Egypt Economic Analysis: GDP, Unemployment, Inflation 2019-2023

advertisement

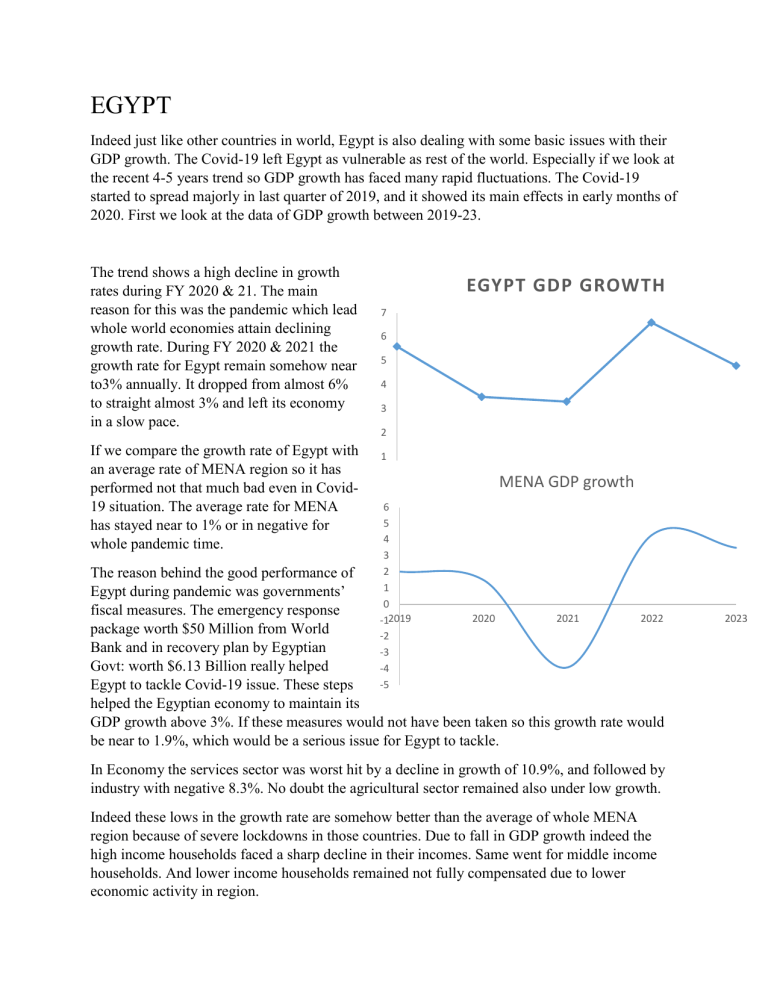

EGYPT Indeed just like other countries in world, Egypt is also dealing with some basic issues with their GDP growth. The Covid-19 left Egypt as vulnerable as rest of the world. Especially if we look at the recent 4-5 years trend so GDP growth has faced many rapid fluctuations. The Covid-19 started to spread majorly in last quarter of 2019, and it showed its main effects in early months of 2020. First we look at the data of GDP growth between 2019-23. The trend shows a high decline in growth rates during FY 2020 & 21. The main reason for this was the pandemic which lead whole world economies attain declining growth rate. During FY 2020 & 2021 the growth rate for Egypt remain somehow near to3% annually. It dropped from almost 6% to straight almost 3% and left its economy in a slow pace. If we compare the growth rate of Egypt with an average rate of MENA region so it has performed not that much bad even in Covid19 situation. The average rate for MENA has stayed near to 1% or in negative for whole pandemic time. EGYPT GDP GROWTH 7 6 5 4 3 2 1 0 2019 6 5 4 3 2 1 0 -12019 2020 MENA GDP growth 2021 2022 The reason behind the good performance of Egypt during pandemic was governments’ fiscal measures. The emergency response 2020 2021 2022 package worth $50 Million from World -2 Bank and in recovery plan by Egyptian -3 Govt: worth $6.13 Billion really helped -4 -5 Egypt to tackle Covid-19 issue. These steps helped the Egyptian economy to maintain its GDP growth above 3%. If these measures would not have been taken so this growth rate would be near to 1.9%, which would be a serious issue for Egypt to tackle. In Economy the services sector was worst hit by a decline in growth of 10.9%, and followed by industry with negative 8.3%. No doubt the agricultural sector remained also under low growth. Indeed these lows in the growth rate are somehow better than the average of whole MENA region because of severe lockdowns in those countries. Due to fall in GDP growth indeed the high income households faced a sharp decline in their incomes. Same went for middle income households. And lower income households remained not fully compensated due to lower economic activity in region. 2023 2023 The thing to worry for Egypt was a fear of long run decline in the Growth rate. Its fear was high level of poverty which would have prevailed due to decline in the economic activity. But from the graphs above we can see that Egypt gained its economic growth again after pandemic situation. It touched its 5 year maximum of above 6% in FY 2021-22. Talking about the prediction for FY 2023, so the GDP growth is again going to touch a lower position as compare to 5 year high. It will register a decline of GDP growth from 6.6% to almost 4.8%. The main reason to this decline will be the Russia Ukraine war. As Egypt is one of the worlds’ largest importer of wheat, with the high reliance on Russia for supplies. As well as the Egypt has good relations with west and sue to this cut of main food products supply will ineed lead Egypt in to huge problems? Again the Egypt might need to divert its sources of wheat import and it might again need some kind of fiscal measure to overcome the less economic growth rate. The unemployment rate indeed Unemployment rate % of labor force fluctuated between year 2019 and 2023. 10 This fluctuation and increase in rate 9 prevailed in 2021 with 9.33% of 8 unemployment rate. If we look for a 7 clear trend between the GDP growth 6 5 and unemployment rate so in year 2021, 4 22 remained aligned with it, but in year 3 2019 2020 and 23 showed some uneven 2 pattern. We know there is an inverse 1 relation between unemployment and 0 GDP growth. If we have higher GDP 2019 2020 2021 2022 growth so we have lower unemployment rate. It is because the higher GDP growth means higher level of economic activity, which means high number of production. This higher level of production is driven with high number of labor employed into the production process. So higher the GDP growth, lower the unemployment rate and vice versa. In year 2019 the GDP growth rate remained at 5.6% with unemployment of 9.17%. As pandemic prevailed in last quadrant of 2019, so the GDP growth shrink to 3.5%. As there was a decline in the GDP growth rate, so it would have been followed by a higher rate of unemployment, but the figures show an opposite picture with a decline in unemployment. After that in year 2021 and 2022 we see an expected and general trend between unemployment and GDP growth. In 2021 the GDP growth showed more downward trend, with and increment in the unemployment rate. This was because of high lockdown and closer of industries due to Covid-19. In 2022 we see again acceptable trend. In 2022 we saw some recovery in GDP growth. Higher GDP growth of 6.6% managed the unemployment rate to 2023 decline from 9.33% to 7.4%. In 2023 the trend is again predicted to be in same directions. The decline in GDP growth is followed by decline in unemployment rate. Comparing the unemployment rate of Egypt with the MENA region average rate of unemployment, so MENA region remained with unemployment rate of almost 10% for consecutive 3 years of 2019, 20, 21. In comparison to MENA the Egypt has sustained a sound and decent unemployment rate. So keeping in view of Covid-19 situation Egypt average unemployment rate was almost 8% from 2019-23 this rate was not too high. Many countries in world witnessed inflation rates more than 15-20%. So in comparison, due to macro intervention by government, Egypt maintained its unemployment rate lower than world average in Covid-19, and is projected to keep it below world average even during 2023 (Which will be affected by Russia Ukraine War). Inflation rate 18 16 If we look at the inflation term so, it 14 defines the weighted average growth in 12 prices of general usage commodities or 10 we can say a growth in yearly CPI. The 8 inflation in Egypt followed the GDP 6 growth rated and remained aligned with 4 it. Before Covid-19 the inflation stood 2 at almost between 8-10% annually. 0 2019 2020 2021 2022 Then as the pandemic prevailed, the average price growth declined and hit its at least lowest of 5 years in end of 2020. We know the inflation in any economy not just indicated the increase in price level, but it also indicated the level of economic activity in the country. Because as the Economic activity increases the job opportunities for people increase, and as people get more jobs so they get more in form of income, and as they get more money in form of income, do the demand more. As supply in economy remains constant, so excessive demand in economy causes inflationary pressure. In Covid-19 times the inflation rate started facing downward due to less economic activity and uncertainty in the economy. The closer of industries and lockdown managed the inflation rate below its potential. Inflation rate tells that by what pace the Aggregate demand in the economy is growing. So decline in the Aggregate demand leads to lower supply in the economy followed by low production and ultimately leading to low inflation rate. As the pandemic ended so Egypt 2023 economy showed once again an economic recovery. This recovery included the GDP growth. The GDP growth was followed by higher and growing inflation rate. Indeed post Covid-19 inflation was not best indicator of economic activity, because this inflation also included the effect of demand pull inflation, which is usually not considered as long term inflation, but is just due to excessive demand I market for a time spare. As economies opened after the Covid-19, the people started to demand more goods and services, which created both demand pull and cost push inflation. So the growth in inflation rate after covid seems bit abnormal. Pre covid inflation rate was 9.15% and after recovery from pandemic the inflation rate stood at 16.2%. This inflation included both speculative and cost push inflation. If we compare the inflation rate of Egypt with other MENA countries, so Egypt maintained its average inflation rate of 9.4%, while MENA countries faced below 1% inflation rate, signaling for lowest economic activity during covid. If we notice, so after recover from pandemic in 2022, in2023 the Egypt had to sustain its inflation to support its economic recovery, but the projected inflation figures for future show the effect of Russia Ukraine war which will slow down the economic activity. Indeed inflation remained too high in Egypt as compare to other countries, but again inflation rate works as accelerator for economic growth. The issue comes when this high inflation persists for a long term. Indeed long term inflation is a bad sigh for an economy, because it keeps devalue our purchasing power more than its growth. And in long run this persisting inflation can result in long recession. Budget deficit is a term explaining itself. It counts for the deficit from budget Govt: faces. If we explain it more so there are two components for budget deficit or surplus. The first if Revenue for government (In form of Taxes), and second one is Expenditures that government do (counted as government expenditures). Govt: Budget deficit related to GDP 0 2019 -1 2020 2021 2022 -2 -3 -4 -5 -6 -7 The term deficits shows when we lack in -8 the positive term. Here the taxes that government collect every year are allocated to expenditures in advance. If the expenditures that government do are more than the revenue that government collect in form of taxes so we say that the budget deficit is prevailing. 2023 The graph above shows the budget deficits for Egyptian government for 5 years. We can note that the Egyptian economy is constantly facing budget deficits. The trend is bit unusual for 5 years. Trend remained good for 2019, but it started to decline as next year came in 2020. The reason for this decline in budget deficit is pandemic. Actually if we see what is budget deficit consisted of. It includes collection of taxes and expenditure done. So during the pandemic the government gave a lot of tax exemptions to different sectors of economy as well as there was low economic activity, so less government expenditures we also supposed to be done. Those low level of tax collection and lower level of government expenditures and foreign ads helped the Egypt to maintain a low level of Budget deficit. The budget deficit in Egypt did not stood at very high level. It remained at average rate of almost -7.122% annually. Indeed indebtedness is a big concern for Egypt, because every year more than half of the government revenue goes in to debt services, and keep Egypt a pray to default situation. Indeed a high foreign assistance can be solution for this high indebtedness. More FDI and foreign inflows can also work to mitigate some effects of high indebtedness. Even after devaluing their currency to help debt, the values of it remained somehow 10-15% above its value. Along those Fiscal measures the application of tight monetary policy can also be effective to control the situation looming. So all tight fiscal and monetary policy along with currency flexibility can be a way to solve issue of indebtedness. The Egypt being a net oil importer country can be highly effected by current oil price fluctuations. Even in 2019 the Egyptian government said that a $1 increase in per barrel price of oil will coat then 4 billion Egyptian pounds. This high uncertainty in international oil market can hurt the Egyptian budget position more and more. The question is why this increase in price is an issue for oil importing counties. It’s because as one economy spends more amount on oil imports than previous, than it can spend less amount on other projects and expenditures. So in case of Egypt the increase in prices will make tough times for economy and can make looks its economic growth outlook problematic. As the prices so up, so now the government has to keep more reserves for oil importing, Not only this but if the oil prices go up, so the prices for energy production will also go up with it, which in end creates the inflationary situation in the economy. On the same time the Egyptian government has also removed the oil subsidies and on other side prices are increasing, so final result will be a negative impact on fiscal levels of government. It will make the fiscal deficit or called budget deficit to go up. This effect of high prices followed by high inflation will make the central bank to opt for the tight monetary policy in present time as well as future. If we look at this trend of increase and more fluctuations in the oil prices all over the world, so many economists believe that this hike is more of due to geopolitical reasons rather than the economic and market reasons. So in the last we can say that the fluctuations in oil prices for Egypt are not good sign, because it will increase the fiscal deficit more and put pressure on it. CA deficit The current account deficit is a negative big push in its value. First we need to understand what is Current account. Mainly the current account of any country consists of two factors, the imports and exports. The positive value of current account shows the more value of exports as compare to imports for an economy. 0 -0,52019 -1 -1,5 -2 -2,5 -3 -3,5 -4 -4,5 -5 2020 2021 2022 Indeed there are other factors also included into the current account, but for now there are only these two factors of most importance. So current account deficit happens when a country imports more goods and services from the world than it exports to the world. So if we look at the data for the Egypt so it shows a looming trend for 5 years. Indeed for all respective years the Egypt has remained the deficit facing country, which proves the statement the Egypt is a net importer from the world. In pre covid time the deficit was stable neat to 3.5% and as the world went into pandemic so Egypt gained much more of the budget deficits. Its deficits moved up from negative 3.4 to negative 4.6. This surge in current account deficit shows that the exports of Egypt fall in time of pandemic and the FDI also decreased with decreased in tourism, so net inflows slowed down which made the imports to look usually higher than the imports. Than after the recovery started the current account also started to show a low deficit numbers. Eventually in end of 2022 the Egypt is projected to give lower current account deficits than even the pre covid time. The prediction for 2023 goes with lowering the current account deficit to minimum of negative 2.6%. Yes there can be a risk for Egyptian economy if this current account witnesses higher deficits. This is because the fluctuations in international commodity prices (All food and energy), can make this current account situation go worse and worsen its position. Because a country like Egypt which is already facing the debt issues, it is not easy to maintain the high level of reserves just to keep up with the price fluctuations in the international market. 2023 If we talk about the overall macroeconomic condition of Egypt so it has positive edge at many places, but it suffers from a lot of issues. The Egyptian economy did well in the pandemic situation and sustained its economic indicators on the track whereas rest of the world including giant economies were suffering from it. So pandemic wise Egypt got a margin, but Egypt should be careful from the situations that are ahead of it in the future. The high number of foreign and domestic debt, high number in the Budget deficit, high number in current account deficit, , high number of unemployment, high number in inflation, low number in economic growth and all these indicators are signing the Egyptian economy that tough times can prevail in future if not right decisions are taken to control them in time. The tight fiscal as well as tight monetary measures are needed to overcome the heated up economy. In fiscal measure the government can launch the emergency financing programs, bailout packages for domestic producers, tax incentives, spending on infrastructure, spending on education and many more such positive fiscal measures. In monetary terms, the central bank should focus on keeping the inflation in check as needed to promote the economic growth, keep unemployment rate in line, and manage the money supply in the market to control the Aggregate demand and maintain price stability.