Contract Law Study Material: Essentials, Consideration, E-Contracts

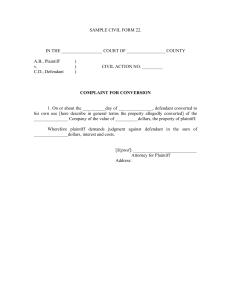

advertisement