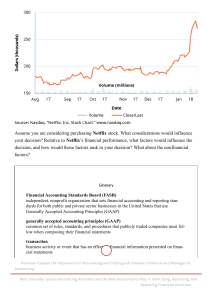

This article talks about the effect of restricting password-sharing on Netflix and the increase in subscription plan prices in the US, UK and France, on the number of its subscriptions. Therefore, before deciding to crack down on passwords and increase prices Netflix should have considered the law of supply and demand and the elasticity of both curves. The law of demand is the inverse relationship of quantity demanded and price whereas the law of supply is the direct relationship between quantity supplied and price. Therefore, as Netflix would have increased their prices they would have experienced a decrease in the quantity demanded, assuming demand is elastic and password restriction could go both ways as people having shared accounts could potentially give up their subscriptions or could have resulted in new subscribers-increasing demand. Therefore, if the demand of new subscribers increases, the Demand curve will shift to the right resulting in higher equilibrium price and quantity. When prices increase quantity supplied increases, but this is a streaming service so it could scale up production. However, Limiting password sharing can be seen as a reduction in the effective supply of the service since fewer people can access it without paying. This could lead to a leftward shift in the supply curve. This, combined with the potential increase in prices, could result in a higher equilibrium price but a lower quantity. Hence the overall effect of equilibrium quantity will depend on the magnitude and elasticity of the curves. The observed outcome indicates that despite the price increase and crackdown on password sharing, demand for Netflix appears to be relatively inelastic, given the significant gain of 9 million subscribers. Through this strategy, Netflix aimed to change non-paying users to paying subscribers resulting in an increase in demand which shifts the demand curve to the right. Also, the people subscribing individually results in an increase in quantity demanded at any given price. Also, this caused the supply curve to shift left and prices to go up. However, the supply curve is highly elastic because as prices go up the quantity supplied increases - in this case Netflix is able to generate new subscriptions (increase in demand). The combination of inelastic demand and elastic supply suggests that Netflix may successfully increase prices without a significant drop in quantity demanded, contributing to enhanced revenue and growth. Moreover, Netflix is competing in an Oligopolist market structure so Netflix should have considered the consumer behaviour within the streaming industry. Thus, an increase in Netflix’s pricing and a change in service policies would have prompted a response from competitors like Amazon Prime or Disney+. Nevertheless, if the competitors hadn’t increased their prices Netflix’s demand curve would have been highly elastic (kinked demand curve concept) making other platforms highly substitutable for consumers to shift to. This means that Netflix would have a greater risk of losing subscribers unless Netflix has strong brand loyalty for its services. In short, to make such changes it is important to anticipate outcomes and potential risks of the actions.