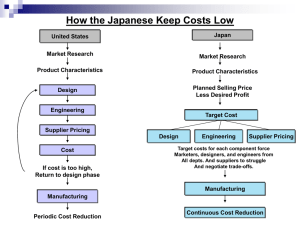

COST ACCOUNTING & COST CONCEPTS Chapter 4: Differential Analysis Accounting Demands Passion Instructions: Write the letter that best corresponds to your answer. Do not write on the test questions and return it after use. Thank you and GODBLESS! 1. Black Tool Company has a production capacity is 1,500 units per month, but current production is only 1,250 units. The manufacturing costs are $60 per unit and marketing costs are $16 per unit. Doug Hall offers to purchase 250 units at $76 each for the next five months. Should Black accept the one-time-only special order if only absorption-costing data are available? a. Yes, good customer relations are essential. b. No, the company will only break even. c. No, since only the employees will benefit. d. Yes, since operating profits will most likely increase. 2. The sum of all costs incurred in all business functions in the value chain (product design, manufacturing, marketing, and customer service, for example) is known as the a. business cost. c. gross product cost. b. full product cost. d. multiproduct cost. 3. The cost to produce Part A was $10 per unit in 20x3 and in 20x4 has increased to $11 per unit. In 20x4, Supplier XYZ has offered to supply Part A for $9 per unit. For the make-or-buy decision, 4. a. incremental revenues are $2 per unit. 5. b. incremental costs are $1 per unit. 6. c. net relevant costs are $1 per unit. 7. d. differential costs are $2 per unit. 8. Constraints may include 9. a. the availability of direct materials in manufacturing. 10. b. linear square feet of display space for a retailer. 11. c. direct labor in the service industry. 12. d. all of the above. 13. Medford Corporation operates a plant with a productive capacity to manufacture 20,000 units of its product a year. The follow information pertains to the production costs at capacity: 14. 15. Variable costs $160,000 16. Fixed costs 240,000 17. -------18. Total costs $400,000 19. ========= 20. A supplier has offered to sell 4,000 units to Medford annually. Assume no change in the fixed costs. What is the price per unit that makes Medford indifferent between the "make" and "buy" options? 21. a. $8 23. c. $20 22. b. $12 24. d. $0 25. Barrie, Inc., produces three products: A, B, and C. Two machines are used to produce the products. The contribution margins, sales demands, and time on each machine (in minutes) is as follows: 26. time time 27. Demand CM on M1 on M2 28. A 100 $12 5 10 29. B 80 18 10 5 30. C 100 25 15 5 31. 32. There are 2,400 minutes available on each machine during the week. How many units should be produced and sold to maximize the weekly contribution? 33. A B C A B C 34. a. 100 80 100 36. c. 100 40 100 35. b. 20 80 100 37. d. 100 80 73 38. Which of the following costs would be relevant in short-term decision making? 39. 40. incremental fixed costs a. 41. 42. all costs of inventory b. 43. 44. total variable costs that are the same in the considered alternatives c. 45. 46. the cost of a fixed asset that could be used in all the considered d. alternatives 47. A cost is sunk if it 48. 49. is not an incremental cost. Cost Accounting: Chapter 4-Differential Analysis 1 Cost Accounting & Cost Concepts Cost Accounting & Cost Concepts Cost Accounting a. 50. 51. is unavoidable. b. 52. 53. has already been incurred. c. 54. 55. is irrelevant to the decision at hand. d. 56. Which of the following are relevant in a make or buy decision? 57. 58. Variabl 60. Avoidable 62. Unavoidable e fixed fixed 59. costs 61. costs 63. Costs 64. 65. 66. no yes yes a. 67. 68. yes no yes b. 69. 70. no no yes c. 71. 72. yes yes no d. 73. Which of the following are relevant in a make or buy decision? 74. 75. Prime 76. Sunk 77. Incremental costs costs costs 78. 79. 80. yes yes yes a. 81. 82. yes no yes b. 83. 84. yes no no c. 85. 86. no no yes d. 87. When a scarce resource, such as space, exists in an organization, the criterion that should be used to determine production is 88. 89. contribution margin per unit. a. 90. 91. selling price per unit. b. 92. 93. contribution margin per unit of scarce resource. c. 94. 95. total variable costs of production. d. 96. The minimum selling price that should be acceptable in a special order situation is equal to total 97. 98. production cost. a. 99. 100. variable production cost. b. 101.102. variable costs. c. 103.104. production cost plus a normal profit margin. Cost Accounting: Chapter 4-Differential Analysis 2 Cost Accounting & Cost Concepts Cost Accounting & Cost Concepts Cost Accounting d. 105. Which of the following costs is irrelevant in making a decision about a special order price if some of the company facilities are currently idle? 106.107. direct labor a. 108.109. equipment depreciation b. 110.111. variable cost of utilities c. 112.113. opportunity cost of production d. 114. A manager is attempting to determine whether a segment of the business should be eliminated. The focus of attention for this decision should be on 115.116. the net income shown on the segment's income statement. a. 117.118. sales minus total expenses of the segment. b. 119.120. sales minus total direct expenses of the segment. c. 121.122. sales minus total variable expenses and avoidable fixed expenses of the d. segment. 123. Assume a company produces three products: A, B, and C. It can only sell up to 3,000 units of each product. Production capacity is unlimited. The company should produce the product (or products) that has (have) the highest 124.125. contribution margin per hour of machine time. a. 126.127. gross margin per unit. b. 128.129. contribution margin per unit. c. 130.131. sales price per unit. d. 132. The relevance of a particular cost to a decision is determined by the: (CMA adapted) A. riskiness of the decision. B. number of decision variables. C. amount of the cost. D. potential effect on the decision. E. accuracy of the cost. 133. In a decision analysis situation, which one of the following costs is not likely to contain a variable cost component? (CMA adapted) A. Labor B. Overhead C. Straight-line Depreciation D. Selling E. Material Cost Accounting: Chapter 4-Differential Analysis 3 Cost Accounting & Cost Concepts Cost Accounting & Cost Concepts Cost Accounting 134. Which of the following statements regarding differential costs is (are) false? (A) The full cost fallacy occurs when a decision-maker fails to include fixed manufacturing overhead in the product's cost. (B) When deciding whether or not to accept a special order, a decision-maker should focus on differential costs instead of full costs. A. Only A. B. Only B. C. Neither A nor B is false. D. Both A and B are true. 135. Which of the following costs are irrelevant for a special order that will allow an organization to utilize some of its present idle capacity? A. Direct materials B. Indirect materials C. Variable overhead D. Unavoidable fixed overhead E. Differential sales commission 136. The AZ Company manufactures kitchen utensils. The company is currently producing well below its full capacity. The BV Company has approached AZ with an offer to buy 20,000 utensils at $0.75 each. AZ sells its utensils wholesale for $0.85 each; the average cost per unit is $0.83, of which $0.12 is fixed costs. If AZ were to accept BV's offer, what would be the increase in AZ's operating profits? A. $400 B. $800 C. $1,600 D. $2,000 E. AZ's operating profits will not increase as a result of accepting the special order. 137. The MNK Company has gathered the following information for a unit of its most popular product: The above cost information is based on 4,000 units. A foreign distributor has offered to buy 1,000 units at a price of $16 per unit. This special order would not disturb regular sales. Variable shipping and other selling expenses would be an additional $1 per unit for the special order. If the special order is accepted, MNK's operating profits will increase by: A. $1,000. B. $1,600. C. $2,000. D. $4,000. E. $5,000. Cost Accounting: Chapter 4-Differential Analysis 4 138. Cost Accounting & Cost Concepts Cost Accounting & Cost Concepts Cost Accounting The following information relates to the Tram Company for the upcoming year. The cost of goods sold includes $1,200,000 of fixed manufacturing overhead; the operating expenses include $100,000 of fixed marketing expenses. A special order offering to buy 50,000 units for $7.50 per unit has been made to Tram. Fortunately, there will be no additional operating expenses associated with the order and Tram has sufficient capacity to handle the order. How much will operate profits be increased if Tram accepts the special order? A. $25,000 B. $62,500 C. $100,000 D. $125,000 E. Operating profits will not increase as a result of accepting the special order. 139. The Blade Division of Axe Company produces hardened steel blades. One-third of Blade's output is sold to the Forestry Products Division of Axe; the remainder is sold to outside customers. Blades' estimated operating profit for the year is: The Forestry Division has an opportunity to purchase 10,000 blades of the same quality from an outside supplier on a continuing basis. The Blade Division cannot sell any additional products to outside customers. Should the Axe Company allow its Forestry Division to purchase the blades from the outside supplier at $1.25 per unit? A. No; making the blades will save Axe $1,500. B. Yes; buying the blades will save Axe $1,500. C. No; making the blades will save Axe $2,500. D. Yes; buying the blades will save Axe $2,500. Cost Accounting: Chapter 4-Differential Analysis 5 140. Cost Accounting & Cost Concepts Cost Accounting & Cost Concepts Cost Accounting The CJP Company produces 10,000 units of item S10 annually at a total cost of $190,000. The XYZ Company has offered to supply 10,000 units of S10 per year for $18 per unit. If CJP accepts the offer, $4 per unit of the fixed overhead would be saved. In addition, some of CJP's facilities could be rented to a third party for $15,000 per year. What are the relevant costs for the "make" alternative? A. $160,000 B. $165,000 C. $175,000 D. $185,000 141. The time from initial research and development to the time that support to the customer ends is the A. product life cycle B. short run C. target time D. predatory price 142. The price based on customers' perceived value for the product and the price that competitors charge: A. predatory price B. target price C. target cost D. dumping price 143. The practice of setting price below cost with the intent to drive competitors out of business: A. predatory pricing B. target pricing C. target costing D. peak-load pricing 144. The practice of setting prices highest when the quantity demanded for the product approaches capacity: A. predatory pricing B. target pricing C. peak-load pricing D. price fixing 145. Agreement among business competitors to set prices at a particular level: A. predatory pricing B. target pricing C. peak-load pricing D. price fixing 146. Exporting a product to another country at a price below domestic cost: A. dumping B. target pricing C. peak-load pricing D. price fixing Cost Accounting: Chapter 4-Differential Analysis 6 Cost Accounting & Cost Concepts Cost Accounting & Cost Concepts Cost Accounting 147. A target cost is computed as A. cost to manufacture plus a desired markup B. cost to manufacture plus designated selling expenses C. market willingness to pay - cost to manufacture D. market willingness to pay - desired profit 148. The operations of Blink Corporation are divided into the Will Division and the Aloy Division. Projections for the next year are as follows: Operating income for Blink Corporation as a whole if the Carter Division were dropped would be A. $133,000 B. $112,000 C. $91,000 D. $49,000 149. Bryon Industries manufactures 20,000 components per year. The manufacturing cost of the components was determined as follows: An outside supplier has offered to sell the component for $17. If Bryon purchases the component from the outside supplier, the manufacturing facilities would be unused and could be rented out for $10,000. If Bryon purchases the component from the supplier instead of manufacturing it, the effect on income would be: A. a $70,000 increase B. a $50,000 decrease C. a $10,000 decrease D. a $30,000 increase Cost Accounting: Chapter 4-Differential Analysis 7 150. Cost Accounting & Cost Concepts Cost Accounting & Cost Concepts Cost Accounting Albany Industries produces two products. Information about the products is as follows: The company's fixed costs totaled $70,000, of which $15,000 can be directly traced to Product 1 and $40,000 can be directly traced to Product 2. The effect on the firm's profits if Product 2 is dropped would be a A. $10,000 increase B. $35,000 increase C. $35,000 decrease D. $10,000 decrease 151. Chetek Industries manufactures 15,000 components per year. The manufacturing cost of the components was determined to be as follows: Assume Chetek Industries could avoid $40,000 of fixed manufacturing overhead if it purchases the component from an outside supplier. An outside supplier has offered to sell the component for $34. If Chetek purchases the component from the supplier instead of manufacturing it, the effect on income would be a A. $60,000 increase B. $10,000 increase C. $100,000 decrease D. $140,000 increase 152. The operations of Superior Corporation are divided into the Northrup Division and the Hawley Division. Projections for the next year are as follows: Operating income for Superior Corporation, as a whole, if the Hawley Division were dropped would be A. $45,000 B. $80,000 C. $100,000 D. $120,000 Cost Accounting: Chapter 4-Differential Analysis 8 Cost Accounting & Cost Concepts Cost Accounting & Cost Concepts Cost Accounting 153. The Winwood Company manufactures two products: Q and T. The costs and revenues are as follows: Total demand for Product Q is 14,000 units and for Product T is 9,000 units. Machine time is a scarce resource. During the year, 54,000 machine hours are available. Product Q requires 5 machine hours per unit, while Product T requires 3 machine hours per unit. How many units of Products Q and T should Winwood produce? 154. Roswell Inc has 5,400 machine hours available each month. The following information on the company's three products is available: If market demand exceeds the available capacity, in what sequence should orders be filled to maximize the company's profits? A. Product 1 first, product 2 second, and product 3 third B. Product 2 first, product 3 second, and product 1 third C. Product 3 first, product 2 second, and product 1 third D. Product 3 first, product 1 second, and product 2 third 155. The Clapton Company manufactures two products: Alpha and Beta. The costs and revenues are as follows: Total demand for Alpha is 10,000 units and for Beta is 6,000 units. Machine time is a scarce resource. During the year, 50,000 machine hours are available. Alpha requires 4 machine hours per unit, while Beta requires 2.5 machine hours per unit. What is the maximum contribution margin Clapton can achieve during a year? A. $444,250 B. $1,014,000 C. $488,000 D. $855,500 Cost Accounting: Chapter 4-Differential Analysis 9 Cost Accounting & Cost Concepts Cost Accounting & Cost Concepts Cost Accounting 156. The Bremmer Company produces 5,000 units of item ZQ98 annually at a total cost of $200,000. The Daisy Company has offered to supply all 5,000 units of ZQ98 per year for $35 per unit. If Bremmer accepts the offer, $8 per unit of the fixed overhead would be saved. In addition, some of Bremmer's leased facilities could be vacated, reducing lease payments by $30,000 per year. What are the relevant costs for the "make" alternative? A. $120,000 B. $175,000 C. $190,000 D. $200,000 157. END OF THE EXAMINATION! Cost Accounting: Chapter 4-Differential Analysis 10