The Attention Economy and How Media Works Simple Truths for Marketers (Karen Nelson-Field) (Z-Library)

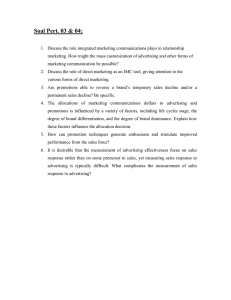

advertisement