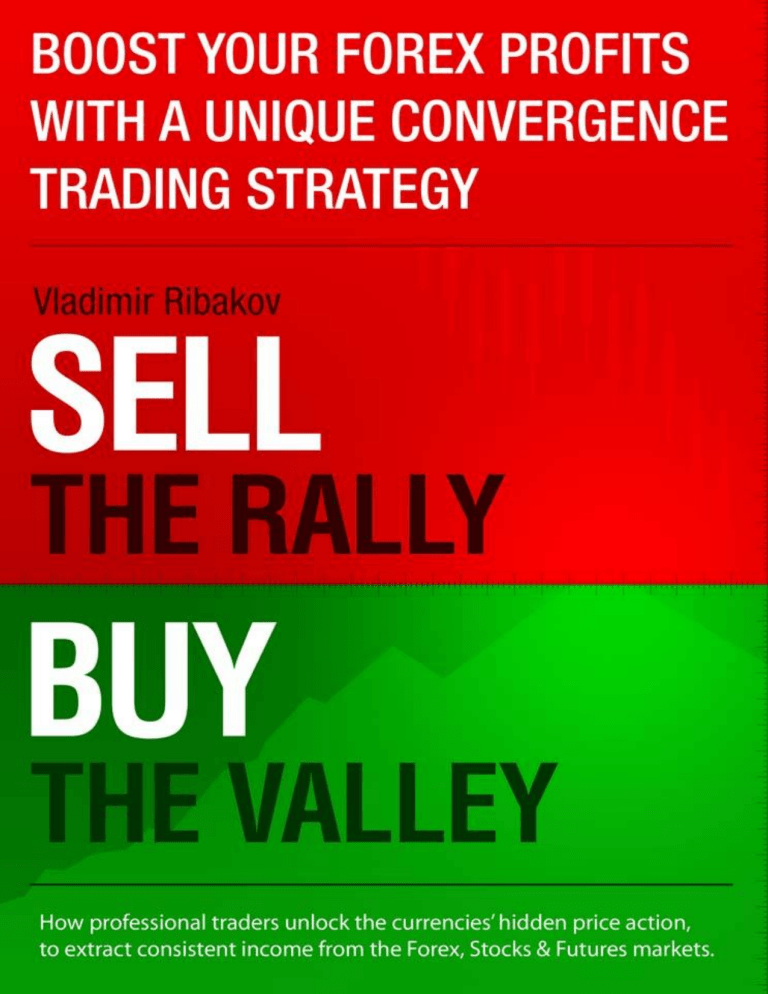

Vladimir Ribakov SELL THE RALLY BUY THE VALLEY How professional traders unlock the currencies’ hidden price action, to extract consistent profits from the Forex, Stocks and Futures markets If you are trading Forex, stocks or futures, and looking for the right tools to ensure your success, this book is the best value you can get for your money and your future. In this book, professional trader Vladimir Ribakov takes the reader behind the scenes of the market’s price action, showing how to maximize profits and identify trading opportunities before the rest of the crowd. This is done using the strategy Vladimir developed throughout the years, which he calls “Sell The Rally, Buy The Valley”. The book comes with a special video webinar over 3.5 hours in length, providing in-depth guidance, real-life examples of trades and additional tips. As an owner of this book, you get exclusive access to the recording of this coaching session. The unique strategy in this book can be applied successfully to the Forex market as well as for stocks, indices and futures markets, and is intended both for beginner and advanced traders. © 2013 Vladimir Ribakov, Forex Signals & Mentoring www.VladimirForexSignals.com Table of Contents Introduction Where can you find me? What's my trading style? What are we going to learn? Divergence and Convergence Basics The importance and power of divergence and convergence Indicators we use with convergences Smart timeframe management: the sniper principle How to enter the trades? Set the Stop loss – 2 options Where to set the take profit Vladimir’s extras: Example 1 Example two Conclusion Introduction Welcome! In this strategy book I would like to share with you a very powerful and unique trading system that I'm using for my own trading. I have developed this system based on the insights and experience I gained through many years of trading financial markets: currencies, indices, stocks, and futures. Let me first introduce myself: Vladimir Ribakov, professional trader and trading coach. I trade for a living, and mentor for pleasure, for my soul. The best thing that ever happened to me was to watch how traders I mentored became successful traders that do it for living already. These are the kind of results enjoyed by both me and my loyal followers: Note: if you'd like to examine these and other statements, as well as my trade-by-trade track record, you're welcome to visit: Vladimir's Forex Signals http://www.VladimirForexSignals.com & mentoring: Where can you find me? Since I find great pleasure in mentoring other traders and seeing them succeed, I enjoy being involved in the online Forex trading community: * I published several of my strategies as standalone semi-automated trading systems, including guide books: the LST system, sRs Trend Rider and the Pips Carrier. * Established myForex Signals & Mentoring club, where I meet my followers daily in my Live Trading Room and Skype chat. * Created the Divergence University Home Study Program: http://www.DivergenceUniversity.com/ * About twice a year, I hold face-to-face trading workshops abroad, in different countries around the world: http://www.WorldForexSeminars.com/ * I publish a well known blog: www.VladimirRibakov.com What's my trading style? I use technical analysis exclusively, to analyze the market and decide on entering and exiting trades. However I do keep a close watch on all financial markets and fundamental factors, and keep my followers updated on my technical and fundamental views through my blog. My style of trading is mainly based on Divergences and Convergences. This means I'm looking for situations when the market is deviating from the real price and there I find my trading opportunities. As I always say to my loyal followers, divergences and convergences are not a strategy but a framework. You must realize that in order to better understand the price action and how the market really moves. When you understand the divergence world, you can really understand and trade price action. Then, when you know what you are doing, you can create any strategy you want, since a strategy can be defined as a group of rules that make our entries and exits easier. What are we going to learn? One of the most powerful tools in the world of technical analysis in general, and the divergences world in particular, is the Convergence. To be more accurate and straightforward: the most powerful tool is the combination of Convergence and Divergence. No worries, I will teach it all ! Trading this powerful combination has some secrets behind the price action scene, and I will teach these secrets as well. "Sell the rally, Buy the valley" is not just a rhyme. It is the essence of we're trying to do in order to gain extraordinary profits from financial markets. I believe your time and energy are extremely valuable, so I wanted to keep this book short and to the point. On the other hand, I made it as comprehensive as possible so you will know all that's needed to trade the strategy. We will learn what convergences are; What and how to combine divergence and convergence together to maximize profits; and most importantly we will learn the hidden ways of the real markets. Just one thing before we continue – this book comes with a companion webinar that you should definitely watch! This is the link to watch the webinar: Sell The Rally Webinar Page: http://vladimirribakov.com/livemarathon/stbv-webinar.html In the webinar you will broaden your knowledge about divergences, as well as convergences and applying the rules to real market situations. Even if you are a rookie, don’t worry, after this marathon you will become a trader armed with the knowledge needed to succeed! So, take a cup of coffee or just water, and let’s start. Divergence and Convergence Basics An indicator is a mathematical formula, which applies a calculation to the market prices, and presents the result in a graphic. For example, at the bottom of the chart you can see the MACD indicator, which is the one we'll be using mostly, as I'll explain a bit later: The purpose of an indicator is to provide insights into the movement of market prices, or predict future movements. The problem is that the current price bar of a chart shows you what happens NOW, while the indicator calculates a series of PAST chart bars. Therefore indicators are said to be lagging: they show you what happened in the past, and they show it with delay. This is why many traders have written off indicators as not useful, since they just show you what happened in the past and do not have a predictive power. But here comes the game changer: If you look at indicators the way everybody looks at them, you are indeed going to be mostly disappointed. However, by using convergence analysis, you are going to exploit a hidden property of the indicators that is the basis of my own trading success, as well as my students'. Let me explain: Given that the indicator represents the math behind the price action, Convergence means that prices match the indicator. In other words, the prices and the indicators say exactly the same and lead us to the same conclusion and direction, something like this: In order for us to easily detect whether the price and the indicator are "converging" (pointing at the same direction) we look at the tops and bottoms. We look both at the tops and bottoms of the indicator, as well as the tops and bottoms of the chart itself. This is how price chart tops and bottoms look like: This is how indicator tops and bottoms look like: In this book we are also going to deal with the opposite case, called Divergence: if we said that convergence means the prices and the indicators lead us to the same direction, divergence means that the prices and the indicators lead us to opposite directions – they don’t agree! In the above example, you can see that the top on the right is lower than its preceding top, which means the chart tops are pointing downwards. The indicator tells a different story: right beneath the two chart tops, we can detect two indicator tops, and they are pointing upwards instead of downwards. In other words: the chart and indicator disagree, and this is called a divergence. If it's not yet clear don't worry, in a few minutes I will elaborate and give examples, both in the book text, and in the companion webinar that you are invited to watch. One last note - sometimes the chart tops and indicator bottoms disagree, or the chart bottoms and indicator tops disagree… these are all cases of divergences, and this is best explained by looking at chart examples, as you can do if you watch my webinar which is an integral part of this book: Sell The Rally Webinar Page: http://vladimirribakov.com/livemarathon/stbv-webinar.html The importance and power of divergence and convergence Why is divergence and convergence so powerful and important? Anyone who traded with real money in their account, even for a short while, realized that it is not as easy as it might seem, or not as easy as some online gurus try to portray it as. I won’t waste your time by rehashing the well known statistics about the 95% players who lose. Let’s just remember that markets can be very deceptive, and while most players look at the surface, relying on lagging indicators, and so let themselves be deceived, there is a clear advantage to those few who look beneath the obvious. That’s where divergence analysis comes into the picture. Some of the world's top traders use divergences since it provides them with unique insight into the underlying forces that drive the market, forces hidden from the rest of the crowd. When certain types of divergences occur, they reveal mistakes in price action. And when the market realizes prices are wrong, the market quickly and violently fixes it. I want to be in before the market realizes the mistake, and that's where the power of divergences is. In the same sense, convergences also reveal a hidden tendency of the market to continue with the current trend. However… A convergence that's useful to us MUST come after a trend. If the market is ranging, don’t look for convergences. There are two types of convergences: Bullish and Bearish. Here are few examples of convergences. Let’s start with a Bearish Convergence: As you can see on the example above, after the bullish trend we got a strong bearish correction down. At the end of this correction, a low was created, which was lower than the last low of the bullish trend. The indicators at this point also created lower lows. This situation is what we call a Bearish Convergence. When you have such situation, look for sell opportunities. For our trading, that’s the first thing we will have to recognize. Other things we will learn soon :) Let’s see one more example for a bearish convergence after a bullish trend. You can see here that after the bullish move up, the price created a correction and at the end of the correction we can see that the low (2) was lower than the last low of the bullish move (1). This is a convergence. And that’s what we are looking for. When you have such situation, look for sell opportunities. Once again, don’t try to skip the levels and learn immediately how to trade it, first, learn to recognize the conditions correct. Ok, so we now understand what it is a bearish convergence, now let’s learn how a bullish convergence looks like. The idea is the same, let’s see some examples: Example 1: At the end of the down move you can see that there was a correction. At the end of the correction (2) the high price was higher than at the highest point of the last down move (1). This is what I call bullish convergence. When you have such situation, look for buy opportunities. Example 2: At the end of the down move you can see that there was a correction. At the end of the correction (2) the high price was higher than at the highest point of the last down move (1). This is what I call bullish convergence. When you have such situation, look for buy opportunities. Ok, I think you get the idea now and it is pretty clear. Let’s lay down some rules so it is easy to remember how to spot a convergence: 1. Find a trend. Convergence MUST come at the end of a trend. 2. Identify it – Bearish or bullish convergence. Bullish convergence comes at the end of a down trend. Bearish convergence comes at the end of bullish trend. 3. Bearish convergence – we are looking for a correction after a bullish trend. The bearish correction should create a low that will be lower than the last low of the bullish move. Like here: 4. Bullish convergence - we are looking for a correction after a bearish trend. The bullish correction should create a high that will be higher than the last high of the bearish move. Like here: That’s it for the first step. Now, make sure to go to the charts and find as many as possible convergences, bullish & bearish. Done? Very good. Now let’s continue and look closely into the indicators we use with convergences. Indicators we use with convergences The most reliable indicator to identify a convergence is the MACD. Simply because the MACD means – Moving Averages Convergence Divergence, which is a promising name since we are looking first of all for convergences… Remember, MACD has two important parts – the moving averages and the histogram, which is the distance between the moving averages on any point. This is how it looks like: Other indicators are not really powerful enough so we can make our decisions based on them, but we can use them as another confirmation for the convergence that we find on MACD. In other words, the indicator that we recognize convergence first of all is the MACD. Other indicators we can use: RSI Stochastic Momentum CCI Volume (for stocks and indices, not forex) Force indicator (for stock and indices, not forex) Ok, so now we know what indicators we can use. If you feel at this point that you need to strengthen your understanding of how to identify convergences and divergences, be sure to watch the companion webinar, where I go over many chart examples and show you how to practically identify them. Sell The Rally Webinar Page: http://vladimirribakov.com/livemarathon/stbv-webinar.html Smart timeframe management: the sniper principle It is time to move forward and keep building our trading system. Remember, we will sell the rallies and buy the valleys. Spotting our entries is actually easy, so let’s make it simple and put all the cards on the table: combination. That’s what we are looking for. What do I mean by combination? You find a convergence on any time frame, such as 30 minutes or 1 hour charts. Then you look for prices to go the opposite way (correction). Then you just look for trades to same direction as the convergence on one or two timeframes lower. You look for trades based on divergences on the same direction as our bigger timeframe convergence. Why is this important? It is what I like to call "the sniper principle": think of a movie where a sniper is assigned to find and kill an enemy character. The sniper has a general idea of where to find the target character, or he knows that person will be at a certain house at a certain time of day, so he goes there and tries to locate the person. That person is our convergence. Once we found the general convergence, we need to "zoom in" closer and look for the fine details, just as the sniper would start going into finer details such as: where exactly to stand, what angle to point the gun, where in the body to point at, etc. For us, these fine details are waiting in the lower timeframe. Now let's go over the simple steps of how to do it: 1. Find a convergence. For example: 2. Look for correction – In our example, look for a down move. Go for one or two timeframes (TF) lower to find buy opportunities. Look for bullish divergences (because you got a bullish convergence) on one or two TF lower. You MUST wait for a divergence to appear before moving on to the next step. Now that we know what to look for, we need to learn how to enter, where to set the stop loss (SL) and take profit (TP) for the trade. Ready for the next chapter? Let’s go: How to enter the trades? Entering is very simple actually. We are not waiting for candle patterns, we are not waiting for any special confirmations - we attack supports/resistances. The most important thing is to first find a divergence which is pointing to the same direction as the convergence. Remember, this divergence should be on one timeframe lower, maximum two (even though I trade most of my trades 1 TF lower, not 2). Then, when you found a divergence, find the 3 closest supports/resistances. These will be the areas you will attack and the areas you will enter and exit the trades. To clarify: if you are looking to buy, you need to find the 3 closest resistances. If looking to sell, you need to find the 3 closest supports. Finally, if prices break through the third support/resistance that’s your sign to get out. Why waste time with words when we can watch some truly revealing charts…? Let’s investigate some examples: Step 1 – We find a convergence: We found a bullish convergence. Now we look for bearish move (a correction) and then we will go to a time frame that is 1-2 time frames lower, to find a bullish divergence (any bullish divergence). For Example, if we are on a H4 chart, we go for H1 or M30. We can see that on 1 TF lower there was a bullish hidden divergence. That’s what we want to see! Now, we can set supports levels which will be our entries: We want to see the prices stop around the support level and create a green candle to hint on potential bullish move to begin. After the first bullish candle we enter. So we set the supports areas by numbers. At point 1 there is great support and we can see that there is already a bullish hidden divergence. So our first entry is there. At point 2 there is also wonderful strong support, BUT there is no stop at this level and prices break through. So we don’t enter there. At point 3 there is strong support area and also a good stop with bullish candle pattern. This is our LAST entry. Remember, that if prices break down and close below the 3rd support that’s a bad sign and we don’t want to stay in. And now to a very important point. I'm always asked what is the best way to enter the trades? Enter, set stop loss and take profit OR to attack the level without a stop loss and just have an exit plan for the trades. It is probably a subject that doesn’t have any clear answer, but I can tell that I prefer the second approach of entering without a stop loss and managing the trades with exit plan. The advantage of trading without a stop loss is that when an empty spike happens you will still be in and won’t be kicked out by stop loss. The disadvantage is that when something unexpected happens prices can run away fast and you will lose more than you planned. So which is better? From my point of view there is no real answer for that but I do prefer the approach of trading without a stop loss. I would summarize this way: if you are in front of a computer don’t use stop loss and have a clear exit plan, that if 3rd support/resistance is broken and closed below/above it, you close the trade manually. If you are not in front of your computer or have issues with closing losing trades manually, then set a SL. BUT if you do set SL, set it 15-20 pips below just to give the trade a chance to work. Ok, so now let’s see an example how to enter sell trade/s. Step 1- Find a bearish convergence: Step 2 – Find a correction and set 3 resistances: Now go for lower TF and set 3 resistances. We found 3 closest resistances and we are waiting for bearish red candles to be created on each to enter a trade. Point 1 – There is a stop and red candle – we enter a sell Point 2 - There is a stop and red candle - we enter a sell Point 3 – prices never reached the level – no entry. So now let’s stop and admit, it is really simple, right? That’s what I call – Sell the Rally. We find bearish conditions. We look for bullish correction and that’s a bullish rally in bearish market, and we are looking to sell this rally. Ok, and now it is time to move forward and learn more about the stop loss where and how to set it correct. Set the Stop loss – 2 options Earlier I explained that there are 2 methods to manage the trades. Let’s elaborate little bit more. First method to manage the trades: As we said, at the first step we find 3 important supports/resistances. Then we are waiting for prices to stop at them and to create bullish/bearish candle pattern (depends on the trade we are looking to enter of course). When we have the pattern we enter a trade. The first option we have for managing the trade is to set a stop loss below the 3rd support or above the 3rd resistance. The only important thing to remember is that as bigger the TF you trade is, the more stop loss you have to set in order to give the trade a real chance to work and to avoid empty spike. Another important thing, we can have MAX 3 entries. Each of them will be on separate support/resistance if there is a candle pattern that approves the entry, BUT the stop loss will be the same for ALL! And that will be below the support or above the resistance. Let’s see an example: We got a bullish convergence on 4 hours chart, and we moved to 1 hour chart to find support levels and entries. Here is the hourly chart: Another example for sell: We had a bearish convergence on 4 hour chart, so we look for a correction up and then we go lower to 1 hour chart to place 3 resistances and entries. That’s all for the first method to manage the trade with the stop loss. Now let’s learn the second method. The second method is all about attacking the levels (supports & resistances) when there is a relevant candle for us but NOT setting the stop loss but instead of that just to close the trade manually in case the 3rd support or resistance will be broken and the prices will close below/above them. The biggest advantage of that is that we will stay in a trade if there is an empty spike. Here is an example: These are the 2 options to get out from a trade with a loss, by stop loss or closing manually if prices break through 3rd support/resistance. And now it is the right time to learn how we actually make money and where we set take profits. Where to set the take profit That’s probably the most interesting part, isn’t it? :-) Let’s start by summarizing all the steps once again: 1. We find a convergence 2. We look for correction 3. We go for lower TF 4. We look for a divergence to the SAME direction as the convergence on higher TF 5. We set 3 supports/resistances 6. We attack the levels if we get relevant candle 7. We set the stop loss or an exit plan 8. We set the TP (take profit) and let the trade work Our focus now is on that last but very important bit. There are two ways to set the TP. One would be more suitable for beginner traders and the other for advanced traders that have some experience with the world of divergences. Let’s start with the simplest way for the beginner: We set the target at the last low (The low that was created before the correction) on the TF that we found the convergence. Let’s see the example: Now we go for lower TF: In the circle we can see the entry. Now we go back for the higher TF: Isn’t that simple? I know it is, that’s why I will not add any other things to ruin the simplicity. Now let’s go for the advanced TP option. Let’s see the same example as the previous one to explain the differences: As you can see on the picture above, I give the trade to run free, until I get a divergence against me – means a bullish divergence. I am waiting for a bullish candle to appear and then I get out. The biggest disadvantage of this way to manage profits is that I have to be around the trading platform to see when the candle is closed and I can’t just set a TP level and forget about the trade. Another important thing is to understand on what indicators I should look for opposite divergence. The answer is very simple, MACD. You can find a divergence on the histogram, on MACD’s MA or on both of them. Yes you can see divergences on other indicators but the MACD is much more reliable and that’s the one we have to work with. Important: if you trade the advanced mode, move the SL to BE when price reach the low/high which should be the target in beginners mode. Let’s see more examples for the TP with opposite divergence. Once again I let the trade work all the way until I get opposite divergence which I can find on the MACD and I get out of the trade once there is a bullish candle. That’s all friends. Now you have all the tools you need to trade convergence or as I like to call it – Sell the rally and Buy the valley. Remember – We sell the rally at bearish convergence and we buy the valley at bullish convergence. And now, I think it is time for extras. In my extras I will give you all the tips you will need to maximize your profits trading this way. Vladimir’s extras: Look for a convergence AFTER a divergence: what do I mean? The best way to confirm that the convergence is not empty and areal move is expected is to make sure that the convergence was created right after a divergence to the same direction. Let’s see an example: As you can see in the example above, right before the convergence appeared there was a bullish divergence that hints on a bullish move. Most of the times it will happen anyway, but sometimes you will see a convergence without a divergence before and that’s a weak sign. But I need to tell that this situation is EXTREMELY rare! You won’t see it happen often that’s for sure J The second extra is, use trend lines when they appear to help: By that I mean that when you found a convergence and moved to lower TF to find potential entry, and the prices stopped on trend line, that is a wonderful sign that they prices will continue in the original direction. Here is an example: We go for lower TF to find entries. In this example we started with a 4 hours chart (H4) and now we are going down to a 1 hour chart: We can see a great combination of the trend line and the first support with makes this entry very powerful and reliable. Higher TF – My recommendation is to trade higher time frames. Divergences and convergences are reliable on any TF but on higher TF (4 hours and higher) they are extremely reliable. Watch for moves! It could be confusing sometimes how to correctly identify lows and highs. For that, I have a simple rule – a low or a high MUST be created after a clear move. If you have doubt if it was a move or not it is not a move! Let me show you examples: Correct lows: Wrong Lows: Risk/Reward – DO NOT enter a trade, any trade, if your take profit is less than 1 to 2 than your stop loss! This is our "risk/reward filter": we want to be sure that for any dollar we risk, we expect to earn at least two dollars. This keeps us on the good side of statistics, given the high rate of success that we enjoy by using convergence/divergence analysis. If you entered a trade and you got opposite divergence, against the direction of your trade, before the target reached – CLOSE the trade manually!!! We will see an example for that later. Ok, now I feel you are 100% ready for the online marathon, which you can watch here: Sell The Rally Webinar Page: http://vladimirribakov.com/livemarathon/stbv-webinar.html It is time to summarize everything from A to Z and show some examples of full trades. Example 1 We find a convergence: The convergence we found here is a bearish convergence. Wonderful! Now we go for lower TF and wait to get a bearish divergence of any kind. The previous chart was 4H so we go for 1H now. We find on 1H chart a bearish hidden divergence. WONDERFUL! Now we set the three closest resistances. Now we wait to see on what of the resistances we get bearish candle and there we will enter. Remember the importance of the R/R. We see that we have bearish candles on first resistance and second resistance as well. Our target is the last low of the convergence on higher TF: Now pay attention – On the first entry (the first resistance) the R/R is BAD! In this case, we skip the trade! On second entry – ALSO!!! So, with this divergence, we skip the trade! Even though it did the job as we can see, the R/R was not good enough and it is better to skip such trades! And a small tip from me – Patience paid off! After few more candles, on the same convergence, that’s what we got: As we can see, the market created a deeper correction up, while on the 4H chart there was still clear as crystal bearish convergence. After deepest correction we got double bearish divergence. Hidden bearish divergence and a continuing bearish divergence on the last part of the correction. Could we ask for more? Probably not. So now we set three closest resistances. We can see we got a bearish candle on the first resistance. That’s our entry. Now we need to make sure we have good risk reward: We can clearly see that the TP is more than twice bigger than the SL, which is exactly what we want!!! So, BRAVO! That’s our first trade together! Everything is going very well, so let's do another trade. Example two Find a convergence: Step one done, we have a convergence. Now let’s look for a correction and go for lower TF to find a bearish divergence. We can see that we have a clear bearish hidden divergence. Now we should set three closest resistances. We can see that we have 3 clear resistances. Now we look for bearish candle on any of them to make an entry. At the first resistance there is a red candle, which is a good sign to enter. BUT now we have to see if our R/R is good enough. We can see that the R/R from first entry is not good enough as it is 1:1 ratio almost. Therefore, it’s better to skip it. We can improve the RR if prices will go higher and enter then. We can see that the prices did go higher and created another stop at the second resistance. The they created a HUGE red candle and after this candle the R/R is bad, yet. So again, if price push back little bit we can have a wonderful R/R and enter the trade. Now we can see that prices have pulled back and we can attack with a fantastic R/R, with a target that is more than 3 times bigger than the Stop Loss. That’s the trades we want to trade. And now the most important thing! Pay attention to the take profit. Was it taken? NO. So how still we turn this trade into wonderful profit? Remember what I said about closing the trade when you have opposite divergence against you BEFORE the target was reached? Well, pay attention to this: After a good down move, and just little bit before the target reached, a bullish divergence was created against us. In this situation we NEVER fight the market, and when we have bullish candle with the bullish divergence we close the trade manually. Remember that – RESPECT the market if you want it to respect you back!!! If you try to take more than the market is ready to give, you will stay with nothing! Conclusion We have just finished our marathon day. I know it was not a short but believe it was worth it since we really learned a lot. As I said not once, divergences and convergences are 100% the most reliable technical tool a trader can ask for, simply because it goes hand by hand with the volumes in the market, with the demands and the supplies on the currencies and any other financial asset. Take all we learned and see how powerful these strategies are! Sell the Rally, Buy the Valley. Remember that! I promise you that you will be amazed. I would’nt dare to waste your time on teaching something that I don’t trade myself. Thank you very much for reading this book, and I wish you good luck and happy trading! *** Finally a small request that will help me grow my community: *** Did you enjoy this ebook and found it useful? Please help me by sharing your opinion in Amazon – it takes less than 5 minutes! 1. In Amazon, search for Vladimir Ribakov and in the search results you will find this book. 2. In the book’s page, scroll down to the Customer Reviews section: 3. At the end of the last review, click the button to add your own review. I would really appreciate it! To your success, Vladimir Ribakov Table of Contents Introduction Where can you find me? What's my trading style? What are we going to learn? Divergence and Convergence Basics The importance and power of divergence and convergence Indicators we use with convergences Smart timeframe management: the sniper principle How to enter the trades? Set the Stop loss – 2 options Where to set the take profit Vladimir’s extras: Example 1 Example two Conclusion This le was downloaded from Z-Library project Your gateway to knowledge and culture. Accessible for everyone. z-library.se singlelogin.re go-to-zlibrary.se O cial Telegram channel Z-Access fi ffi https://wikipedia.org/wiki/Z-Library single-login.ru