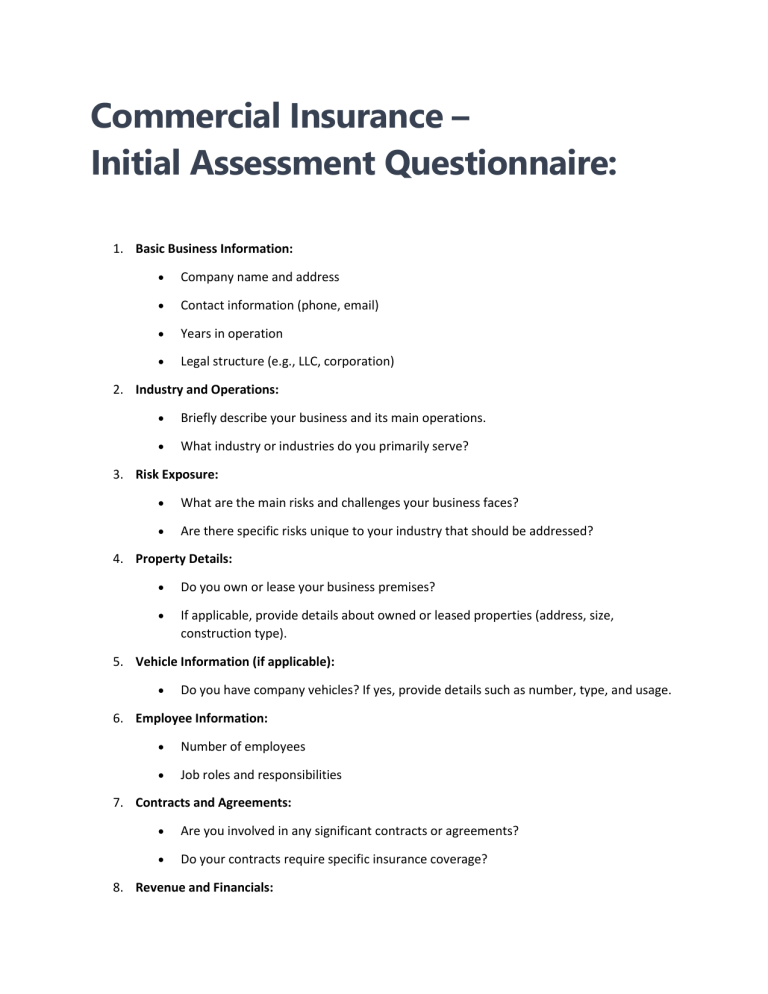

Commercial Insurance – Initial Assessment Questionnaire: 1. Basic Business Information: Company name and address Contact information (phone, email) Years in operation Legal structure (e.g., LLC, corporation) 2. Industry and Operations: Briefly describe your business and its main operations. What industry or industries do you primarily serve? 3. Risk Exposure: What are the main risks and challenges your business faces? Are there specific risks unique to your industry that should be addressed? 4. Property Details: Do you own or lease your business premises? If applicable, provide details about owned or leased properties (address, size, construction type). 5. Vehicle Information (if applicable): Do you have company vehicles? If yes, provide details such as number, type, and usage. 6. Employee Information: Number of employees Job roles and responsibilities 7. Contracts and Agreements: Are you involved in any significant contracts or agreements? Do your contracts require specific insurance coverage? 8. Revenue and Financials: Annual revenue for the last fiscal year Projected revenue for the upcoming year 9. Previous Insurance History: Details of previous insurance coverage (current carrier, coverage limits, any claims) 10. Specific Industry Requirements: For freight brokers: Do you handle cargo? If yes, what types and values? For mortgage brokers: Do you offer any financial or mortgage-related advice or services? 11. Professional Liability: Are you interested in professional liability (errors and omissions) coverage? 12. Safety and Risk Management Practices: Describe any safety measures or risk management practices in place. 13. Additional Coverages: Are there specific coverages or endorsements you believe are crucial for your business? 14. Future Plans: Any expansion or changes in operations planned for the near future?