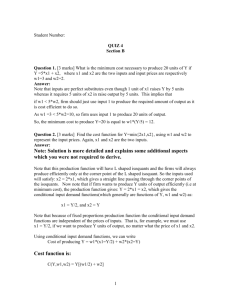

MICROECONOMICS 2112 Topic 3: Production theory Topic 4: Theory of Costs 1 Outline Production theory Organization and objectives of the firm Baumol’s theory of sales revenue maximization Production functions Equilibrium of the firm A single-product firm A multiproduct firm Theory of costs Cost minimization and input choices Comparative statics of the cost minimization solution changes in input prices Change in the output level Cost functions Short-run analysis and long-run distinction 2 References Koutosyiannis, A (1986), Modern Microeconomics (2nd Edition). Macmillan Publishing Co. Ltd [Chapters 3 – 4, Chapter 15] Mansfield, E (1991),Microeconomics, 7th Edition. W. W. Norton and Company [Chapters 7 – 8, Nicholson, W (1992), Microeconomic Theory: Basic Principles and Extensions, 5th Edition. Hracourt Brace Ionanovich College Publishers, London Salvatore, D (2003), Microeconomics: Theory and applications, 4th Edition. New York: Oxford University Press Browning, E.K. & Zupan, M.A. (2005), Microeconomic Theory and applications (9th Edition). Whitehouse Station: John Wiley Curtis E.B. & Diane F.E. & Douglass .W. Allen (2009), Microeconomics: Theory with applications (7th Edition). Pearson Education Canada 3 Introduction: theory of the firm What is a firm? • It is basically a unit that produces a good or service for sale – Ask class to list some common firms they know in the country/ internationally • How? – by combining F.O.Ps – class to identify the main FOPs • Common types of firms include: - class to define/ research – Sole proprietorships – Partnerships – Corporations 4 Introduction: theory of the firm • The main focus of the topics we shall cover is “what influences firm behavior” • Regardless of the type, the main categories of decisions firms (owners) have to deal with are: 1. The amount of funds to spend on inputs (e.g.) 2. The amount of funds to spend on each input (e.g.) 3. The quantity of each input to be allocated to the production of each output (e.g.) 4. The quantity of each final product to be produced (e.g.) 5 Introduction: theory of the firm • 2 main theories are thus considered in the analysis of firm behavior: – The theory of production – analyzing the relationship between inputs and outputs (i.e. how much/what quantity of the input/FOP is needed to produce a given output level) – The theory of costs – looks at the relationship between the levels of output and the levels of costs (i.e. how much will it cost to produce a given level of output) • The prevailing assumption underlying the analysis of firm behavior is that of profit maximization 6 Introduction: theory of the firm • We assume that a firm’s main objective is to maximize profits – Based on the marginalist principle. – That economic decisions are made at the “margin”. – i.e. the value of that additional unit determines the decision the economic agent will make. – Draw a parallel to the concept of marginal utility – as the MU of a particular good decreases, less units of that good will be consumed – For the case of firms, consider, the marginal product (MP), marginal costs (MC), marginal revenue (MR) – Ask group to define/recall each 7 Introduction: theory of the firm • Profits maximization occurs where/ when MR = MC – a firm will continue to produce a good or service as long as MR > MC – When MR < MC, the value/ revenue of producing an additional unit of a good is not worth its cost • Is profit maximization, however, always the sole objective of a firm? 8 Introduction: theory of the firm • Main criticisms of the profits maximization goal: – Uncertainty of firms – firms do not have all the necessary information to (pre-) determine the level of profits – Profit maximization is not always the sole objective of firms. • Other objectives include; – – – – – Sales revenue maximization/ managerialism Long-run/ term survival Market sharing Reputation building (good image) Sustainability considerations the triple bottom-line 9 Introduction: theory of the firm A brief look at the managerialism objective: • A modern firm (large corporation) is viewed as a coalition (of managers, workers, suppliers, customers, stock holders, etc.) • All have conflicting goals that must be reconciled if the firm is to survive. • Most important member is “top management” – have decision making powers, info access, set goals, hiring etc. • Main x-tic is the separation of ownership from management 10 Introduction: theory of the firm • The owners, i.e. the shareholders, are diverse, numerous, differ in size/ scale; and are rarely involved in the day-to-day running of the firm. • Which gives the managers leeway to pursue their own objectives besides profit maximization. • Profit maximization is the owners’ objective (dividends are paid from profits). • However, the managers must deliver an acceptable level of profits (+ other conditions) to ensure their job security • The main premise is that managers maximize their own utility subject to a minimum profit constraint. 11 Introduction: theory of the firm The principal – agent problem • Mainly arises in large corporations with a separation of ownership and control of the firm – Owner’s (the principal) objective –> maximize profits – Manager’s (the agent) objective –> maximize benefits accruing to them (e.g. salaries, bonuses, etc.) • The agent works for the principal, but would rather pursue their own objectives • The principal – agent problem arises because of this conflict of interest • Overcoming it –> contracts incentivizing “good behavior”/ an alignment of both camps’ objectives e.g. stock options 12 Introduction: theory of the firm Baumol’s theory of sales revenue maximization • Offers justifications of why a firm’s goal may be sales revenue maximization rather than profit maximization • The separation of ownership and management gives managers discretion to pursue own objectives rather than the owners’ profit maximization goal • Managers more preoccupied with sales revenue maximization Why is this? - Salaries and benefits of managers tied more to the sales revenue than profits - Banks and financiers are more willing to finance firms with large and growing sales - Personnel problems are better handled when sales are ↑13 Baumol’s model: rationalization - - • Large and growing sales overtime are a source of prestige for managers (profits go to shareholders) Managers prefer steady performance with satisfactory profits rather than high profits (may not be easy to outdo profit targets period after period) High and growing sales enable a firm consolidate its market position Baumol presents 2 basic models to explain this behaviour: – The static single period model, – The multi-period dynamic model of growth of sales revenue maximization • We shall consider the static one – period model 14 Baumol’s model Basic assumptions of the static model • The time horizon of the firm is a single period • The goal of the firm during this period is sales revenue maximization s.t a profit constraint • The minimum profit constraint is exogenously determined (by shareholders, banks, financiers etc.) • The firm produces a single product • The firm does not advertise • The traditional costs and revenue curves are assumed 15 Baumol’s model Illustration of the firm’s equilibrium 16 Baumol’s model • • • • • • The total sales revenue will be maximum at the highest point of the TR curve TR2 (here MR = 0) It is output level OD, corresponding to TR2 which maximizes the sales revenue. (and so the ideal production point for the sales revenue maximizing firm) Whether this maximum sales revenue level is attained will depend on the minimum acceptable profit level. If the minimum acceptable profit level is given by TL, the sales maximizing firm will not be able to produce output level OD, but will rather produce output level OC which satisfies the minimum profit constraint. Earning profit at point G and sales revenue TR1 . 17 Profit level TL is thus called the operative profit constraint Baumol’s model Implications of the model: • The sales revenue maximizing firm will be sell its output at a lower price than the profit maximizing firm. – • • The price at any given level of output is the slope of the line drawn from the origin to the corresponding point on the TR curve. The sales revenue maximizing firm will produce a higher level of output compared to the profit maximizing firm. The sales revenue maximizing firm will earn lower profits than the profit maximizing firm – – The profit maximizing firm would produce output level OB, where the profit attained is highest at point F. The sales revenue maximizing firm produces output level OC earning profits at point G. 18 Baumol’s model Implications of the model: • Both firms will produce where the price elasticity is greater than 1, i.e. where demand is elastic – Recall that the relationship between MR and price elasticity is given by; 1 𝑀𝑅 = 𝑃 1 − 𝑒 When 𝒆 < 𝟏, 𝑴𝑹 < 𝟎 implying that TR is declining. – Maximum sales revenue occurs where 𝑴𝑹 = 𝟎, and 𝒆 = 𝟏. Maximum sales revenue is only attained when the profit constraint is non-operative. If the profit constraint is operative, 𝒆 > 𝟏 19 Baumol’s model Effects of changes in costs on the equilibrium of the firms: • The effect of an increase in costs on the equilibrium of the sales revenue maximizer and the profit maximizer is summarized below: Cost type Fixed costs Variable costs Firm objective Sales revenue maximizer Affects equilibrium - ↓ output level - ↑ prices - Cost increase shifts ∏ curve downwards Profit maximizer No effect on equilibrium price & output - Reduction in profits Both affected since profit curve shifts down and to the left. - ↓ output level - ↑ prices Output reduction greater for the sales revenue maximizer See illustrations of new positions explained above in the course texts/ handout. 20 Baumol’s model Criticisms of the Baumol model: • Difficult to know the relevant level of the profit constraint due to uncertainty in the firms • Based on the implicit assumption that the firm has market power; i.e. has control on its price and expansion policies and can take decisions without being affected by competitors’ reactions • Model ignores competition (both actual and potential) from rival firms • Doesn’t establish the relationship between the firm and industry, i.e. if all firms in an industry are sales maximizers, how will the industry equilibrium be attained? 21 • Firms do advertise, as a non-price competition tool Theory of Production • The theory of production seeks to analyze the relationship between inputs and outputs • i.e. how much/what quantity of the input/FOP is needed to produce a given output level – A key determinant of a firm’s behavior is the state of technology • How to combine the available inputs to produce desired output level. – This relationship between inputs and outputs is summarized by the production function 22 Production functions • • The production function summarizes the technical conditions facing the firm. It expresses the technical relationship between the inputs used per period of time and the output of the firm produced per period of time. – It represents the technology of a firm of an industry or the economy as a whole. – Technological progress changes the production function • Mathematically expressed as: 𝑸 = 𝒇 𝑳, 𝑲, 𝑺, 𝑹 … , where L, K, S, R represent such inputs as labor input, capital input, land input, and other raw materials. All other inputs typically lumped into the capital input 𝑸 = 𝒇 𝑳, 𝑲 . 23 Production functions • The analysis of firm behavior particularly focuses on 2 time periods/ production horizons – The short run – time period in which some of the firm’s inputs are fixed. (Q: which ones would these typically be?) – The long run – time period long enough that all the firm’s inputs are variable – The decisions available to the firm will obviously vary depending on the time period. • • What follows is a look at the associated laws of production. The laws of production describe the technically possible ways of increasing production. 24 The short run production function • In the short run, some inputs are fixed while others can be varied. Typical consideration is of a production function with a single variable input (usually labor) The law of variable proportions or the law of diminishing returns • Describes the rate of change of the firm’s output in response to a change in one of the inputs with one or more inputs held constant. (i.e. how does output change as more units of the variable input are applied to the fixed input?) – – Ceteris paribus, as equal units of a variable input are applied to fixed amounts of other factors per unit of time, after a certain point, the resulting increases in total output become smaller and smaller. i.e. the increase in output per unit change of the variable output will fall. 25 The short run production function Illustration: Production function with a single input 26 The short run production function – Increasing one variable input while others are held fixed, the resulting output increases first at an increasing rate, then at a constant rate and then at a decreasing rate • The laws of return – Law of increasing returns – the %age increase in output is greater than the %age increase in the variable input – Law of constant returns – the %age increase in output is equal to the %age increase in the variable input – Law of diminishing returns – the %age increase in the output is less than the %age increase in the variable input 27 The short run production function • The law can be stated in terms of the behavior of any of the 3 curves: – Total product (TP) – total output produced by total units of input employed. – Average product (AP) – output per unit of input employed. Graphically, the AP is the slope of the straight line drawn from the origin to the TP curve 𝑻𝑷 corresponding to that output level; 𝐴𝑃𝐿 = 𝑳 – Marginal product (MP) – the unit change in output resulting from an additional unit of input employed. Graphically, the MP is the slope of a tangent line drawn 𝒅𝑸 on the TP curve; 𝑀𝑃𝐿 = 𝒅𝑳 28 The short run production function Illustration: relationship between MP and AP 29 The short run production function The stages of production • The relationship between the TP, MP and AP curves can be used to explain the 3 stages of production. 30 The short run production function The stages of production • Stage I: – Starts from zero output to maximum AP. At APmax , AP = MP. – Known as the stage of increasing returns. As more units of the variable factor are added to the fixed factors, TP increases at an increasing rate up to a point. – The MP curve first rises then falls; the AP curve rises throughout but remains below the MP curve. – This region is referred to as the region of increasing resource productivity or the extensive region. [labor specialization gains] 𝑴𝑷 – The elasticity of production, (𝒆𝒑 = 𝑨𝑷 ), is the %age change in output relative to a %age change in the variable factor. – In this region, 𝒆𝒑 > 𝟏, a unit increase in input leads to more than a unit change in output. 31 The short run production function The stages of production • Stage II: – Starts from maximum AP to zero MP. (TP is at the maximum level) – TP is increasing but at a decreasing rate, MP and AP are all declining though still positive. – Known as the stage of diminishing returns. – The optimal combination of factor inputs is achieved during this stage. – Referred to as the economic region of production or the region of declining resource productivity. – Firm has exhausted its ability to increase labor productivity through specialization – As long as MP is greater than the additional costs of the input, it pays for the firm to increase production. 32 The short run production function The stages of production • Stage III: – Starts from maximum TP (MP = 0). – This is the range over which MP is negative. Increasing the units of labor yields smaller TP. – Region is known as the intensive region. All curves are declining. – No rational firm is hiring labor in this region. – At the intensive margin, 𝐞𝐩 = 𝟎, the proportionate increase in output is less than the proportionate increase in labor. – Diminishing total returns occur because of the fixed quantity of the fixed input; e.g. size of the plant. – As more workers are hired, the limited space will become a constraint to efficient working; coordination also becomes difficult 33 The short run production function The stages of production • The relationship between the TP, MP and AP curves can be used to explain the 3 stages of production. • Mark the stages as explained above on the diagram on the slide that follows: 34 35 The short run production function DIY: check your understanding The table below represents a hypothetical short-run production function for wheat. Work out and plot the respective curves for TP, AP and MP. Mark the 3 stages of production on your graph. Labor units Total product 0 0 1 3 2 8 3 12 4 15 5 17 6 17 7 16 8 13 Average pdt? Marginal pdt? 36 The short run production function DIY: check your understanding - Fill in the blanks in the table below. - Does the production function exhibit diminishing marginal returns? At what units of labor do they begin to set in? Labor units Total product Average pdt? Marginal pdt? 3 --- 30 unknown 4 --- --- 20 5 130 --- --- 6 --- --- 5 7 --- 19.5 --- 37 The long run production function • Here the production horizon is long enough that all inputs are variable. • Typical consideration is of production functions with two variable inputs (capital and labor) • The laws of production used for the long run analysis of production are the laws of returns to scale. • The laws of returns to scale refer to the changes in output as all factors vary in the same proportion; i.e. how output responds in the long run to changes in the scale of the firm. Side bar: - the answer to the above question helps determine (in part) whether firms of different sizes can survive in the industry. • 3 possibilities thus come up:- increasing, constant or decreasing returns to scale. 38 The long run production function • • Consider a production function given by; 𝑿𝟎 = 𝒇 𝑳, 𝑲 , and all factors are increased by the same proportion k. A new level of output, 𝑿∗ is obtained where 𝑿∗ = 𝒇 𝒌𝑳, 𝒌𝑲 Increasing returns to scale if the increase in output 𝑿∗ is larger than the proportionate change in the inputs Constant returns to scale – if the increase in output 𝑿∗ is equal to the proportionate change in inputs Decreasing returns to scale – the increase in output 𝑿∗ , is less than the proportionate change in inputs • The production function is said to be homogenous if the factor k can be factored out of the function. Otherwise it is a non-homogenous function – The new level of output can be expressed as a function of the initial 39 output level and the factor increase. The long run production function That is: Given 𝑋0 = 𝑓 𝐿, 𝐾 And the factor inputs are increased by the same proportion, k 𝑋 ∗ = 𝑓 𝑘𝐿, 𝑘𝐾 Factoring out k 𝑋 ∗ = 𝑘 𝑣 𝑓 𝐿, 𝐾 𝑿∗ = 𝒌𝒗 𝑿𝟎 • The power v of k in the above equation is the degree of homogeneity and is a measure of the returns to scale. i.e. if: 𝒗 = 𝟏 ?? returns to scale 𝒗 < 𝟏 ?? returns to scale 𝒗 > 𝟏 ?? returns to scale 40 The long run production function • The returns to scale are measured mathematically by the coefficients of the production function. • Consider a Cobb – Douglas production function given by: 𝑸𝟎 = 𝒃𝑳𝜶 𝑲𝜷 The returns to scale for this function are measured by the sum (𝜶 + 𝜷) Proof: Increasing inputs K and L by a factor µ, will give a new level of output given by: 𝑸𝟏 = 𝒃(𝝁𝑳)𝜶 (𝝁𝑲)𝜷 𝑸𝟏 = 𝒃𝑳𝜶 𝑲𝜷 𝝁𝜶+𝜷 𝑸𝟏 = 𝝁𝜶+𝜷 𝑸𝟎 E.g. Suppose the production function of a good is given by; 𝑄 = 10√𝐿√𝐾 What returns to scale does the function exhibit? Explain your answer 41 The long run production function Linearly homogenous production functions: • A production function is said to be linearly homogenous if the degree of homogeneity is 1. i.e. 𝑓 𝜇𝐿, 𝜇𝐾 = 𝜇1 𝑓 𝐿, 𝐾 = 𝜇𝑓 𝐿, 𝐾 • Therefore it exhibits constant returns to scale output increases by the same proportion as the increase in the inputs. • APL and APK remain unchanged if K and L are changed by the same proportion (the K-L ratio is constant). • MPL and MPK remain unchanged if K and L are changed by the same proportion (the K-L ratio is constant). 42 The long run production function Illustration of the production function with 2 variable inputs • In this case, there are/ will be quite a number of different ways in which to produce a given level of output. • The production function in this case is a bit more complicated will be a 3-dimensional plane • But is simplistically represented/ illustrated by what we call isoquants. • An isoquant therefore shows all the possible combinations of labor and capital with which a firm can produce the same quantity of output. • Recall that in the long run analysis, a firm’s decision revolves around the scale of production – To increase the scale of production/ expand operations through going more labor intensive or capital intensive? 43 The long run production function • Therefore, isoquants help us analyze the trade-offs that real firms have to make regarding input substitution. 44 The long run production function • Isoquants help us analyze the trade-offs that real firms have to make regarding input substitution. – Moving from combination B to D, the firm will have to substitute more labor units for capital – i.e. the production process becomes more labor-intensive • Isoquants have similar properties like the indifference curves seen in consumer theory. Class to list/recall these properties • Production rays or processes, on the other hand, are lines drawn from the origin through the isoquants. – Along the ray, output level changes but the input (K – L) ratio is constant – Along the isoquant, the input (K – L) ratio is changing but output level remains constant. • The degree of substitutability among the variable inputs will determine the steepness/ curvature of the isoquants 45 The long run production function • The “steepness” of an isoquant determines the rate at which the firm can substitute between labor and capital in its production process. • This steepness is measured by the marginal rate of technical substitution of labor for capital (MRTSL,K) • The (MRTSL,K) implies/ tells us the following: – By how much capital must decrease for every unit increase in labor to maintain a constant level of output OR – By how much capital must increase for every unit decrease in labor to maintain a constant level of output. • The (MRTSL,K) is therefore the slope of the isoquant at a given point. 46 The long run production function • The (MRTSL,K) is therefore the slope of the isoquant at a given point. 47 The long run production function • The relationship between the MRTSL,K and the marginal products, MPL and MPK can be shown by: – Recall that with all inputs being variable, ∆𝑄 is the sum of the change in output from a change in K and a change in output from a change in L, which can be expressed as: ∆𝑄 = ∆𝐾𝑀𝑃𝐾 + ∆𝐿𝑀𝑃𝐿 But along the isoquant, ∆𝑄 = 0,. Therefore, −∆𝐾𝑀𝑃𝐾 = ∆𝐿𝑀𝑃𝐿 − Recall that − ∆𝐾 ∆𝐿 ∆𝐾 𝑀𝑃𝐿 = ∆𝐿 𝑀𝑃𝐾 = 𝑀𝑅𝑇𝑆𝐿,𝐾 , therefore 𝑴𝑷𝑳 𝑴𝑹𝑻𝑺𝑳,𝑲 = 𝑴𝑷𝑲 If at a given input combo, 𝑀𝑃𝐿 = 10 and 𝑀𝑃𝐾 = 2, what substitution decision will 48 the firm make? The long run production function Substitutability among inputs: • Beyond the degree of substitutability among the factor inputs, it is important for a firm to know how easy the substitution will be. – i.e. as the relative factor prices change, how easily can the firm shift from a labor-intensive process to a capital-intensive one and vice-versa? – Recall the COVID-19 situation and the transition to remote systems – The evolution of the service delivery channels in the TELCO and banking industries. – What observations can you make from these 2 cases? • The elasticity of substitution is a numerical measure of how easy it is for a firm to substitute among factor inputs. – It measures how quickly the MRTSL,K changes as we move along the isoquant. – It is equal to the %age change in the capital – labor ratio for every 1% change in the MRTSL,K 49 The long run production function Illustration of elasticity of substitution – As labor is substituted for capital, the capital – labor ratio, K/L, must fall. The MRTSL,K also falls. 50 The long run production function • The elasticity of substitution is calculated as: 𝜎= %𝑎𝑔𝑒 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 − 𝑙𝑎𝑏𝑜𝑟 𝑟𝑎𝑡𝑖𝑜 %𝑎𝑔𝑒 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑀𝑅𝑇𝑆𝐿,𝐾 𝐾 %∆ 𝐿 𝜎= %∆𝑀𝑅𝑇𝑆𝐿,𝐾 • • The value of σ lies between 0 and infinity; i.e. 0 ≤ σ ≤ ∞. What is the significance of the elasticity of substitution? – – If σ is close to 0, there is little opportunity to substitute between inputs If σ is large, there is substantial opportunity to substitute between inputs. Special production functions • The isoquants may take on different shapes depending on the degree of substitutability between factors. 51 The long run production function 1. The linear production function perfect substitutability – – – – Factor inputs are perfect substitutes Assumes output can be produced using only one/ either of the 2 inputs MRTS is constant σ=∞ 52 The long run production function 2. Fixed-proportions production function perfect complements - Factor inputs are perfect complements// one way of producing the output 𝜎=0 No flexibility in substitution among inputs 53 The long run production function 3. Cobb-Douglas production function - K and L can be substituted for each other continuously over a certain range MRTS is not constant along the isoquant and 0 < σ < ∞; usually = 1 54 The long run production function • The Cobb-Douglas function is the most popularly used in applied research and can be used to illustrate the concepts introduced. • Consider a production function given by the form: 𝑿 = 𝑨𝑳𝜶 𝑲𝜷 • Prove that: 𝑴𝑷𝑳 = 𝜶𝑿𝑳 = 𝜶𝑨𝑷𝑳 𝑿 𝑴𝑷𝑳 = 𝜷𝑲 = 𝜷𝑨𝑷𝑲 𝜶 𝑲 𝑴𝑹𝑺𝑳,𝑲 = 𝜷 × 𝑳 𝝈=𝟏 • Furthermore; 𝜶 𝜷 – The factor intensity is measured by the ratio . The higher the ratio, the more labor-intensive the production technique. – The production efficiency is measured by the coefficient 𝑨. – The returns to scale are measured by the sum 𝜶 + 𝜷. 55 The long run production function DIY: Check your understanding: Given the Cobb – Douglas function of the following forms, determine: a. b. c. d. The marginal product of the factors MRTSL,K The elasticity of substitution. The type of returns to scale each function exhibits. Explain your answers. For: a) 𝑄 = 20 𝐾𝐿; b) 𝑄 = 𝐿3 𝐾 3 c) 𝑄 = 𝐿𝐾 2 3 d) 𝑄 = 5𝐿 𝐾 e) 𝑄 = 𝐿𝐾 2 1 3 56 Equilibrium of the firm Equilibrium of the single-product firm: • How does the firm choose the optimal combination of inputs so as to achieve its profit maximization goal? • Where; 𝝅 =𝑹−𝑪 𝝅 = 𝑷𝒙 𝑿 − 𝑪 • The underlying assumptions are that; – The output price 𝑷𝒙 is given – The factor prices are also given • In the short run, the problem facing the firm is that of constrained profit maximization. • The constraint are due to the technical and financial limitations: – To maximize output from a given cost outlay [Max 𝝅 s.t a cost constraint] – To minimize costs for producing a given level of output. [Max 𝝅 s.t an 57 output constraint] Equilibrium of the firm Equilibrium of the firm: • For each case, the objective function of the firm can be stated as: Case 1: Profit maximization subject to a cost constraint ഥ 𝝅 = 𝑷𝒙 𝑿 − 𝑪 Considering that the output and factor prices as well as the total cost are given, the firm’s choice is to maximize the volume of output 𝑿. Case 2: Profit maximization for a given level of output ഥ−𝑪 𝝅 = 𝑷𝒙 𝑿 Considering that the factor and output prices are given, the firm’s choice will be to minimize its cost of production • Graphically we use the isoquants and iso-cost lines to determine the firm’s equilibrium • The firm’s equilibrium occurs at the point of tangency between 58 the highest isoquant and the iso-cost line. Equilibrium of the firm • At the equilibrium point, the slopes of the iso-cost line and isoquant are equal; i.e. 𝑀𝑃𝐿 𝑤 = 𝑀𝑃𝐾 𝑟 Illustration of the firm’s equilibrium under cases 1 and 2: 59 Equilibrium of the firm • The firm’s equilibrium can also be derived formally or mathematically as follows: CASE 1 The firm’s objective is to maximize its output given the total cost outlay and the factor prices, i.e. max 𝑿 = 𝒇 𝑳, 𝑲 𝑋>0 ഥ = 𝒘𝑳 + 𝒓𝑲 𝑠. 𝑡 𝑪 With the constrained maximization problem, we solve it using the Langrangian multiplier. Forming a composite function, Z given by: 𝑍 = 𝑓 𝐿, 𝐾 + 𝛾 𝐶ҧ − 𝑤𝐿 − 𝑟𝐾 The F.O.Cs for output maximization are that the partial derivatives 𝜕𝑍 𝜕𝛾 𝜕𝑍 𝜕𝑍 , 𝜕𝐿 𝜕𝐾 and should all be equal to zero. 𝜕𝑍 𝜕𝐿 = 𝜕𝑓 𝜕𝐿 − 𝛾𝑤 = 0; 𝑀𝑃𝐿 = 𝛾𝑤; 𝜕𝑍 𝜕𝐾 = 𝜕𝑓 𝜕𝐾 − 𝛾𝑟 = 0; 𝑀𝑃𝐾 = 𝛾𝑟; 𝜕𝑍 𝜕𝛾 = 𝐶ҧ − 𝑤𝐿 − 𝑟𝐾 = 0 𝐶ҧ = 𝑤𝐿 + 𝑟𝐾 60 Equilibrium of the firm 𝑀𝑃𝐿 = 𝛾𝑤; 𝑀𝑃𝐾 = 𝛾𝑟; From the above equations, 𝐶ҧ = 𝑤𝐿 + 𝑟𝐾 𝑀𝑃𝐿 𝑤 = 𝑀𝑃𝐾 𝑟 𝑀𝑃𝐿 𝑀𝑃𝐾 = =𝛾 𝑤 𝑟 𝛾 is the marginal cost of production The implication of the above identity is that when the firm is in equilibrium, the marginal product from the last dollar spent on an additional unit of labor is equal to the marginal product derived from the last dollar spent on an additional unit of capital. 61 Equilibrium of the firm • The firm’s equilibrium can also be derived formally or mathematically as follows: - CASE 2 The firm’s objective is to minimize its costs to produce a give output level i.e. m𝑖𝑛 𝑪 = 𝒘𝑳 + 𝒓𝑲 ഥ = 𝒇 𝑳, 𝑲 𝑠. 𝑡 𝑿 𝐿,𝐾>0 With the constrained maximization problem, we solve it using the Langrangian multiplier. Forming a composite function, Z given by: 𝑍 = 𝑤𝐿 + 𝑟𝐾 − 𝛾[𝑋ത − 𝑓 𝐿, 𝐾 ] The F.O.Cs for output maximization are that the partial derivatives 𝜕𝑍 𝜕𝛾 𝜕𝑍 𝜕𝑍 , 𝜕𝐿 𝜕𝐾 and should all be equal to zero. 𝜕𝑍 𝜕𝐿 =𝑤−𝛾 w = 𝛾𝑀𝑃𝐿 ; 𝜕𝑓 𝜕𝐿 = 0; 𝜕𝑍 𝜕𝐾 =𝑟−𝛾 𝑟 = 𝛾𝑀𝑃𝐾 ; 𝜕𝑓 𝜕𝐾 = 0; 𝜕𝑍 𝜕𝛾 = −[𝑋ത − 𝑓 𝐿, 𝐾 = 0 𝑋ത = 𝑓 𝐿, 𝐾 62 Equilibrium of the firm From the above equations, 𝑀𝑃𝐿 𝑤 = 𝑀𝑃𝐾 𝑟 • Observe that the equilibrium conditions derived under both cases are the same. • Therefore the conditions for the equilibrium of the firm are: The slope of the isoquant = slope of the iso-cost line, i.e. 𝒘 𝒓 𝑴𝑷𝑳 = 𝑴𝑷 = 𝑴𝑹𝑻𝑺𝑳,𝑲 𝑲 The isoquants must be convex to the origin • What would be the implication of a concave isoquant? 63 Equilibrium of a multiproduct firm • Consider the case of a multiproduct firm. List some examples of multiproduct firms (+ the product lines) in the market. How do they decide how much of each product to produce and maximize profits? • For simplicity, we assume a firm produces 2 products, X and Y using 2 factors, capital (K) and labor (L). – • The respective production functions are given by: 𝑿 = 𝒇𝟏 𝑳, 𝑲 and 𝒀 = 𝒇𝟐 𝑳, 𝑲 The production possibility (or transformation) curve (PPC) shows the combinations of 𝑿 and 𝒀 which use up all the available resources of the firm. – – – Obtained using the Edgeworth box and contract curve The edgeworth box shows the possible combinations of X and Y that can be produced by the available factors of production. The points of tangency of the 2 product isoquants form the 64 contract curve. Equilibrium of a multiproduct firm The Edgeworth box and contract curve: illustration • Consider the firm producing at point T: – What quantities of X and Y is the firm producing? – Determine the input allocations to the production of X and Y – Do points P, m, Q represent better or worse allocations than T? Explain your answer 65 Equilibrium of a multiproduct firm • • • All points on the contract curve, are efficient. Any point off the contract curve implies a lower level of output of at least one product. A multiproduct firm will be in equilibrium at these points given the level of inputs. Any point on the contract curve, defines a combination of X and Y which lies on the PPC The slope of the PPC is given by: 𝑀𝑅𝑇𝑥.𝑦 = 𝜕𝑦 𝑀𝑃𝐿,𝑦 𝑀𝑃𝐾,𝑦 = = 𝜕𝑥 𝑀𝑃𝐿,𝑥 𝑀𝑃𝐾,𝑥 66 Equilibrium of a multiproduct firm • The optimal combination of X and Y that a multiproduct firm will actually produce will be the output pair that yields the highest revenue. • The iso-revenue curve is a locus of points showing the quantity combinations of X and Y whose sale yields the same revenue to the firm. The equation of the iso-revenue curve is: 𝑹 = 𝑷𝒙 𝑿 + 𝑷𝒚 𝒀 – The slope of the iso-revenue curve is equal to the ratio of the commodity prices. • 𝝅 maximization in this case is achieved by maximizing revenue. • Graphically, the equilibrium of the firm occurs at the point of tangency between the PPF and the highest iso-revenue curve. – The slopes of the iso-revenue curve and the PPF are equal at this point; i.e. 𝑀𝑅𝑃𝑇𝑥,𝑦 𝑑𝑦 𝑀𝑃𝐿,𝑦 𝑀𝑃𝐾,𝑦 𝑃𝑥 = = = = 𝑑𝑥 𝑀𝑃𝐿,𝑥 𝑀𝑃𝐾,𝑥 𝑃𝑦 67 Equilibrium of a multiproduct firm • Graphically, the equilibrium of the firm occurs at the point of tangency between the PPF and the highest iso-revenue curve. 68 Theory of costs - introduction • From production theory, we saw that firms have many input combinations to choose from to produce a given level of output. • But these inputs are not costless – wages/ salaries paid to labor, rent to capital, profits to entrepreneurs, etc. • How then does a firm choose the optimal input combination? • The optimal choice will be that which minimizes the firm’s cost outlay. • From an economist’s perspective, costs, however, do not only include monetary outlays. From an economist’s view, the cost concept is broader. • We introduce some basic cost concepts which normally figure into a firm’s economic decisions: 69 Theory of costs - introduction • Explicit costs – involve an actual monetary/cash outlay. E.g.?? • Implicit costs – costs that don’t involve a cash outlay. E.g.?? • Opportunity cost – value of the 2nd best alternative foregone when a choice is made. Usually the market price of an input. – E.g. I own a property which I use as my home. What’s the opportunity cost in that? • Sunk costs – an unrecoverable expenditure. E.g.?? – Do business registration fees count as sunk or non-sunk costs? – Aren’t relevant when making decisions • Economic costs – sum of the firm’s decision-relevant explicit and implicit costs • Accounting costs – sum of the explicit costs already incurred. • Depreciation – loss in value of a durable good. 70 The firm’s cost minimization problem • Considering the firm’s profit maximization goal, a firm has 2 options: – Minimize costs to produce a given level of output – Maximize output for a given level of total outlay • Key assumptions to derive the cost minimization input choices of the firm: – – The firm uses 2 homogenous inputs – capital (K) and labor (L) The inputs are hired in competitive markets, i.e. input prices, w and r are given. • Considering the above, the firm’s cost function is thus given by: 𝑪 = 𝒘𝑳 + 𝒓𝑲 • The iso-cost line is the locus of points of the factor combinations that exhaust the firm’s total cost outlay • The slope of the iso-cost line is given by the ratio of input prices. 71 The firm’s cost minimization problem • The cost minimization input choices of the firm will differ depending on the production time horizon. Short-run cost minimization: ഥ , the firm’s choice is to use just enough • With capital fixed as 𝑲 labor to produce the required output levels • Because of this inflexibility, the short-run costs tend to be higher. • To determine the labor demand function, solve the function 𝑸 = 𝒇(𝑲, 𝑳) for L. (i.e. make L the subject of the equation). Check your understanding: • Consider a production function given by: 𝑸 = 𝟓𝟎 𝑲𝑳; the firm’s ഥ . What amount of labor will the firm hire to capital is fixed at 𝑲 minimize costs in the short-run? 72 The firm’s cost minimization problem Short-run cost minimization: ഥ , the firm’s choice is to use just enough • With capital fixed as 𝑲 labor to produce the required output levels 73 The firm’s cost minimization problem Long-run cost minimization: • Recall that in the LR, the firm can vary all inputs. • We have previously derived the condition for cost minimization as: 𝑴𝑹𝑺𝑻𝑳,𝑲 = 𝑴𝑷𝑳 𝒘 = 𝑴𝑷𝑲 𝒓 – i.e. occurs at the point of tangency between the isoquant and iso-cost line, where their slopes are equal. • From the cost minimization condition, we are able to derive the corresponding input demand functions (i.e. the quantities of K and L that minimize the firm’s costs). 𝑴𝑷 𝑳 • Re-arranging the above condition gives: 𝑴𝑷 = 𝑲. 𝒘 𝒓 – i.e. the marginal productivity per dollar spent should be equal for all inputs. 𝑀𝑃 𝑀𝑃 – If 𝑤 𝐿 > 𝑟 𝐾 , the firm should hire more labor and reduce on the capital units employed and vice versa. 74 The firm’s cost minimization problem Long-run cost minimization: • We have previously derived the condition for cost minimization as: 𝑴𝑹𝑺𝑻𝑳,𝑲 = 𝑴𝑷𝑳 𝒘 = 𝑴𝑷𝑲 𝒓 – i.e. occurs at the point of tangency between the isoquant and iso-cost line, where their slopes are equal. 75 The firm’s cost minimization problem Application of the cost minimization problem/ examples: 1. Consider the production function given by: 𝑸 = 𝟓𝟎 𝑲𝑳; and the price of labor, 𝒘 = $𝟓 per unit and the price of capital, 𝒓 = $𝟐𝟎 per unit. – What is the cost-minimizing input combination if the firm wants to produce 1000 units per year? – What is the firm’s minimum cost of producing the 1000 units? 2. Consider the above production function and factor prices, derive the expressions for the demand curves for labor and capital. 3. Suppose that the firm’s production function is given by: 𝑸 = 𝟑 ഥ. 𝟏𝟎𝑲 𝑳. The firm’s capital is fixed at 𝑲 – What amount of labor will the firm hire to solve its short-run cost minimization problem? 4. Attempt the exercises in the course handout and past papers.76 Changes in the input prices • A change in an input’s price changes the input price ratio and thus the slope of the iso-cost line. – Resulting in a different cost minimizing input combination – Firm substitutes the cheaper input for the expensive one 77 Changes in the output level • With input prices constant, an increase in output moves the firm to a higher isoquant – More units of the inputs are required for the new production volume – Resulting in a different cost minimizing input combination – With more units of both inputs for the case of normal inputs 78 Changes in the output level • The expansion path is the locus of the resulting cost minimizing input combinations as output level changes – The expansion path is upward sloping for normal inputs – If one of the inputs is inferior, i.e. the firm uses less of it as output increases (when would such a situation arise?), the expansion path will be downward sloping. 79 Cost functions • Having established the solution to the firm’s cost minimization problem, we move on to analyze the structure of the cost function. • Cost function are derived functions. (How so??) • For simplicity, expressed as a function of output. i.e. 𝐶=𝑓 𝑄 Where 𝑑𝑦 𝑑𝑥 = 𝑓′ 𝑄 > 0 • The distinction of the costs is also on the basis of the production time horizon; – Short-run costs • Fixed costs – definition and e.gs? • Variable costs – definition and e.gs? – Long-run costs 80 Long run cost functions • For simplicity, the total cost function is expressed as a function of output. 81 Cost functions: TC, AC & MC • As is the case with production, the per unit costs are an important consideration for decision making; – Average costs (AC) defined by? 𝐶 𝑄 𝐴𝐶 𝑄 = 𝑞 – Marginal costs (MC) defined by? 𝑑𝐶 𝑄 𝑀𝐶 𝑄 = 𝑑𝑞 • For a linear cost function, 𝐴𝐶 𝑄 = 𝑀𝐶 𝑄 , which is a constant. – – – • Consider a cost function given by 𝐶(𝑄) = 𝛼𝑄 Determine AC and MC Graph the MC, AC and TC curves. For the non-linear cost functions, the degree of 𝑄 in 𝐶(𝑄) is higher than 1. Analysis typically considers cubic cost functions. 82 Cost functions: TC, AC & MC • The relationship between the TC, MC and AC is as illustrated below: – The AC and MC curves are U-shaped. 83 Cost functions: TC, AC & MC • Furthermore; – – – – – AC decreases as quantity increases (the costs are spread over a larger volume of output) When AC is decreasing, 𝐴𝐶 𝑞 > 𝑀𝐶(𝑞) When AC is increasing, 𝐴𝐶 𝑞 < 𝑀𝐶 𝑞 𝑀𝐶 𝑞 = 𝐴𝐶(𝑞), when the AC curve is at its minimum point What will be the optimal production zone for the firm below? 84 Short run cost functions • • Recall that in the short run, some inputs are considered fixed whereas others are variable. The short-run cost curve is thus a sum of 2 components:- the variable costs (SVC) and the fixed costs (SFC). – • Define each With our 2-input assumption, the short run total cost curve, STC will be given by: Where ഥ + 𝑤𝐿 𝑆𝑇𝐶 = 𝑟𝐾 𝑆𝑇𝐶 = 𝑆𝐹𝐶 + 𝑆𝑉𝐶 𝑆𝑇𝐶 𝑞 = 𝑆𝐹𝐶 𝑞 = 0 + 𝑆𝑉𝐶(𝑞) • Consider the production function given by: 𝑄 = 50√𝐿𝐾, with ഥ 𝑤 = 25, 𝑟 = 100 and capital fixed at level 𝐾. – Derive the short run total cost function. – Consequently, what are the expressions for the SFC and SVC? 85 Short run cost functions • Graphically, the short-run costs are represented as: 86 Short run cost functions: SAC, SAFC, SMC, SAVC • • The relationship between the different short-run cost curves (SMC, SAC) is much the same as was generally defined earlier. The relationships are illustrated below: – Note that; 𝑆𝐴𝐶 𝑞 = 𝑆𝐴𝐹𝐶 + 𝑆𝐴𝑉𝐶 87 Short run and long-run cost functions • • • As noted previously, the inflexibility around input choices that the firm faces in the short run tend to result in higher costs. Whereas in the long run, because the firm is able to vary all inputs, it will be able to achieve lower costs. Consider the situation illustrated below: – The firm wants to increase production from 𝑄1 to 𝑄2 88 Short run and long-run cost functions • Relationship between STC and LTC: – – – The firm wants to increase production from 𝑄1 to 𝑄2 The relationship between the STC and the LTC will be such that 𝑺𝑻𝑪 𝑸 > 𝑳𝑻𝑪(𝑸) for all levels of K except when the level of K is the cost-minimizing level of capital. i.e. the STC curve always lies above the LTC curve. 89 Short run and long-run cost functions • Relationship between LTC and SMC and SAC: – – – – The long run average cost curve is derived from the SACs. Each point on the LAC corresponds to a point of tangency between the LAC and SAC. The LAC curve can thus be considered as an envelope curve. And can thus be used to determine the optimal plant size or production level. 90 Short run and long-run cost functions • Relationship between the LMC, LAC, SMC and SAC: – The optimal long run position for the firm will occur at the minimum point of the LAC. – At this point, it holds that 𝑳𝑴𝑪 = 𝑺𝑴𝑪 = 𝑺𝑨𝑪 = 𝑳𝑨𝑪 91 Cost functions: work it out Check your understanding:: • Consider the cost curves given by: 1. 𝑻𝑪 𝑸 = 𝟏𝟎𝟎𝟎𝑸 − 𝟑𝟎𝑸𝟐 + 𝑸𝟑 2. 𝑻𝑪 𝑸 = 𝟒𝟎𝑸 − 𝟏𝟎𝑸𝟐 + 𝑸𝟑 – – • • For each, derive the corresponding MC and AC curves At what quantity is the optimal production point/ level ? Consider the total cost functions given by: 1. 2. 3. 𝑻𝑪 𝒒 = 𝟏𝟎𝑸 𝑻𝑪 𝑸 = 𝟏𝟔𝟎 + 𝟏𝟎𝑸 𝑻𝑪 𝑸 = 𝟏𝟎𝑸𝟐 4. 5. 𝑻𝑪 𝑸 = 𝟏𝟎 𝑸 – Write the expressions for TFC, SAC, AVC and SMC 𝑻𝑪 𝑸 = 𝟏𝟔𝟎 + 𝟏𝟎𝑸𝟐 For 𝑺𝑻𝑪 𝑸 = 𝟏𝟎𝟎𝟎 + 𝟓𝟎𝑸𝟐, derive the expressions for the SAC, SAVC and SAFC curves. 92