? Eligibility also talks about the member getting service from a particular provider is valid or not. Member having HMO plan __________________________________________________________________________________ 40793118 Ver. 1.0 Page 33 of 130 Members ___________________________________________________________________ Every member has associated Primary Care Physician (PCP) for medical services and Primary Care Dentist (PCD). Provider validates the eligibility of the member for the service asked. The service will be provided only if the person is eligible for the same. Member having PPO plan A member will fall under a network and can get service from any provider falling in that network. Member having POS plan Member is free to go to any provider. If goes to in-network provider the co-pay will be less. But there is no restriction on the choice of the provider. So eligibility checks would be carried away but will not hold back the member from getting the service. Member having indemnity plan Member is free to go to any provider. Provider need not do any eligibility checks for member’s eligibility. 3.5.4 Eligibility Data Transfer Most of the insurance companies transfer the eligibility data electronically. This methodology eliminates the need to submit paper forms or produce and send cumbersome tapes, cartridges and diskettes, which can get lost or damaged. These are generally unattended, automated transmissions that include security features like encryption technology and unique IDs and passwords for user verification and system access. 3.5.5 Eligible Dependents Eligible dependents are member’s spouse and/or unmarried children under age 23 who live with member in a regular parent-child relationship. This includes children who are away at school as well as divorced children living at home and dependent upon member for support. If member is divorced, children who do not live with the member are eligible if member is legally required to support those children. Stepchildren, foster children, legally adopted children, and children in a guardian-ward relationship are also eligible provided they live with member and are substantially dependent upon member for support and maintenance. Affidavits of Dependency and legal documentation are required with enrollment forms for these cases. Coverage for an enrolled child will end when the child marries, moves out of the household, or turns age 23. Coverage for children age 23 ends on December 31 of the year in which they turn age 23 If a child is not capable of self-support when (s) he reaches age 23 due to mental illness, mental retardation, or a physical disability, coverage may be continued. 3.5.6 Exercise 1. 2. 3. 4. Providers need not validate the member eligibility before catering any kind of service. (Y/N) Providing member's eligibility data to the providers is a responsibility of the insurer. (Y/N) Son Bill of age 21 got married and moved out will be a valid dependent of Joe. (Y/N) Daughter July aging 26 passing through a phase of mental illness is treated as a valid dependent. (Y/N) Answers 1. N 2. Y 3. N 4. Y __________________________________________________________________________________ 40793118 Ver. 1.0 Page 34 of 130 Members ___________________________________________________________________ 3.6 Member Services Insurance companies provide plenty of services to make information available to its members. Members can make various inquiries, like the status of his/her claims, claim eligibility, Provider inquiry etc. 3.6.1 Means of services Phone call Designed/Toll free numbers for member services. There could be menu driven recorded message that will provide you information you want. E-mail Member services e-mail address to which a member can send a mail and ask for the service. Postal mail Paper driven approach in which member has to fill up a service request form and send to the member service station where the requested service application will be taken care of. FAX Paper driven approach in which member has to fill up a service request form and send to the member service station where the requested service application will be taken care of. Walk in Situated are member service offices, where a member can enter personally to login a service request. Web based applications. Web-based application is the most common of all of above modes. There will be web-based application where a member can login and avail the service or can login the service request. 3.6.2 Services provided by the insurer View information/ Inquiry only Insurance companies do provide a facility via which a member can view his/her benefit information and the status of his/her eligibility. There are several ways this service is provided most common is through phone calls, web-based applications. Essential security features are incorporated in the applications to prevent the data loss and data disclosure. Member has to register his/her name in the application and the data would be shared. o o o Personal Details This includes the name, address, contact numbers and other details. Claim Status When a member has filed a claim, he can keep track on what is the status of the claim. Benefits summary Talks about a partial, general description of your medical benefits and includes member costsharing information, such as co-payment or coinsurance requirements. o Benefits Snapshot Review primary care physician or primary care dentist selections for the member and the covered dependents. Review coverage status for medical and/or dental care. o Provider directory Provider directory is that enlists the providers those are in the network of the insurer/in contract with the insurer. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 35 of 130 Members ___________________________________________________________________ Update information These services are catered through phone calls, web-based applications or the walk in offices situated. o Updating personal information Member may wish to update the personal information such as address or contact number etc. can walk in the offices set up by the insurer and do the changes. Some times the employers update the insurer about these changes. o Password change facility If there were a web-based application that caters all these facilities there would be a facility to change the password set up by the member. o Provider change facility Member may wish to change the primary care physician or primary care dentist he/she has a facility to do so. o o A marriage or divorce of the employee The death of the employee's spouse or a dependent The birth, proposed adoption, or adoption of a child of the employee The termination or commencement of employment of the employee's spouse The switching from part-time to full-time employment status or from full-time to part-time status by the employee or employee's spouse The taking of an unpaid leave of absence of the employee or employee's spouse The significant change in health coverage of employee or spouse attributable to spouse's employment Other services Providing forms Forms like medical claim submit form/ dependent care reimbursement form, are made available on the web-sites/applications that might be needed by the member. These forms could be submitted via postal mail to the claims offices (the address is generally specified on the ID cards). Log issues and complaints: o Logging provider complaint Member is free to log in any complaint about the service or the provider. o Clarification about the benefits Member can get the doubts about the benefits at any point of time. There will be company's officials sitting in the offices assisting the member in doing that plus there are designated mail-Ids a member can send a mail to. Internet also helps out by providing enough data on the site. o Add or delete family members at open enrollment. Some of the cases are: Distribution of ID cards, booklets: Issue ID Card Member may need to issue a new ID card if misplaced/lost. The facility to replace the ID card would be provided. The member has to fill a form for the ID card issuance. A new card will be sent to the address we have on file for you. Updating member with new products, facilities: __________________________________________________________________________________ 40793118 Ver. 1.0 Page 36 of 130 Members ___________________________________________________________________ There are many upcoming services/ benefits newly provided by the insurance company. Member is kept updated with the information by weekly/ monthly reports or news on the websites. o o o 3.7 New benefits information. New facilities information About products and programs that are available in the state. Premium Collection A member can pay premium to the insurer by following means: Transferring fund from member’s account to insurer’s account: The member authorizes the insurer to get money transferred to insurer’s account. Once the money is transferred to insurer’s account, an acknowledgement letter is sent to the member stating that so and so amount of money is transferred from member’s account to insurer’s account as an insurance premium for a particular month. Charging to the member’s credit card Some times member authorizes the insurer to charge the premium to his/her credit card. The member receives the acknowledgement letter from insurer giving detail about the premium received. The acknowledgement letter contains the detail about the payment such as premium amount, moth, policy number etc. Payment by cheque If the member is willing to make a payment through cheque, he/she receives a premium statement through post. The premium statement is sent to the member along with an envelope. Address of the insurer is preprinted on the envelope. The member tears of the lower part of invoice, fills in the detail (name, cheque number, policy number etc.) and sends it along with the cheque in the envelope received with the invoice. Some insurance companies also send the premium statements through email. Monthly statements are emailed to the member portable document format (.pdf) attachment. Sending statements through email has many advantages, statements: Can be viewed on computer. Can be zoomed in for larger print and easier reading and can be printed on virtually any inkjet or laser printer to get perfect copies. Can print as many copies as needed. Can be stored electronically on computer for easy retrieval. 3.8 3.8.1 Member Group Maintenance What are Groups? Groups are the frameworks used to organize billing, claim payments, recording, accounting and reporting of data to the plan sponsors (employers/ associations). 3.8.2 Groups Formation When a plan sponsor enrolls its employees, the breakdown of the employee into groups will be done. The decision of the group structure will be based on Profit centers Unions Benefits __________________________________________________________________________________ 40793118 Ver. 1.0 Page 37 of 130 Members ___________________________________________________________________ Class of employee Locations Other categories specific to the plan sponsor For a group insurance, groups are created and entered into the systems first then the enrollment for the individual members would be done. Being a parent entity some data is defined at a group level that will be inherited by the members following under that group. This data would generally contain Employer information Plan Effective Date Plan Termination Date Benefits Covered Network Information Co-pay rates Claim offices The members could override some of the features. 3.8.3 Groups Maintenance Member and Groups' maintenance is performed annually. Most Groups' renew their Plans every year in January. The CONTRACT IS RENEWED for a group and the members are REINSTATED. Other maintenance performed on the member data is … Members Maintenance includes Member's personal information changes (Address Change, Comment, Member Name Change, Reinstatement, Suspended). Membership details (Effective Date Change, membership Termination date changes, Employment Change, Family Effective Date Change, Family Group to Group Change. ID-Card Request. Payroll Change. Provider Office Change. Recalculate Family Contract. Group Maintenance includes Office Details changes (Contact Number, Contact Address Changes) Third Party Address Change, Third Party Address Maintenance, Third Party Phone Number Change. Mass Id-Card Request (Co-pay Change), Mass Id-Card Request. Membership Effective Date Change. Membership Termination. Change Membership Termination Date. Employment Change. Office Effective Date Change. Office Termination Change. Payroll Change. Provider Office Change. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 38 of 130 Members ___________________________________________________________________ 3.9 Disability Benefits Disability income insurance provides members with an income if they become sick or injured and are unable to work. The funds paid are not specified for medical expenses - they can be used in any way the member wishes them to use. Employers can provide coverage for employees too. 3.9.1 Member’s concern When a member buys an individual disability insurance policy, pay attention to whether the contract is noncancelable or guaranteed renewable. Non-cancelable means that the policy can't be canceled and the premium can't be raised for the life of the policy as long as member continues to pay premiums. Guaranteed renewable means that the policy can't be canceled as long as member pays premiums, but the premium can be raised under certain circumstances (the state insurance department must approve the change, which would apply to all individuals in the same insurance classification). A non-cancelable contract is preferable to a guaranteed renewable contract. Often, non-cancelable policies are offered only to low-risk occupational groups at a high premium. For a guaranteed renewable contract company cannot raise your premium on an individual basis, they must have the permission of state's insurance department, so may be premium will be raised only every few years. Opting for the guaranteed renewable provision may save as much as 30 percent of the premium cost. 3.9.2 Exercise Questions 1. What types of services does the insurer provide? 2. When the groups are formed in case of a group insurance? 3. Enlist the services offered for group maintenance. 4. Disability benefits contracts in which policy cannot be canceled and premium cannot be raised are _________. 5. Disability benefits contracts in which policy cannot be canceled but premiums can be raised are _________. Answers: 4. Non-cancelable. 5. Guaranteed renewable. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 39 of 130 Members ___________________________________________________________________ __________________________________________________________________________________ 40793118 Ver. 1.0 Page 40 of 130 Members ___________________________________________________________________ __________________________________________________________________________________ 40793118 Ver. 1.0 Page 41 of 130 Providers ___________________________________________________________________ UNIT - IV 4 Provider 4.1 Provider types Providers are those people, organization or institution that provide services to those enrolled into the system i.e. the members. There can be numerous classifications of providers depending upon the facilities provided by them. Provider types can be classified broadly in the following ways: Individual providers: These are those person who are not part of any group or association e.g. Dentists, physicians etc. Group Or Entity: These are group of people who provide services under a common name e.g. Hospital etc. IPA or PORG: (Independent Practice Association or Provider ORGanization) It is the legal entity that provides administrative and contract related services for providers. Depending on contract the Providers can be classified as: PAR: Such a provider is a participating provider and has a valid contract with Healthcare organization. NON-PAR: These are those non-participating providers whose contract with Healthcare organization is terminated. COMMUNITY PROVIDER: These providers do not have a contract at all with Healthcare organization. Other way of classifying them based on the type of contract is as follows: PCP: Primary care physician. As the name suggests it is the PCP who is in constant touch with the members directly. Every member is supposed to approach the PCP first before going to anyone else. SPECIALIST: A specialist is one who has one or more areas of specialization in medical field. PREFERRED PROVIDER: These are those providers who work on contract basis by negotiating the compensation they charge. NON-PREFERRED PROVIDER: These are those providers who are not contracted to furnish services or supplies within ‘PREFERRED’ network. BACKUP-PROVIDER: A provider can specify another provider as his/her backup. Backup provider provides medical services to the patients of the provider when he is not available. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 42 of 130 Providers ___________________________________________________________________ Based on nature of service, providers can be classified as following: 4.2 FACILTIES: These are those providers who provide facilities such as wards, ICU’s, Hospital, Maternity Home etc. EQUIPMENTS: These are those providers who provide medical equipment for executing medical tests such as X-ray labs, path labs etc. SUPPLIERS: These are those providers who provide medicines and surgical instruments. E.g. Pharmacies. Provider Participation HCO (Healthcare organizations) usually elicit provider participation (into their network) using some standard marketing strategies. Some of these are as follows: Quick settling of claims Most HCO(s) attract specialist providers into their network by promising them quick turn-around of their claims. Some HCO(s) have pioneered the E-Pay/E-Cash option, which involves clearing provider claims within a fortnight (subject to the provider electronically filing the claim in a prescribe format). Minimum number of member visits Some HCO(s) guarantee providers; a minimum number of member (or dependent) visits, so as to assure a minimum amount of revenue by way of claims. E Learning Virtual Communities As some of the fringe benefits, large HCO(s) provider e-learning options to enrolled providers via virtual communities on the Internet. These are specialist networks of providers, which share knowledge and intellectual property via the Internet. 4.3 Provider Contract Contract is an agreement between the provider or group of providers and the insurance company about the services the provider(s) will provide and the payment that the insurance company will make to the provider for the services rendered. 4.3.1 Provider Contract Process Providers who wish to participate in one of the networks must complete an application and the corporate credentialing process, or an appropriately delegated credentialing process. Health insurance companies sometimes delegate credentialing to some physician groups, e.g., individual practice associations (IPAs), and physician hospital organizations - PHO(s). Once a provider is accepted as a participating provider, there will be routine visits to the provider's office and a re-credentialing process every two years. 4.3.2 Credentialing Criteria The process requires providers to present documentation of training, education and other relevant information. Health insurance companies usually consider: Licensure and/or certification Drug Enforcement Agency (DEA) registration (for Medical Doctors and Doctors of Osteopathy) Professional liability history Medical education and training Specialty board certifications Mental and physical health Disciplinary history (including licensure, DEA registration, hospital membership/privileges, professional organizations, Medicare/Medicaid) Work history Malpractice insurance coverage history __________________________________________________________________________________ 40793118 Ver. 1.0 Page 43 of 130 Providers ___________________________________________________________________ Clinical privileges at a hospital 4.3.3 Verification of Provider Credentialing Information Health insurance companies verify the information about providers through a variety of sources: State medical boards National Technical Information Service tape American Medical Association master file American Osteopathic Association directories American Boards of Medical Specialties National Practitioners Data Bank Malpractice carrier Court records Office of Inspector General reports Hospital providers 4.3.4 Types of Contracts All major health insurance companies have several different types of provider contracts based on the type of servicing provider. Some of the different types of provider contracts include PCP contracts, Specialist contracts and Hospital contracts. 4.3.5 Provider Reimbursement Most health insurance companies incorporate the following payment methods to reimburse providers for services. Quality-Based Physician Compensation Quality Care Compensation System Quality-Based Physician Compensation Participating providers in the network have agreed to be compensated in various ways. For example, many participating primary care physicians are compensated in accordance with the Quality Care Compensation System* (QCCS) described below. Additionally, specialists, hospitals, some primary care physicians and other providers in the network are paid in the following ways: Per individual service (fee-for-service at contracted rates) Per hospital day Under other capitation methods (a certain amount per member, per month) By integrated delivery systems, independent practice associations (IPAs), physician hospital organizations, mental health companies and similar provider organizations that are compensated by us on a capitated basis or other basis Quality Care Compensation System Under the Quality Care Compensation System, physicians are paid by capitation. This means the physician is paid a fixed amount twice a month for every member who selected that physician to be his/her primary care physician. Under capitation, a physician receives payment for a patient whether the physician sees the patient that month or not. In most areas, the system uses a three-part quality factor to adjust the physician’s capitation payments. Quality Review considers: Results of member surveys Review of the care (like childhood immunization rates, flu shots and cholesterol screenings) members get from their physicians Number of our members who change their primary care physicians __________________________________________________________________________________ 40793118 Ver. 1.0 Page 44 of 130 Providers ___________________________________________________________________ How well the physician provides access to care and manages the care of patients with chronic illnesses like asthma, diabetes and heart failure 4.4 Exercise 1. 2. 3. 4. The legal entity that provides administrative and contract related services for providers are also a type of provider – True or False. A provider is called as ________ provider if he has a valid contract with the company. Providers who provide medicines and surgical instruments are known as ___________. Contract is an agreement between the provider or group of providers and the _________________. Answers: 1. True. (E.g. IPA, PORG etc) 2. PAR or Participating 3. Suppliers 4. Insurance Company 4.5 Provider Referral A referral is a form of authorization given to a member to access services performed outside the Primary Care Physician’s (PCP) office. A PCP or an authorized provider provides it when special care is required. A PCP can issue themselves referrals for non-routine services. A referral once issued has a validity period, which is generally fixed and can be 30 to 90 days and to utilize the referral the initial visit must be within that validity period. Referral is not always required to visit outside PCP. It depends on the plan taken by the member. Some plan has flexibility to visit any provider without any prior authorization in that case referral doesn’t come into picture. 4.5.1 Referrals processing Referral entry – All the referral should be entered in the referral database so that it can be used if required. The information which needs to be entered are Member number, Encounter date, details of the provider for whom referral given, details of the provider who is referring, referral validity ‘From’ and ‘To’ date and service code (it specifies the king of service/treatment). Referral inquiry by member or referral number – Once the entry is made then at any time one can inquire about the details of any referral. The inquiry can be done either on the basis of member number or referral number which ever is known. Referral maintenance – through this process one can modify the existing referral entry. If some referral has to be cancelled then we can do that through this process. Referral entry can be done through batch or online processing however inquiry and maintenance is done through online screens. Referral purging – This can be done in batch mode. A Job will scan all referrals within the referral database. If the referral meets the purge criteria below, it will be written to two output files. The first will be a detailed dump of the referral that will be written to a purge file. This information will be written to a yearly archive file that is used to recall purged referrals. The second is a file that is used by another job, which will do the actual erase of the referral. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 45 of 130 Providers ___________________________________________________________________ All referrals over 18 months old are purged, with the following exceptions: o o o If the date of the referral entry is less than 18 months from the current date, and the referral has been logically deleted, the referral will not be purged. If the procedure/service code indicates that it is an infertility referral (e.g. 58550, 58551, 58552, 58555, 58560), and a visit has been taken within the last 30 months, the referral will not be purged. If the referral is 18 months or older, and a visit has been taken within the last 6 months, the referral will not be purged. 4.5.2 Referral types There are two types of referrals: Paper referrals – In case the provider is not connected to company’s network he can enter the referral details on a paper which can later be scanned to a microfilm or manually entered by a processor to the database of the insurer. Electronic referrals – Direct online entry by provider. This is possible if the provider is connected to the company’s network directly or through a third party. 4.6 Provider Network A network is a group of contracted providers (doctors, hospitals, laboratories, etc.) who have agreed to treat AUSHC members at negotiated rates and have agreed to abide by patient and quality management programs. Our objective is to establish networks large enough to satisfactorily serve the targeted population to whom they will be available. Factors such as population, availability of health care services, local practices, and travel time are taken into consideration when contracting with local providers to join the networks. A rental network is an arrangement in which another organization (besides AUSHC) contracts with a group of providers. AUSHC then reimburses that organization for allowing our customers to use the network. 4.6.1 Quality Provider Networks AUSHC believes members benefit from quality provider networks in the following ways: Comprehensive: Several providers participate with AUSHC including, primary care physicians, specialists, and acute care hospitals. Specialized Care: National Medical Excellence Program helps members needing highly specialized medically necessary treatment such as transplants or cancer at national recognized institutions when the required procedure is not available locally. Tough Standards: All providers must meet our comprehensive credentialing standards. Primary care physicians, in particular, must meet more than two-dozen criteria for admission into our networks, one of the toughest participation requirements in the country. Extensive Monitoring: Participating Primary Care Physicians are re-credentialed approximately every two years based on a number of criteria including chart audits and the results of member surveys. All providers’ performance in monitored regularly. 4.6.2 Network Adequacy Network adequacy refers to both the availability of a participating provider within geographic perimeters and the availability of essential services from a participating provider. In other words, networks are adequate when there are enough providers available for the member population in a geographic area, and when members have access to the various types of medical services they may need. A PPO network must be complete enough to provide members’ access to a participating provider for a core of essential medical/dental services. __________________________________________________________________________________ 40793118 Ver. 1.0 Page 46 of 130 Providers ___________________________________________________________________ The local Network Management staff has the ongoing responsibility of ensuring that each network has the proper composition of providers. They compare the existing network with adequacy guidelines for the specific service area and identify whether there is a need for new providers. After developing a list of providers by type needed to meet customer needs, network staff target providers to be recruited and contracted. The criteria used to select participating providers reflect minimum network composition standards, but may vary to accommodate local supply and regulatory requirements. 4.6.3 Rental networks A rental network is an arrangement in which another organization (e.g., Pro Net) contracts with the providers. Instead of engaging in direct contracting arrangement with individual providers, Aetna reimburses the rental network organization for allowing our members to use the network. 4.6.4 Network Hospital Standards Our current hospital contracts require network hospitals to represent and warrant that they are, and will remain during the term of the contract, appropriately licensed and accredited by either the American Osteopathic Association (AOA) or the Joint Commission on Accreditation of Healthcare Organizations (JCAHO). All facilities are also required by contract to notify us of any change in coverage, licensure or accreditation status. They must also maintain adequate malpractice and general liability insurance or selfinsurance, and provide evidence of such insurance upon request. 4.7 Provider maintenance This process involves collecting information on all type of Health Care Providers, which includes hospitals, Doctors, Labs etc. In the healthcare organization, one the major database is Provider database. Almost all the system uses this database to get any information about any provider. Provider maintenance should be done everyday in order to keep the provider database up to date all the time. 4.7.1 some common information of Providers Some of the common information that needs to be captured for a provider is given below: Provider number – this is a unique number which is system generated, given to each provider to identify the provider easily. All the inquiry or maintenance of providers is done based on provider number. Provider name – it is the name of the provider if he is an individual provider. If it is any group or hospital then name of that should be stored. Provider status – Shows current status of the provider. A provider who is providing healthcare services on current date is an active provider. The status can be retired, closed, deceased etc. Provider type – Provider type is categorization of the providers depending on the type of healthcare services they provide. E.g. – Physician, Dentist, Psychologist, Clinical Social worker, Midwife, Nurse Practitioner, Nutritionist, Radiology center, transportation etc. Provider Specialty - The area in which a provider specializes is called his SPEC or specialty. Billing Address - The address at which the payment of claims is made to a provider is called the billing address. A provider can have more than one billing addresses. If the code for billing address is o It’s the principle service address. If a provider has more than one service locations, one of their addresses is identified as principle billing address. Provider can have maximum of ten __________________________________________________________________________________ 40793118 Ver. 1.0 Page 47 of 130 Providers ___________________________________________________________________ Service Locations (SLs). The addresses of rest of the nine SLs are stored as 01, 02….09 Service addresses. If there are no levels 10, 14 or 15 billing address, only then the payment is made to the principle service address. o This is CAP and Claims billing address. If a provider wishes to have a billing address, which is different from all his SL addresses, he specifies a level 10 billing address. Both claims and capitation payments go to this address only if provider has not specified level 14 and level 15 addresses. o 14 & 15 – If a provider wishes to have separate addresses for capitation and claims payment, he can specify level 14 billing address for payment of capitation and level 15 billing address for payment of claims. Claims payment schedule – It is the interval of claim payment to the provider. It can be weekly, bi-weekly or monthly. Contract info – this information tell whether the provider is in contract with the company or not. There would be providers in the database, which are not in contract with the company, but the company needs to put their details as well, to process their claims. There are some plans available in which the member can visit any provider irrespective to his contract with the company. Effective and termination date - All information maintained are time sensitive. Providers will participate with an organization for a certain period and may discontinue. 4.8 Exercise 1. 2. 3. 4. Referral is mandatory to visit a specialist irrespective of insurance plan/policy – True or False. A unique number given to each provider, which ease in maintenance of that provider record, is ____________. Provider network is adequate when: a) There are enough providers available for the member population in a geographic area, b) Members have access to the various types of medical services they may need, c) Both of the above, d) None of the above. ____________________ is the interval of claim payment to the provider. Answers: 1. False. (E.g. In Indemnity plan referral is not mandatory) 2. Provider number 3. C. 4. Claims payment schedule 4.9 Review Questions 1. 2. 3. 4. 5. What are the various criteria for the provider type classification? What are the credentialing Criteria considered by the Insurance Company before making an agreement with the provider? Explain various stages in Provider referral processing? What is the difference between Provider Type and Specialty? What payment methods do insurance companies use to reimburse providers? __________________________________________________________________________________ 40793118 Ver. 1.0 Page 48 of 130 Providers ___________________________________________________________________ 4.10 References AETNA Intranet http://www.healtheon.com/ http://www.healthinsurance.com/ http://www.healthaffairs.org/ http://www.doctorandpatient.com/ http://www.doctorquality.com/www/provider.asp/ http://www.masslegalnurse.com/healthcareproviderinfo.htm/ http://healthcare.ucla.edu __________________________________________________________________________________ 40793118 Ver. 1.0 Page 49 of 130 Providers ___________________________________________________________________ __________________________________________________________________________________ 40793118 Ver. 1.0 Page 50 of 130 Sales ___________________________________________________________________ UNIT - V 5 Sales 5.1 Unit Objectives This unit aims to familiarize the reader with some aspects of insurance sales and quote creation. The various entities involved like Brokers and Underwriters are also discussed. 5.2 Introduction Sales and Marketing form an important activity in the health insurance industry, as there is stiff competition in the market. An insurance company has its own marketing workforce and also a pool of external agents (brokers). Together they use various methods and strategies to sell the plans to as many customers as possible. User groups called actuaries and underwriters play key roles in deciding the rates and thus in selling the products even though they do not interact directly with customers. 5.3 Brokers An insurance company generally has a pool of brokers. As in every other business, in health insurance too brokers bring together buyers and sellers against a commission, here buyers being the customer group buying a plan and sellers being the insurance company. A substantial percentage from customer groups’ payments result in distributing some percentage as commission to brokers. Brokers are also called Producers in this context. Users within the company need to maintain particulars of brokers and information regarding broker-customer relationship. 5.3.1 Calculation for Brokers Broker Commission calculation can be divided into following main sub topics Product-wise compensation: Sometimes a broker group deals with only a particular kind of product. In such cases the Customer and Cash receipts information is maintained and broker commission is calculated from that. Key Producer Compensation – Sometimes the company identifies key producers and gives them bonus if they get more than a fixed number of new subscribers. Producer Data is frozen at the end of a year. This bonus is in addition to commission a producer receives on premium paid by Customer Groups. The bonus distribution could be something like this: Net Subscribers Produced Override % of Premium 150-750 1% 750-2500 2% 2501+ 3% Cap of $60,000 per Customer group per calendar year. Medicare Promotion Compensation – Some companies pay bonus to brokers for bringing in new Medicare Applications. This bonus is one time payment for new application and it depends on number of new application submitted. Each Customer group should submit a stipulated minimum number of applications for corresponding broker to qualify for commission. The banding of the medicare promotion award could be something like this: Program To Date Application Level 40793118 Payoff per Application Ver 0.00a Page 51 of 150 Sales ___________________________________________________________________ 1-250 $100 250-500 $125 500-1000 $150 1000-2000 $175 2000+ $200 Cap of $60,000 per Customer group per calendar year. 5.4 5.4.1 Quote Creation What is a quote? A quote is a statement of rates of a particular product, possibly after relevant customizations, given by a seller to prospective buyers. In context of health insurance, a quote is a statement of cost, benefits and conditions of a chosen plan, for the member(s). It contains information about: 1. Effective Date & Renewal Date (date from which the policy will take effect and date when the policy will be due for renewal. If not renewed by that time, the policy becomes void) 1. Name of the firm buying the policy 2. Service Area – Area in which the members will be based 3. Name of Plan 4. Details of coverage (benefits like pcp visit, inpatient hospitalization etc) 5. Rates (the premium due per member. In case of a group insurance policy the rates may be banded on basis of age/ gender/ family status). 6. Some standard information – like applicable conditions, statutory information etc 5.4.2 The Process Of Quote Creation For the process of Quote Creation to begin Product-Benefit Setup and Rate Setup need to be completed as part of pre-sales activities. Admin users usually do product setup. They enter data about new/updated plans, benefits and new locations where plans will be offered for sale. They group and combine benefits into plans and maintain data about product-offerings in different service-areas i.e. make certain products saleable in certain area and withdraw some products from some areas as and when required. (It is to be noted here that an insurance company needs an approval from the government in order to sell a plan in an area at any time.) These are all mainly data-entry operations. A highly specialized and trained user group called Actuarials does rate Setup. On the basis of statistical considerations and mathematical calculations and with the aid of rating applications, Actuaries come up with rates for each product. These rates are called Community rates or Book Rates or Base Rates and they depend only on: The plan chosen - the benefits included in a plan are basis of the cost of the plan. The location / service area of the customer group - Government regulations often mandate certain kinds of coverage. State regulations affect prices, tax structures etc. All these affect the cost of the plan. The effective date - rates are revised from time to time and hence the dae of commencement of coverage affects the rates. However, do not take account of any factors specific to any customer-group. Hence Book Rates are same for any customer group availing a particular plan in the same area and hence the name Community Rates. These rates need to be approved by the concerned department in some states. Actuaries also calculate the 40793118 Ver 0.00a Page 52 of 150 Sales ___________________________________________________________________ values of group-specific factors for different locations at different times. But they do not apply these factors. (In section 5.6 we will study in details how Actuarials arrive at these rates.) Figure 1 below depicts the setup workflow. Figure 1: Workflow for Quote Creation Once set up is complete, marketing activities begin. Marketing personnel are broadly of two types Representatives who interact with customers and Assistants who have some (generally limited) access to applications generating quotes. Initially representatives approach prospective customers. Prospective customers include new prospects and existing customers whose policies are approaching renewal dates. They suggest some suitable plans to these customer groups. Customers give their details and preferences. Through a few iterations customers see some generic rate sheets (like Copay sheets, product comparison reports etc) which give them a rough idea of the costs of the short listed plans, and narrow their selection to a few plans. At this point the representatives approach the assistants to get the quotes for these plans, in order to let the customers know of the exact price (premium, copay & coinsurance) of the chosen plan(s). The assistants first pull out the book rates, and then apply special rates or group specific factors depending on the profile of the group and their specific needs. A few examples of special rates could be increased rates due to industry specific risks, requirement of extended coverage, reduced rates due to prior history of low number of claims and so on. Generally marketing people are given privilege to create only very straightforward quotes. For most special rates they need to fall back for on another user group called Underwriters. Some special rates can be used only by underwriters, while some others can be used by marketing assistants also but need a validation / approval from Underwriters. 40793118 Ver 0.00a Page 53 of 150 Sales ___________________________________________________________________ Underwriters have the final say on the rates. They can make adjustments according to their discretion. (We will discuss activities of underwriters and special rates in detail in section 5.7). Once they approve the quotes the marketing people present them to the customers. If rates are acceptable to the customer group they sign on the quote sheet, thus entering into a legally binding contract and members are enrolled for the accepted policy. Fig2 below is a pictorial depiction of this workflow: Fig 2 To support these various activities a health insurance company typically has a suite of applications as shown in fig 2: 40793118 Ver 0.00a Page 54 of 150 Sales ___________________________________________________________________ Marketing assistants Fig 3.0 Here we see that central to the system are the Admin and the Rating Applications. Admin applications are used by Admin Users for Product Setup. Actuaries to calculate the Base Rates of Products use rating applications. Quoting Engines and Renewal Applications use the data generated by these applications. Quoting Engines generate quotes with customer specific rates. Renewal Applications pick up contracts that will be shortly due for renewal, and are also used for renewing contracts. Underwriters and Marketing assistants use both of these. Enveloping all these there may or may not be a Quote front end - which would act as a single interface or gateway for all marketing, managerial and underwriter users to the suitable application. An optional layer above these would be a web-based front end - Intranet for use of all internal users and Internet for use by customers to get data online. Exercises: 1. Product Setup is done by (a) admin users (b)marketing people (c)actuaries (d)underwriters 2. The final say on the rates is with (a) marketing people (b)actuaries (c) underwriters 3. If two customer-groups in the same service area are buying the same policy at the same time would necessarily have ______________(same /different) Book Rates. 4. The difference between Book Rate and final rate would be due to ______________factors. Answers: 1. a ;2.c ; 3.same 4. Group-specific 40793118 Ver 0.00a Page 55 of 150 Sales ___________________________________________________________________ 5.5 Actuaries The role of the Actuary is said to be that of the designer, the adapter, the problem solver, the risk estimator, the innovator, and the technician of the continually changing field of financial security systems. In the field of health insurance actuaries use statistical methods and some judgment to arrive at Book Rates for plans and the values for group-specific factors. Each plan is a collection of benefits. So, in order to calculate Book Rates, Actuaries first estimate the cost the insurer has to incur in terms of payments towards doctors / hospitals/ equipment etc. to provide that benefit to one member in a certain period of time. This is also called the pure insurance cost for a unit of coverage for each benefit or the PMPM (per member per month) for the benefit. Some of the factors that are considered for this calculation are: Statutes and regulations: state and federal laws mandate certain coverage in certain areas, taxation laws, prices etc. Risks: the risks associated with providing the benefit, the probability of occurrence of each risk and the severity of the impact of the risk Time value of money: this variable is based on the concept that X amount of money can yield more value today, than Y days down the line. Further, if income is expected to increase in future, then this future income can be brought into the present e.g. when one takes a mortgage. Evaluation of benefits and estimation of costs is done along these lines. Random variables: actuaries use statistics and probability to estimate what they call "the certainty of uncertainty". Examples of random variables: I. Time until termination - measures length of time that some well-defined status exists e.g. the estimated duration of hospitalization for a particular coverage, the time between the occurrence of the illness and filing of claims, the time between filing of a claim and the actual settlement etc. II. Number of claims - number of claims arising from a specified block within any given time - some coverages show a seasonal variation, some show a long term trend III. Total Claims - The total dollar amount of claims arising from a particular block over a particular time period Rate of interest: (or more generally, the rate of investment return). Interest rates vary in many dimensions, from time to time, from place to place, by degree of security risk, and by time to maturity and thus affect any financial assessment. Assumptions, conservatism & adjustments: last but not least, a high percentage of all actuarial calculations is based on one or more assumptions. This is where the judgment factor comes in. Actuarial conservatism means the use of any actuarial technique (usually but not always the choice of one or more assumptions) that leads to a higher price for a set of benefits, or a higher value of a liability. Conservatism would lead to higher prices. But too much of conservatism would make prices uncompetitive. Sometimes adjustments also need to be made in view of unusual circumstances. In all these the actuaries must exercise utmost caution and judgment. The PMPMs of all the benefits in a plan are added to get the PMPM of the entire plan. On this, Actuaries apply i) Cost and utilization factor: This estimates how a change in the price of a benefit affects the members’ usage of that benefit and in turn the company’s income e.g. if Copay for a specialist consultation increases a member may go in for specialist consultation less frequently. ii) Trend factor: This takes care of market trends and possible changes in rates over subsequent quarters. iii) Retention factor- Normal profits are hereby built into the rates 40793118 Ver 0.00a Page 56 of 150 Sales ___________________________________________________________________ Thus the actuaries arrive at the Book Rates or the Community Rates for the plans. For estimating the values of group specific factors also they use similar considerations. Exercises Q1. PMPM of a plan is the same as Book Rate. (True/ False) Q2. Profits are included in the rates by applying _______________ factor. Q2. PMPM of a plan identifies the income of the company per member per month for that plan. (True/ False) Answers 1. false 2. Retention 3.false 5.6 Underwriters Underwriters form a very important user group in any insurance industry. Their main function is to approve/ validate the group specific factors added to Book Rates by marketing people and apply mark-up or discount based on their judgement. Sometimes underwriters have exclusive access to some special factors. Thus, they have the final say on the rates. Some group specific factors that underwriters need to consider are: Industry factor: Some industries expose employees to or protect them from some job specific risks. The probable frequency of members availing this benefit varies accordingly. For example people working in S/w industry are likely to go for routine eye check-ups more frequently. Accordingly underwriters apply factors specific to the industry to adjust the rates. Dependant age: A firm may want employees’ dependents to be covered to a higher / lower age than the default coverage. Rates need to be raised or lowered accordingly. Prior experience: Underwriters need to analyze the customer-group’s prior history of claims. If number of claims for a plan is low, they get a discount and vice versa. Class Rate/ Tabular Rate: Sometimes firms requests and sometimes state regulations mandate that the demographic composition of the group needs to be considered. E.g. an unmarried males in age group 20-30 would be assumed to be more prone to accidents than a married male in age group 40-50, while the latter may be more prone to a heart attack. This would affect the probable usage of relevant benefits, and suitable factors are applied to account for these. Class rating is a rating methodology where rates are banded into tiers (single, couple, parent child and family) and members pay according to the kind of coverage they want. Tabular Rating is a rating methodology wherein multiple tier rates are exploded into age/gender bands, thus generating a table or matrix. Here each member pays more accurately for the risk he/she adds. Mutualized : Some customer groups may have outlets/ offices in various locations across the country. Depending on the geographical factors and state regulations even the book rates could vary from place to place. In such cases the group may request a blended, uniform rate across the organization. Undewriters need to take care of this. 40793118 Ver 0.00a Page 57 of 150 Sales ___________________________________________________________________ Misquote: In case of repeat business underwriters need to analyze in retrospect whether some erroneous rates had been quoted in the previous cycle, and accordingly adjust the final rates in the current cycle. Rounding: Underwriters may decide to round off rates to penny, dime or quarter. This can make much difference when a large number of members are involved. Unusual: Underwriters need to consider various unusual factors to adjust final rates. These may be as varied as unforeseen fluctuations in the economy, sudden spread of a disease, some national calamity, some expected change in the customer group’s business and so on. Underwriter Judgement: Underwriters reserve rights to adjust rates based on their discretion. This calls for extreme caution and accurate estimation skills. To sum up, underwriters need to identify and calculate the risk of loss from policyholders, recommend acceptance or denial of the risk, establish appropriate premium rates and write policies those cover these risks. The group underwriter also needs to analyze the overall composition of the group to assure that the total risk is not excessive. Their judgement must be shrewd because an insurance company may lose business to competitors if the underwriters appraise risks too conservatively, or it may have to pay excessive claims if the underwriting actions are too liberal. Exercises 1. Underwriters cannot exercise any discretionary power. (True/ False) 2. Underwriters should always estimate risks very conservatively for the company to profit ( True/Fasle) 3. While determining final rates for a cycle, underwriters should take into account previous dealings with the same customer group. (True/ False) Answers: 1. false 2. false 3. true 5.7 Insurance Payer’s Sales Department The marketing of a healthcare product is done predominantly in three ways: a) Advertising – Putting up advertisements in various media. b) Telemarketing – Calling up prospective customers and giving them information about the products. c) Mailing – Sending product information to prospects through postal mails. The sales manager decides the strategy for marketing like which service areas should be targeted, how many prospects should be targeted in various region, what age group of prospect should be targeted for a particular product, should phone follow-up be done after sending mails etc. Depending upon the strategy, target prospects are picked up from the database. The mails to prospects are processed through Code1 Plus software which validates addresses and gives CASS certification. US Postal Department gives discount on CASS certified mails. Mailstream system is used to pre-sort the mails to obtain further discounts from postal department. 40793118 Ver 0.00a Page 58 of 150 Sales ___________________________________________________________________ To ensure if the mails are delivered, seeds are implanted in each batch of mails dispatched. Seeds are sales department employees and if the mail reaches the seed, it’s a fair assumption that all the prospects addressed in that batch of mails must have received the mails too. After sending mails, new prospects with phone numbers are loaded to the Dialers. Tele marketing department retrieves the names from Dialer box for phone follow-ups. History of mailing is maintained for each prospect and each product to ensure that one product is not marketed to the same prospect twice. It also helps to ensure that same set of prospects are not getting selected for marketing too often. Postal mails sent by sales department fall in three categories: a) Regional mailing: Mailing is restricted to selected regions or states. b) Meeting mailing: Informing the new prospects about seminars or meetings conducted by Aetna and requesting them to attend the same. c) Member mailing: Involves mailing to existing customers of Aetna. The various ways of obtaining the information about new prospects are External vendors Telemarketing Responders External vendors supply the list of new prospects every year. These names stay on the database for one year from the date the names were received from the vendor. Responders are customers, who voluntarily contact healthcare company to get information on it’s products. The responders names do not expire from database. Telemarketing department gets new prospective customers by calling people. These prospective customers are entered into the database by Tel Marketing department. Their expiry date is one year from the date on which it was entered. Exercises True or False 1. Marketing by mailing involves sending e-mails to prospects. 2. Code1 plus software validates addresses. 3. Meeting mailing informs prospects about meetings and seminars. 4. Responders expire from the database after one year. Answers : 1. False 2. True 3. True 4. False 5.7.1 External Agents that deal with Sales Department of Insurance Payers External agents that deal with sales department of Insurance Payers are : a) Vendors who supply data of new prospects. b) Vendors who supply data of all the deaths in a given service area. c) Vendors who supply data of prospects who do not want telemarketing ie they do not want to be called and informed about new products. d) Vendors who maintain latest information like addresses of all prospects and update our data files by matching it with theirs. 40793118 Ver 0.00a Page 59 of 150 Sales ___________________________________________________________________ 5.8 1. 2. 3. 4. 5. 6. 7. 8. Review Questions Summarize the workflow involved in quote creation. Summarize the build up of the final rates in a quote(pmpm-book rate-final rate) How do actuaries arrive at Book Rates for a plan? Summarize some group-specific factors underwriters consider during quote creation. Define prospects. Who are responders? What is CASS certification? What is the role of external agents in sales department? 40793118 Ver 0.00a Page 60 of 150 Sales ___________________________________________________________________ 40793118 Ver 0.00a Page 61 of 150 Benefits ___________________________________________________________________ UNIT - VI 6 Benefits 6.1 Unit Objectives This unit will acquaint the reader with different types of healthcare plans and the benefits they offer. 6.2 Introduction Healthcare is very expensive in the U.S.A and it is essential for people to have some kind of health insurance. Insurance is available from various organizations in various forms. Each insurance company has its own, customized way of providing insurance, called a ‘Plan’. Plans can be broadly classified as – 1. 2. 3. 6.3 Indemnity plans also known as ‘Fee-For-Service’ plans. Managed Care plans. Other Plans. Indemnity Plans Indemnity plans are the traditional fee-for-service kind of plans. The member is eligible to visit any provider of his choice. He has to pay the provider for services availed and then file a claim for reimbursement of the same. The amount of reimbursement will depend on whether, or not, the member has satisfied his deductible. In case the deductible has been satisfied the insurance company will pay its share. In case the deductible has not been satisfied, the reimbursement amount will be lesser. Advantages Members do not have to choose a ‘Primary Care Physician’ (PCP, as he is known, is an entity associated with managed care plans, and will be explained later in the unit). No need of a referral (prior permission from the insurance company) to visit a specialist doctor. In case of managed care plans (as will be explained later in the unit) members are required to choose a provider from a network (or a group) to get higher level of benefits. In case of Indemnity plans, there is no concept of network and members can avail the services of any provider. Thus, Indemnity plans offer maximum freedom of choice to a member in choosing a healthcare provider. This is the primary reason why people may prefer to be in an Indemnity plan. Disadvantages Members have to pay high premiums. Members need to meet a deductible before they can start claiming benefits. Preventive care is not covered. This means that for a routine check-up, the member cannot file a claim. Filing of claims is the responsibility of the member. It involves a lot of paperwork and is time consuming. 40793118 Ver 0.00a Page 62 of 150 Benefits ___________________________________________________________________ A typical Indemnity plan will look like this - Plan Feature Benefit Calendar Year Deductible $200 Family Limit Deductible 3 * Deductible Co-payment None Coinsurance 80%/20% Coinsurance Limit $ 1000.00 Emergency Room 80% if true emergency. Reduced benefits if not a true emergency Hospital 80%/20% Physicians 80%/20% Preventive care No coverage Other Covered Expenses 80% Table 1: A sample Indemnity plan 6.4 The member has to pay a deductible of $200 every year before he can start claiming the benefits. For the entire family to be covered, this amount is $600. The insurer will reimburse only 80% of the costs; rest the member will have to pay out of his pocket. There is no coverage for any preventive care, i.e. a routine checkup is not covered. The coinsurance limit is $1000,this means that, the maximum amount, which the member may have to pay is $1000.Above this; insurer will provide 100% reimbursement of costs. Managed Care Plans Indemnity plans, as explained earlier, provide great flexibility to members in choosing a provider. But, this freedom comes at a very high cost. Members have to pay heavy premiums and need to meet deductibles before they can start claiming benefits. For people who cannot afford to spend large amounts on their healthcare, Indemnity insurance is not a good option. They prefer to use managed care plans, which are more cost effective. Managed care plans originated in the early 1970s. In 1970s healthcare costs had sky rocketed. Hence, to make insurance more affordable to the common people, in 1973 the US congress passed the ‘Health Maintenance Act’ and set standards for the industry. This paved the way for the formation of ‘Managed Care Organizations’ (MCO). 40793118 Ver 0.00a Page 63 of 150 Benefits ___________________________________________________________________ MCOs’ are a collection of interdependent systems (the insurance company, doctors, pharmacies, hospitals) that integrate the financing and delivery of health care services. They involve an agreement between an insurance company and a group of providers (also known as network of providers). These providers agree to provide basic healthcare services to members of the insurer’s plans. While, the insurer tries to increase their patient volume by offering greater benefits to its members when they use this network. Thus, by increasing the patient volumes and regulating the use of providers, insurance companies are able to provide coverage at reduced levels of cost. Following are the common managed care options: 6.4.1 Health Maintenance Organization (HMO) A HMO is a managed care organization. Members of a HMO receive benefits by utilizing the insurer's HMO network. This network consists of contracted doctors and hospitals that provide treatment to members of the insurer's HMO plans. HMOs provide medical treatment on a prepaid basis, which means that HMO members pay a fixed monthly fee, regardless of how much medical care is needed in a given month. In return for this fee, most HMOs provide a wide variety of medical services, from office visits to hospitalization and surgery. Members are required to choose a contracted doctor as their Primary Care Physician, a “PCP”. All the care they receive is provided by, or under the direction of, the “PCP” The PCP takes care of the member’s medical needs that fall under his expertise. He refers members to a specialist for medical care when necessary. Without the PCP’s referral, members are not eligible to claim benefits for services availed from a specialist doctor. Members are also required to get permission (called a referral) from the insurer before availing services of out-of-network providers. Without this permission the member is not eligible to receive any benefits. There are two types of HMOs Staff Model HMO: In this form of HMO, the doctors are employees of the HMO itself and the HMO can be seen as a central medical facility. Individual Practice Association (IPA): In this form, a HMO contracts with individual doctors who have a private practice of their own. Each provider is a given a fixed monthly fee according to the number of patients on his schedule. This fee is not related to the number of patients actually serviced (this means, even if not a single member went to this provider, he would still receive his full monthly fee). This fee paid is also called the ‘Capitation Fee’ and hence the plan is sometimes known as a ‘Capitated Plan’. To recap, there is a group of providers contracted by the insurer who form a network. A member has to choose any one of the doctors in this network as his PCP. The PCP will take care of all needs of the member, right from providing treatment to filing claims on his behalf. For services outside the scope of his expertise, the PCP will refer the members to a specialist. Members do not have a choice in deciding which doctor they want to get treatment from, as the PCP and the insurer manage their complete healthcare. Members cannot use services of any out-of–network provider (i.e. a provider not contracted by the insurer) without prior permission of the insurer. Advantages 40793118 Ver 0.00a Page 64 of 150 Benefits ___________________________________________________________________ With most types of insurance (other than HMO), members are responsible for paying a percentage of the bill every time they receive medical care. Additionally, there may be a deductible that must be met before the insurer starts picking up the tab. In contrast, HMO members pay a fixed monthly fee, regardless of how much medical care is needed in a given month. Instead of deductibles, HMOs often have nominal co-payments. This leads to ‘Low out of pocket costs’. Besides reducing out-of-pocket costs and paperwork, HMOs encourage members to seek medical treatment early, before health problems become severe. Additionally, many HMOs offer health education classes and discounted health club memberships. Hence, the focus is on wellness and preventative care. HMOs generally do not place a limit on the member’s lifetime benefits (i.e. the total amount of money he can claim during his lifetime) .The HMO will continue to cover his treatment as long as he is a member. Disadvantages: An HMO member must choose a primary care physician (PCP). The PCP provides general medical care and must be consulted before members seek care from another physician or specialist. This screening process helps to reduce costs both for the HMO and the members, but it can also lead to complications if the PCP doesn't provide the referral needed by the member i.e. tight controls can make it more difficult to get specialized care. Except for emergencies occurring outside the HMO's treatment area, HMO members are required to obtain all treatment from HMO providers. The HMO will not pay for non-emergency care provided by a non-HMO provider. Additionally, there may be a strict definition of what constitutes an emergency. A typical HMO plan will look like this - Plan Feature Benefit Calendar Year Deductible None Family Limit Deductible None Co-payment $10.00 Coinsurance 100% Coinsurance Limit None Emergency Room $35.00 copay Hospital 100 % Physicians $10.00 copay Preventive care $10.00 copay Other Covered Expenses 100% Table 2: A sample HMO plan 40793118 Ver 0.00a Page 65 of 150 Benefits ___________________________________________________________________ 6.4.2 A member who enrolls under this plan does not have any deductible to meet before he can claim benefits. Every time he avails the service of a provider he has to pay $10 irrespective of the kind of services availed. In case he has to use the emergency room facilities, he will have to pay $35 as copay. For all kinds of treatment, the insurance company will pay 100% of the providers charges If compared with the Indemnity plan provided in the earlier section, it becomes clear that the cost for the member is much less. Preferred Provider Organization (PPO) Like an HMO, a preferred provider organization (PPO) is a managed healthcare system. However, there are several important differences between HMOs and PPOs. A PPO is actually a group of doctors and/or hospitals that provide medical services only to a specific group or association. The PPO may be sponsored by a particular insurance company, by one or more employers, or by some other type of organization. PPO physicians provide medical services at discounted rates and may set up utilization control programs to help reduce the cost of medical care. In return, the sponsor(s) attempts to increase patient volume by creating an incentive for employees or policyholders to use the physicians and facilities within the PPO network. PPO members usually pay for services as they are rendered. The PPO sponsor (employer or insurance company) generally reimburses the member for the cost of the treatment minus any co-payment. In some cases, the provider may submit the bill directly to the insurance company for payment. The insurer then pays the covered amount directly to the healthcare provider, and the member pays his or her co-payment amount. The healthcare providers and the PPO sponsor(s) negotiate the price for each type of service in advance. When a member receives care from a participating provider they receive benefits, which are at the higher level of benefit coverage, usually 100% payment rate, known as ‘Preferred Benefits’. When members receive care from a non-participating provider they receive benefits, which are at the lower level of benefit coverage, usually 80% payment rate, known as ‘Non-Preferred Benefits’. Advantages Free choice of healthcare provider, as PPO members are not required to seek care from PPO physicians. However, there is a strong financial incentive to do so. For example, members may receive 90% reimbursement for care obtained from in-network physicians but only 60% for outof-network treatment. In order to avoid paying an additional 30% out of their own pockets, most PPO members choose to receive their healthcare within the PPO network. Disadvantages As mentioned previously, there is a strong financial incentive to use PPO network physicians. For example, members may receive 90% reimbursement for care obtained from in-network providers but only 60% for treatment provided by out-of-network providers. Thus, if a member’s longtime family doctor is outside of the PPO network, he may choose to continue seeing him, but it will cost more. 40793118 Ver 0.00a Page 66 of 150 Benefits ___________________________________________________________________ A PPO member has to file claims on his own. Additionally, most PPOs have larger co-payment amounts than HMOs, and members may be required to meet a deductible. Hence, the expenses and paperwork are higher as compared to HMOs. A typical PPO plan will look like this – Plan Feature Preferred Benefit Non-preferred Benefit Calendar Year Deductible None $200.00 Per Confinement deductible None $200.00 Family Limit Deductible None 3x deductible Copay $10.00 office visit None Coinsurance 100% 80% / 20% Coinsurance Limit None $1000.00 Physicians 100% after $10.00 copay 80%/20% Emergency room $25.00 Same as preferred emergency, else none. Hospital 100% 80% / 20% Other Covered Services 100% 80% / 20% if true Table 3: A sample PPO plan Preferred option closely mirrors the HMO option while the non-preferred option approaches the Indemnity option. The benefits are reduced in case of non-preferred option. 6.4.3 Point Of Service (POS) POS plans give two benefit levels. The plan can be visualized as having 2 sides. One side is for in-network services and the other side is for out-of-network services. When a member uses the in-network benefits, the POS plan mirrors an HMO. Like an HMO, the member pays no deductible and usually only a minimal co-payment when he uses an in-network healthcare provider. But, he also must choose a primary care physician who is responsible for all referrals within the POS network. When he uses the out-of-network benefits, the POS plan is an indemnity plan. The member will likely be subject to a deductible and co-payment. Advantages POS coverage allows a member to increase his freedom of choice. Like a PPO, he can mix the types of care he receives. For example, the member’s child could continue to see his pediatrician 40793118 Ver 0.00a Page 67 of 150 Benefits ___________________________________________________________________ who is not in the network, while the member himself receives his healthcare from in-network providers. POS plan encourages members to use in-network providers but does not make it mandatory, as with HMO coverage. As with HMO coverage, members pay only a nominal amount for in-network care. Usually, copayment is around $10 per treatment or office visit. Unlike HMO coverage, members always retain the right to seek care outside the network at a lower level of coverage. No deductible is required for in-network services, while there is no PCP for out-of-network services. Disadvantages There are substantial co-payments and deductibles for out-of-network care. In most cases, members must have paid a specified deductible before coverage begins on out-ofnetwork care. As in an HMO, members must choose a primary care physician (PCP) and hence there is a tight control to get specialized care within the network. A typical POS plan will look like this – Plan Feature In-Network Out-of-network Calendar Year Deductible None $200.00 Per Confinement Deductible None $200.00 Family Limit Deductible None 3x deductible Copay $10.00 None Coinsurance 100% 80% / 20% Coinsurance Limit None $1000.00 Physicians 100% after $10.00 copay 80%/20% Emergency room $25.00 Same as preferred emergency, else none. Hospital 100% 80% / 20% Other Covered Services 100% 80% / 20% if true Table 4: A sample POS plan The POS plan is very similar to a PPO plan, with maximum benefits within network and reduced benefits out-of-network. The major difference between them is in the in-network option. Here, the PPO plan gives more flexibility for choice of provider, as compared to the POS plan. 40793118 Ver 0.00a Page 68 of 150 Benefits ___________________________________________________________________ 6.4.4 Exclusive Provider Organization (EPO) In order to fulfill the diverse needs of participants, providers, and employers, EPO Plans—a hybrid of POS plans were developed. These plans offer members great flexibility at the lowest price by combining various plans. For example, some insurers will offer an EPO/HMO plan. This provides members with the ease and low cost of the HMO, while providing them with the option to make appointments directly with a larger group of providers (instead of just their primary care provider). The choice of providers is greater than the typical HMO, and the price is somewhat higher, also. A PPO may also make an EPO option available to members. Advantages Limited out-of-pocket expenses, as there are no deductibles and very less copays. Disadvantages 6.5 Members need to choose from the HMO and EPO networks, this leads to less flexibility in choice of provider. Which plan is the best? The first thing to note is that, there is no such thing as ‘the best plan’. All the plans outlined till now are generic plans, which can be customized according to the members needs. However, in general, managed care plans are better suited for the average individual because they end up being more cost effective in the long run. In contrast, Indemnity plans with more out-of-pocket charges (in the form of deductibles and co-payments) often limit the maximum amount of benefits that members may receive over their lifetime. Indemnity plans, however, give more freedom than managed care plans in terms of using the healthcare provider of choice. The variation in the various plans can be understood more effectively by referring to the following table. 40793118 Ver 0.00a Page 69 of 150 Benefits ___________________________________________________________________ Constraint Indemnity HMO PPO POS EPO PCP Not required Required Not required Required Required Deductible Required Not required (In-network) required Same as PPO Not required not (Out-of-network) required Out Network Coverage Of Available Not available Available Available Not available Referral for specialist visit Not required Required Not required Required Required Cost (1-5) 5 is max 5 1 4 3 2 Freedom (15) 5 is max. 5 1 4 3 2 Table 5: Comparison of various plans So, the choice ultimately depends on the member’s personal circumstances and preferences. If the goal is to minimize costs, he is probably better off with a managed care plan. On the other hand, if his goal is maximum flexibility and cost is not a major factor, indemnity plans should be preferred. 6.5.1 1. 2. 3. 4. 5. 1. 2. 3. 4. 5. Exercise Plan offers the maximum freedom of choice for a member. Considering the cost for a member, which plan is most effective? POS plans do not offer out-of-network coverage (Y/N). PPO plan members do not have to choose a PCP (Y/N). Plot a graph of ‘cost to member’ (x axis) versus ‘freedom of choice’ (y axis) and place the various plans on it. Answers Indemnity HMO N Y Indemnity Freedom PPO POS EPO HMO 40793118 Ver 0.00a Page 70 of 150 Benefits ___________________________________________________________________ Cost Figure 3: Variation of Freedom with Cost 6.6 Other Plans In addition to the common Indemnity and Managed care plans listed above; insurers offer a wide variety of specific plans. Most of these plans in some or other will belong to the two main categories listed above. The plans discussed till now were medical plans and did not cover: Work related injuries Treatment provided by relatives Cosmetic surgery Government health services Vision benefits Dental benefits Over the counter medicines and non-prescription drugs To cover these, insurers provide the following plans: 6.6.1 Vision Plans Vision insurance provides coverage for services relating to the care and treatment of eyes. It typically covers services delivered by an optometrist or ophthalmologist. Depending on the specific plan, some or all of the following services may be covered: Yearly eye exams Glasses (with an annual limit) Contact lenses and fitting (with an annual limit) Glaucoma screening Some vision plans may provide more extensive coverage (such as certain eye surgeries), while others may limit coverage to reasonable and customary charges incurred during routine eye exams. Reasonable and customary charges generally don't include the cost of glasses and contact lenses. With some employer-sponsored vision plans, coverage may be even more narrowly limited to the medical treatment of certain eye conditions Vision care insurance may provide direct payment to the eye care provider for the services. Or the member may be required to cover the charges out-of-pocket at the time of service, and then file a claim for reimbursement. It depends on the specific plan. 6.6.2 Dental Plans Dental insurance provides coverage for services relating to the care and treatment of teeth and gums. The basic difference between a Medical and Dental disease is that a medical disease can be unpredictable and catastrophic while most dental diseases are preventable. Regular dental checkups and cleaning will be sufficient to maintain dental health. The regular dental visits allow problems to be diagnosed early and corrected without involved diagnostic testing or treatment. This keeps the cost of dental care much lower than medical care. Dental plans are of three types based on the mode of treatment and payment. 40793118 Ver 0.00a Page 71 of 150 Benefits ___________________________________________________________________ Indemnity Plans: This type of plan pays the dentist on a traditional fee-for-service basis. A monthly premium is paid by the member, which directly reimburses the dentist for the services provided. Insurance companies usually pay between 50 percent and 80 percent of the dentist's fee for covered services; the member pays the remaining. Indemnity plans also can limit the amount of services covered within a given year and pay the dentist based on a variety of fee schedules. Capitation Plans: This type of plan provides comprehensive dental care to enrolled patients through designated provider dentists. A Dental Health Maintenance Organization (DHMO similar to a medical HMO) is a common example of a capitation plan. The dentist is paid on a per capita (per head) basis rather than for actual treatment provided. Participating dentists receive a fixed monthly fee based on the number of patients assigned to the office. In addition to premiums, patient copays may be required for each visit. Direct Reimbursement Plans: Under this self-funded plan, an employer or company sponsor pays for dental care with its own funds, rather than paying premiums to an insurance company. The member pays the dentist directly and, once furnished with a receipt showing payment and services received, the employer reimburses the employee a fixed percentage of the dental care costs. The plan may limit the amount of dollars a member can spend on dental care within a given year, but often places no limit on services provided. Members can select a dentist of their choice and, in conjunction with the dentist, can play an active role in planning a treatment that is most appropriate and affordable. 6.6.3 Pharmacy Plans Pharmacy plans enable the members to buy prescription drugs from participating or non-participating pharmacists at lower rates against a premium amount paid for the Plans. They usually involve a ‘Managed Pharmacy Benefit Network’ (network of pharmacists which contracts with the Insurer), which offers drugs to plan holders at reduced rates. Most pharmacy plans that pay for prescription drug benefits have benefit tiers that group certain medications together for pricing purposes. Brand-name drugs that are usually in the top tier are most expensive; while generic medications are in the lower tier and are least expensive .The types of drugs can be classified as Branded drugs – which are patented drugs (10 yrs patent) and hence costly. Generic Drugs - which are Non-patented drugs with same chemical relatively cheaper. Non-Formulary drugs - which are the cheapest. compositions and are Most health plans have three or four pharmacy benefit tiers, but some have as many as seven. The typical three tiers of a pharmacy plans are 1. Single tier plans Fixed copay for all types of drugs mentioned in the plan. 2. Two tier plans Lower copay for Generic drugs Higher copay for Branded drugs 3. Three tier plans Lowest copay for Generic drugs Medium copay for branded drugs 40793118 Ver 0.00a Page 72 of 150 Benefits ___________________________________________________________________ 6.6.4 Highest copay for Non formulary drugs Medicare Plans Medicare is a government-sponsored program that provides health insurance to retired individuals, regardless of their medical condition. Most people become eligible for Medicare upon reaching age 65. In addition, people may be eligible if they are disabled or have end-stage terminal disease. The Health Care Financing Administration (HCFA), a division of the U.S. Department of Health and Human Services, has overall responsibility for administering the Medicare program. Although the Social Security Administration processes Medicare applications and claims, the HCFA sets standards and policies. Medicare coverage consists of two main parts - Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). A third part, Medicare Part C (Medicare+Choice) is a program that allows members to choose from several types of health-care plans: Part A covers services associated with inpatient hospital care (i.e., the costs associated with an overnight stay in a hospital, skilled nursing facility, or psychiatric hospital, such as charges for the hospital room, meals, and nursing service s). Part A also covers hospice care and home health care. Part B covers other medical care. Physician care, whether it was received while member was an inpatient at a hospital, at a doctor's office, or as an outpatient at a hospital or other healthcare facility. Also covered are laboratory tests, physical therapy or rehabilitation services, and ambulance service. Part C expands the kinds of private health-care plans that may offer Medicare benefits to include managed care plans, medical savings accounts, and private fee-for-service plans. They are in addition to the fee-for-service options available under Medicare Parts A and B. 6.6.5 Medigap Medicare does not cover all health-care costs during retirement. Members may purchase a supplemental medical insurance policy called Medigap. Medigap is specifically designed to fill some of the gaps in Medicare coverage. Medigap policies are sold through private insurance companies. However, they are standardized and regulated by federal and state law. There is no variation in the types of medigap policies provided by various insurance companies. Only ten standardized plans can be offered as Medigap plans. All ten must cover certain services. Medigap policies pay most, if not all, Medicare coinsurance amounts. Some also provide coverage for deductibles and services that are not covered by Medicare such as prescription drugs and preventive care. 6.6.6 Medicaid Medicaid is a health insurance program for people with low income. It is a joint federal-state program to provide medical assistance to aged, disabled, or blind individuals (or to needy, dependent children) who cannot afford the necessary medical care. Each state administers its own Medicaid programs based on broad federal guidelines and regulations. Within these guidelines, each state (1) determines its own eligibility requirements, (2) prescribes the amount, duration, and types of services, (3) chooses the rate of reimbursement for services, and (4) oversees its own program. 40793118 Ver 0.00a Page 73 of 150 Benefits ___________________________________________________________________ Medicaid pays for a number of medical costs, including hospital bills, physician services, home health care, and long-term nursing home care. States may elect to provide other services for which federal matching funds are available. Some of the most frequently covered optional services are clinic services, medical transportation, services for the mentally retarded in intermediate care facilities, prescribed drugs, optometrist services and eyeglasses, occupational therapy, prosthetic devices, and speech therapy. 6.6.7 Long Term Care Most of plans discussed till now are the kind, which pay for hospital bills and doctor visits. Long-term care, however, offers the assistance people need if they have a chronic illness or disability that leaves them unable to care for themselves. This may be used to help the aged, as well as young and middle-aged people who have been injured or have suffered a debilitating illness. As with other insurance policies, members pay a set premium that offsets the risk of a much larger out-of-pocket expense. The treatments covered by long term care insurance usually include four general types of care: in home care; adult day care; assisted living and nursing home living. 6.6.8 Disability Income Insurance Disability income insurance provides members with an income if they become sick or injured and are unable to work. The funds paid are not specified for medical expenses - they can be used in any way the member wishes them to use. Employers can provide coverage for employees too. Some policies include special features like: 6.6.9 Key-person insurance to protect a firm against the loss of income resulting from the disability of a key employee. Recovery benefits that pay after members return to work full-time, and are re-establishing a customer or client base. For jointly owned businesses, a disability buy-out policy disburses funds for one partner or business entity to buy a disabled partner's share of the company. Catastrophic Coverage Plans Catastrophic coverage is not a separate entity by itself but forms a part of an existing plan. Most of the plans seen till now can be customized to include coverage for catastrophic illnesses. They pay hospital and medical expenses above a certain deductible, which is usually very high. However the maximum lifetime limit of benefits is high enough to cover the cost of catastrophic illness. The most common example is the Medicare plans which include a clause for catastrophic coverage. Others include disability income insurance, catastrophic PPO and catastrophic EPO coverage. 6.6.10 1. 2. 3. 4. 5. 6. Exercise Pharmacy plans usually have tiers of benefits. Medicare has parts. Policy extends the Medicare policy by offering additional benefits. Is used to protect a firm against the loss of income resulting from the disability of a key employee. In case of Dental insurance, plans are similar to HMO plans The federal government regulates Medicare benefits? (Y/N). 40793118 Ver 0.00a Page 74 of 150 Benefits ___________________________________________________________________ 7. 8. Long Term care covers nursing home care? (Y/N) Who all are eligible for Medicaid benefits? Answers 1. 3 2. 3 (hospital, medical, medicare+choice) 3. Medigap 4. Key person insurance 5. Capitation 6. Y 7. Y 8. All people who cannot afford medical care. 6.7 Individual Insurance and Group Insurance. With group health insurance, a single policy covers the medical expenses of many different people (a group) instead of covering just one person. Because only one policy is issued for the entire group, the initial cost of establishing group coverage is lower than the cost of issuing a separate policy to each person. Employer-sponsored plans and associations are among the most common sources of group health insurance, with the sponsoring employer or association paying all or part of the premium. Individual health insurance is a type of policy that covers the medical expenses of only one person. Unlike group insurance, members purchase individual insurance directly from an insurance company. When they apply for individual insurance, they are evaluated in terms of how much risk they present to the insurance company. This is generally done through a series of medical questions and/or a physical exam. Member’s risk potential will determine whether he qualifies for insurance and how much the insurance will cost. Individual insurance is somewhat more risky for insurers than group insurance, because group insurance allows the insurer to spread the risk over a larger number of people. For this reason, individual insurance is generally more difficult to obtain and more costly than group insurance. Unlike individual insurance, where each person's risk potential is evaluated and used to determine insurability, all eligible people can be covered by a group policy regardless of age or physical condition. The premium for group insurance is calculated based on characteristics of the group as a whole, such as average age and degree of occupational hazard. In general, the only real disadvantage of group insurance is limited or no freedom to customize the policy to member’s individual needs. The policy is typically negotiated between the insurer and the "master" policy owner (employer or association) without any inputs from the member. The specific policy provisions are all determined in advance, as are the deductible amount and co-payment percentage. 6.8 Laws and Legislations Most people in U.S.A count on their employer for health insurance coverage. But what will happen to their health insurance if they stop working or no longer qualify for benefits? Their company might begin downsizing. They could suffer a serious injury and become disabled. These events can occur when least expected, leaving them without health benefits. So the federal government has provided certain laws to help people cope with the situations mentioned above. The two most important of these are – 40793118 Ver 0.00a Page 75 of 150 Benefits ___________________________________________________________________ 6.8.1 Consolidated Omnibus Budget Reconciliation Act of 1986 (COBRA) If a person and his dependents are covered by an employer-sponsored health insurance plan, COBRA entitles him to continue coverage under circumstances that would otherwise cause him to lose this benefit. As an employee, he is entitled to COBRA coverage only if his employment has been terminated or downsized. However, his dependents may be eligible for COBRA benefits if they are no longer entitled to employer-sponsored benefits due to divorce, death, or in certain other situations. Most employers are required to offer COBRA coverage. A person can continue his health insurance for 18 months under COBRA, if his employment has been terminated or if his work hours have been reduced. If a person is entitled to COBRA coverage for other qualifying reasons, he can continue the coverage for 36 months. In addition, the person will have to pay the premium for COBRA coverage; his employer is not required to pay any part of it. In 1996, the Health Insurance Portability and Accountability Act (HIPAA) expanded on COBRA. 6.8.2 Health Insurance Portability and Accountability Act (HIPAA) HIPAA is an extensive law that is intended to be the first major step toward healthcare reforms in the U.S.A. The major provisions of HIPAA do the following: 6.9 Allow workers to move from one employer to another without fear of losing group health insurance. Require health insurance companies that serve small groups (2-50 employees) to accept every small employer that applies for coverage. Increase the tax deductibility of medical insurance premiums for the self-employed. Require health insurance plans to provide inpatient coverage for a mother and newborn infant for at least 48 hours after a normal birth or 96 hours after a cesarean section. Review Questions. 1. What is the difference between Managed care and Indemnity Plans? 2. What are the various type of Managed care Plans? 3. What is the main difference between POS and PPO plans? 4. What are the various types of Dental and Vision Plans? 5. In case of managed care plans, which plan is most cost effective and why? 6. State whether true of false – Private insurance companies provide Medicare plans. In case of a joint business venture, each partner can take out an insurance policy to cover the expenses, in case, the other partner is no longer able to perform his duties. Medicaid policy is the most expensive type of Indemnity plan. Copay is what the member pays to the insurance company for treatment. 40793118 Ver 0.00a Page 76 of 150 Benefits ___________________________________________________________________ 6.10 Coinsurance is the insurance provided by two insurance companies to one individual. Deductible is usually zero for most HMO plans. Long-term care is covered under Medicare. References 1. http://www.yourhealthplans.com 2. http://www.insurance.com 3. “A to Z of Health Insurance” – By Prashant Burse, Abhishek Virginkar and Saurabh Kulkarni. 4. “Managed Care – An Overview ” – By Amit Shukla. 40793118 Ver 0.00a Page 77 of 150 Benefits ___________________________________________________________________ 40793118 Ver 0.00a Page 78 of 150 Claims ___________________________________________________________________ UNIT - VII 7 7.1 Claims Claim generation and submission to Providers Members enrolled in Insurance Company’s healthcare programs visit health services providers such as a primary physician, specialist, hospital or pharmacy to receive healthcare. Each visit that a member makes to a provider is called an encounter. Generally these visits by member are made to PCPs, who are Primary Care Physicians and are Capitated Providers. This means that they get a fixed fee on a monthly or bi-monthly basis. They do not bill Insurance Company for services provided. If the primary physician deems fit he may refer the member to a specialist. A record of this referral is maintained in the system. The referral acts as an authorization for the member to visit a specialist, for a combination of fixed number of visits and fixed duration. This specific combination depends on plan to which the member has subscribed. This PCP files a claim with Insurance Company for non-capitated or specialist services he might have provided to the member. The claim may be filed either on a standard paper form or electronically. The claims are received by the Integrated Receipt system, validated for basic information necessary and then loaded into the Claims database. These claims are then adjudicated using Insurance Company’s business rules and policies, to decide the payment to be made to providers or denials if any. Complex or ambiguous claims, also claims with any missing information, are put in a ‘PEND’ status. Manual intervention is required for further processing such claims. Claims Online/Pend systems are used for this purpose, as well as for catering to general claims enquiries. On completion of claims adjudication, desired cheques are cut by AP (Accounts Payable). Feedback is sent to Claims system again which is used to store the completed claims history in Claims database/files. 7.1.1 Claims Intake Process Claims are received from health services providers either as paper documents or in electronic form. Electronic forms are routed through a third party (Envoy). Paper claims are received on standard forms. They are scanned to capture image copies that are then translated to electronic form. The users have the ability to modify the claims online. All HMO electronic claims from the Envoy submitter will be directed to a system (pre-receipts) before sending them to core Receipts System. This pre-receipts system will identify each claim with a Universal Claim Key (UCK). The UCK is passed along with each transaction to the appropriate adjudication engine. Edits within the pre-receipts system are enhanced to include HMO claims. The claims will be in a Common Claim Format (CCF) as opposed to the UB92 & NSF format that Receipts system used to receive. Receipts system performs basic edits on these claims and loads it to the Claims database. Claims that fail the edits are routed back to the provider for corrections. The Receipts system is required to receive a transaction in CCFMQ format, this process is known as HMO REFORMAT. The HMO Reformat will be responsible for reading a CCFMQ record as input and produce 40793118 Ver 0.00a Page 79 of 150 Claims ___________________________________________________________________ a UB92 Hospital transaction format or a NSF1500 Specialist transaction format as output. The Reformat will also be responsible for passing the UCK along to the HMO system on each transaction. The newly reformatted claims will follow the existing Receipts system path for electronic claims; subject to existing Receipts system edits. At the completion of all Receipts system edits, claims will flow into the Generate Response process. This process will evaluate each edit flag, in order to determine if a claim will be Accepted or Rejected. The generation of a status response is required to be sent back to Pre-receipts system at this point. This response status serves as the initial response for all HMO claims. The response for claims that have been rejected also represents a final response. Receipts system Conversion. The Conversion process handles Hospital and Specialist claims differently. When Hospital claims are processed Revenue codes are grouped and rolled and then translated into Benefit codes. Each benefit code represents a detail line. Due to limitations of the HMO Adjudication, claims that have more than a specific number of detail lines after the grouping and rollup logic will be split in segments consisting of that specific number of detail lines. If a claim is split in the Conversion, modifications are made to establish the UCK segment number. The modifications consist of inquiring on the UCK database table or file and generation of the event response for pre-Receipts system. The last process within the Receipt System is the Load to the HMO database. The Load is responsible for passing the UCK to the HMO Adjudication system. Some paper claims cannot be loaded into Receipt System usually due to non-standard formats. These claim forms are captured on microfilm. Users enter these claims online, directly into the Claims Online Adjudication system. 7.1.2 Claims Intake : Diagrammatic Encounter PROVIDER MEMBER EDI Claim ENVOY IKFI Paper Claim EDI 40793118 Referral Ver 0.00a Prereceipts REFERRAL SYSTEM Receipts Page 80 of 150 Claims ___________________________________________________________________ 7.2 Claim Adjudication Process Claim adjudication is a process in which the actual data on the Claim is compared with the data in the system and based on the business rules or policies the payment of the Claim is decided. The paid amount need not be equal to the billed amount Claim adjudication process can be divided into three processes as below which can be further subdivided 7.2.1 Claim Preparation and determining eligibility The member information is validated. o Member no is validated. o Determination of whether member is suspended or terminated ( i.e. DOS > suspense or term date). o Determination of whether this claim is a fraudulent specific member claim. The provider information is validated. o Provider no is validated. o Par status of Provider is validated .Capitation of the Provider is validated . o Provider type is evaluated i.e if the provider is hospital type or a specialist etc. o Provider name and address is validated. o Check is done for whether Provider is suspended. o Provider Specialty is validated . Determination of whether the claim is too old. o Date of Service of the Claim is compared with the current date. 40793118 Ver 0.00a Page 81 of 150 Claims ___________________________________________________________________ Determine if the claim is timely filed o Date of service of the Claim is compared with the received date of the Claim. The difference of the dates is compared with the timely filing limits which is pre-decided based on different types of Provider,types of benefits provided,member category etc . if the claim has not been file within the proper timeframe it is denied . Determination of whether the claim is duplicate ( by comparing with history). o Here the Date of service of the claim, member no , Provider no , diagnosis code, proc code ,Place of service is checked with a history claim for determining duplicity. Group/plan eligibility is checked. o Determination of whether the member is covered under the GROUP, CONTRACT, PLAN, AND PRODUCT which for which the Claim has has been filed Benefit eligibility is checked o Here depending on the Provider type, Place of service and the benefit code of the claim , it is determined if the member is eligible to receive the particular benefit for which claim has been filed. Check for Product component eligibility Here it is decided if the claim should be processed as in network or indemnity depending on Product component of the Claim. Presence/Absence of referral. Provider network. Par status of provider. Direct access ( i.e for which no authorization needed). Claim emergency or non emergency. Product benefit eligibility is checked Here, depending on the member region, procedure code , and presence of any rider , it is determined if the member is eligible for the benefit of the product under which the member is covered. Check stacked benefits o This involves checking of existing accumulators that are under the indemnity component and then under either the rider or base medical component.This process will dictate what component leg a claim is adjudicated against based on the following scenarios: No accumulator is maxed out on either indemnity or hmo legs Result: Claim will process as normal Accumulator maxed out on indemnity but not hmo leg Result: claim will be processed as hmo Accumulator maxed out on hmo leg Result: claim will be processed as indemnity. Product exception override is checked o In this, based on various factors like service start and end dates , Group, Place of service,Area , Provider network, provider specialty , etc it is determined if there is any exception to the benefits payable for the product for which claim is filed. Determination of whether this is a member reimbursement or provider is already reimbursed. 40793118 Ver 0.00a Page 82 of 150 Claims ___________________________________________________________________ o Here a determination is made whether the member has to be directly reimbursed ( like in Indemnity Claims) or the provider ahs to be paid ( like an HMO plan). Also a this involves a check to see if provider has already been reimbursed for the services e.g – capitated providers Verify Referral o Is member no on referral same as on claim ? o Is this Direct access referral ? o Is referral OON ? o Is referral denied ? o Validate provider no on referral and provider speciality. o Validate referral dates o Validate referral visit o Validate referral diagnosis o Validate referral procedure Verify precertification : Precertification is the process of collecting information prior to inpatient admissions and performance of selected ambulatory procedures, and services. The process permits advance eligibility verification, determination of coverage, and communication with the physician and/or member. It also allows the health care service company to coordinate the patient’s transition from the inpatient setting to the next level of care (discharge planning), or to register patients for specialized programs like disease management, case management, or our prenatal program. A pre-cert penalty will be applied to the claim when: o The claim is non-referred, and o The service requires pre-certification, and o A "PS" pre-cert referral or authorization is not found All three conditions must be met before the pre-cert penalty can be charged. This applies to both par and non-par providers. The percentage pre-cert penalty is assessed on the payable benefit, after any deductible and co-insurance have been taken. Pre system is not applied generally for the following types of services: o Cardiac Rehab o Chemotherapy o Radiation Therapy o Respiratory Therapy Who precertifies medical services? o admitting physicians o primary care physicians (PCP) o specialists o hospitals o Members on plans that allow out-of-network benefits must precertify certain services themselves and failure to do so will result in a reduction of the benefit paid. Where precert and referral are not required, only refers to participating providers. Any nonpar usage requires authorization by patient management on order to obtain HMO benefits. Diagnosis code of the claim is verified i.e whether the diagnosis is effective for DOS of the claim. 40793118 Ver 0.00a Page 83 of 150 Claims ___________________________________________________________________ Drug code (drg) is validated Procedure/service code is validated . It also involves verification of service code for sensitivity ( i.e sex restriction for a particular procedure) Claimcheck Any claims system needs to do have the following checks either through interface to the HBOC/GMIS Claim Check software package or by other means which performs the following edits: o Unbundling-the use of two or more CPT procedure codes to describe a procedure performed in a single session when one comprehensive code exists. o Incidental Procedures-one or more procedures performed concurrently with a primary procedure, but which require little additional physician resources and/or is clinically integral to the performance of the primary procedure. o Mutually Exclusive Procedures-two or more procedures that by medical practice standards should not be billed on the same patient on the same date of service. o Age/Sex discrepancies and cosmetic and duplicate procedures. 7.2.2 Determine payment Following are the processes that affect the amount and extent of payment of a Claim. Prorated maternity o Determine maternity pct i.e for a female member joining during pregnancy,the system will automatically prorate the claim as follows based on her effective date with the health care company e.g . Date of Delivery % of Reimbursement 1-30 days after member became effective 70% 31-61 days after member became effective 80% 62-91 days after member became effective 90% 92 days or more after member became effective 100% Contract interface o Contract is an agreement between the provider or group of providers and the insurance company about the services the provider(s) will provide and the payment that the insurance company will make to the provider for the services rendered. o Providers are generally contracted to provide services for specific benefit codes, Diagnosis codes, Procedure codes.The Payment method used in for paying of Contracted provider is based on Flat rate,Per unit rate , Rating system. Balance bill processing o Balance billing occurs when a doctor or other health care provider charges the patient more than the maximum allowable charge (the amount paid by the healthcare company for the health care services provided by the provider.) o Providers who balance bill can charge approx upto 15% over the maximum allowable charge and this must be paid in addition to the Prime copayment, or extra and Standard deductible and cost-share. o Balance billing fees can only be charged by non-participating providers. Facility fee processing if applicable 40793118 Ver 0.00a Page 84 of 150 Claims ___________________________________________________________________ o This fee is applicable if the member receives the health care in a facility . It checks for place of service , start and end of the service and presence of any contract of the Facility with the Healthcare company in determining the facility fee . Product exception override o If it is determined that there is a product exception overide then then various overrides and their values are determined like Copay ,deductible, counsurance , precert penalty etc which are applicable to the claim. Copay processing interface o Copay is the amount payable by the member i.e. it is the member’s responsibility. It is some fixed part of the claimed amount that the member has to pay for the diagnosis or treatment he has undergone. o There are different types of copays like per stay, per day, per visit etc. o In the member’s contract there is also mentioned about the maximum amount of copay for the member and the family for the particular procedure code that is to be paid. o Copay based on no. of days is also dependent on the number of days of stay. It is in ranges. For Ex : Copay has one value for first five days, another for next fifteen days & another for the rest. o Copay can also be zero. Accumulators o Claim that have been denied or contain a benefit that is not covered or that do not have an accumulator are deemed exempt from the accumulator processing. The possible product components are checked. If the indemnity component has been valued, the process will use this component first .All the accumulators that have been defined under the product benefit are retrieved. Once an accumulator is retrieved, the following are checked: The accumulator must be effective. There are age requirements set up within this accumulator. The members age is checked against these parameteres. o Accumulators are used to track Individual member out of pocket payments as well as family amounts. o There are various types of accumulators which are used for tracking Copay, Deductible, Coinsurance, Precertification amounts, visits, etc of the member. o The accumulator year to date amounts are compared with the pre-decided limits of these amounts and the payment amount of the claim is adjusted accordingly. Indemnity processing if applicable o Indemnity processing comes into picture if the claim is not a emergency or does not have a referral . Here the claim is processed as fee-for-service or out of network claim.It calculates various payements pertaining to indemnity claims like deductible,coinsurance,precert penalty,out of pocket payments etc . It determines the various amounts that can be applied according to the member and the family limits ( referring to amounts already taken in previous claims) . Coordination of Benefits o 40793118 Coordination of benefits (COB) allows insurance carriers to offset payments when a claimant carries insurance with multiple carriers. For example, a claimant may have dental insurance with AUSHC and with Blue Cross/Blue Shield. The dental claim is submitted first to the primary payor (in this example, AUSHC), which pays as the plan allows. The claim is then submitted to the secondary payor (Blue Cross/Blue Shield). This provision prevents double or over-payment by the carriers. Ver 0.00a Page 85 of 150 Claims ___________________________________________________________________ o o 7.2.3 The insurance industry has established standard rules to determine which insurer is primary payor. If, after a provider has been paid, a. Healthcare company discovers that another insurer is the primary carrier, the process followed is , they will: Notify the provider that they have discovered that another insurer is the primary carrier. Provide the name and address of the primary carrier and the patient’s name and address and any other pertinent information. Inform the provider that he/she can return their previous payment or elect to have them debit his/her account after 60 days, thereby giving him/her an opportunity to seek reimbursement from the member’s primary insurer. Inform the provider that he/she can write or call the person signing the notification if there is additional information that would alter the proposed process. Update Claim Accumulator updates o This involves updating of Various accumulators for Copay , deductible , coinsurance etc depending upon the processing of the claim. Referral updates o Referrals are updated for no of visits after the claim has been processed properly. Claims database updates o Processed Claims stored for maintaining History. 7.2.4 Claim adjudication outputs Check extract o Adjudicated claims that are passed to Accounts payable for check printing. Reporting o A host of reports to provide summary and detail information and statistics Claims History o Claims history records generated and used for future Claims adjudication and used for reporting and financial reconciliation of Self-Insured groups. Letters o Letters are sent to the member and/or provider giving information as to why : A claim was denied A claim is delayed Is still Under review Waiting for Additional information Extra Payment done - Penalties etc that a Healthcare company liable to pay in certain cases Any Other Information required . o Denial letters are sent if : other insurance paid in full experimental procedure not covered Cosmetic surgery not covered Decision re-reviewed, no change Explanation of benefits – (covered in other section) 40793118 Ver 0.00a Page 86 of 150 Claims ___________________________________________________________________ 40793118 Ver 0.00a Page 87 of 150 Claims ___________________________________________________________________ ADJUDICATION CLAIM PREPARATION AND ELIGIBILITY DETERMINE PAYMENT Validate member no Validate provider no Maternity percent Contracts Is Claim too Old ? Is Claim timely filed ? Indemnity processing Facility fee Is Claim duplicate ? Group/Plan eligibilty Product exception override Copay processing Benefit eligibility Product component eligibilty Coordination of benefits Accumulator processing Product bebefit eligibility Product exception override Check Stacked benefits Verify referral Memb reimburseme nt /Prov reimburseme nt ? Veryify Diagnosis code Verify precert Verify Proc code CLAIM UPDATION Referral updates CLAIM OUTPUTS Accumulator updates Check extract Reports Claim history Letters Figure 2 : Claim adjudication process Validate drug code 40793118 Claim check Ver 0.00a Page 88 of 150 Claims ___________________________________________________________________ 7.3 Claim Payments 7.3.1 Provider Payments Inputs for any provider payment, in most of the general scenarios, would come in the form of claims filed by the providers. When members have encounters with provider, these providers will file claim for the services rendered to the member. These claims then are taken through claim adjudication process to decide how much amount should be paid to the member or the claim should get denied. 7.3.1.1 Capitated Provider If provider is a Capitated Provider, which means he gets a fixed fee by Insurance Company on monthly basis irrespective of actual services provided by the provider during the period under consideration, then all his claims are bound to get denied if filed for services covered under capitation. If the provider is non-capitated, then claim gets adjudicated against Insurance Company’s business policies and rules as imposed by federal/state laws. 7.3.1.2 Provider as Specialist If a provider is giving services to member as a Specialist, then the claims filed would require specific referral already in place, which should be covering the visit and specific services for the member. Otherwise claims without proper referral get denied. 7.3.1.3 Copay Adjustments If the claim filed required member to pay some copay amount, then the insurance company will pay the provider adjudicated amount less the copay amount as described by member’s plan. 7.3.1.4 COB Adjustments If Coordination of benefit applies for any member, then provider receives payment from primary and secondary insurance companies. He has to file claims with all the involved insurance companies. 7.3.1.5 Duplicate Claims In case of late payments by insurance company, provider has tendency to file the same claim again. Procedures are in place which detect such duplicate claims and avoid the repayments. 7.3.1.6 Provision for Advance Payment Some insurance companys also have a facility to pay the providers some lumpsum amount in advance. Over a specific period of time, these amounts are then adjusted during adjudication against the claims filed by provider. 7.3.1.7 Provision for Advance Payment Some providers, especially the big providers like Hospitals, are paid extra for the quality of services they provide. This incentive to be paid is decided as fixed % of the contractual amount between Insurance company and the provider. It becomes mandatory to identify all the types of services that will become eligible for consideration under quality incentive. Mostly all the In-patient type of services and none of the Out-patient type of services are eligible for this incentive, both with a few exception. Principle categories for this payment are as follow: Quality of Care It measures the quality of care based on physician and member surveys. Once the service is provided to a member, a survey is conducted where in the member fills in a form to comment about the quality of service provided by the hospital. In the physician surveys, the physicians fill in the data such as quality of operating rooms, administration in the hospital etc. Hospitals send the survey results to Insurance company. This data is then passed through ‘United States Quality Algorithms (USQA)’ routines. These routines (which are black box to the insurance company’s system), based on some algorithms, assign points / marks. Higher these points, the higher will be the incentive. Efficiency of Care It measures the efficiency of the care based on length of stay for surgery, medicine and OB/GYN, adverse events and C-section rates. If a member spends more time in hospital for a service, then higher will be the costs that hospital incurs and hence the claim amount. So, longer the stay, the lesser will be the incentives paid. Also, higher the adverse conditions, lower will be the payments as it is hospital’s 40793118 Ver 0.00a Page 89 of 150 Claims ___________________________________________________________________ responsibility to see that fewer adverse events arise. For each of these measures, system assigns points, through USQA routines. For this category: higher the points, lower will be the payments. Commitment to Managed Care Principles The negotiators have the providers fill in a questionnaire that contains the questions such as: o if the provider sends the data to Insurance Company electronically o if there exists long term contract between hospital and Insurance Company o if nurses from the hospital participate in training programs conducted by Insurance Company The provider has to fill in either Yes or No to each of these questions. Based on the answers, points are assigned and based on the points, the payment is made. Higher the points, higher will be the payments. 7.3.1.8 Payment to Insurance Company It may happen that provider claims are incorrectly adjudicated and provider is overpaid. Under such circumstances, insurance company intimates provider of the extra payment made and provider is required to repay to the company accordingly. When provider’s claim is adjudicated, whether denied or paid, the provider is informed by the Insurance Company regarding the reasons and split of payments. 7.3.2 Member Re-imbursement Following are various scenarios when member is eligible for re-imbursement by The Insurance Company. 7.3.2.1 Copay Limit Reached If member has already reached the copay limit mentioned on his plan and in the next encounter he still pays the copay, then the insurance company will reimburse all the amount paid towards copay back to member. 7.3.2.2 Member goes Out-Of-Network If member visits a provider out of network then he has to file a claim for the benefits provided under his plan. In this case insurance company pays directly to member, part or full payment made by him to provider. 7.3.2.3 Deductible Applies Member pays to the provider Out-of-Network and files a claim with the Insurance company. If the member has not reached the Deductible limit, then Insurance Company will then deny such a claim. 7.3.2.4 Co-insurance Applies In this case, as defined in the plan adopted by member, a fixed % of adjudicated claim amount is paid back to the member. 7.4 Claim Adjustments These are the various types of adjustments that can be made to the claim. 7.4.1 Refund Adjustment This type of adjustment takes place when a Health Services Provider overpays the provider. Provider over-payment letter is generated one claim per letter. When provider agrees and refunds over-payment (provider will cut check and send in), cash date for check is recorded and necessary deductions are applied to claim. Deduction may be split across multiple claims. The original claims are overridden with new payment codes. New negative claims created with negative dollar amount. Claim gets completed without adjudication. 40793118 Ver 0.00a Page 90 of 150 Claims ___________________________________________________________________ 7.4.2 Minus Debit Adjustment In case of overpayment to providers, a letter is sent to the provider notifying of overpayment. If provider does not agree to cut and send check to refund over-payment, minus debit option is used to create an equal amount negative check. Original completed claim remains unchanged. Further claims of the provider are not paid till the all the amount on the negative claim has been recovered. Once the whole dollar amount is adjusted the process stops and all the claims get completed and letter is sent to the provider stating why payment has not been made to him. 7.4.3 Manual Check Adjustment Sometimes a check is required to be created manually if there is a need to adjust amount of payment. Such a check is created by entering data into the system manually. The manual check request paperwork is then sent to Claims system. On receipt of the manual check paperwork a Manual claim is entered. A connection is established between the manual check and the claim entered. The claim does not undergo adjudication. It is completed and stored. This is to account for the payment being made using the manual check, i.e. there has to be a claim for which a check is created. 7.4.4 Void Adjustment The Claim is completed but the check is still in open status (Check information has still not been sent to the bank) only in this scenario a void can be issued on the check. When void is done then a new set of claims are generated which are associated with the same check with negative amounts as the original claims. The check status is also changed from open (blank) to Void (V). 7.4.5 Stop Adjustment The Claim is completed but the check is still open (check information has been sent to the bank but not been encashed yet). Only in this scenario a stop can be issued on the check. In the process, when stop payment is done, the original claims remain untouched. A new set of claims are generated which have amount equal to negative of the amounts of the original claims. The check status is changed from open (blank) to Stopped (S). 7.5 Government reporting There are two types of government-sponsored plans in U.S Medicare - Health Care Financing Administration (HCFA), a government body administers Medicare, the nation's largest health Insurance program, which covers 37 million U.S. Citizens. Medicare provides health insurance to people aged 65 and over and those who have permanent kidney failure and people with certain disabilities. Medicaid - Medicaid is a jointly funded, Federal-State health insurance program for certain lowincome and needy people. It covers approximately 36 million individuals including children, the aged, blind, and/or disabled, and people who are eligible to receive federally assisted income maintenance payments. 40793118 Ver 0.00a Page 91 of 150 Claims ___________________________________________________________________ Thus, the Federal government sponsors Medicare while the Medicaid plans are specific to the particular state. Government reporting is needed in a Healthcare industry especially for those plans that are funded by the government. If a Health care company has Medicare and Medicaid as the two sponsored programs, it needs to report all of its encounters (visit of a member to the provider or health care) to the government. For Medicare encounters, earlier the government used to pay the health care companies a flat rate per member. It means that no matter a person visited a hospital or not, the healthcare company would still get paid for that member. And similarly no matter how much money the health care company spends on a person who was a frequent visitor to the hospital, it would still get the same flat rate from the government. With this model there is not a very stringent need for the healthcare company to report all of its encounters correctly to the government. Since the number of encounters and the particular diagnosis that was performed had very less significance in the payments that were made. But sometime around the end of 2000, the risk adjustment model emerged. Meaning that now the government would also consider the health of the member when it makes a payment for that member to the health care company. This is where Encounter data reporting started coming into picture. Hence now it was important for the health care company to report each and every claim that it received, to the government. Although the risk adjustment model has come up, it still doesn’t form a significant portion in the payment model. But there’s a gradual increase in its share. Health care company reports the claims that have been filed by the providers to the government. Depending on the diagnosis that has been performed on a particular claim, the government assigns a severity code (PIP SCORE) to the particular member. The scores for AIDS/Chemotherapy are the highest, meaning that all the claims belonging to this category that Health care company sends to the government would mean an additional revenue to Health care company from the government. If a person has not visited a hospital during the entire year, then government assigns a score of 04 (which is the least PIP SCORE) to this member and Health Care Company would be paid at a flat rate for this member. This is the reason why government reporting is important for a Healthcare industry. The score calculation and the payments are made on an annual basis. Balanced Budget Act of 1997 mandates all healthcare organizations to electronically transmit Medicare hospital inpatient encounters to Healthcare Financing Administration through a fiscal intermediary. Medicare submissions are sent to CMS (Center for Medicare and Medicaid services), which acts as an intermediary between Health Care Company and the Federal government. While the Medicaid submissions go directly to the state. The encounters have to be submitted in a fixed format called the Uniform Billing Code- 1992 form. After the submission the intermediary is supposed to send an acknowledgement back to the health care company which gives details of o o o 40793118 Claims accepted. Claims rejected and reasons for the same. The list of claims in the wait status for more information. Ver 0.00a Page 92 of 150 Claims ___________________________________________________________________ 7.6 Explanation of Benefits (EOB) EOB is the letter sent to a member by the Insurance company giving the details of the services rendered to him by the providers and the amount to be borne by the member for the services he has taken. It also gives the cap amounts applicable to him. It is not a bill but an explanation of the benefits. The Explanation of Benefits provides members a statement of claim payments. It gives the member a detailed explanation of these amounts. The charges for which the provider has billed the Health Insurance company The charges whcih are for services covered by Group Benefits The charges that the member must pay to meet his/her deductible The amount the Healthcare Insurance company paid The amount that the member owes The EOB for the National Advantage Program lists: billed charges allowable amount non-covered amount Some health insurance companies may prefer to generate EOB only for certain type of services e.g. for indemnity or fee for service claim where deductible, coinsurance, etc are applicable and not for all type of claims. In case of multiple MC (primary and secondary) the primary MC coordinates the benefits between the two MC and sends a COB (Coordination of benefits) to the member. When requesting payment from a secondary payer it is extremely important that the EOB/remittance information be provided from the primary payer. 7.7 7.7.1 Accumulators 7.7.1 What are Accumulators? Accumulators are generally database records, dedicated to accumulating specific type of data over a specific period. 7.7.2 7.7.2 Function/Purpose of Accumulators The main use of accumulators is during the claims adjudication process. The accumulator amounts are checked to find if they are exceeding the limit for a particular member (which is decided when a member enrolls to a PLAN). So, the amount of money that is going to be paid to/from a member is decided based on the accumulator amounts. When the same has been decided, the corresponding accumulators are updated with those amounts for the latest instance under consideration. 7.7.3 What is accumulated? 7.7.3.1 Copay – for member, member + family Copay is accumulated separately for member as well as member and all his/her dependents. Once the maximum limit set by plan is met, member no more pays copay to provider. 40793118 Ver 0.00a Page 93 of 150 Claims ___________________________________________________________________ 7.7.3.2 Co-insurance – for member, member + family Co-insurance is also accumulated separately for member as well as member and all his/her dependents. It comes into picture when deductible limit is met. 7.7.3.3 Deductible - for member, member + family Co-insurance is also accumulated separately for member as well as member and all his/her dependents. Some plans provide for facility of carry over deductible. Accumulators records are updated accordingly in such cases. (Details will come down the line in the document) 7.7.3.4 Visits – for member Visits of the member to provider are accumulated. In a general scenario, this figure may be used to decide the method of payment, say partial/full/some percentage of billed, depending upon how many visits covered for a specific service to same provider, during predefined period. 7.7.3.5 Family Dollars Insurance company’s disbursement to member or the provider. 7.7.3.6 Out of Pocket - member, member + family These accumulators include combined figures of co-insurance and deductibles. 7.7.4 Types of Accumulator 7.7.4.1 Periodic Accumulators These accumulators will cover up the amounts for period as mentioned in the effective plan for the member. Carry over Deductible Updates Some plans provide for the provision that, deductible paid by member in a specific later portion of the effective year, will be considered as deductible paid towards next year, in case member chooses to continue. This reduces burden on member and acts as incentive for member to continue with the co-insurance company. In this case, accumulators for the next period will get updated for the deductibles paid. Example: o If a member XYZ has plan year 01-Jan-2001 to 31-Dec-2001. o Plan provision says Carry over deductible is applicable for last 30 days of the plan year. o Member’s deductible limit is say $ 500. o Accumulator for yr. 2001 will go on accumulating the data till end of Nov-2001. Say, it accumulates $ 350. o Members pays remaining deductible (part or full, say $100) during the last 30 days of plan year. o Then new accumulators will be generated as if paid for the next year 2002. $100 will get updated in these accumulators. o If member chooses to continue, because of this facility, he now needs to pay $100 less towards deductible in the next plan year. 7.7.4.2 Lifetime Accumulators These accumulators will sum up the amounts for the life time for a member. 7.8 Overall Claims system diagram : 40793118 Ver 0.00a Page 94 of 150 Claims ___________________________________________________________________ Figure 3: Claims overview 7.9 Review Questions. 1. Why are letters required? What are different types of letters? 2. What are the various types of Claim adjustments? 3. What does Government reporting consist of? 4. What are the various criteria for deciding the payment of a claim? 5. What is the significance of maintaining Claims history? 6. State whether true of false – COB deals with claim payment, EOB is letter sent after adjudication. Copay is not the member’s responsibility. Claim adjustments can be done before Claim adjudication. Pre-certification penalty is in excess of any deductible and/or coinsurance applicable to the claim. 40793118 Ver 0.00a Page 95 of 150 Claims ___________________________________________________________________ 7.10 Member encounters have to be submitted to the government in a fixed format. Accumulators are updated for denied claims. References http://www.ehealthinsurance.com/ Aetna Batch driver file (CLPRD.CLDJABDJ.DRIVER) SA_AETHMOM2.DOC (System appreciation document for Claims maintainance project) SA_AETEDR2.DOC (System appreciation document) and other docs from Encounter data reporting project 40793118 Ver 0.00a Page 96 of 150 Claims ___________________________________________________________________ 40793118 Ver 0.00a Page 97 of 150 External Agents ___________________________________________________________________ UNIT - VIII 8 8.1 External Agents Unit Objectives This unit will acquaint the reader with the role played by the external agents in the Healthcare Industry. 8.2 Introduction In Heath Care Industry, all the services and management activities cannot be carried by the insurance payer itself on it's own. It requires some help from some external sources or agencies. This unit deals with the various different agencies in a Health Care Industry and the role played by them. 8.3 8.3.1 Government Agencies Centers for Medicare & Medicaid Services (CMS) The Centers for Medicare & Medicaid Services (CMS) is a federal agency within the U.S. Department of Health and Human Services. CMS runs the Medicare and Medicaid programs - two national health care programs that benefit about 75 million Americans. And with the Health Resources and Services Administration, CMS runs the State Children's Health Insurance Program (SCHIP), a program that is expected to cover many of the approximately 10 million uninsured children in the United States. CMS also regulates all laboratory testing (except research) performed on humans in the United States. Approximately 158,000 laboratory entities fall within CMS's regulatory responsibility. And CMS, with the Departments of Labor and Treasury, helps millions of Americans and a small company get and keep health insurance coverage, and helps eliminate discrimination based on health status for people buying health insurance. CMS also performs a number of quality-focused activities, including regulation of laboratory testing (CLIA), development of coverage policies, and quality-of-care improvement. CMS maintains oversight of the survey and certification of nursing homes and continuing care providers (including home health agencies, intermediate care facilities for the mentally retarded, and hospitals), and makes available to beneficiaries, providers, researchers and State surveyors information about these activities and nursing home quality. CMS spends over $360 billion a year buying health care services for beneficiaries of Medicare, Medicaid and SCHIP. CMS: assures that the Medicaid, Medicare and SCHIP programs are properly run by its contractors and state agencies; establishes policies for paying health care providers; conducts research on the effectiveness of various methods of health care management, treatment, and financing; and assesses the quality of health care facilities and services and taking enforcement actions as appropriate. 40793118 Ver 0.00a Page 98 of 150 External Agents ___________________________________________________________________ Figure 1 below describes the interaction of CMS and State Government with a Healthcare Industry. 8.3.2 DEPARTMENT OF HEALTH AND HUMAN SERVICES (DHSS) The DEPARTMENT OF HEALTH AND HUMAN SERVICES is the United States government's principal agency for protecting the health of all Americans and providing essential human services, especially for those who are least able to help themselves. The Department Include more than 300 Programs, covering a wide spectrum of activities. Some highlights include: Medical and social science research Preventing outbreak of infectious disease, including immunization services Assuring food and drug safety Medicare (health insurance for elderly and disabled Americans) and Medicaid (health insurance for low-income people) Financial assistance and services for low-income families Improving maternal and infant health Head Start (pre-school education and services) Preventing child abuse and domestic violence Substance abuse treatment and prevention Services for older Americans, including home-delivered meals Comprehensive health services for Native Americans HHS is the largest GRANT-MAKING AGENCY in the federal government, providing some 60,000 grants per year. HHS' Medicare program is the nation's largest health insurer, handling more than 900 million claims per year. HHS works closely with STATE, LOCAL AND TRIBAL Governments and many HHS-funded services are provided at the local level by state, county or tribal agencies, or through private sector grantees. 11 HHS operating divisions, including eight agencies in the U.S. Pubic Health Service and three human 40793118 Ver 0.00a Page 99 of 150 External Agents ___________________________________________________________________ service agencies administer the Department's programs. In addition to the services they deliver, the HHS programs provide for equitable treatment of beneficiaries nationwide, and they enable the collection of national health and other data. 8.3.3 Centers for Disease Control and Prevention (CDC) The Centers for Disease Control and Prevention (CDC) is recognized as the lead federal agency for protecting the health and safety of people - at home and abroad, providing credible information to enhance health decisions, and promoting health through strong partnerships. CDC serves as the national focus for developing and applying disease prevention and control, environmental health, and health promotion and education activities designed to improve the health of the people of the United States. CDC, located in Atlanta, Georgia, USA, is an agency of the Department of Health and Human Services. Infectious diseases, such as HIV/AIDS and tuberculosis, have the ability to destroy lives, strain community resources, and even threaten nations. In today's global environment, new diseases have the potential to spread across the world in a matter of days, or even hours, making early detection and action more important than ever. CDC plays a critical role in controlling these diseases, traveling at a moment's notice to investigate outbreaks abroad or at home. 8.3.4 Agency for Health Care Research and Quality (AHRQ) The Agency for Healthcare Research and Quality (AHRQ) research provides evidence-based information on health care outcomes; quality; and cost, use, and access. Information from AHRQ’s research helps people make more informed decisions and improve the quality of health care services. AHRQ was formerly known as the Agency for Health Care Policy and Research. AHRQ's strategic goals reflect the needs of its customers. These goals are to Support improvements in health outcomes. The field of health outcome research examines the end results of the structure and processes of health care on the health and well being of patients and populations. A unique characteristic of this research is the incorporation of the patient's perspective in the assessment of effectiveness. Public and private-sector policymakers are also concerned with the end results of their investments in health care, whether at the individual, community, or population level. Strengthen quality measurement and improvement. Achieving this goal requires developing and testing quality measures and investigating the best ways to collect, compare, and communicate these data so they are useful to decision-makers. AHRQ's research will also emphasize studies of the most effective ways to implement these measures and strategies in order to improve patient safety and health care quality. Identify strategies that improve access, foster appropriate use, and reduce unnecessary expenditures. Adequate access and appropriate use of health care services continues to be a challenge for many Americans, particularly the poor, the uninsured, members of minority groups, rural and inner city residents, and other priority populations. The Agency will support studies of access, health care utilization, and expenditures to identify whether particular approaches to health care delivery and payment alter behaviors in ways that promote access and/or economize on health care resource use. 8.3.5 National Information Center on Health Services Research and Health (NICHSR) Care Technology The 1993 NIH Revitalization Act created a National Information Center on Health Services Research and Health Care Technology (NICHSR) at the National Library of Medicine to improve "the 40793118 Ver 0.00a Page 100 of 150 External Agents ___________________________________________________________________ collection, storage, analysis, retrieval, and dissemination of information on health services research, clinical practice guidelines, and on health care technology, including the assessment of such technology." The Center works closely with the Agency for Healthcare Research and Quality (AHRQ), formerly the Agency for Health Care Policy and Research (AHCPR), to improve the dissemination of the results of health services research, with special emphasis on the growing body of evidence reports and technology assessments which provide organizations with comprehensive, science-based information on common, costly medical conditions and new health care technologies. The overall goals of the NICHSR are: to make the results of health services research, including practice guidelines and technology assessments, readily available to health practitioners, health care administrators, health policy makers, payers, and the information professionals who serve these groups to improve access to data and information needed by the creators of health services research to contribute to the information infrastructure needed to foster patient record systems that can produce useful health services research data as a by-product of providing health care. 8.3.6 Health Resources and Services Administration (HRSA) The Health Resources and Services Administration's mission is to improve and expand access to quality health care for all. HRSA assures the availability of quality health care to low income, uninsured, isolated, vulnerable and special needs populations and meets their unique health care needs. 8.3.7 5. 6. 7. Exercise ___ is the Federal Agency that runs the Medicare and Medicaid programs. Information from ______'s research helps people make more informed decisions and improve the quality of health care services. The ____ is the United States government's principal agency for protecting the health of all Americans. Answers: 5. CMS 6. AHRQ 7. DHSS 8.4 Government Acts and Regulations 8.4.1 HIPAA The Health Insurance Portability & Accountability Act of 1996 (August 21), Public Law 104-191, which amends the Internal Revenue Service Code of 1986. Also known as the Kennedy-Kassebaum Act. Improved efficiency in healthcare delivery by standardizing electronic data interchange, and Protection of confidentiality and security of health data through setting and enforcing standards. More specifically, HIPAA calls for: Standardization of electronic patient health, administrative and financial data 40793118 Ver 0.00a Page 101 of 150 External Agents ___________________________________________________________________ Unique health identifiers for individuals, employers, health plans and health care providers Security standards protecting the confidentiality and integrity of "individually identifiable health information," past, present or future. WHO IS AFFECTED? All healthcare organizations. This includes all health care providers, even 1-physician offices, health plans, employers, public health authorities, life insurers, clearinghouses, billing agencies, information systems vendors, service organizations, and universities. ARE THERE PENALTIES? HIPAA calls for severe civil and criminal penalties for noncompliance, including: -- fines up to $25K for multiple violations of the same standard in a calendar year -- fines up to $250K and/or imprisonment up to 10 years for knowing misuse of individually identifiable health information COMPLIANCE DEADLINES? Most entities have 24 months from the effective date of the final rules to achieve compliance. Normally, the effective date is 60 days after a rule is published. The Transactions Rule was published on August 17, 2000. So the compliance date for that rule is October 16, 2002. The Privacy Rule was published on December 28, 2000, but due to minor glitch didn't become effective until April 14, 2001. Compliance is required for the Privacy Rule on April 14, 2003. HOW WILL WE BE AFFECTED? Broadly and deeply. Required compliance responses aren't standard, because organizations aren't. For example, an organization with a computer network will be required to implement one or more security authentication access mechanisms - "user-based," "role-based," and/or "context-based" access - depending on its network environment. Effective compliance will require organization-wide implementation. Steps will include: Building initial organizational awareness of HIPAA Comprehensive assessing of the organization's information security systems, policies and procedures Developing an action plan with deadlines and timetables Developing a technical and management infrastructure to implement the plan Implementing a comprehensive action plan, including Developing new policies, processes, and procedures Building "chain of trust" agreements with service organization Redesigning a compliant technical information infrastructure Purchasing new, or adapting, information systems Developing new internal communications Training and enforcement Now, we'll explore the next level of HIPAA - specifics that, for many of us, cause more confusion than clarity. Let's try to make "Administrative Simplification" simple! HIPAA's "Administrative Simplification" provision is composed of four parts, each of which have generated a variety of "rules" and "standards." Many of the rules and standards are still in the "proposed" (by DHHS) stage; however, most are expected to become "final" rules within the year 2000. Even more confusing, the rules, when final, will often have different compliance deadlines. The four parts of Administrative Simplification are: ELECTRONIC HEALTH TRANSACTIONS STANDARDS 40793118 Ver 0.00a Page 102 of 150 External Agents ___________________________________________________________________ UNIQUE IDENTIFIERS SECURITY & ELECTRONIC SIGNATURE STANDARDS PRIVACY & CONFIDENTIALITY STANDARDS ELECTRONIC HEALTH TRANSACTIONS STANDARDS The term "Electronic Health Transactions" includes health claims, health plan eligibility, enrollment and disenrollment, payments for care and health plan premiums, claim status, first injury reports, coordination of benefits, and related transactions. Today, health providers and plans use many different electronic formats. Implementing a national standard will mean we will all use one format, thereby "simplifying" and improving transaction efficiency nationwide. The proposed rule requires use of specific electronic formats developed by ANSI, the American National Standards Institute, for most transactions except claims attachments and first reports of injury. Proposed regulations for these exceptions are not yet out. Virtually all health plans will have to adopt these standards, even if a transaction is on paper or by phone or FAX. Providers using non-electronic transactions are not required to adopt the standards; although if they don't, they will have to contract with a clearinghouse to provide translation services. Health organizations also must adopt STANDARD CODE SETS to be used in all health transactions. For example, coding systems that describe diseases, injuries, and other health problems, as well as their causes, symptoms and actions taken must become uniform. All parties to any transaction will have to use and accept the same coding. Again, in the long run, this is intended to reduce mistakes, duplication of effort and costs. Fortunately, the code sets proposed as HIPAA standards are already used by much health plans, clearinghouses and providers, which should ease the transition. UNIQUE IDENTIFIERS FOR PROVIDERS, EMPLOYERS, HEALTH PLANS and PATIENTS The current system allows us to have multiple ID numbers when dealing with each other, which HIPAA sees as confusing, conducive to error and costly. It is expected that standard identifiers will reduce these problems. SECURITY OF HEALTH INFORMATION & ELECTRONIC SIGNATURE STANDARDS The new Security Standard will provide a uniform level of protection of all health information that is housed or transmitted electronically and that Pertains to an individual. In addition, organizations that use Electronic Signatures will have to meet a standard ensuring message integrity, user authentication, and non-repudiation. The Security standard mandates safeguards for physical storage and maintenance, transmission, and access to individual health information. It applies not only to the transactions adopted under HIPAA, but to all individual health information that is maintained or transmitted. However, the Electronic Signature standard applies only to the transactions adopted under HIPAA. The Security Standard does not require specific technologies to be used; solutions will vary from business to business, depending on the needs and technologies in place. Also, no transactions adopted under HIPAA currently require an electronic signature. PRIVACY AND CONFIDENTIALITY The Final Rule for Privacy was published just as President Clinton was leaving office, on December 28, 2001. A paperwork glitch delayed notification of Congress, so the Congressional Review period didn't begin until February, pushing the effective date of the rule until April 14, 2001. DHHS Secretary Tommy 40793118 Ver 0.00a Page 103 of 150 External Agents ___________________________________________________________________ Thompson used the time to solicit additional comments during March. DHHS received over 11,000 comments and plans to issue guidelines and clarification of the final rule in response. Compliance will be required on April 14, 2003 for most covered entities. In general, privacy is about whom has the right to access personally identifiable health information. The rule covers all individually identifiable health information in the hands of covered entities, regardless of whether the information is or has been in electronic form. The Privacy standards: limit the non-consensual use and release of private health information; give patients new rights to access their medical records and to know who else has accessed them; restrict most disclosure of health information to the minimum needed for the intended purpose; establish new criminal and civil sanctions for improper use or disclosure; establish new requirements for access to records by researchers and others. The new regulation reflects the five basic principles outlined at that time: Consumer Control: The regulation provides consumers with critical new rights to control the release of their medical information Boundaries: With few exceptions, an individual's health care information should be used for health purposes only, including treatment and payment. Accountability: Under HIPAA, for the first time, there will be specific federal penalties if a patient's right to privacy is violated. Public Responsibility: The new standards reflect the need to balance privacy protections with the public responsibility to support such national priorities as protecting public health, conducting medical research, improving the quality of care, and fighting health care fraud and abuse. Security: It is the responsibility of organizations that are entrusted with health information to protect it against deliberate or inadvertent misuse or disclosure. 8.4.2 CORBA Health insurance programs allow workers and their families to take care of essential medical needs. These programs can be one of the most important benefits provided by an employer. There was a time when group health coverage may have been terminated when a worker lost his job or changed employment. That changed in 1986 with the passage of health benefit provisions in the Consolidated Omnibus Budget Reconciliation Act (COBRA). Now, terminated employees or those who lose coverage because of reduced work hours may be able to buy group coverage for themselves and their families for limited periods of time. If you are entitled to COBRA benefits, your health plan must give you a notice stating your right to choose to continue benefits provided by the plan. You have 60 days to accept coverage or lose all rights to benefits. Once COBRA coverage is chosen, you may be required to pay for the coverage. What Is the Continuation Health Law? Congress passed the landmark Consolidated Omnibus Budget Reconciliation Act (COBRA) health benefit provisions in 1986. The law amends the Employee Retirement Income Security Act (ERISA), the Internal Revenue Code and the Public Health Service Act to provide continuation of group health coverage that otherwise might be terminated. COBRA contains provisions giving certain former employees, retirees, spouses and dependent children the right to temporary continuation of health coverage at group rates. This coverage, however, is only available in specific instances. Group health coverage for COBRA participants is usually more expensive than health coverage for active employees, since usually the employer pays a part of the premium for active employees 40793118 Ver 0.00a Page 104 of 150 External Agents ___________________________________________________________________ while COBRA participants generally pay the entire premium themselves. It is ordinarily less expensive, though, than individual health coverage. The law generally covers group health plans maintained by employers with 20 or more employees in the prior year. It applies to plans in the private sector and those sponsored by state and local governments. The law does not, however, apply to plans sponsored by the Federal government and certain church-related organizations. Group health plans sponsored by private sector employers generally are welfare benefit plans governed by ERISA and subject to its requirements for reporting and disclosure, fiduciary standards and enforcement. ERISA neither establishes minimum standards or benefit eligibility for welfare plans nor mandates the type or level of benefits offered to plan participants. It does, however, require that these plans have rules outlining how workers become entitled to benefits. Under COBRA, a group health plan ordinarily is defined as a plan that provides medical benefits for the employer's own employees and their dependents through insurance or another mechanism such as a trust, health maintenance organization, self-funded pay-as-you-go basis, reimbursement or combination of these. Medical benefits provided under the terms of the plan and available to COBRA beneficiaries may include: inpatient and outpatient hospital care physician care surgery and other major medical benefits prescription drugs any other medical benefits, such as dental and vision care Life insurance, however, is not covered under COBRA. Who Is Entitled to Benefits? There are three elements to qualifying for COBRA benefits. COBRA establishes specific criteria for plans, beneficiaries and events, which initiate the coverage. Plan Coverage Group health plans for employers with 20 or more employees on more than 50 percent of the working days in the previous calendar year are subject to COBRA. The term "employees" includes all full-time and parttime employees, as well as self-employed individuals. For this purpose, the term employees also include agents, independent contractors and directors, but only if they are eligible to participate in a group health plan. Beneficiary Coverage A qualified beneficiary generally is any individual covered by a group health plan on the day before a qualifying event. A qualified beneficiary may be an employee, the employee's spouse and dependent children, and in certain cases, a retired employee, the retired employee's spouse and dependent children. Qualifying Events "Qualifying events" are certain types of events that would cause, except for COBRA continuation coverage, an individual to lose health coverage. The type of qualifying event will determine who the qualified beneficiaries are and the required amount of time that a plan must offer the health coverage to them under COBRA. A plan, at its discretion, may provide longer periods of continuation coverage. The types of qualifying events for employees are: voluntary or involuntary termination of employment for reasons other than "gross misconduct" 40793118 Ver 0.00a Page 105 of 150 External Agents ___________________________________________________________________ reduction in the number of hours of employment The types of qualifying events for spouses are: Termination of the covered employee's employment for any reason other than "gross misconduct" Reduction in the hours worked by the covered employee Covered employee's becoming entitled to Medicare Divorce or legal separation of the covered employee Death of the covered employee The types of qualifying events for dependent children are the same as for the spouse with one addition: loss of "dependent child" status under the plan rules as shown in Figure 1, Qualifying Events Termination Reduced Hours Beneficiary Employee Spouse Dependent Child Coverage 18 months Employee entitled to Medicare Divorce or legal separation Death of covered employee Spouse Dependent child 36 months Loss of "dependent child" status Figure: 2 Periods of Coverage Dependent child 36 months Your Rights: Notice and Election Procedures COBRA outlines procedures for employees and family members to elect continuation coverage and for employers and plans to notify beneficiaries. The qualifying events contained in the law, create rights and obligations for employers, and plan administrators and qualified beneficiaries. Qualified beneficiaries have the right to elect to continue coverage that is identical to the coverage provided under the plan. Employers and plan administrators have an obligation to determine the specific rights of beneficiaries with respect to election, notification and type of coverage options. Notice Procedures General Notices An initial general notice must be furnished to covered employees, their spouses and newly hired employees informing them of their rights under COBRA and describing provisions of the law. COBRA information also is required to be contained in the summary plan description (SPD) which participants receive. ERISA requires employers to furnish modified and updated SPDs containing certain plan information and summaries of material changes in plan requirements. Plan administrators must automatically furnish the SPD booklet 90 days after a person becomes a participant or a beneficiary begins receiving benefits or within 120 days after the plan is subject to the reporting and disclosure provisions of the law. Specific Notices 40793118 Ver 0.00a Page 106 of 150 External Agents ___________________________________________________________________ Specific notice requirements are triggered for employers, qualified beneficiaries and plan administrators when a qualifying event occurs. Employers must notify plan administrators within 30 days after an employee's death, termination, reduced hours of employment or entitlement to Medicare. Multi-employer plans may provide for a longer period of time. A qualified beneficiary must notify the plan administrator within 60 days after events such as divorce or legal separation or a child's ceasing to be covered as a dependent under plan rules. Disabled beneficiaries must notify plan administrators of Social Security disability determinations. A notice must be provided within 60 days of a disability determination and prior to expiration of the 18month period of COBRA coverage. These beneficiaries also must notify the plan administrator within 30 days of a final determination that they are no longer disabled. Plan administrators, upon notification of a qualifying event, must automatically provide a notice to employees and family members of their right to elect COBRA coverage. The notice must be provided in person or by first class mail within 14 days of receiving information that a qualifying event has occurred. There are two special exceptions to the notice requirements for multi-employer plans. First, the time frame for providing notices may be extended beyond the 14- and 30-day requirements if allowed by plan rules. Second, employers are relieved of the obligation to notify plan administrators when employees terminate or reduce their work hours. Plan administrators are responsible for determining whether these qualifying events have occurred. Election The election period is the time frame during which each qualified beneficiary may choose whether to continue health care coverage under an employer's group health plan. Qualified beneficiaries have a 60-day period to elect whether to continue coverage. This period is measured from the later of the coverage loss date or the date the notice to elect COBRA coverage is sent. COBRA coverage is retroactive if elected and paid for by the qualified beneficiary. A covered employee or the covered employee's spouse may elect COBRA coverage on behalf of any other qualified beneficiary. Each qualified beneficiary, however, may independently elect COBRA coverage. A parent or legal guardian may elect on behalf of a minor child. A waiver of coverage may be revoked by or on behalf of a qualified beneficiary before the end of the election period. A beneficiary may then reinstate coverage. Then, the plan need only provide continuation coverage beginning on the date the waiver is revoked. How COBRA Coverage Works Example 1: John Q. participates in the group health plan maintained by the ABC Co. John is fired for a reason other than gross misconduct and his health coverage is terminated. John may elect and pay for a maximum of 18 months of coverage by the employer's group health plan at the group rate. Example 2: Day laborer David P. has health coverage through his wife's plan sponsored by the XYZ Co. David loses his health coverage when he and his wife become divorced. David may purchase health coverage with the plan of his former wife's employer. Since in this case divorce is the qualifying event under COBRA, David is entitled to a maximum of 36 months of COBRA coverage. 40793118 Ver 0.00a Page 107 of 150 External Agents ___________________________________________________________________ Example 3: RST, Inc. is a small business, which maintained an insured group health plan for its 10 employees in 1987 and 1988. Mary H., a secretary with six years of service, leaves in June 1988 to take a position with a competing firm, which has no health plan. She is not entitled to COBRA coverage with the plan of RST, Inc. since the firm had fewer than 20 employees in 1987 and is not subject to COBRA requirements. Example 4: Jane W., a stockbroker, left brokerages firm in May 1990 to take a position with a chemical company. She was five months pregnant at the time. The health plan of the chemical company has a pre-existing condition clause for maternity benefits. Even though Jane signs up for the new employer's plan, she has the right to elect and receive coverage under the old plan for COBRA purposes because the new plan limits benefits for pre-existing conditions. Covered Benefits Qualified beneficiaries must be offered coverage identical to those received immediately before qualifying for continuation coverage. For example, a beneficiary may have had medical, hospitalization, dental, vision and prescription benefits under single or multiple plans maintained by the employer. Assuming a qualified beneficiary had been covered by three separate health plans of his former employer on the day preceding the qualifying event, that individual has the right to elect to continue coverage in any of the three health plans. Non-core benefits are vision and dental services, except where they are mandated by law in which case they become core benefits. Core benefits include all other benefits received by a beneficiary immediately before qualifying for COBRA coverage. If a plan provides both core and non-core benefits, individuals may generally elect either the entire package or just core benefits. Individuals do not have to be given the option to elect just the non-core benefits unless those were the only benefits carried under that particular plan before a qualifying event. A change in the benefits under the plan for active employees may apply to qualified beneficiaries. Beneficiaries also may change coverage during periods of open enrollment by the plan. Duration of Coverage COBRA establishes required periods of coverage for continuation health benefits. A plan, however, may provide longer periods of coverage beyond those required by COBRA. COBRA beneficiaries generally are eligible to pay for group coverage during a maximum of 18 months for qualifying events due to employment termination or reduction of hours of work. Certain qualifying events, or a second qualifying event during the initial period of coverage, may permit a beneficiary to receive a maximum of 36 months of coverage. Coverage begins on the date that coverage would otherwise have been lost by reason of a qualifying event and can end when: The last day of maximum coverage is reached Premiums are not paid on a timely basis The employer ceases to maintain any group health plan Coverage is obtained with another employer group health plan that does not contain any exclusion or limitation with respect to any pre-existing condition of such beneficiary A beneficiary is entitled to Medicare benefits 40793118 Ver 0.00a Page 108 of 150 External Agents ___________________________________________________________________ Special rules for disabled individuals may extend the maximum periods of coverage. If a qualified beneficiary is determined under Title II or XVI of the Social Security Act to have been disabled at the time of a termination of employment or reduction in hours of employment and the qualified beneficiary properly notifies the plan administrator of the disability determination, the 18-month period is expanded to 29 months. Although COBRA specifies certain maximum required periods of time that continued health coverage must be offered to qualified beneficiaries, COBRA does not prohibit plans from offering continuation health coverage that goes beyond the COBRA periods. Some plans allow beneficiaries to convert group health coverage to an individual policy. If this option is available from the plan under COBRA, it must be offered to you. In this case, the option must be given for the beneficiary to enroll in a conversion health plan within 180 days before COBRA coverage ends. The premium is generally not at a group rate. The conversion option, however, is not available if the beneficiary ends COBRA coverage before reaching the maximum period of entitlement. Paying for COBRA Coverage Beneficiaries may be required to pay the entire premium for coverage. The premium cannot exceed 102 percent of the cost to the plan for similarly situated individuals who have not incurred a qualifying event. Premiums reflect the total cost of group health coverage, including both the portion paid by employees and any portion paid by the employer before the qualifying event, plus two percent for administrative costs. For disabled beneficiaries receiving an additional 11 months of coverage after the initial 18 months, the premium for those additional months may be increased to 150% of the plan's total cost of coverage. Premiums due may be increased if the costs to the plan increase but generally must be fixed in advance of each 12-month premium cycle. The plan must allow you to pay premiums on a monthly basis if you ask to do so. The initial premium payment must be made within 45 days after the date of the COBRA election by the qualified beneficiary. Payment generally must cover the period of coverage from the date of COBRA election retroactive to the date of the loss of coverage due to the qualifying event. Premiums for successive periods of coverage are due on the date stated in the plan with a minimum 30-day grace period for payments. The due date may not be prior to the first day of the period of coverage. For example, the due date for the month of January could not be prior to January 1 and coverage for January could not be cancelled if payment is made by January 31. Premiums for the rest of the COBRA period must be made within 30 days after the due date for each such premium or such longer period as provided by the plan. The plan, however, is not obligated to send monthly premium notices. COBRA beneficiaries remain subject to the rules of the plan and therefore must satisfy all costs related to deductibles, catastrophic and other benefit limits. Claims Procedures Health plan rules must explain how to obtain benefits and must include written procedures for processing claims. Claims procedures are to be included in the SPD booklet. You should submit a written claim for benefits to whomever is designated to operate the health plan (employer, plan administrator, etc.). If the claim is denied notice of denial must be in writing and furnished 40793118 Ver 0.00a Page 109 of 150 External Agents ___________________________________________________________________ generally within 90 days after the claim is filed. The notice should state the reasons for the denial; any additional information needed to support the claim and procedures for appealing the denial. You have 60 days to appeal a denial and must receive a decision on the appeal within 60 days after that unless the plan provides for a special hearing, or a group, which meets, only on a periodic basis, must make the decision. Contact the plan administrator for more information on filing a claim for benefits. Complete plan rules are available from employers or benefits offices. There can be charges up to 25 cents a page for copies of plan rules. Coordination with Other Benefits The Family and Medical Leave Act (FMLA), effective August 5, 1993, requires an employer to maintain coverage under any "group health plan" for an employee on FMLA leave under the same conditions coverage would have been provided if the employee had continued working. Coverage provided under the FMLA is not COBRA coverage, and FMLA leave is not a qualifying event under COBRA. A COBRA qualifying event may occur, however, when an employer's obligation to maintain health benefits under FMLA ceases, such as when an employee notifies an employer of his or her intent not to return to work. Further information on FMLA is available from the nearest office of the Wage and Hour Division, listed in most telephone directories under U.S. Government, Department of Labor, Employment Standards Administration. Role of the Federal Government Continuation coverage laws are administered by several agencies. The Departments of Labor and Treasury have jurisdiction over private sector health plans. The United States Public Health Service administers the continuation coverage law as it affects public sector health plans. Conclusion Rising medical costs have transformed health benefits from a privilege to a household necessity for most Americans. COBRA creates an opportunity for persons to retain this important benefit. Workers need to be aware of changes in health care laws to preserve their benefit rights. A good starting point is reading your plan booklet. Most of the specific rules on COBRA benefits can be found there or with the person who manages your health benefits plan. Be sure to periodically contact the health plan to find out about any changes in the type or level of benefits offered by the plan. The Department of Labor maintains this article to enhance public access to the Department's information. This is a service that is continually under development. While we try to keep the information timely and accurate, we make no guarantees. We will make an effort to correct errors brought to our attention. 8.4.3 1. 2. Exercise HIPAA Means Health Insurance Portability & Affordability Act. Say True or False. ______ Contains provisions giving certain former employees the right to temporary continuation of health coverage at group rates. 40793118 Ver 0.00a Page 110 of 150 External Agents ___________________________________________________________________ 3. Improved efficiency in healthcare delivery by standardizing electronic data interchange is a main feature in HIPAA. Say True or False. Answers: 1. False 2. COBRA 3. True 8.5 Clearing Houses A HealthCare Transaction Clearinghouse performs auditing services on insurance claims. If a claim is determined to be free of typographical, syntax, and logistical content errors, it is forwarded to the insurance company responsible for payment. If errors are detected, it is returned to the HealthCare Provider along with an explanation of what was wrong. The HealthCare Provider may then correct the related errors and resubmit for another pass. This process may be repeated until the claim passes the inspection. 8.5.1 Benefits Of A Clearinghouse Cash Flow If a HealthCare Provider were to send claims through the mail, many weeks would pass before he would receive mail notification that errors were holding up payment release on his submitted claims. A Clearinghouse collapses the wait cycle into an average of 5-21 days, down from 4-8 weeks on paper claims. Net result: Improved cash flow. Guaranteed Delivery Insurance Companies often claim not having received claims that HealthCare Providers send through the mail. When the claim travels electronically through a clearinghouse, these instances are greatly reduced. Connectivity Some insurance companies offer direct filing software. But clearinghouses can typically access hundreds of insurance companies through a single port of entry from the office of the HealthCare Provider. Today's HealthCare Clearinghouse market is very confusing. The industry is riddled with organizations that are exceptionally difficult to decipher. Some clearinghouses charge $0.50 per claim, others nothing, and yet others in-between somewhere. 8.5.2 Clearinghouse versus Direct Filing Topic Audit Logic Using A Clearinghouse Routinely check for as many as 10,000 - 30,000 combinations of errors. Instant notification back to the Provider. Unbiased Audits performed on claims are not 40793118 Ver 0.00a Direct Filing Same, but most are not reported back to the HealthCare Provider. In many cases claims just "sit there" until a tracer or formal complaint is received. Then rejection occurs. Filing a claim to an insurance company Page 111 of 150 External Agents ___________________________________________________________________ Processing critiqued in favor of the insurance company with regard to how claims are coded. Typically, a clearinghouse has nothing to gain by delaying submissions or other operational errors. Some clearinghouses though, have strong ties with insurance companies that result in biased editing. A clearinghouse has everything to gain by HealthCare Providers getting paid quickly and collecting as much of a submitted claim value as possible. A clearinghouse serves as a liaison to the HealthCare Provider. direct is almost reminiscent of allowing the IRS to file your tax return. Insurance companies tend to "pick" on some HealthCare Providers and not on others. HealthCare Providers using the free or low cost software distributed by some insurance companies are subject to biased auditing without knowing so, since the software may reject certain coding combinations during data entry. Coding is crucial in determining the income of a HealthCare Provider. This may go unnoticed by incompetent or negligent staff inside the office of the HealthCare Provider. Insurance companies have everything to gain by delaying payment to HealthCare Providers. Clearly, direct filing to insurance companies offers potentially hard to detect disadvantages to U.S. HealthCare Providers. As indicated, all clearinghouses are not created equal. They typically fall into one of three possible group types. The following chart will illustrate all the groups Clearinghouse Types Type 1 Type 2 Type 3 Biased processing, close affiliation with insurance companies Unbiased, standard working relationship with insurance companies Unbiased, close affiliation with leading Type 2 clearinghouses. Typically competitive in cost and superior in service. It may be helpful, to understand how clearinghouses make their money. 8.5.3 Clearinghouse Income Type 1 Biased, most income derives from insurance companies and is formally referred to as "rebates". Rebates, however, imply that something was initially received. Insurance companies typically do not charge anything to receive claims. Type 2 Primary income is derived from the submitting HealthCare Provider, to whom services are rendered. As Type 1 clearinghouses developed "rebate" income, Type 2 clearinghouses followed up by negotiating rebates as well. Type 3 Unbiased and "rebate" free. Type 3 clearinghouses utilize Type 2 gateways for transporting claims, but render unique and superior audits resulting in improved services at a lower cost to the HealthCare Provider. Type 3 clearinghouses "lease" Type 2 40793118 Ver 0.00a Page 112 of 150 External Agents ___________________________________________________________________ gateways to insurance companies at volume driven rates, thus avoiding the typical enormous overhead of Type 2 clearinghouses. 8.5.4 1. 2. Exercise List down the Benefits of a Clearinghouse. A HealthCare Transaction Clearinghouse performs auditing services on ___________ _______. Answers: 1. Cash Flow, Guaranteed Delivery & Connectivity. 2. Insurance Claims. 8.6 Third Party Administrators Third Party Administrator is an entity required to make or responsible for making payment on behalf of a group health plan. "Administrator" means any person who adjusts or settles claims on, residents of this state in connection with life, dental, health, or disability insurance or self-insurance programs. "Administrator" does not include any of the following: An insurance agent or solicitor licensed in this state whose activities are limited exclusively to the sale of insurance and who does not provide any administrative services; Any person who administers or operates the workers' compensation program of a self-insuring employer under of the Revised Code; Any person who administers pension plans for the benefit of the person's own members or employees or administers pension plans for the benefit of the members or employees of any other person; Any person that administers an insured plan or a self-insured plan that provides life, dental, health, or disability benefits exclusively for the person's own members or employees; Any health-insuring corporation holding a certificate of authority of the Revised Code or an insurance company that is authorized to write life or sickness and accident insurance in this state. Administrators may be tested and shall be licensed by the superintendent of insurance in accordance with rules adopted by the superintendent. An administrator who has been licensed or certified by the state of the administrator's domicile under a statute or rule of the Revised Code shall, upon application, be licensed without testing, provided the state of domicile recognizes and grants licenses to administrators of this state who have obtained licenses under such sections. No person shall solicit a plan or sponsor of a plan to act as an administrator for, or provide administrative services to, a plan or sponsor of a plan that is either domiciled in this state or has its principal headquarters or principal administrative office in this state unless the person is duly licensed under sections 3959.01 to 3959.16 of the Revised Code. No administrator shall do any of the following: Use plan sponsor funds for any purpose or purposes not specifically set forth in written form by the administrator; 40793118 Ver 0.00a Page 113 of 150 External Agents ___________________________________________________________________ Fail to disclose in written solicitation material and on an on-going basis, at least once annually, to the plan sponsor all of the following: All fixed plan costs, identifying what each fixed cost includes; Levels of the specific excess insurance stop-loss deductible; The aggregate excess insurance stop-loss attachment point factors, including any minimum attachment point factors; The names of all insurance payers providing protection for the plan sponsor's plans, and any ownership relationship of five per cent or more between the administrator and such insurance payers. Fail to remit insurance company premiums within the policy period or within the time period agreed to in writing between the insurance company and the administrator; Fail to disclose in written form the method of collecting and holding any plan sponsor's funds. 8.7 Specialized Adjudication Engines/Companies Adjudicator A powerful engine that links to the existing software equipped with simple Boolean rules, that enables to conquer the mysticism of Claims Adjudication. The system contains the most commonly used routines to analyze a healthcare claim and one can also write specific rules required for adjudicating the claims. Features: Repricing Validates eligibility of patients, procedures, modifiers and diagnoses Detects unbundling and upcoding Allows you to reduce levels of service Alerts of potential fraudulent billing Prepares an explanation of benefits with messages specific to your operation, computing the amount approved according to established fee Schedules and provider's contractual agreement Gives you the tools to automate correspondence with patients and providers AccuChecker is one such Adjudication Engine. This system comes equipped with "AccuChecker for Windows", a comprehensive database that contains procedures, diagnoses and the Medicare fee schedule. "AccuChecker for Windows" has the 2001 tables of procedures and ICD-9 codes, also uses the HFCA published guidelines for medical procedures, in an effort to maximize cost containment and fairness in adjudicating claims. If you process claims that require different fee schedules, like for example Workers Compensation cases, the system allows you to insert additional files with the information needed. 8.8 General Agents They provide end-to-end connectivity that allows brokers and their clients to shop, purchase, enroll, serve and renew policies. They are the people who work behind the scenes to reduce administrative hassles, resolve complex service issues, and preserve the integrity of broker-client relationships. 40793118 Ver 0.00a Page 114 of 150 External Agents ___________________________________________________________________ As a full-service agency, they provide valuable services, including licensing and appointment with insurance payer, supporting brokers in plan development, consultation, negotiation, case installation and communication, as well as plan management and customer service. 8.9 8.9.1 Accreditation Agencies The Accreditation Process Organizations applying for accreditation participate in a process that entails a rigorous review occurring in four phases. The initial phase "Building the Application", which consists of completing the application forms and supplying supporting documentation, usually takes several months. Once the application and base fee are received by URAC (The American Accreditation Healthcare Commission/Utilization Review Accreditation Commission (URAC), the leading accreditation organization for traditional health insurers), the remaining three phases of the accreditation process cover a period of approximately three to six months. These phases include the following: 8.9.1.1 Desktop Review In the desktop review process, one or more full-time URAC reviewers analyze the applicant's documentation in relation to the URAC standards. The applicant's documentation usually consists of, but is not limited to, formal policies and procedures, organizational charts, position descriptions, contracts, sample template letters, and program descriptions and plans for departments such as quality management and credentialing. After receiving a desktop review summary, the applicant usually must provide additional documentation clarifying any pending issues. 8.9.1.2 Onsite Review After the desktop review is complete, the accreditation review team conducts an onsite review to verify compliance with the standards. During this review, carried out by the same team that performed the desktop review, management is interviewed about the organization's programs and staff is observed performing its duties. In addition, audits are conducted and personnel and credentialing files analyzed. Education and quality management programs are reviewed in detail as well. During the onsite visit, URAC reviewers also share "best practices" and provide other helpful guidance. 8.9.1.3 Committee Review The last phase in the accreditation process is a review by two URAC committees that include professionals from a variety of areas in health care as well as industry experts selected from or chosen by URAC's member organizations. The committee review process begins with a written summary documenting the findings of the desktop and onsite reviews. This summary is submitted to URAC's Accreditation Committee for evaluation with discussion with the review team as needed. An accreditation recommendation is then forwarded to URAC's Executive Committee, which has the authority to grant accreditation. After reviewing the summary and considering the Accreditation Committee's recommendation, the Executive Committee makes a final accreditation determination. 8.9.1.4 Accreditation Status Applicants who successfully meet all requirements are awarded a full two-year accreditation, and an accreditation certificate is issued to each company site that participated in the accreditation review. Conditional accreditation may be awarded to applicants who have appropriate documentation, but incomplete implementation of certain policies and procedures. Conditional accreditation may also be awarded to companies determined to be "start-ups", e.g., those that have not yet implemented their program or have not had at least six months of operational experience at the time of the onsite review. Organizations that are unable to meet URAC standards may be placed on corrective action status, denied accreditation, or choose to withdraw. 40793118 Ver 0.00a Page 115 of 150 External Agents ___________________________________________________________________ Follow-up activities for organizations receiving conditional accreditation or corrective action may include submission of additional or revised documentation and another onsite review. When these follow-up activities are complete, a follow-up executive summary is submitted to URAC's committees for a possible change to full accreditation. Accreditation Certificates A certificate of accreditation is awarded to accredited organizations, attesting to the program the organization is accredited for. Each accredited site is given its own certificate. This will help the applicant differentiate its various products in the health care market and target a variety of current and potential clients. Accredited organizations also provide copies of accreditation certificates to regulators in states where URAC accreditation is deemed. Ongoing Compliance with the Standards Accredited organizations must continue to remain in compliance with the applicable standards throughout the accreditation cycle. If an accredited company is unable to comply with URAC Standards, its accreditation will likely be rescinded. Complaints against an Accredited Company URAC has a grievance procedure for investigation of complaints about an accredited company. Complaints may originate from consumers, providers or regulators. After an investigation of each complaint, which may or may not include an onsite visit, URAC may sanction an accredited company. Sanctions may range from a letter of reprimand to revocation of accreditation, depending on the nature and frequency of the violations. Accreditation Cycle and Reaccreditation URAC accreditation is granted for two years starting the first day of the month following URAC's Executive Committee approval. Accredited companies seeking reaccreditation must submit the reaccreditation application to URAC at least four months before the accreditation expiration date or six months prior to expiration if the accredited company is a network reapplying for Health Plan or Health Network accreditation. Web Site Accreditation Process The Web site accreditation process has some notable differences from the other accreditation programs. The application process is divided into two distinct phases: 1) the pre-application, and 2) the formal application. URAC first requires applicants to submit a “pre-applications” including payment information and general information about the company and it’s Web site. Once the pre-pay is processed, URAC will initiate the formal application process. URAC will send the primary contact person a letter and/or email confirming receipt of the pre-application. The letter of receipt will include confidential access codes assigned to the applicant that are used to access the secure, online formal application which contains questions specifically related to the Standards. Once completed, the formal application will be assigned to an Accreditation Reviewer. The Accreditation Reviewer will follow the formal application through the accreditation process and is the same reviewer who will conduct all activities associated with the review process -- desktop review, onsite review, and presentation of the application to the URAC committees. Unlike other URAC accreditation programs, onsite visits are not "required" during the application process and a telephone interview of corporate officials is conducted instead. In certain circumstances, URAC reserves the right to conduct an onsite review if the telephone interview and formal application are inconclusive. 40793118 Ver 0.00a Page 116 of 150 External Agents ___________________________________________________________________ URAC's model of performing accreditation reviews allows the Accreditation Reviewers to develop an indepth knowledge of the organization under review and provides a mechanism for the applicant to receive on-going feedback regarding the application and review findings. With group health insurance, a single policy covers the medical expenses of many different people (a group) instead of covering just one person. Because only one policy is issued for the entire group, the initial cost of establishing group coverage is lower than the cost of issuing a separate policy to each person. Employer-sponsored plans and associations are among the most common sources of group health insurance, with the sponsoring employer or association paying all or part of the premium. Individual health insurance is a type of policy that covers the medical expenses of only one person. Unlike group insurance, members purchase individual insurance directly from an insurance company. When they apply for individual insurance, they are evaluated in terms of how much risk they present to the insurance company. This is generally done through a series of medical questions and/or a physical exam. Member’s risk potential will determine whether he qualifies for insurance and how much the insurance will cost. Individual insurance is somewhat more risky for insurers than group insurance, because group insurance allows the insurer to spread the risk over a larger number of people. For this reason, individual insurance is generally more difficult to obtain and more costly than group insurance. Unlike individual insurance, where each person's risk potential is evaluated and used to determine insurability, all eligible people can be covered by a group policy regardless of age or physical condition. The premium for group insurance is calculated based on characteristics of the group as a whole, such as average age and degree of occupational hazard. In general, the only real disadvantage of group insurance is limited or no freedom to customize the policy to member’s individual needs. The policy is typically negotiated between the insurer and the "master" policy owner (employer or association) without any input from the member. The specific policy provisions are all determined in advance, as are the deductible amount and co-payment percentage. 8.10 Drug Manufacturers Health Insurance group identifies potential drug manufactures, who to promote the sales, want to put their products on preferred drug list/network. Health Insurance sets up a contract with each of them, for all the products they wish to add to preferred drug list, regarding rebates that can be obtained from the individual manufacturers when drugs bought under health insurance policies cross pre-defined limits. These limits are decided at the contract level and can be directly proportional to the number of drugs sold or can be based upon the market-share value for that drug across all the competitor drugs. Actual rebate value is decided when the contract is set up and varies over a wide range depending on the contract and manufacturer. The contract details of every manufacturer are set up through some process like Volume Discount on-line processes. The on-line screens are also used to enter the business rules (exclusion & inclusion) that determine the actual set of already adjudicated claims that can be considered for the rebates as defined in the contracts. Formulary and Cost Management Group using VDS on-line transactions only enter all these information. Any drug on the NDC list can be covered under the contract (but usually very costly and very rarely used drugs are not part of rebate contract). The drug information is obtained from First Data Bank, which is an independently managed US wide database for drugs. Doctors as well as pharmacies are provided with the preferred drug list (usually on-line). Doctors can prescribe a drug outside this preferred list. Whenever a member goes to buy a drug from a pharmacy, his claim is adjudicated online by the Real time Adjudication System. A member has to pay standard Co-pay when he buys a preferred drug; but if he buys drug outside the preferred drug network; he has to pay higher Co-pay. A member can take a plan, which allows him to buy outside the preferred network for same Co40793118 Ver 0.00a Page 117 of 150 External Agents ___________________________________________________________________ pay, but this plan attracts higher premium. Once the claim is adjudicated, it is entered in the database. The Volume Discount System runs on a quarterly basis. An extraction job runs on this database every quarter and pulls out those claims for which there are rebate contracts set up. Various inclusion/exclusion rules are applied, along with the business rules from the contracts and summary files are obtained which form the input to the invoicing stage. In the invoicing stage, a set of jobs does the actual rebate amount calculations, based on the manufacturer, contract, client, group, product indicator etc. Invoices for the dollar amounts payable by each manufacturer is prepared. This process also generates detailed utilization information to support rebates invoiced. The invoice amounts and the details are communicated to the manufacturing companies, either electronically or through postal mails. Once the rebate checks arrive, the relevant details are entered through Volume Discount Allocation system. 8.11 Review Questions 1. 2. 3. 4. 8.12 List down some of the features of Adjudicators. Explain the role of Third party Administrators. What is the role of Drug Manufacturers in a Healthcare Industry? What are the four parts of Administrative Simplification in HIPAA? References 5. http://www.yourhealthplans.com 6. http://www.insurance.com 7. http://www.accuchecker.com 8. http://www.alliance-edi.com 9. http://www.horizon-healthcare.com 10. http://www.iix.com 11. http://www.hipaadvisory.com 12. http://www. yourhealthplanonline.com 13. http://www.hcfa.gov 14. http://www.healthinsurance.com 15. http://www.healtheon.com 16. http://www.nlm.nih.gov/nichsr/nichsr.html 17. http://www.cdc.gov/ 18. http://www.os.dhhs.gov/ 19. http://www.hrsa.dhhs.gov/ 40793118 Ver 0.00a Page 118 of 150 External Agents ___________________________________________________________________ 20. http://www.yourhealthplans.com 21. http://www.insurance.com 22. http://www.accuchecker.com 23. http://www.alliance-edi.com 24. http://www.horizon-healthcare.com 25. http://www.iix.com 26. http://www.hipaadvisory.com 27. http://www. yourhealthplanonline.com 28. http://www.hcfa.gov 29. http://www.healthinsurance.com 30. http://www.healtheon.com 31. http://www.nlm.nih.gov/nichsr/nichs r.html 32. http://www.cdc.gov/ 33. http://www.os.dhhs.gov/ 34. http://www.hrsa.dhhs.gov/ 40793118 Ver 0.00a Page 119 of 150 Summary ___________________________________________________________________ UNIT - IX 9 9.1 Summary Unit Objectives This unit will summarize the contents of this course material by presenting a detailed description of healthcare industry workflow. 9.2 Workflow The detailed workflow for the healthcare industry can be represented as shown in the Following figure. Figure 4: Detailed Workflow 40793118 Ver 0.00a Page 120 of 150 Summary ___________________________________________________________________ This diagram can be broken down into following stages – 9.2.1 The Beginning: Member wants to purchase insurance The sales and marketing department approaches potential member(s). They collect the required information such as number of members, their age, previous medical history, income data, etc to prepare a quote. The actuaries calculate the rates for the various services to be offered by the insurance company. Based on these rates, the marketing department of the company creates a quote and presents it to the plan sponsor. If this quote is accepted, the underwriters validate the rates offered by the marketing department. Based on their judgment and experience they tailor the rates and prepare the details of plan coverage and commercial agreements. This data goes into an offer presentation, which is submitted, to the quote requester. If this is accepted by the quote requester, then the policy department of the insurance company prepares a policy which has details such as policy number, member number, type of plan, payment details, PCP information (in case of managed care plans), claim posting address amongst other things. Now the member is formally enrolled with the insurance company. If there was any broker involved in the deal, then the insurance company pays him a commission based on the size and nature of the deal. 9.2.2 Getting a provider For an insurance company to deliver healthcare services to its members, it needs to have an agreement with healthcare providers such as doctors, hospitals and pharmacies. Usually, doctors are contracted by paying them a fixed capitation fee (this is the case for most individual doctors). They can also be contracted in the form of an IPA or may be put on the payroll of the insurance company, as in the staff model. Hospitals and pharmacies are usually contracted on a volume-for-rebate basis. The insurance company guarantees an increased patient volume and they in turn give rate discounts to the members. But before the providers can become a part of the network they need to get accreditation from the relevant accreditation agencies. 9.2.3 An Enrolled member wants to seek medical services. If the member is enrolled in an Indemnity plan, then things are very simple. He can go to any provider of his choice. He pays the provider then and there and files a claim with the insurance company. However, it is necessary that he should have satisfied his deductible for that particular year. In case of managed care plans, the flow is a bit more complicated. The member first has to visit his PCP. The PCP will try to provide as many services as he can. But, if a medical condition arises which requires treatment from a specialist, the PCP will provide a referral to the member. This referral authorizes the member to seek medical services of a specialist provider. The PCP will also file a claim on behalf of the member. The member only has to pay fixed copay to both the PCP and the specialist. This is the flow in case of HMO and EPO plans. In case of POS and PPO plans, the member can seek services from out of network providers. However, they will have to meet a deductible before they can avail this facility. Also the concept of coinsurance will come into picture. In case of PPO plans the member has the added advantage that he does need to have a PCP for In-network care. 40793118 Ver 0.00a Page 121 of 150 Summary ___________________________________________________________________ 9.2.4 Member has filed a claim In most cases the claim is first validated for typographical and information errors by clearinghouses. Incorrect claims are returned back to the member (or his PCP whoever has file the claim). If the claims are found to be free of such errors, they are sent to the insurance company. The company validates the claims based on various factors (as were detailed out in the unit on claims). There is usually a rule engine (a software) in place for adjudication. If the claim is found to be a valid one, then the member is paid for his expenses. He is also sent an EOB detailing the payments made and the reasons for those. In case of the member having coverage with multiple carries, the primary payer takes care of the COB or coordination of benefits. In case the claims have incomplete information or the information is ambiguous, the claim examiners do the adjudication manually. If the claim requires very specialized processing (and if the rule engine for that is not available with the insurance company), then the claim adjudication is outsourced to a company specializing in adjudication of such claims. This helps reduce the burden on the insurance company and speeds up the process, as otherwise these claims would have to be adjudicated manually. The information about the entire processing is usually stored in a database for further reference. Claims adjudication requires a lot of information about various entities such as members, providers, policy that are stored in their respective databases. In short claims adjudication requires lot of database interaction and is the most complex of all processes. The turn around time take to process the claims is also an important consideration for members and providers. Hence the insurance companies try to reduce the time for adjudication by going automatic claim adjudication systems. 9.2.5 Effect of external agencies Health insurance is a highly regulated area in the U.S.A. There are several government agencies that help in regulation of the healthcare industry. The federal government too, plays an important role in shaping the way the industry functions. As a matter of fact, it was the path breaking HMO act of 1973, which paved the way for the managed care model, which has since then dominated the market. The federal spending on healthcare also has been on a steady rise. The government controlled Medicare and Medicaid are amongst the most important healthcare plans available. Accreditation agencies such as URAC (The American Accreditation Healthcare Commission/Utilization Review Accreditation Commission) play an important role in ensuring that only qualified providers are able to sell their services in the market. In addition there are several other agencies such as clearinghouses and third party administrators who help the insurance companies deliver better services to the members. 9.3 Review Questions. NA 9.4 References. 40793118 Ver 0.00a Page 122 of 150 Summary ___________________________________________________________________ 40793118 Ver 0.00a Page 123 of 150 Appendix ___________________________________________________________________ 10 Appendices 10.1 Appendix A: Total E-Business Services Forecast for Healthcare Total E-Business Services Forecast for Healthcare, by Region, 1998-2003 (Millions of U.S. Dollars) Healthcare 1998 1999 2000 2001 2002 2003 CAGR (%) Asia/Pacific 42,140 69,479 109,086 161,800 258,829 363,187 53.8 Canada 5,964 9,437 14,393 20,146 31,285 40,612 46.8 Europe 151,081 266,752 411,988 592,628 816,164 1,090,850 48.5 Japan 81,917 140,551 210,402 289,018 417,477 515,259 44.5 Latin America 29,749 45,834 66,144 91,122 141,314 194,674 45.6 Rest of World 5,444 10,020 13,523 17,805 25,931 32,668 43.1 United States 184,113 293,804 442,867 646,682 1,050,979 1,606,505 54.2 Total Healthcare Worldwide 500,408 835,877 1,268,403 1,819,201 2,741,979 3,843,756 50.3 Source: Dataquest (January 2000) 10.2 Appendix B: The world Healthcare market and Healthcare IT spending The US healthcare market is predominantly privately run. Whereas they are Tax based systems (all providers are government owned) are in vogue in UK/Australia. In Germany/ France, there are Insurancebased systems in which providers are subcontracted by the government. Other countries spend less on IT as a % of revenues- 1.5% in Europe, Japan and Australia. 40793118 Ver 0.00a Page 124 of 150 Appendix ___________________________________________________________________ Worldwide, investment in IT in healthcare is at a low of 3% as compared to an overall average of 6% and 12% for Financial services. Healthcare market, a core focus for most governments around the world will continue to grow as newer technologies and sciences (Genomics, Proteomics and Bio technology) revolutionize health care. (Source: Gartner Research, Inc) 10.3 Appendix C: The Cash Flux of the US Healthcare Industry Healthcare started in a “not for profit” mindset and that still has influence in decisions made in this sector, but the profit angle is increasingly focused on. Other countries spend less on healthcare than the US does because single payer systems tend to have efficiencies in purchasing, less choice to patients and administration efficiencies. (Source: Gartner Research, Inc) 40793118 Ver 0.00a Page 125 of 150 Appendix ___________________________________________________________________ US is the largest spender in this market, account for 43% of the world spending- US also leads in the IT development of this market. The total health care spending (by private and public in the US) is 1.3 Trillion, 70% of the Federal budget of the US- a whopping number by any standards. (Source: Gartner Research, Inc) 10.4 Appendix C: Sample Quote Sheet Page 1 XXXX Proposal For July 26, 2001 ABCDEF Inc Effective Date 10/01/2001 Renewal Date 10/01/2001 Service Area Colorado - Central Benefits For ZZZZ Plan Quote ID 7011968 Primary Office Visit Copay: ($5) Specialist Copay: ($5) SPU Surgery Copay: ($0) Hospitalization Copay/A: ($0) Emergency Room Copay: ($35) MH O/P Copay: ($25) 20v/cal Routine Eye Exam Copay: ($5) Routine GYN Exam Copay: ($5) 1v/yr Pediatric Preventive Dental Copay: ($5) Colorado Composite Rates Single Parent and Child(ren) Couple Family 40793118 $114.00 $264.60 $227.70 $413.30 Ver 0.00a Page 126 of 150 Appendix ___________________________________________________________________ The foregoing rates apply in the Service Area specified above. Rates will vary for other service areas. Service Area is determined by the location of the subscriber's primary care doctor. Quote Conditions Assumed Dependent Eligibility Dependent means a spouse, an unmarried child under nineteen (19) years of age, an unmarried child who is a full-time student under twenty-four (24) years of age and who is financially dependent upon the parent, and an unmarried child of any age who is medically certified as disabled and dependent upon the parent. Rates are pending approval by state regulators and are subject to adjustment based on regulatory determinations. These monthly quoted rates are valid as of the Effective Date and apply only to the benefit level and conditions stated above and are subject to the terms and conditions set forth in the HMO's Group Master Contract. Any changes in benefit level or conditions stated above may require a change in rates. This proposal is subject to change at any time prior to the acceptance by AUSHC of Employer's offer. Benefit Waiting Period (BWP) Standard BWP is 3 months minimum, 6 months maximum or match the incumbent carrier's BWP up to 6 months maximum. Employer Authorization ___________________________________ Date ______________________ CC: AAAAA BBBBBB For office use only Grp Type 10 Code P RA TR X Val'd Seq#/Grp# 058963- Quote ID 7011968 Rate Calc Customer ID 2254643 U PPID 532205 Colorado law requires carriers to make available a Colorado Health Plan Description Form,which is intended to facilitate comparison of health plans.The form must be provided automatically within three (3) business days to a potential policyholder who has expressed interest in a particular plan.The carrier also must provide the form, upon oral or written request,within three(3) business days, to any person who is interested in coverage under or who is covered by a health benefit plan of the carrier. There are two different rate structures available depending on the employer case size.Groups with 10 or more eligible employees have the right to see what the premium would be quoted either of two ways; a composite rate structure (an average rate based upon employee enrollment which vary by family status)or an age banded rate structure (a rate based on the age of the enrolledemployee). There are three different rate tiers available when electing the composite rate structure, i.e., (a) 2 tier which is average rate for employee only and employee/family,(b) 3 tier whichis an average rate for employee only,employee, spouse or 40793118 Ver 0.00a Page 127 of 150 Appendix ___________________________________________________________________ children and employee/family and (c) 4 tier which is an average rate for employee only,employee/spouse, employee/children and employee/family.Groups with under 10 employees may only elect an age banded rate structure. 07/26/2001 1:48:14 PM 7011882 LIFRAM12 40793118 Ver 0.00a Page 128 of 150 Glossary ___________________________________________________________________ 11 Glossary Benefit: (1) Right of the insured to receive either cash or services promised under the terms of an insurance policy. (2) A major line of coverage provided by an insurance company (i.e. Life, Medical, Dental, Long Term Disability, etc.) Co-insurance: A specific percentage of the cost of treatment the member has to pay for all covered medical expenses remaining after the deductible has been met. Co-Pay: The fixed amount, which the member has to pay for service availed from a provider. For e.g.: A member has to pay $5 every time he visits his PCP, his co-pay is $5. Deductible: The minimum amount, which has to be paid by the member to the insurance company before he can claim for benefits. Diagnosis Code : Code used for diagnosis that the patient has undergone. Insurer: The organization that provides insurance. Member: The person or group who seeks insurance. Network: A group of providers in designated areas who are contracted by the insurance company to provide healthcare services to its members. PCP: Or the primary care physician is a doctor contracted by the insurance company to manage the healthcare of a member. Plan: An agreement between the Insurance Company and the member that details the services that can be provided to the plan holders i.e. the member. A plan document identifies the benefits the members are to receive and the requirements they must meet to become entitled to those benefits. It covers aspects like – o Policy agreements, o What types of medical services will be covered, o What will be the maximum amount for which the member is covered, o What are the payments that the member makes? Policy: The legal document or contract issued by the insurance company to the member that sets forth the terms and conditions of the insurance. Premium: A fixed amount, which the member has to pay to the insurance company on a timely basis (annually/quarterly/monthly) as a fee for providing insurance coverage. Provider: The person or group that provides medical services. For e.g. doctors, hospitals, pharmacies all can be providers. Referral: An authorization from a PCP permitting a member to visit a specialist doctor for further treatment. Benefit Code : Code assigned to Benefits, benefits meaning Medical Services (Service Types say Surgery) Insurance company will pay for, fully or partially. 40793118 Ver 0.00a Page 129 of 150 Glossary ___________________________________________________________________ Rider : These are add-ons to basic plan at some extra cost and will cover additional benefits. Generally observed for Indemnity Plans. Capitation : Fixed amount of money paid to provider, on monthly basis and/or per member basis ,for full medical care of an individual. Primary care Physician : The physicians/doctors providing full range of basic health services to patients. The member is expected to consult its PCP first for any kind of health service for HMO care . Drug Code : Code for medication provided as a part of treatment. Proc/Service Code : Code for particular service coming under particular service type. The service is specific whereas service type is generic. Self Insured Groups : Some companies like (Eg. AT&T) makes contrat with healthcare companies for adjudicating claims for a fixed sum of money, where in the company (i.e. AT&T ) provides insurance for its employees by collecting money from them annually ( funding or contribution) . 40793118 Ver 0.00a Page 130 of 150