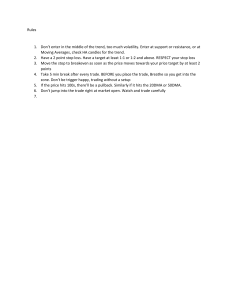

TRADING PLAN My trading day 1. Get up early – around 7am. Go over my morning routine. Breathe deep and enjoy all the good things in life! 2. Meditate and get concentrated – if I don’t feel well –don’t trade! 3. Read my “Before trading checklist” and make sure I know every single point of it! 4. Check out News Calendar and mark if there is any red news (H). 5. Start analyzing. Delete every analyzed pair and do it again so that a story will be built. Be much focused and adhere to all the criteria! 6. Select one 1 to 3 setups, which I completely understand! Write down how I would like to trade them in my journal and note every move from then on. Focus on the move and what I want to see. If it develops – perfect, if not – let go!! 7. Wait very patiently for the price to develop. I trade around NY open, so relax until then! NO RUSH NEEDED!! Possible entries late at night as well. TRADING SYSTEM Weekly key levels, support and resistance. Mark any wick support/ resistance levels and see if there is a reaction. Follow the weekly candles and get to know what is about to potentially happen. Mark the key levels Step down to D1, where the analysis begins: - Plot trend-lines (from wick to wick). The best set up is having a 3rd touch on the TL. - Which trend is on D1? HLs or LHs? Look for the overall trend. What do we expect now? A new HH or LL? Always keep in mind the D1 trend! Candlestick formations. What are the candles telling us on D1? Check for morning/ evening star, spin tops, dojis and engulfing candles. - Remember it’s more important where it is then what it is! - Candle formation have 85% win rate on D1 and 75% on 4H D1 Fibonacci-if there are clear swings, place your fib. The more they correspond with playgrounds, the better. Important Notes NO TRADES on Monday and Friday! When feeling impatient and pumped I AM A CONSISTENT WINNER BECAUSE: 1. I objectively identify my edges. The way to be objective is to operate out of beliefs that keep my expectations neutral and to always take the unknown forces into consideration. 2. I completely accept risk or I am willing to let go of the trade. 3. I act on my edges without reservation or hesitation. 4. I pay myself as the market makes money available for me. 5. I continually monitor my behavior after making errors. 6. I understand the absolute necessity of these principles of consistent SUCCESS and therefore I shall never violate them!! M.D’ Rules 1. Anything can happen. 2. I don’t need to know what is going to happen next in order to make money. 3. There is a random distribution between wins and losses for any given set of variables that define an edge. 4. An edge is nothing more than an indication of HIGHER PROBABILITY of one thing happening over another. Always put odds in my favor before entering a trade! 5. Every moment in the market is unique AND LASTLY, I’M THE NEXT 19YEAR OLD MILLIONAIRE!!!!