Financial Management:

Principles & Applications

Thirteenth Edition

Chapter 14

The Cost of Capital

Copyright Education,

© 2018, 2014, 2011 Pearson

Inc. All Reserved

Rights Reserved

Copyright © 2018, 2014, 2011 Pearson

Inc. Education,

All Rights

Learning Objectives (1 of 2)

1. Understand the concepts underlying the firm’s

overall cost of capital and the purpose for its

calculation.

2. Evaluate a firm’s capital structure, and determine

the relative importance (weight) of each source

of financing.

3. Calculate the after-tax cost of debt, preferred

stock, and common equity.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Learning Objectives (2 of 2)

4. Calculate a firm’s weighted average cost of

capital.

5. Discuss the pros and cons of using multiple,

risk-adjusted discount rates and describe the

divisional cost of capital as a viable alternative

for firms with multiple divisions.

6. Adjust the NPV for the costs of issuing new

securities when analyzing new investment

opportunities.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Principles Applied in This Chapter

• Principle 1: Money Has a Time Value.

• Principle 2: There is a Risk-Return Tradeoff.

• Principle 3: Cash Flows Are the Source of Value.

• Principle 4: Market Prices Reflect Information.

• Principle 5: Individuals Respond to Incentives.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

14.1 THE COST OF CAPITAL: AN OVERVIEW

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Cost of Capital: An Overview (1 of 3)

• We can view the returns that investors expect to receive

on the firm’s stocks and bonds as the cost to the firm of

attracting the capital used to fund the firm’s investment in

assets. We can think of the cost of capital for a firm as

the weighted average of the required returns of the

securities that are used to finance its business. We refer to

this as the firm’s weighted average cost of capital, or

WACC.

• WACC incorporates the required rates of return demanded

by the firm’s lenders and investors along with the particular

mix of financing sources that the firm uses.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Cost of Capital: An Overview (2 of 3)

The riskiness of a firm affects its WACC in two

ways:

– First, required rate of return on the debt and equity

securities that the firm issues will be higher if the firm is

riskier, and

– Second, risk influences how the firm chooses the

extent to which it is financed with debt and equity

securities.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Cost of Capital: An Overview (3 of 3)

The firm’s WACC is used in a number of ways:

– First, WACC is used to value the entire firm.

– Second, firms often use WACC as the starting point for

determining the discount rate for individual investment

projects they might undertake

– Finally, firms sometimes use their WACC to evaluate

their performance

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

WACC equation

Proportion of

Proportion of

After-Tax Cost

Cost of Preferred

Capital Raised

Capital Raised

Stock ( k ps )

of Debt kd (1 T)

of Capital (WACC )

by Debt(w d )

by Pr eferred Stock ( k ps )

W eighted

Average Cost

Proportion of

Cost of Common

Capital Raised

Stock ( kcs )

by Common Stock(w )

cs

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

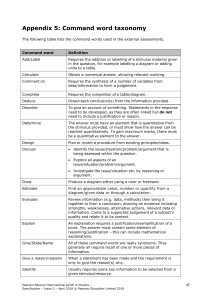

Figure 14.1 A Template for Calculating WACC

Source of Capitala

(1)

Market Value

Weightb (2)

×

After-Tax Cost

of Capitalc(3)

=

Product of

Columns 2 and 3d

Debt

wd

×

kd (1 − T)

=

wd × kd (1 − T)

Preferred stock

wps

×

kps

=

wps × kps

Common equity

wcs

×

kcs

=

wcs × kcs

Sum =

100%

Blank

Blank

Blank

WACC

aThe

sources of capital included in the WACC calculation include all interest-bearing debt (short- and long-term) but

exclude non-interest-bearing debt such as accounts payable and accrued expenses. In addition, preferred stock and

common equity are included. The total of all the market values of all the capital sources included in the WACC

computation is generally referred to as the firm’s enterprise value, and the mix of debt and equity defines the firm’s capital

structure.

bThe

weight used to average the cost of each source of capital should reflect the relative importance of that source of

capital to the firm’s value on the date of the analysis. This means that the proper weight for each source is based on the

market value of that source of capital as a percentage of the sum of the market values of all sources.

investor’s required rate of return is the basis for estimating the cost of capital for each source of financing to the firm.

However, because interest on the firm’s debt is tax-deductible to the firm, we must adjust the lender’s required rate of

return to an after-tax basis. The required rate of return for each source of financing, like the weight used to average it,

should reflect a current estimate based on current market conditions.

cThe

dThe

weighted average of the individual costs of the sources of capital is found by summing the products of the weight and

cost of each source.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

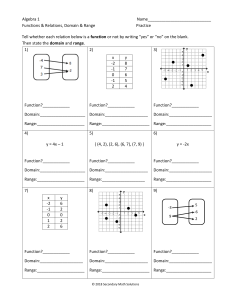

Three—Step Procedure for Estimating the

Firm’s WACC (1 of 2)

1. Define the firm’s capital structure by determining

the weight of each source of capital. (see column 2,

figure 14.1). The weight (importance) of each source

of capital is based on the current market value of

each source of capital.

2. Estimate the cost of each source of financing.

These costs are equal to the investor’s required

rates of return after adjusting the cost of debt for the

effects of taxes (see column 3, figure 14-1)

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Three—Step Procedure for Estimating the

Firm’s WACC (2 of 2)

3. Calculate a weighted average of the cost of

capital from all source of financing. This step

requires calculating the product of the after-tax

cost of each capital source used by the firm and

the weight associated with that source. The sum

of these products is the WACC. (see column 4,

figure 14-1)

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

14.2 DETERMINING THE FIRM’S

CAPITAL STRUCTURE WEIGHTS

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Determining the Firm’s Capital Structure

Weights (1 of 2)

The weights are based on the following sources of

financing: debt (short-term and long-term), preferred

stock and common equity. Liabilities such as

accounts payable are not included in capital

structure.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Determining the Firm’s Capital Structure

Weights (2 of 2)

• In theory, market value is preferred for all

securities. However, not all market values may be

readily available.

• In practice, we generally use book values for debt

and market values for equity securities.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

CHECKPOINT 14.1: CHECK YOURSELF

Calculating the WACC

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Problem

After completing her estimate of Templeton’s WACC, the

CFO decided to explore the possibility of adding more lowcost debt to the capital structure. With the help of the firm’s

investment banker, the CFO learned that Templeton could

probably push its use of debt to 37.5% of the firm’s capital

structure by issuing more debt and retiring (purchasing) the

firm’s preferred shares. This could be done without

increasing the firm’s costs of borrowing or the required rate

of return demanded by the firm’s common stockholders.

What is your estimate of the WACC for Templeton under this

new capital structure proposal?

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 1: Picture the Problem (1 of 2)

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 1: Picture the Problem (2 of 2)

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 2: Decide on a Solution Strategy (1 of 2)

We need to determine the WACC based on the

given information:

– Weight of debt = 37.5%; Cost of debt = 6%

– Weight of common stock = 62.5%; Cost of common

stock =15%

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 2: Decide on a Solution Strategy (2 of 2)

We can compute the WACC based on the following

equation:

Proportion of

Proportion of

After-Tax Cost

Cost of Preferred

Capital Raised

Capital Raised

Stock ( k ps )

of Debt kd (1 T)

of Capital (WACC )

by Debt(w d )

by Pr eferred Stock ( k ps )

W eighted

Average Cost

Proportion of

Cost of Common

Capital Raised

Stock ( kcs )

by Common Stock(w )

cs

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 3: Solve

The WACC is equal to 11.625% as calculated below.

Blank

Weights

Cost

Product

Debt

0.375

0.06

0.0225

Common Stock

0.625

0.15

0.09375

Preferred Stock

0

0.1

0

Blank

1

WACC

0.11625

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 4: Analyze

We observe that as Templeton chose to increase

the level of debt to 37.5% and retire the preferred

stock, the WACC decreased marginally from

12.125% to 11.625%. Thus altering the weights will

change the WACC.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

14.3 ESTIMATING THE COST OF

INDIVIDUAL SOURCES OF CAPITAL

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Cost of Debt (1 of 4)

The cost of debt is the rate of return the firm’s

lenders demand when they loan money to the firm.

We estimate the market’s required rate of return on

a firm’s debt using its yield to maturity and not the

coupon rate.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Cost of Debt (2 of 4)

After-tax cost of debt = Yield (1-tax rate)

Example What will be the yield to maturity on a debt

that has par value of $1,000, a coupon interest rate

of 5%, time to maturity of 10 years and is currently

trading at $900? What will be the cost of debt if the

tax rate is 30%?

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Cost of Debt (3 of 4)

Enter:

– N = 10; PV = −900; PMT = 50; FV =1000

– I/Y = 6.38%

– After-tax cost of Debt = Yield (1-tax rate)

= 6.38 (1−.3)

= 4.47%

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Cost of Debt (4 of 4)

It is not easy to find the market price of a specific

bond. It is a standard practice to estimate the cost

of debt using yield to maturity on a portfolio of

bonds with similar credit rating and maturity as the

firm’s outstanding debt.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Figure 14-2 A Guide to Corporate Bond Ratings (1 of 2)

Moody’s

S&P

Fitch

Definitions

Aaa

AAA

AAA

Prime, Maximum Safety

Aa1

AA+

AA+

High Grade, High Quality

Aa2

AA

AA

Blank

Aa3

AA−

AA−

Blank

A1

A+

A+

Upper Medium Grade

A2

A

A

Blank

A3

A−

A−

Blank

Baa1

BBB+

BBB+

Lower Medium Grade

Baa2

BBB

BBB

Blank

Baa3

BBB−

BBB−

Blank

Ba1

BB+

BB+

Non-investment Grade

Ba2

BB

BB

Speculative

Ba3

BB−

BB−

Blank

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Figure 14-2 A Guide to Corporate Bond Ratings (2 of 2)

Moody’s

S&P

Fitch

Definitions

B1

B+

B+

Highly Speculative

B2

B

B

Blank

B3

B−

B−

Blank

Caa1

CCC+

CCC

Substantial Risk

Caa2

CCC

−

In Poor Standing

Caa3

CCC−

−

Blank

Ca

−

−

Extremely Speculative

C

−

−

May Be in Default

−

−

DDD

Default

−

−

DD

Blank

−

D

D

Blank

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Figure 14-3 Corporate Bond Yields: Default Ratings and

Term to Maturity (1 of 2)

Rating

1 year

2 years

3 years

5 years

7 years

10 years

30 years

Aaa/AAA

0.22

0.31

0.42

0.76

1.26

2.00

3.41

Aa1/AA+

0.26

0.43

0.58

0.96

1.46

2.17

3.62

Aa2/AA

0.29

0.55

0.74

1.16

1.66

2.35

3.83

Aa3/AA−

0.31

0.58

0.77

1.20

1.70

2.39

3.88

A1/A+

0.32

0.60

0.80

1.23

1.73

2.43

3.93

A2/A

0.55

0.80

0.98

1.40

1.89

2.57

4.03

A3/A−

0.62

0.95

1.18

1.66

2.19

2.92

4.51

Baa1/BBB+

0.83

1.19

1.42

1.91

2.45

3.18

4.80

Baa2/BBB

1.00

1.39

1.65

2.17

2.73

3.48

5.17

Baa3/BBB−

1.49

1.87

2.11

2.62

3.16

3.91

5.56

Ba1/BB+

2.27

2.64

2.90

3.41

3.98

4.75

6.37

Ba2/BB

3.04

3.41

3.68

4.21

4.79

5.58

7.19

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Figure 14-3 Corporate Bond Yields: Default Ratings and

Term to Maturity (2 of 2)

Rating

1 year

2 years

3 years

5 years

7 years

10 years

30 years

Ba3/BB−

3.82

4.18

4.47

5.00

5.61

6.42

8.00

B1/B+

4.60

4.95

5.25

5.79

6.42

7.26

8.82

B2/B

5.38

5.72

6.04

6.59

7.24

8.10

9.63

B3/B−

6.15

6.49

6.82

7.38

8.06

8.93

10.45

Caa/CCC+

6.93

7.26

7.61

8.17

8.87

9.77

11.26

U.S. Treasury Yield

0.18

0.25

0.32

0.60

1.00

1.59

2.76

Legend:

These data are actually reported as spread to Treasury yields, so for a 30-year Baa1/BBB+-rated corporate bond, the yield

would be reported as 204 basis points over the 30-year Treasury yield of 2.76%. A basis point is 1/100th of a percent, so 204

basis points correspond to 2.04%.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Cost of Preferred Equity (1 of 2)

The cost of preferred equity is the rate of return

investors require of the firm when they purchase its

preferred stock.

k ps

Div ps

Pps

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Cost of Preferred Equity (2 of 2)

Example The preferred shares of Relay Company

that are trading at $25 per share. What will be the

cost of preferred equity if these stocks have a par

value of $35 and pay annual dividend of 4%?

Using equation 14-2a

kps = $1.40 ÷ $25 = .056 or 5.6%

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Cost of Common Equity

The cost of common equity is the rate of return

investors expect to receive from investing in firm’s

stock, which, in turn, reflects the risk of investing in

the equity of the firm. This return comes in the form

of cash distributions (dividends and cash proceeds

from the sale of the stock). There are two commonly

used approaches for calculating the cost of equity:

1. The dividend growth model (from chapter 10)

2. CAPM (from chapter 8)

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Dividend Growth Model: Discounted

Cash Flow Approach (1 of 2)

1. First, estimate the expected stream of dividends

that the common stock is expected to provide t

the stockholder.

2. Second, using these estimated dividends as the

estimated cash flows from the stock, and the

firm’s current stock price, calculate the internal

rate of return on the stock investment.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Dividend Growth Model – Discounted

Cash Flow Approach (2 of 2)

Market Price

of Common Stock (Pcs )

Common Stock Dividend for Year 1( D1)

Common Equity Required Growth Rate in

Rate

of

Return

(

k

)

cs

Dividends ( g )

kcs

D1

g

Pcs

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

CHECKPOINT 14.2: CHECK YOURSELF

Estimating the Cost of Common Equity for

Pearson plc using the

Constant Dividend Growth Rate Model

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Problem

Prepare two additional estimates of Pearson’s cost

of common equity using the dividend growth model

where you use growth rates in dividends that are

25% lower than the estimated −1.70% (i.e., for g

equal to −2.13% and −1.28%)

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 1: Picture the Problem (1 of 2)

We are given the following:

– Price of common stock (Pcs ) = $10.79

– Growth rate of dividends (g) = −2.13% and −1.28%

– Dividend (D0) = $1.08 per share

– Cost of equity is given by dividend yield + growth rate.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 1: Picture the Problem (2 of 2)

Dividend Yield

=D1 ÷ P0

Growth Rate (g)

Cost of Equity

(kcs )

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 2: Decide on a Solution Strategy

We can determine the cost of equity using equation

14-3a

kcs

D1

g

Pcs

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 3: Solve

At growth rate of 4.69%

kcs = {$1.08(.9787)/$10.39} + −.0213 = .0771 or 7.71%

At growth rate of 7.81%

kcs = {$1.08(.9872)/$10.39} −.0128 = .0856 or 8.56 %

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 4: Analyze

• Pearson’s cost of equity is estimated at 7.33% and

10.53% based on the different assumptions for

growth rate.

• Thus growth rate is an important variable in

determining the cost of equity. However,

estimating the growth rate is not easy.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Estimating the Rate of Growth, g

The growth rate can be obtained from:

– websites that post analysts forecasts, and

– using historical data to compute the arithmetic average

or geometric average.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Arithmetic and Geometric Average

Year

Dividend

$ Change

% Change

2012

$0.800

Blank

Blank

2013

0.825

$0.025

3.1%

2014

0.840

0.015

1.8%

2015

0.875

0.035

4.2%

2016

0.900

0.025

2.9%

Blank

Arithmetic Average

Blank

3.0%

Blank

Geometric Average

Blank

2.99%

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Pros and Cons of the Dividend Growth

Rate Model Approach

• Pros – Simplicity

• Cons – severely dependent upon the quality of

growth rate estimates; constant dividend growth

rate for ever is an oversimplification

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Capital Asset Pricing Model (1 of 2)

CAPM (from chapter 8) was designed to determine

the expected or required rate of return for risky

investments.

Risk Premium for Common Equity

( Equity Beta Market Risk Premium)

Cost of common Risk - Free

Equity Beta Expected Return on

Risk - Free

Equity (kcs )

Rate (rf ) Coefficient ( cs ) the Market Portfolio ( rm ) Rate ( rf )

Market Risk Premium

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Capital Asset Pricing Model (2 of 2)

Equation 14-4 illustrates that the expected return on

common stock is determined by three key

ingredients:

– The risk-free rate of interest,

– The beta or systematic risk of the common stock

returns, and

– The market risk premium.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Advantages and Disadvantages of the

CAPM approach

Advantages – simplicity, wider applications

Disadvantages – Choice of risk-free is not clearly

defined, estimates of beta and market risk premium

will vary depending on the data used.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

CHECKPOINT 14.3: CHECK YOURSELF

Estimating the Cost of Common Equity

Using the CAPM

Prepare two additional estimates of Pearson’s cost of common equity using the CAPM

where you use the most extreme values of each of the three factors that drive the

CAPM.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 1: Picture the Problem (1 of 4)

CAPM describes the relationship between the

expected rates of return on risky assets in terms of

their systematic risk. Its value depends on:

– The risk-free rate of interest,

– The beta or systematic risk of the common stock

returns, and

– The market risk premium.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 1: Picture the Problem (2 of 4)

However, there can be wide variation in the

estimates for each one of these variables. Here we

are given the following estimates:

– The risk-free rate of interest (.01% or 2.80%)

– The beta or systematic risk of the common stock

returns (.8 or 1.2)

– The market risk premium (4% or 8%)

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 1: Picture the Problem (3 of 4)

The cost of equity can be estimated using the

CAPM equation:

Risk Premium for Common Equity

( Equity Beta Market Risk Premium)

Cost of Common Risk - Free

Equity Beta Expected Return on

Risk - Free

Equity (kcs )

Rate (rf ) Coefficient ( βcs ) theMarket Portfolio ( rm ) Rate ( rf )

Market Risk Premium

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 1: Picture the Problem (4 of 4)

The cost of equity is given by Risk-free rate + (Risk

premium × Beta):

Risk-Free Rate

Risk Premium

× Beta

Cost of Equity

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 2: Decide on a Solution Strategy

Since we have been given the estimates for market

factors (risk-free rate and risk premium) and firmspecific factor (beta), we can determine the cost of

equity using CAPM.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 3: Solve

Risk Premium for Common Equity

( Equity Beta Market Risk Premium)

Cost of Common Risk - Free

Equity Beta Expected Return on

Risk - Free

Equity (kcs )

Rate (rf ) Coefficient ( βcs ) the Market Portfolio ( rm ) Rate ( rf )

Market Risk Premium

• kcs = 0.014 + 0.8(4) = 3.214%

• kcs = 3.01 + 1.2(8) = 12.61%

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 4: Analyze

• Pearson’s cost of equity is shown to be sensitive

to the estimates used for risk-free rate of interest,

beta and market risk premium.

• Based on the estimates used, the cost of common

equity ranges from 3.21% to 12.61%.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

14.4 SUMMING UP: CALCULATING THE

FIRM’S WACC

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Summing Up: Calculating the Firm’s

WACC

When estimating the firm’s WACC, following issues

should be kept in mind:

– Use Market-Based Weights: weights should be based

on market values of firm’s securities rather than their

book values

– Use Market-Based Costs of Capital: the cost of capital

for each source of funds should reflect the current

market prices and expected future returns rather than

historical rates from the past.

– Use Forward-Looking weights and Opportunity Costs.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

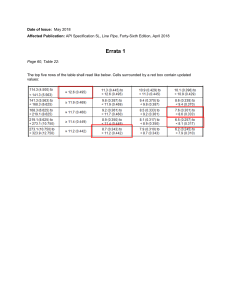

Weighted Average Cost of Capital in

Practice

• The cost of capital varies across firms because of

differences in their lines of business, which

determine business risk, and differences in

individual firms’ capital structures or financial

leverage, which is the source of financial risk.

• Figure 14.4 shows the estimates of WACCs for a

sample of large U.S. firms. The WACCs range

from 3.31 percent to 7.20 percent. In general, the

firms with the highest costs of capital are those

with the lowest use of debt financing.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Figure 14.4 WACCs for a Sample of Large U.S. Firms (1 of 2)

(Panel A) Cost of Capital Estimates

Debta

After-Tax

Cost of Debtb

% Equity

Cost of

Equityc

WACC

Blank

%

American Airlines (AAL)

28.20%

2.94%

71.80%

7.50%

6.22%

American Electric Power (AEP)

40.61%

2.60%

59.39%

3.80%

3.31%

Emerson Electric (EMR)

11.64%

2.26%

88.36%

7.85%

7.20%

Exxon-Mobil (XOM)

8.53%

1.79%

91.47%

7.10%

6.65%

Ford (F)

65.21%

2.94%

34.79%

7.90%

4.67%

General Electric (GE)

19.11%

2.15%

80.89%

8.05%

6.92%

Starbucks (SBUX)

0.81%

2.86%

99.19%

6.15%

6.12%

Target (TGT)

19.23%

2.26%

80.77%

5.20%

4.63%

Wal-Mart (WMT)

16.77%

2.09%

83.23%

3.90%

3.60%

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Figure 14.4 WACCs for a Sample of Large U.S. Firms (2 of 2)

(Panel B) Supporting Information Used to estimate the WACC

Bond

Ratingd

Spread to

10-Year

Treasury

Risk-Free

Rate (10Year Treasury)

BeforeTax Cost

of Debt

Beta

Cost of

Equity

(CAPM)

American Airlines (AAL)

Baa3

2.53%

2.0%

4.53%

1.10

7.50%

American Electric Power

(AEP)

Baa1

2.00%

2.0%

4.00%

0.36

3.80%

Emerson Electric (EMR)

A2

1.47%

2.0%

3.47%

1.17

7.85%

Exxon-Mobil (XOM)

Aaa

0.76%

2.0%

2.76%

1.02

7.10%

Baa3

2.53%

2.0%

4.53%

1.18

7.90%

A1

1.30%

2.0%

3.30%

1.21

8.05%

Baa2

2.40%

2.0%

4.40%

0.83

6.15%

Target (TGT)

A2

1.47%

2.0%

3.47%

0.64

5.20%

Wal-Mart (WMT)

Aa2

1.21%

2.0%

3.21%

0.38

3.90%

Blank

Ford (F)

General Electric (GE)

Starbucks (SBUX)

Source: Computations performed by the authors using publicly available sources in 2016.

a% Debt = Net Debt/Enterprise Value.

bThe assumed tax rate is 35%, so After-Tax Cost of Debt = Before-Tax Cost of Debt (1 − .35).

c% Equity = Equity Value/Enterprise Value = 1 − % Debt.

dMoody's rating for a recent debt issue by the firm.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

14.5 ESTIMATING PROJECT COSTS OF CAPITAL

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Estimating Project Cost of Capital

• Should one overall WACC be used to evaluate all

new investments? In theory, No, since all projects

may not the same risk characteristics as the

overall firm.

• However, a recent survey found that more than 50

percent of firms tend to use a single, companywide discount rate to evaluate all of their

investment proposals.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Rationale for Using Multiple Discount

Rates

Figure 14.5 illustrates the danger of using a single

discount rate to evaluate investment projects with

different levels of risk. There will be a tendency to to

take on too many risky investment projects, and

pass up good investment projects that are relatively

safe.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Figure 14.5 Using the Firm’s WACC Can Bias Investment

Decisions toward Risky Projects

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Why Don’t Firms Typically Use Project

Cost of Capital?

1. It may be difficult to trace the source of financing

for individual project since most firms raise

money in bulk for all the projects.

2. It adds to the time and cost in getting approval

for new projects.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Estimating Divisional WACCs (1 of 2)

• If a firm undertakes investment with very different

risk characteristics, it will try to estimate divisional

WACCs.

• Generally, the divisions are defined either by

geographical regions (e.g., Latin American region)

or by industry (e.g., exploration and production,

pipelines, and refining for a large, integrated oil

company)

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Estimating Divisional WACCs (2 of 2)

• The advantages of using a divisional WACC

include the following:

– It provides different discount rates that reflect

differences in the systematic risk of the projects

evaluated by different divisions

– It entails only one cost of capital estimate per division

(as opposed to unique discount rates for each project)

– The use of common discount rate throughout the

division limits managerial latitude and the attendant

influence costs

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Using Pure Play Firms to Estimate

Divisional WACCs

• Here a firm with multiple divisions may identify a

comparable firm with only one division (called a

“pure play” comparison firms or “comps”).

• The estimate of pure play firm’s cost of capital can

then be used as a proxy for that particular

division’s cost of capital.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Figure 14.6 Choosing the Right WACC: Discount Rates and

Project Risk

Method

Description

Advantages

WACC

Estimated WACC

for the firm as an

entity; used as the

discount rate on all

projects.

• Is a familiar concept to

• Does not adjust discount

most business executives.

rate for differences in

project risk.

• Minimizes estimation

Divisional

WACC

Disadvantages

When to Use

• When projects are similar in

risk to the firm as a whole.

• When using multiple discount

costs, as there is only one • Does not provide for

rates creates significant

cost-of capital calculation

flexibility in adjusting for

problems with influence

for the firm.

differences in project debt in

costs.

the

capital

structure.

• Reduces the problem of

influence cost issues.

Estimated WACC for • Uses division-level risk to

individual business

adjust discount rates for

units or divisions

individual projects.

within the firm; used • Reduces influence costs

as the only discount

to the competition among

rate within each

division managers to

division.

lower their division’s cost

of capital.

• Does not capture

• When individual projects

intradivision risk differences

within each division have

in projects.

similar risks and debt

capacities.

• Does not account for

differences in project debt

capacities within divisions.

• Allows potential influence

costs associated with the

choice of discount rates

across divisions.

• When discount rate

discretion creates significant

influence costs within

divisions but not between

divisions.

• Is difficult to find singledivision firms to be proxies

for divisions.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Divisional WACC—Estimation Issues and

Limitations (1 of 2)

Although divisional WACC is generally a significant

improvement over the single, company-wide WACC, the

way that it is often implemented using industry-based

comparison firms has a number of potential

shortcomings:

• The sample of firms in a given industry may include

firms that are not good matches for the firm doing the

analysis or for one of its divisions.

• The division being analyzed may not have a capital

structure that is similar to that of the sample firms in

the industry data.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Divisional WACC—Estimation Issues and

Limitations (2 of 2)

• The firms in the chosen industry that are used as

proxies for divisional risk may not be good

reflections of project risk.

• Good comparison firms for particular division may

be difficult to find.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

14.6 FLOATATION COSTS AND PROJECT NPV

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Floatation Costs

Floatation costs are fees paid to an investment

banker and costs incurred when securities are sold

at a discount to the current market price.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

WACC, Floatation Costs and Project NPV

(1 of 3)

Because of floatation costs, the firm will have to

raise more than the amount it needs.

Financing

Flotation-Cost-Adjusted

Initial Outlay

Needed

Flotation Cost

1

as

a

Percent

of

Funds

Raised

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

WACC, Floatation Costs and Project NPV

(2 of 3)

Example If a firm needs $100 million to finance its

new project and the floatation cost is expected to be

5.5%, how much should the firm raise by selling

securities?

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

WACC, Floatation Costs and Project NPV

(3 of 3)

Financing

Flotation-Cost-Adjusted

Initial Outlay

Needed

Flotation Cost

1

as

a

Percent

of

Funds

Raised

= $100 million ÷ (1−.055) = $105.82 million

• Thus the firm will raise $105.82 million, which

includes floatation cost of $5.82 million.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

CHECKPOINT 14.4: CHECK YOURSELF

Incorporating Floatation Costs

Into the Calculation of NPV

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

The Problem

Before Tricon could finalize the financing for the

new project, stock market conditions changed such

that new stock became more expensive to issue. In

fact, floatation costs rose to 15% of new equity

issued and 3% of new debt issued. Is the project

still viable (assuming the present value of future

cash flows remain unchanged)?

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 1: Picture the Problem (1 of 2)

The NPV will be equal to the present value of the

future cash flows less the initial outlay and floatation

costs.

NPV = PV(inflows)

– Initial outlay

– Floatation costs

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 1: Picture the Problem (2 of 2)

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 2: Decide on a Solution Strategy (1 of 2)

We need to first estimate the average floatation

costs that Tricon will incur when raising the funds.

This can be done using equation 14-5.

Weighted Average

Flotation Cost

Flotation Cost

Flotation Cost

wd

w

cs

of

Debt

as

a

Percent

of

Equity

as

a

Percent

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 2: Decide on a Solution Strategy (2 of 2)

Next, the “grossed-up” investment outlay can be

estimated using equation 14-6 and subtracted from

the present value of the expected future cash flows

to determine whether the project has a positive

NPV.

Financing

Flotation-Cost-Adjusted

Initial Outlay

Needed

Flotation Cost

1

as

a

Percent

of

Funds

Raised

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 3: Solve (1 of 3)

We can use equation 14-5 to estimate the weighted

average floatation cost as follows:

Weighted Average

Flotation Cost

Flotation Cost

Flotation Cost

wd

w

cs

of Debt as a Percent

of Equity as a Percent

= .40 × .03 + .60 × .15

= .102 or 10.2%

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 3: Solve (2 of 3)

The “grossed up” initial outlay for $100 million

project can be estimated using equation 14-6:

Financing

Flotation Cost Adjusted

Initial Outlay

Needed

Flotation Cost

1

as

a

Percent

= $100 million ÷ (1 − 0.102) = $111.36 million

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 3: Solve (3 of 3)

• Thus, floatation costs is equal to $11.36 million.

• NPV = $115 million − $111.36 million

= $3.64 million

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Step 4: Analyze

• The project is feasible even after consideration of

higher floatation costs as the NPV is positive at

$3.64 million.

• However, the problem illustrates that floatation

costs can be significant and cannot be ignored

while evaluating projects.

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Key Terms

• Cost of capital

• Cost of common equity

• Cost of debt

• Cost of preferred equity

• Divisional WACC

• Floatation costs

• Risk Premium

• Weighted Average Cost of Capital (WACC)

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Lecture PowerPoint Template

• Use this template for Introduction to Psychology

Lecture PowerPoints

• Meets current accessibility standards for students

with disabilities

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Contents (1 of 2)

•

•

•

•

•

•

•

•

•

Set Up

Slide Layouts

Outline View

Copyright Line

Reading Order

Chapter Opener

Learning Objectives

Adding Text

Structure

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Contents (2 of 2)

• Figures and Images

• Alternative Text

• Tables

• Graphics

• Multimedia

• Authoring

• QA

• Accessibility Checker

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Set Up: Version

• Ideally, you should be working in the most current

version of PPT

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Copyright

Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved