Gregory-Mankiw-Principles-of-Microeconomics-Asia-Pacific-Edition-Cengage-2018

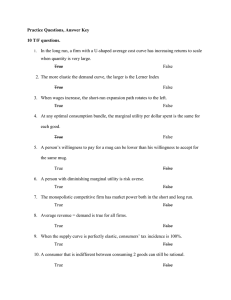

advertisement