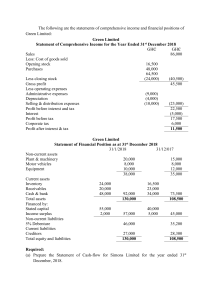

RIFT VALLEY UNIVERSITY TARGET GROUP- 4TH YEAR AcFn EXTENSION STUDENTS COURSE-ADVANCED FINANCIAL ACCOUNTING I (AcFn-4011) Group Assignment: Submission Date- one day final exam date Instructions Submit on time Attempt all questions Show all the necessary steps Sharing Answer is strictly forbidden Assignment should be submitted via soft copy to the instructor telegram/email address (mohitadese23@gmail.com). 1. List and discuss in detail the key differences between IFRS 4 and IFRS 17, and the rational for the amendment and replacement of IFRS 4 by IFRS 17. 2. Discuss in detail about A. Insurance contract measurement models with practical illustrations that incorporates major insurance contract features and shows initial and subsequent measurement of insurance contracts. (Note-Don’t forget to discuss their key differences and applicable areas) B. Insurance contract with direct participation and discretionary participation features. 3. Brockman Guitar Company is in the business of manufacturing top-quality, steel-string folk guitars. In recent years, the company has experienced working capital problems resulting from the procurement of factory equipment, the unanticipated buildup of receivables and inventories, and the payoff of a balloon mortgage on a new manufacturing facility. The founder and president of the company, Barbara Brockman, has attempted to raise cash from various financial institutions, but to no avail because of the company’s poor performance in recent years. In particular, the company’s lead bank, First Financial, is especially concerned about Brockman’s inability to maintain a positive cash position. The commercial loan officer from First Financial told Barbara, “I can’t even consider your request for capital financing unless I see that your company is able to generate positive cash flows from operations.” 1|Page 1|Page Thinking about the banker’s comment, Barbara came up with what she believes is a good plan: With a more attractive statement of cash flows, the bank might be willing to provide long-term financing. To “window dress” cash flows, the company can sell its accounts receivables to factors and liquidate its raw materials inventories. These rather costly transactions would generate lots of cash. As the chief accountant for Brockman Guitar, it is your job to tell Barbara what you think of her plan. Instructions Answer the following questions. a. What are the ethical issues related to Barbara Brockman’s idea? b. What would you tell Barbara Brockman? 4.The following information relates to the draft financial statements of Global trading company. Summarized statement of financial position as at: 31 December 2018 Assets Non-current assets Property, plant and equipment (note (i)) Current assets Inventory Trade receivables Tax refund due Bank Total assets Equity and liabilities Equity Equity shares of $1 each (note (ii)) Share premium (note (ii)) Retained earnings Non-current liabilities 10% loan note (note (iii)) Finance lease obligations Deferred tax 2|Page 31 December 2017 $’000 $’000 19,000 25,500 12,500 4,500 500 nil ––––––– 36,500 ––––––– 4,600 2,000 nil 1,500 ––––––– 33,600 ––––––– 10,000 3,200 4,500 –––––– nil 4,800 1,200 7,700 ––––––– 17,700 6,000 8,000 4,000 6,300 –––––– 5,000 2,000 800 10,300 ––––––– 18,300 7,800 Current liabilities 10% loan note (note (iii)) Tax Bank overdraft Finance lease obligations Trade payables Total equity and liabilities 5,000 nil 1,400 1,700 4,700 –––––– 12,800 ––––––– 36,500 nil 2,500 nil 800 4,200 –––––– 7,500 ––––––– 33,600 Summarized Income statements for the years ended: 31 December 2018 31 December 2017 $’000 $’000 Revenue 55,000 40,000 Cost of sales (43,800) (25,000) ––––––– ––––––– Gross profit 11,200 15,000 Operating expenses (12,000) (6,000) Finance costs (note (iv)) (1,000) (600) ––––––– ––––––– Profit (loss) before tax (1,800) 8,400 Income tax relief (expense) 700 (2,800) ––––––– ––––––– Profit (loss) for the year (1,100) 5,600 The following additional information is available: Property, plant and equipment is made up of: As at: 31 December 2018 31December 2017 $’000 $’000 Leasehold property nil 8,800 Owned plant 12,500 14,200 Leased plant 6,500 2,500 ––––––– ––––––– 19,000 25,500 ––––––– ––––––– During the year Alpha Trading sold its leasehold property for $8·5 million and entered into an arrangement to rent it back from the purchaser. There were no additions to or disposals of owned plant during the year. The depreciation charges (to cost of sales) for the year ended 31 December 2018 were: $’000 Leasehold property 200 Owned plant 1,700 Leased plant 1,800 3,700 (i) 3|Page (ii) On 1 April 2017 there was a bonus issue of shares from share premium of one new share for every 10 held. On 1 July 2017 there was a fully subscribed cash issue of shares at par. (iii) The 10% loan note is due for repayment on 31 March 2018. Alpha Trading is in negotiations with the loan provider to refinance the same amount for another five years. (iv) The finance costs are made up of: For year ended: Finance lease charges Overdraft interest Loan note interest 31 December 2018 $’000 300 200 500 1,000 31 December 2017 $’000 100 nil 500 600 Required: Prepare a statement of cash flows for Alpha Trading for the year ended 31 December 2018 in accordance with IAS 7 Statement of cash flows, using the indirect method; (ii) Based on the information available, advice the loan provider on the matters you would take into consideration when deciding whether to grant Alpha Trading a renewal of its maturing loan note. (i) (b) On a separate matter, you have been asked to advice on an application for a loan to build an extension to a sports club which is a not-for-profit organization. You have been provided with the audited financial statements of the sports club for the last four years. Required: Identify and explain the ratios that you would calculate to assist in determining whether you would advise that the loan should be granted. 4|Page 5. General Motors Company, a major retailer of bicycles and accessories, operates several stores and is a publicly traded company. The comparative statement of financial position and the income statement for General Motors as of May 31, 2022, are as follows. The company is preparing its statement of cash flows. General Motors Company Comparative Statements of Financial Position As of May 31 2022 2021 Plant assets $600,000 $502,000 Less: Accumulated depreciation—plant assets 150,000 125,000 Plant assets (net) 450,000 377,000 Inventory 220,000 250,000 Prepaid expenses 9,000 7,000 Accounts receivable 75,000 58,000 Cash 28,250 20,000 Total current assets 332,250 335,000 $782,250 $712,000 Share capital—ordinary, $10 par $370,000 $280,000 Retained earnings 145,000 120,000 515,000 400,000 70,000 100,000 Current assets Total assets Equity Total equity Non-current liabilities Bonds payable 5|Page Current liabilities Accounts payable 123,000 115,000 Salaries and wages payable 47,250 72,000 Interest payable 27,000 25,000 Total current liabilities 197,250 212,000 Total liabilities 267,250 312,000 $782,250 $712,000 Total equity and liabilities General Motors Company Income Statement For the Year Ended May 31, 2022 Sales revenue $1,255,250 Cost of merchandise sold 722,000 Gross profit 533,250 Expenses Salaries and wages expense 252,100 Interest expense 75,000 Other expenses 8,150 Depreciation expense 25,000 Total expenses 360,250 Operating income 173,000 Income tax expense 43,000 Net Income 130,000 6|Page The following is additional information concerning General Motor’s transactions during the year ended May 31, 2022. 1. All sales during the year were made on account. 2. All merchandise was purchased on account, comprising the total accounts payable account. 3. Plant assets costing $98,000 were purchased by paying $28,000 in cash and issuing 7,000 ordinary shares. 4. The “other expenses” are related to prepaid items. 5. All income taxes incurred during the year were paid during the year. 6. In order to supplement its cash, General Motor issued 2,000 ordinary shares at par value. 7. There were no penalties assessed for the retirement of bonds. 8. Cash dividends of $105,000 were declared and paid at the end of the fiscal year. Instructions a. Compare and contrast the direct method and the indirect method for reporting cash flows from operating activities. b. Prepare a statement of cash flows for General Motors Company for the year ended May 31, 2022, using the direct method. Be sure to support the statement with appropriate calculations. c. Using the indirect method, calculate only the net cash flow from operating activities for General Motors Company for the year ended May 31, 2022. d. What would you expect to observe in the operating, investing, and financing sections of a statement of cash flows of: 1. A severely financially troubled firm? 2. A recently formed firm that is experiencing rapid growth? 7|Page 6. Teresa Ramirez and Lenny Traylor are examining the following statement of cash flows for Panaka Clothing Store’s first year of operations. Panaka Clothing Store Statement of Cash Flows For the Year Ended January 31, 2022 Sources of cash From sales of merchandise € 382,000 From sale of ordinary shares 380,000 From sale of debt investment 120,000 From depreciation 80,000 From issuance of note for truck 30,000 From interest on investments 8,000 Total sources of cash 1,000,000 Uses of cash For purchase of fixtures and equipment 330,000 For merchandise purchased for resale 253,000 For operating expenses (including depreciation) For purchase of debt investment 170,000 For purchase of truck by issuance of note 30,000 For purchase of treasury shares 10,000 For interest on note 3,000 Total uses of cash 891,000 Net increase in cash € 109,000 8|Page 95,000 Teresa claims that Panaka’s statement of cash flows shows a superb first year, with cash increasing €109,000. Lenny replies that it was not a superb first year: the year was an operating failure, the statement was incorrectly presented, and €109,000 is not the actual increase in cash. Instructions a. With whom do you agree, Teresa or Lenny? Explain your position. b. Using the data provided, prepare a statement of cash flows in proper indirect method form. The only non-cash items in income are depreciation and the gain from the sale of the investment (purchase and sale are related). 9|Page