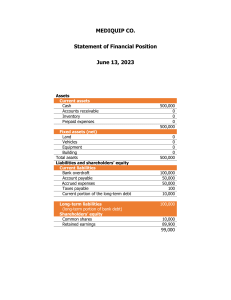

Accounting Principles 1. Matching Principle Accounts are prepared on accrual basis. Matching principle requires the business to record in its financial statements an expense in the same accounting period as the revenue it helped earn was recorded. Under matching principle: - Income accrued or prepaid (income prepaid for future accounting period) is excluded from its revenue. Expenses incurred but remained unpaid is recorded as expenses in income statement and the corresponding amount owing is recorded accrued expenses Expenses prepaid are recorded as prepayments. Application - Rent received for the month of October 2023 was received by the landlord in August 2023. The amount prepaid is shown in current liabilities as other payables. - Insurance for $600 was paid for the period 1 July 2023 to 30 June 2024. If the company’s accounting year end is 30 September 2023, the amount of prepayment for insurance is 600/12 x 9 = $450 for the period from 1 October 2023 to 30 June 2024. The expenses prepaid is shown in current asset as prepayment. - Electricity outstanding at the end of the month is accrued as expenses for the month though it was paid in subsequent month. The amount accrued is shown under other payable in the statement of financial position. 2. Business Entity Principle The affairs of the business are treated as separate from non-business activities of its owners. This principle is applicable to partnership, limited companies and clubs and societies etc. Application - The expenses paid for owners are recorded as drawings in a sole trader’s account. Cash withdrawn from the business by a sole trader is recorded as drawings. 3. Consistency Principle Similar transactions should be recorded using the same accounting method year after year. Application - If a business has been using straight-line method of depreciation, it should not suddenly switch to reducing balance method. The business has been using first-in-first-out(FIFO) in valuing its inventory, it should not change to weighted average method of valuing its inventory. 1 Accounting Principles 4. Duality Principle The principle requires every transaction must have at least two entries, one account mut be debited and another account is credited. The amount for debit and credit must be equal. It is the foundation of the double entry system of book-keeping. Application - When an asset, say motor vehicle, is bought for cash, the motor vehicle account is debited and the cash account is credited. When rental is paid from the bank account through standing instruction, the expense account, rent payable account is debited and bank account is credited. 2