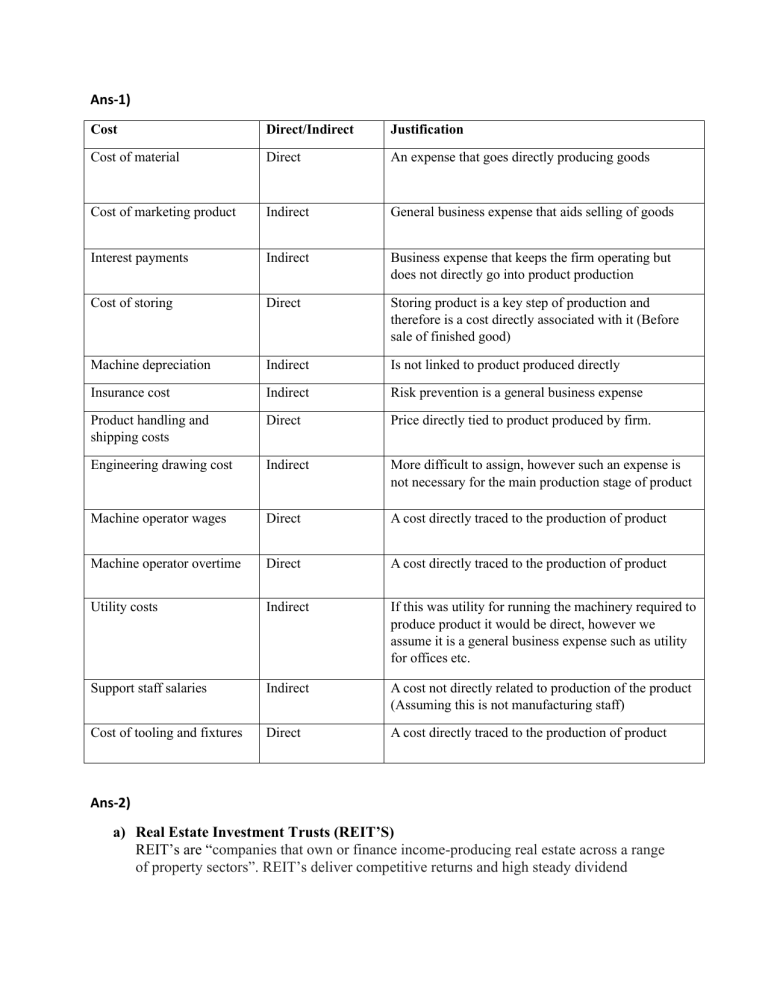

Ans-1) Cost Direct/Indirect Justification Cost of material Direct An expense that goes directly producing goods Cost of marketing product Indirect General business expense that aids selling of goods Interest payments Indirect Business expense that keeps the firm operating but does not directly go into product production Cost of storing Direct Storing product is a key step of production and therefore is a cost directly associated with it (Before sale of finished good) Machine depreciation Indirect Is not linked to product produced directly Insurance cost Indirect Risk prevention is a general business expense Product handling and shipping costs Direct Price directly tied to product produced by firm. Engineering drawing cost Indirect More difficult to assign, however such an expense is not necessary for the main production stage of product Machine operator wages Direct A cost directly traced to the production of product Machine operator overtime Direct A cost directly traced to the production of product Utility costs Indirect If this was utility for running the machinery required to produce product it would be direct, however we assume it is a general business expense such as utility for offices etc. Support staff salaries Indirect A cost not directly related to production of the product (Assuming this is not manufacturing staff) Cost of tooling and fixtures Direct A cost directly traced to the production of product Ans-2) a) Real Estate Investment Trusts (REIT’S) REIT’s are “companies that own or finance income-producing real estate across a range of property sectors”. REIT’s deliver competitive returns and high steady dividend income, a form of long-term capital appreciation. There are several Canadian REIT’s with varying levels of return, this can be averaged to about 5-6%. From the options above, the minimum attractive rate of return would be from the Index ETF’s at around 10% beating the current Canadian inflation rate of 6.8%. b) Stock Market: Investing in the stock market offers the potential for long-term growth, although it does come with some level of risk. To reduce risk, you can consider investing in a mix of established companies and exchange-traded funds (ETFs) that track broad market indices. Historical average returns for the stock market have been around 7-10% per year, but it can vary significantly. c) Bonds: Bonds are fixed-income securities issued by governments or corporations. They provide a relatively lower risk compared to stocks. Treasury bonds are considered the least risky. The potential returns from bonds are typically lower than those from stocks, averaging around 2-5% per year, depending on the type of bond and prevailing interest rates. Ans-4) a) Book value after 6 years: $310,000 Difference between book value and sold market value: $100,000 b) Loss on Disposal c) Tax would be owed or credited to the firm due to the sale of the asset: $33,000