ACL – Reading list and Case Summaries

Week 1 – INTRODUCTION

44, 51, 116, 122

Book – Pages 1 – 6, 234 – 250, 762 – 802, 806 – 829, 861 – 881

Relevant sections of the constitution

-

Any person who:

(i)

is under any acknowledgment of allegiance, obedience, or adherence to a foreign power, or is a subject or a

citizen or entitled to the rights or privileges of a subject or a citizen of a foreign power; or

(ii)

is attainted of treason, or has been convicted and is under sentence, or subject to be sentenced, for any

offence punishable under the law of the Commonwealth or of a State by imprisonment for one year or

longer; or

(iii)

is an undischarged bankrupt or insolvent; or

(iv)

holds any office of profit under the Crown, or any pension payable during the pleasure of the Crown out of

any of the revenues of the Commonwealth: or

(v)

has any direct or indirect pecuniary interest in any agreement with the Public Service of the Commonwealth

otherwise than as a member and in common with the other members of an incorporated company consisting

of more than twenty-five persons;

shall be incapable of being chosen or of sitting as a senator or a member of the House of Representatives.

-

But subsection (iv) does not apply to the office of any of the Queen’s Ministers of State for the

Commonwealth, or of any of the Queen’s Ministers for a State, or to the receipt of pay, half pay, or a pension,

by any person as an officer or member of the Queen’s navy or army, or to the receipt of pay as an officer or

member of the naval or military forces of the Commonwealth by any person whose services are not wholly

employed by the Commonwealth.

-

The Parliament shall, subject to this Constitution, have power to make laws for the peace, order, and good

government of the Commonwealth with respect to:

-

(A large number of things…)

The Commonwealth shall not make any law for establishing any religion, or for imposing any religious

observance, or for prohibiting the free exercise of any religion, and no religious test shall be required as a

qualification for any office or public trust under the Commonwealth.

1

-

The Parliament may make laws for the government of any territory surrendered by any State to and accepted by

the Commonwealth, or of any territory placed by the Queen under the authority of and accepted by the

Commonwealth, or otherwise acquired by the Commonwealth, and may allow the representation of such

territory in either House of the Parliament to the extent and on the terms which it thinks fit.

Relevant cases

(1920) 28 CLR 129

Case summary/Quote:

Constitution is the political compact of the whole of Australia people:

“That instrument is the political compact of the whole of the people of Australia, enacted into binding law by

the Imperial Parliament, and its chief and special duty of this Court faithfully to expound and give effect to it

according to its own terms, finding the intention from the words of the compact, and upholding it throughout

precisely as framed” (at 142)

Constitution is the Australian people’s & elections fix problems not Courts:

“When the people of Australia, to use the words of the Constitution itself, “united in a Federal

Commonwealth”, they took power to control by ordinary constitutional means any attempt on the part of the

national Parliament to misuse its powers. If it be conceivable that the representatives of the people of Australia

as a whole would ever proceed to use their national powers to injure the people of Australia considered

sectionally, it is certainly within the power of the people themselves to resent and reverse what may be done.

No protection of this Court in such a case is necessary or proper”. (at 151-152)

(2017) 263 CLR 284

Relevant Sections: 44

Background: A number of senators nominated as candidates for election, and in turn, were elected. Mr.

Ludlam, Ms Waters and Senator Roberts were born overseas; NZ, Canada and India respectively. In the other

cases (The other senators) each had one or more parents or grandparents who had been born overseas. It was

found they had dual citizenships. The question arose whether s44 of the Constitution was interpreted literally,

and that they should be struck from being able to nominate as candidates.

Held: That proof of an election candidate’s knowledge of his or her foreign citizenship, or of facts that might

put a candidate on inquiry as to that possibility, is not necessary to disqualify that person from being chosen or

sitting as a senator or member.

2

Per curiam (By the Court). A person who, at the time that he or she nominates for election, retains the status of

subject or citizen of a foreign power will be disqualified by reason of s 44(i), except where the operation of the

foreign law is contrary to the constitutional imperative that an Australian citizen not be irremediably prevented

by foreign law from participation in representative government. Where it can be demonstrated that the person

has taken all steps that are reasonably required by the foreign law to renounce his or her citizenship and within

his or her power, the constitutional imperative is engaged.

You’re not irredeemably disqualified if you take reasonable steps…

Case summary/Quote:

-

Kiefal CJ

The facts in the references concerning Senators Canavan, Nash and Xenophon, Ms Waters and Mr Joyce

illustrate that, if s 44(i) of the Constitution operated to disqualify those parliamentarians, that operation would

be far removed from its purpose in addressing split allegiances. It was held in Sykes v Cleary that the text of s

44(i) does not have its literal meaning and so does not give unqualified effect to foreign law. (1992) 176 CLR

77 at 107, 113, 127, 131, 137).

-

(paragraphs 20 – 23) The Court accepted the approach to treat s 44(i) as though it had two limbs, being two

severable bases for ineligibility (Re Canavan (2017) 349 ALR 534, 540–1 [20]–[23]):

o 1. acknowledgement of allegiance to a foreign power; and

o 2. citizenship, or entitlement to the rights of citizenship, of a foreign power.

-

(paragraph 13) - The approach to construction urged by the amicus and on behalf of Mr Windsor gives s 44(i)

its textual meaning, subject only to the implicit qualification in s 44(i) that the foreign law conferring foreign

citizenship must be consistent with the constitutional imperative underlying that provision, namely, that an

Australian citizen not be prevented by foreign law from participation in representative government where it can

be demonstrated that the person has taken all steps that are reasonably required by the foreign law to renounce

his or her foreign citizenship.

-

(paragraph 21) - The amicus submitted that s 44(i) has two limbs, not three as was suggested by Brennan J.

He contended that the first limb disqualifies a person who “is under any acknowledgment” of the stated kind,

and the second limb disqualifies a person who “is a subject or a citizen or entitled to the rights or privileges of a

subject or a citizen of a foreign power”. In the first limb, the words “under any acknowledgment” capture any

“person who has formally or informally acknowledged allegiance, obedience or adherence to a foreign power

and who has not withdrawn or revoked that acknowledgment”(Nile v Wood (1987) 167 CLR 133 at 140).

Within this limb the word “acknowledgment” connotes an act involving an exercise of the will of the person

concerned. In contrast, in the second limb of s 44(i), the words “subject”, “citizen” and “entitled to the rights”

connote a state of affairs involving the existence of a status or of rights under the law of the foreign power. (cf

Sykes v Cleary (1992) 176 CLR 77 at 107, 110, 131).

-

Subject or citizen – the role of the foreign law: (paragraph 37) - Whether a person has the status of a

subject or a citizen of a foreign power necessarily depends upon the law of the foreign power. That is so

3

because it is only the law of the foreign power that can be the source of the status of citizenship or of the rights

and duties involved in that status.

-

In Sue v Hill, Gleeson CJ, Gummow and Hayne JJ referred with approval to the reasoning of Brennan and

Gaudron JJ in Sykes v Cleary ((1992) 176 CLR 77 at 112-114, 135-136). in confirming the proposition that s

44(i) looks to the relevant foreign law to determine whether a candidate is a foreign citizen ((1999) 199 CLR

462 at 486-487 [47]).

-

Renouncing your citizenship (of a foreign subject) isn’t enough to suggest you’ve taken reasonable steps:

(paragraph 66) - It is evident that this view did not commend itself to the other five Justices, who proceeded

on the basis that a unilateral renunciation was not sufficient to terminate the status of citizenship under the

foreign law.

-

Summary of construction of s44: (paragraphs 70-71)

Section 44(i) operates to render “incapable of being chosen or of sitting” persons who have the status of subject

or citizen of a foreign power. Whether a person has the status of foreign subject or citizen is determined by the

law of the foreign power in question. Proof of a candidate's knowledge of his or her foreign citizenship status

(or of facts that might put a candidate on inquiry as to the possibility that he or she is a foreign citizen) is not

necessary to bring about the disqualifying operation of s 44(i).

-

A person who, at the time that he or she nominates for election, retains the status of subject or citizen of a

foreign power will be disqualified by reason of s 44(i), except where the operation of the foreign law is

contrary to the constitutional imperative that an Australian citizen not be irremediably prevented by foreign law

from participation in representative government. Where it can be demonstrated that the person has taken all

steps that are reasonably required by the foreign law to renounce his or her citizenship and within his or her

power, the constitutional imperative is engaged.

Week 2 – TRADE AND COMMERCE POWER

Book – Pages 889 – 900

and/or

51(i), 98, 92, 122

class/lectures

-

Section 51(i)

-

“Constitutional trade and commerce” (E.g Criminal Code Act 1995 (Cth)

o Important: Need to distinguish between intrastate and interstate (within states and between states)

-

Section 98 confirms s 51(i) ‘extends to navigation & shipping & railways the property of any state”

-

Section 92 – trade & commerce between the states to be absolutely free (s92 case law is bad case law??)

o The same words ‘trade & commerce’ have same meaning as s51(i) James v Cth (1936) 55 CLR 1

o Per Knox CJ, Isaacs, Starke JJ

▪

Is not confined to mere act of transportation across borders

▪

Includes all commercial arrangements of which transportation is the direct and necessary result

4

▪

Includes negotiations, bargaining, transport and delivery

o Regulate conduct of persons employed in international or interstate trade & commerce

▪

Re Maritime Union of Australia; Ex parte CSL Pacific Inc (2003)

o Participate in interstate trade & commerce

▪

Airlines: Australian National Airways v Cth (ANA Case) (1945)

▪

Shipping: Australian Coastal Shipping Commission v O’Reilly (1962)

-

Australian Airlines Act 1945 (Cth) sets up a govt airline to run interstate & territorial air transport services.

-

ANA (Australian National Airways Pty Ltd) argued that s51(i):

o Only allowed Cth to regulate, but not to partake in trade & commerce;

o Did not authorize interstate transportation of people who were not themselves engaging in interstate

trade & commerce

-

HCA said

o allowed Cth to actually engage in, not just regulate, interstate trade & commerce

o All for profit interstate transportation is interstate ‘trade & commerce’

o Cth Constitution meant to endure

o Broad interpretation: No importation of limitation into power’s descriptive words.

o Law authorizing Cth to operate interstate transportation, whether monopoly or not, is a law w.r.t

interstate ‘trade & commerce’

-

Its demise did not eliminate the distinction between interstate and intrastate trade & commerce

-

S51(i) did not grant intrastate trade & commerce power to Cth. It did not reserve it to the States – Strickland v

Rocla Concrete Pipes (1971) per Barwick CJ.

-

Strict observance of distinction between intra and inter-state.

In 1919 Australia had entered into the Convention Relating to the Regulation of Aerial Navigation, and parliament

enacted the Aircraft Navigation Act 1920, which authorised the Governor-General to make regulations to give effect to

the Convention. Henry was convicted of flying without a license, having flown around, over and under the Sydney

Harbour Bridge. The Commonwealth relied upon 3 sources of constitutional power, interstate trade and commerce,

foreign affairs and territories.

5

Henry Goya Henry was an aviator who had his aviation licence suspended. Two days after the suspension he

nevertheless flew a plane, setting off from Mascot airport and then flying around, over and under the Sydney Harbour

Bridge. He was convicted of breaching regulation 6 of the federal Air Navigation Regulations which prohibited an

unlicensed person from flying an aircraft "within the limits of the Commonwealth". The regulations were made

pursuant to section 4 of the Aircraft Navigation Act 1920, which authorised the Governor-General to make regulations

to give effect to the Convention for the Regulation of Aerial Navigation. He challenged the constitutional validity of

the regulation

-

Air Navigation Act 1920 (Cth) s4:

o Allowed Regs to control air navigation in Australia

o Did not distinguish between intra and interstate air navigation

-

Broad language used because States were originally supposed to refer their powers to Cth under s51(xxxvii)

-

But ultimately, only Tasmania effectively did.

-

Latham CJ:

o Uniform air navigation rules are clearly desirable. Grave risks of serious accident if rules are not

uniform throughout Australia.

o But: expediency cannot control the natural construction of statutory language.

o Rejected the argument that if interstate or foreign/interstate trade & commerce are so intermingled that

Cth must control intrastate trade & commerce

o Might be different if there was evidence that intermingling made it impossible for Cth to regulate

interstate/foreign trade & commerce without regulating intrastate trade & commerce

-

Dixon J

o S4 made no distinction between inter/intra state air navigation but attempted to regulate the entire

subject of air navigation

o Acknowledged that distinction between intra/inter state air navigation is inconvenient and difficult to

maintain.

o But, express limitation in s51(i), however artificial, must be maintained when ascertaining what is

incidental to the power

-

Evatt & McTiernan JJ:

o No denial that if intrastate air navigation has a direct & proximate relationship to interstate air

navigation that it might engage the incidental power in s51(i).

-

Henry had not been flying from or to any other state or country. The Commonwealth argued that the

commingling in air routes and airports of aircraft proceeding intrastate with those traveling interstate, enabled it

to control all aircraft. The Court rejected the commingling argument, preferring to maintain a distinction

between interstate and intrastate trade. Mr Henry could not be prevented by the Commonwealth from stuntflying around Sydney Harbour under the commerce power. The Constitution clearly distinguished between

intrastate and interstate commerce, and confined the Commonwealth to the latter

6

Can Cth use the incidental power in s51(i) to legislate on purely intrastate trade & commerce?

-

Dixon J

o Distinction may be artificial & outdated.

o But it is a distinction that Constitution adopts and so must be observed.

o Incidental power in s51(i) cannot ignore the distinction made in the text

-

Air Navigation Regulations 1947 (Cth):

o Coverage extended to include intrastate flights in 1964.

▪

Reg 198: commercial flying operators must hold a federal licence.

▪

Reg 199: matters of safety, regularity & operational efficiency of air navigation to be considered

when issuing licence for "other than interstate service'

▪

Reg 200B: licensee under Reg 198 may operate flights regardless of State laws.

-

Air Transport Act 1964 (SW) required operators in NSW to be licensed.

-

Airlines of NSW had its NSW licence cancelled, and appealed to HCA alleging NSW Act to be inconsistent

with Cth Regs.

o This should have been an inconsistency argument (s109) between the states and Cth

-

HCA (6:1) Regs 198 and 199 were valid

-

Kitto & Windeyer JJ relied on s51(i);

o Kitto: Purposes of Regs 198-199 is to aid & protect safety, regularity and operational efficiency of

intrastate air navigation, to protect against danger of physical interference to interstate air navigation.

So, they are within s51(i) power.

o NOT within s51(i) power if the danger is merely economic interference with interstate trade (eg. Lower

profits)

-

McTiernan J relied on s51(xxix) external affairs power [Chicago Convention 1944]

-

Menzies & Owen JJ relied on both s 51(i) & s51(xxix);

-

Backwick CJ agreed both were applicable, preferring s51(i);

-

Taylor J (dissenting) both regs were invalid

Conclusion: So 51(i) talks about trade and commerce. S98 allows s51(i) to incorporate flights and navigation. the Air

Navigation Act 1920 (Cth) tried to control flights but did not specify between ‘intra or interstate’ flights. Ex Henry

bloke flew in Sydney Harbour… Because the Cth act didn’t specify above, his offence was dismissed. The Court

found that broad language was used because the States were originally supposed to refer their powers to the Cth under

s51(xxxvii).

7

So the commonwealth created regulations under the Air Navigation Regulation 1947 (Cth). This coverage (The

controlling of flights etc) extended to include ‘intrastate’ flights (The regs covered pilots holding a federal licence,

safety protocols etc etc). NSW had a hissy fit over this in Airlines of NSW v NSW (No 2), because their NSW

legislation stated their NSW pilots had to be licensed. Airlines of NSW had their licences cancelled alleging that the

new Cth regulations were inconsistent. As above, the HCA (6:1) found the Cth regs were valid.

Sufficient Connection

-

Incidental scope of s51(i) may be greater when trade & commerce is international.

-

There needs to be a sufficient connection between the intrastate activity and interstate/overseas trade.

-

The connection cannot be so ‘insubstantial, tenuous or distance’ per Dixon J Melbourne Corp v Cth (1947)

Activities preliminary to trade

-

Production or manufacture is not part of interstate trade; it is preliminary to trade.

-

Interstate trade & commerce begins when the goods are moved across state lines (after production or

manufacture is complete) – Beal v Marrickville Margarine (1966) 114 CLR 283.

-

What about production for export?

O'Sullivan y Noarlunga Meat (1954)

-

Customs Act 1901 (Cth)

-

Commerce (Meat Export) Regs (Cth)

o Reg 4B prohibited export of meat unless meat had been treated & stored in premises registered (by

Cth).

o Reg 5: all premises used for the slaughter, treatment & storage of meat for export shall be registered.

-

Detailed standards were specified in regs.

-

Metropolitan & Export Abattoirs Act 1936 (SA) prohibited use of any premises for slaughtering stock

-

for export without a state licence.

-

Noarlanga Meat Ltd did not hold a SA licence.

-

Fullagar J:

o s 51 (i) power over trade & commerce with other countries does authorise legislation controlling

slaughter of meat for export.

o Whole process of killing to packing is conditioned by predetermined destination.

o "Slaughter for export" is a definitive objective conception distinct from slaughter for home

consumption. Distinct quality & grade, packaging, labelling, handling etc, for export. of mining metals

for export, sowing wheat for Export

o Cf mining metals for export, sowing wheat for export

Economic Connection?

8

-

Recall ANA Case:

o S51(i) authorizes Cth to participate in interstate trade and commerce, not just regulate

-

Recall Airlines of NSW v NSW (No 2):

o Within power as there was physical danger to interstate air navigation.

o Would not have been within power if interference was purely economic.

-

ANAC wanted its airline, Trans-Australian Airlines (TAA) to stopover at Port Hedland (WA) in its PerthDarwin route.

o Australian National Airlines Act 1945 (Cth) s 19B allowed ANAC to transport passengers intrastate

for the purpose of the efficient, competitive or profitable conduct of ANAC’s business.

o Ansett, TAA’s competitor, challenged the validity of s19B.

-

HCA: s19B valid based on 122 (power over territories) per Stephen, Mason and Murphy JJ.

-

Insofar as validity under s51(i):

o Barwick CJ, Gibbs & Stephen JJ held it not within s51(i) incidental power.

o Murphy J dissented, arguing for winder interpretation of s51(i) power.

o Mason J did not decide on s51(i) issue.

-

Stephen J:

o Constitutional division of power over trade & commerce between Cth & States meant incidental powers

in s51(i) is narrowly construed when dealing with intrusion into intrastate trade & commerce.

o In Airlines of NSW v NSW (No 2):

▪

Cth cannot regulate intrastate air navigation to enhance profitability of interstate/international

air navigation.

▪

Kitto J’s distinction between physical and economic danger to interstate air navigation.

o S19B supported by s122. Acts Interpretation Act 1901 (Cth) s15A used to read down s19B to exclude

its invalid operation.

-

Put down legal principles.

Physical / economic danger.

Inter/Intra state.

Incidental.

Don’t think of case names.

Think of issues

Relevant sections of the constitution

-

The Parliament shall, subject to this Constitution, have power12 to make laws for the peace, order, and good

government of the Commonwealth with respect to:

o (i) trade and commerce with other countries, and among the States;

9

-

On the imposition of uniform duties of customs, trade, commerce, and intercourse among the States, whether

by means of internal carriage or ocean navigation, shall be absolutely free.

But notwithstanding anything in this Constitution, goods imported before the imposition of uniform duties of

customs into any State, or into any Colony which, whilst the goods remain therein, becomes a State, shall, on

thence passing into another State within two years after the imposition of such duties, be liable to any duty

chargeable on the importation of such goods into the Commonwealth, less any duty paid in respect of the goods

on their importation.

-

The power of the Parliament to make laws with respect to trade and commerce extends to navigation and

shipping, and to railways the property of any State.

-

The Parliament may make laws for the government of any territory surrendered by any State to and accepted by

the Commonwealth, or of any territory placed by the Queen under the authority of and accepted by the

Commonwealth, or otherwise acquired by the Commonwealth, and may allow the representation of such

territory in either House of the Parliament to the extent and on the terms which it thinks fit

Relevant cases

(1945) 71 CLR 29

Relevant Sections: section 51(i) – trade and commerce

Case summary/Quote:

-

In this case, Australian National Airways (ANA) challenged the validity of the Air Navigation Act 1920 (Cth),

which gave the Commonwealth the power to take over and operate any airline in the country. ANA argued that

this law exceeded the Commonwealth's constitutional powers and was therefore unconstitutional.

-

The High Court, however, ruled in favor of the Commonwealth, holding that the Air Navigation Act was a

valid exercise of the Commonwealth's constitutional power to make laws with respect to trade and commerce.

The court emphasized that the airline industry was a vital part of the national economy, and that the

Commonwealth had the power to regulate and control it in the national interest.

-

The decision in this case had significant implications for the development of Australian constitutional law and

the scope of Commonwealth power. It established that the Commonwealth had broad powers to regulate and

control trade and commerce, including the power to nationalize industries deemed vital to the national interest.

10

-

The Commonwealth could make the law under s51(i) which was ‘interstate’.

(1954) 92 CLR 565

Relevant Sections: s51(i), s109

Case summary/Quote:

-

a case decided in the High Court of Australia regarding the scope of the trade and commerce power, under s

51(i) of the Australian Constitution, and inconsistency between Commonwealth and State laws, under section

109 of the Constitution.

-

Noarlunga Meat Ltd was charged with contravening the Metropolitan and Export Abattoirs Act 1936 (SA), s

52a, because it did not hold a State licence for slaughtering stock. All premises outside the metropolitan area

"for the purpose of slaughtering stock for export as fresh meat in a chilled or frozen condition" were required to

obtain a licence from the State Agriculture Minister. However, the defendant company was registered under the

Commerce (Meat Export) Regulations (Cth). Regulation 4B prohibited the exportation of meat unless an export

permit had been granted, and regulation 5 required that all premises used for the slaughter of meat to be

registered.

-

The defendant company argued that the State act was invalid by virtue of inconsistency with the

Commonwealth regulations, which is dealt with in s 109 of the Constitution.

-

The Commonwealth has the power to make laws with respect to "trade and commerce with other countries, and

among the States", as per s 51(i) of the Constitution. This power authorises the prohibition of the export of

certain commodities, and by extension the prohibition of commodities with certain restrictions. Regulation 4B

is therefore within its power.

-

Regulation 5 does not fall under the direct head of power. Instead, it falls within the implied incidental power,

which was best expressed in D'Emden v Pedder (1904) 1 CLR 91 at p 110. Fullagar J, with whom Dixon CJ

and Kitto J concurred, stated that the Commonwealth may control any steps leading to the export itself

(generally labelled as "production") that may affect "beneficially or adversely" Australia's export trade. This

includes provisions to control the quality of meat being exported, which may involve regulation of such stages

as packaging and handling. In fact, it may be necessary to "enter the factory or the field or the mine" to secure

Australia's export industry.

11

-

In general regulation of production may occur where there is an objectively different method of production

between meat destined for home and foreign consumption, but Fullagar J was clear in restricting the

application of the principle to the specific factual circumstances at hand.

-

Fullagar J noted that it was possible to obey both sets of laws simultaneously, by acquiring both State and

Commonwealth licenses. However, it was his opinion that the regulations expressed an intention to

"completely and exhaustively" cover the field with regards to the regulation of such premises; he found the

detailed regulations compelling in this regard. Furthermore, the State law would have acted to deny the rights

granted by a certificate obtained under the Commonwealth regulations.

-

The court was split 3-3. As this was a stated case and not an appeal, the decision of the Chief Justice

prevailed,[2] in what is sometimes described as a statutory majority

(1965) 113 CLR 54

Relevant Sections: s51(i), s51i(xxix – incidental).

Case summary/Quote:

-

A case about the validity of Commonwealth regulations about intrastate air navigation. Although the

Commonwealth has the power to regulate interstate air navigation under s 51(i) of the Constitution, it can only

regulate intrastate air navigation under the implied incidental power attached to that head of power. It was held

that intrastate air navigation can be regulated to the extent that it provides for the safety of, or prevention of

physical interference with, interstate or foreign air navigation

-

Section 51(i) permits the Commonwealth to make laws, for interstate and foreign air operations, about safety,

regularity and efficiency, as this would protect, foster and encourage interstate and foreign trade and

commerce. Barwick CJ stated that this would then serve to extend to include intrastate air navigation, due to

intrinsic factors related to flight, and the factual situation in this case.

Relevant Sections: s51(i)

Case summary/Quote:

-

ANAC wanted its airline, Trans-Australian Airlines (TAA) to stopover at Port Hedland (WA) in its PerthDarwin route.

o Australian National Airlines Act 1945 (Cth) s 19B allowed ANAC to transport passengers intrastate

for the purpose of the efficient, competitive or profitable conduct of ANAC’s business.

12

o Ansett, TAA’s competitor, challenged the validity of s19B.

-

HCA: s19B valid based on 122 (power over territories) per Stephen, Mason and Murphy JJ.

-

Insofar as validity under s51(i):

o Barwick CJ, Gibbs & Stephen JJ held it not within s51(i) incidental power.

o Murphy J dissented, arguing for winder interpretation of s51(i) power.

o Mason J did not decide on s51(i) issue.

-

Stephen J:

o Constitutional division of power over trade & commerce between Cth & States meant incidental powers

in s51(i) is narrowly construed when dealing with intrusion into intrastate trade & commerce.

o In Airlines of NSW v NSW (No 2):

▪

Cth cannot regulate intrastate air navigation to enhance profitability of interstate/international

air navigation.

▪

Kitto J’s distinction between physical and economic danger to interstate air navigation.

o S19B supported by s122. Acts Interpretation Act 1901 (Cth) s15A used to read down s19B to exclude

its invalid operation.

Week 3 – COMMONWEALTH TAXATION AND SPENDING

51(ii), 53, 54, 55, 83, 90, 99

Book – Pages 317 – 329, 1087 – 1100, 475 – 484, 493 – 503

class/lectures

and/or

o S51 – power to make laws…w.r.t

▪

ii) taxation; but so as not to discriminate between states or parts of states

o s90 – State’s limitation – Cth has exclusive power to levy duties of excise

▪

States are constitutionally barred from levying duties of excise

o S53 – The Senate:

▪

Cannot introduce bills imposing taxation or appropriating revenue/moneys;

▪

Cannot amend Bills imposing taxation or appropriating revenue/moneys for the ordinary annual

services of the Govt.

o S 55 – No tacking of non-tax matter onto a tax law

o S99 – Cth shall not by any law of trade, commerce or revenue, give preference to one state (or part

thereof) over another state (or part thereof)

o Per Latham CJ in Matthews v Chicory Marketing Board (Vic) (1938)

o A tax is

▪

A compulsory exaction of money

13

▪

By a public authority

▪

For public purposes

•

▪

Enforceable by law

And is not a payment for services rendered

o Air Caledonie Int’l v Cth (1988)

▪

HCA: Lathan CJ’s definition of tax in Matthew v Chicory is not exhausted & there are other

(non-exhaustive) criteria:

•

A penalty is not a tax

•

Taxes cannot be arbritrary

o A compulsory exaction

▪

Compulsion is a critical, but not the sole element.

•

▪

Bear in mind the exceptions: A compulsory licensing fee is not automatically a tax.

Compulsion may exist even if there is legally an avenue to avoid payment but in practice there

is little choice but to pay up

•

See A-G (NSW) v Homebush Flour Mills Ltd (1937) 56 CLR 390: the compulsory

acquisition scheme in Flour Acquisition Act 1931 (NSW)

▪

But note obiter in Air Caledonie

•

No reason in principle why a tax should not take a form other than the exaction of

money…

o By a Public Authority

▪

Air Caledonie

•

No reason in principle why the compulsory exaction of money… could not be properly

seen as taxation notwithstanding that it was by a non-public authority…

▪

What about the scenario where a law requires the compulsory payment of money to a nonpublic body?

▪

Aust Tape Manufacters Assocation Ltd v Cth (1993)

•

Copyright Amendment Act 1989 (cth)

o Required blank tape sellers to pay a ‘royalty’ to a ‘collecting society’, not to the

(Cth’s) Consolidated Revenue Fund

•

HCA (4:3)

o It was not a royalty – it was unrelated to any right, permission or consent by

copyright owners

o It is not essential to the concept of tax that the exaction should be by a public

authority

o For public purposes

▪

Air Caledonie

14

•

No reason in principle why the compulsory exaction of money… could not be properly

seen as taxation notwithstanding that it was… for the purposes which could not properly

be described as public

▪

What about the scenario where a law requires the compulsory payment of money to a nonpublic body?

•

Tape Manufacturers

o If a levy is payable into Consolidated Revneue Fund, the levy is regarded as

exacted for a public purpose; the converse proposition is not necessarily true.

o ‘public purposes’ is not synonymous with ‘government purposes’

o Directing a levy to be paid to a collecting society for distribution to copyright

holders as a solution to a problem of public importance is of necessity a public

purpose

o What if revenue raising not tax’s main purpose?

▪

Northern Suburbs General Cemetery Reserve Trust v Cth (Traiining Guarantee case) (1993)

•

A scheme that is revenue neutral to the Cth.

•

Employers who do not spend a minimum % of payroll on training employees owe a tax

debt

•

▪

Act does not list revenue raising as an object

HCA

•

It does not cease to be a tax just because revenue raising is merely secondary to another

object

•

Recap: Kitto J on characterisation in Fairfax v FCT

o Is a payment into Consolidated Revenue Fund automatically a tax?

▪

All taxes must be paid into Consolidated Revenue Fund (see s81); but are all payments into

CRF considered as taxes?

▪

Luton v Lessels (2002):

•

Child support (registration & Collection) Act 1988 (Cth)

•

Child support (Assessment) Act 1989 (Cth)

•

Child support payments so registered became a debt to the Cth. Amounts are payable

into CRF, then ultimately to child’s carer:

•

▪

Was this a tax (Validity challenged under s 55).

HCA held that it was not a tax

•

Guadron & Hayne JJ:

o Repeated Latham CJ’s definition of what a tax would typically be, but they are

not determinative – need to look at laws feature

o Not every payment into CRF is a tax

15

o This compulsory exaction falls outside description of taxation as:

▪

Existing obligation terminated and substituted with an equal obligation to

Cth

▪

Carer to receive same fund as partner??

o Tracing through CRF?

▪

Ray Morgan Research Pty Ltd v FCT (Superannuation Guarantee Case) (2011)

•

Superannuation Guarantee Charge Act 1992 (Cth) & Superannuation Guarantee

(Administration) Act 1992 (Cth)

▪

-

•

Was there a private and direct benefit on the employees (as opposed to public purpose)?

•

Can money be traced through CRF to disprove any public purpose?

HCA upheld the laws

Fee for services

S53: A proposed law shall not be taken to… impose taxation… by reason only of its containing… fees

for services

o A fee for services, even if compulsory, is not a tax,

o Elements of a free for services

▪

1. There is a specific identifiable service,

▪

2. A fee is paid for the service;

▪

3. The service is rendered to the person required to make the payment;

▪

4. The fee is proportionate to the service’s cost

o Fee for services

▪

▪

Harper v Vic (1966) – it is a fee for services (rather than a tax) if:

•

The fees purpose is to defray the cost of providing the specified services;

•

The fees are not devoted to building up consolidated revenue

•

The service’s cost determines the fee’s quantum

Parton v Milk Board (Vic) (1949) – It is not a fee for service (but a tax) if:

(ESSAY?)

•

Charge is used to fund governmental purposes unrelated to services rendered;

•

No particular service was rendered to the payer

o Air Caledonie Int’l v Cth (1988)

▪

$5 ‘immigration’ clearance fee’ payable by citizens & non-citzens, for clearance services

▪

HCA held that it was a tax and not a fee for servces:

•

Fee was not a fee for the privilege of entering Australia, as citizens had a right of entry

and did not need any clearnce from the executive.

•

▪

No actual service was rendered to citizens

S55 – No tacking allowed

16

•

Laws imposing taxation shall deal only with the imposition of taxation, and any

provision therein dealing with any other matter shall be of no effect.

o Case about Tax Bonus for Working Australians Act (No 2) 2009 (Cth)

▪

One off ‘tax bonus’ payment during GFC

▪

HCA (4:3) held Act a valid under 51 (xxxix) & a valid exercise of executive power

▪

Minority judges considered whether s 51 (ii) could support the Act

▪

Tax bonus was referred to a taxpayer’s taxable income in previous FY.

o But, tax bonus could be tax actually paid. One’s tax bonus could be lower or $0 if one had a higher

taxable income.

o Cth conceded s 51 (ii) did not support case where tax bonus > actual tax paid.

o Hayne & Kiefel JJ:

▪

Act had no direct connection between tax bonus amount & tax actually paid

▪

Act was not a law w.r.t taxation

▪

Read down the Act to make it a law w.r.t taxation by linking the tax bonus to amount of tax

paid.

o Tax Bonus Act 2009 (Cth) & the fiscal stimulus package during the GFC.

o Nationhood power is an executive power within s 61.

o Parliament may legislate to support nationhood power in matters incidental to its execution, using

s51(xxxix) express incidental power.

o Appropriation power in s81 is not a source of power that confers on Cth a substantive spending power

o S99 is triggered only if there is a preference, some sort of commercial advantage. A law that is merely

discriminatory does not trigger s 99.

o Mere geographical preference alone does not infringe s 99. Locality must be singled out for differential

treatment because it is a state or a part of a state.

o A law that discriminates on its face and in its effect is invalid

▪

Cameron v Deputy FCT (1923) – found not valid (Different taxes for states)

o Fortescue Metals Group v Cth (2013)

▪

Cth’s Minerals Resource Rent Tax (MRRT) levied a tax at 22.5% of miner’s annual profit

above a set threshold, less any mining royalties paid to Cth, state and territories

17

▪

-

Did MRRT discrimate between states?

Historical background of appropriation & responsible government, per French CJ in Pape 2009:

o Parliamentary control of executive spending: origins in 17 th Century England – bill of rights 1689

o Consolidated Revenue Fund 1787

o House of Commons had supreme control over taxation: no taxes without parliamentary approval

o 1. The impoisition of taxation must be authroised by Parliament

o All Crown revenue forms part of the CRF

o Only Parliament can authroise the appropriation of money from the CRF

o Mr Williams, a father of 4 children who attended Qld state school, challenged Cth’s funding of National

School Chaplaincy Program (NSCP), Scripture Union Qld (SUQ) had Funding Agreement with Cth to

provide chaplaincy services under NSCP.

o Relevant argument raised by Williams: Cth did not have power to enter into Agreement & make

payment to SUQ. As per Pape, s81 was not a substantive spending power.

o Cth had to argue that Agreement & spending could be supported by Cth executive power

o HCA rejected the Cth’s arguments.

▪

Executive power to spend is not found in ss 81 and 83 – per Pape

▪

Cth’s power to spend is not unlimited.

▪

Pape re – affirmed.

o Mr Williams challenged s 32B and Sch 1 AA. The challenged was unanimously upheld.

Relevant sections of the constitution

-

The Parliament shall, subject to this Constitution, have power to make laws for the peace, order, and good

government of the Commonwealth with respect to:

o (ii) taxation; but so as not to discriminate between States or parts of States

-

Proposed laws appropriating revenue or moneys, or imposing taxation, shall not originate in the Senate. But a

proposed law shall not be taken to appropriate revenue or moneys, or to impose taxation, by reason only of its

18

containing provisions for the imposition or appropriation of fines or other pecuniary penalties, or for the

demand or payment or appropriation of fees for licences, or fees for services under the proposed law.

-

The Senate may not amend proposed laws imposing taxation, or proposed laws appropriating revenue or

moneys for the ordinary annual services of the Government.

-

The Senate may not amend any proposed law so as to increase any proposed charge or burden on the people.

-

The Senate may at any stage return to the House of Representatives any proposed law which the Senate may

not amend, requesting, by message, the omission or amendment of any items or provisions therein. And the

House of Representatives may, if it thinks fit, make any of such omissions or amendments, with or without

modifications. Except as provided in this section, the Senate shall have equal power with the House of

Representatives in respect of all proposed laws.

-

The proposed law which appropriates revenue or moneys for the ordinary annual services of the Government

shall deal only with such appropriation.

-

Laws imposing taxation shall deal only with the imposition of taxation, and any provision therein dealing with

any other matter shall be of no effect.

-

Laws imposing taxation, except laws imposing duties of customs or of excise, shall deal with one subject of

taxation only; but laws imposing duties of customs shall deal with duties of customs only, and laws imposing

duties of excise shall deal with duties of excise only.

-

No money shall be drawn from the Treasury of the Commonwealth except under appropriation made by law.

But until the expiration of one month after the first meeting of the Parliament the Governor-General in Council

may draw from the Treasury and expend such moneys as may be necessary for the maintenance of any

department transferred to the Commonwealth and for the holding of the first elections for the Parliament.

-

On the imposition of uniform duties of customs the power of the Parliament to impose duties of customs and of

excise, and to grant bounties on the production or export of goods, shall become exclusive.

19

-

On the imposition of uniform duties of customs all laws of the several States imposing duties of customs or of

excise, or offering bounties on the production or export of goods, shall cease to have effect, but any grant of or

agreement for any such bounty lawfully made by or under the authority of the Government of any State shall

be taken to be good if made before the thirtieth day of June, one thousand eight hundred and ninety-eight, and

not otherwise.

-

The Commonwealth shall not, by any law or regulation of trade, commerce, or revenue, give preference to one

State or any part thereof over another State or any part thereof.

Relevant cases

(1988) 165 CLR 462

Relevant Sections: s55 – Taxing section

Case summary/Quote:

-

Defines a tax… But also suggests that s55 can remove the section as opposed to the whole act (Mainly

because this was an amendment act – so it could be excised safely without damaging the entirety of the

mother act).

-

(i) It was clear that the 'fee' purportedly exacted by the Act s 34A possessed all of the positive attributes which

had been accepted as prima facie sufficient to stamp an exaction of money with the character of a tax. It was

compulsory, it was exacted by a public authority for public purposes and it was enforceable by law. If an

amending Act purported to insert a provision imposing taxation in an existing valid Act which contained

provisions dealing only with other matters, it sought to bring about something which the Commonwealth

Constitution directly and in terms forbade and which was not within the competence of the Parliament to

achieve. It followed that the effect of the conclusion that s 34A was a law imposing taxation was that the

Amendment Act s 7 was ineffective to amend the Migration Act by adding s 34A to its provisions. The

Commonwealth's demurrer should be overruled.

(1993) 176 CLR

480

Relevant Sections: s 51(ii), s55

Case summary/Quote:

-

Reaffirmed Air Caledonie about a ‘tax’. That the collecting body doesn’t have to be a government body

for it to be a tax.

20

-

The Commonwealth made an amendment to the Copyright Act 1968 which was designed to compensate

copyright owners for the domestic and private taping of audio material not deemed to be illegal. The money

was not paid to the Commonwealth, but to a private entity that distributed the funds to copyright owners as a

private copying levy.

-

The Court majority (Mason CJ, Brennan, Deane, Gaudron JJ) relied on dicta from Air Caledonie International

v Commonwealth,[2] and ruled that the collecting body of a fee does not have to be a public body for the fee to

be regarded as a tax. Therefore, a levy collected by a private body dictated by a statute for public purposes

gives the private body a public character. The decision also raised the notion of raising taxes for the public

interest.

-

The decision also contained a strong dissent from the minority (Dawson, Toohey and McHugh JJ). They were

critical of the dicta from Air Caledonie as it contained no principles, and no examples. They did not view the

fee paid as tax because it was not paid into general government consolidated revenue (Section 81 of the

Constitution requires taxes to be paid into consolidated revenue). The royalty imposed by the government was

a special type of debt that did not satisfy the elements of taxation. McHugh J added that the term "public

purpose" meant government purpose, and the fee imposed had no government purpose. The Commonwealth

played a merely supervisory role

(1938) 60 CLR 263

Relevant Sections: s51(ii), s55

Case summary/Quote:

o Per Latham CJ in Matthews v Chicory Marketing Board (Vic) (1938)

o A tax is

▪

A compulsory exaction of money

▪

By a public authority

▪

For public purposes

•

▪

-

Enforceable by law

And is not a payment for services rendered

This was also a case that considered section 90 of the Australian Constitution, which prohibits States from

levying excise (taxes). Although the meaning of excise was considered in Peterswald v Bartley,[2] this case

significantly broadened its reach.

-

21

-

In this case, the law in question was a Victorian tax on producers of chicory, which was measured at the rate of

one pound per half-acre, of land planted with the crop. The minority in this case, consisting of Latham CJ and

McTiernan J, followed the Peterswald definition and held that an excise must have some relation to the

quantity or value of the goods.

-

On the contrary, the majority, whose principal judgment was delivered by Dixon J, allowed this extension.

After examining the history of excise in England, his Honour concluded that the definition in Peterswald may

be too narrow. All that is required is that the "tax must bear a close relation to the production or manufacture,

the sale or the consumption of goods and must be of such a nature as to affect them as the subjects of

manufacture or production or as articles of commerce". Hence, although the tax in this case did not directly

refer to the quantity or value of the chicory produced, the land area has a "natural, although not a necessary"

relation to the quantity produced, and it is a "controlling element". This was formulated with reference to the

framers of the Constitution, who adopted an excise as "a tax directly affecting commodities"

(1993) 176 CLR

555

Relevant Sections: s 51(ii), s54/55, s81-83

Case summary/Quote:

-

Two Commonwealth Acts, the Training Guarantee Act 1990 and the Training Guarantee (Administration) Act

1990 mandated a minimum amount an employer had to spend training their workforce. Further, employers had

to pay any shortfall in the amount that had to be spent in training and the actual amount to the government.

Northern Suburbs General Cemetery Reserve Trust did not spend the minimum amount, and had to pay the

difference to the government. They argued the Act was unconstitutional because it was not a valid law with

respect to taxation. If the laws achieved their purpose, then no revenue would actually be collected by the

Commonwealth. Further, looking at the statements of objectives of the Acts, raising revenue was not an

objective.

-

Per Mason CJ, Deane, Toohey and Gaudron JJ:

o The laws were made pursuant to the taxation power. Although revenue raising was not a stated

objective, it intrinsically was an objective of the Acts. More importantly, if a law on its face is one with

respect to taxation, the law does not cease to have that character simply because parliament seeks to

achieve a purpose not within Commonwealth power.

22

o The plaintiffs argued that the money paid was not a tax but a fee for services. The court held that it was

not a fee for services because the connection between the service and the fee was too remote. The court

could not determine for what service the fee was paid.

(1936) 54 CLR 657

Relevant Sections: 51(ii), 92, 99 (Discrimination between the states)

Case summary/Quote:

-

It may be noted that the discrimination which is forbidden by s 51 (II) includes discrimination between parts of

the same State.

-

Dixon J, in the consideration of this case, my opinion has fluctuated, but I have reached the conclusion that, in

specifying ports in four States only for the purpose of the Transport Workers (Seamen) Regulations, SR 1935

(No 125), the Commonwealth, by a regulation of commerce, gave preference to those States or parts thereof

over the other States, contrary to s 99 of the Constitution, and that a declaration to that effect ought to be made

o In Crowe v Commonwealth, (1935) ALR 445, I said that in relation to trade and commerce, as

distinguished from revenue, the preference referred to by s 99 is evidently some tangible advantage

obtainable in the course of trading or commercial operations, or at least some material or sensible

benefit of a commercial or trading character. I intended the expression "trading or commercial

operations" to bear a very wide and general meaning. It includes the activities which attend carriage by

sea or land. Further consideration has confirmed me in the view which I then expressed. I repeat that the

preference may consist in a greater tendency to promote trade, in furnishing some incentive or facility,

or in relieving from some burden or impediment. But it is, perhaps, desirable to notice that the phrase is

not "give a preference," but "give preference."

Fortescue Metals Group Ltd v Commonwealth (2013) 250 CLR 548

Relevant Sections: s51(ii), 99

Case summary/Quote:

-

Fortescue challenged validity of 4 CTH acts/regs in relation to taxes/excises etc.

23

-

Fortescue principally argued that the impugned legislation discriminated between States, contrary to the

Commonwealth Constitution s 51(ii), and gave preference to one State over another, contrary to the

Constitution s 99. This was on the basis that, where minerals resource rent tax (MRRT) was payable, the

formula by which it was calculated meant that miners in different States may be liable for different amounts of

MRRT, despite conducting identical operations. The Court concluded that the MRRT Legislation did not

discriminate between States. It noted that the fact that a miner would pay a different amount of MRRT if that

miner conducted identical operations in another State did not demonstrate discrimination

-

"Section 99 of the Constitution does not prohibit discrimination between the States, but merely prohibits

preference by one State or any part of a State over another by the Commonwealth in the exercise of any power

which is itself not discriminatory between the States" [at para 70].

-

In this quote, the High Court of Australia is referring to Section 99 of the Australian Constitution, which

prohibits the Commonwealth from giving preference to any state or part of a state in the exercise of any power

conferred by the Constitution. The court is emphasizing that this provision does not prohibit discrimination

between the states by the Commonwealth, but only prohibits the Commonwealth from giving preference to one

state or part of a state over another. This means that the Commonwealth can impose taxes or other measures

that have different effects on different states, as long as it does not give preference to one state or part of a state

over another.

8 CLR 156

Relevant Sections: s51(ii), s61, s116

This reaffirms Pape. Commonwealth needs a head of power to

spend.

Case summary/Quote:

-

Background:

-

As part of the National School Chaplaincy Programme, the Commonwealth government entered into a contract

with a company, Scripture Union Queensland, for the provision of chaplaincy services at a State school in

Queensland. The contract was described as the Darling Heights Funding Agreement. Ronald Williams, the

father of four children attending the school, brought proceedings in the High Court challenging the validity of

the funding agreement and the making of payments under the funding agreement. Mr Williams contended that

the Commonwealth did not have power under s 61 of the Constitution to enter into the funding agreement, and

that the funding agreement was prohibited by s 116 of the Constitution.[1]: para 2

-

LEXUS NEXUS

-

Determination on special case.

24

-

Respondent Commonwealth of Australia entered into funding agreement with public company for provision of

chaplaincy services at school in Queensland pursuant to Commonwealth's National School Chaplaincy

Program (NSCP).

-

Chaplaincy services included assisting school and community 'in supporting spiritual wellbeing of students' and

being approachable by all students, staff and members of school community of all religious affiliations'.

-

Funding for NSCP provided under funding arrangements administered by respondent and not by legislation.

-

Applicant father of children enrolled in school in which NSCP was implemented sought declaration respondent

did not have authority to make payments to public company pursuant to funding agreement or other similar

agreement.

-

Claimed had standing because had special interest in subject because applicant's children attended school in

respect of which funds have been expended by respondent.

-

Claimed expenditure for NSCP did not fall within any ordinary and recognised functions of respondent.

-

Claimed payments of moneys under funding agreement were not authorised as enterprise or activity peculiarly

adapted to Australian government and could not be described as spending on ordinary annual services of

government.

-

Claimed funding agreement was means of carrying out or implementing new policy by entering into contract.

-

Claimed respondent did not have unlimited capacity to enter into contract.

-

Claimed agreement did not constitute 'benefits to student' because not possible to demonstrate any benefit to

any particular student at any particular time.

-

Claimed payments to private company pursuant to funding agreement prohibited by Commonwealth

Constitution s 116 because eligibility criteria imposed religious test as qualification for office of chaplains.

-

Respondent claimed applicant had no standing to challenge matters and consequently intervention by States

was of no consequence.

-

Claimed subject matter of agreement covered by Constitution s 51(xxiiiA) because agreement provided for

involved provision of benefits to students.

-

Claimed power of executive government to enter into funding agreement and to make payments to private

company pursuant to agreement and NSCP derived from Constitution s 61.

-

Claimed making of funding agreement and payments to private company were within executive power and

covered by Constitution s 51(xxiiiA) because agreement provided for provision of benefits to students.

-

Claimed respondent possessed capacities, in common with legal person, including capacity to obtain

information, to spend money lawfully available to be spent or enter into contracts.

-

Held, making the determination (6:1):

-

(i) Did the applicant have standing to challenge the funding agreement and the payments to the private

company?

25

o Per Gummow and Bell JJ (Crennan, Kiefel, Heydon and French CJ agreeing): The applicant had

standing to challenge the validity of the funding agreement. The applicant was extensively supported by

the states of Victoria and Western Australia who each exercised the right of intervention given by the

(CTH) Judiciary Act 1903 s 78A.

o Per Heydon J: The applicant had a special interest in having a judicial determination of the validity of

payment made for the period during which the applicant's children attended school.

-

(ii) Was the funding agreement invalid and payments made under it unlawful by reason that the funding

agreement and those payments were beyond the executive power of the respondent under the Constitution s 61?

o Per French CJ (Gummow, Bell and Crennan JJ agreeing): Yes. The Constitution section 61 did not

empower the respondent, in the absence of statutory authority, to contract for or undertake the

challenged expenditure on chaplaincy services.

o Per Heydon J (dissenting): The respondent did not need statutory authority to pay money to carry out

the NSCP pursuant to the contract because the NSCP did not create rights and obligations which

conflict with existing rights and obligations or with State or federal law. In any event, the applicant

failed to identify the source and nature of any limitations of executive power.

-

(iii) Did the funding agreement fall within legislative heads of power of the Constitution ss 51(xx) and

51(xxiiA)? (Benefits to students, maternity allowances etc etc)

o Per Hayne J: No. The provision of payment for a chaplain to a school was not a form of 'benefits to

student'. The payments made under the NSCP were made to provide a service to which students may

resort and from which they may derive advantage.

o Per Kiefel J: The benefits provided to students in reliance on s 51(xxxiiiA) must be provided to students

as a class.

o Per Heydon J (dissenting): The Constitution s 51(xxiiiA) conferred power to enact legislation

permitting the respondent to provide non-monetary benefits to students by financing others to provide

those benefits.

-

(iv) Did the executive have an unlimited capacity to enter into contracts and pay money pursuant to such

contracts?

o Per Gummow and Bell JJ: No. The executive power of the respondent did not extend to enabling it to

enter into contracts and undertake expenditure of public moneys.

o Per French CJ: The respondent was not just another legal person with contractual capacity. Character of

the respondent government as a national government did not entitle it to enter into any such field of

activity by executive action alone. Such an extension of respondent executive powers would

correspondingly reduce those of the States and compromise 'truly federal government'.

26

o Per Hayne J: The extent to which the respondent may enter into agreements and dispose of property did

not depend on assumptions about its capacities but must be ascertained by interpreting the Constitution.

o Per Crennan J: If the respondent had unrestricted power to enter into such agreements, the respondent

would be able to implement new policies without the processes of scrutiny and debate from the

Parliament.

o Kiefel J: The Constitution s 96 confirmed that the executive power was not unlimited. The executive

was not authorised by the Constitution to expand its powers by contract.

-

(v) Were the payments made by the respondent pursuant to the funding agreement prohibited by the

Constitution s 116?

o Per Gummow and Bell JJ (Hayne, Kiefel, Crennan JJ and French CJ agreeing): No. Chaplains engaged

by the private company did not hold office under the Commonwealth. The chaplain did not enter into

any contractual or other arrangement with the respondent. It was not sufficient to render the chaplain as

a holder of an office under the respondent merely because the respondent funded the employment of the

chaplain

(2014) 252 CLR 416

Relevant Sections: s51(ii), s61, s116

Case summary/Quote:

-

Within days of Williams (No 1), the Commonwealth Parliament reacted by passing the Financial Framework

Legislation Amendment Act (No 3) 2012 (Cth) (FFLA Act) .

-

The FFLA Act purported to give the Commonwealth Government a general power to spend money for any

purpose specified in regulations, which are made by the Executive rather than by Parliament. Professor Anne

Twomey, Professor of Constitutional Law at the University of Sydney, described the FFLA Act as the

Parliament’s “act of hara-kiri”,[1] since its effect was to give the Executive the power to “spend money on

whatever it wished without the need for further legislation or parliamentary scrutiny”.

-

Unsurprisingly, the Commonwealth then made regulations purporting to authorise a suite of “arrangements,

grants and programs”, including the chaplaincy program.

-

On its face, this meant that the chaplaincy program no longer fell afoul of the High Court’s reasoning in

Williams (No 1), since it was authorised by legislation.

27

-

However, undeterred, Mr Williams commenced a new High Court proceeding, challenging the constitutionality

of the FFLA Act provisions and the regulations.

-

LEXUS NEXUS

-

Determination on special case.

-

Respondent Commonwealth of Australia entered into funding agreement with public company for provision of

chaplaincy services at school in Queensland.

-

Funding agreement was made under National School Chaplaincy and Student Welfare Program.

-

Applicant parent of children enrolled in school in which chaplaincy services were implemented challenged

payment of money made by Commonwealth to public company.

-

Applicant successful in claim that funding agreement and payments made under agreement were not supported

by executive power of Commonwealth.

-

Parliament enacted (CTH) Financial Framework Legislation Amendment Act (No 3) 2012 (FFLAA) which

amended (CTH) Financial Management and Accountability Act 1997 (FMAA) and (CTH) Financial

Management and Accountability Regulations 1997 (FMAR) intended to provide legislative support for making

of agreements and payments.

-

In instant proceeding, applicant challenged validity of provisions of FMAA and FMAR entitled

'Supplementary powers to make commitments to spend public money etc', which was inserted by FFLAA.

-

Respondents claimed Appropriation Acts for years 2011-2012, 2012-2013 and 2013-2014 authorised making

of funding agreement by providing that amounts appropriated by those Appropriation Acts may be applied to

outcome identified as National School Chaplaincy and Student Welfare Program.

-

Held, making the determination (6:0):

-

(i) Was the funding agreement supported by the Appropriation Acts?

o Per French CJ, Hayne, Kiefel, Bell and Keane JJ (Crennan J agreeing): This question was unnecessary

to answer because the conclusions reached about the validity of the impugned provisions of the FMAA,

the FMAR and the FFLAA would apply equally to the Appropriation Acts if they otherwise provided

authority for the making of the agreement and payments in issue.

-

(ii) Were the impugned provisions wholly invalid?

o Per French CJ, Hayne, Kiefel, Bell and Keane JJ (Crennan J agreeing): Yes. In operation with respect to

the funding agreement and with respect to payments made under the funding agreement, none of

FMAA s 32B, FMAR Pt 5AA and sched 1AA of FFLAA Sch 1 item 9 were valid laws of

Commonwealth.

-

(iii) Was the Commonwealth's entry into, and expenditure of moneys under, the funding agreement, supported

by the executive power of the Commonwealth?

28

o Per French CJ, Hayne, Kiefel, Bell and Keane JJ: No. The agreement providing for payments to the

public company was invalid, because it was beyond the executive power of the Commonwealth and that

the making of the relevant payments by the Commonwealth to the public company under that

agreement was not supported by the executive power of the Commonwealth under the Commonwealth

Constitution s 61.

o Per Crennan J (dissenting on this point): Yes. It was not necessary for this Court to express any views

about the wisdom of governments providing services to school communities and students which support

the wellbeing of students. The Court's task was limited to determining whether the National School

Chaplaincy and Student Welfare Program was sufficiently connected to s 51(xxiiiA), which was relied

upon by the Commonwealth as a relevant head of power to support validity.

-

(iv) Did the applicant have standing to challenge the making of payments?

o Per French CJ, Hayne, Kiefel, Bell and Keane JJ (Crennan J agreeing): Yes. The applicant has standing

to challenge the making of payment, in the circumstances of the case, and to the extent necessary for the

determination of the matter.

-

(v) Was the making of the payments identified in the question unlawful?

o Per French CJ, Hayne, Kiefel, Bell and Keane JJ (Crennan J agreeing): Yes. The making of payments

was unlawful because it was not authorised by statute and was beyond the executive power of the

Commonwealth.

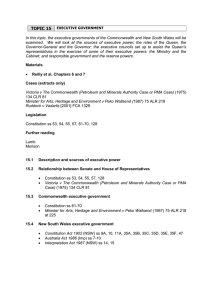

Week 4 – THE CROWN, THE EXECUTIVE POWER AND NATIONAL SECURITY 51(vi), (xxxix) 61

Book – Pages 432 – 484

-

and/or

class/lectures

Crown plays role in society (Has this power – vested in the crown). protector, conferred title/take land away,

treaties, disputes (adjudicator), makes the laws, law enforcer, taxes, currency.

-

The crown was brought into the Australian constitution. 1901 (we federated).

o S61 – execute and maintain the constitution. Very important. The job of the crown is to execute and

maintain the constitution. It constitutes the nation state. Constitutional order.

-

Crown comes first. The constitution brings it in.

-

(Making war and peace etc…). Though parliament controls purse strings… so hard to sustain war if Parliament

doesn’t support…

-

Parliament can’t do anything about prerogative powers.

29

-

Desuetude – No longer really used. Power belonging to crown that has fallen into such disuse that it isn’t used

anymore.

Relevant sections of the constitution

-

The Governor-General may appoint such times for holding the sessions of the Parliament as he thinks fit, and

may also from time to time, by Proclamation or otherwise, prorogue the Parliament, and may in like manner

dissolve the House of Representatives.

-

Summoning Parliament

o After any general election the Parliament shall be summoned to meet not later than thirty days after the

day appointed for the return of the writs.

-

First session

o The Parliament shall be summoned to meet not later than six months after the establishment of the

Commonwealth.

-

Every House of Representatives shall continue for three years from the first meeting of the House, and no

longer, but may be sooner dissolved by the Governor-General.

-

matters incidental to the execution of any power vested by this Constitution in the Parliament or in either

House thereof, or in the Government of the Commonwealth, or in the Federal Judicature, or in any department

or officer of the Commonwealth.

-

The executive power of the Commonwealth is vested in the Queen and is exercisable by the Governor-General

as the Queen’s representative, and extends to the execution and maintenance of this Constitution, and of the

laws of the Commonwealth.

-

The Governor-General may appoint officers to administer such departments of State of the Commonwealth as

the Governor-General in Council may establish.

-

Such officers shall hold office during the pleasure of the Governor-General. They shall be members of the

Federal Executive Council, and shall be the Queen’s Ministers of State for the Commonwealth.

-

Ministers to sit in Parliament

30

o After the first general election no Minister of State shall hold office for a longer period than three

months unless he is or becomes a senator or a member of the House of Representatives.

-

The command in chief of the naval and military forces of the Commonwealth is vested in the GovernorGeneral as the Queen’s representative.

-

This Constitution shall not be altered except in the following manner:

-

The proposed law for the alteration thereof must be passed by an absolute majority of each House of the

Parliament, and not less than two nor more than six months after its passage through both Houses the proposed

law shall be submitted in each State and Territory to the electors qualified to vote for the election of members

of the House of Representatives.

-

But if either House passes any such proposed law by an absolute majority, and the other House rejects or fails

to pass it, or passes it with any amendment to which the first-mentioned House will not agree, and if after an

interval of three months the first-mentioned House in the same or the next session again passes the proposed

law by an absolute majority with or without any amendment which has been made or agreed to by the other

House, and such other House rejects or fails to pass it or passes it with any amendment to which the first

mentioned House will not agree, the Governor-General may submit the proposed law as last proposed by the

first-mentioned House, and either with or without any amendments subsequently agreed to by both Houses, to

the electors in each State and Territory qualified to vote for the election of the House of Representatives.

-

When a proposed law is submitted to the electors the vote shall be taken in such manner as the Parliament

prescribes. But until the qualification of electors of members of the House of Representatives becomes uniform

throughout the Commonwealth, only one-half the electors voting for and against the proposed law shall be

counted in any State in which adult suffrage prevails.

-

And if in a majority of the States a majority of the electors voting approve the proposed law, and if a majority

of all the electors voting also approve the proposed law, it shall be presented to the Governor-General for the

Queen’s assent.

-

No alteration diminishing the proportionate representation of any State in either House of the Parliament, or the

minimum number of representatives of a State in the House of Representatives, or increasing, diminishing, or

otherwise altering the limits of the State, or in any manner affecting the provisions of the Constitution in

31

relation thereto, shall become law unless the majority of the electors voting in that State approve the proposed

law.

-

In this section, Territory means any territory referred to in section one hundred and twenty-two of this

Constitution in respect of which there is in force a law allowing its representation in the House of

Representatives

Relevant cases

(1918) 25 CLR 32

Relevant Sections:

s51(vi), s61

Case summary/Quote:

-

This case goes to show how far, or how much power the executive will have in times of war

-

Isaacs, Powers and Rich JJ at 46

o "In the allocation and distribution of powers effected by the Constitution of the Commonwealth the

Defence power is exclusively assigned to the Commonwealth. It is a matter of common knowledge that

the necessity of a single authority for the defence of Australia was one of the urgent, perhaps the most

urgent, of all the needs for the establishment of the Commonwealth. That power now rests in the one

hand so far as Australian authority extends”

-

LEXUS NEXUS

-

Appeal against decision of Supreme Court of New South Wales.

-

Wheat broker operating in New South Wales made sales of wheat to persons in various states.

-

Government of New South Wales interfered with contracts and broker suffered loss.

-

Government claimed acts done in exercise of Royal prerogative in time of war.

-

Wheat Pool Scheme to export wheat to United Kingdom approved by Prime Minister.

-

Scheme involved no element of compulsion or interference.

-

Jury found that object of Government's actions was not for benefit of nation.

-

Supreme Court found in favour of respondent Treasurer of New South Wales.

-

Whether acts of Government made under provisions of Scheme.

-

Held, allowing the appeal:

o (i) Even assuming that the exercise of the Royal prerogative in war time could justify acts of the nature