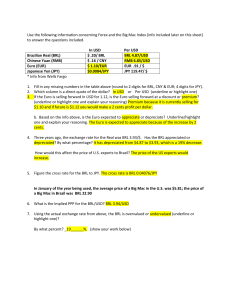

Name: Jacquelyn Perez Use the following information concerning Forex and the Big Mac Index (info included later on this sheet) to answer the questions included. Brazilian Real (BRL) Chinese Yuan (RMB) Euro (EUR) Japanese Yen (JPY) * Info from Wells Fargo In USD $ .20/ BRL $ .16 / CNY $1.19/ EUR $0.0084/ JPY Per USD BRL 5.00/ $ RMB 6.5/ $ EUR .91 / $ JPY 119.47/ $ 1. Fill in any missing numbers in the table above (round to 2 digits for BRL, CNY & EUR; 4 digits for JPY). 2. Which column is a direct quote of the dollar? In USD or Per USD (underline or highlight one) 3. If the Euro is selling forward In USD for 1.12, is the Euro selling forward at a discount or premium? (underline or highlight one and explain your reasoning) The Euro is selling at .07 less that what it is set at in the US, meaning there is a discount. b. Based on the info above, is the Euro expected to appreciate or depreciate? Underline/highlight one and explain your reasoning. Because the Euro is being sold at a discounted rate, we can infer that its value has depreciated. 4. Three years ago, the exchange rate for the Real was BRL 3.93/$. Has the BRL appreciated or depreciated? By what percentage? The BRL has appreciated by 27% How would this affect the price of U.S. exports to Brazil? The price of exports from US to Brazil might increase. 5. Figure the cross rate for the BRL to JPY. In January of the year being used, the average price of a Big Mac in the U.S. was $5.81; the price of a Big Mac in Brazil was BRL 22.90 6. What is the Implied PPP for the BRL/USD? 7. Using the actual exchange rate from above, the BRL is overvalued or undervalued (underline or highlight one)? By what percent? _______%. (show your work below)